Prospectus Filed Pursuant to Rule 424(b)(2) (424b2)

April 01 2014 - 10:33AM

Edgar (US Regulatory)

|

Calculation of Registration Fee

|

|

Title of Each Class of Securities Offered

|

Maximum Aggregate Offering Price

|

Amount of Registration Fee

|

|

Credit Suisse FI Enhanced Big Cap Growth Exchange Traded Notes due October 22, 2018 Linked to the Russell 1000

®

Gross Index Total Return

|

$464,375

|

$59.81

|

Filed pursuant to Rule 424(b)(2)

Registration Statement No. 333-180300-03

March 31, 2014

Pricing Supplement Addendum No. 16 dated March

31, 2014

To Pricing Supplement No. ETN-11/A dated October

21, 2013,

To Prospectus Supplement dated March 23, 2012

and

To Prospectus dated March 23, 2012

|

|

|

Credit Suisse FI Enhanced Big Cap Growth Exchange Traded Notes due October 22, 2018 Linked to the Russell 1000

®

Gross Index Total Return (“ETNs”)

|

|

Issuer:

|

Credit Suisse AG, acting through its Nassau Branch

|

|

|

|

|

CUSIP/ISIN:

|

22539T563/US22539T5636

|

|

|

|

|

NYSE Arca Ticker Symbol:

|

FIBG

|

|

|

|

|

Aggregate Offering Price of ETNs:

|

$464,375

|

|

|

|

|

Public Offering Price per ETN:

|

$46.4375

|

|

|

|

|

Principal Amount of ETNs:

|

$407,800

|

|

|

|

|

Principal Amount per ETN:

|

$40.78

|

|

|

|

|

Trade Date:

|

March 31, 2014

|

|

|

|

|

Settlement Date:

|

April 3, 2014

|

|

|

|

|

Agent:

|

Credit Suisse Securities (USA) LLC (“CCSU”), an affiliate of the Issuer

|

|

|

|

|

Proceeds to Issuer:

|

100.00% of the Aggregate Offering Price

|

|

|

|

|

Agent’s Discount and Commission:

|

0.00%. However, CSSU is expected to charge normal commissions for the purchase of the ETNs and may receive all or a portion of the investor fee. In addition, CSSU our agent for any repurchases at the investor’s option may charge investors a fee, with respect to each ETN that is redeemed prior to the Maturity Date, equal to the product of (i) 0.05%

times

(ii) the Closing Level of the Index on the Early Redemption Valuation Date or Accelerated Valuation Date, as the case may be,

times

(iii) the Index Units as of the immediately preceding Trading Day. For a further description of the fees and commissions payable pertaining to the ETNs please see the section entitled “Supplemental Plan of Distribution (Conflicts of Interest)” in the accompanying pricing supplement.

|

You may lose some or all of your principal if you invest

in the ETNs. See “Risk Factors” beginning on page PS-25 of the accompanying pricing supplement for risks relating to

an investment in the ETNs.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or determined that this pricing supplement addendum, or the

accompanying pricing supplement, prospectus supplement and prospectus, is truthful or complete. Any representation to the contrary

is a criminal offense. The ETNs are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance

Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

Credit Suisse

Sky Petroleum (CE) (USOTC:SKPI)

Historical Stock Chart

From Jan 2025 to Feb 2025

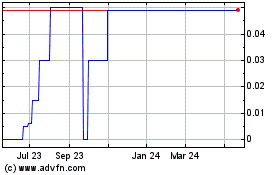

Sky Petroleum (CE) (USOTC:SKPI)

Historical Stock Chart

From Feb 2024 to Feb 2025