Searchlight Minerals Corp. Closes on $4 Million Capital Raise

September 23 2013 - 5:00AM

Marketwired

Searchlight Minerals Corp. Closes on $4 Million Capital Raise

Luxor Capital Partners LP and Company's CEO Are Largest

Investors in Secured Convertible Note Financing

HENDERSON, NV--(Marketwired - Sep 23, 2013) - Searchlight

Minerals Corp. (OTCBB: SRCH) ("Searchlight" or the "Company") today

announced that it has closed on a $4 million capital raise by the

sale of five-year Senior Secured Convertible Notes ("the Notes") to

a number of accredited investors.

The Notes, which were issued on September 18, 2013, will pay

interest to investors semi-annually at a rate of 7% per annum and

are convertible at each holder's option into the Company's common

stock at a price of $0.40 per share. The Note holders have the

right to purchase pro rata up to $600,000 of additional

separate notes on or before September 18, 2014, on the same terms

and conditions as the original Notes. The Note holders also may

elect to have their Notes redeemed by the Company at par beginning

September 18, 2015. The Notes are secured by a lien on all of the

assets of the Company and its two subsidiaries.

The lead investors in the capital raise were affiliates of Luxor

Capital Group LLC ("Luxor"), the Company's largest shareholder, and

Martin Oring, the CEO of the Company. Members of Mr. Oring's family

also participated as investors in the capital raise. Luxor

purchased $2.6 million of the Notes, which increased its beneficial

ownership in the Company from approximately 17% to 21%.

"We are pleased that Luxor, our largest outside investor, has

elected to increase its ownership position in the Company by

participating as the lead investor in this capital raise," stated

Martin Oring, Chief Executive Officer of Searchlight. "The new

capital will be used to validate the technical and commercial

feasibility of the autoclave process in extracting gold and other

precious and base metals from the Clarkdale Slag Project. We are

currently working with the pregnant leach solution generated by our

large pilot autoclave tests to pursue the recovery of gold as

metal-in-hand. Once we are consistently able to achieve this

objective, we intend to commission a bankable feasibility study

that can demonstrate the economic viability of the Clarkdale Slag

Project."

About Searchlight Minerals Corp.

Searchlight Minerals Corp. is an exploration stage company

engaged in the acquisition and exploration of mineral properties

and slag reprocessing projects. The Company holds interests in two

mineral projects: (i) the Clarkdale Slag Project, located in

Clarkdale, Arizona, which is a reclamation project to recover

precious and base metals from the reprocessing of slag produced

from the smelting of copper ore mined at the United Verde Copper

Mine in Jerome, Arizona; and (ii) the Searchlight Gold Project,

which involves exploration for precious metals on mining claims

near Searchlight, Nevada. The Clarkdale Slag Project is the more

advanced of two ongoing projects that the Company is pursuing. The

Searchlight Gold Project is an early-stage gold exploration

endeavor on 3,200 acres located approximately 50 miles south of Las

Vegas, Nevada.

Searchlight Minerals Corp. is headquartered in Henderson,

Nevada, and its common stock trades on the OTCBB under the symbol

"SRCH." Additional information is available on the Company's

website at www.searchlightminerals.com and in the Company's filings

with the U.S. Securities and Exchange Commission.

Forward-Looking Statements

This Press Release may contain, in addition to historical

information, forward-looking statements. Statements in this Press

Release that are forward-looking statements are subject to various

risks and uncertainties concerning the specific factors disclosed

under the heading "Risk Factors" in the Company's periodic filings

with the Commission. When used in this Press Release in discussing

the recent developments on the Company's mineral projects,

including, without limitation, the resolution of certain issues

relating to the operation of production modules, the words such as

"believe," "could," "may," "expect" and similar expressions are

forward-looking statements. The risk factors that could cause

actual results to differ from these forward-looking statements

include, but are not restricted to technical issues with the

mineral projects that may affect production modules and primary

process components, challenges in moving from pilot plant scale to

production scale, the risk that actual recoveries of base and

precious metals or other minerals re-processed from the slag

material at the Clarkdale site will not be economically

feasible, uncertainty of estimates of mineralized

material, operational risk, the Company's limited operating

history, uncertainties about the availability of additional

financing, geological or mechanical difficulties affecting the

Company's planned mineral recovery programs, the risk that actual

capital costs, operating costs and economic returns may differ

significantly from the Company's estimates and uncertainty whether

the results from the Company's feasibility studies are sufficiently

positive for the Company to proceed with the construction of its

processing facility, operational risk, the impact of governmental

and environmental regulation, financial risk, currency risk

volatility in the prices of precious metals and other statements

that are not historical facts as disclosed under the heading "Risk

Factors" in the Company's periodic filings with securities

regulators in the United States. Consequently, risk factors

including, but not limited to the aforementioned, may result in

significant delays to the projected or anticipated production

target dates.

For further information, please contact: RJ Falkner &

Company, Inc. Investor Relations Counsel (800) 377-9893 Email

Contact

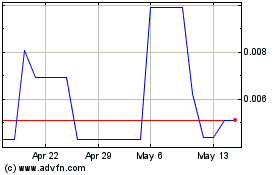

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Oct 2024 to Nov 2024

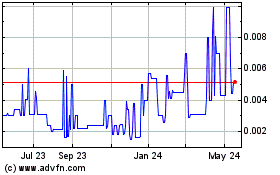

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Nov 2023 to Nov 2024