SSE Expects Adjusted EPS to Beat Guidance

March 29 2018 - 1:55AM

Dow Jones News

By Carlo Martuscelli

SSE PLC (SSE.LN) said Thursday that it expects to report

adjusted earnings per share of more than 120 pence (169 cents) for

the year ending March 31, beating its previously-stated target

range of 116 pence to 120 pence.

The U.K. gas-and-electricity supplier said it expects to declare

a dividend increase that is at least equal to inflation--forecast

to be around 3.7%.

SSE said its capital-and-investment expenditure for the year

will be around GBP1.5 billion.

The company said it expects all three of its segments to be

profitable in the 2018 fiscal year. Adjusted operating profit for

its wholesale division is expected to be "significantly higher"

than the year before due to increased electricity output from its

renewable and gas-fired plant. It reiterated that adjusted

operating profit from its networks unit is expected to be around

GPB150 million lower than the previous year.

Retail adjusted operating profit is expected to be in line with

the previous year.

Finance Director Gregor Alexander said the company is in a good

position to deliver results ahead of its expectations at the start

of the financial year.

SSE said the previously announced spin off and merger of its

household and services businesses with Npower--the U.K.

retail-energy unit of Germany's Innogy SE (IGY.XE)--remains on

course, but the timing is not certain. It said that a total of

8,800 employees will be transferred to the new retail group.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

March 29, 2018 02:40 ET (06:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

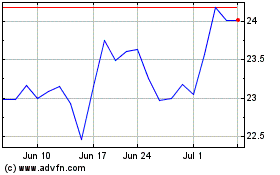

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Mar 2024 to Apr 2024

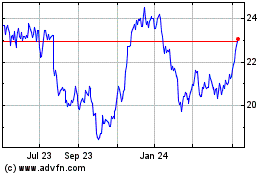

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Apr 2023 to Apr 2024