SSE Shares Fell in Early Trade on Cut to Adjusted EPS Forecast -- Update

February 08 2019 - 4:42AM

Dow Jones News

(Update includes share price fall, more information on Capacity

Market scheme)

--SSE has cut its adjusted EPS forecast for the year ending

March 31, 2019.

--The energy company assumes it won't be able to recognize GBP60

million relating to the U.K.'s Capacity Market scheme this

financial year

--SSE is also considering options for its energy-services

business after a deal with Innogy collapsed last year

By Oliver Griffin

Shares in SSE PLC (SSE.LN) fell in early trade Friday after the

company cut its forecast for adjusted earnings per share in fiscal

2019, with income due in relation to the U.K.'s Capacity Market

scheme left in limbo by a European Union court ruling made in

November.

Last November the EU's Court of Justice ruled that the Capacity

Market scheme constituted illegal state aid. The scheme, which is

designed to keep energy bills in Britain low, was suspended while

the U.K. government tries to win approval to restart it.

Energy company SSE said while recognition of outstanding payment

under the scheme should be "a matter of timing only," it doesn't

think it will be able to recognize the outstanding 60 million

pounds ($77.6 million) it is owed in the current financial

year.

As a result, SSE said it now expects adjusted EPS for the

fiscal-year ending March 31 in a range of 64 pence-69 pence, down

from earlier estimates of 70 pence-75 pence.

Despite the cut to its adjusted EPS forecast, SSE said it still

intends to declare a full-year dividend of 97.5 pence a share.

The energy company also used the trading update as an

opportunity to provide insight on what it plans to do next with its

SSE Energy Services business.

In November last year a proposed merger between the business and

Npower Ltd., the U.K. retail division of Innogy SE's (IGY.XE), was

scrapped when terms for the deal couldn't be agreed.

SSE said it believes the energy-services business will best

succeed outside of the group. To that end, SSE said it is

considering a standalone demerger and listing of the business, a

sale of the unit or an alternative transaction.

If none of the options is viable, SSE said it might retain its

energy-services business as a separate, ring-fenced business within

the group that would be expected to be cashflow positive.

For the full year, SSE said it still expects its capital and

investment expenditure to total around GBP1.7 billion.

Shares at 1010 GMT were unchanged at 1,173.50 pence. Shares had

fallen as much as 2.1% to 1,148.50 pence earlier in the

session.

Write to Oliver Griffin at oliver.griffin@dowjones.com;

@OliGGriffin

(END) Dow Jones Newswires

February 08, 2019 05:27 ET (10:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

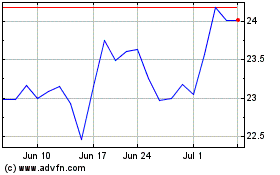

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Mar 2024 to Apr 2024

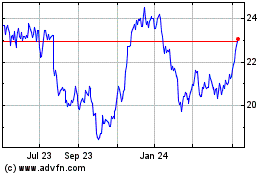

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Apr 2023 to Apr 2024