UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

x

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended

May 31, 2017

or

¨

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transaction period from _______ to _______

Commission File No.

333-206804

|

SavMobi Technology Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

47-3240707

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

Travessa do Cais, No. 3A, Edg. Kai Lei, Macau

(Address of principal executive offices, Zip Code)

+85365230932

(Registrant’s telephone number, including area code)

73B Bank Avenue, Amritsar, Punjab, 143001, India

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Exchange Act:

Common stock, par value $0.001 per share.

(Title of each class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o

Yes

x

No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o

Yes

x

No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

o

Yes

x

No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o

Yes

o

No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

o

Yes

o

No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

¨

|

|

(Do not check if a smaller reporting company)

|

Emerging growth company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

x

Yes

o

No

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. N/A

As of August 29, 2017 the Company has 47,500,000 shares of common stock issued and outstanding

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A amends the Annual Report on Form 10-K of SavMobi Technology Inc. originally filed with the Securities and Exchange Commission (the "SEC") on August 29, 2017 (the "Original Filing") is being filed to correct typographical errors in the Balance Sheets, Statements of Stockholders' Equity and Note 5.

Except as otherwise noted, information included in this Amendment No. 1 is stated as of May 31, 2017 and does not reflect any subsequent information or events.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Form 10-K/A also contains new certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Accordingly, Item 15 of Part IV has also been amended and restated in its entirety to include the currently dated certifications as exhibits.

SAVMOBI TECHNONOGY INC.

TABLE OF CONTENTS

Use of Certain Defined Terms

Except as otherwise indicated by the context, references in this report to “Savmobi Technology Inc.”, “we,” “us,” “our,” “our Company,”

Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

PART I

ITEM 1. BUSINESS

Business Overview

On March 6, 2015 the Company was incorporated in the State of Nevada and established a fiscal year end of May 31. Initially the business platform was in providing application software to a global vendor platform to connect people to businesses and provide a new shopping experience. The Company’s previous principal offices are located in 73B Bank Avenue, Amritsar, Punjab, 143001, India.

On May 18, 2017, Lakwinder Singh Sidhu, the Company’s former Director and CEO, completed a transaction with New Reap Global Ltd., by which New Reap Global Ltd., acquired 32,500,000 shares of common stock, representing 68.4% ownership of the Company. After the change ownership, the Company’s current principal offices are located in Travessa do Cais, No 3A, Edg. Kai Lei, Macau.

The Company has not yet implemented its initial and new business model and to date has generated no revenues. It is the Company's intention to provide vendor tools technology. The proposed planned platform connects businesses to consumers based on location and preferences for products and services. Consumers received promotions while they are travelling via their smartphone. Vendors can send promotions and special offers simply through the web. When the consumer goes to the vendor's location, they can redeem the promotion through their smartphone allowing the proposed platform to keep track of performance analytics. SavMobi's proposed Mobile Marketing Platform intends to help businesses by bringing customers into their door and increasing sales.

Initially we intend to develop and deliver application Mobile Marketing Platform, containing the Vendor Center and Mobile Apps. The Vendor Center intends to allow SavMobi vendors to manage and monitor their promos. It is at the proposed core of all SavMobi Vendor Services. SavMobi Members can use the mobile apps to receive, view & redeem promos, set their preferences, and discover new vendors in their area.

Every business is different, so we've giving the Vendor the ability to determine the discount or offer what is appropriate for them.

The proposed SavMobi Mobile Apps intends to provide members with the full consumer experience of the proposed Mobile Marketing Platform. Members can use the mobile apps to receive, view & redeem promos, set their preferences, and discover new vendors in their area.

We have focused our current operations on the organization and development of our business plan. Our business plan is intended to design and to create a targeted and organized approach to building our intended Vendor and Member enrollment. We believe that once the proposed development of SavMobi's Mobile Marketing Platform is completed, this will allow SavMobi to hit the ground running with many options for our proposed customers.

After the change in control of management, the Company is phasing out the initial business plan and has now shifted the business operation of the Company outsourced accounting and bookkeeping services for its clients. Under this revised business plan, the Company will receive a monthly retainer fee from its clients and has cautiously projected this will have a positive cashflow and generate profit to the Company.

Corporate History

The Company was incorporated by its former president and sole director Mr. Lakwinder Singh Sidhu in the State of Nevada on March 6, 2015, and established a May 31 fiscal year end. On May 18, 2018, Mr. Lakwinder Singh Sidhu resigned from his official positions as CEO and CFO and on the same day the shareholders of the Corporation voted Mr. Poh Kee Liew as Director and CEO, and Mr. Gim Hooi Ooi as Director and CFO.

Recent Developments

Capital Stock

The Company’s capitalization is 75,000,000 common shares with a par value of $0.001 per share. No preferred shares have been authorized or issued. Total shares issued and outstanding as of May 31, 2017 is 47,500,000.

As of May 31, 2015, the Company has not granted any stock options and has not recorded any stock-based compensation.

On April 28, 2015, the Company issued 375,000,000 (7,500,000 pre-split) common shares at $0.00001 per share to the sole director and President of the Company for cash proceeds of $7,500.

On March 8, 2016, the Company issued 15,000,000 (300,000 pre-split) shares of its common stock at $0.001 ($0.05 pre-split) for $15,000 net proceeds to the Company. As of May 31, 2016, the Company had not received funds for 500,000 shares (total related value of $500). This is reflected in the balance sheet as Stock Subscriptions Receivable. On January 10, 2017, we received $500.

On April 20, 2016, the directors of the Company approved a special resolution to undertake a forward split of the common stock of the Company on a basis of 50 new common shares for 1 old common share. All references in these financial statements to number of common shares, price per share and weighted average number of shares outstanding prior to the 50:1 forward split have been adjusted to reflect the stock split on a retroactive basis, unless otherwise noted.

On April 20, 2016, the founding shareholder returned 342,500,000 (6,850,000 pre-split) restricted shares of common stock to treasury for $10 and the shares were subsequently cancelled by the Company.

On May 18, 2017, Lakwinder Singh Sidhu, the Company’s former Director and CEO, completed a transaction with New Reap Global Ltd., by which New Reap Global Ltd., acquired 32,500,000 shares of common stock, representing 68.4% ownership of the Company. New Reap Global Ltd., paid $300,000 in cash.

Industry Analysis/Competition

Market Analysis

Initially SavMobi proposed Marketing Platform and Mobile App was to provide delivery and receipt of promotional offers. Current management plans to maintain some of the technological advantages of the previous business platform, but to utilize these features in providing accounting and bookkeeping services, specified towards start-ups, small and medium size businesses, corporations and public listed companies. We aim to help our clients to ensure that their risks are minimized, whilst also maximizing their opportunity towards profitability.

Research from Statisa Inc (https://www.statista.com) reveals that revenue of accounting services in the United States from 2009 to 2014 increasing from $81.88B to $94B gradually. This reflects the exponential demand of accounting services, proving the viability and proof of concepts of the current business plan.

Competition

Cited by over 70% of respondents, attracting and developing new business is the top challenge for accounting and financial services firms. This is in line with a trend across the professional services industries. In many market segments, it’s growing more and more challenging to generate new clients. The competition is fierce.

Demand for accounting services depends on new business formations, the increasing complexity of corporate business, and personal income. The profitability of individual firms depends on the right mix of services and effective marketing. Large firms have advantages in providing wider ranges of services to large corporate clients and having the resources to serve customers with many locations. However, small firms can also compete effectively by specializing and providing superior service.

In a study conducted by The Sleeter Group, 85% of small business owners surveyed said they want their accountant to help them be more proactive in helping them find and use technologies that can help their business become more productive. And 76% reported that their current accountant wasn’t being proactive enough. Nearly half (47%) reported they had changed their accounting firm in the past, at least in part because the firm only provided responsive services.

Patent and Trademarks

We do no currently own any domestic or foreign patents relating to our initial proposed Mobile Marketing Platform and current new plan on accounting and bookkeeping services business.

Employees

As of May 31, 2017, other than its CEO, Mr. Poh Kee Liew and its CFO Mr. Gim Hooi Ooi, the Company has no employees.

ITEM 1A. RISK FACTORS

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable to a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K.

ITEM 2. PROPERTIES

The Company does not own any real estate or other properties and has not entered into any long term lease or rental agreements for property.

ITEM 3. LEGAL PROCEEDINGS

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or stockholder is a party adverse to the Company or has a material interest adverse to the Company.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

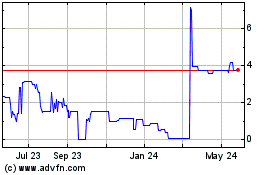

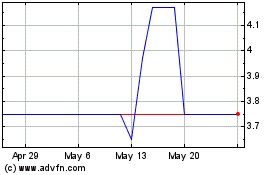

Our common stock was not quoted on any exchange or trading platform and therefore no data is available for the periods ended May 31, 2017 and May 31, 2016.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable to a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Management’s Discussion and Analysis of Financial Condition and Results of Operations is intended to provide a reader of our financial statements with a narrative from the perspective of our management on our financial condition, results of operations, liquidity, and certain other factors that may affect our future results. The following discussion and analysis should be read in conjunction with our audited consolidated financial statements and the accompanying notes thereto included in “Item 8. Financial Statements and Supplementary Data.” In addition to historical financial information, the following discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. See “Forward-Looking Statements.” Our results and the timing of selected events may differ materially from those anticipated in these forward-looking statements as a result of many factors.

Business Overview

SavMobi initially was a technology provider of vendor tools.

After the change in control of management, the Company is phasing out the initial business plan and has now shifted the business operation of the Company to outsourced accounting and bookkeeping services for its clients. Under this revised business plan, the Company will receive a monthly retainer fee from its clients and has cautiously projected this will have a positive cashflow and generate profit to the Company. We aim to help our clients to ensure that their risks are minimized, whilst also maximizing their opportunity towards profitability.

Plan of Operations

After the change in control of management, the Company is phasing out the initial business plan and has now shifted the business operation of the Company outsourced accounting and bookkeeping services for its clients. Management is now reviewing a Macau company to acquire as its subsidiary to hold our accounting and bookkeeping business. We tentatively plan on opening our office in Macau and beginning full operations within the next 12 months.. As part of this plan, we intend on recruiting an executive account manager and bookkeeper as we begin to actively source for new clients to outsource their bookkeeping and accounting services to us directly. We estimate we will have sufficient cash flow to maintain the Company’s daily operations within next 12 months.

Going Concern

Our auditor has indicated in their reports on our financial statements for the fiscal years ended May 31, 2017 and May 31, 2016, that conditions exist that raise substantial doubt about our ability to continue as a going concern due to our recurring losses from operations, deficit in equity, and the need to raise additional capital to fund operations. A “going concern” opinion could impair our ability to finance our operations through the sale of debt or equity securities.

Results of Operations

Fiscal Year Ended May 31, 2017 compared to Fiscal Year Ended to May 31, 2016

We did not earn any revenues from March 6, 2015 (inception) to May 31, 2017.

Expenses for the year ended May 31, 2017 totaled $20,422 consisting primarily of office and general expenses of $4,772, professional fees of $15,650 and exchange gain of $894, resulting in a net loss of $19,528. Expenses for the period for the year ended May 31, 2016 totaled $20,751 consisting primarily of office and general expenses of $4,651, professional fees of $16,100 and exchange gain of $408, resulting in a net loss of $20,343. The net loss in 2017 reduced by $815, compared to 2016 was primarily due to other income exchange gain was increased by $486 compared to 2016.

Capital Resources and Liquidity

Our auditor’s report on our May 31, 2017 financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing business. Since our sole director maybe unwilling or unable to loan or advance us additional capital, we believe that if we do not raise additional capital over the next 12 months, we may be required to suspend or cease the implementation of our business plans. See “May 31, 2017 Audited Financial Statements – Auditors Report.”

As of May 31, 2017, we had $371 of cash compared to $12,399 of cash as of May 31, 2016. We anticipate that our current cash and cash equivalents and cash generated from financing activities will be insufficient to satisfy our liquidity requirements for the next 12 months. To date the Company has incurred operating losses since inception of $43,314. As at May 31, 2017, the Company has a working capital deficit of $129.

The Company requires additional funding to meet its ongoing obligations and to fund anticipated operating losses. Our auditor has expressed substantial doubt about our ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on raising capital to fund its initial business plan and ultimately to attain profitable operations. These financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might result from this uncertainty.

We expect to incur marketing and professional and administrative expenses as well expenses associated with maintaining our filings with the Commission. We will require additional funds during this time and will seek to raise the necessary additional capital. If we are unable to obtain additional financing, we may be required to reduce the scope of our business development activities, which could harm our business plans, financial condition and operating results. Additional funding may not be available on favorable terms, if at all. The Company intends to continue to fund its business by way of equity or debt financing and advances from related parties. Any inability to raise capital as needed would have a material adverse effect on our business, financial condition and results of operations.

If we cannot raise additional funds, we will have to cease business operations. As a result, investors in the Company’s common stock would lose all of their investment.

Off Balance Sheet Arrangements

There are no off-balance sheet arrangements currently contemplated by management or in place that are reasonably likely to have a current or future effect on the business, financial condition, changes in financial condition, revenue or expenses, result of operations, liquidity, capital expenditures and/or capital resources.

Recent Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable to a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The full text of the Company's audited consolidated financial statements for the fiscal years ended May 31, 2017 and May 31, 2016, begins on page F-1 of this Annual Report on Form 10-K.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISLCOSURES

There have been no changes in or disagreements with accountants regarding our accounting, financial disclosures or any other matter.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting, as required by Sarbanes-Oxley (SOX) Section 404 A. The Company’s internal control over financial reporting is a process designed under the supervision of the Company’s Chief Executive Officer and Chief Financial Officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company’s financial statements for external purposes in accordance with U.S. generally accepted accounting principles.

Management assessed the effectiveness of the Company’s internal control over financial reporting based on the criteria for effective internal control over financial reporting established in SEC guidance on conducting such assessments as of the end of the period covered by this report. Management conducted the assessment based on certain criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management concluded that our internal controls over financial reporting were not effective as of May 31, 2017.

The matters involving internal controls and procedures that the Company’s management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee and lack of a majority of outside directors on the Company's board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; (3) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (4) ineffective controls over period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by the Company's Chief Financial Officer in connection with the audit of our financial statements as of May 31, 2017 and communicated the matters to our management.

Management believes that the material weaknesses set forth in items (2), (3) and (4) above did not have an affect on the Company's financial results. However, management believes that the lack of a functioning audit committee and lack of a majority of outside directors on the Company's board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures can result in the Company's determination to its financial statements for the future years.

We are committed to improving our financial organization. As part of this commitment, we will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to the Company: i) Appointing one or more outside directors to our board of directors who shall be appointed to the audit committee of the Company resulting in a fully functioning audit committee who will undertake the oversight in the establishment and monitoring of required internal controls and procedures; and ii) Preparing and implementing sufficient written policies and checklists which will set forth procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements.

Management believes that the appointment of one or more outside directors, who shall be appointed to a fully functioning audit committee, will remedy the lack of a functioning audit committee and a lack of a majority of outside directors on the Company's Board. In addition, management believes that preparing and implementing sufficient written policies and checklists will remedy the following material weaknesses (i) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (ii) ineffective controls over period end financial close and reporting processes. Further, management believes that the hiring of additional personnel who have the technical expertise and knowledge will result proper segregation of duties and provide more checks and balances within the department. Additional personnel will also provide the cross training needed to support the Company if personnel turn over issues within the department occur. This coupled with the appointment of additional outside directors will greatly decrease any control and procedure issues the company may encounter in the future.

We will continue to monitor and evaluate the effectiveness of our internal controls and procedures and our internal controls over financial reporting on an ongoing basis and are committed to taking further action and implementing additional enhancements or improvements, as necessary and as funds allow.

This annual report does not include an attestation report of the company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the company’s registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

There have been no changes in our internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rules 13a-15 or 15d-15 under the Exchange Act that occurred during the small business issuer's last fiscal year that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

We will continue to monitor and evaluate the effectiveness of our internal controls and procedures and our internal controls over financial reporting on an ongoing basis and are committed to taking further action and implementing additional enhancements or improvements, as necessary and as funds allow.

Changes in Internal Control over Financial Reporting

There were no changes that have affected, or are reasonably likely to materially affect, our internal control over financial reporting (as defined in Rules 13a-15(f) or 15d-15(f) under the Exchange Act) during the fiscal year ended May 31, 2016.

ITEM 9B. OTHER INFORMATION

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Our executive officers and director are as follows:

|

Name

|

|

Age

|

|

Position

|

|

Poh Kee Liew

|

|

45

|

|

Chief Executive Officer and Chairman of the Board of Directors

|

|

Gim Hooi Ooi

|

|

36

|

|

Chief Financial Officer and member of the Board of Directors

|

Mr. Liew and Mr. Ooi have held their offices/positions since May 18, 2017. Mr. Liew and Mr. Ooi are expected to hold their offices/positions at least until the next annual meeting of our stockholders.

The former officer of the Company Mr. Lakwinder Singh Sidhu resigned his positions on May 18, 2017.

Business Experience

Mr. Liew, 45, is the current CEO of New Asia Energy, Inc. and was the Director of Business Development for AD Channel Creative, a Malaysian company since 2008. He has more than 20 years’ experience in internal financial and public relations management. He is a recognized graphic designer, and accomplished in internet social media platform development. Mr. Liew has a Diploma in Graphic Design from the PJ College Art and Design, Malaysia, in 1995.

Mr. Ooi, Age 36, brings years of executive experience in the banking and financial services. He is the current CFO of Wike Corporation and was formerly Senior Relationship Manager of Alliance Bank Malaysia Berhad and Account Relationship Manager at Hong Leong Bank Berhad. Mr. Ooi graduated with a BA in Mass Communication from University of Tunku Abdul Rahman in 2005.

Director Independence

Our board of directors is currently composed of two members, Mr. Poh Kee Liew and Mr. Gim Hooi Ooi, who do not qualify as independent directors in accordance with the published listing requirements of the NASDAQ Global Market. The NASDAQ independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director, nor any of his family members has engaged in various types of business dealings with us. In addition, our board of directors has not made a subjective determination as to each director that no relationship exists which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, though such subjective determination is required by the NASDAQ rules. Had our board of directors made these determinations, our board of directors would have reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management.

Involvement in Legal Proceedings

To our knowledge, there have been no material legal proceedings during the last ten years that would require disclosure under the federal securities laws that are material to an evaluation of the ability or integrity of any of our directors or executive officers.

Potential Conflicts of Interest

We are not aware of any current or potential conflicts of interest with Mr. Liew or Mr. Ooi, other business interests and his involvement with SavMobi Technology Inc.

ITEM 11. EXECUTIVE COMPENSATION

Summary Compensation Table

SavMobi Technology Inc., has made no provisions for paying cash or non-cash compensation to its sole officer and director. No salaries are being paid at the present time, and none will be paid unless and until our operations generate sufficient cash flows.

The table below summarizes all compensation awarded to, earned by, or paid to our named executive officer for all services rendered in all capacities to us for the period from inception through May 31, 2017.

Summary Compensation of Named Executive Officers

|

Name and Principal Position

|

|

Fiscal Year

|

|

Salary ($)

|

|

|

Bonus ($)

|

|

|

Stock

Awards ($)

|

|

|

Option

Awards ($)

|

|

|

All Other Compensation ($)

|

|

|

Total ($)

|

|

|

Lakwinder Singh Sidhu (former officer)

|

|

2016

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0

|

|

|

Lakwinder Singh Sidhu (former officer)

|

|

2017

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0

|

|

|

Poh Kee Liew - CEO

|

|

2017

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0

|

|

|

Gim Hooi Ooi - CFO

|

|

2017

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0

|

|

Mr. Liew and Mr. Ooi have held their offices/positions since May 18, 2017. Mr. Liew and Mr. Ooi are expected to hold their offices/positions at least until the next annual meeting of our stockholders.

The former officer of the Company Mr. Lakwinder Singh Sidhu resigned his positions on May 18, 2017.

Outstanding Equity Awards at Fiscal Year End

We did not pay any salaries in 2017 or 2016. None of our executive officers received any equity awards, including, options, restricted stock, performance awards or other equity incentives during the fiscal year ended May 31, 2017 and May 31, 2016 for SavMobi Technology Inc.

Employment Contracts

SavMobi Technology has not entered into any employment agreements with its former sole officer and director. After change in control on May 18, 2016, Company also did not sign any employment agreement with newly appointment CEO and CFO. However, Company plans to pay them $1,500 and $2,000 respectively monthly as their salary starting next quarter.

Stock Awards Plan

The company has not adopted a Stock Awards Plan, but may do so in the future. The terms of any such plan have not been determined.

Director Compensation

The Board of Directors of the Company has not adopted a stock option plan. The company has no plans to adopt it but may choose to do so in the future. If such a plan is adopted, this may be administered by the board or a committee appointed by the board (the “Committee”). The committee would have the power to modify, extend or renew outstanding options and to authorize the grant of new options in substitution therefore, provided that any such action may not impair any rights under any option previously granted. SavMobi Technology Inc. may develop an incentive based stock option plan for its officers and directors and may reserve up to 10% of its outstanding shares of common stock for that purpose.

The table below summarizes all compensation awarded to, earned by, or paid to our directors for all services rendered in all capacities to us for the period from inception (March 6, 2015) through May 31, 2017.

|

DIRECTOR COMPENSATION

|

|

Name

|

|

Fees Earned or

Paid in

Cash

($)

|

|

|

Stock Awards

($)

|

|

|

Option Awards

($)

|

|

|

Non-Equity

Incentive

Plan

Compensation

($)

|

|

|

Non-Qualified

Deferred

Compensation

Earnings

($)

|

|

|

All

Other

Compensation

($)

|

|

|

Total

($)

|

|

|

Lakwinder Singh Sidhu (former director)

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Poh Kee Liew

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Gim Hooi Ooi

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

Mr. Liew and Mr. Ooi have held their offices/positions since May 18, 2017. Mr. Liew and Mr. Ooi are expected to hold their offices/positions at least until the next annual meeting of our stockholders.

The former officer of the Company Mr. Lakwinder Singh Sidhu resigned his positions on May 18, 2017.

Board Committees

We have not formed an Audit Committee, Compensation Committee or Nominating and Corporate Governance Committee as of the filing of this Annual Report. Our Board of Directors performs the principal functions of an Audit Committee. We currently do not have an audit committee financial expert on our Board of Directors. We believe that an audit committee financial expert is not required because the cost of hiring an audit committee financial expert to act as one of our directors and to be a member of an Audit Committee outweighs the benefits of having an audit committee financial expert at this time.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information with respect to the beneficial ownership of our voting securities by (i) each director and named executive officer, (ii) all executive officers and directors as a group; and (iii) each shareholder known to be the beneficial owner of 5% or more of the outstanding common stock of the Company as of May 31, 2017.

Beneficial ownership is determined in accordance with the rules of the SEC. Generally, a person is considered to beneficially own securities: (i) over which such person, directly or indirectly, exercises sole or shared voting or investment power, and (ii) of which such person has the right to acquire beneficial ownership at any time within 60 days (such as through exercise of stock options or warrants). For purposes of computing the percentage of outstanding shares held by each person or group of persons, any shares that such person or persons has the right to acquire within 60 days of May 31, 2017 are deemed to be outstanding, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership.

|

Name and Address of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership Common Stock (1)

|

|

|

Directors and Officers

|

|

No. of Shares

|

|

|

% of Class

|

|

|

New Reap Global Ltd.

|

|

|

|

|

|

|

|

|

|

Room 301, Unit 3, Bld B1, Qingchun Rd 6 Yuan,

Huairou District, Beijing, China.

|

|

|

32,500,000

|

|

|

|

68.42

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Lihui Chen

#443 Xiao Zhang Ge Zhuang Village, Yan Jiao Kai Fa District,

San He City, Hebei, China.

|

|

|

2,500,000

|

|

|

|

5.26

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Poh Kee Liew

17, Jln 22/154, Tmn Bukit Anggerik, 56000 Cheras, Malaysia.

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Gim Hooi Ooi

21, Simpang N/V, 34700 Simpang, Taiping, Perak, Malaysia

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

All officers, directors and Related Party as a group

|

|

|

35,000,000

|

|

|

|

73.68

|

%

|

_________

|

(1)

|

Based on 47,500,000 shares of common stock issued and outstanding as of May 31, 2017.

|

|

|

|

|

(2)

|

On May 18, 2017, Lakwinder Singh Sidhu, the Company’s former Director and CEO, completed a transaction with New Reap Global Ltd., by which New Reap Global Ltd., acquired 32,500,000 shares of common stock, representing 68.4% ownership of the Company. New Reap Global Ltd., paid $300,000 in cash.

|

ITEM 13. CERTAIN RELATIONSHIP AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

Transactions with Related Persons

On April 28, 2015, the Company issued 375,000,000 (7,500,000 pre-split) common shares at $0.00001 ($0.001 pre-split) per share to the sole director and President of the Company for cash proceeds of $7,500.

On April 20, 2016, the directors of the Company approved a special resolution to undertake a forward split of the common stock of the company on a basis of 50 new common shares for 1 old common share. All references in these financial statements to number of common shares, price per share and weighted average number of shares outstanding prior to the 200:1 forward split have been adjusted to reflect the stock split on a retroactive basis, unless otherwise noted.

On January 25, 2016, the founding shareholder returned 342,500,000 (6,850,000 pre-split) restricted shares of common stock to treasury for $10 and the shares were subsequently cancelled by the Company.

On May 18, 2017, Lakwinder Singh Sidhu, the Company’s former Director and CEO, completed a transaction with New Reap Global Ltd., by which New Reap Global Ltd., acquired 32,500,000 shares of common stock, representing 68.4% ownership of the Company. New Reap Global Ltd., paid $300,000 in cash.

During this year, the Company received $19,529 from Lakhwinder Singh Sidhu, the Company’s former President and Director, for operating expenses payment and paid back $3,037. On May 1, 2017, the former president of the Company forgave the related party loan to the Company of $20,695. This is reflected in the financial statements as a credit to Additional-Paid-In-Capital.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Fees paid to Auditors

Audit Fees

For the fiscal year ended May 31, 2017, audit fees were $10,000. For the period ended May 31, 2016, audit fees were $10,000

The SEC requires that before our independent registered public accounting firm is engaged by us to render any auditing or permitted non-audit related service, the engagement be either: (i) approved by our Audit Committee or (ii) entered into pursuant to pre-approval policies and procedures established by the Audit Committee, provided that the policies and procedures are detailed as to the particular service, the Audit Committee is informed of each service, and such policies and procedures do not include delegation of the Audit Committee’s responsibilities to management.

We do not have an Audit Committee. Our Board pre-approves all services provided by our independent registered public accounting firm. All of the above services and fees paid during 2017 and 2016 were pre-approved by our Board.

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

Please see the “Exhibit Index,” which is incorporated herein by reference, following the signature page for a list of our exhibits.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

SAVMOBI TECHNOLOGY INC.

|

|

|

|

|

|

|

Dated: September 26, 2017

|

By:

|

/s/ Poh Kee Liew

|

|

|

|

|

Poh Kee Liew

President, CEO and Director

Principal Executive Officer

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Signature

|

|

Date

|

|

|

|

|

|

|

|

/s/ Gim Hooi Ooi

|

|

September 26, 2017

|

|

|

Gim Hooi Ooi

CFO and Director

Principal Financial Officer

Principal Accounting Officer

|

|

|

|

EXHIBIT INDEX

________

[1] Incorporated by reference from the Company’s S-1 filed with the Commission on September 8, 2015.

f[2] Incorporate by reference from the Company’s S-1 filed with the Commission on September 8, 2015

* Included in Exhibit 31.1

**

Included in Exhibit 32.1

SAVMOBI TECHNOLOGY INC.

FINANCIAL STATEMENTS

(Audited)

May 31, 2017

|

PLS CPA, A PROFESSIONAL CORPORATION

t

4725 MERCURY STREET #210

t

SAN DIEGO

t

CALIFORNIA 92111

t

t

TELEPHONE (858)722-5953

t

FAX (858) 761-0341

t

FAX (858) 764-5480

t

E-MAIL changgpark@gmail.com

t

|

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Savmobi Technology Inc.

We have audited the accompanying balance sheet of Savmobi Technology Inc. of May 31, 2017 and 2016 and the related financial statements of operations, changes in shareholder’s equity and cash flows for the year ended May 31, 2017 and 2016. These financial statements are the responsibility of the Company’s management.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Savmobi Technology Inc. as of May 31, 2017 and 2016, and the results of its operation and its cash flows for the year ended May 31, 2017 and 2016 in conformity with U.S. generally accepted accounting principles.

The financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company’s losses from operations raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ PLS CPA

PLS CPA, A Professional Corp.

August 29, 2017

San Diego, CA. 92111

Registered with the Public Company Accounting Oversight Board

SAVMOBI TECHNOLOGY INC

BALANCE SHEETS

|

|

|

May 31,

2017

|

|

|

May 31,

2016

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash

|

|

$

|

371

|

|

|

$

|

12,399

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS

|

|

$

|

371

|

|

|

$

|

12,399

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

500

|

|

|

$

|

9,992

|

|

|

Due to related party (Note 4)

|

|

|

-

|

|

|

|

4,203

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES

|

|

|

500

|

|

|

|

14,195

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

Common stock (Note 3)

|

|

|

|

|

|

|

|

|

|

Authorized 75,000,000 shares of common stock, $0.001 par value, Issued and outstanding 47,500,000 shares of common stock (May 31, 2016 – 47,500,000)

|

|

|

47,500

|

|

|

|

47,500

|

|

|

Additional paid in capital

|

|

|

(4,315

|

)

|

|

|

(25,010

|

)

|

|

Stock subscription receivable

|

|

|

-

|

|

|

|

(500

|

)

|

|

Accumulated deficit

|

|

|

(43,314

|

)

|

|

|

(23,786

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS’ DEFICIT

|

|

|

(129

|

)

|

|

|

(1,796

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

$

|

371

|

|

|

$

|

12,399

|

|

The accompanying notes are an integral part of these financial statements.

SAVMOBI TECHNOLOGY INC.

CONDENSED STATEMENTS OF OPERATIONS

|

|

|

Year ended

May 31,

2017

|

|

|

Year ended

May 31,

2016

|

|

|

|

|

|

|

|

|

|

|

REVENUE

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

Office and general

|

|

$

|

4,772

|

|

|

$

|

4,651

|

|

|

Professional fees

|

|

|

15,650

|

|

|

|

16,100

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL EXPENSES

|

|

|

(20,422

|

)

|

|

|

(20,751

|

)

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSES)

|

|

|

|

|

|

|

|

|

|

Exchange (Loss) gain

|

|

|

894

|

|

|

|

408

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OTHR INCOME(EXPENSE)

|

|

|

894

|

|

|

|

408

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

|

(19,528

|

)

|

|

|

(20,343

|

)

|

|

|

|

|

|

|

|

|

|

|

|

BASIC NET LOSS PER COMMON SHARE

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF BASIC COMMON SHARES OUTSTANDING

|

|

|

47,500,000

|

|

|

|

339,082,192

|

|

The accompanying notes are an integral part of these financial statements.

SAVMOBI TECHNOLOGY INC.

STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE PERIOD FROM March 6, 2015 (INCEPTION) TO MAY 31, 2017

|

|

|

Common Stock

|

|

|

Additional

|

|

|

Stock

|

|

|

|

|

|

|

|

|

|

|

Number of

shares

|

|

|

Amount

|

|

|

Paid-in

Capital

|

|

|

Subscription Receivable

|

|

|

Accumulated

Deficit

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares issued for cash –

at $0.00001 per share, April 28, 2015

|

|

|

375,000,000

|

|

|

$

|

375,000

|

|

|

$

|

(367,500

|

)

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

7,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year ended May 31, 2015

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(3,443

|

)

|

|

|

(3,443

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, May 31, 2015

|

|

|

375,000,000

|

|

|

|

375,000

|

|

|

|

(367,500

|

)

|

|

|

-

|

|

|

|

(3,443

|

)

|

|

|

4,057

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares issued for cash-

At $0.001 per share March 8, 2016

|

|

|

15,000,000

|

|

|

|

15,000

|

|

|

|

-

|

|

|

|

(500

|

)

|

|

|

-

|

|

|

|

14,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares cancelled –

at $0.000000029 per share, April 20, 2016

|

|

|

(342,500,000

|

)

|

|

|

(342,500

|

)

|

|

|

342,490

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(10

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year ended May 31, 2016

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(20,343

|

)

|

|

|

(20,343

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, May 31, 2016

|

|

|

47,500,000

|

|

|

$

|

47,500

|

|

|

$

|

(25,010

|

)

|

|

$

|

(500

|

)

|

|

$

|

(23,786

|

)

|

|

$

|

(1,796

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares issued for cash – January 10, 2017

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

500

|

|

|

|

-

|

|

|

|

500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder loan forgiven- May 31, 2017

|

|

|

-

|

|

|

|

-

|

|

|

|

20,695

|

|

|

|

-

|

|

|

|

-

|

|

|

|

20,695

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year ended May 31, 2017

|

|

|

-

|

|

|

|

--

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(19,528

|

)

|

|

|

(19,528

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, May 31, 2017

|

|

|

47,500,000

|

|

|

$

|

47,500

|

|

|

$

|

(4,315

|

)

|

|

$

|

-

|

|

|

$

|

(43,314

|

)

|

|

$

|

(129

|

)

|

The accompanying notes are an integral part of these financial statements.

SAVMOBI TECHNOLOGY INC.

STATEMENTS OF CASH FLOWS

|

|

|

Year ended

May 31,

2017

|

|

|

Year ended

May 31,

2016

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss for the period

|

|

$

|

(19,528

|

)

|

|

$

|

(20,343

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in Accounts payables and accrued liabilities

|

|

|

(9,492

|

)

|

|

|

9,992

|

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH USED IN OPERATING ACTIVITIES

|

|

|

(29,020

|

)

|

|

|

(10,351

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOW FROM INVESTING ACTIVITIES

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOW FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds on sale of common stock

|

|

|

-

|

|

|

|

14,990

|

|

|

Stock subscription receivable

|

|

|

500

|

|

|

|

(500

|

)

|

|

Proceeds from related party

|

|

|

19,529

|

|

|

|

604

|

|

|

Payment for the loan from related party

|

|

|

(3,037

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY FINANCING ACTIVITIES

|

|

|

16,992

|

|

|

|

15,094

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH

|

|

|

(12,028

|

)

|

|

|

4,743

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH, BEGINNING

|

|

|

12,399

|

|

|

|

7,656

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH, ENDING

|

|

$

|

371

|

|

|

$

|

12,399

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION AND NONCASH FINANCING ACTIVITIES;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

The accompanying notes are an integral part of these d financial statements.

|

NOTE 1 – NATURE OF OPERATIONS AND BASIS OF PRESENTATION

|

On March 6, 2015 the Company was incorporated in the State of Nevada and established a fiscal year end of May 31. Initially the business platform was in providing application software to a global vendor platform to connect people to businesses and provide a new shopping experience. The Company’s previous principal offices are located in 73B Bank Avenue, Amritsar, Punjab, 143001, India.

On May 18, 2017, Lakwinder Singh Sidhu, the Company’s former Director and CEO, completed a transaction with New Reap Global Ltd., by which New Reap Global Ltd., acquired 32,500,000 shares of common stock, representing 68.4% ownership of the Company. After the change ownership, the Company’s current principal offices are located in Travessa do Cais, No 3A, Edg. Kai Lei, Macau.

Initially SavMobi proposed Marketing Platform and Mobile App was to provide delivery and receipt of promotional offers. After the change in control of management, the Company is phasing out the initial business plan and has now shifted the business operation of the Company to outsourced accounting and bookkeeping services for its clients. Management is now reviewing a Macau company to acquire as its subsidiary to hold our accounting and bookkeeping business. Under this revised business plan, the Company will receive a monthly retainer fee from its clients and has cautiously projected this will have a positive cash flow and generate profit to the Company. We aim to help our clients to ensure that their risks are minimized, whilst also maximizing their opportunity towards profitability. The Company has not yet implemented its initial and new business model and to date has generated no revenues.

Going concern

To date the Company has generated no revenues from its business operations and has incurred operating losses since inception of $43,314. As at May 31, 2017, the Company has a working capital deficit of $129. The Company requires additional funding to meet its ongoing obligations and to fund anticipated operating losses. The ability of the Company to continue as a going concern is dependent on raising capital to fund its initial business plan and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt as to the Company’s ability to continue as a going concern. The Company intends to continue to fund its business by way of private placements and advances from related parties as may be required. As of May 31, 2017, the Company has issued 375,000,000 founders shares at $0.00001 per share for net proceeds of $7,500 to the Company and private placements of 15,000,000 common shares at $0.001 per share for net proceeds of $15,000. These financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might result from this uncertainty.

|

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

Basis of Presentation

The financial statements present the balance sheet, statements of operations, stockholders’ equity (deficit) and cash flows of the Company. These financial statements are presented in the United States dollars and have been prepared in accordance with accounting principles generally accepted in the United States.

Segmented Reporting

FSAB ASC 280, “Disclosure about Segments of an Enterprise and Related Information”, changed the way public companies report information about segments of their business in their quarterly reports issued to shareholders. It also requires entity-wide disclosures about the products and services the entity provides, the material countries in which it holds assets and reports revenues and its major customers.

Comprehensive Loss

“Reporting Comprehensive Income,” establishes standards for the reporting and display of comprehensive loss and its components in the financial statements. As at May 31, 2017, the Company has no items that represent a comprehensive loss and, therefore, has not included a schedule of comprehensive loss in the financial statements.

|

SAVMOBI TECHNOLOGY INC.

NOTES TO FINANCIAL STATEMENTS

May 31, 2017

|

|

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

|

Use of Estimates and Assumptions

Preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Accordingly, actual results could differ from those estimates.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers highly liquid financial instruments purchased with a maturity of three months or less to be cash equivalents.

Foreign Currency Translation

The Company translates the foreign currency financial statements into US Dollars using the year or reporting period end of average exchange rates in accordance with the requirements of Accounting Standards Codification subtopic 830-10, Foreign Currency Matters (“ASC 830-10”). Assets and liabilities of these subsidiaries were translated at exchange rates as of the balance sheet date. Revenues and expenses are translated at average rates in effect for the periods presented. The cumulative translation adjustment is included in the accumulated other comprehensive gain (loss) within shareholders’ equity (deficit). Foreign currency transaction gains and losses arising from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations.

Financial Instruments

All significant financial assets, financial liabilities and equity instruments of the Company are either recognized or disclosed in the financial statements together with other information relevant for making a reasonable assessment of future cash flows, interest rate risk and credit risk. Where practical the fair values of financial assets and financial liabilities have been determined and disclosed; otherwise only available information pertinent to fair value has been disclosed.

Loss per Common Share

The basic earnings (loss) per share is calculated by dividing the Company’s net income available to common shareholders by the weighted average number of common shares during the year. The diluted earnings (loss) per share is calculated by dividing the Company’s net income (loss) available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. Diluted earnings (loss) per share are the same as basic earnings (loss) per share due to the lack of dilutive items in the Company.

Income Taxes

The Company follows the liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax balances and tax loss carry-forwards. Deferred tax assets and liabilities are measured using enacted or substantially enacted tax rates expected to apply to the taxable income in the years in which those differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the date of enactment or substantive enactment.

|

SAVMOBI TECHNOLOGY INC.

NOTES TO FINANCIAL STATEMENTS

May 31, 2017

|

Stock-based Compensation