Aberdeen Asian Income Fund Limited Edison issues update on Aberdeen Asian Income Fund

November 11 2021 - 2:00AM

RNS Non-Regulatory

TIDMAAIF

Aberdeen Asian Income Fund Limited

11 November 2021

London, UK, 11 November 2021

Edison issues update on Aberdeen Asian Income Fund (AAIF)

With a focus on income and growth, Aberdeen Asian Income Fund's

(AAIF) dual investment strategy has proved successful. The team

targets the income and growth potential of Asia's most compelling

and sustainable companies. AAIF's 4.1% yield is competitive with

its four Asian income peers. The focus on high-quality businesses

creates a relatively defensive tilt in regional equities. Over the

past 12 months (to end-October), AAIF posted a 24.3% NAV total

return, outperforming peers and both the broad and high dividend

yield indices, by 13.5pp and 7.7pp, respectively. AAIF's team

believes the fund's focus on quality has helped deliver a

consistently robust performance during the pandemic.

The abrdn team is known for its quality stock-picking approach

and value tilt. Followed by the team since the company's launch in

December 2005, this quality approach served investors well during a

challenging 2020, protecting on the downside. The outperformance

has continued into 2021, against a backdrop of increasingly

negative sentiment towards Asian markets on the back of regulatory

measures across a number of corporate sectors in China,

particularly technology, property and education. This has

contributed to AAIF's cum-fair discount widening to 12.9% compared

to its three-year average of 9.6%. We believe there is scope for

this to narrow if investors rotate into quality and value. In

addition, the commercial robustness and financial strength of

portfolio investees should support AAIF's future dividend

payout

Click here to view the full report or here to sign up to receive

research as it is published.

All reports published by Edison are available to download free

of charge from its website

www.edisongroup.com

About Edison: E dison is a leading research and investor

relations consultancy, connecting listed companies to the widest

pool of global investors. By focusing on the volume and quality of

investors reached - across institutions, family offices, wealth

managers and retail investors - Edison can create and gauge intent

to purchase, even in the darkest pools of capital, and then make

introductions via non-deal roadshows, events or virtual

meetings.

Having been the first in-market 17 years ago, Edison now has

more than 100 analysts covering every economic sector.

Headquartered in London, Edison also has offices in New York,

Frankfurt, Amsterdam and Tel Aviv and a presence in Athens,

Johannesburg and Sydney.

Edison is authorised and regulated by the Financial Conduct

Authority .

Edison is not an adviser or broker-dealer and does not provide

investment advice. Edison's reports are not solicitations to buy or

sell any securities.

For more information, please contact Edison:

Victoria Chernykh +44 (0)20 3077 5700

investmenttrusts@edisongroup.com

Sarah Godfrey +44 (0)20 3681 2519

investmenttrusts@edisongroup.com

Learn more at www.edisongroup.com and connect with Edison on:

LinkedIn www.linkedin.com/company/edison-group-/

Twitter www.twitter.com/Edison_Inv_Res

YouTube www.youtube.com/edisonitv

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRABMBATMTIBBTB

(END) Dow Jones Newswires

November 11, 2021 03:00 ET (08:00 GMT)

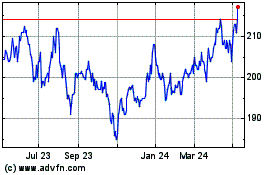

Abrdn Asian Income (LSE:AAIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

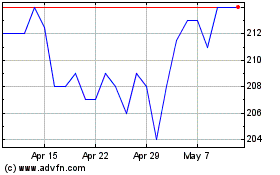

Abrdn Asian Income (LSE:AAIF)

Historical Stock Chart

From Apr 2023 to Apr 2024