TIDMAAS

RNS Number : 9548T

Aberdeen Standard Asia Focus PLC

30 November 2021

Aberdeen Standard Asia Focus PLC

Legal Entity Identifier (LEI): 5493000FBZP1J92OQY70

Proposed Changes to the Company

30 November 2021

The Board of Aberdeen Standard Asia Focus PLC (the "Company" or

"AAS") has conducted a comprehensive review of the Company's

long-term strategy to ensure that the investment policy captures

the immense opportunities that exist in the Asian small cap market.

This applies to both South Asia but also North Asia with the

emergence of China as the world's second largest economy and fast

expanding stock markets to match.

As part of the review, the Board also addressed the issue of how

to make the Company more competitive whilst giving shareholders,

and in particular, retail investors a more meaningful participation

in the Company's ongoing success. The Board believes that the

measures proposed below will assist in the marketability of the

Company's shares, thus increasing the potential to narrow the

discount to net asset value.

During the course of the review, the Board has consulted with

abrdn, outside specialists in the Asian markets and the Company's

major shareholders.

As a result of this, the Board intends to propose the following

changes to the Company:

- Amend the investment policy to allow more flexibility to

invest in growing small companies across Asia;

- Strengthen the management team by adding Flavia Cheong,

abrdn's Head of Equities, Asia Pacific, as joint lead manager with

Hugh Young. The investment management team will be bolstered to

reflect the increasing importance of China;

- Increase the target dividend by 100% to 32.0 pence per

ordinary share for the financial year ending 31 July 2022, payable

quarterly and thereafter maintain the progressive dividend policy

of the last 25 years;

- Reduce the running costs of the Company. abrdn have agreed to

an amended, tiered management fee, still payable on market

capitalisation. The amended fee will be 0.85% per annum for the

first GBP250m, 0.6% per annum for the next GBP500m and 0.5% per

annum for market capitalisation of GBP750m and above. It is

currently set at 0.96% of market capitalisation;

- Increase the marketability of the Company's ordinary shares

for small investors by introducing a five for one ordinary share

split; and

- Introduce a performance-linked tender offer, which would be

triggered in the event of underperformance of the NAV per ordinary

share versus the MSCI AC Asia ex Japan Small Cap Index over a

five-year period commencing 1 August 2021.

Changes to Investment Policy

The Company will continue to focus on offering investors

exposure to attractive small, quoted companies in Asia that have

excellent prospects for strong growth in shareholder value, good

balance sheets and skilled, experienced management. As has been

demonstrated over the last 26 years where GBP1,000 invested in 1995

is now worth approximately GBP22,500 (share price at close on 26

November 2021 with dividends reinvested) with the dividends

(including special dividends) to shareholders increasing from 1.2

pence per ordinary share in 1996 to 16.0 pence in 2021. The Board

and abrdn believe that this area of the market will continue to

deliver strong growth over the medium to long term.

Over the same period, the stock markets of the region have

developed from small emerging markets to some of the largest in the

world. Therefore, the Board believes it is necessary to make

changes to the Company's investment objective and policy to ensure

abrdn can continue to invest in companies that can deliver the best

returns for shareholders and not to be inhibited by the enormous

difference in the relative size of the Asian markets. The

definition of a small cap company varies from market to market with

China and India at one end of the scale and very small markets,

like Sri Lanka, at the opposite end.

The Company's current investment objective and policy limits

investment into companies that have a market capitalisation of up

to approximately US$1.5 billion. The Board strongly believes this

is limiting the portfolio managers from investing in the high

growth companies particularly in larger markets like China and

India. As a result, the Board proposes to remove this market

capitalisation limit from the investment policy while stressing

that this will remain as a small company portfolio. The investment

managers will continue to seek out small companies capable of

delivering strong capital growth.

Historically, the Company has had limited investments in

Australasia and the Board does not believe the outlook for this

region will offer the same growth prospects as other parts of Asia.

Therefore, the Board proposes amending the investment policy so no

new investments will be made in Australasia. The Company currently

has three holdings in Australasia and the investment manager does

not intend to dispose of these should shareholders approve the

change in investment policy.

The changes to the investment objective and policy are subject

to FCA and shareholder approval.

abrdn Investment Team

The Board is delighted to announce that Flavia Cheong, abrdn's

Head of Equities, Asia Pacific, will be joining the management team

of AAS, as joint lead manager alongside Hugh Young and Gabriel

Sacks. Neil Sun will also join the team directly responsible for

managing the potential increased weighting in North Asia.

abrdn continues to build out its investment presence in Shanghai

and Hong Kong, with a current team of 8 investment professionals,

expected to grow to 10 during 2022, focusing on researching Chinese

equities. The Company and the investment team will be able to draw

on the knowledge and expertise of these individuals, giving AAS

greater access to Chinese small cap companies. Over time, it is

envisaged that they will also take on greater individual

responsibility for AAS's Chinese holdings.

Flavia Cheong is the Head of Asia Pacific Equities at abrdn,

where, as well as sharing responsibility for company research, she

oversees regional portfolio construction. Before joining abrdn in

1996, she was an economist with the Investment Company of the

People's Republic of China, and earlier with the Development Bank

of Singapore. Flavia graduated with a BA in Economics and an MA

(Hons) in Economics from the University of Auckland. She is a CFA

charter holder.

Neil Sun is an Investment Manager within the Asian Equities Team

at abrdn. Neil joined the company in 2018. Previously, Neil worked

as a Research Analyst at Deutsche Bank covering the lithium battery

supply chain in Hong Kong. Prior to that, Neil worked for JPMorgan

Asset Management as a Research Analyst covering both China and

Taiwan equities. Neil graduated with a BBA in Finance from National

Taiwan University, and passed level II of the CFA Program.

Future Dividend Policy

The Company's policy remains to provide long-term capital growth

but the Board notes some investors are looking for a regular level

of income alongside capital growth, particularly in the current low

interest rate environment.

The Board is therefore proposing to increase the level of target

dividends paid by the Company through distribution from capital

reserves as well as income. Under this new policy, the Board aims

to set a target dividend of 32.0 pence per ordinary share for the

financial year ending 31 July 2022 and progressively grow it

thereafter [1] . This would represent a 100% increase in the

dividend based on the 16.0 pence per ordinary share recommended in

the financial year ending 31 July 2021. This target dividend will

be paid in equal quarterly instalments.

Assuming that the changes are approved at the General Meeting on

27 January 2022, the Company intends to declare in February 2022 an

initial target dividend of 16.0 pence per ordinary share relating

to the 6 month period from 1 August 2021 to 31 January 2022 and

thereafter 8.0 pence per ordinary share per quarter. In the current

year, we estimate that this level of dividend would require a 5.0

pence per ordinary share (GBP1.6 million) distribution from capital

reserves.

The Company's dividend record is very strong with the ordinary

dividend having been maintained or increased in 24 out of 25 years.

This one time step change will mean that in future it is unlikely

the Company will be paying special dividends but, absent a market

collapse, the Board will aim to maintain its progressive approach

albeit off a higher base.

The Board has no desire to change how the portfolio managers

select stocks for the portfolio.

Management Fee

The Company currently pays a management fee at the rate of 0.96%

per annum of the Company's market capitalisation. Following

discussions with abrdn, the Board is pleased to announce a new,

tiered management fee, still based on market capitalisation. The

amended fee will be 0.85% per annum for the first GBP250m, 0.6% per

annum for the next GBP500m and 0.5% per annum for market

capitalisation of GBP750m and above. This represents a fee of 0.74%

based on the Company's last closing share price of 1,465.0 pence

and is a reduction of 23% in the management fee.

The change in management fees will be conditional on shareholder

approval of the proposals outlined in this announcement and will be

back dated as if it had been effective from 1 August 2021.

Share Split

The Board is proposing to implement a sub-division of the

Company's share capital. This is intended to improve the liquidity

of the Company's shares and enhance the ability of investors to

make more efficient regular monthly investments.

The Directors are recommending a five for one share split which

will increase the number of ordinary shares in issue by a factor of

five.

The Conversion Price of the 2.25 per cent convertible unsecured

loan stock 2025 will be automatically and pro rata adjusted should

shareholders approve the share split.

Introduction of a Performance-Linked Tender Offer

The Board is proposing the introduction of a performance-linked

tender offer. If the Company's NAV total return is less than that

of the MSCI AC Asia ex-Japan Small Cap Index over a five-year

assessment period (commencing 1 August 2021), shareholders should

be offered the opportunity to realise a proportion of their holding

for cash at a level close to NAV less costs of the tender offer.

The tender offer would be capped at a maximum of 25% of the issued

share capital of the Company at that time.

Shareholder Approvals and Timing

The changes are conditional on the necessary shareholder

approvals and the appropriate regulatory approvals.

It is currently envisaged that a shareholder circular and notice

of general meeting setting out further details of the proposed

changes will be sent to shareholders in December 2021 along with

notice of the Annual General Meeting. The General Meeting to

approve the proposals is expected to be convened on 27 January

2022, following the Annual General Meeting.

The Company will hold an interactive Online Shareholder

Presentation which will be held at 11:00 a.m. on Wednesday 19

January 2022. At the presentation, the Chairman and Manager will

provide further details on the proposals and there will be the

opportunity for an interactive question and answer session. Full

details on how to how to register for the Online Shareholder

Presentation can be found at

https://www.workcast.com/register?cpak=5119566346944925 .

Nigel Cayzer, Chairman commented:

"This Company has achieved an outstanding result for

shareholders delivering some of the best returns available from

funds quoted on the London Stock Exchange with GBP1,000 invested in

1995 now worth approximately GBP22,500. This is in large part

thanks to the work of Hugh Young, and his team in Singapore.

I am confident that the Board instigated review will best

position the Company to continue the strong performance of the last

quarter century.

The changes we announce today will significantly reduce the

running costs of the Company through the reduction in the

management fee, increase the annual participation in the success of

the Company through the dividend increase , and introduce a

possible tender offer in 5 years.

We also welcome the broadening of the investment management team

which will strengthen our access to the North Asian markets

including China, where huge opportunities exist in small cap

stocks. "

Hugh Young, abrdn commented:

"I am delighted to welcome Flavia Cheong as my co-manager. She

will assist Gabriel Sacks and the teams in both North and South

Asia in taking advantage of the opportunities that continue to

present themselves across the Asian markets. The maturing of the

stock markets in China over the last ten years opens up another

fertile field for us to look for companies capable of delivering

exceptional returns, particularly when combined with the rigorous

abrdn investment process that has served so well in the past. I

remain as excited by the opportunities in Asia as I did when I

first arrived in Singapore 30 years ago. I believe the changes

announced today will strengthen both the investment proposition and

underpin the future prospects of the Company."

Flavia Cheong, abrdn, commented

"I am delighted to be joining the team at AAS. We are all very

excited by the future of small companies across Asia. The

successful implementation of the changes to the aims and policy of

the Company has my full and enthusiastic support and we all look

forward to continuing the journey so ably started by Hugh in

1995."

For further information

abrdn

William Hemmings +44 (0)20 7463 6223

Stephanie Hocking +44 (0)20 7463 6403

Panmure Gordon

Sapna Shah +44 (0)20 7886 2783

Alex Collins +44 (0)20 7886 2767

Brunswick

Nick Cosgrove +44 (0)207 404 5959

Robin Wrench +44 (0)207 404 5959

[1] Should the share split be approved by shareholders this

dividend will be rebased to 6.40 pence per ordinary share. This is

a target dividend and not a profit forecast and should not be taken

as an indication of the Company's expected or actual future

results.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFZMZMMLRGMZZ

(END) Dow Jones Newswires

November 30, 2021 02:00 ET (07:00 GMT)

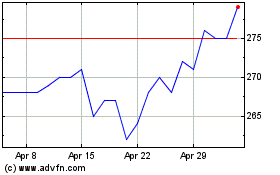

Abrdn Asia Focus (LSE:AAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

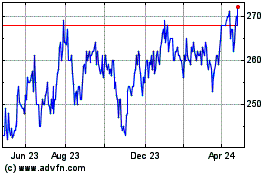

Abrdn Asia Focus (LSE:AAS)

Historical Stock Chart

From Apr 2023 to Apr 2024