TIDMAAS

RNS Number : 9552T

Aberdeen Standard Asia Focus PLC

30 November 2021

ABERDEEN STANDARD ASIA FOCUS PLC

Legal Entity Identifier (LEI): 5493000FBZP1J92OQY70

ANNUAL FINANCIAL REPORT FOR THE YEARED 31 JULY 2021

STRATEGIC REPORT - COMPANY SUMMARY AND FINANCIAL HIGHLIGHTS

Financial Highlights

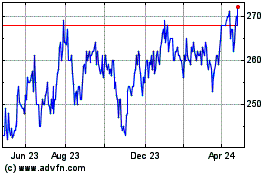

Net asset value total return MSCI AC Asia Pacific MSCI AC Asia Pacific

(diluted){AB} ex Japan Index total ex Japan Small Cap

return{C} Index total return{C}

2021: +41.9% 2021: +14.1% 2021: +37.2%

2020: -13.6% 2020: +1.9% 2020: -2.5%

-------------------------------------- ---------------------- -----------------------

Share price total return{A} Discount to net asset Dividends per Ordinary

value{AB} share{D}

2021: +38.2% 2021: 13.9% 2021: 6.00p

2020: -13.2% 2020: 11.4% 2020: 19.00p

-------------------------------------- ---------------------- -----------------------

{A} Alternative Performance Measure (see below for definition).

{B} Presented on a diluted basis as the Convertible Unsecured Loan

Stock ("CULS") is "in the money" (2020 not "in the money" so basic

net asset value used).

{C} Currency adjusted, capital gains basis.

{D} Dividends are subject to shareholder approval at the Annual General

Meeting.

STRATEGIC REPORT - CHAIRMAN'S STATEMENT

Results

I am very pleased to not only announce the annual results for

the year ended 31 July 2021 but also to announce a series of

changes that follow from a comprehensive strategic review, that the

Board has undertaken during the last 12 months.

In large part thanks to the work of Hugh Young, and his team in

Singapore, this Company has achieved, since it was founded in 1995,

an outstanding result for shareholders, delivering some of the best

returns available from funds quoted on the London Stock Exchange.

The purpose of the review and the introduction of new talent to the

abrdn team, outlined in more detail below, is to put the Company in

a position whereby it can repeat the success of the last quarter

century in the next; to turn GBP1,000 invested in 1995 into

GBP22,500 today (share price at close on 26 November 2021 with

dividends reinvested).

The Board has also proposed a number of changes including a

reduction in the management fee to significantly reduce the running

costs of the Company, an increase in the dividend target for the

current financial year and the introduction of a performance based

tender offer in five years.

Year Under Review

The past year and more has been an unprecedented time, with the

world as a whole having to deal with the shape-shifting Covid-19

virus. And yet, stock markets have continued to mark new highs,

even as the pandemic upended everyday routines and threw supply

chains into disarray. Stock investors found themselves in a sweet

spot, as the largesse of governments and support of central banks

not only helped fuel a nascent recovery in the global economy, but

also pumped ample liquidity into asset prices.

Asia, the first region to emerge from the depths of the

pandemic, was also among the first to mull over monetary policy

tightening, especially in markets such as China and South Korea.

While regulatory fears in China hit the share prices of a variety

of major oligopolistic companies hard, small cap stocks were far

less affected. As a result, the MSCI Asia Pacific ex-Japan Small

Cap Index, outpaced its large-cap counterpart, rebounding 37.2%

over the year under review. With such a strong performance it is

pleasing, therefore, to report that your Company's net asset value

("NAV") outperformed that Index during the year, rising by 41.9% on

a total return basis. The Company's share price also outperformed

the Index, despite the discount widening slightly (from 11.4% to

13.9%), rising by 38.2% on a total return basis.

This theme of much-improved performance also means that, over

three years to 31 July 2021, the Company's performance, in share

price and NAV terms, is broadly in line with the MSCI Asia Pacific

ex-Japan Small Cap Index and comfortably ahead of the MSCI AC Asia

Pacific ex-Japan Index. Strong outperformance has been compounded

for our loyal long term shareholders who have enjoyed NAV returns

over ten years and since inception of 161% and 2,160% respectively,

compared to 116% and 487% for the MSCI Asia Pacific ex-Japan Index

and 94% over ten years (figures since the Company's inception not

available) for the MSCI Asia Pacific ex-Japan Small Cap Index.

Market Overview

In the reporting period, liquidity and sentiment have continued

to underpin equity markets. Governments and central banks unleashed

their arsenals to counter the dampening effects of lockdowns,

ranging from direct cash transfers to interest rate cuts and asset

purchases. With social-distancing measures stifling both consumer

spending and businesses, a surfeit of money found its way into

financial markets, lifting asset prices. In the summer, with the

virus seemingly under control, regional economies reopened and

demand returned. But as supply chains ran into bottlenecks, arising

largely from mobility restrictions on labour, prices rose across

products like smartphones and cars. This boosted companies' bottom

lines which, in turn, added to the market euphoria. Subsequently,

fresh waves of outbreaks that resulted in localised lockdowns in

various countries only slightly tempered investor optimism, as

consumers and businesses adapted better to the challenging

conditions.

Nowhere was this more apparent than China, one of Asia's two

economic giants. It was "first in, first out" of the pandemic for

the world's most populous nation, after an aggressive countrywide

lockdown in the initial months of 2020. Its economy had mostly

bounced back to normal by mid-2020. But by then, Beijing had also

decided to set a new policy course, one that would evoke growing

consternation among investors. As I intimated in the Half-Yearly

Report, Beijing was pivoting from its focus on industry upgrading

to spurring consumption through fairer wealth distribution. In the

past 12 months, policymakers strengthened their focus on this goal,

introducing a raft of reforms across various sectors, from internet

and e-commerce, to private tutoring and healthcare. Whilst such

measures caused a retreat in the broad stock market indices due to

the sheer size of some of the companies involved, the situation

proved fortuitous for your Manager, who identified bargains in

downtrodden quality names and added to your Company's exposure. The

spirit of private enterprise remains strong in China, which after

all is the world's second-largest economy. Now boasting a highly

developed infrastructure, a well-educated workforce and cutting

edge technology, China still presents a great opportunity for the

diligent stock picker and your Manager is keen to add more Chinese

exposure to your Company's holdings as the opportunity presents

itself.

In neighbouring India, the other Asian behemoth that makes up

the largest part of the portfolio, stocks jumped nearly 80% in

spite of very real challenges, including fresh waves of Covid-19

outbreaks. A fruitful monsoon in late 2020, which supported rural

spending, along with a pro-growth Budget in early 2021 lifted stock

prices. Even when the country slipped into the death-grip of the

pandemic's second wave in April, markets stayed resilient, with

investors looking past the immediate crisis on hopes of a quick

rebound. Also underpinning share prices were surprisingly good

corporate earnings growth, as well as New Delhi's preference to

leave mobility restrictions to the discretion of states rather than

a one-size-fits-all approach. Meanwhile, a rich seam of initial

public offerings allowed your Manager to subscribe to a couple of

high quality names that raised the Company's exposure to

new-economy growth stocks. Overall, the portfolio has a broad

exposure to key sectors, from new-economy software firms to more

traditional ones, such as energy and real estate, all of which

stand to benefit from the massive domestic market.

Elsewhere, the Company's exposure to Taiwan was a key

contributor to the Company's outsized returns. Over the period,

your Manager also put more money in the market, bolstering the

portfolio's exposures to tech hardware and digital services.

Conversely, the Company's gains were capped by poor performance in

parts of Southeast Asia, which struggled to contain the

coronavirus. As a result, your Manager divested a number of

underlying holdings and reduced positions in Thailand and Malaysia,

which now have dimmer growth outlooks. A more detailed report of

the Company's performance and portfolio changes can be found in the

Manager's review.

Dividend

As highlighted in last year's Annual Report the Board intends to

smooth out the short-term impact of the pandemic on earnings by

using revenue reserves where necessary, and is therefore

recommending an increased final dividend of 15.0p per share (2020

14.5p) together with a special dividend of 1.0p (2020: 4.5p). The

payments will necessitate a small distribution of GBP2.55m from the

Company's brought forward revenue reserves to cover this shortfall

in revenue, and following the payment there will be over 24p per

share of reserves available for future years' dividends. If

approved by shareholders at the Annual General Meeting of the

Company on 27 January 2022, both dividends will be paid on 2

February 2022 to shareholders on the register as at 7 January

2022.

The proposed future dividend policy of the Company is outlined

below and will apply to the current financial year ending 31 July

2022.

Gearing and Share Capital Management

The Company's year-end net gearing was 10.0%. The gearing is

provided by the GBP36.68 million of Convertible Unsecured Loan

Stock 2025 ("CULS 2025") together with the new GBP30 million 15

year Senior Unsecured Loan Note (the "Loan Note"). The new Loan

Note was drawn down on 1 December 2020 and used to repay, and

cancel in full, the Company's GBP20 million Revolving Credit

Facility with the Royal Bank of Scotland. Under the terms of the

Loan Note, an additional GBP35 million is available for drawdown by

the Company for a five-year period. The Board's current intention

would be to only draw this down to repay any of the Company's

existing CULS 2025, either at their redemption in 2025, or

before.

The level of gearing is managed actively by the Investment

Manager and at the time of writing total debt amounted to GBP65.6

million representing net gearing of 10%.

During the year the Company purchased for treasury 1,055,000

Ordinary shares at a discount to the prevailing NAV (exclusive of

income). Share buy backs can provide liquidity to the market and

reduce the volatility of any discount as well as modestly enhancing

the NAV for shareholders.

Annual General Meeting

The Board has been considering how best to deal with the

continuing risks and impacts of the Covid-19 pandemic on

arrangements for the Company's AGM. The Board has decided to hold a

functional only AGM on Thursday 27 January 2022 in London at which

the usual formal business will be proposed.

In advance of the AGM, in order to provide certainty, whilst

encouraging and promoting interaction and engagement with our

shareholders, the Board has decided to hold an interactive Online

Shareholder Presentation which will be held at 11:00 a.m. on

Wednesday 19 January 2022. At the presentation, shareholders will

receive updates from the Chairman and Manager and there will be the

opportunity for an interactive question and answer session.

Following the online presentation, shareholders will still have

time to submit their proxy votes prior to the AGM and I would

encourage all shareholders to lodge their votes in advance in this

manner. Full details on how to how to register for the Online

Shareholder Presentation can be found at

https://www.workcast.com/register?cpak=5119566346944925 .

A copy of the online presentation, including the detailed

presentation from the Manager, along with the AGM results, will be

made available to shareholders on the Company's website shortly

after the AGM.

Shareholders are encouraged to raise any questions in advance of

the AGM by registering for the Online Presentation or alternatively

via email at Asia.Focus@abrdn.com. Any questions received will be

replied to by either the Manager or Board via the Company

Secretary.

We will keep shareholders updated of any changes through the

Company's website (asia-focus.co.uk) and announcements to the

London Stock Exchange. We trust that shareholders will be

understanding of this approach.

The Board strongly encourages all shareholders to exercise their

votes in respect of the meeting in advance by completing the

enclosed form of proxy, or letter of direction for those who hold

shares through the abrdn savings plans. This should ensure that

your votes are registered in the event that physical attendance at

the AGM is not possible or restricted.

In addition to the usual ordinary business being proposed at the

AGM, as special business the Board is seeking to renew the

authority to issue new shares and sell treasury shares for cash at

a premium without pre-emption rules applying and to renew the

authority to buy back shares and either hold them in treasury for

future resale (at a premium to the prevailing NAV per share) or

cancel them.

Directorate

As previously advised, Martin Gilbert retired from the Board on

27 November 2020 and Philip Yea retired from the Board at the AGM

on 1 December 2020. On behalf of the Board I would like to

reiterate our thanks for their dedication and service to the

Company. Following the AGM, Debby Guthrie became Audit Committee

Chair.

As part of its on-going succession planning, the Board intends

to undertake a search for two further independent non-executive

Directors shortly. I do not intend to stand for election beyond

this year and therefore the Company will be announcing my successor

during the course of 2022.

The Future

In the last twelve months, the Board has conducted a

comprehensive review of the Company's long-term strategy to ensure

that the investment policy captures the immense opportunities that

exist in the Asian small cap market. This applies to both South

Asia but also North Asia with the emergence of China as the world's

second largest economy and fast expanding stock markets to

match.

As part of the review, the Board also addressed the issue of how

to give shareholders and, in particular, retail investors a more

meaningful participation in the Company's ongoing success. The

Board believes that the measures proposed below will assist in the

marketability of the Company's shares thus increasing the potential

to narrow the discount to NAV, which has been a long standing

ambition of the Company.

During the course of the review the Board has consulted with

abrdn, external specialists in the Asian markets and the Company's

major shareholders.

As a result of this, the Board intends to propose the following

changes to the Company.

- Amend the investment policy to allow more flexibility to

invest in growing small companies across Asia;

- Strengthen the management team by adding Flavia Cheong, Head

of Equities, Asia as joint lead manager with Hugh Young. The

investment management team will be bolstered to reflect the

increasing importance of North Asia including China;

- Increase the target dividend by 100% to 32.0p for the

financial year ending 31 July 2022, payable quarterly and

thereafter maintain the progressive dividend policy of the last 25

years

- Reduce the running costs of the Company. abrdn have agreed to

an amended, tiered, management fee, still payable on market

capitalisation. The tiers are 0.85% for the first GBP250m, 0.6% for

the next GBP500m and 0.5% for market capitalisation of GBP750m and

above. It was previously set at 0.96% of market capitalisation;

- Increase marketability of the shares for small investors by

introducing a five for one share split; and

- Introduce a performance-linked tender offer, which would be

triggered in the event of underperformance of the NAV per share

versus the MSCI AC Asia ex-Japan Small Cap Index over a five-year

period commencing 1 August 2021.

We have also made an announcement to the stock market

contemporaneously with the announcement of these results. These

changes are subject to regulatory and shareholder approvals.

It is currently envisaged that the circular and notice of

General Meeting setting out further details of these proposed

changes will be sent to shareholders in December 2021 along with

the Annual Report and notice of the Annual General Meeting, to seek

necessary shareholder approvals to implement these proposals. The

webinar presentation for shareholders on 19 January 2022 will

provide further details on this future strategy and shareholders

will have an opportunity to put questions to the Board and Manager.

The General Meeting to approve the proposals is expected to be

convened on 27 January 2022, following the Annual General

Meeting.

Changes to Investment Policy

The Company will continue to focus on offering investors

exposure to attractive small, quoted companies in Asia that have

excellent prospects for strong growth in shareholder value, good

balance sheets and skilled, experienced management. As has been

demonstrated over the last 26 years where GBP1,000 invested in 1995

is now worth approximately GBP22,500 (share price at close on 26

November 2021 with dividends reinvested) with the dividends

(including special dividends) to shareholders going from 1.2p in

1996 to 16.0p in 2021. The Board and abrdn believe that this area

of the market will continue to deliver strong growth over the

medium to long term.

Over the same period, the stock markets of the region have

developed from small emerging markets to some of the largest in the

world. Therefore, the Board believes it is necessary to make

changes to the Company's investment objective and policy to ensure

abrdn can continue to invest in companies that can deliver the best

returns for shareholders and despite the enormous difference in the

relative size of the Asian markets. The definition of a small cap

company varies from market to market with China and India at one

end of the scale and very small markets such as Sri Lanka at the

other end.

The Company's current investment objective limits investment

into companies that have a market capitalisation of up to

approximately US$1.5 billion. The Board strongly believes this is

limiting the portfolio managers from investing in the high growth

companies particularly in larger markets like China and India. As a

result, the Board proposes to remove this market capitalisation

limit from the investment policy while stressing that the

investment managers will continue to identify small companies

capable of delivering exceptional growth.

Historically, the Company has had limited investments in

Australasia and the Board does not believe the outlook for this

region will offer the same growth prospects as other parts of Asia.

Therefore, the Board proposes to amend the investment policy to

clarify that no new investments will be made in Australasia. The

Company currently has three holdings in Australasia and the Manager

does not intend to dispose of these should shareholders approve the

change in investment policy.

Full details of the changes to the investment objective and

investment policy are subject to FCA and shareholder approval.

abrdn Investment Team

The Board is delighted to announce that Flavia Cheong, abrdn's

Head of Equities - Asia, will be joining the management team of the

Company, as joint lead manager alongside Hugh Young and Gabriel

Sacks. Neil Sun will also join the team, and will be directly

responsible for managing the potential increased weighting in North

Asia.

Flavia Cheong is the Head of Asia Pacific Equities at abrdn,

where, as well as sharing responsibility for company research, she

oversees regional portfolio construction. Before joining abrdn in

1996, she was an economist with the Investment Company of the

People's Republic of China, and earlier with the Development Bank

of Singapore. Flavia graduated with a BA in Economics and an MA

(Hons) in Economics from the University of Auckland. She is a CFA

charter holder.

Neil Sun is an Investment Manager within the Asian Equities Team

at abrdn. Neil joined the company in 2018. Previously, Neil worked

as a Research Analyst at Deutsche Bank covering lithium battery

supply chain in Hong Kong. Prior to that, Neil worked for JPMorgan

Asset Management as a Research Analyst covering both China and

Taiwan equities. Neil graduated with a BBA in Finance from National

Taiwan University, and passed level II of the CFA Program.

abrdn continues to build out its presence in Shanghai and Hong

Kong, with a team of eight investment professionals expected to

grow to ten during 2022, focusing on researching Chinese equities.

The Company and the investment team will be able to draw on the

knowledge and expertise of these individuals, giving the Company

access to Chinese small cap companies. Over time, it is envisaged

that they will also take on greater individual responsibility for

overseeing the Company's Chinese holdings.

Future Dividend Policy

The Company's policy remains to provide long-term capital

growth, but the Board is aware that some investors are looking for

a regular level of income alongside capital growth, particularly in

the current low interest rate environment.

The Board is therefore proposing to increase the level of target

dividends paid by the Company through distribution from capital

reserves as well as income. Under this new policy, the Board aims

to set a target dividend of 32.0p per Ordinary share for the

financial year ending 31 July 2022 and progressively to grow it

thereafter. This would represent a 100% increase in the dividend

based on 16.0p recommended in the financial

year ended 31 July 2021. This target dividend would be paid in equal quarterly instalments.

Assuming that the changes are approved at the General Meeting on

27 January 2022, the Company intends to declare in February 2022 an

initial target dividend of 16.0p per Ordinary share relating to the

six month period from 1 August 2021 to 31 January 2022 and

thereafter 8.0p per Ordinary share per quarter. In the current

year, we estimate that this level of dividend would require a 5.0p

per Ordinary share (GBP1.6m) distribution from capital

reserves.

As previously stated, our dividend record is very strong with

the Ordinary dividend having been maintained or increased in 24 out

of 25 years. This one-time step change will mean that in future it

is unlikely we will be paying special dividends but absent a market

collapse, we will aim to maintain our progressive approach albeit

off a higher base.

I would like to emphasise that the Board has no desire to change

how the portfolio Manager selects stocks for the portfolio.

Management Fees

The Company currently pays a management fee at the rate of 0.96%

per annum of the Company's market capitalisation. Following

discussions with abrdn, the Board is pleased to announce a new,

tiered management fee, still based on market capitalisation. The

tiers are 0.85% of the first GBP250m, 0.6% of the next GBP500m and

0.5% of GBP750m and above. This represents a fee of 0.74% based on

the Company's last closing share price of 1465.0p and is a

reduction of 23% in the management fee. This change will be

conditional on shareholder approval of the proposals outlined above

and will be back dated as if it had been effective from 1 August

2021.

Share Split

The Board is proposing to implement a sub-division of the

Company's share capital. This is intended to improve the liquidity

of the Company's shares and enhance the ability of investors to

make more efficient regular monthly investments.

The Directors are recommending a five for one share split which

will increase the number of Ordinary shares in issue by a factor of

five.

The Conversion Price of the 2.25 per cent. convertible unsecured

loan stock 2025 (the "CULS") will be automatically and pro-rata

adjusted should shareholders approve the share split.

Introduction of Tender Offer

The Board is proposing the introduction of a performance linked

tender offer. If the Company's NAV total return is less than that

of the MSCI AC Asia ex-Japan Small Cap Index over a five-year

assessment period (commencing 1 August 2021), shareholders should

be offered the opportunity to realise a proportion of their holding

for cash at a level close to NAV less costs of the tender offer.

The tender offer would be capped at a maximum of 25% of the issued

share capital of the Company at that time.

Outlook

The excellent performance over both the long and short term, the

reduction in the running costs of the Company, the structural

increase in the dividend, a possible tender offer in five years in

the event the performance of the Company were to falter (though we

believe the strong economic prospects in Asia make this unlikely),

succession planning and the increasing breadth of management

expertise being brought to the abrdn management team all form the

basis of optimism.

The maturing of the stock markets in China over the last ten

years opens up another fertile field for managers to identify small

growing companies capable of delivering exceptional returns

particularly when combined with the rigorous abrdn investment

process that has served the Company so well in the past. As Hugh

Young has cited in today's announcement to the Stock Exchange, he

remains as excited by the opportunities in Asia as he did when he

first arrived in Singapore 30 years ago and believes that the

changes announced today will strengthen both the investment

proposition and underpin the future prospects of the Company.

The results since the year end bear this out. In this period

since 31 July 2021, the NAV per share has advanced another 8.3% to

GBP1683.3p - a far cry from the 97p per share achieved on listing

in 1995. Against this background, your Board has every confidence

in the future of your company.

Nigel Cayzer,

Chairman

29 November 2021

STRATEGIC REPORT - OVERVIEW OF STRATEGY

Business Model

The business of the Company is that of an investment company

which seeks to qualify as an investment trust for UK capital gains

tax purposes.

Investment Objective*

The Company aims to maximise total return to shareholders over

the long term from a portfolio made up predominantly of smaller

quoted companies (with a market capitalisation of up to

approximately US$1.5 billion at the time of investment which was

raised to this level on 23 May 2018 from the previous ceiling of

US$1bn) in the economies of Asia and Australasia excluding Japan,

by following the investment policy described below. When it is in

shareholders' interests to do so, the Company reserves the right to

participate in the rights issue of an investee company

notwithstanding that the market capitalisation of that investee may

exceed the stated ceiling. The Directors envisage no change in this

activity in the foreseeable future.

Investment Policy*

The Company's assets may be invested in a diversified portfolio

of securities (including equity shares, preference shares,

convertible securities, warrants and other equity-related

securities) predominantly in quoted smaller companies spread across

a range of industries and economies in the investment region

including Australia, Bangladesh, Cambodia, China, Hong Kong, India,

Indonesia, Korea, Laos, Malaysia, Myanmar, New Zealand, Pakistan,

The Philippines, Singapore, Sri Lanka, Taiwan, Thailand and

Vietnam, together with such other economies in Asia as the

Directors may from time to time determine, (collectively, the

"Investment Region"). Investments may also be made through

collective investment schemes, in unquoted equities (up to 10% of

the net assets of the Company, calculated at the time of

investment) and in companies traded on stock markets outside the

Investment Region provided that over 75% of their consolidated

revenue, operating income or pre-tax profit is earned from trading

in the Investment Region or they hold more than 75% of their

consolidated net assets in the Investment Region.

Risk Diversification

The Company does not invest more than 15% of its gross assets at

the time of investment either in other listed investment companies

(including listed investment trusts), or in the shares of any one

company. The Manager is authorised to invest up to 15% of the

Company's gross assets in any single stock.

Gearing

The Board is responsible for determining the gearing strategy

for the Company. Gearing is used selectively to leverage the

Company's portfolio in order to enhance returns where and to the

extent this is considered appropriate to do so. Gearing is subject

to a maximum gearing level of up to 25% of adjusted NAV at the time

of draw down.

Delivering the Investment Policy

The Directors are responsible for determining the investment

policy and the investment objective of the Company. Day to day

management of the Company's assets has been delegated, via the

AIFM, to the Investment Manager, abrdn Asia. abrdn Asia invests in

a diversified range of companies throughout the Investment Region

in accordance with the investment policy. abrdn Asia follows a

bottom-up investment process based on a disciplined evaluation of

companies through direct visits by its fund managers. Stock

selection is the major source of added value. No stock is bought

without the fund managers having first met management. abrdn Asia

estimates a company's worth in two stages, quality then price.

Quality is defined by reference to management, business focus, the

balance sheet and corporate governance. Price is calculated by

reference to key financial ratios, the market, the peer group and

business prospects. Top-down investment factors are secondary in

the abrdn Asia's portfolio construction, with diversification

rather than formal controls guiding stock and sector weights.

Except for the maximum market capitalisation limit, little regard

is paid to market capitalisation.

A detailed description of the investment process and risk

controls employed by abrdn Asia is disclosed in the published

Annual Report and financial statements for the year ended 31 July

2021. A comprehensive analysis of the Company's portfolio is

disclosed in the published Annual Report and financial statements

for the year ended 31 July 2021 including a description of the ten

largest investments, the portfolio investments by value,

sector/geographical analysis and currency/market performance. At

the year end the Company's portfolio consisted of 64 holdings.

* Shareholders' attention is drawn to the detailed proposed

changes to the Objective and Policy in the Chairman's Statement

Investment Manager and Alternate Investment Fund Manager

The Company's Alternative Investment Fund Manager, appointed as

required by EU Directive 2011/61/EU, is Aberdeen Standard Fund

Managers Limited ("ASFML") which is authorised and regulated by the

Financial Conduct Authority. Day to day management of the portfolio

is delegated to abrdn Asia Limited ("abrdn Asia", the "Manager" or

the "Investment Manager"). ASFML and abrdn Asia are wholly owned

subsidiaries of abrdn plc (previously known as Standard Life

Aberdeen plc).

Comparative Indices

The Company does not have a benchmark. abrdn Asia utilises two

general regional indices, the MSCI AC Asia Pacific ex Japan Index

(currency adjusted) and the MSCI AC Asia Pacific ex Japan Small Cap

Index (currency adjusted), as well as peer group comparisons for

Board reporting. It is likely that performance will diverge,

possibly quite dramatically in either direction, from these or any

other indices. abrdn Asia seeks to minimise risk by using in depth

research and does not see divergence from an index as risk.

Promoting the Company's Success

In accordance with corporate governance best practice, the Board

is now required to describe to the Company's shareholders how the

Directors have discharged their duties and responsibilities over

the course of the financial year following the guidelines set out

under section 172 (1) of the Companies Act 2006 (the "s172

Statement"). This Statement, from 'Promoting the Success of the

Company' to "Long Term Investment", provides an explanation of how

the Directors have promoted the success of the Company for the

benefit of its members as a whole, taking into account the likely

long term consequences of decisions, the need to foster

relationships with all stakeholders and the impact of the Company's

operations on the environment.

The purpose of the Company is to act as a vehicle to provide,

over time, financial returns to its shareholders. The Company's

Investment Objective is disclosed below. The activities of the

Company are overseen by the Board of Directors of the Company.

The Board's philosophy is that the Company should operate in a

transparent culture where all parties are treated with respect and

provided with the opportunity to offer practical challenge and

participate in positive debate which is focused on the aim of

achieving the expectations of shareholders and other stakeholders

alike. The Board reviews the culture and manner in which the

Manager operates at its regular meetings and receives regular

reporting and feedback from the other key service providers.

Investment trusts, such as the Company, are long-term investment

vehicles, with a recommended holding period of five or more years.

Typically, investment trusts are externally managed, have no

employees, and are overseen by an independent non-executive board

of directors. Your Company's Board of Directors sets the investment

mandate, monitors the performance of all service providers

(including the Manager) and is responsible for reviewing strategy

on a regular basis. All this is done with the aim of preserving

and, indeed, enhancing shareholder value over the longer term.

Stakeholders

The Company's main stakeholders have been identified as its

shareholders, the Manager (and Investment Manager), service

providers, investee companies and debt providers. More broadly, the

environment and community at large are also stakeholders in the

Company. The Board is responsible for managing the competing

interests of these stakeholders. Ensuring that the Manager delivers

out performance for Ordinary shareholders over the longer term

without adversely affecting the risk profile of the Company which

is known and understood by the loan note holders and CULS holders.

This is achieved by ensuring that the Manager stays within the

agreed investment policy.

Shareholders

The following table describes some of the ways we engage with

our shareholders:

AGM The AGM normally provides an opportunity for

the Directors to engage with shareholders,

answer their questions and meet them informally.

The next AGM will take place on 27 January

2022 in London. We encourage shareholders to

lodge their vote by proxy on all the resolutions

put forward.

Annual Report We publish a full annual report each year that

contains a strategic report, governance section,

financial statements and additional information.

The report is available online and in paper

format.

Company Announcements We issue announcements for all substantive

news relating to the Company. You can find

these announcements on the website.

Results Announcements We release a full set of financial results

at the half year and full year stage. Updated

net asset value figures are announced on a

daily basis.

Monthly Factsheets The Manager publishes monthly factsheets on

the Company's website including commentary

on portfolio and market performance.

Website Our website contains a range of information

on the Company and includes a full monthly

portfolio listing of our investments as well

as podcasts by the Investment Manager. Details

of financial results, the investment process

and Investment asia-focus.co.uk

Investor Relations The Company subscribes to the Manager's Investor

Relations programme (further details are disclosed

in the published Annual Report and financial

statements for the year ended 31 July 2021).

The Manager

The key service provider for the Company is the Alternative

Investment Fund Manager and the performance of the Manager is

reviewed in detail at each Board meeting. The Manager's investment

process is outlined in the published Annual Report and financial

statements for the year ended 31 July 2021. Shareholders are key

stakeholders in the Company - they are looking to the Manager to

achieve the investment objective over time and to deliver a regular

growing income together with some capital growth. The Board is

available to meet at least annually with shareholders at the Annual

General Meeting and this includes informal meetings with them over

lunch following the formal business of the AGM. This is seen as a

very useful opportunity to understand the needs and views of the

shareholders. In between AGMs, the Directors and Manager also

conduct programmes of investor meetings with larger institutional,

private wealth and other shareholders to ensure that the Company is

meeting their needs. Such regular meetings may take the form of

joint presentations with the Investment Manager or meetings

directly with a Director where any matters of concern may be raised

directly.

Other Service Providers

The other key stakeholder group is that of the Company's third

party service providers. The Board is responsible for selecting the

most appropriate outsourced service providers and monitoring the

relationships with these suppliers regularly in order to ensure a

constructive working relationship. Our service providers look to

the Company to provide them with a clear understanding of the

Company's needs in order that those requirements can be delivered

efficiently and fairly. The Board, via the Management Engagement

Committee, ensures that the arrangements with service providers are

reviewed at least annually in detail. The aim is to ensure that

contractual arrangements remain in line with best practice,

services being offered meet the requirements and needs of the

Company and performance is in line with the expectations of the

Board, Manager, Investment Manager and other relevant stakeholders.

Reviews include those of the Company's depositary and custodian,

share registrar, broker and auditors.

Principal Decisions

Pursuant to the Board's aim of promoting the long term success

of the Company, the following principal decisions have been taken

during the year:

Portfolio The Investment Manager's Review details the key

investment decisions taken during the year and subsequently. The

Investment Manager has continued to monitor the investment

portfolio throughout the year under the supervision of the Board. A

list of the key portfolio changes can be found in the Investment

Manager's Report.

Gearing The Company utilises gearing in the form of CULS and

Loan Notes with the aim of enhancing shareholder returns over the

longer term. The Board has adopted a pro-active approach to gearing

with the aim of locking in attractive interest rates over the

longer term. On 1 December 2020, the Company issued a GBP30 million

15 year Senior Unsecured Loan Note (the "Loan Note") at an

annualised interest rate of 3.05%. The Loan Note is be unsecured,

unlisted and denominated in sterling. The Loan Note ranks pari

passu with the Company's other unsecured and unsubordinated

financial indebtedness. The Loan Note was used to repay the

Company's revolving credit facility with the Royal Bank of

Scotland.

Share Buybacks During the year, the Board has continued to buy

back Ordinary shares opportunistically in order to manage the

discount by providing liquidity to the market.

Board Investment Review During the year the Board has conducted

a comprehensive investment review which has culminated in a number

of proposals which are explained in detail in the Chairman's

Statement.

Long Term Investment

The Investment Manager's investment process seeks to outperform

over the longer term. The Board has in place the necessary

procedures and processes to continue to promote the long term

success of the Company. The Board will continue to monitor,

evaluate and seek to improve these processes as the Company

continues to grow over time, to ensure that the investment

proposition is delivered to shareholders and other stakeholders in

line with their expectations.

Key Performance Indicators (KPIs)

The Board uses a number of financial performance measures to

assess the Company's success in achieving its objective and to

determine the progress of the Company in pursuing its investment

policy. The main KPIs identified by the Board in relation to the

Company, which are considered at each Board meeting, are as

follows:

KPI Description

------------------------------- ------------------------------------------------------

NAV Return (per share) The Board considers the Company's NAV total

return figures to be the best indicator of

performance over time and is therefore the

main indicator of performance used by the Board.

The figures for this year and for the past

1, 3, 5, 10 years and since inception are set

out in the published Annual Report and financial

statements for the year ended 31 July 2021

.

=============================== ======================================================

Performance against comparative The Board also measures performance against

indices a combination of two regional indices - the

MSCI AC Asia Pacific ex Japan Index (currency

adjusted) and the MSCI AC Asia Pacific ex Japan

Small Cap Index (currency adjusted). Graphs

showing performance are shown in the published

Annual Report and financial statements for

the year ended 31 July 2021 . At its regular

Board meetings the Board also monitors share

price performance relative to competitor investment

trusts over a range of time periods, taking

into consideration the differing investment

policies and objectives employed by those companies.

=============================== ======================================================

Share price The Board also monitors the price at which

(on a total return basis) the Company's shares trade relative to the

MSCI Asia Pacific ex Japan Index (sterling

adjusted) on a total return basis over time.

A graph showing the total NAV return and the

share price performance against the comparative

index is shown in the published Annual Report

and financial statements for the year ended

31 July 2021.

=============================== ======================================================

Discount/Premium to NAV The discount/premium relative to the NAV per

share represented by the share price is closely

monitored by the Board. The objective is to

avoid large fluctuations in the discount relative

to similar investment companies investing in

the region by the use of share buy backs subject

to market conditions. A graph showing the share

price premium/(discount) relative to the NAV

is also shown in the published Annual Report

and financial statements for the year ended

31 July 2021 .

=============================== ======================================================

Dividend The Board's aim is to maintain or increase

the Ordinary dividend so that shareholders

can rely on a consistent stream of income.

Dividends paid over the past 10 years are set

out in the published Annual Report and financial

statements for the year ended 31 July 2021

.

------------------------------- ------------------------------------------------------

Principal Risks and Uncertainties

There are a number of risks which, if realised, could have a

material adverse effect on the Company and its financial condition,

performance and prospects. The Board has undertaken a robust review

of the principal risks and uncertainties facing the Company

including those that would threaten its business model, future

performance, solvency or liquidity. Those principal risks are

disclosed in the table below together with a description of the

mitigating actions taken by the Board. The principal risks

associated with an investment in the Company's Shares are published

monthly on the Company's factsheet or they can be found in the

pre-investment disclosure document published by the Manager, both

of which are available on the Company's website.

The Board also has a process to consider emerging risks and if

any of these are deemed to be significant these risks are

categorised, rated and added to the risk matrix. Although the

uncertainty surrounding the timing of Brexit has now abated,

economic risk for the Company remains, in particular currency

volatility may adversely affect the translation rates of future

earnings from the portfolio following the expiry of the

transitional arrangements in January 2021.

The Board notes that there are a number of contingent risks

stemming from the Covid-19 pandemic that may impact the operation

of the Company. These include investment risks surrounding the

companies in the portfolio such as employee absence, reduced

demand, reduced turnover and supply chain breakdowns. The

Investment Manager will continue to review carefully the

composition of the Company's portfolio and to be pro-active in

taking investment decisions where necessary. Operationally,

Covid-19 is also affecting the suppliers of services to the Company

including the Manager, Investment Manager and other key third

parties. To date these services have continued to be supplied

seamlessly and the Board will continue to monitor arrangements in

the form of periodic updates from the Manager and Investment

Manager.

In addition to the risks listed below, the Board is also very

conscious of the risks emanating from increased environmental,

social and governance challenges. The recent scrutiny by western

governments of human rights violations in Xinjiang is an example of

the need for continued vigilance regarding the supply chain

exposure of investee companies and the fair and humane treatment of

workers. Likewise, as climate change pressures mount, the Board

continues to monitor, through its Manager, the potential risk that

investee companies may fail to keep pace with the appropriate rates

of change and adaption.

In all other respects, the Company's principal risks and

uncertainties have not changed materially since the date of this

Annual Report and are not expected to change materially for the

current financial year.

Description Mitigating Action

-------------------------------------------- ---------------------------------------------

Investment strategy and objectives The Board keeps the level of discount

- the setting of an unattractive at which the Company's shares trade

strategic proposition to the market as well as the investment objective

and the failure to adapt to changes and policy under review and in particular

in investor demand may lead to the holds an annual strategy meeting

Company becoming unattractive to where the Board

investors, a decreased demand for reviews updates from the Investment

shares and a widening discount. Manager, investor relations reports

and the Broker on the market. In

Risk Unchanged during Year particular, the Board is updated

at each Board meeting on the make-up

of and any movements in the shareholder

register.

============================================ =============================================

Investment portfolio and investment The Board sets, and monitors, its

management: investing outside of investment restrictions and guidelines,

the investment restrictions and and receives regular board reports

guidelines set by the Board could which include performance reporting

result in poor performance and inability on the implementation of the investment

to meet the Company's objectives, policy, the investment process and

as well as a weakening discount. application of the guidelines. The

Investment Manager is in attendance

Risk Unchanged during Year at all Board meetings. The Board

also monitors the Company's share

price relative to the NAV.

============================================ =============================================

Financial obligations (Gearing): The Board sets a gearing limit and

the requirement for the Company to receives regular updates on the

meet its financial obligations, or actual gearing levels the Company

increasing the level of gearing, has reached from the Investment

could result in the Company becoming Manager together with the assets

over-geared or unable to take advantage and liabilities of the Company and

of potential opportunities and result reviews these at each Board meeting.

in a loss of value to the Company's In addition, Aberdeen Standard Fund

shares. It could also result in the Managers Limited, as alternative

Company being unable to meet the investment fund manager, has set

interest repayments due on the CULS an overall leverage limit of 2x

and Loan Note holders. on a commitment basis (2.5x on a

gross notional basis) and includes

Risk Unchanged during Year updates in its reports to the Board.

============================================ =============================================

Financial and regulatory: the financial The financial risks associated with

risks associated with the portfolio the Company include market risk,

could result in losses to the Company. liquidity risk and credit risk,

In addition, failure to comply with all of which are mitigated by the

relevant regulation (including the Investment Manager. Further details

Companies Act, the Financial Services of the steps taken to mitigate the

and Markets Act, the Alternative financial risks associated with

Investment Fund Managers Directive, the portfolio are set out in note

Accounting Standards and the listing 19 to the financial statements.

rules, disclosure and prospectus The Board relies upon the abrdn

rules) may have an impact on the Group to ensure the Company's compliance

Company. with applicable regulations and

from time to time employs external

Risk Unchanged during Year advisors to advise on specific concerns.

============================================ =============================================

Operational: the Company is dependent The Board receives reports from

on third parties for the provision the Manager on internal controls

of all systems and services (in particular, and risk management at each board

those of abrdn) and any control failures meeting. It receives assurances

and gaps in these systems and services from all its significant service

could result in a loss or damage providers, as well as back to back

to the Company. assurances where activities are

themselves sub-delegated to other

Risk Unchanged during Year third party providers with which

the Company has no direct contractual

relationship. Further details of

the internal controls which are

in place are set out in the Directors'

Report.

============================================ =============================================

Investing in unlisted securities: The Board recognises that investing

the Company has the ability to invest in unlisted securities carries a

in unlisted securities, although higher risk/reward profile. Accordingly

no such investments have been made it seeks to mitigate this risk by

to date. Unquoted investments are limiting investment into such securities

long-term in nature and they may to 10% of the Company's net assets

take a considerable period to be (calculated at the time of investment).

realised. Unquoted investments are For the year ended 31 July 2021

less readily realisable than quoted no unlisted investments were made.

securities. Such investments may

therefore carry a higher degree of

risk than quoted securities. In valuing

investments the Company may rely

to a significant extent on the accuracy

of financial and other information

provided to the Manager as well as

the performance of listed peer multiples

which may impact unquoted valuations

negatively.

Risk Unchanged during Year

============================================ =============================================

Market and F/X: insufficient oversight The Manager's risk department reviews

or controls over financial risks, investment risk and a review of

including market risk, foreign currency credit worthiness of counterparties

risk, liquidity risk and credit risk is undertaken by its Counterparty

could result in a loss to the Company. Credit Risk team. The Company does

not hedge foreign currency exposure

Risk Unchanged during Year but it may, from time to time, partially

mitigate it by borrowing in foreign

currencies.

============================================ =============================================

Promoting the Company

The Board recognises the importance of promoting the Company to

prospective investors both for improving liquidity and enhancing

the value and rating of the Company's shares. The Board believes an

effective way to achieve this is through subscription to and

participation in the promotional programme run by the Manager on

behalf of a number of investment trusts under its management. The

Company's financial contribution to the programme is matched by the

Manager. The Manager reports quarterly to the Board giving analysis

of the promotional activities as well as updates on the shareholder

register and any changes in the make-up of that register.

The purpose of the programme is both to communicate effectively

with existing shareholders and to gain new shareholders with the

aim of improving liquidity and enhancing the value and rating of

the Company's shares. Communicating the long-term attractions of

your Company is key and therefore the Company also supports the

Manager's investor relations programme which involves regional

roadshows, promotional and public relations campaigns.

Board Diversity

The Board recognises the importance of having a range of

skilled, experienced individuals with the right knowledge

represented on the Board in order to allow the Board to fulfil its

obligations. The Board also recognises the benefits and is

supportive of the principle of diversity in its recruitment of new

Board members. The Board will not display any bias for age, gender,

race, sexual orientation, religion, ethnic or national origins, or

disability in considering the appointment of its Directors.

However, the Board will continue to ensure that all appointments

are made on the basis of merit against the specification prepared

for each appointment and, therefore, the Company does not consider

it appropriate to set diversity targets. At 31 July 2021, there

were three male Directors and two female Directors on the

Board.

Environmental, Social and Governance ("ESG") Engagement

Whilst the management of the Company's investments is not

undertaken with any specific instructions to exclude certain asset

types or classes, the Investment Manager embeds ESG into the

research of each asset class as part of the investment process. ESG

investment is about active engagement, with the goal of improving

the performance of assets held around the world.

The Investment Manager aims to make the best possible

investments for the Company, by understanding the whole picture of

the investments - before, during and after an investment is made.

That includes understanding the environmental, social and

governance risks and opportunities they present - and how these

could affect longer-term performance. Environmental, social and

governance considerations underpin all investment activities. With

1,000+ investment professionals, the Investment Manager is able to

take account of ESG factors in its company research, stock

selection and portfolio construction - supported by more than 50

ESG specialists around the world. Please refer to the published

Annual Report and financial statements for the year ended 31 July

2021 for further detail on the Investment Manager's ESG policies

applicable to the Company.

The Company has no employees as the Board has delegated day to

day management and administrative functions to Aberdeen Standard

Fund Managers Limited. There are therefore no disclosures to be

made in respect of employees. The Company's socially responsible

investment policy is outlined above.

Due to the nature of the Company's business, being a company

that does not offer goods and services to customers, the Board

considers that it is not within the scope of the Modern Slavery Act

2015 because it has no turnover. The Company is therefore not

required to make a slavery and human trafficking statement. In any

event, the Board considers the Company's supply chains, dealing

predominantly with professional advisors and service providers in

the financial services industry, to be low risk in relation to this

matter.

The Company has no greenhouse gas emissions to report from the

operations of its business, nor does it have responsibility for any

other emissions producing sources under the Companies Act 2006

(Strategic Report and Directors' Reports) Regulations 2013.

Viability Statement

The Company does not have a formal fixed period strategic plan

but the Board formally considers risks and strategy at least

annually. The Board considers the Company, with no fixed life, to

be a long term investment vehicle, but for the purposes of this

viability statement has decided that a period of three years is an

appropriate period over which to report. The Board considers that

this period reflects a balance between looking out over a long term

horizon and the inherent uncertainties of looking out further than

three years.

In assessing the viability of the Company over the review period

the Directors have conducted a robust review of the principal

risks, focusing upon the following factors:

- The principal risks detailed in the Strategic Report;

- The ongoing relevance of the Company's investment objective in the current environment;

- The demand for the Company's Shares evidenced by the

historical level of premium and or discount;

- The level of income generated by the Company;

- The level of gearing and flexibility of the Company's Loan Stock and Loan Notes; and

- The liquidity of the Company's portfolio including the results

of stress test analysis performed by the Manager under a wide

number of market scenarios.

Accordingly, taking into account the Company's current position,

the fact that the Company's investments are mostly liquid and the

potential impact of its principal risks and uncertainties, the

Directors have a reasonable expectation that the Company will be

able to continue in operation and meet its liabilities as they fall

due for a period of three years from the date of this Report. In

making this assessment, the Board has considered that matters such

as significant economic or stock market volatility, a substantial

reduction in the liquidity of the portfolio or changes in investor

sentiment could have an impact on its assessment of the Company's

prospects and viability in the future.

Future

The Board's view on the general outlook for the Company can be

found in my Chairman's Statement whilst the Investment Manager's

views on the outlook for the portfolio are included in the

Investment Manager's Review.

Nigel Cayzer,

Chairman

29 November 2021

STRATEGIC REPORT - INVESTMENT MANAGER'S REVIEW

Overview

The share prices of Asian smaller companies rose sharply in

sterling terms in the year under review, far outpacing their

large-cap counterparts. Small caps continued to advance steadily

despite the upheaval wrought by the Covid-19 health crisis. The

rally was underpinned by the shift to work-from-home which

escalated demand for digital solutions. Investors were also hopeful

that the recovery led by China and massive US stimulus would boost

the region's exports. All this more than mitigated disappointment

over a slow vaccine rollout by several countries.

Leading the frontrunners was India. We were pleasantly surprised

by good earnings growth across most sectors. An accommodative

monetary policy, fiscal support for the rural economy, as well as

the significant spending boost for infrastructure, provided a

conducive environment. Also, flexible mobility restrictions during

a deadly second wave of the coronavirus softened the blow on its

economy.

Elsewhere in the region, South Korea and Taiwan's small caps

were propelled by record exports. Technology trends and the

resumption of economic activity worldwide, especially in China,

boosted demand for their semiconductors, electronics goods, cars

and petrochemicals.

Portfolio Review and Activity

The Company's NAV rose by 41.9% in sterling terms, comfortably

outperforming the MSCI AC Asia Pacific ex-Japan Small Cap Index's

gain of 37.2%.

Good stock choices in Taiwan and Hong Kong, as well as the

off-benchmark positions in Vietnam, accounted for the upbeat

performance. By sector, the exposure to retail and technology

proved prudent. In particular, the Trust's sizeable positions in

niche players with significant technology-related advantages were

highly favourable.

The share price of the period's top contributor, Momo.com, more

than tripled as changing consumer habits continued to support the

move to online shopping. The leading Taiwanese business-to-consumer

online retail platform also benefitted from its investments in

logistics and an expansion in product categories. Pacific Basin

further boosted the portfolio with absolute share price gains that

exceeded Momo.com's. The bulk shipping company based in Hong Kong

benefited greatly from rebounding economic activity, higher

commodities prices and consequently higher freight prices.

In Vietnam, technology conglomerate FPT and real estate

developer Nam Long supported the portfolio. We view FPT as one of

the market's best listed companies, with its exposure to the rising

global demand for technology services, particularly from Japan

where digital transformation continues to accelerate. This is

counterbalanced by its interests in domestic-oriented businesses,

such as telecoms, education and retail, which also have good growth

outlooks. Meanwhile, Nam Long is benefiting from a housing market

recovery. We believe its foray into integrated townships, which

include providing amenities such as schools and hospitals, will add

value to its residential projects.

Another standout was South Korea's Park Systems, which

manufactures microscopes integral in the production of increasingly

minuscule computer chips that enhance computing speed. Park

Systems, along with Hana Microelectronics are notable for their

roles in the semiconductor supply chain with the advent of

artificial intelligence, 5G communications networks, electric

vehicles and the Internet of Things.

Meanwhile, the Trust's Indian holdings that contributed included

technology services provider Cyient, consumer marketing technology

company Affle India as well as oil & gas services company Aegis

Logistics. Cyient was boosted by an improving demand outlook for

engineering and technology services, with expectations that it is

at the start of a multi-year upgrading cycle. In Affle's case,

investors were excited by its ability to crunch vast amounts of

data and reach targeted consumers on mobile devices. For Aegis, the

company's storage and logistics segment benefited from the

burgeoning flow of chemicals and fuels across the country. In

addition, the government's push for the adoption of cleaner energy

has also boosted its liquefied natural gas business.

Conversely, the Trust's positions in the financial sector were

hampered by the resurgence of the virus in certain parts of the

region, which in turn, clouded the outlook for these lenders' asset

quality. We remain confident that our financial holdings are of the

highest quality and that they will not be unduly affected. A

military coup in Myanmar in early 2021 also came as a surprise and

led to a sharp sell-off in the shares of Yoma Strategic. We remain

invested and so far the company has announced relatively resilient

results, but we will be monitoring developments closely and the

exposure is contained at less than 1% of the portfolio.

Turning to changes within the portfolio, we participated in the

initial public offerings (IPOs) of two companies in the materials

sector. First was surface materials specialist Nanofilm, which

performed well for your Company. Not only is its proprietary

cutting-edge technology used by the latest smartphones, laptops and

tablets, but it is also the sole supplier to nine of its top 10

customers, including Apple. We are confident about Nanofilm's

long-term prospects, as it embarks on commercialising innovative

products, such as corrosion-resistant coatings that enable the

hydrogen economy. Next was India-listed niche specialty chemicals

company Tatva Chintan. Its products are in high demand, helped by

favourable policies, especially in the area of emissions

control.

Other initiations tied to the accelerated demand for digital

services were Nazara Technologies, eCloudvalley, Taiwan Union

Technology, Aspeed and Pentamaster. An example is Nazara

Technologies, which is dominant in diversified gaming in India. The

company has a growing portfolio of successful titles in eSports,

mobile gaming and recreational e-learning for children. The

fast-paced competitive gaming industry in India is still in its

infancy and we see great potential in the company's gaming and

e-learning ecosystems.

In addition, we introduced a couple of new positions with

greater environmental and social credentials, including Medikaloka

Hermina. The company is a leading private hospital chain in

Indonesia which meets growing demand for services under the

country's new Mandatory Health Insurance Scheme (JKN). It has

proven adept at managing the provision of JKN-related services, and

has emerged as a leader in this area. We were also on the lookout

for companies that would gain from governments' efforts to avert

climate change. To this end, we established a position in KMC. We

expect the global leader in bicycle chains to benefit from higher

demand for cleaner modes of transport in developed markets, as well

as the growing popularity of electric bicycles.

Elsewhere, we initiated Credit Bureau Asia and Yantai Pet Foods.

Credit Bureau is Singapore's main credit bureau. In Cambodia and

Myanmar, it enjoys first-mover advantage as their sole license

holder. We believe it is well-positioned to benefit from steady

demand for high-quality credit, risk and business data. Yantai Pet

Foods is a pet food manufacturer with established credentials and a

diversified customer base of global brands. In addition, it is

developing its own local brand to tap into China's rising pet

ownership and demand for premium products.

Against these, we exited Kansai Nerolac to recycle capital into

more nascent opportunities, as the Indian paint company is

relatively mature and commanded a demanding valuation. We also sold

several companies as our conviction in their investment case waned.

They include Kingmaker Footwear, Mustika Ratu, SBS Transit, Eastern

Water Resources, AEON Co (Malaysia), Public Financial and CDL

Investments.

Outlook

The resurgence of coronavirus infections has given rise to

caution and is likely to delay economic recovery, particularly in

tourism-dependent countries in the region. The Trust's largest

exposure is to India, which is seeing the fruits of government

reform that attempts to reboot its economy after several years of

sluggish growth. Another sizeable allocation is in Taiwan, which

remains very well-positioned in the technology supply chain,

notwithstanding the spillover impact of the conflict between the US

and China. We believe the mainland remains pro-innovation despite

the recent tightening of regulatory oversight, and this should

continue to support export growth throughout the Asia-Pacific

region.

The portfolio provides exposure to high growth sectors that

supply hardware, software and platforms for the latest consumer

electronics, artificial intelligence and the Internet of Things. It

is also positioned in traditional sectors that address the region's

increasing urbanisation needs, as well as rising demand for better

healthcare and aspirational consumer goods in tandem with Asia's

growing affluence. Our focus remains on quality businesses that are

well-placed to benefit from these long-term trends that will power

the overall growth in the region.

Hugh Young and Gabriel Sacks

abrdn Asia Limited

Investment Manager

29 November 2021

STRATEGIC REPORT - RESULTS

FINANCIAL HIGHLIGHTS

31/07/2021 31/07/2020 % change

------------------------------------------ --------------- --------------- ---------

Total assets GBP557,183,000 GBP405,653,000 +37.4

Total equity shareholders' funds

(net assets) GBP487,958,000 GBP358,956,000 +35.9

Net asset value per share (basic) 1,554.52p 1,106.45p +40.5

Net asset value per share (diluted) 1,545.11p n/a

Share price (mid market) 1,330.00p 980.00p +35.7

Market capitalisation GBP417,483,000 GBP317,934,000 +31.3

Discount to net asset value (basic){A} 14.4% 11.4%

Discount to net asset value (diluted){A} 13.9% n/a

MSCI AC Asia Pacific ex Japan Index

(currency adjusted, capital gains

basis) 878.57 786.37 +11.7

MSCI AC Asia Pacific ex Japan Small

Cap Index (currency adjusted, capital

gains basis) 1,878.91 1,399.93 +34.2

Net gearing{A} 10.0% 9.9%

Dividends and earnings

Total return per share (basic){B} 461.70p (182.57)p

Revenue return per share (basic) 7.52p 21.45p -64.9

Dividends per share{C} 16.00p 19.00p -15.8

Dividend cover{A} 0.47 1.13

Revenue reserves{D} GBP12,618,000 GBP16,276,000 -22.5

Operating costs

Ongoing charges ratio{A} 1.10% 1.09%

------------------------------------------ --------------- --------------- ---------

{A} Considered to be an Alternative Performance Measure (see below).

{B} Measures the total earnings for the year divided by the weighted

average number of Ordinary shares in issue (see note 9).

{C} The figures for dividends per share reflect the dividends for

the year in which they were earned.

{D} Prior to payment of final and special dividends.

PERFORMANCE (TOTAL RETURN)

1 year 3 year 5 year 10 year Since

% return % return % return % return inception

------------------------------------- --------- --------- --------- --------- ----------

Share price{A} +38.2 +33.6 +55.8 +131.9 +2040.5

Net asset value per Ordinary share

- diluted{AB} +41.9 +31.3 +58.6 +161.1 +2159.9

MSCI AC Asia Pacific ex Japan Index

(currency adjusted) +14.1 +23.0 +64.1 +116.1 +487.6

MSCI AC Asia Pacific ex Japan Small

Cap Index (currency adjusted) +37.2 +33.1 +62.2 +94.3 n/a

------------------------------------- --------- --------- --------- --------- ----------

{A} Considered to be an Alternative Performance Measure.

{B} 1 year return calculated on a diluted basis as CULS is "in the money".

All other returns are calculated on a diluted basis.

Source: abrdn, Morningstar, Lipper & MSCI

DIVIDS

Rate xd date Record date Payment date

----------------------- ------- --------------- ----------------- ----------------

Proposed final 2021 15.00p 6 January 2022 7 January 2022 2 February 2022

Proposed special 2021 1.00p 6 January 2022 7 January 2022 2 February 2022

----------------------- ------- --------------- ----------------- ----------------

16.00p

----------------------- ------- --------------- ----------------- ----------------

Final 2020 14.50p 12 November 13 November 2020 9 December 2020

2020

Special 2020 4.50p 12 November 13 November 2020 9 December 2020

2020

----------------------- ------- --------------- ----------------- ----------------

19.00p

TEN YEAR FINANCIAL RECORD

Year to 31 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

July

--------------- -------- --------- -------- -------- --------- --------- --------- --------- --------- ---------

Total revenue

(GBP'000) 9,168 11,512 11,427 14,746 10,992 13,896 14,673 14,632 13,595 9,624

--------------- -------- --------- -------- -------- --------- --------- --------- --------- --------- ---------

Per share (p)

Net revenue

return 13.18 13.84 11.43 18.21 9.22 19.31 19.27 21.64 21.45 7.52

Total return 68.56 275.43 (31.46) (50.13) 165.38 172.29 36.78 78.18 (182.57) 461.70

Net ordinary

dividends