TIDMAAU

RNS Number : 1362F

Ariana Resources PLC

14 July 2021

14 July 2021

AIM: AAU

FINAL AUDITED RESULTS FOR THE YEARED 31 DECEMBER 2020

NOTICE OF ANNUAL GENERAL MEETING ("AGM")

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

exploration and development company operating in Europe, announces

its final audited results for the year ended 31 December 2020.

The Report and Accounts will be posted to shareholders as

applicable, and are available on the Company's website (

www.arianaresources.com ) , and extracts are set out below.

The AGM will be held at the East India Club, 16 St James's

Square, London, SW1Y 4LH on Wednesday, 18 August 2021 at 11:00

am.

The Company also announces that Dr. Kerim Sener, Managing

Director, and Michael de Villiers, Chairman, will provide an

investor webinar on Tuesday, 20 July 2021 at 10:00 am.

The webinar is open to all existing and potential investors and

will consist of a brief update on the final results followed by

Q&A session, held on the Investor Meet Company platform.

Investors can sign up to Investor Meet Company for free and then

click "Add to meet" Ariana Resources via the following link to join

the webinar:

https://www.investormeetcompany.com/ariana-resources-plc/register-investor

.

Investors who have already registered and clicked "Add to meet"

Ariana Resources, will be automatically invited.

-- Investors are encouraged to submit questions pre-event via

the Investor Meet Company Platform, once registered.

-- Questions can be submitted pre-event via the "Ask a Question"

function located on your Investor Meet Company dashboard, in

addition questions can be submitted during the live event.

-- Whilst the Company will not be in a position to answer every

question it receives, it will address the most prominent within the

confines of information already disclosed to the market through

regulatory notifications.

-- Responses to the Q&A will be published at the earliest

opportunity on the Investor Meet Company platform.

-- Investor feedback can also be submitted directly to

management post the event to ensure the Company can understand the

views of all elements of its shareholder base.

Chairman's Statement

Fellow shareholders,

I am pleased to report that Ariana has again had an outstanding

year with gold production at 18,645 ounces, at an average life of

mine cash cost less than US$500 per ounce, alongside a most

successful ongoing exploration programme. This set the stage for a

transformational transaction concluded after the year end, whereby

Ariana sold a significant portion of its Turkish assets for a cash

consideration, whilst still maintaining a sizeable share of the

cash-generating operations, enabling Ariana to continue to

implement its successful exploration and development strategy.

During the period, the Kiziltepe Mine continued to perform well

above feasibility rates. This has been the case since the

commencement of operations and is testament to the determination

and professionalism of the operating team. Despite the challenges

of the COVID-19 pandemic, they have managed to advance production,

exploration drilling and plant expansion work simultaneously. The

plant expansion, which is expected to be commissioned during the

second half of 2021, allows for a doubling of the current level of

mill throughput. This will enable a lower unit cost, as lower grade

ore is brought on stream. Excellent exploration and development

work has identified extensive additional mineral resources in the

immediate vicinity of the plant, which have the potential to extend

the life of mine significantly.

The mine continued to produce gold in the lowest cost quartile

internationally. This has enabled both the repayment of the

original construction loan and an ongoing profit distribution to

the Joint Venture ("JV") shareholders. This quality of operation

enabled the original JV partners to attract a highly regarded third

JV partner, namely Özaltin Holding A.S., which bought a 53% stake

in Zenit Madencilik San. ve Tic. A.S., now incorporating the

Salinba Gold Project, in addition to the Kiziltepe Mine and the Tav

an Gold Project. We now have a three-way partnership working on our

Turkish portfolio of assets and we are looking forward to the

accelerated development of these projects.

Over the last year, the delays and obstacles arising from the

ongoing pandemic naturally led to the direction of available

manpower predominantly to the Kiziltepe Mine. Fewer resources were

physically deployed on the other Company assets, though project

work continued across the portfolio, leading significantly to

several important resource updates. Currently the Tav an Project is

awaiting its Environmental Impact Assessment approvals and various

provisional permitting applications are in process. At the present

rate of progress, we are expecting production at Tav an to be

achieved from late 2022. Meanwhile, further work is ongoing at the

Salinba Project, with a new drilling programme scheduled to

commence later in 2021.

While presenting some challenges, this new operating environment

has also introduced a number of new opportunities, which, along

with the successful completion of the Özaltin JV transaction, will

allow Ariana to pursue more ambitious exploration programmes. This

is being pursued predominantly through the use of freely available

information and databases integrated with data held by Ariana. This

is a highly technical process of data interpretation and target

definition, which our exploration team is particularly skilled in.

We use this information to develop partnerships with carefully

chosen collaborators who then go on to develop assets. This

approach has yielded success many times in the past.

The Ariana team has never been afraid of drilling up a "duster".

Yet in my 16 years of recollection there have not been many, if any

at all. When undertaking new exploration, one must allow for the

occasional "miss" when aiming at a new target. It takes a lot of

courage and determination to launch into a new territory and most

definitely needs the support of a close team to undertake such new

ventures. It seems appropriate to take inspiration from one of the

most prolific goal scorers, Wayne Gretzky, whose mantra was "you

missed 100% of the shots you don't take". With that in mind, I am

encouraging our very talented and dedicated exploration teams to

carry on with their excellent work, with the assurance that there

is 100% support, and the understanding that we are all in this for

the long game, for that next mega discovery which is just over the

next hill.

What Ariana is particularly good at is seeing the big picture:

where to look next and with whom to collaborate to achieve the best

outcome. To this end, we have taken a global view of the Tethyan

Metallogenic Belt ("TMB"), our area of expertise, then delved into

our extensive database of potential targets and pulled in our best

partners for collaboration in these areas to form a number of new

exploration opportunities. This is now taking the form of Western

Tethyan Resources Ltd, a company which is focused on the Eastern

European end of the TMB, while we continue to support the

successful work of Venus Minerals Ltd on the island of Cyprus.

Meanwhile, further exploration and development will continue in

Turkey via our well-established operations hub in Ankara, where

Ariana is establishing a dedicated office and technical centre.

This is allowing a full multidisciplinary team to work on both data

and material samples under one roof. This is both an effective and

efficient operation in a very well-resourced location. Via these

regional partnerships, Ariana has reach over 2,500km of some of the

most prospective territory for gold, silver and copper deposits in

the world.

Any company's annual review would be incomplete without some

discussion and comment on "the herd of elephants in the room" in

our sector. To mention just a few of these: the magnitude of the

pandemic has probably taken most of us by surprise and left many of

us considering what are the most important things to us in our

working and private lives. To that end, it is probably worth

thinking of what one's core values are and what we deliver in our

day-to-day work. I can honestly say that the Ariana team are

focused on delivering the most professional job possible despite

the challenges of the moment. The dedication and focus of our team

is admirable and the Company is especially grateful.

The other elephant in the room, and an important subject

undergoing continual internal review, is Environmental, Social and

Governance ("ESG"). I see this subject as being largely about one's

core values and how we interact with our stakeholders and the

environment. In the broader sense, stakeholders are as wide ranging

as the environment in which we operate, the communities located

around our exploration prospects, the Kiziltepe mine community and

the ultimate beneficiaries of our commercial endeavours, our staff

and shareholders, in addition to local and national economies. In

all areas this range of stakeholders must be treated with fairness

and respect, as well as being kept informed about aspects of the

Company's affairs that materially affect them. This relationship is

inevitably a two-way street of communication with both sides

practising active listening and respect for one another's point of

view. It is through this process that I think we learn the

most.

Of course, the one stakeholder which does not have a voice of

its own needs special mention here. I think the environment and

climate change should be discussed as a broader and integrated

topic. While the extractive industries continue to get the blunt

edge of media attention, it is plainly obvious that human

civilisation cannot exist without incurring an impact on the Earth.

All primary industries, whether it is fishing, farming, forestry or

mining, leave a physical and lasting impact, altering the

environment through their presence. One only has to view Google

Earth to see the massive physical evidence of sea pollution,

farming, forestry and the odd mining or tailings dam site. However,

of all industries in my opinion, mining delivers significantly more

permanent benefit relative to its physical impact on the Earth. We

cannot change the fact that our industry has already had a

significant impact and made many mistakes. Nevertheless, we can

positively affect the future and our overall environmental impact

going forwards.

With this in mind, Ariana aims to continue to explore for our

natural assets in a constructive and sustainable manner, very

conscious of our legacy. Mining for resources predates farming and

probably followed mankind's first hunting and fishing activities.

As we now try to live in closer harmony with our natural world and

take steps towards living in the least polluting way, we will also

need to continue to explore for the minerals that will allow for

greater electrification and pollution-scrubbing of fossil fuels.

Ariana will continue along this theme, to look for sizeable

deposits in the copper, gold and silver space along with other

elements, set against the backdrop of the requirement for a cleaner

environment. The mining industry has been the leader in dealing

with the ESG agenda for decades, ahead of many other industries. It

has been at the top of the agenda on all the mining projects I have

ever been involved with during my working life. This will continue

to be the case. A lot more thought and resources should be invested

in mineral exploration to deliver our ongoing needs for new

minerals and the clean and effective use of remaining

resources.

We cannot leave the discussion of "elephants in the room"

without considering the largest destination for much of what is

mined, that being Asia, in particular China. China is by far the

largest consumer of coal and iron and is consequentially the

largest producer of industrial pollution by some margin. China has

made very clear steps towards disinvesting out of polluting

industries and increasing investment in cleaner energy

alternatives. It is a very well publicised fact that there are

simply not enough of the required battery and electrification

metals available to meet the forecast demand for a significant

switch to broader electrification. This trend, along with worldwide

government stimulus and post-pandemic investment, further supports

the view that whilst we have been in a commodities super-cycle for

some time, this is likely to continue with the help of Chinese

demand, placing Ariana in the right place at the right time to

continue to enjoy this growing trend.

With Ariana now looking at a wider field of potential

exploration, it is appropriate that we have a wider spread of our

team and partners across our theatres of operation. This currently

ranges across Australia, Cyprus, Kosovo, Turkey and the UK. Our

team is consequently able to cover nine time zones and a multitude

of prospective geological regions simultaneously. This strategy

allows for "boots on the ground" and "the eyeball mark one" to be

deployed without any need for international air travel, which in

itself satisfies a significant part of our ESG commitment going

forward.

Last but not least, we intend to reward our shareholders who

have remained invested over the long haul through the payment of

dividends. Court approval of our capital reorganisation has been

received and this will enable the declaration of a dividend which

the Board will announce in due course. As current guidance on AGM

regimes is returning to face-to-face meetings, with social

distancing, it may again be possible to meet you in person to

present our results and provide a company update. We would however

still encourage you to exercise your proxy votes well in advance of

the AGM date as you did last year. I would like to close by

thanking our corporate advisors and growing clan of strategic

partners for their dedication and support in helping Ariana achieve

its ongoing success.

Financial Review

The Group recorded a profit before tax for the year of GBP5

million, compared to GBP7 million in the prior year. The key driver

of this was the decline in profitability of our Joint Venture

company, Zenit Madencilik San. ve Tic. A.S. ("Zenit"), where our

share of their profit for the year reduced by GBP1.4 million, as

set out in note 6 to the accounts. Despite the price of gold being

strong over the period, and operationally the Company remaining

very robust, the decline in performance was in part due to the

lower grade ore being processed through the plant. However, the JV

company remains in a very strong position, having paid off all its

original capital loans, and the plant is currently being expanded

to increase throughput to match the expanding resource base.

Otherwise on the Group Income Statement front, there are few

surprises - costs remain broadly constant year on year, with no

write downs of previously capitalised exploration expenditure.

Within Other Comprehensive Income, there continues to be a large

charge recorded in respect of the foreign exchange loss due to the

weakening Turkish Lira. This represents the revaluation of Group

assets denominated in Lira, so does not directly impact us

operationally. Fortunately, our implicit revenue stream from

Zenit's gold production is directly linked to the US dollar

denominated price of gold.

As far as the Statement of Financial Position is concerned, our

primary assets are our aforementioned investment in Zenit, which

increased in value due to our share of the company's net assets

increasing year on year, along with our investment in Salinba . As

referenced in note 25, the Group concluded the disposal of both

these assets in February 2021, and so we have transferred the cost

of Salinba to current assets at the year end to reflect this. In

the future we will continue to record our ongoing investment in

23.5% of the share capital of the enlarged Zenit by way of equity

accounting, i.e. our share of that company's profits and net

assets, in our published accounts.

The Statement of Financial Position also reflects our earn-in to

our Cyprus venture - at the year end we had spent GBP1.2 million,

which is being converted to share capital as we earn into our full

50% stake in due course. In cash terms the Group performed strongly

with a net increase in cash of GBP2.5 million, arising mainly from

repayment of loans and dividends from Zenit.

The disposal of part of our interests in Turkey for a

consideration before costs and taxation of US$35.75 million (with a

further US$2 million due to be paid in instalments following the

transfer of the Satellite Projects), approved by shareholders prior

to the year end but concluded in February of this year, together

with the capital reorganisation finalised through the Courts in

June of this year, has put the Group firmly on a path towards

payment of dividends going forward; a suitable return for our loyal

shareholders.

Outlook

With some of the difficulties of 2020 behind us, we are now

looking strategically and operationally to the horizon of the next

decade. Since our IPO in 2005, we have transformed the Company from

a junior gold explorer to one which is sustainably self-financing,

holding a diverse portfolio of mineral exploration, development and

mining project investments. Most importantly of all from an

investor perspective, the Company can demonstrate a robust

track-record across several metrics which, among others, includes

our industry-leading discovery cost per ounce of gold and our

operational cash-costs which are in the lower quartile

internationally. From an environmental stand-point, our joint

venture operations produce gold at a CO(2) per ounce level which

significantly beats the international average.

Having diligently built these solid foundations for our future

business during the best part of the past two decades, we very much

look forward to the new "Roaring 20s". As it was 100 years ago,

with the world having emerged from a catastrophic pandemic, so will

it be today. While the 1920s were marked by the development of

technologies which enabled commercial flight, liquid-fuelled

rockets, energy distribution and television, the 2020s will be

marked by the development of commercial space-flight, renewable

energy, artificial intelligence and virtual reality, amongst other

technological advances. With the global population having increased

by 430% over the past century, the increased requirements of these

and other industries on the mining sector are unprecedented. Your

Company finds itself at the dawn of this new age with the

capability and financial resources to meet these demands head

on.

Stated simply, our reinvigorated purpose is to discover the

mineral resources needed by mankind faster, better and cheaper than

our competitors. We will continue to achieve this by mitigating

risks, mobilising cutting-edge technologies, minimising

environmental impact and maximising partnerships with local

communities. In addition, very unusually for a mineral exploration

and development company, we are advancing a strategy to enable the

Company to pay dividends over the long-term. This is in recognition

of the important role played by our shareholders, who provided the

risk-capital we required during our formative period and in the

expectation of facilitating a virtuous circle of future investment

in our Company.

Michael de Villiers

Chairman

13 July 2021

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2020

2020 2019

Continuing operations Note GBP'000 GBP'000

--------------------------------------------------- ---- -------- ----------

Administrative costs (1,360) (1,242)

General exploration expenditure (35) (18)

Intangible exploration assets - written

off 11a - (364)

Other gains 4 - 627

Other income - 61

--------------------------------------------------- ---- -------- ----------

Operating loss 5 (1,395) (936)

--------------------------------------------------- ---- -------- --------

Profit/(loss) on disposal of equity securities

at FVOCI - 20

Share of profit of Joint Venture accounted

for using the equity method 6 6,478 7,891

Investment income 7 5

--------------------------------------------------- ---- -------- --------

Profit before tax 5,090 6,980

--------------------------------------------------- ---- -------- --------

Taxation 8 (327) (46)

--------------------------------------------------- ---- -------- --------

Profit for the year from continuing operations 4,763 6,934

Earnings per share (pence) attributable

to equity holders of the company

--------------------------------------------------- ---- -------- --------

Basic and diluted 10 0.45 0.65

--------------------------------------------------- ---- -------- --------

Other comprehensive income

Items that are or may be reclassified subsequently

to profit or loss:

Exchange differences on translating foreign

operations (3,647) (1,774)

Items that will not be classified subsequently

to profit or loss:

Net change in fair value of equity securities

at FVOCI 13 - 49

--------------------------------------------------- ---- -------- --------

Other comprehensive loss for the year net

of income tax (3,647) (1,725)

--------------------------------------------------- ---- -------- --------

Total comprehensive profit for the year 1,116 5,209

--------------------------------------------------- ---- -------- --------

The accompanying notes form part of these financial

statements.

Consolidated Statement of Financial Position

For the year ended 31 December 2020

Note 2020 2019

GBP'000 GBP'000

--------------------------------------------- ----- --------- ---------

Assets

Non-current assets

Trade and other receivables 15 100 93

Intangible exploration assets 11a - 16,404

Intangible assets 11b 168 187

Land, property, plant and equipment 12 41 50

Earn-In advances 13 1,206 -

Investment in Joint Venture accounted

for using the equity method 6 11,213 7,768

--------------------------------------------- ----- --------- ---------

Total non-current assets 12,728 24,502

--------------------------------------------- ----- --------- ---------

Current assets

Trade and other receivables 16 298 4,574

Cash and cash equivalents 2,978 453

Assets classified as held for sale 18 16,002 -

--------------------------------------------- ----- --------- ---------

Total current assets 19,278 5,027

--------------------------------------------- ----- --------- ---------

Total assets 32,006 29,529

--------------------------------------------- ----- --------- ---------

Equity

Called up share capital 19 6,070 6,054

Share premium 19 12,053 11,821

Other reserves 720 720

Share based payments 19 307 364

Translation reserve (9,617) (5,970)

Retained earnings 17,164 12,298

--------------------------------------------- ----- --------- ---------

Total equity attributable to equity holders

of the parent 26,697 25,287

--------------------------------------------- ----- --------- ---------

Total equity 26,697 25,287

--------------------------------------------- ----- --------- ---------

Liabilities

Non-current liabilities

Deferred tax liabilities 20 - 2,273

Other financial liabilities 21 - 1,651

--------------------------------------------- ----- --------- ---------

Total non-current liabilities - 3,924

--------------------------------------------- ----- --------- ---------

Current liabilities

Trade and other payables 17 1,385 318

Liabilities directly associated with

classified as held for resale 18 3,924 -

--------------------------------------------- ----- --------- ---------

Total current liabilities 5,309 318

--------------------------------------------- ----- --------- ---------

Total equity and liabilities 32,006 29,529

--------------------------------------------- ----- --------- ---------

The accompanying notes form part of these financial

statements.

Company Statement of Financial Position

For the year ended 31 December 2020

Note 2020 2019

GBP'000 GBP'000

----------------------------------- ----- --------- ---------

Assets

Non-current assets

Trade and other receivables 15 7,027 8,508

Investments in group undertakings 14 377 365

Earn-In advances 13 1,206 -

----------------------------------- ----- --------- ---------

Total non-current assets 8,610 8,873

----------------------------------- ----- --------- ---------

Current assets

Trade and other receivables 16 - 534

Cash and cash equivalents - -

----------------------------------- ----- --------- ---------

Total current assets - 534

----------------------------------- ----- --------- ---------

Total assets 8,610 9,407

----------------------------------- ----- --------- ---------

Equity

Called up share capital 19 6,070 6,054

Share premium 19 12,053 11,821

Share based payments reserve 19 307 364

Retained earnings (9,826) (8,838)

----------------------------------- ----- --------- ---------

Total equity 8,604 9,401

----------------------------------- ----- --------- ---------

Liabilities

Current liabilities

Trade and other payables 17 6 6

----------------------------------- ----- --------- ---------

Total current liabilities 6 6

----------------------------------- ----- --------- ---------

Total equity and liabilities 8,610 9,407

----------------------------------- ----- --------- ---------

The accompanying notes form part of these financial

statements.

Consolidated Statement of Changes in Equity

For the year ended 31 December 2020

Share Share Other Share Translation Retained Total attributable

capital premium reserves based reserve earnings to equity

GBP'000 GBP'000 GBP'000 payments GBP'000 GBP'000 holders

reserve of parent

GBP'000 GBP'000

Changes in equity

to 31 December

2019

Balance at 1

January 2019 6,054 11,821 720 250 (4,196) 5,315 19,964

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Profit for the

year - - - - - 6,934 6,934

Other comprehensive

income - - - - (1,774) 49 (1,725)

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Total comprehensive

income - - - - (1,774) 6,983 5,209

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Share options - - - 114 - - 114

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Transactions

with owners - - - 114 - - 114

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Balance at 31

December 2019 6,054 11,821 720 364 (5,970) 12,298 25,287

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Changes in equity

to 31 December

2020

Profit for the

year - - - - - 4,763 4,763

Other comprehensive

income - - - - (3,647) - (3,647)

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Total comprehensive

income - - - - (3,647) 4,763 1,116

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Issue of ordinary

shares 16 232 - - - - 248

Share options - - - 46 - - 46

Transfer between

reserves - - - (103) - 103 -

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Transactions

with owners 16 232 - (57) - 103 294

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

Balance at 31

December 2020 6,070 12,053 720 307 (9,617) 17,164 26,697

------------------------ ------ --------- ---------- ---------- ------------ ---------- -------------------

The accompanying notes form part of these financial

statements.

Company Statement of Changes in Equity

For the year ended 31 December 2020

Share Share Share Retained Total

capital premium based earnings GBP'000

GBP'000 GBP'000 payments GBP'000

reserve

GBP'000

--------------------------- --------- --------- ---------- ---------- ---------

Changes in equity to

31 December 2019

Balance at 1 January

2019 6,054 11,821 250 (8,010) 10,115

--------------------------- --------- --------- ---------- ---------- ---------

Loss for the year - - - (828) (828)

Other comprehensive - - - - -

income

--------------------------- --------- --------- ---------- ---------- ---------

Total comprehensive

income - - - (828) (828)

--------------------------- --------- --------- ---------- ---------- ---------

Share options - - 114 - 114

Transactions with owners - - 114 - 114

--------------------------- --------- --------- ---------- ---------- ---------

Balance at 31 December

2019 6,054 11,821 364 (8,838) 9,401

--------------------------- --------- --------- ---------- ---------- ---------

Changes in equity to

31 December 2020

Loss for the year - - - (1.091) (1,091)

Other comprehensive - - - - -

income

--------------------------- --------- --------- ---------- ---------- ---------

Total comprehensive

income - - - (1,091) (1,091)

--------------------------- --------- --------- ---------- ---------- ---------

Issue of ordinary shares 16 232 248

Share options - - 46 - 46

Transfer between reserves - - (103) 103 -

--------------------------- --------- --------- ---------- ---------- ---------

Transactions with owners 16 232 (57) 103 294

--------------------------- --------- --------- ---------- ---------- ---------

Balance at 31 December

2020 6,070 12,053 307 (9,826) 8,604

--------------------------- --------- --------- ---------- ---------- ---------

The accompanying notes form part of these financial

statements.

Consolidated Statement of Cash Flows

For the year ended 31 December 2020

2020 2019

GBP'000 GBP'000

------------------------------------------------------ --------- ---------

Cash flows from operating activities

Profit for the year 4,763 6,934

Adjustments for:

Profit on disposal of subsidiary undertaking,

net of tax - (627)

(Profit)/loss on disposal of equity securities

at FVOCI - (20)

(Profit) on disposal of equipment - (53)

Depreciation of non-current assets 20 20

Write down of intangible exploration assets - 364

Fair value adjustments - (49)

Share of profit in Joint Venture (6,478) (7,891)

Share based payments charge 45 114

Investment income (7) (5)

Income tax expense 327 46

------------------------------------------------------ --------- ---------

Movement in working capital (1,330) (1,167)

Decrease in trade and other receivables 3,056 918

Increase in trade and other payables 1,021 253

------------------------------------------------------ --------- ---------

Cash inflow from operating activities 2,747 4

Taxation paid (282) (8)

------------------------------------------------------ --------- ---------

Net cash from operating activities 2,465 (4)

------------------------------------------------------ --------- ---------

Cash flows from investing activities

Earn-In Advances (672) -

Purchase of land, property, plant and equipment (3) (12)

Payments for intangible assets (262) (516)

Proceeds from disposal of equity securities

at FVOCI - 104

Proceeds from disposal of equipment - 55

Dividends from Joint Venture 776 -

Investment income 7 5

------------------------------------------------------ --------- ---------

Net cash used in investing activities (154) (364)

------------------------------------------------------ --------- ---------

Cash flows from financing activities

Issue of share capital 248 -

------------------------------------------------------ --------- ---------

Net cash generated from financing activities 248 -

------------------------------------------------------ --------- ---------

Net increase/(decrease) in cash and cash equivalents 2,559 (368)

Cash and cash equivalents at beginning of year 453 938

------------------------------------------------------ --------- ---------

Exchange adjustment on cash and cash equivalents (34) (117)

------------------------------------------------------ --------- ---------

Cash and cash equivalents at end of year 2,978 453

------------------------------------------------------ --------- ---------

Selected Notes to the Consolidated Financial Statements for the

year ended 31 December 2020

1. General Information

Ariana Resources PLC (the "Company") is a public limited company

incorporated, domiciled and registered in the UK. The registered

number is 05403426 and the registered address is

2nd Floor, Regis House, 45 King William Street, London, EC4R

9AN.

The Company's shares are listed on the Alternative Investment

Market of the London Stock Exchange. The principal activities of

the Company and its subsidiaries (together the "Group") are related

to the exploration for and development of gold and

technology-metals, principally in Turkey.

The consolidated financial statements are presented in Pounds

Sterling (GBP), which is the parent company's functional and

presentation currency, and all values are rounded to the nearest

thousand except where otherwise indicated. The financial

information has been prepared on the historical cost basis modified

to include revaluation to fair value of certain financial

instruments and the recognition of net assets acquired including

contingent liabilities assumed through business combinations at

their fair value on the acquisition date modified by the

revaluation of certain items, as stated in the accounting

policies.

Basis of Preparation

The Group financial statements have been prepared and approved

by the Directors in accordance with International Financial

Reporting Standards as adopted by the EU ("Adopted IFRSs") and

effective for the Group's reporting for the year ended 31 December

2020.

The separate financial statements of the Company are presented

as required by the Companies Act 2006. As permitted by that Act,

the separate financial statements have been prepared in accordance

with IFRS. These financial statements have been prepared under the

historical cost convention (except for financial assets at FVOCI)

and the accounting policies have been applied consistently

throughout the period.

Going Concern

These financial statements have been prepared on the going

concern basis.

The Directors are mindful that there is an ongoing need to

monitor overheads and costs associated with delivering on its

strategy and certain exploration programmes being undertaken across

its portfolio. The Group is not expecting to raise additional

capital at this time, but may do so to support its strategy and

specific activities on occasion. The Group has no bank facilities

and has been meeting its working capital requirements from cash

resources. At the year end the Group had cash and cash equivalents

amounting to GBP2.953 million (2019: GBP453,000).

As set out in note 26, subsequent to the year end the Group

partly disposed of its interests in Zenit Madencilik San. Ve Tic.

A.S. ("Zenit") and Pontid Madencilik San. Ve Tic. Limited for a

gross consideration before costs and taxation of US$37.75

million.

The Directors have prepared cash flow forecasts for the Group

for the period to 31 July 2022 based on their assessment of the

prospects of the Group's operations. The cash flow forecasts

include expected future cash flows from our Joint Venture

investment in Zenit along with the normal operating costs for the

Group over the period together with the discretionary and

non-discretionary exploration and development expenditure. The

forecasts indicate that on the basis of existing cash and other

resources, and expected future dividend payments from Zenit, the

Group will have adequate resources to meet all its expected

obligations in delivering its work programme for the forthcoming

year.

The Group believes there should be no significant material

disruption to the mining operations in Zenit from COVID-19, but the

Board continues to monitor these risks and Zenit's business

continuity plans.

In preparing these financial statements the Directors have given

consideration to the above matters and on this basis they believe

that it remains appropriate to prepare the financial statements on

a going concern basis.

6. Share of profit of interest in Joint Venture

In July 2010 the Group entered into an agreement with Proccea

Construction Co. ("Proccea") such that Galata Madencilik San. ve

Tic. Ltd. ("Galata") would transfer its principal assets at

Kiziltepe and Tav an, collectively known as the "Red Rabbit Gold

Project" into a wholly owned subsidiary, Zenit Madencilik San. ve

Tic. A.S. ("Zenit"). Proccea earned their 50% share in Zenit by

investing US$8 million in the capital of Zenit, US$1.4 million of

such funds having been spent on a Feasibility Study and an

Environmental Impact Assessment ("EIA"), with the balance on

initial mine construction, once the Feasibility Study and EIA were

completed satisfactorily. Shareholdings in Zenit represents the

ratio of 50% the Group and 50% to Proccea, with Proccea in

management control, but with key decisions requiring approval from

both the Group and Proccea.

Zenit entered production during March 2017, with commercial

production declared from 1 July 2017. Operational revenues and

costs arising from pre-commercial production were capitalised in

2017 along with any new capital expenditure incurred during 2018

including the construction of the district road diversion necessary

for the full development of the Arzu South open pit. Total revenue

for the year was c. US$37.5 million (2019: US$45.1 million) in gold

and silver sales.

The liability of the Joint Venture includes current and

non-current portions of a bank loan repayable to Turkiye Finans

Katilim Bankasi A.S. and Garanti Bankasi A.S.. Management does not

foresee any significant restrictions on the ability of the Joint

Venture to repay these loans.

The Group accounts for its Joint Venture with Proccea in Zenit

using the equity method in accordance with IAS 28 (revised). At 31

December 2020 the Group has a 50% (2019: 50%) interest in Zenit.

Ultimately profits from Zenit are shared in the ratio of 50:50

between Group and Proccea.

Principal place of business for Zenit is Ankara, Turkey. Zenit

was also incorporated in Ankara, Turkey.

Financial information of the Joint Venture, based on its

translated financial statements, and reconciliations with the

carrying amount of the investment in the consolidated financial

statements are set out below:

Statement of Comprehensive Income 2020 2019

For the year ended 31 December 2020 GBP'000 GBP'000

--------------------------------------------- --------- ---------

Revenue 29,145 35,337

Cost of sales (13,335) (15,444)

--------------------------------------------- --------- ---------

Gross Profit 15,810 19,893

Administrative expenses (1,750) (1,636)

--------------------------------------------- --------- ---------

Operating profit 14,060 18,257

Finance expenses including foreign exchange

losses (3,143) (4,762)

Finance income including foreign exchange

gains 2,262 2,667

--------------------------------------------- --------- ---------

Profit before tax 13,179 16,162

Taxation charge (223) (380)

--------------------------------------------- --------- ---------

Profit for the year 12,956 15,782

--------------------------------------------- --------- ---------

Proportion of the Group's profit share 50% 50%

Group's share of profit for the year 6,478 7,891

--------------------------------------------- --------- ---------

Statement of financial position 2020 2019

As at 31 December 2020 GBP'000 GBP'000

----------------------------------------------------- --------- ---------

Assets

Non-current assets

Other receivables and deferred tax asset 1,244 440

Intangible exploration assets 670 837

Kiziltepe Gold Mine (including capitalised

mining costs, land, property, plant and equipment) 18,817 23,275

----------------------------------------------------- --------- ---------

Total non-current assets 20,731 24,552

----------------------------------------------------- --------- ---------

Current assets

Cash and cash equivalents 8,031 7,184

Trade and other receivables 286 752

Inventories 2,598 1,745

Other receivables, VAT and prepayments 2,004 2,187

----------------------------------------------------- --------- ---------

Total current assets 12,919 11,868

----------------------------------------------------- --------- ---------

Total assets 33,650 36,420

----------------------------------------------------- --------- ---------

Liabilities

Non-current liabilities

Borrowings 2,126 3,241

Asset retirement obligation 924 1,000

----------------------------------------------------- --------- ---------

Total non-current liabilities 3,050 4,241

----------------------------------------------------- --------- ---------

Current liabilities

Borrowings 4,881 5,776

Trade payables 1,544 1,883

Other payables 1,749 8,984

----------------------------------------------------- --------- ---------

Total current liabilities 8,174 16,643

----------------------------------------------------- --------- ---------

Total liabilities 11,224 20,884

----------------------------------------------------- --------- ---------

Equity 22,426 15,536

Proportion of the Group's profit share 50% 50%

Carrying amount of investment in Joint Venture 11,213 7,768

----------------------------------------------------- --------- ---------

Movement in Equity - our share

Opening balance 7,768 3,968

Profit for the year 6,478 7,891

Translation and other reserves (2,257) (1,049)

Dividend receivable (776) (3,042)

----------------------------------------------------- --------- ---------

Closing balance 11,213 7,768

----------------------------------------------------- --------- ---------

10. Earnings per share on continuing operations

The calculation of basic profit per share is based on the profit

attributable to ordinary shareholders of GBP4,763,000 (2019:

GBP6,934,000) divided by the weighted average number of shares in

issue during the year being 1,062,538,317 shares (2019:

1,059,677,953). There is no material effect on the basic earnings

per share for the dilution provided by the share options.

11a. Intangible exploration assets

Deferred exploration expenditure

GBP'000

Cost

---------------------------------------- ---------------------------------

At 1 January 2019 16,975

Additions and capitalised depreciation 516

Reclassification of expenditure (206)

Exchange movements (517)

Expenditure written off (364)

---------------------------------------- ---------------------------------

At 31 December 2019 16,404

---------------------------------------- ---------------------------------

Additions and capitalised depreciation 263

Exchange movements (665)

Expenditure reclassified to assets

held for sale (note 18) (16,002)

---------------------------------------- ---------------------------------

At 31 December 2020 -

---------------------------------------- ---------------------------------

Net book value

At 1 January 2019 16,975

At 31 December 2019 16,404

---------------------------------------- ---------------------------------

At 31 December 2020 -

---------------------------------------- ---------------------------------

None of the Group's intangible assets are owned by the

Company.

The technical feasibility and commercial viability of extracting

a mineral resource are not yet fully demonstrable in the above

intangible exploration assets. These assets are not amortised,

until technical feasibility and commercial viability is

established. Intangible exploration costs written off represent

costs relating to certain projects that are no longer considered

economically viable or where exploration licences have been

relinquished.

15. Non-current trade and other receivables

Group Company

2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------- ---------- --------- ----------

Amounts owed by Group undertakings - - 7,027 8,508

------------------------------------ --------- ---------- --------- ----------

Other receivables 100 93 - -

------------------------------------ --------- ---------- --------- ----------

100 93 7,027 8,508

------------------------------------ --------- ---------- --------- ----------

Other receivables falling due after more than one year represent

amounts due from the government of Turkey in respect of VAT

relating to the Group's exploration projects. The amounts owed to

the Company by Group undertakings are interest free and repayable

on demand.

16. Trade and other receivables

Group Company

2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------- --------- ---------- --------- ----------

Amounts owed by Joint Venture Company - 3,383 - -

Other receivables 183 598 - -

Earn-In advances reclassified to Non-current

assets - 534 - 534

Prepayments 115 59 - -

---------------------------------------------- --------- ---------- --------- ----------

298 4,574 - 534

---------------------------------------------- --------- ---------- --------- ----------

The carrying values of other receivables approximate their fair

values because these balances are expected to be cash settled in

the near future.

17. Trade and other payables

Group Company

2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- --------- --------- --------- ---------

Trade and other payables 147 109 - -

Social security and other taxes 14 66 - -

Other creditors and advances 1,099 7 - -

Accruals and deferred income 125 136 6 6

---------------------------------- -------------- --------- --------- ---------

1,385 318 6 6

---------------------------------- -------------- --------- --------- ---------

The above listed payables are all unsecured. Due to the

short-term nature of current payables, their carrying values

approximate their fair value.

18. Assets and liabilities classified as held for sale

Group Company

2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- --------- --------- ----------- ---------

Assets classified as held for sale

Intangible Exploration assets 16,002 - - -

------------------------------------- ------------ --------- ----------- ---------

Total assets of group held for sale 16,002 - - -

------------------------------------- ------------ --------- ----------- ---------

Liabilities directly associated with

assets classified as held for sale

Deferred tax liabilities 2,273 - - -

Contingent consideration payable 1,651 - - -

---------------------------------------- --------- --------- ----------- ---------

Total liabilities of group held for 3,924 - - -

sale

---------------------------------------- --------- --------- ----------- ---------

The above assets and liabilities held for sale were reclassified

from non-current assets and non-current liabilities due to the

Group concluding the disposal, since the year end, of its interests

in its Salinbas and all other exploration projects, held through

its subsidiary companies based in Turkey. Further details are

disclosed in note 26.

19. Called up share capital and premium

Allotted, issued Number Ordinary Deferred Called up Share

and fully paid Shares shares Share capital Premium

ordinary 0.1p shares GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------------- --------- --------- --------------- ---------

In issue at 1

January 2020 1,059,677,943 1,059 4,995 6,054 11,821

Share options exercised 16,000,000 16 - 16 232

------------------------- -------------- --------- --------- --------------- ---------

In issue at 31

December 2020 1,075,677,943 1,075 4,995 6,070 12,053

------------------------- -------------- --------- --------- --------------- ---------

During 2013 the existing ordinary shares were sub-divided into

one new ordinary share of 0.1 pence ("New Ordinary Share") and one

deferred share of 0.9 pence ("Deferred Share"). The New Ordinary

Shares have a nominal value of 0.1 pence. The percentage of New

Ordinary Shares held by each shareholder following the subdivision

is the same as the percentage of existing ordinary shares held by

the shareholder before the change.

Fully paid Ordinary Shares carry one vote per share and carry

the right to dividends. Deferred Shares have attached to them the

following rights and restrictions:

-- they do not entitle the holders to receive any dividends and distributions;

-- they do not entitle the holders to receive notice or to

attend or vote at General Meetings of the Company;

-- on return of capital on a winding up the holders of the

Deferred Shares are only entitled to receive the amount paid up on

such shares after the holders of the Ordinary Shares have received

the sum of 0.1p for each ordinary share held by them and do not

have any other right to participate in the assets of the

Company.

Potential issue of ordinary shares

Share options

The Company issued 64,000,000 new options to Directors and staff

at an exercise price of 1.55 pence, vesting over 3 years,

commencing on 1 January 2018. At 31 December 2020 the Company had

options outstanding for the issue of ordinary shares as

follows:

Date options Exercisable Exercisable Exercise Number Options Number at

granted from to price granted exercised 31 December

during the 2020

year

-------------- ------------- ------------- ----------- ----------- ------------- -------------

1 January 1 January 31 December

2018 2018 2023 1.55p 64,000,000 (16,000,000) 48,000,000

-------------- ------------- ------------- ----------- ----------- ------------- -------------

Total 64,000,000 (16,000,000) 48,000,000

-------------------------------------------- ------- ----------- ------------- -------------

The fair value of services received in return for share options

are measured by reference to the fair value of share options

granted. The fair value of employee share options is measured using

the Black-Scholes model. Measurement inputs and assumptions are as

follows:

Costs associated with options issued on the 1 January 2018

and exercisable by 2023

Share price when options issued 1.25p

Expected volatility (based on closing prices

over the last 7 years) 67.84%

Expected life 5 years

Risk free rate 0.75%

Expected dividends 0%

The expected volatility is wholly based on the historic

volatility (calculated based on the weighted average of the last 7

years of quotation).

Group and Company

2020

Share based payments reserve GBP'000

------------------------------------ ------------------

At 1 January 2020 364

Charge during the year 46

Transfer to retained earnings for

options exercised during the year (103)

------------------------------------ ------------------

At 31 December 2020 307

------------------------------------ ------------------

As set out in note 2 the Group recognised an expense of

GBP46,000 (2019: GBP114,000) relating to equity share based payment

transactions in the year.

20. Deferred tax liabilities

Group Company

2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- --------- --------- --------- ---------

Opening and closing deferred - 2,273 - -

tax liability

----------------------------- --------- --------- --------- ---------

Deferred tax has been provided against the fair value uplift of

intangible exploration assets that resulted from a previous

business combination. This liability has been reclassified under

liabilities directly associated with assets held for sale, as set

out in note 18.

21. Other financial liabilities

Group Company

2020 2019 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ----------- --------- ----------- ---------

Contingent consideration payable - 1,651 - -

------------------------------------ ----------- --------- ----------- ---------

The consideration above relates to a 2% net smelter returns

royalty on the future production revenue at Salinba . This

liability arose as a result of the business combination as noted in

note 20. This liability has been reclassified under liabilities

directly associated with assets held for sale, as set out in note

18.

26. Post year end events

In February 2021 the Group concluded the disposal of its

interests in Salinba held through its subsidiary company Pontid

Madencilik San ve Tic. Ltd to Zenit, and the subsequent disposal of

53% of its existing shareholding in Zenit to Özaltin Holding A.S.

for an overall consideration of US$35.75 million before costs and

taxation, retaining a 23.5% interest in the ongoing joint venture.

A further US$2 million is to be paid in instalments to the Group by

Zenit following the transfer of three remaining Satellite Projects

by Galata Madenicilik San. ve Tic. Ltd. to Zenit.

In June 2021 the Company was successful in its application to

the Court for permission to reduce its share capital via the

cancellation of its share premium account and historical deferred

shares in issue.

Note to the announcement

The financial information set out above does not constitute the

Company's statutory accounts for the year ended 31 December 2020,

or year ended 31 December 2019, but is derived from those accounts.

Statutory accounts for 2019 have been delivered to the Registrar of

Companies and those for 2020 on which the auditors have provided an

unqualified report will be delivered following the AGM.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628 3396

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited Tel: +44 (0) 20 7886 2500

John Prior / Hugh Rich / Atholl

Tweedie

Yellow Jersey PR Limited Tel: +44 (0) 7951 402 336

Dom Barretto / Joe Burgess / Henry arianaresources@yellowjerseypr.com

Wilkinson

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus and Kosovo.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a joint venture with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at July 2020). The

joint venture comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 227,000 ounces gold and 0.7 million ounces silver (as at April

2020). The mine has been in profitable production since 2017 and is

expected to produce at a rate of c.20,000 ounces of gold per annum

to at least the mid-2020s. A Net Smelter Return ("NSR") royalty of

2.5% on production is being paid to Franco-Nevada Corporation.

The Tavsan Gold Project is located in western Turkey and

contains a JORC Measured, Indicated and Inferred Resource of

253,000 ounces gold and 3.7 million ounces silver (as at June

2020). The project is being progressed through permitting and an

Environmental Impact Assessment, with the intention of developing

the site to become the second joint venture gold mining operation.

A NSR royalty of up to 2% on future production is payable to

Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Goldfield, which contains the "Hot Gold

Corridor" comprising several significant gold-copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana is earning-in to 75% of Western Tethyan Resources Ltd

("WTR"), which operates across Eastern Europe and is based in

Pristina, Republic of Kosovo. The company is targeting its

exploration on major copper-gold deposits across the

porphyry-epithermal transition.

Ariana is also earning-in to 50% of UK-registered Venus Minerals

Ltd ("Venus") and has to date been earning into an entitlement to

37.5%. Venus is focused on the exploration and development of

copper-gold assets in Cyprus which contain a combined JORC Inferred

Resource of 9.5Mt @ 0.65% copper (excluding additional gold, silver

and zinc).

Panmure Gordon (UK) Limited is broker to the Company and

Beaumont Cornish Limited is the Company's Nominated Adviser and

Broker.

For further information on Ariana you are invited to visit the

Company's website at www.arianaresources.com .

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAKXDFLXFEFA

(END) Dow Jones Newswires

July 14, 2021 02:00 ET (06:00 GMT)

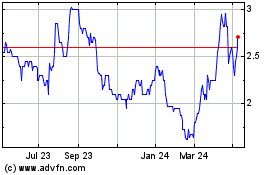

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

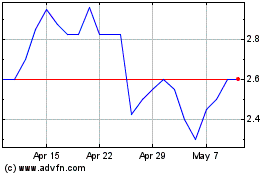

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024