TIDMABDP

RNS Number : 3336T

AB Dynamics PLC

24 November 2021

24 November 2021

AB Dynamics plc

Final Results for the Year Ended 31 August 2021

"Robust performance supported by recovering demand and strategic

progress"

AB Dynamics plc ("AB Dynamics", the "Company" or the "Group"),

the designer, manufacturer and supplier of advanced testing systems

and measurement products to the global automotive market, is

pleased to announce its final results for the year ended 31 August

2021.

Audited Audited

2021 2020

GBPm GBPm

Revenue 65.4 61.5 +6%

Gross margin 56.8% 58.4% (160 bps)

Adjusted operating profit(1) 10.8 11.3 (4%)

Adjusted operating margin(1) 16.6% 18.4% (180 bps)

Statutory operating profit(2) 4.2 4.8 (12%)

Adjusted cash flow from

operations(1) 16.0 6.9 +131%

Net cash 22.3 30.0 (26%)

------------------------------- -------- -------- ----------

Pence Pence

Adjusted diluted earnings

per share(1) 37.4 39.9 (6%)

Statutory diluted earnings

per share(2) 13.1 17.8 (26%)

Total dividend per share 4.8 4.4 +10%

------------------------------- -------- -------- ----------

(1) Before amortisation of acquired intangibles, acquisition

related charges and exceptional items. A reconciliation to

statutory measures is given below.

(2) The prior year comparative has been restated to reflect the

write off of previously capitalised ERP development costs on

adoption of the IFRIC update on cloud computing arrangements.

Financial highlights

-- Strong second half performance, managing supply chain

disruption and currency headwinds effectively in order to meet

strengthening demand during the period

-- Continued recovery in the Group's markets translated into

improved order intake with positive book to bill ratio across both

divisions

-- Revenue for the first half of the year was broadly comparable

to H2 2020 with COVID-19 impact continuing into the current

year

-- Track testing revenue decreased by 4%, impacted by COVID-19

disruption to customer testing activity, although driving robot and

Advanced Driver Assistance System (ADAS) platform revenue recovered

well during the second half

-- Laboratory testing and simulation revenues increased by 62%

as a result of significant growth in SPMM and simulation revenues

following the deferments in the prior year and successful sales

campaigns

-- Reduction in adjusted operating margins to 16.6% driven by

product mix and continued strategic investment in capability to

support long-term growth drivers

-- Significant cash generation of GBP16.0m (2020: GBP6.9m)

leaving net cash at year end of GBP22.3m (2020: GBP30.0m) after

funding the acquisition of Vadotech and investing GBP6.6m in

capital expenditure in the period

-- Proposed final dividend of 3.2p per share, with total

dividend of 4.8p per share (2020: 4.4p per share) reflecting the

Board's confidence in the Group's financial position and

prospects

Operational and strategic highlights

-- Further progress made on implementation of strategic

initiatives to enhance commercial and operational capability and

provide a platform for sustainable long-term growth

-- New product development continued as planned with successful

launches including high speed ADAS platforms and a next generation

simulator

-- Growth in recurring revenue to 35%, up from 28% of Group

revenue through acquired businesses and increased sales of service

and support contracts

-- Solid performance from Vadotech which was acquired in the second half of the year

-- Significant work undertaken to evolve the next phase of the

Group's strategy, targeting diversification alongside the

established pillars and opening up new markets beyond

automotive

-- Post year end launch of ABD Solutions, a new business unit

focused on providing retrofit solutions that enable the automation

of conventional off-road vehicle fleets rapidly and cost

effectively

Current trading and outlook

-- Q1 trading to date in line with H2 2021 exit rate

-- Customer operations remain disrupted in some locations, but

underlying demand recovery continues to strengthen with sustainable

long-term structural and regulatory growth drivers remaining

intact

-- Supply chain disruption expected to persist into the current

year, with further operational initiatives in train to meet

demand

-- Progress in development of ABD Solutions with investment

required during 2022 to generate incremental growth opportunities

thereafter

-- Continued innovation and capability investment generating positive commercial momentum

-- Well placed and sufficiently invested to capitalise on opportunities

There will be a presentation for analysts this morning at 9.30am

at the London Stock Exchange. Please contact

abdynamics@tulchangroup.com if you would like to attend.

Commenting on the results, Dr James Routh, Chief Executive

Officer said:

"The Group has delivered another year of strong performance,

despite the ongoing impacts of COVID-19, particularly in the first

half of the year. The second half delivered record levels of order

intake, revenue and cash generation, which provides a strong

foundation for continued growth in 2022.

Against the backdrop of continued market uncertainty, the Group

continued to invest in all areas of the business, further

supporting our ambitious growth plans. During the year, we made

demonstrable progress in evolving the Group's strategic direction,

both with the acquisition of Vadotech and also through the launch

of ABD Solutions, a major new growth initiative to diversify the

business. The Group also continued to strengthen the operational

and commercial platform of the business through investing in new

product development, capabilities and the senior management

team.

Our market drivers remain strong. Against that background and

based on the recent track record of strong order intake and

continued strategic investment, the Board is confident of

delivering progress during 2022 and beyond."

Enquiries:

AB Dynamics plc 01225 860 200

Dr James Routh, Chief Executive Officer

Sarah Matthews-DeMers, Chief Financial

Officer

Peel Hunt LLP 0207 418 8900

Mike Bell

Ed Allsopp

Tulchan Communications 0207 353 4200

James Macey White

Matt Low

Laura Marshall

The person responsible for arranging the release of this

information is David Forbes, Company Secretary.

About AB Dynamics plc

AB Dynamics is a leading designer, manufacturer and provider of

advanced products for testing and verification of Advanced Driver

Assistance Systems ("ADAS") technology, autonomous vehicle

development and vehicle dynamics to the global automotive research

and development sector.

AB Dynamics is an international group of companies headquartered

in Bradford on Avon. AB Dynamics currently supplies all the top

automotive manufacturers, Tier 1 suppliers and service providers,

who routinely use the Group's products to test and verify vehicle

safety systems and dynamics.

Group overview

The Group delivered a robust performance against continued

macroeconomic challenges due to the ongoing COVID-19 pandemic, in

what has been another year of fluctuating market conditions and

change.

The performance during the year was split by two markedly

differing halves. As expected, the first half performance was

characterised by ongoing market impacts from COVID-19, followed by

an exceptional second half performance with the Group delivering

record levels of order intake and revenue for a half year period,

despite certain supply chain constraints and the impact of staff

isolation in the UK.

The Group continued to deliver progress against our stated

strategic priorities, with the acquisition of Vadotech delivering

both expansion of our international footprint and increasing our

service capability. We have also expanded our strategy and put in

place plans to diversify the business into large, attractive

adjacent markets through our new business unit, ABD Solutions.

The current market conditions and strong second half order

intake performance provide a solid platform for continued growth

and performance during 2022.

Financial performance

The Group results show revenue growth of 6% to GBP65.4m (2020:

GBP61.5m) with the significant majority of GBP38.1m delivered in

the second half of the financial year, which is the highest

half-year revenue during the Group's history. Despite the adverse

impacts of UK-based staff isolations, supply chain constraints and

adverse foreign exchange impacts, the Group second half revenue

growth of 42% (H2 2020: GBP26.8m) was strong, driven by ADAS

platforms, laboratory testing and simulation sales and the

acquisition of Vadotech and is 19% higher than the comparable

period in the pre-COVID-19 financial year (H2 2019: GBP32.1m).

Organic revenue decreased by 3%, or 1% on a constant currency

basis, with the first half of the prior year being a particularly

strong comparative, having been concluded before the impact of

COVID.

Excluding the distortive H1 comparative, organic revenue has

improved, increasing from GBP26.8m in H2 2020 to GBP32.2m in H2

2021, growth of 20%.

The Group continues to increase the proportion of recurring

revenue which grew to 35% (2020: 28%) through a higher proportion

of sales relating to software and services and further enhanced by

the recent acquisition of Vadotech Group.

Gross margins reduced by 160 bps to 56.8% (2020: 58.4%),

impacted by a higher proportion of large capital equipment revenues

in laboratory testing and simulation, which are lower margin than

the Group's other products and services.

Adjusted operating profit decreased 4% to GBP10.8m (2020:

GBP11.3m), a reduction in adjusted operating margin of 180 bps to

16.6% (2020: 18.4%). The reduction in operating margin was impacted

by the dilution of the gross margin and continued investment to

further strengthen the Group's operational and commercial platform

through investment in senior management, people and systems.

The Group delivered strong adjusted operating cash flow of

GBP16.0m with the net cash position at year end of GBP22.3m (2020:

GBP30.0m) underpinning a robust balance sheet, despite the

acquisition of Vadotech Group for gross consideration of GBP17.3m

and capital investment in our new Engineering Design Centre, an

expanded test track facility in California and ongoing new product

development, totalling GBP6.6m.

Net finance costs were GBP0.4m (2020: GBP0.4m), with lease

interest of GBP0.1m and the unwinding of the discounted value of

the deferred consideration on Vadotech of GBP0.3m.

This left adjusted profit before tax of GBP10.4m (2020:

GBP10.9m).

The Group adjusted tax charge totalled GBP1.9m (2020: GBP1.9m),

an adjusted effective tax rate of 18.2% (2020: 17.7%). The

effective tax rate is lower than the current UK corporation tax

rate due to allowances for research and development and patent

box.

Adjusted diluted earnings per share were 37.4p (2020: 39.9p), a

decrease of 6%.

Statutory operating profit decreased by 12% to GBP4.2m (2020:

GBP4.8m) and after net finance costs of GBP0.4m (2020: GBP0.4m),

statutory profit before tax decreased by 14% from GBP4.3m to

GBP3.8m, giving statutory basic earnings per share of 13.2p (2020:

17.9p). The statutory tax charge was GBP0.8m (2020: GBP0.3m). A

reconciliation of statutory to underlying non-GAAP financial

measures is provided below.

Sector review

The track testing sector delivered revenue of GBP49.7m (2020:

GBP51.8m), a 4% reduction on the prior year and a 2% reduction at

constant currency. The first half of the financial year showed a

continued impact of COVID-19 with revenues at GBP20.9m (H1 2020:

GBP29.6m), with a strong recovery in second half revenues to

GBP28.8m (H2 2020: GBP22.2m).

The track testing performance was characterised by a reduction

in sales of driving robots, ADAS platforms and track test services

at Dynamic Research Inc (DRI), offset by the initial contribution

from road-based testing at Vadotech.

Driving robot sales reduced by 20% to GBP16.9m (2020: GBP21.1m),

particularly in the second half, as lower H1 order intake impacted

H2 revenues. Order intake for driving robots recovered strongly in

H2 with full- year order intake significantly higher than 2020. The

Group expects a moderate growth in driving robots once new

regulatory requirements for new ADAS technologies are released.

Revenues in ADAS platforms reduced 6% to GBP22.7m (2020:

GBP24.1m) due to the weaker first half of the financial year with

revenue recovering strongly in H2 to GBP13.1m (H1 2021: GBP9.6m).

Demand for ADAS platforms, particularly the LaunchPad family of

products, continues to build, in particular the Group's new

LaunchPad 80 product used for testing higher speed objects such as

motorcycles. The Group also launched the GST 120 during the year,

providing the ability to test up to 120 kph and providing enhanced

deceleration capabilities through its anti-lock braking system.

The trend towards multi-object test scenarios will further drive

demand for a range of platforms that meet these test requirements,

including platforms to carry a range of objects (e.g. pedestrian

dummies, cyclists, scooters, motorcycles etc) that can operate at a

range of speeds and can interact with a variety of test vehicles

from passenger cars to commercial vehicles.

Revenue related to the provision of testing services increased

53% to GBP10.1m (2020: GBP6.6m) due to the impact of the

acquisition of Vadotech Group in March 2021, partly offset by a

weaker performance at DRI. Track testing operations at DRI were

impacted in H1 by the COVID-19 pandemic preventing physical testing

taking place and the change in the US government delayed the award

of new contracts from the government agency NHTSA.

The laboratory testing and simulation sector delivered strong

overall revenue growth of 62% to GBP15.7m (2020: GBP9.7m), through

significant growth of 28% in Suspension Parameter Measurement

Machine (SPMM) sales revenue and a very strong simulation

performance, growing by 98%. Many of the H2 2020 deferred orders

for larger capital items such as SPMM and Advanced Vehicle Driving

Simulator (aVDS) were received, which supported the strong revenue

performance.

The growth in sales revenue in laboratory testing equipment

(including SPMM) of 28% to GBP6.4m (2020: GBP5.0m) was due to

continued strong demand from China, with order intake continuing

through H2 to support the delivery of FY 2022 revenue. The

manufacture of the first ANVH test machine to a major automotive

OEM is nearing completion, which contributed to the laboratory

testing and simulation sector performance.

The simulation sector performed very well with revenue growth of

98% to GBP9.3m (2020: GBP4.7m) due to the delivery of several aVDS

simulator systems and a recovery in revenues at rFpro following the

delays to the motorsport season in FY 2020. The outlook for

simulation is robust with a strong order book for aVDS simulators

and the market for rFpro simulation software supporting continued

growth.

Strategic progress

The Group continues to make good progress against its stated

core strategic priorities, as well as expanding the strategy to

include diversification and further integrating ESG as a core

tenet.

Following a comprehensive review of the potential market for

leveraging our core technologies, the Group established ABD

Solutions, a new business unit focused on the application of

robotics technology and control in attractive adjacent markets to

automate selected vehicle applications. Initial market sectors for

ABD Solutions are mining, agriculture, materials handling and

defence applications.

It is important to emphasise that this new business unit is

incremental to our existing business and our previously stated

strategic plans around the core business remain firmly in place.

During the year, we continued to invest in both R&D and

capabilities to expand this attractive core market. AB Dynamics

completed the build and fit out of the new Engineering Design

Centre in the UK, housing the engineering teams of AB Dynamics, a

simulation development area and demonstration suite, laboratories

and prototyping facilities. A range of new products were launched

to market, in particular, the LaunchPad 80, Guided Soft Target 120

and aVDS Mk2. All new product launches have gained significant

market traction and provided a strong contribution to the recent

growth in order intake.

Significant ongoing investment has been made in building the

bench strength and capabilities in senior management. During the

year, the Group established a divisional management structure, with

the recruitment of senior regional leadership, and further build

out of the corporate team with the appointment of a Chief Strategy

Officer. Additional investments have been made at all levels of

management to ensure solid foundations are established for our

ambitious growth plans.

Acquisitions

During the second half of the year, the Group acquired Vadotech

Group for a maximum consideration of up to EUR26m. Vadotech Group

is a leading supplier of testing services in the Asia Pacific

region, headquartered in Singapore with key operations in China,

Japan and Germany. Vadotech Group expands the range of services

offered by the Group into full vehicle assessments, particularly to

German OEMs, under long-term customer framework agreements and has

established an electric vehicle and e-mobility training centre in

Germany. The acquisition provided a strategically important

footprint in the Asia Pacific region, allowing the introduction of

our new divisional operating hub in Singapore. Vadotech Group has

performed well since acquisition and in line with the Board's

expectations.

Acquisitions have and will continue to be a significant part of

our overall strategy.

Alternative performance measures

In the analysis of the Group's financial performance and

position, operating results and cash flows, alternative performance

measures are presented to provide readers with additional

information. The principal measures presented are adjusted measures

of earnings including adjusted operating profit, adjusted operating

margin, adjusted profit before tax and adjusted earnings per

share.

This financial information includes both statutory and adjusted

non-GAAP financial measures, the latter of which the Directors

believe better reflect the underlying performance of the business

and provide a more meaningful comparison of how the business is

managed and measured on a day-to-day basis. The Group's alternative

performance measures and KPIs are aligned to the Group's strategy

and together are used to measure the performance of the business

and form the basis of the performance measures for remuneration.

Adjusted results exclude certain items because if included, these

items could distort the understanding of the performance for the

year and the comparability between the periods.

We provide comparatives alongside all current year figures. The

term 'adjusted' is not defined under IFRS and may not be comparable

with similarly titled measures used by other companies. All profit

and earnings per share figures in this financial information relate

to underlying business performance (as defined above) unless

otherwise stated.

A reconciliation of statutory measures to adjusted measures is

provided below:

2021 2020

Statutory Adjustments Adjusted Statutory* Adjustments * Adjusted

Operating profit (GBPm) 4.2 6.6 10.8 4.7 6.6 11.3

Operating margin (%) 6.4 10.2 16.6 7.7 10.7 18.4

Profit before tax (GBPm) 3.8 6.6 10.4 4.3 6.6 10.9

Taxation (GBPm) (0.8) (1.1) (1.9) (0.3) (1.6) (1.9)

Profit after tax (GBPm) 3.0 5.5 8.5 4.0 5.0 9.0

Diluted earnings per share (pence) 13.1 24.3 37.4 17.8 22.1 39.9

Cash flow from operations 14.3 1.7 16.0 6.2 0.7 6.9

The adjustments comprise:

2021 2020

(Restated)*

GBPm GBPm

Amortisation of acquired intangibles 4.4 3.5

Acquisition related (credit) / costs 0.8 (1.9)

ERP development costs 1.4 0.7

Inventory impairment - 3.3

Restructuring - 1.0

-------------------------------------- ----- -------------

Adjustments 6.6 6.6

-------------------------------------- ----- -------------

*Comparatives have been restated following the adoption of IFRIC

update on cloud computing arrangements.

Adjustments totalled GBP6.6m (2020: GBP6.6m), of which GBP4.4m

related to amortisation of acquired intangible assets, GBP0.8m to

acquisition costs and GBP1.4m to ERP development costs, which,

following an update to the accounting standards in relation to

cloud computing arrangements, can no longer be capitalised.

Return on capital employed (ROCE)

Our capital-efficient business and high margins enable

generation of strong ROCE (defined as adjusted operating profit as

a percentage of capital employed). However, in the years in which

we acquire businesses or new properties, our capital base grows

disproportionately with profit, therefore the ratio will be

impacted. The current year has been impacted by the acquisition of

Vadotech and commissioning the new Engineering Design Centre,

accounting for the decrease in ROCE in the year from 15.2% in 2020

to 11.5% in 2021.

Research and development

While research and development forms a significant part of the

Group's activities, a significant proportion relates to specific

customer programmes which are included in the cost of the product.

Development costs of GBP1.2m (2020: GBP0.2m) have been capitalised

in relation to projects for which there are a number of near-term

sales opportunities. Other research and development costs, all of

which have been written off to the income statement as incurred,

total GBP0.5m (2020: GBP0.8m).

Foreign exchange translation has provided a minor headwind on

revenue and profit, with the US dollar, euro and yen all weakening

against sterling. On a constant currency basis, restating the

current year at 2021 average rates, revenue would have been GBP1.5m

higher and adjusted operating profit GBP0.2m higher.

Dividends

The Board is recommending a final divided of 3.24p per share

giving a total dividend for the year of 4.84p per share, which is

an increase of 10% over the prior year, resuming the Board's

progressive dividend policy.

Summary and outlook

The Group has delivered another year of strong performance,

despite the ongoing impacts of COVID-19, particularly in the first

half of the year. The second half delivered record levels of order

intake, revenue and cash generation, which provides a strong

foundation for continued growth in 2022.

Against the backdrop of continued market uncertainty, the Group

continued to invest in all areas of the business, further

supporting our ambitious growth plans. During the year, we made

demonstrable progress in evolving the Group's strategic direction,

both with the acquisition of Vadotech and also through the launch

of ABD Solutions, a major new growth initiative to diversify the

business. The Group also continued to strengthen the operational

and commercial platform of the business through investing in new

product development, capabilities and the senior management

team.

Our market drivers remain strong. Against that background, and

based on the recent track record of strong order intake and

continued strategic investment, the Board is confident of

delivering progress during 2022 and beyond.

Directors' Responsibility Statement on the Annual Report and

Accounts

The responsibility statement below has been prepared in

connection with the Group's full annual report and accounts for the

year ended 31 August 2021. Certain parts thereof are not included

within this announcement.

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare such financial

statements for each financial year. Under that law, they have

elected to prepare the Group financial statements in accordance

with International Financial Reporting Standards (IFRS) adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union and in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006 and applicable law and have elected to prepare the Parent

Company financial statements in accordance with UK Accounting

Standards and applicable law (UK Generally Accepted Accounting

Practice).

Under Company law, the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Parent Company and of

their profit or loss for that year. In preparing each of the Group

and Parent Company financial statements, the Directors are required

to:

-- Select suitable accounting policies and apply them consistently;

-- Make judgments and accounting estimates that are reasonable and prudent;

-- State whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- Prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and the Parent

Company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the parent

company's transactions and disclose with reasonable accuracy at any

time the financial position of the parent company and enable them

to ensure that the financial statements comply with the Companies

Act 2006. They are also responsible for safeguarding the assets of

the parent company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

They are further responsible for ensuring that the Strategic

report and the Directors' report and other information included in

the Annual Report and Accounts are prepared in accordance with

applicable law in the United Kingdom.

The maintenance and integrity of the AB Dynamics plc web site is

the responsibility of the Directors; the work carried out by the

auditors does not involve the consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred in the accounts since they were initially

presented on the website.

Legislation in the United Kingdom governing the preparation and

dissemination of the accounts and the other information included in

annual reports may differ from legislation in other

jurisdictions.

We confirm that to the best of our knowledge:

-- the Financial Statements, prepared in accordance with the

relevant financial reporting framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole;

-- the Strategic report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the Principal Risks and

Uncertainties that they face; and

-- the Annual Report and Accounts, taken as a whole, are fair,

balanced and understandable and provide the information necessary

for shareholders to assess the Company's position and performance,

business model and strategy.

This responsibility statement was approved by the Board of

Directors on 24 November 2021 and has been signed on its behalf by

James Routh and Richard Elsy CBE.

AB Dynamics plc

Consolidated statement of comprehensive income

For the year ended 31 August 2021

2021 2020

Adjustments Statutory

Adjusted Adjustments Statutory Adjusted (Restated)* (Restated)*

Note GBP'000 GBP000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 2 65,380 - 65,380 61,514 - 61,514

Cost of sales (28,269) - (28,269) (25,592) - (25,592)

Gross profit 37,111 - 37,111 35,922 - 35,922

General and

administrative expenses (26,288) (6,630) (32,918) (24,591) (6,574) (31,165)

---------- ------------- ----------- ---------- ------------- -------------

Operating profit 10,823 (6,630) 4,193 11,331 (6,574) 4,757

------------------------- ------- ---------- ------------- ----------- ---------- ------------- -------------

Operating profit is

analysed as:

Before depreciation and

amortisation 13,500 (2,198) 11,302 13,421 (3,025) 10,396

Depreciation and

amortisation (2,677) (4,432) (7,109) (2,090) (3,549) (5,639)

---------- ------------- ----------- ---------- ------------- -------------

Operating profit 10,823 (6,630) 4,193 11,331 (6,574) 4,757

------------------------- ------- ---------- ------------- ----------- ---------- ------------- -------------

Finance income 15 - 15 218 - 218

Finance expense (91) - (91) (30) - (30)

Other finance expense (332) - (332) (564) - (564)

Profit before tax 10,415 (6,630) 3,785 10,955 (6,574) 4,381

Tax expense (1,895) 1,095 (800) (1,939) 1,580 (359)

---------- ------------- ----------- ---------- ------------- -------------

Profit for the year 8,520 (5,535) 2,985 9,016 (4,994) 4,022

---------- ------------- ----------- ---------- ------------- -------------

Other comprehensive

income

Items that may be

reclassified to

consolidated

income statement:

Cash flow hedges (31) - (31) - - -

Exchange loss on foreign

currency net

investments (614) - (614) (1,978) - (1,978)

Total comprehensive

income for the year 7,875 (5,535) 2,340 7,038 (4,994) 2,044

---------- ------------- ----------- ---------- ------------- -------------

Earnings per share -

basic (pence) 6 37.7p (24.5p) 13.2p 40.1p (22.2p) 17.9p

Earnings per share -

diluted (pence) 6 37.4p (24.3p) 13.1p 39.9p (22.1p) 17.8p

*Restated following adoption of IFRIC update on cloud computing arrangements (see note 1).

AB Dynamics plc

Consolidated statement of financial position

As at 31 August 2021

2020

2021 (Restated)*

GBP'000 GBP'000

ASSETS

Non-current assets

Goodwill 22,221 16,170

Acquired intangible assets 28,282 17,623

Other intangible assets 1,565 460

Investment 12 12

Property, plant and equipment 25,815 24,309

Right-of-use assets 913 701

78,808 59,275

Current assets

Inventories 6,771 9,180

Trade and other receivables 15,500 12,844

Contract assets 4,269 2,926

Taxation 1,443 2,962

Fixed term deposits - 5,000

Cash and cash equivalents 23,282 26,183

--------- -------------

51,265 59,095

Assets held for sale 1,893 -

LIABILITIES

Current liabilities

Borrowings - 505

Trade and other payables 10,933 10,387

Contract liabilities 3,568 1,983

Derivative financial instruments 31 -

Short-term lease liabilities 456 473

Deferred consideration 4,929 -

19,917 13,348

Non-current liabilities

Deferred tax liabilities 6,552 2,549

Long-term lease liabilities 511 249

7,063 2,798

Net assets 104,986 102,224

--------- -------------

Shareholders' equity

Share capital 226 226

Share premium 62,210 61,736

Reconstruction reserve (11,284) (11,284)

Merger relief reserve 11,390 11,390

Translation reserve (2,414) (1,800)

Hedging reserve (31) -

Retained earnings 44,889 41,956

--------- -------------

Total equity 104,986 102,224

--------- -------------

*Restated following reclassification of fixed term deposits with

a maturity date of greater than three months at inception and

following adoption of IFRIC update on cloud computing

arrangements.

AB Dynamics plc

Consolidated statement of changes in equity

For the year ended 31 August 2021

Share Share Merger Reconstruction Translation Hedging Retained Total

capital premium relief reserve reserve reserve earnings equity

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 September

2019 222 60,049 11,390 (11,284) 178 - 38,252 98,807

Share based

payments - - - - - - 1,282 1,282

Total

comprehensive

income - - - - (1,978) - 4,022* 2,044*

Deferred tax

on share based

payments - - - - - - (974) (974)

Dividend paid - - - - - - (626) (626)

Issue of shares 4 1,687 - - - - - 1,691

At 31 August

2020 226 61,736 11,390 (11,284) (1,800) - 41,956 102,224

--------- --------- --------- --------------- ------------ --------- ---------- --------

Share based

payments - - - - - - 1,139 1,139

Total

comprehensive

income - - - - (614) (31) 2,985 2,340

Deferred tax

on share based

payments - - - - - - 165 165

Dividend paid - - - - - - (1,356) (1,356)

Issue of shares - 474 - - - - - 474

At 31 August

2021 226 62,210 11,390 (11,284) (2,414) (31) 44,889 104,986

--------- --------- --------- --------------- ------------ --------- ---------- --------

*Restated following adoption of IFRIC update on cloud computing

arrangements.

The share premium account is a non-distributable reserve

representing the difference between the nominal value of shares in

issue and the amounts subscribed for those shares.

The reconstruction reserve and merger relief reserve have arisen

as follows:

The acquisition by the Company of the entire issued share

capital of Anthony Best Dynamics Limited in 2013 was accounted for

as a Group reconstruction. Consequently, the assets and liabilities

of the Group were recognised at their previous book values as if

the Company had always been the parent company of the Group.

The share capital for the period covered by these consolidated

financial statements and the comparative periods is stated at the

nominal value of the shares issued pursuant to the above share

arrangement. Any differences between the nominal value of these

shares and previously reported nominal values of shares and

applicable share premium issued by Anthony Best Dynamics Limited

were transferred to the reconstruction reserve.

Retained earnings represent the cumulative value of the profits

not distributed to shareholders but retained to finance the future

capital requirements of the Group.

The items included in the consolidated statement of changes in

equity that relate to transactions with owners are share based

payments, dividends paid and issues of shares.

AB Dynamics plc

Consolidated cash flow statement

For the year ended 31 August 2021

2020

2021 (Restated)*

GBP'000 GBP'000

Cash flows from operating activities

Profit before tax 3,785 4,381

Depreciation and amortisation 7,109 5,639

Finance expense / income 408 (188)

Share based payment 1,240 1,282

Acquisition related costs / (credit) 304 (2,548)

Operating cash flows, before changes in

working capital 12,846 8,566

Decrease in inventories 2,409 1,992

Increase in trade and other receivables (3,913) (565)

Increase / (decrease) in trade and other

payables 2,956 (3,737)

------------------ ------------

Cash flows from operations 14,298 6,256

--------------------------------------------- ------------------ ------------

Cash impact of adjusting items 1,663 654

Adjusted cash flows from operations 15,961 6,910

--------------------------------------------- ------------------ ------------

Interest received 15 218

Finance costs paid (154) -

Income tax received / (paid) 1,062 (2,229)

Net cash flows from operating activities 15,221 4,245

------------------ ------------

Cash flows used in investing activities

Acquisition of businesses (14,329) (2,823)

Purchase of property, plant and equipment (5,536) (7,276)

Capitalised development costs and purchased

software (1,104) (232)

Net cash used in investing activities (20,969) (10,331)

------------------ ------------

Cash flows used in financing activities

Net movements in loans (493) 477

Purchase of fixed term deposits - (20,000)

Maturity of fixed term deposits 5,000 15,000

Dividends paid (1,356) (626)

Proceeds from issue of share capital 474 1,691

Repayment of lease liabilities (656) (592)

Net cash flow generated from / (used in)

financing activities 2,969 (4,050)

------------------ ------------

Net decrease in cash, cash equivalents and

bank overdrafts (2,779) (10,136)

Cash, cash equivalents and bank overdrafts

at beginning of the year 26,183 36,225

Effects of exchange rate changes (122) 94

Cash, cash equivalents and bank overdrafts

at end of the year 23,282 26,183

------------------ ------------

*Restated following reclassification of fixed term deposits

with a maturity date of greater than three months at inception

and following adoption of IFRIC update on cloud computing arrangements.

AB Dynamics plc

Notes to the consolidated financial statements

For the year ended 31 August 2021

1. Basis of preparation

The Company is a public limited company limited by shares and

incorporated under the UK Companies Act. The Company is domiciled

in the United Kingdom and the registered office and principal place

of business is Middleton Drive, Bradford on Avon, Wiltshire, BA15

1GB.

The principal activity of the Group is the design, manufacture

and development of advanced testing and measurement products and

services to the global automotive industry. The Group's products

and services are used primarily for the development of road

vehicles, particularly in the areas of active safety and autonomous

systems.

The annual financial statements of the Group are prepared in

accordance with International Financial Reporting Standards

('IFRS') adopted pursuant to Regulation (EC) No 160612002 as it

applies in the European Union and in accordance with international

accounting standards in conformity with the requirements of the

Companies Act 2006 as applicable to companies reporting under IFRS.

A copy of the statutory accounts for the year ended 31 August 2020

has been delivered to the Registrar of Companies. The auditor's

report on those accounts was unqualified and did not contain any

statements under section 498(2) or (3) of the Companies Act

2006.

The same accounting policies, presentation and methods of

computation have been followed as those which were applied in the

preparation of the Group's annual statements for the year ended 31

August 2020, with the exception of updating accounting policies to

reflect changes required by the IFRIC update on cloud computing

arrangements which has given rise to a prior year adjustment of

GBP0.7m to reduce other intangible assets and retained

earnings.

Certain new standards, amendments to standards and

interpretations are not yet effective for the year ended 31 August

2021 and have therefore not been applied in preparing the annual

financial statements.

Going concern basis of accounting

The Directors have assessed the principal risks discussed in

note 8, including by modelling a severe but plausible downside

scenario for COVID-19, whereby the Group experiences:

-- A reduction in demand of 25% over the next two financial years

-- 10% increase in operating costs from supply chain disruption

-- Increase in cash collection cycle

-- Increase in input cost resulting in reduction in gross margin to 40%

With GBP23.3m of cash at 31 August 2021 and a GBP15m undrawn

revolving credit facility, in this severe downside scenario, the

Group has sufficient headroom to be able to continue to operate for

the foreseeable future. The Directors believe that the Group is

well placed to manage its financing and other business risks

satisfactorily, and have a reasonable expectation that the Group

will have adequate resources to continue in operation for at least

12 months from the signing date of the financial statements. They

therefore consider it appropriate to adopt the going concern basis

of accounting in preparing the financial statements.

2. Segment information

The Group derives revenue from the sale of its advanced

measurement, simulation and testing products derived in assisting

the global automotive industry in the laboratory and on the test

track. The income streams are all derived from the utilisation of

these products which, in all aspects except details of revenue, are

reviewed and managed together within the Group and as such are

considered to be the only segment.

The operating segment is based on internal reports about

components of the Group, which are regularly reviewed and used by

the Board of Directors being the Chief Operating Decision Maker

('CODM').

Analysis of revenue by country of destination:

2021 2020

GBP'000 GBP'000

United Kingdom 4,449 2,146

Rest of Europe 11,352 14,775

North America 15,884 15,606

Asia Pacific 32,717 27,788

Rest of the World 978 1,199

--------- -----------

65,380 61,514

--------- -----------

No customer individually represents 10% or more of total

revenue.

Assets and liabilities by segment are not reported to the Board

of Directors, therefore are not used as a key decision making tool

and are not disclosed here.

A disclosure of non-current assets by location is shown

below:

2021 2020

GBP'000 GBP'000

United Kingdom 41,174 40,482

Rest of Europe 1,009 747

North America 15,522 17,940

Asia Pacific 21,103 106

78,808 59,275

--------- -----------

Revenues are disaggregated as follows:

2021 2020

GBP'000 GBP'000

Revenue by sector

Track testing 49,680 51,760

Laboratory testing and simulation 15,700 9,754

--------- -----------

65,380 61,514

--------- -----------

3. Alternative Performance measures

In the analysis of the Group's financial performance and

position, operating results and cash flows, alternative performance

measures are presented to provide readers with additional

information. The principal measures presented are adjusted measures

of earnings including adjusted operating profit, adjusted operating

margin, adjusted profit before tax and adjusted earnings per

share.

The financial statements include both statutory and adjusted

non-GAAP financial measures, the latter of which the Directors

believe better reflect the underlying performance of the business

and provide a more meaningful comparison of how the business is

managed and measured on a day-to-day basis. The Group's alternative

performance measures and KPIs are aligned to the Group's strategy

and together are used to measure the performance of the business

and form the basis of the performance measures for remuneration.

Adjusted results exclude certain items because if included, these

items could distort the understanding of the performance for the

year and the comparability between the periods.

We provide comparatives alongside all current year figures. The

term 'adjusted' is not defined under IFRS and may not be comparable

with similarly titled measures used by other companies. All profit

and earnings per share figures in this report relate to underlying

business performance (as defined above) unless otherwise

stated.

2021 2020

GBP'000 GBP'000

Amortisation of acquired intangibles 4,432 3,549

Acquisition related costs / (credit) 840 (1,865)

ERP development costs 1,358 654

Inventory impairment - 3,267

Restructuring - 969

--------- -----------

6,630 6,574

-------------------------------------- --------- -----------

Amortisation of acquired intangibles

The amortisation relates to the acquisition of Vadotech Group on

3 March 2021 and the businesses acquired in 2019, DRI and

rFpro.

Acquisition related costs / (credit)

The costs relate to the acquisition of the Vadotech Group as

well as staff retention payments to the employees of rFpro. The

cash to pay this was contributed by the previous owner of rFpro

prior to acquisition, but as the employees had to remain within the

business for a period prior to receiving payment, a charge had to

be recognised in the income statement in both the current and the

prior year. The credit in the prior year relates to the release of

deferred consideration on the rFpro acquisition which, due to

COVID-19 disruption, was not payable.

ERP development costs

During April 2021 the IFRS Interpretations Committee finalised

their agenda decision regarding configuration and customisation

costs in Cloud Computing Arrangements (Software as a Service,

'SaaS') under IAS 38. The agenda decision specifies that where ERP

systems are hosted on the cloud, no intangible asset arises and

configuration and customisation costs should be written off. The

ERP system currently being implemented is hosted on the cloud;

therefore the capitalised expenditure for development costs has now

been expensed.

Inventory impairment

In the prior year, following a detailed review of inventory

levels and usage, a number of items previously included in the

carrying value were written off and the system of accounting for

inventory updated to better reflect the Group's current

operations.

Restructuring

The restructuring costs in 2020 relate to rebalancing the skill

base of the business and termination of agents.

Tax

The tax impact of these adjustments was as follows: amortisation

GBP0.7m (2020: GBP0.5m) acquisition related GBP0.1m (2020:GBP0.1m),

ERP GBP0.3m (2020:GBP0.1m), inventory nil (2020: GBP0.6m) and

restructuring nil (2020: GBP0.3m).

4. Tax

The statutory effective rate of tax for the year is higher than

(2020: lower than) the standard rate of corporation tax in the UK

of 19% (2020: 19%).

The adjusted effective tax rate, adjusting both the tax charge

and the profit before tax is 18.2% (2020: 17.7%).

5. Dividend paid

2021 2020

GBP'000 GBP'000

Final 2019 dividend paid of GBP0.028

per share - 626

Final 2020 dividend paid of GBP0.044 994 -

per share

Interim dividend paid of GBP0.016 362 -

per share

1,356 626

-------------------------------------- --------- -----------

In respect of the year ended 31 August 2021, the Board has

proposed a final dividend of 3.24p per share totalling GBP733,000.

An interim dividend was paid of 1.6p per share totalling

GBP362,000. If approved, the final dividend will be paid on 28

January 2022 to shareholders on the register on 31 December

2021.

6. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to equity holders by the weighted average number of

ordinary shares in issue during the period.

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all potentially dilutive shares. The Company has one

category of potentially dilutive shares, namely share options.

The calculation of earnings per share is based on the following

earnings and number of shares:

2021 2020

GBP'000 GBP'000

Profit for the year attributable

to owners of the Group 2,985 4,022

Adjusted profit after tax 8,520 9,016

Weighted average number of shares

('000)

Basic 22,602 22,482

Diluted 22,782 22,622

Earnings per share

Basic 13.2 pence 17.9 pence

Diluted 13.1 pence 17.8 pence

Adjusted basic 37.7 pence 40.1 pence

Adjusted diluted 37.4 pence 39.9 pence

7. Share capital

The allotted, called up and fully paid share capital is made up

of 22,622,344 ordinary shares of GBP0.01 each.

Note Number Share Share premium

of shares capital GBP'000 Total

000 GBP'000 GBP'000

At 1 September

2019 22,220 222 60,049 60,271

27 September 2019 (i) 200 2 770 772

------- ----------- --------- -------------- ----------

11 December 2019 (ii) 32 - 142 142

------- ----------- --------- -------------- ----------

3 March 2020 (iii) 58 1 229 230

------- ----------- --------- -------------- ----------

3 March 2020 (iv) 6 - 27 27

------- ----------- --------- -------------- ----------

4 May 2020 (v) 33 - 410 410

------- ----------- --------- -------------- ----------

2 June 2020 (vi) 16 - 64 64

------- ----------- --------- -------------- ----------

19 August 2020 (vi) 11 1 45 46

------- ----------- --------- -------------- ----------

At 31 August 2020 22,576 226 61,736 61,962

----------- --------- -------------- ----------

8 October 2020 (vii) 8 - 29 29

------- ----------- --------- -------------- ----------

4 December 2020 (ix) 1 - 18 18

------- ----------- --------- -------------- ----------

15 March 2021 (x) 33 - 412 412

------- ----------- --------- -------------- ----------

17 May 2021 (xi) 4 - 15 15

------- ----------- --------- -------------- ----------

At 31 August 2021 22,622 226 62,210 62,436

=========== ========= ============== ==========

(i) On 27 September 2019, a total of 199,526 share options were

exercised of GBP0.01 each for GBP3.95.

(ii) On 11 December 2019, a total of 31,970 share options were

exercised of GBP0.01 each for GBP3.95.

(iii) On 3 March 2020, a total of 58,086 share options were

exercised of GBP0.01 each for GBP3.95.

(iv) On 3 March 2020, a total of 6,173 share options were

exercised of GBP0.01 each for GBP4.45.

(v) On 4 May 2020, a total of 33,333 share options were

exercised of GBP0.01 each for GBP12.30.

(vi) On 2 June 2020, a total of 16,162 share options were

exercised of GBP0.01 each for GBP3.95.

(vii) On 19 August 2020, a total of 11,321 share options were

exercised of GBP0.01 each for GBP3.95.

(viii) On 8 October 2020, a total of 7,631 share options were

exercised of GBP0.01 each for GBP3.95.

(ix) On 4 December 2020, a total of 692 shares were issued to

James Routh of GBP0.01 in satisfaction of 20% of his respective

annual bonus payments for the year ended 31 August 2020, and a

total of 349 shares were issued to Sarah Matthews-DeMers of GBP0.01

in satisfaction of 20% of her respective annual bonus payments for

the year ended 31 August 2020.

(x) On 15 March 2021, a total of 33,333 share options were

exercised of GBP0.01 each for GBP12.30.

(xi) On 17 March 2021, a total of 3,786 share options were

exercised of GBP0.01 each for GBP3.95.

8. Principal risks

The principal risks and uncertainties impacting the Group are

described on pages 56-58 of our Annual Report 2021. They include:

COVID-19, downturn or instability in major markets, loss of major

customers and change in customer procurement processes, failure to

deliver new products, dependence on external routes to market,

acquisitions integration and performance, supply chain,

cybersecurity and business interruption, competitor actions, loss

of key personnel, threat of disruptive technology, product

liability, failure to manage growth, foreign currency, credit risk

and intellectual property/patents.

9. Related party transactions

Mr A Best, former Chairman of the Company, is a trustee and

beneficiary of the Best Middleton Trust. Rental payments of

GBP44,000 (2020: GBP48,000) were made in the year to the Trust. In

July 2021 the lease was terminated and therefore all agreements

with a controlling shareholder have now ceased.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPGRAGUPGGMW

(END) Dow Jones Newswires

November 24, 2021 01:59 ET (06:59 GMT)

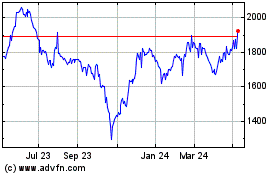

Ab Dynamics (LSE:ABDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

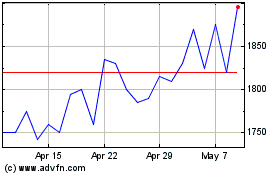

Ab Dynamics (LSE:ABDP)

Historical Stock Chart

From Apr 2023 to Apr 2024