TIDMACRL

RNS Number : 9073Y

Accrol Group Holdings PLC

18 May 2021

18 May 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Accrol Group Holdings plc

("Accrol, the "Group" or the "Company")

TRADING UPDATE

For the full year ended 30 April 2021

Accrol (AIM: ACRL), the UK's leading independent tissue

convertor, announces the following trading update ahead of its

Final Results for the year ended 30 April 2021 ("FY21" or the

"Period"), which are scheduled to be released in July 2021.

Substantial progress has been made on gross margins in the

Period, which are ahead of market expectations. This has been

achieved through the Group's relentless drive for operational

excellence and the Board is very pleased to report, once again,

that the business is now more operationally efficient than it has

ever been.

Adjusted earnings are expected to be in line with expectations,

despite a lower than anticipated increase in sales in the year,

resulting from consumer COVID-19 panic-buying of branded products

in the early stages of the pandemic. Sales across the whole

industry have been depressed in recent months, while consumer

stockpiling unwound.

Accrol's market share continued to rise in FY21 and is now 16%,

compared to 13% in FY20. Given the ongoing focus on operational

improvement and the Group's strong market positioning, the Board is

increasingly confident in the prospects for the business, and this

is demonstrated by the further investment in manufacturing capacity

(detailed below).

FY21 financials

Total revenues in FY21 increased by 1.5% to GBP136.8m (FY20:

GBP134.8m). Group volumes on a like for like basis declined by

3.9%, against a total market decline of 5.5%(1) . Accrol continued

to increase its share with the discounters, despite a sector

decline of 12% in the year.

With growing momentum in the grocer sector, the Group is well

placed to capitalise on consumers' return to the discounters, as

the country re-opens and volumes normalise.

Net debt (pre-IFRS16) at the end of the Period was GBP14.6m,

compared with GBP18.1m at 31 October 2020 and GBP17.9m at 30 April

2020. This reduction has been delivered, despite the acquisition of

John Dale Ltd announced in April 2021 for a net cash consideration

of GBP3.9m, and an expansion in raw material and finished good

stock levels to support service responsiveness.

Acquisitions & other developments

The integration of Leicester Tissue Company ("LTC"), acquired in

November 2020 for an initial consideration of GBP35.0m, continues

to progress well, with annualised cost synergies of GBP3.0m now

expected, which is three times higher than announced on

acquisition. These are being driven through operational

improvements across the wider group. The revenue synergies

previously announced have all started but growth here has been

slower, reflecting the market conditions in the period since

acquisition. LTC provides a geographic, strategic and financial

platform for the Group's growth ambitions and we anticipate further

tangible benefits as the integration progresses.

The Group also recently announced the acquisition of John Dale

Ltd, a highly scalable flushable and bio-degradable wet wipes

business. The business provides a well invested platform to build a

business of scale, in an attractive segment of the tissue market.

Early integration activities have progressed as planned. The Group

expects to use the site to build a fully flushable wet wipe

business capable of taking an appropriate market share of this

GBP0.5bn sector.

The Group continues to invest in its core operations and will be

adding further capacity at its Leyland converting plant from Q3 of

FY22, to fulfil the expected increase in volume demand. In

addition, the Group is making progress on its paper mill

development plans and the Board expects to update the market in the

near term.

Outlook

Whilst remaining mindful of the ongoing challenges of the

COVID-19 pandemic, the Board views the future with confidence,

building on the Group's strengthened customer relationships,

improved levels of service and quality, and its higher value

product range. The Group expects volumes across the UK tissue

sector to normalise in H1 22 and that its main market, the

discounters, will grow strongly, as the UK returns to pre-pandemic

shopping patterns.

Input costs already announced by the industry are increasing

significantly in the near term given the rise in global pulp prices

and other commodities. Raw material stock levels have been expanded

to provide some short-term mitigation, whilst price recovery

measures are enacted. The Group is making good early progress in

recovering these higher costs, as it moves into the new financial

year.

As previously announced, the Board intends to restore dividend

payments and expects to propose a final dividend for FY21 of no

less than 0.5p per ordinary share.

Gareth Jenkins, Chief Executive Officer, said:

"I am pleased to report a continued improvement across the

enlarged group, and I am particularly proud of our employees, who

have responded magnificently, keeping all our operations open and

maintaining the highest standards in service and product quality

for our customers.

"The integration of LTC, which is now complete, has delivered

some fantastic results that will benefit the wider group in the

long term. In this pandemic year, we have fully automated our

largest factory, installed a business-wide operating system, and

grown our margins further. We now have a business capable of

benefitting further, as the UK exits lockdown, and we remain

excited about the future for the Group."

(1) Kantar data based on retail sales for the period from May

2020 to March 2021

Enquiries:

Accrol Group Holdings plc

Dan Wright, Executive Chairman Via Belvedere Communications

Gareth Jenkins, Chief Executive Officer

Richard Newman, Chief Financial Officer

Zeus Capital Limited (Nominated Adviser

& Broker)

Dan Bate / Jordan Warburton Tel: +44 (0) 161 831

1512

Dominic King / John Goold Tel: +44 (0) 203 829

5000

Liberum Capital Limited (Joint Broker) Tel: +44 (0) 20 3100

2222

Clayton Bush / Edward Thomas

Belvedere Communications Limited

Cat Valentine Tel: +44 (0) 7715 769

078

Keeley Clarke Tel: +44 (0) 7967 816

525

Llew Angus Tel: +44 (0) 7407 023

147

accrolpr@belvederepr.com

Overview of Accrol

Accrol Group Holdings plc is a leading tissue converter and

supplier of toilet tissues, kitchen rolls, facial tissues and wet

wipes to many of the UK's leading discounters and grocery retailers

across the UK. Following the recent acquisitions of LTC in

Leicester and John Dale Ltd in Flint, North Wales, the Group now

operates from six manufacturing sites, including four in

Lancashire, which generate revenues totalling c.16% of the GBP1.9bn

UK retail tissue market.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDKOBQABKDAPD

(END) Dow Jones Newswires

May 18, 2021 02:00 ET (06:00 GMT)

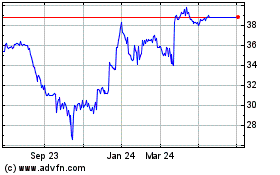

Accrol (LSE:ACRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accrol (LSE:ACRL)

Historical Stock Chart

From Apr 2023 to Apr 2024