TIDMACRL

RNS Number : 6876L

Accrol Group Holdings PLC

17 May 2022

17 May 2022

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Accrol Group Holdings plc

("Accrol, the "Group" or the "Company")

TRADING UPDATE

FY22 in line with market expectations

Accrol (AIM: ACRL), the UK's leading independent tissue

converter, announces the following trading update ahead of its

Final Results for the year ended 30 April 2022 ("FY22" or the

"Period"), which are scheduled to be released in September

2022.

In the period since the Company's last trading update of 12

January 2022, the Group has continued to demonstrate resilience

against a challenging backdrop of rapid cost inflation. As a

result, revenue, adjusted EBITDA, and adjusted profit before tax

for FY22 are expected to be in line with market expectations(1)

.

The Group has successfully navigated the substantial

inflationary pressures on input costs, including pulp, energy, and

supply chain, by engaging constructively with its customers to

pass-on these additional costs, through significant price increases

and further process efficiencies.

Highlights

FY22

-- Revenue, adjusted EBITDA, and adjusted profit before tax

for FY22 in line with market expectations(1)

-- Successful recovery of all increased input costs secured

by the end of Q4 FY22

-- Market share by revenue increased to 16.0% (H1 FY22: 15.3%)

and by volume to 19.5% (H1 FY22: 18.9%)

-- New customers secured and deeper penetration of key accounts,

through increasing product diversity - notably Amazon, Unitas

(30k convenience stores) and Ocado

-- Final elements of the extensive automation programme and

machine investment in the Tissue business completing in Q1

FY23. Only planned modest levels of maintenance investment

capital required going forward

Outlook

-- Revenue for the year ending 30 April 2023(1) ("FY23") now

expected to be in the range of GBP200m to GBP220m, as a

result of the successful recovery of all input cost increases

-- The Group is well positioned to benefit from its product

range and its supply positions across the discount retailers

as their growth accelerates following the pandemic and the

inflationary pressures now impacting consumers

-- Increasing Board confidence in FY23 outcome

(1) For the purposes of this announcement, the Group believes

market consensus for the year ended April 2022 to be revenue of

GBP160m, adjusted EBITDA of GBP9m and adjusted PBT of GBP1m, and

the for the year ended April 2023, revenue of GBP185m, adjusted

EBITDA of GBP15m and adjusted PBT of GBP7m.

FY22 Financials

The overall UK tissue market has grown by 0.7% to GBP2.1bn(2)

based on retail sale value, reflecting the inflationary pressures

within the market. Accrol's market share growth has returned,

increasing to 16.0%(2) from 15.3%(2) at H1 FY22 (FY21: 15.9%)(2) ,

reflecting the strong recovery of the discounter retailers in

recent months. ((2) Source: Kantar)

Total revenues in FY22 increased by 17% to GBP159.4m (FY21:

GBP136.6m). Market conditions continued to improve throughout the

year with shopping behaviours becoming more normalised as COVID

related restrictions were eased and then removed completely.

Net debt (pre-IFRS16) at 30 April 2022 was GBP27.5m, (31 October

2021: GBP21.6m), following the Group's accelerated investment in

automation and the necessary expansion in working capital to manage

supply constraints and rising costs.

The Group recently amended and extended its existing banking

arrangements, through to August 2024 providing additional

facilities to support its growth. These new facilities provide

increased headroom in both the scale, tenure and liquidity of the

facilities and the associated banking covenants. The amended

facilities provide an additional GBP8.5m of funding headroom, an

increase of c.25% over and above the previous arrangements that

would have expired in August 2023. Given the breadth and depth of

the Group's historic automation and machine investment programme,

any material future capital investment will be capacity and

earnings enhancing.

Foreign exchange

The majority of the Group's tissue requirement is fulfilled

through the purchase of parent reels in US dollars. Forward foreign

currency contracts are used in the purchase process for this

product. The nature of these contracts allows time for the Company

to manage any significant and unforeseen movements in the exchange

rate through pricing agreements with its customers.

Strategic review

The Strategic Review, announced on 12 January 2022, is ongoing

and the Board intends to provide a full update in the FY22 results

announcement in September.

Outlook

Whilst remaining mindful of the extremely challenging external

environment, the Board views the prospects for Accrol with

increasing confidence, given the strong recovery of input cost

rises, strengthened customer relationships, improved levels of

service and quality, and its higher value product range.

The Group expects volumes across the UK tissue sector to return

to pre-pandemic levels and that its main market, the discount

retailers, will grow strongly, as consumers seek value and quality,

given tighter household budgets.

Gareth Jenkins, Chief Executive Officer of Accrol, said:

"This has been the most challenging period in the industry that

I have experienced, with tissue pricing reaching unprecedented

levels, driven by energy prices and supply constraints. We have

successfully recovered these increased input costs to date and are

confident we can continue to recover any further rises through

innovation, efficiency and our supportive retailer customer

base.

"We have a well invested business and exit the year in a strong

position both operationally and commercially."

Dan Wright, Executive Chairman of Accrol, added:

" The new improved banking arrangements demonstrate continued

confidence in the Group's operating performance and ongoing support

for our development plans. The investments we have already made

into the efficiency of our operations have served us well through

these incredibly challenging times and we are confident that they

will bear considerable fruit in FY23 and beyond."

The Group has produced a short video to showcase its operations

and investment in the extensive automation of the business. Click

here: Accrol Today .

For further information, please contact:

Accrol Group Holdings plc

Dan Wright, Executive Chairman Via Belvedere Communications

Gareth Jenkins, Chief Executive Officer

Richard Newman, Chief Financial Officer

Zeus Capital Limited (Nominated Adviser

& Broker)

Dan Bate / Jordan Warburton Tel: +44 (0) 161 831 1512

Dominic King Tel: +44 (0) 203 829 5000

Liberum Capital Limited (Joint Broker) Tel: +44 (0) 20 3100 2222

Clayton Bush / Edward Thomas

Belvedere Communications Limited

Cat Valentine Tel: +44 (0) 7715 769 078

Keeley Clarke Tel: +44 (0) 7967 816 525

accrolpr@belvederepr.com

Overview of Accrol

Accrol Group Holdings plc is a leading tissue converter and

supplier of toilet tissues, kitchen rolls, facial tissues, and wet

wipes to many of the UK's leading discounters and grocery retailers

across the UK. Following the recent acquisitions of LTC in

Leicester and JD in Flint, North Wales, the Group now operates from

six manufacturing sites, including four in Lancashire, which

generate revenues totalling c.16% of the cGBP2.1bn UK retail tissue

market.

For more information, please visit www.accrol.co.uk .

Link for Accrol Today video:

https://www.accrol.co.uk/our-business/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDQLFFLELEBBE

(END) Dow Jones Newswires

May 17, 2022 10:04 ET (14:04 GMT)

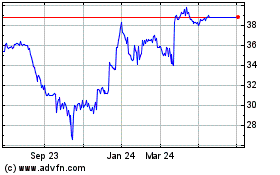

Accrol (LSE:ACRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accrol (LSE:ACRL)

Historical Stock Chart

From Apr 2023 to Apr 2024