TIDMACSO

RNS Number : 1103T

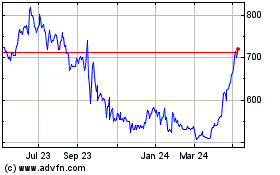

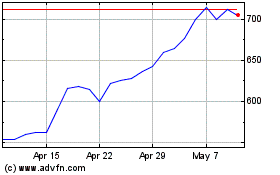

Accesso Technology Group PLC

23 March 2021

23 March 2021

accesso (R) Technology Group plc

("accesso" or the "Group")

PRELIMINARY RESULTS FOR THE YEARED 31 DECEMBER 2020

Results ahead of revised expectations, stronger foundation for

future growth

accesso Technology Group plc (AIM: ACSO), the premier technology

solutions provider to leisure, entertainment and cultural markets,

today announces preliminary results for the year ended 31 December

2020 ('2020').

Commenting on the results, Steve Brown, Chief Executive Officer

of accesso, said:

"During 2020 we proved ourselves resilient in the face of a

near-total shutdown of our industry as global travel and leisure

was severely impacted by the COVID-19 pandemic. I am proud of how

our team responded, and how we worked through the personal,

professional, and financial impacts together.

With so many of our customers shuttered, we took the opportunity

to refocus and reshape our business. We have removed duplication,

refined processes, reduced costs, aligned our teams for greater

efficiency, improved customer support, and delivered new

innovation. We now have a growth-ready foundation on which to

address substantial pent-up demand as the pandemic recedes.

During 2020 we delivered strong performance where and when our

customers were able to open. This gives us confidence that our

underlying opportunity is intact or even enhanced. In the last

year, technology has become an even more critical element of the

guest experience as both venues and customers increased their need

and reliance on digital services to drive efficiency and improved

experiences.

While the pandemic is not yet behind us, with vaccination

programmes underway in our key geographies, we feel confident of a

progression to more normal trading conditions in 2021. With the

strength of our technology offering, solid relationships, and an

amplified focus on technology by venue operators, we are well-set

to re-embark on our growth journey."

Headline Financial Results

-- Group revenue was $56.1m (2019: $117.2m), a resilient performance

ahead of expectations set out at the onset of the pandemic

o Repeatable revenues(1) fell 56.8% to $41.3m due to the impact

of COVID-19 closures, representing 73.6% of total revenue.

o Non-repeatable revenue(1) reduced by 32.9% to $12.3m (2019:

$18.3m), with lower impact due to licence fees and professional

service revenues, particularly relating to our work in the

cruise segment, continuing to be delivered throughout the

year.

-- Cash EBITDA (2) , now the Group's principal operating metric,

decreased to a loss of $11.5m (2019: +$7.1m). The reduction of

$18.6m against a revenue decline of $61.1m is a testament to

the swift and decisive actions of management to realign the Group's

cost base in response to the pandemic. Statutory cash used in

operations was an outflow of $11.9m (2019: inflow of $24.6m).

-- Net cash at December 31, 2020 was $29.7m(4) (2019: $0.4m). This

reflects a $46.1m (net of costs) placing in June 2020 the proceeds

of which remained at the Company's disposal due to strong cash

management.

-- New debt facility committed by the Group on 19 March 2021 with

Investec Bank PLC. All year-end bank loan borrowings with Lloyds

Bank PLC have been settled and the Group now has access to an

unutilised GBP18m, revolving facility with a term of 3 years

to March 2024; draw down is subject to securing charges over

our US subsidiary entities.

-- Adjusted basic EPS (3) was a loss of 60.64 cents per share (2019:

+30.78 cents per share), a basic loss per share of (84.78) cents

per share (2019: Loss of 184.26 cents per share))

-- Statutory loss before tax was $32.9m (2019: loss $57.6m) largely

reflecting a $61.1m revenue reduction net of cost saving exercises

deployed by management.

Operational & Strategic highlights

-- Leadership change: Steve Brown returns as CEO; Fern MacDonald

appointed CFO; new Chief Commercial Officer ('CCO'), new Head

of Product and Head of People returned to the Group reflecting

structural realignment to drive productivity and efficiency.

-- Business platform transformation: Along with cost-action to manage

pandemic pressures, development teams have been aligned around

focus areas; operational teams aligned around key markets; support

systems consolidated; and product roadmap defined.

-- Innovation to support customers: Online reservations, virtual

queuing, mobile Food & Beverage technology all support venue

openings with social distancing while providing longer term adoption

opportunities. Cross-product integration opportunity continues

to receive strong validation with 50 venues now utilising more

than one solution (2019: 26).

-- Innovation drives new business wins: Virtual queuing success,

robust demand for accesso Passport(R) eCommerce and strong performance

from our new mobile Food & Beverage solution all underline new

demand for post-COVID eCommerce and Guest Experience technologies.

-- Opportunity ahead remains intact: Underlying demand remains strong

while eCommerce has become more critical to operator success.

More venues signed on for online ticketing solutions in 2020

(45) than signed on during 2019 (42). Markets served by accesso

are expected to rebound quicker than the broader leisure space

due to more localised target audiences.

Outlook & guidance

-- Encouraging start to 2021: Despite European and Californian attractions

remaining closed in January and February the Group delivered

strong revenue performance, trading only 19% down on the same

two months in 2019. Our year-to-date eCommerce trading also indicates

strong pent-up demand, with year-to-date eCommerce ticket volumes

in APAC at 15% and 21% above 2020 and 2019 respectively. North

American volumes are up 54% and 28% over the same periods. The

majority of our remaining venues have now either opened or have

scheduled openings through to May 2021.

-- COVID-19 remains impactful: The Group anticipates travel and

tourism will be substantially restricted in 2021 however our

late-2020 experience suggests significant pent-up demand will

come through as the pandemic recedes. Venues in certain regions

have already reopened at reduced capacity or plan to reopen between

April and early summer. Out largest clients have all indicated

their plans to fully reopen all parks ahead of summer (assuming

Government approval).

-- Cautious optimism for the year ahead: We remain cautiously optimistic

for 2021 as vaccine rollouts accelerate. We expect performance

in H1 to be above 2020 levels with a return to something close

to normal trading expected later in H2. Our strong balance sheet

and available facilities enable us to manage potential downside

scenarios.

-- Financial Results: With base level demand expected to be ahead

of 2020, we anticipate neutral to slightly positive cash flow

for 2021, based upon anticipated revenue of not less than $83m.

We do not anticipate utilising any additional credit facility

on a full year basis and expect to retain significant cash resources

as a contingency.

Footnotes

(1) Repeatable revenue consists of transactional revenue such as

a ticket sold by a customer or as a percent of revenue generated

by a venue operator and recurring maintenance, support and platform

revenue. Non-repeatable revenue is revenue that occurs one-time

(e.g. up-front licence fees) or is not repeatable based upon

the current agreement (e.g. billable professional services hours)

and is unlikely to be repeatable without additional successful

sales execution by accesso

(2) Cash EBITDA is calculated as operating profit before the deduction

of amortisation, impairment of intangible assets, depreciation,

acquisition costs, deferred and contingent payments, and costs

related to share-based payments less capitalised development

costs paid in cash as per the consolidated cash flow statement.

(3) Adjusted basic earnings per share is calculated using an after

adjusting operating profit that is adjusted for impairment of

intangible assets, amortisation on acquired intangibles, deferred

and contingent consideration linked to continued employment,

acquisition and aborted sale expenses, finance charges relating

to deferred and contingent liabilities and share-based payments,

net of tax at the effective rate for the period on the taxable

adjusted items

(4) Net cash is calculated as cash and cash equivalents less borrowings

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014 ("MAR"). Upon the publication of this

announcement, this inside information is now considered to be in

the public domain

***

The Company will be hosting a presentation for analysts at 1300

UK time this morning. Analysts and institutional investors are also

able to request a copy of the presentation and audio webcast

conference details by contacting accesso@fticonsulting.com. A copy

of the presentation made to analysts will be available for download

from the Group's website, shortly after the conclusion of the

meeting.

accesso Technology Group plc

Steve Brown, Chief Executive Officer

Fern MacDonald, Chief Financial Officer +44 (0)118 934 7400

Numis Securities Limited (Nominated Adviser

and Sole Broker)

Simon Willis, Mark Lander, Hugo Rubinstein +44 (0)20 7260 1000

FTI Consulting, LLP

Matt Dixon, Adam Davidson +44 (0)20 3727 1000

About accesso Technology Group

At accesso, we believe technology has the power to redefine the

guest experience. Our patented and award-winning solutions drive

increased revenue for attraction operators while improving the

guest experience. Currently serving over 1,000 clients in more than

30 countries around the globe, accesso's solutions help our clients

streamline operations, generate increased revenues, improve guest

satisfaction and harness the power of data to educate business and

marketing decisions.

accesso stands as the leading technology provider of choice for

tomorrow's attractions, venues and institutions. We invest heavily

in research and development because our industries demand it, our

clients benefit from it and it makes a positive impact on the guest

experience. Our innovative technology solutions allow venues to

increase the volume and range of on-site spending and to drive

increased transaction-based revenue through cutting edge ticketing,

point-of-sale, virtual queuing, distribution and experience

management software.

Furthermore, COVID-19 has highlighted the benefits our

technology is able to bring to venues from facilitating social

distancing using our robust and sophisticated virtual queuing

solutions; reservation systems delivered through our agile

eCommerce platform to enable capacity management, taking queues

away from front gates; and attraction eateries utilising our

contactless food and beverage offerings.

Many of our team members come from backgrounds working within

the attractions and cultural industry. In this way, we are

experienced operators who run a technology company serving

attractions operators, versus a technology company that happens to

serve the market. Our staff understands the day-to-day operations

of managing complex venues and the challenges this creates, and

together we strive to provide our clients and their guests with

technology that empowers them to do more and enjoy more. From our

agile development team to our dedicated client service specialists,

every team member knows that their passion, integrity, commitment,

teamwork and innovation are what drive our success.

accesso is a public company, listed on AIM: a market operated by

the London Stock Exchange. For more information visit

www.accesso.com . Follow accesso on Twitter , LinkedIn and Facebook

.

***

Chief Executive's statement

My decision to return to accesso as CEO in early 2020 was driven

by my firm view that our business has a unique opportunity to be

successful in the markets we serve. We have a customer-base,

technology set and level of scale which sets us apart from the

competition, and we have a level of ambition, driven by some of the

best people in our industry, that none can match. Despite a year in

which the COVID-19 pandemic has turned our industry upside-down, my

level of belief remains the same.

There is no doubt that circumstance intervened and made 2020

quite different from the year I had imagined. We were only able to

focus on growth for a few short weeks. Quite soon we had to shift

quickly, reinforcing our financial position and building

operational resilience to ensure we could weather the coming storm.

We right-sized our employee base, initiated a four-day working week

for many staff during the period of reduced operations, reducing

our underlying administrative expenditure by $1.4m to an average of

$4.7m per month during the year. We also raised $46.1m from

shareholders in June 2020 as contingency and took the opportunity

to bring forward planned changes that would simplify our structure,

reduce inefficiency, and bring clarity to the overall accesso

operation. These actions, focused on three pillars of activity we

called People, Process and Product, solidified our outlook and gave

us the license to focus our energy on supporting our customers by

doing what we do best: innovating to help them make the most of

their opportunities.

Throughout the pandemic we have adopted a simple mantra in

relation to our customer base: treat clients like family. accesso

has built its reputation on trusted partnership, and our

relationships are strengthened in times of challenge. Whether

helping to facilitate refunds for cancelled events, tapping into

previously unused product features, or making last minute feature

changes to enable re-openings, our teams worked with a level of

quality and commitment that our customers will not soon forget.

Our proactive approach enabled us to adapt and develop

technology solutions suited to our customers' new reality. During

the year we used our virtual queuing technology to enable in-venue

social distancing, contactless food & beverage ordering to

reduce in-person interactions, online reservations and ticketing to

assist with capacity management, plus a range of other

modifications to support the emerging needs of our industry.

Whilst our full-year revenues were significantly impacted by the

pandemic, our team's ability to adapt and align with our customers

to provide essential technology was nothing short of remarkable.

Together we faced unprecedented adversity with the type of purpose,

passion and partnership that are at the core of our company vision

statement. With the hard work done across 2020 to reshape our

business, I am as optimistic as ever about the future.

2020 in review

Our Market

2020 was an incredibly difficult year for our customers and

end-markets in general. The introduction of global lockdowns from

March onwards put a stop to almost all trading activity through

most of the European and North American summers, and although we

did see some reopenings at reduced capacities during the autumn,

volumes for the year were far lower than normal.

Despite the overall supressed trading, during 2020 we did see

technology - and particularly eCommerce - playing an increasingly

important role in the activity which did take place. With the

breadth of venue-types we serve looking to manage strict capacity

controls and facilitate less face-to-face interaction with staff,

we saw our online ticketing business provide much-needed capability

to the venues that were able to reopen.

Across the broader global environment, we saw consumers across

demographics shift to online food delivery, online supermarket

shopping and other web-based alternatives. Online buying took

centre stage and we are confident that this increased adoption of

mobile technology represents a permanent behavioural shift in many

cases. Historic trends indicate that once customers adopt

eCommerce, the efficiency gains and guest experience upsides tend

to mean they continue transacting in this manner. We will only know

the true extent of the impact of these dynamics on our addressable

market when the pandemic has passed, but the early signs are

certainly encouraging.

As we enter 2021, we still expect pandemic restrictions in many

venues to persist in the near to mid-term. However, our overall

confidence of a return to more normal conditions later in the year

is bolstered by the increasing traction of the various vaccination

programmes being rolled out in our key markets.

We are also aware that the various segments of our market are

likely to recover at different speeds. For example, we expect the

recovery for destination travel to be slower than that of the

regional attractions, live event venues and cultural a ttractions

like theatres, museums and zoos which are closer to home and can be

planned at a moment's notice. Destination travel requires longer

lead-times for planning, higher costs to adopt and more travelling

for guests, while the regional attractions of scale can reopen

quickly and capture demand as soon as restrictions ease. For

live-event operators, those who can operate on a cash positive

basis even with capacity restrictions are likely to recover fairly

quickly. For others, progress will be uneven and dependent on the

ability to invest in securing talent, committing to a planning

schedule and commencing ticket sales. These are all dynamics which

rely to a certain extent upon the removal of social distancing

requirements in order to operate profitably.

Approximately 60% of accesso's typical transaction-based volume

is concentrated in leisure categories expected to realise fairly

rapid recovery versus the broader leisure sector. This assumption

is underpinned by our strong trading performance through the autumn

and early winter of 2020 and is also reflected in the performance

we have delivered in the first part of 2021.

Whilst the early months of the year typically see lower

transaction volume, our year-to-date 2021 eCommerce trading

indicates the level of potential pent-up demand. Across the APAC

region, eCommerce volumes for this period were up 21% and 15% on

2019 and 2020 respectively, and in North America, driven primarily

by a range of new ski customers in the period, eCommerce volumes

were up 54% and 28% on the same periods. Whilst our European

markets remained in lockdown for much of this period, results in

recent weeks show robust performance as UK theme park customers

have opened up their eCommerce sites for bookings following release

of the UK government's reopening plans.

Financial performance

During 2020, accesso delivered financial performance ahead of

the expectations it had set out following the onset of the

pandemic, reporting revenue for the year of $56.1m. Given the lower

levels of activity across our industry, our transactional revenue

stream, usually a bedrock of our financial performance, was down

from $85.6m in 2019 to $31.3m in 2020. Our professional services

revenue stream continued steadily as our TE2 work for the cruise

sector and other key clients moved forward as customers looked to

utilise the downtime to continue project efforts.

Profitability was impacted by this lower level of revenue

although our decisive cost-management ensured the bottom-line

impact was limited. This was illustrated by our Cash EBITDA, our

key earnings measure, which was a loss of $11.5m in 2020, down from

$7.1m of earnings in 2019, despite a $61.1m reduction in revenue.

Our statutory loss for the year was $29.9m, again reflecting the

revenue reduction in the year.

Importantly, the Group retains a very strong liquidity position

with net cash at the December year-end of $29.7m and a refinanced

debt facility from 19 March 2021. Draw down on the new facility is

conditional on finalising security charges over the US subsidiary

entities, providing the Group with additional liquidity of GBP18m

through a revolving Coronavirus Large Interruption Scheme Loan

facility for a 3-year term to March 2024.

Our Business

During 2020 we worked tirelessly to reshape and refocus accesso

to build a more efficient and productive organisation for the

longer term. This work took place in three pillars: People,

Process, and Product.

People

We began our efforts in this first pillar area by reshaping our

leadership team. With a new CFO, new CCO, new Head of Product and

the return of our former Head of People in place, we then conducted

a structural realignment across the broader organisation. This

process removed duplication resulting from piecemeal merger

integration, and more effectively aligns our teams with clear

accountability for the future.

For example, all software engineers working on our various

eCommerce solutions are now in one team rather than being spread

across the various system groups within accesso. Additionally, our

operational teams are now aligned with key market segments such as

Theme Parks, Cultural Attractions, and the Ski Industry. The shift

from software system alignment to industry alignment allows for

improved client relationships, particularly as the number of

clients using multiple solutions continues to increase. We now go

forward with a team focused on shared success across our entire

business, with a refreshed and better-structured approach to client

service.

Employee turnover was notably higher in 2020 than in prior years

at 33% (2019: 19%), driven largely by the impact of reductions

implemented to streamline and reduce long-term operating costs.

Whilst we started the year with a headcount of 560 and 17 open

positions, we ended the year with a headcount of 435 and 70 open

positions (excluding seasonal staff). Open positions were largely

held for recruitment in 2021 as we awaited clarity on the

vaccination programme. To date, nearly half of the open positions

have been filled and recruiting efforts continue for the

remainder.

We reinforced our commitment to Diversity and Inclusion, with

the addition of a dedicated page on our website outlining our

approach to providing a workplace that thrives on innovation from

individuals from a wide range of backgrounds with diverse talents.

That page can be found at www.accesso.com/about/diversity-inclusion

.

We also continued our commitment to support our local

communities as our team members utilised the days allocated for

each to volunteer for a service activity of their choice. For

example, one team member volunteered at an animal shelter during

the California wildfires whilst another sewed masks for a local

urgent care facility.

Process

Along with this organisational realignment, we needed to adjust

our operational processes to ensure we can capitalise on the

benefits of our new staffing structure. We therefore worked to

bring teams on to the same internal support systems, enabling

seamless collaboration across the group. We have also redesigned

how customer system enhancement requests move through our workflow,

improving quality while reducing delivery times. We have

transformed accesso from a company operating in multiple product

silos to a business with a single operational platform, focused on

customer success and growth.

Product

Product innovation continues to be a vital part of our

go-forward plan at accesso, and during the year we identified

several opportunities to continue our overall improvement journey.

Importantly, we have developed a clearly defined product roadmap

across the full technology set, both to improve our near-term

output and to ensure strategic focus into the medium and

longer-term. To build the foundation for this work, this year we

completed the migration to AWS of our North American technology

footprint, and the migration of accesso Passport to Cybersource.

These developments enable a more unified payment processing

solution across the Group. Since its launch, we have generated over

5 million payment tokens through the platform and eliminated the

need to store credit-card details on our systems.

During the year we also sharpened our focus on integration

between systems to respond more effectively to the growing demand

for operators to combine deployment of multiple accesso solutions.

Furthermore, our ongoing interaction with customers has helped to

develop specific upgrades in some of our existing product areas.

These conversations led us to adapt our virtual queuing offering to

assist with social distancing, enhance our mobile food &

beverage offerings, adapt our online reservation programmes,

develop live-event streaming capability and rollout a full update

of the accesso Siriusware(SM) solution.

With the appointment of a Head of Product to oversee our entire

technology estate, we are now much better-positioned to evolve our

technology platform in a manner that is more strategic, more

efficient, and more responsive to customer needs. As a result of

the changes we've made, our team is now set up simultaneously to

work on our longer-term plan while managing our customers' evolving

near-term needs.

New Business - Signs of Recovery and Opportunity

Despite the pandemic, accesso still found ways of supporting

operators and bringing new innovation to the market in 2020. In the

first half, new business activity was focused on facilitating

social distancing through virtual queuing, and in June, Holiday

World in the United States began using our accesso LoQueue(R)

virtual queuing as the solution underpinning all visitation at its

sites. Several other existing customers including Walibi Holland in

the Netherlands and Village Roadshow Theme Parks in Australia also

evolved their use of virtual queuing from a premium offering to a

baseline feature of admission. During the second half, Parc Asterix

in France also signed on for virtual queuing, with extremely

positive feedback on the product's ability to drive revenue, ensure

guest satisfaction and increase operational efficiency. In total,

more than 6 million guest rides were fulfilled in the parks

utilising our 100% virtual queuing solution to facilitate social

distancing. Over 50% of guests surveyed by Walibi Holland indicated

an increased likelihood to return to the venue if virtual queuing

remained in place.

Alongside this, we conducted virtual queuing-related tests with

other customers and expanded our virtual queuing outreach to other

sectors with a view to exploring possibilities for more

comprehensive offerings in the longer term. While the appetite for

more widespread in-venue use of virtual queuing remains strong

across the industry, most large-scale operators managed through the

near term with manual processes given the lower levels of

attendance. Notably, our 'classic' premium virtual queuing offering

performed ahead of our expectations when customer venues have been

open.

We were also pleased to work with our partner, Digisoft, to

adapt our Prism wearable device in a unique manner. Utilising the

range of sophisticated technical capabilities and with software

enhancements developed by Digisoft, the Prism band has been adapted

to identify, measure and track interactions between wearers in a

GDPR compliant manner to a secure administrator information hub.

Our patented wristband also provides social distancing guidance via

on-screen and vibration alerts in the workplace. We were pleased to

successfully pilot this program with the Irish Defence Force as

well as with a large pharmaceutical company in their US based

laboratory. Whilst we do not view this specific adaptation as a

significant future revenue opportunity, this unique use-case is

further testament to the underlying strength of our technology set

and our ability to access a broad range of opportunities.

In ticketing, we quickly pivoted to offer existing reservation

functionality to our general admission venues and as a result

booked nearly 9 million guest reservations. Despite the

significantly reduced operations around the globe, we still sold 25

million tickets through accesso Passport, down just 41% on 2019 as

nearly all venues required advance purchase of tickets for entry.

Nearly 3.4 million tickets were sold in the winter holiday period

as venues adapted to provide drive-through or socially distanced

experiences.

Overall, the challenges of 2020 have highlighted the benefit to

venues of having a robust and agile eCommerce platform as they

reopen. Consequently, we have been successful in implementing 29

new accesso Passport deployments during the year, of which 21 were

signed during 2020. Notably, demand from our existing accesso

Siriusware POS customers to add accesso Passport eCommerce was

strong, with implementation at 16 new ski venues. This success

highlights the opportunity for growth with our existing customer

base. Whilst accesso Siriusware provides POS and Guest Management

to 117 ski venues, only 21 of those are also utilising accesso

Passport eCommerce. This represents a significant near-term

penetration opportunity and is an area of key focus for the Group.

As a result, we have now named an executive product leader to focus

solely on our accesso Siriusware/accesso Passport development

roadmap and champion the efforts to accelerate feature integrations

between the two products. Beyond the ski sector, the remaining 165

accesso Siriusware customers remain key cross-sell prospects for

our eCommerce solution particularly in light of the pandemic's

impact and the overall expansion of visitor expectations over

time.

During the year we also saw a rise in demand for one of our

incubator solutions as leisure operators have taken time to review

their future technology plans to drive improved efficiency and

guest service. As venues have looked to reduce contact at food

locations, we have seen more traction than anticipated with the

adoption of our mobile food ordering solution. We deployed our

contactless Food & Beverage solution to Alterra Mountain

Company across some 40 restaurants within their ski resort

portfolio, and we are now working with them to add restaurants at 8

additional resorts in 2021. Two standalone ski customers along with

Grupo Vidanta and Cedar Fair are also implementing the solution. As

a result of this success and building upon our significant

expertise with online ticketing, we are now evaluating the

potential long-term opportunity in the broader food & beverage

sector. Given our solution integrates with a restaurant's POS

solution (for those not utilising our own), this presents a

potentially sizeable market opportunity.

Many venues in the live entertainment sector are also looking to

improve their technology infrastructure as they move towards

reopening, particularly as it relates to online booking

functionality. Despite the industry disruption, accesso ShoWare(SM)

was implemented at 29 new venues in 2020 (compared to 55 in 2019)

as operators used the dark time to update their offerings with

advanced functionality. Beyond 2020, the sales pipeline continues

to gain momentum.

Within Ingresso, we are focused on the post-pandemic recovery as

we onboarded 19 new distributors and 44 new supplier venues in

2020, including Merlin, which is now utilising our Ingresso

platform to support digital sales through third party channels.

Security infrastructure

accesso is viewed as a premier technology solutions provider to

the verticals it serves, and as a result, we continue to invest in

ensuring our technology offering leads the market. An increasingly

critical focus of our clients, and therefore the Group, is around

data security and compliance against an evolving global landscape.

Intrusion threats are becoming more sophisticated and regulations

covering the handling of data demand that compliance is at the

forefront of our business. accesso is acutely aware of the

importance of security to the Group's clients and their guests and

continues to employ state-of-the-art systems to mitigate risk

across the group. With the introduction of GDPR and other global

privacy initiatives, compliance continues to be a top priority

across the business and accesso has maintained pace with all

relevant developments.

With our migration to CyberSource, we have taken new measures to

reduce our data security exposure risk. Whilst we do not disclose

the details of our specific security measures or systems,

throughout 2020 we continued to invest in further enhancements, new

systems, and revisiting procedures as well as the organisational

strength of our security group.

Brexit

The impact of the UK leaving the European Union ("Brexit") has

thus far been limited for the Group. It is recognised that there

could be an impact to consumer spending within the UK or EU and

this could impact attendance at certain venues or investment

decisions by leisure operators. Additionally, there could be a

positive or negative impact on exchange rates which could alter

international visitation patterns. Brexit is not anticipated to

have a material impact on the operations or financial results of

the Group given its significant operations in the US and its

growing global presence outside of the EU.

Board

Having served as a Non-Executive director of accesso since 2010,

David Gammon has now stepped down from our Board. Following an

extensive search David was replaced by Jody Madden who started her

tenure on January 1, 2021. Jody is an experienced technology

leader, and is currently Chief Executive Officer of Foundry, a

London-based creative software developer for the Media,

Entertainment and Digital Design industries. She has 20 years of

experience in Media and Entertainment and has held a range of

senior roles at Digital Domain, Lucasfilm and Industrial Light

& Magic prior to joining Foundry. Jody is also on the Board of

Directors of the Sustainable Food Center, a Central Texas

non-profit group. As part of her Board role Jody will be heading a

new ESG committee as the Group continues its efforts to meet

best-practice standards in this vital area.

Board composition is an important reflection of our focus on

diversity and inclusion. We are pleased that our Board is now

comprised of 50% female directors and overall represents a broad

range of experience across industries. We are thankful to the Board

for their continued support and strategic guidance as we have

worked fervently to manage the impacts of the pandemic and ensure

the long-term success of the business.

2020 Financial Review

The Group delivered a resilient financial performance against

the backdrop of COVID-19 during 2020, with revenue and Cash EBITDA

ahead of our revised range of expectations. accesso's two operating

divisions, Guest Experience and Ticketing both started the year

with strong revenue growth, before being significantly impacted by

the COVID-19 pandemic. As venues reopened, both divisions acted as

key enablers of social distancing and advanced ticketing.

As expected, the Group's transactional revenue stream was

severely impacted by COVID-19. Decisive cost actions, fund-raising

activity and a banking facility refinancing have ensured the

business remains on a firm footing. As venues begin to reopen at

full scale throughout 2021, the Group now sees opportunity to

benefit from latent consumer demand showing through in key markets,

with the deeper partnerships it has built throughout 2020 enabling

it to push on to growth and success in 2021 and beyond.

Alternative performance measures

The Board continues to utilise consistent alternative

performance measures ("APMs") internally and in evaluating and

presenting the results of the business. The Board views these APMs

to be more representative of the Group's underlying

performance.

The historic strategy of enhancing accesso's technology

offerings via acquisitions, as well as an all employee share option

arrangement, necessitate adjustments to statutory metrics to remove

certain items which the Board does not believe are reflective of

the underlying business. These adjustments include aborted

acquisition or aborted sale related expenses, amortisation related

to acquired intangibles, deferred and contingent consideration

linked to continued employment, share-based payments and

impairments.

By consistently making these adjustments, the Group provides a

better period-to-period comparison and is more readily comparable

against businesses that do not have the same acquisition history

and equity award policy.

APMs include cash EBITDA, adjusted basic EPS, net cash,

underlying administrative expenditure and repeatable and

non-repeatable revenue analysis. Cash EBITDA is defined as

operating profit before the deduction of amortisation, impairment

of intangible assets, depreciation, acquisition costs, deferred and

contingent payments, and costs related to share-based payments and

paid capitalised internal development costs; Adjusted basic

earnings per share is calculated after adjusting operating profit

for impairment of intangible assets, amortisation on acquired

intangibles, deferred and contingent consideration linked to

continued employment, acquisition and aborted sale expenses,

finance charges relating to deferred and contingent liabilities and

share-based payments, net of tax at the effective rate for the

period on the taxable adjusted items; net cash is defined as

available cash less borrowings and Underlying administrative

expenses which is administrative expenses adjusted to add back the

cost of capitalised development expenditure and property lease

payments and remove amortisation, impairment of intangible assets,

depreciation, acquisition costs, deferred and contingent payments,

and costs related to share-based payments. Repeatable and

non-repeatable revenue analysis is set out and explained below.

The Group considers Cash EBITDA, which disregards any benefit to

the income statement of capitalised development expenditure, as the

principle operating metric.

Key financial metrics

Revenue quality

Reported Group revenue for 2020 was $56.1m (2019: $117.2m), a

reduction of 52.1% on the prior year period. The following is an

analysis of the Group's revenue visibility. Transactional revenue

consisting of Virtual Queuing, Ticketing and eCommerce is defined

as revenue earned as either a fixed amount per sale of an item,

such as a ticket sold by a customer or as a percentage of revenue

generated by a venue operator. Normally this revenue is repeatable

where a multi-year agreement exists and purchasing patterns by

venue guests do not significantly change, as they did in 2020 as a

result of the pandemic. Other repeatable revenue is defined as

revenue, excluding transactional revenue, that is expected to be

earned through each year of a customer's agreement, without the

need for additional sales activity, such as maintenance and support

revenue. Non-repeatable revenue is revenue that occurs one-time

(e.g. up-front licence fees) or is not repeatable based upon the

current agreement (e.g. billable professional services hours) and

is unlikely to be repeatable without additional successful sales

execution by accesso . Other revenue consists of hardware sales and

other revenue that may or may not be repeatable with limited sales

activity if customer behaviour remains consistent.

2020 2019

$000 $000 %

Virtual queuing 7,407 24,687 (70.0)

Ticketing and eCommerce 23,883 60,909 (60.8)

Maintenance and support 7,711 8,742 (11.8)

Platform fees 2,263 1,149 97.0

------- ------ --------------------- -------

Total Repeatable 41,264 95,487 (56.8)

------- ------ --------------------- -------

Licence revenue 2,322 3,496 (33.6)

Professional services 9,954 14,787 (32.7)

------- ------ --------------------- -------

Non-repeatable revenue 12,276 18,283 (32.9)

------- ------ --------------------- -------

Hardware 1,493 2,499 (40.3)

Other 1,061 913 16.2

------- ------ --------------------- -------

Other revenue 2,554 3,412 (25.1)

------- ------ --------------------- -------

Total revenue 56,094 117,182 (52.1)

======= ====== ===================== =======

Total Repeatable as

% of total 73.6% 81.5%

The Group's revenue was severely impacted by the COVID-19

pandemic across 2020, with its repeatable revenue stream down 56.8%

year-on-year due to lower customer volumes across the leisure

industry. The Group's non-repeatable revenue also declined by 32.9%

down to $12.3m. This stream saw lower impact as licence fees

continued to be recognised and professional services work resumed

after a short interruption when customer attention turned to cost

saving and managing themselves through mandated closures.

The Group's ticketing and distribution segment was significantly

impacted by lower guest volumes in 2020, although it did perform

strongly when venues were open. On the ticketing side, its

flexibility in supporting online transactions and contactless

interactions enabled it to deliver revenues of $36.6m, down 37.1%

on 2019 which reflects a better-than-expected performance given the

length of certain markets closures. The outlook for the Group's

accesso Passport platform remains healthy and should benefit from

the continued trend towards eCommerce following the pandemic. The

Group's distribution business, which remains dependent on the

severely impacted UK West End Theatre market, saw a revenue decline

of 93.5% in the year. Whilst this market is currently closed it

does have a line of sight to reopening under the UK Government's

four step plan, with reduced capacities and social distancing from

17 May 2021 and without restriction from 21 June 2021. Immediately

following the announcement of the UK's reopening plan, consumers

began booking tickets to available shows, and the Group is hopeful

for a partial recovery in H2 2021 subject to the success of the

UK's reopening plan.

The Group's Guest Experience segment was similarly impacted by

COVID-19, however it continues to make good progress in rolling out

its total-virtual-queuing solutions at scale with operators such as

Village Roadshow Theme Parks, Holiday World, Walibi Holland and

Parc Asterix. As part of these rollouts the Group was able to adapt

its technology to facilitate social distancing, enabling venues to

reopen with guest experience quality still intact. Revenue in the

segment was down 52.1% in the year.

Revenue on a segmental basis was as follows:

2020 2019

$000 $000 %

Ticketing 36,603 58,237 (37.1)

Distribution 1,363 21,097 (93.5)

------- -------------- -------

Ticketing and distribution 37,966 79,334 (52.1)

------- -------------- -------

Queuing 8,348 25,208 (66.9)

Other guest experience 9,780 12,640 (22.6)

------- -------------- -------

Guest experience 18,128 37,848 (52.1)

------- -------------- -------

Total revenue 56,094 117,182 (52.1)

======= ============== =======

Revenue on a geographic and segmental basis was as follows:

2020 2019

Ticketing

and Guest Ticketing Guest

Distribution Experience Group and Distribution Experience Group

$000 $000 $000 $000 $000 $000

Primary geographic

markets

UK 4,380 848 5,228 25,500 2,047 27,547

Other Europe 1,177 649 1,826 1,859 2,185 4,044

Australia/South

Pacific/Asia 1,663 750 2,413 2,942 768 3,710

USA and Canada 30,014 15,739 45,753 45,987 32,668 78,655

Central and

South America 732 142 874 3,046 180 3,226

-------------- ------------ -------- ------------------ ------------ --------

37,966 18,128 56,094 79,334 37,848 117,182

============== ============ ======== ================== ============ ========

On a geographic basis, as was reported in the Group's interim

results announcement, venues in the United Kingdom and Other Europe

were largely closed from mid-March until early July and then again

in November and December depending on the sector. Some regions and

types of attraction remained closed through to August 2020 and in

the case of the UK theatre sector, have yet to reopen. This

accounts for a revenue reduction in the UK of $22.3m. From July

through to November we did see some reopenings in our main

geographies with the exception of California-based venues, albeit

at lower capacity, and we experienced healthy demand during this

period. Texas, New Jersey and New York, our other key US regions,

experienced more limited mandated closures with venues remaining

largely open with capacity restrictions from June.

Customer concentration

The Group continues to be a trusted technology partner to

leading leisure operators. The success of these partnerships does

result in a level of revenue concentration. When the Group

delivered its results for H1 2020 it committed to providing

investors with an ongoing update regarding the level of

concentration on a full year basis. For 2020 the top five customers

accounted for 50.2% of revenue (2019: 53.5%). The Group's top ten

customers accounted for 57.4% (2019: 61.3%). The Group is pleased

to report a negligible level of customer attrition and remains

committed to working strategically with our customers to ensure we

provide the best possible service aligned to their needs.

Gross margin

Management has reviewed how costs are allocated between

administrative expenses and cost of sales. In order to give a

clearer and more meaningful picture of activity within the

business, certain costs linked to the delivery of professional

services revenue, previously shown within administrative costs have

been reclassified to cost of sales in 2020.

The Group's reported gross profit margin was 76.6% in 2020,

compared to 67.3% in 2019 when adjusting for $6.7m of professional

service cost of sales to aid comparability. This 9.3% increase

primarily results from a change in sales mix compared with 2019.

Our lower-margin distribution business is a smaller portion of our

revenue for this period and conversely higher margin revenue

streams such as licence fees, maintenance and support and platform

fees are proportionately greater during 2020. These movements

combine to drive a higher gross profit margin.

Administrative expenses

Reported administrative expenses, including the non-cash expense

related to intangible impairments, decreased 48.3% to $73.3m (2019:

$141.9m), reflecting the Group's efforts to right-size its

operational footprint. Underlying administrative expenditure

decreased by 23.1% to $56.5m (2019: $73.5m) due to cost action

implemented following the onset of the pandemic. Management reduced

the Group's monthly underlying administrative expenses by $1.4m to

an average of $4.7m for the year principally by implementing a

company-wide four-day working week which ended in a phased manner

in H2. The Group also utilised the available government job

retention schemes in the USA, UK and Australia, receiving $595k in

support. Furthermore, the Group also reduced its workforce by 68

full time employees and 30 contractors alongside significantly

decreased discretionary spend including travel, marketing and

tradeshows. No government assistance has been sought from December

2020 onwards.

2020 2019

$000 $000

Administrative expenses as reported 73,339 141,906

Capitalised development expenditure (1) 2,969 21,064

Deferred equity settled acquisition consideration (150) (1,416)

Amortisation related to acquired intangibles (2,573) (11,286)

Share based payments (1,398) (1,845)

Amortisation and depreciation (2) (14,664) (16,014)

Property lease payments not in administrative

expense (1) 1,622 1,451

Impairment of intangibles (2,627) (53,617)

Professional services cost (3) - (6,723)

Underlying administrative expenditure 56,518 73,520

========= ===============

(1) See consolidated cash flow statement

(2) This excludes acquired intangibles but includes depreciation

on right of use assets.

(3) Professional service costs incurred in the delivery of professional

services revenue adjusted in comparative year to be comparable

with the year ended 31 December 2020.

Cash EBITDA

The Group recorded an operating loss of $30.4m (2019 operating

loss: $56.3m); and Cash EBITDA reduced from $7.1m in 2019 to a loss

of $11.5m in 2020. This $18.6m Cash EBITDA reduction is entirely a

result of the $61.1m revenue reduction, with the Group mitigating

profit impact substantially through the cash preservation

measures.

The table below sets out a reconciliation between statutory

operating loss and cash EBITDA:

2020 2019

$000 $000

Operating loss (30,354) (56,278)

Add: Aborted sale/acquisition expenses 461 305

Add: Deferred equity settled acquisition

consideration (1) 150 1,416

Add: Amortisation related to acquired intangibles 2,573 11,286

Add: Share based payments 1,398 1,845

Add: Impairment of intangible assets 2,627 53,617

Add: Amortisation and depreciation (excluding

acquired intangibles) 14,664 16,014

Capitalised internal development costs paid

in cash (2,969) (21,064)

--------- ----------------------

Cash EBITDA (11,450) 7,141

========= ======================

(1) Under IFRS 3, consideration paid to employees of the acquired

entity, who must remain employees' post-acquisition in order

to receive earn out or deferred consideration, is treated as

compensation expense rather than consideration.

The group reported a statutory loss before tax of $32.9m (2019:

loss of $57.6m). Adjusted basic loss per share was 60.64 cents

(2019: 30.78 cents earnings per share). Basic loss per share in

2020 was 84.78 cents (2019 basic loss per share: 184.26 cents).

Development expenditure

2020 2019

Development expenditure by segment $000 $000

Ticketing and distribution 14,044 19,856

% of ticketing and distribution segment

revenue 37.0% 25.0%

------- -------

Guest Experience 7,113 13,689

% of guest experience segment revenue 39.2% 36.2%

------- -------

Total development expenditure 21,157 33,545

% of total revenue 37.7% 28.6%

------- -------

Total development expenditure for 2020 decreased 36.9% to

$21.2m, (2019: $33.5m) due to the impact of 4-day working weeks, a

reduction of 30 contractors and the restructure of our development

teams into a single unit. Despite this decrease to development

expenditure, 2020 has been a period of innovation within accesso,

with frontline and technical teams working at great pace to deliver

solutions to enable business continuity for our customers

throughout the COVID-19 pandemic.

While the Group remains focused on innovation, the reduction

against the previous expectation reflects an integration roadmap

more in-line with the Group's overall efficiency drive, in addition

to the 4-day working week being in place for longer periods of time

than previously expected.

The group capitalises elements of development expenditure where

it is appropriate and in accordance with IAS 38 Intangible assets.

Capitalised development expenditure of $3.0m (2019: $22.0m),

representing 14.0% (2019: 65.7%) of total development expenditure.

This material decrease in the proportion of development expenditure

being capitalised is not a reflection of lesser importance of the

work being undertaken. Development continues to expand the product

set and add features that will be important for our customers'

operations in the future. However, a more conservative approach to

thresholds for such investment expenditure has been applied. The

revised approach reflects the steady maturing of the suite of

commercialised products.

Cash and Net Cash

Net cash at the end of the period was $29.7m (2019: $0.4m),

consisting of cash balances of $56.4m and borrowings of $26.7m.

2020 2019

$000 $000

--------- ---------

Borrowings (including capitalised finance

costs) (26,699) (15,851)

Less: Cash in hand & at bank 56,355 16,205

Net cash 29,656 354

--------- ---------

This strong net cash position benefited from $46.1m of net

proceeds raised through the Group's equity placing and open offer

which completed in June 2020. In the absence of the equity raise

our adjusted net debt would have been $16.4m reflecting the

COVID-19 impact on our top line. The net cash position would have

been significantly worse if it had not been mitigated by diligent

working capital management, immediate action on preserving cash,

utilisation of Government schemes, deferring payroll taxes where

permitted and reducing underlying administrative expenses as noted

above.

As a consequence of the COVID-19 pandemic impacting revenues,

the Group has seen a net cash outflow from operations in the year

of $14.5m (2019: $26.2m inflow).

As noted above, the Group's total development expenditure

reduced significantly to $21.2m in 2020 (2019: $33.5m). The

reduction in gross research and development costs, combined with a

heavily curtailed capital expenditure investment into property,

plant and equipment of $0.4m (2019: $1.9m) has helped to further

preserve the Group's cash balances.

At the period end the Group had a borrowing facility with Lloyds

Bank plc which was renegotiated in June 2020 together with the

successful completion of the equity placing. The Group gained

access to an additional facility of GBP8m ($9.8m) under the

Coronavirus Large Business Interruption Loan Scheme (the "CLBILS

Facility"). The CLBILS Facility was available to the Group for 15

months until August 2021 and remained undrawn as at 31 December

2020.

The Group's year end drawn borrowing facility of $26.7m was

settled on 19 March 2021 following a successful refinancing of its

lending facilities with Investec Bank plc, conditional on the

clearance of priority security charges over US subsidiary entities.

The group has a 3-year, GBP18m Coronavirus Large Interruption

Scheme Loan revolving credit facility at a 3.5% margin expiring in

March 2024 with quarterly covenant tests on minimum revenue and

minimum liquidity for 2 years to December 2022. From March 2023

additional covenants are added for leverage and interest cover.

As a result of the immediate measures taken by management on

cost and cash flow management and the successful equity fundraise

and loan facilities refinanced in March 2021, the Board believes

that the Group is in a strong financial position and ends the year

with net cash of $29.7m.

Dividend

The Board maintains its consistent view that the payment of a

dividend is unlikely in the short to medium term with cash more

efficiently invested in continued product development and

integration efforts supporting the Group's strategy.

Impairment

In line with relevant accounting standards, the Group reviews

the carrying value of all intangible assets on an annual basis or

at the interim where indicators of impairment exist. As announced

on 16 September 2020 in our interim results release, at 30 June

2020 it was identified that the remaining intangible assets of

Ingresso Group Limited had indicators of impairment due to the

impact of COVID-19 and the slower anticipated recovery within the

UK theatre sector. This test was revisited at 31 December 2020 with

the same outcome.

The consequence of this test is that the carrying value of the

Ingresso allocated assets was reduced by $1.4m (2019: $7.0m), which

has been charged to administrative expenses during the year.

Certain development costs of $1.2m were also impaired following a

review of their year-end carrying values.

Taxation

The effective tax rate on statutory loss before tax of $32.9m

(2019: $57.6m) was 9.2% (2019: 12.1%).

The key reconciling items to actual tax rates is $8.3m of

unrecognised deferred tax asset on US losses, net of $0.4m of prior

year items and $2.6m US carry forward credits, excluding these

items the adjusted effective tax would have been 25% (2019: 17%

excluding the $4.2m non-taxable goodwill impairment) being

reflective of the US tax rates where the majority of the group's

earnings are derived. $45m of gross US losses/credits are

unrecognised due to the uncertainty of near-term profitability and

the current period loss.

Consolidated statement of comprehensive income

for the financial year ended 31 December 2020

2020 201 9

Notes $000 $000

------------------------------------------------ ------ --------- ----------

Revenue 56,094 117,182

Cost of sales (13,109) (31,554)

--------- ----------

Gross profit 42,985 85,628

Administrative expenses (73,339) (141,906)

--------- ----------

Operating loss before impairment of intangible

assets (27,727) (2,661)

Impairment of intangible assets 10 (2,627) (53,617)

------------------------------------------------ ------ --------- ----------

Operating loss (30,354) (56,278)

Finance expense (2,518) (1,324)

Finance income 10 21

--------- ----------

Loss before tax (32,862) (57,581)

--------- ----------

Income tax benefit 8 3,008 6,985

Loss for the period (29,854) (50,596)

========= ==========

Other comprehensive income

Items that will be reclassified to income

statement

Exchange differences on translating foreign

operations 4,910 611

Income tax credit on items recorded in 1,129 -

other comprehensive income

--------- ----------

6,039 611

Total comprehensive loss (23,815) (49,985)

========= ==========

All profit and comprehensive income is

attributable to the owners of the parent

Losses per share expressed in cents per

share:

Basic 9 (84.78) (184.26)

Diluted 9 (84.78) (184.26)

C onsolidated statement of financial position

as at 31 December 2020

31 December 31 December

Registered Number: 03959429 2020 2019

Notes $000 $000

---------------------------------- ------ ------------ ------------

Assets

Non-current assets

Intangible assets 10 129,503 142,456

Property, plant and equipment 2,439 3,766

Right of use assets 4,166 5,715

Contract assets 1,109 3,654

Deferred tax assets 8 7,701 8,647

------------ ------------

144,918 164,238

------------ ------------

Current assets

Inventories 1,927 1,004

Contract assets 3,404 5,926

Trade and other receivables 15,968 23,676

Income tax receivable 1,858 50

Cash and cash equivalents 56,355 16,205

------------ ------------

79,512 46,861

------------ ------------

Liabilities

Current liabilities

Trade and other payables 17,328 31,811

Derivative financial liabilities 758 -

Finance lease liabilities 1,163 1,307

Contract liabilities 7,525 7,299

Income tax payable 667 4,005

------------ ------------

27,441 44,422

------------ ------------

Net current assets 52,071 2,439

------------ ------------

Non-current liabilities

Deferred tax liabilities 8 7,580 10,778

Contract liabilities 1,303 1,823

Other non-current liabilities - 30

Finance lease liabilities 3,790 4,976

Borrowings 26,699 15,851

------------ ------------

39,372 33,458

------------ ------------

Total liabilities 66,813 77,880

------------ ------------

Net assets 157,617 133,219

============ ============

Shareholders' equity

Called up share capital 11 595 427

Share premium 153,327 107,403

Own shares held in trust - (665)

Retained earnings (15,864) 11,331

Merger relief reserve 19,641 19,641

Translation reserve (82) (4,918)

------------ ------------

Total shareholders' equity 157,617 133,219

============ ============

Consolidated statement of cash flow

for the financial year ended 31 December 2020

2020 2019

Notes $000 $000

--------------------------------------------------- ------ --------- ---------

Cash flows from operations

Loss for the period (29,854) (50,596)

Adjustments for:

Depreciation (excluding finance lease assets) 1,758 1,694

Depreciation on finance leased assets 1,461 1,320

Amortisation on acquired intangibles 10 2,573 11,286

Amortisation on development costs and other

intangibles 10 11,446 13,000

Impairment of intangibles 10 2,627 53,617

Loss on disposal of property, plant and

equipment 22 114

Share-based payment 1,398 1,845

Deferred consideration charge 150 1,416

Finance expense 2,518 1,324

Finance income (10) (21)

Foreign exchange gain 1,308 (90)

Income tax benefit 8 (3,008) (6,985)

RDEC tax credits (384) -

(7,995) 27,924

(Increase)/Decrease in inventories (923) 86

Decrease/(Increase) in trade and other

receivables 6,658 (5,865)

Increase/(Decrease) in contract assets/

contract liabilities 4,847 (1,140)

(Decrease)/Increase in trade and other

payables (14,444) 3,562

Cash (used in)/generated from operations (11,857) 24,567

Tax (paid)/received (2,657) 1,597

--------- ---------

Net cash (outflow)/inflow from operating

activities (14,514) 26,164

--------- ---------

Cash flows from investing activities

Deferred consideration settlement (477) (1,017)

Capitalised internal development costs (2,969) (21,064)

Purchase of property, plant and equipment (437) (1,945)

Acquisition of other intangible assets - (4)

Interest received 6 21

--------- ---------

Net cash used in investing activities (3,877) (24,009)

--------- ---------

Cash flows from financing activities

Share issue 48,215 306

Share issue costs (2,123) -

Sale of shares held in trust 198 -

Interest paid (633) (830)

Payments on property lease liabilities (1,622) (1,451)

Proceeds from borrowings 10,116 4,802

Repayments of borrowings - (9,728)

Net cash generated from/ (utilised in)

financing activities 54,151 (6,901)

--------- ---------

Increase/ (Decrease) in cash and cash equivalents 35,760 (4,746)

Cash and cash equivalents at beginning

of year 16,205 20,704

Exchange gain on cash and cash equivalents 4,390 247

--------- ---------

Cash and cash equivalents at end of year 56,355 16,205

========= =========

Consolidated statement of changes in equity

for the financial year ended 31 December 2020

Merger Own shares

Share Share Retained relief held Translation

capital premium earnings reserve in trust reserve Total

$000 $000 $000 $000 $000 $000 $000

--------- --------- ---------- --------- ----------- ------------ -----------

Balance at

1 January 2020 427 107,403 11,331 19,641 (665) (4,918) 133,219

--------- --------- ---------- --------- ----------- ------------ -----------

Comprehensive income for the

year

(Loss) for

period - - (29,854) - - - (29,854)

Other comprehensive

income

Exchange differences

on translating

foreign operations - - - - - 4,910 4,910

Income tax

credit on items

recorded in

other comprehensive

income - - 1,129 - - - 1,129

--------- --------- ---------- --------- ----------- ------------ ---------

Total comprehensive

income for

the year - - (28,725) - - 4,910 (23,815)

--------- --------- ---------- --------- ----------- ------------ -----------

Issue of share

capital 168 48,047 - - - - 48,215

Share issue

costs - (2,123) - - - - (2,123)

Share-based

payments - 1,398 - - (74) 1,324

Equity-settled

deferred consideration - - 150 - - - 150

Share option

tax charge

- deferred - - 50 - - - 50

Reduction of

shares held

in trust - - (68) - 665 - 597

Total contributions

by and distributions

by owners 168 45,924 1,530 - 665 (74) 48,213

Balance at

31 December

2020 595 153,327 (15,864) 19,641 - (82) 157,617

========= ========= ========== ========= =========== ============ ===========

Balance at

1 January 2019 421 107,103 60,143 19,641 (665) (5,529) 181,114

Comprehensive income for the

year

(Loss) for

period - - (50,596) - - - (50,596)

Other comprehensive

income

Exchange differences

on translating

foreign operations - - - - - 611 611

--------- --------- ---------- --------- ----------- ------------ -----------

Total comprehensive

income for

the year - - (50,596) - - 611 (49,985)

--------- --------- ---------- --------- ----------- ------------ -----------

Contributions by and distributions

to owners

Issue of share

capital 6 300 - - - - 306

Share-based

payments - - 1,845 - - - 1,845

Equity-settled

deferred consideration - - 1,416 - - - 1,416

Share option

tax charge

- deferred - - (1,584) - - - (1,584)

Share option

tax charge

- current - - 107 - - - 107

Total contributions

by and distributions

by owners 6 300 1,784 - - - 2,090

Balance at

31 December

2019 427 107,403 11,331 19,641 (665) (4,918) 133,219

========= ========= ========== ========= =========== ============ ===========

Notes to the consolidated financial information

for the financial year ended 31 December 2020

1. Reporting entity

accesso Technology Group plc is a public limited company

incorporated in the United Kingdom, whose shares are publicly

traded on the AIM market. The company is domiciled in the United

Kingdom and its registered address is Unit 5, The Pavilions,

Ruscombe Park, Twyford, Berkshire RG10 9NN. This consolidated

financial information comprises the company and its subsidiaries

(together referred to as the "Group").

The Group's principal activities are the development and

application of ticketing, mobile and eCommerce technologies,

licensing and operation of virtual queuing solutions and providing

a personalised experience to customers within the attractions and

leisure industry. The eCommerce technologies are generally licensed

to operators of venues, enabling the online sale of tickets, guest

management, and point-of-sale ("POS") transactions. The virtual

queuing solutions and personalised experience platforms are

installed by the Group at a venue, and managed and operated by the

Group directly or licensed to the operator for their operation.

2. Basis of accounting

The preliminary results for the year ended 31 December 2020 and

the results for the year ended 31 December 2019 are prepared under

International Financial Reporting Standards and applicable law. The

accounting policies adopted in this preliminary announcement are

consistent with the Annual Report for the year ended 31 December

2020.

The financial information set out above does not constitute the

company's statutory accounts for the years ended 31 December 2020

or 2019 but is derived from those accounts. Statutory accounts for

2019 have been delivered to the registrar of companies, and those

for 2020 will be delivered in due course. The auditor has reported

on those accounts; their reports were (i) unqualified, (ii) did not

include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

While the financial information included in this announcement

has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRS), this announcement does not itself contain sufficient

information to comply with IFRS.

The Group's consolidated financial statements have been prepared

in accordance with IFRS. They were authorised for issue by the

Company's board of directors on 23 March 2021.

Details of the Group's accounting policies are included in Notes

3 and 4.

3. Changes to significant accounting policies

Other new standards and improvements

A number of new standards are also effective or available for

early adoption from 1 January 2020 but they do not have a material

effect on the Group's financial information.

-- Amendments to References to Conceptual Framework in IFRS Standards

-- Definition of a Business (Amendments to IFRS 3

-- Definition of Material (Amendments to IAS 1 and IAS8)

-- Interest Rate Benchmark Reform (Amendments to IFRS 9, IAS

39 and IFRS 7)

-- COVID-19-Related Rent Concessions (Amendment to IFRS 16)

New standards and interpretations not yet adopted

A number of new standards, amendments to standards, and

interpretations are either not effective for 2020 or not relevant

to the group, and therefore have not been applied in preparing

these accounts.

4. Significant accounting policies

The principal accounting policies adopted in the preparation of

the financial information are set out below. The policies have been

consistently applied to all the periods presented.

Basis of consolidation

This consolidated financial information incorporates the results

of accesso Technology Group plc and all of its subsidiary

undertakings as at 31 December 2020 using the acquisition method.

Subsidiaries are all entities over which the Group has the ability

to affect the returns of the entity and has the rights to variable

returns from its involvement with the entity. The results of

subsidiary undertakings are included from the date of

acquisition.

The acquisition of subsidiaries is accounted for using the

acquisition method. The cost of the acquisition is measured at the

aggregate of the fair value, at the date of exchange, of assets

given, liabilities incurred or assumed, and equity instruments

issued by the Group in exchange for control of the acquiree. Any

costs directly attributable to the business combination are written

off to the Group income statement in the period incurred. The

acquiree's identifiable assets, liabilities, and contingent

liabilities that meet the conditions under IFRS 3 are recognised at

their fair value at the acquisition date.

Goodwill arising on acquisition is recognised as an asset and

initially measured at cost, being the excess of the cost of the

business combination over the Group's interest in the net fair

value of the identifiable assets, liabilities, and contingent

liabilities recognised.

Investments, including the shares in subsidiary companies held

as fixed assets, are stated at cost less any provision for

impairment in value. Where necessary, adjustments are made to the

financial statements of subsidiaries to bring the accounting

policies used in line with those used by the Group.

Lo-Q (Trustees) Limited, a subsidiary company that holds an

employee benefit trust on behalf of accesso Technology Group plc,

is under control of the Board of directors and hence has been

consolidated into the Group results.

All intra-Group transactions, balances, income and expenses are

eliminated on consolidation.

Going concern

The financial information has been prepared on a going concern

basis which the directors consider to be appropriate for the

following reasons.

Following the impact of COVID-19 and the subsequent decrease in

revenues, accesso Technology Group plc (the Group), took several

steps to preserve the cash position of the Group including raising

additional cash of $46.1m through a placing and open offer,

obtaining additional loan facilities of GBP8m until 31 August 2021

($10.4m) and reducing underlying administrative expenses by $1.4m a

month for the year.

Subsequent to year end the Group has signed a new banking

agreement with Investec Bank PLC and settled in full the facility

with Lloyds Bank PLC. This agreement gives a facility of GBP18m

through to March 2024 and the covenants in the first 2 years are

minimum revenue and minimum liquidity only. Minimum revenue

covenants are tested quarterly on a 12-month basis ending on each

test date at $50m for June 2021, September 2021 and December 2021;

$55m for March 2022, June 2022 and September 2022; and $60m for

December 2022. Minimum liquidity is GBP10.7m of freely available

cash to be tested for four consecutive quarters starting on June

2021. As at 19 March 2021 the Group has cash of $28.6m and

available facilities of GBP18m subject to Investec Bank PLC

securing charges over our US subsidiaries.

The Directors have prepared cash flow forecasts for the Group

for a period of 24 months from the date of this financial

information, which indicate that, taking account of severe but

plausible downsides and the anticipated impact of COVID-19, the

Group will have sufficient funds to meet the liabilities of the

Group as they fall due for that period.

The base case assumes that there is a steady re-opening of

attractions and that Group revenue and EBITDA gradually increases

through 2021 although are still below the levels seen in 2019.

Within the base case there are contingencies to allow for a

shortfall to the expected level of performance. Under this

scenario, the Group has sufficient liquidity and adequate headroom

within its existing cash reserves and facilities and complies with

all covenants throughout the review period.The severe but plausible

downside case assumes that the impact of COVID-19 lasts for longer