TIDMADT1

RNS Number : 8085V

Adriatic Metals PLC

19 April 2021

Adriatic Metals PLC

('Adriatic Metals' or the 'Company')

VARES PROJECT OPERATIONS AND CORPORATE UPDATE

To read the release in full, including seeing all the figures,

please visit

https://www.adriaticmetals.com/investors/asx-announcements/

Vares Project Highlights

- Rupice underground mine plan optimised, targeting the central

higher-grade zones earlier. This has resulted in a 26% increase in

silver-equivalent contained metal mined during the first 24

months.

Demolition of the Old Processing Plant Site is nearing

completion. A geotechnical drilling program to test the structural

integrity of the original concrete pad has been completed.

- Urban Planning Permit and Exploitation Permit for Rupice are

on course to be received later this quarter.

- Exploration permit for the 32km(2) of new concession area,

granted in Q3 2020, is expected within a month.

- Exploration drilling has now re-commenced at Rupice.

- A Vares Project Geology Presentation has been made available

on the Company's website and via a separate ASX and LSE release. To

download the presentation see the announcements page on the

Adriatic Metals see link:

https://www.adriaticmetals.com/investors/asx-announcements/

- Adriatic Metals Chief Geologist, Phil Fox, will host a Vares

Project Geology Webinar on Tuesday, 20 April 2021 at 09:00 London /

10:00 CET / 16:00 Perth / 18:00 Sydney. To register for the

webinar, see link:

https://us02web.zoom.us/webinar/register/WN_oxZb0DJLQJepx7hjS9MNig

- The Company has received several non-binding term sheets for the Vares Project Financing.

Corporate Highlights

- Appointment of Thomas Horton as Head of Corporate Development & Investor Relations.

- Appointment of RBC Capital Markets as the Company's Joint

Corporate Broker, effective 30 March, 2021.

- Adriatic Metals PLC (ASX:ADT, LSE:ADT1) is pleased to provide

an operations update on the Company's flagship Vares Project (the

"Vares Silver Project" or "Project"), and a corporate update.

OPERATIONS - VARES SILVER PROJECT

Definitive Feasibility Study

The Company has appointed Ausenco, Mining Plus & Wardell

Armstrong as the principal consultants for the Project Definitive

Feasibility Study ("DFS"). All workstreams are advancing well with

results expected in Q3 2021.

Mining Plus have optimised the Rupice underground mine design,

targeting the high-grade zones of the deposit earlier in the mine

plan via a new portal location and decline ("Updated Mine Design").

This has increased the silver-equivalent contained metal mined by

26% during the first 24 months of the mine plan.

Figure 1 plots both the Updated Mine Plan and the

Pre-feasibility Study ("PFS") mine plan, showing the contained

silver-equivalent metal mined (on a monthly basis) over the first

24 months for each mine plan. Both mine plans have a fixed mining

rate of circa 2,200 tonnes per day. Therefore, the higher

silver-equivalent contained metal in the Updated Mine Plan

(percentage shown on right hand axis) is due to higher grade ore

mined.

Figure 1. Chart Showing Contained Metal Mined in the PFS vs the

Updated Mine Design

Note: the silver equivalent assumptions are the same as those

disclosed in Table 1 of Updated Rupice Mineral Resource Estimate,

as announced 01 September 2020. For a link to the announcement see

link:

https://www.adriaticmetals.com/investors/asx-announcements/

The new portal location and decline design for the second portal

has been moved to a lower position, further down the hill at

Rupice. The second portal provides a more direct route to the

central zone high-grade zone (as shown in purple in Figure 2),

thereby bringing it forward in the mine plan.

-

Figure 2. Cross section of the Update Mine Design

Note: the silver equivalent assumptions are the same as those

disclosed in Table 1 of Updated Rupice Mineral Resource Estimate,

as announced 01 September 2020. For a link to the announcement see

link:

https://www.adriaticmetals.com/investors/asx-announcements/

-

A geotechnical drilling program has commenced for the new portal

and decline location used in the Updated Mine Design. The program

will consist of two holes that will ultimately follow the decline's

route from surface to the Rupice orebody. The geotechnical drilling

for the proposed site of the ventilation raise shaft has been

completed.

The old Veovaca processing plant site is located 5km from Vares

and processed ore from the historical Veovaca open pit until the

late 1980s ("Old Processing Plant Site"). The Vares Project will

reuse this brownfield site for the new processing plant ("Vares

Processing Plant").

In Q4 2020, demolition and remediation work of the Old

Processing Plant Site commenced and is currently nearing

completion. Most of the concrete and steel structures have been

demolished and are in the process of being sorted and removed. All

removed concrete is being stored and will be recycled as base for

the haul road. The original concrete pad will remain as the

foundation for the new Vares Processing Plant and a geotechnical

drilling program to test its structural integrity has been

completed.

Environmental and Social Impact Assessment ("ESIA")

The ESIA, led by Wardell Armstrong International, is moving into

the final stage of environmental baseline data collection and

monitoring. This is expected to be completed by the end of May -

albeit some key data will continue to be collected after this date

to provide additional background information.

Concurrently, work has started on the impact prediction and

analysis and development of mitigation measures, which will lead to

the development of various management plans (e.g. social, community

health and safety, water, waste, biodiversity, air quality and

noise, and emergency preparedness) as well as the mine closure

plan. These plans will be key to implementing the various

mitigation measures during project construction, operation and

closure. All is progressing as planned. The in-house environmental

team continue to work closely with the lead engineering

consultants, Wardell Armstrong International and Ausenco, to ensure

that the DFS and the ESIA provide the best outcomes technically,

environmental and socially. The ESIA will be developed in

accordance with some of the most demanding practices globally;

namely the EBRD Performance Requirements and IFC Performance

Standards, which also align with the Equator Principles.

In line with EBRD's Project Support Agreement, as announced on

27 October 2020, the Company appointed ERM Romania to conduct an

Environmental and Social Due Diligence ("ESDD"). The ESDD report

concluded that it "did not identify any hindrances to permitting

the project". In March 2021, Wardell Armstrong International

produced an updated Scoping Study Report, which supported the

positive comments made in the ESDD.

Permitting

The Rupice underground exploitation permitting process is

progressing. The Company is in the process of completing the

acquisition of the various land parcels in and surrounding the

Rupice deposit. In addition, applications have been made to convert

the land from a Forestry and Agricultural classification to an

Industrial classification. All consents for the conversion have

been received by the relevant private landowners, and positive

opinions received for the adaption of the Vares Municipal Spatial

Plan, confirming the area as Industrial Land, have been received.

It is expected that the Urban Planning Permit for Rupice and the

Exploitation Permit will be issued later this quarter.

As announced on 02 September 2020, the Company was granted

32km(2) of newly granted concession area surrounding the Vares

Project (areas shown in blue in figure 3), in addition to the

original 9km(2) (areas shown in red in figure 3). The Company is

awaiting the issuance of the Exploration Licence before drilling

can commence on the expanded areas. This is expected to be received

within a month.

Figure 3. Map of the Vares Project Mineral Concession Area

Exploration

Following warmer than expected Spring weather, exploration

drilling has now re-commenced. Initially, one diamond core drill

rig has been deployed to the Rupice area, with a second diamond

core drill rig planning to be mobilised on the northern extensions

of Rupice in the coming month. In addition, an aeromagnetic and

radiometric survey is expected to commence later this month across

the entirety of the current 41km(2) of granted concession area. The

Company will update the market in due course on the progress of

these programs.

The Company has produced a Vares Silver Project Geology

Presentation that is available on its website. The presentation

covers in detail the geology of the Project and the proposed

exploration work program for 2021. To download the presentation see

the ASX Announcements page on the Adriatic Metals website:

https://www.adriaticmetals.com/investors/asx-announcements/

Adriatic Metal's Chief Geologist, Phil Fox, will host a geology

focused webinar on Tuesday, 20 April 2021 at 09:00 London / 10:00

CET / 16:00 Perth / 18:00 Sydney. The webinar will run through

Vares Silver Project Geology Presentation. An open Q&A session

will be available at the end of the session. To register for the

webinar see link:

https://us02web.zoom.us/webinar/register/WN_oxZb0DJLQJepx7hjS9MNig

Community Engagement

Active engagement with stakeholders remains ongoing and has been

adapted in reaction to the challenges of the pandemic. Smaller

focus groups have been organised in order to ensure an effective,

integrated two-way communication with all stakeholders. Stakeholder

engagement will continue with this format for the foreseeable

future. The Public Liaison Committee, which was set up to provide

local communities and institutions a two-way forum through which to

communicate information about the Vares Silver Project, had its

quarterly meeting in January. This was the 4(th) meeting since

inception and all feedback from the meeting was positively

received.

The Company is working alongside the European Bank for

Reconstruction and Development and Globe 24-7 in creating the

syllabus for a mining engineering vocational course at Mješovita

srednja škola Nordbat 2 (the local Vares High School). The course,

which is scheduled to commence in August 2021, will be the

first-time in 30 years that mining has been taught at the

school.

Working alongside the local Scouts Association in Vares and

World Vision, employees of Eastern Mining worked on a project

called "I love Vares". This was a community wide effort to clear up

litter in the town and around the regional Vares roads and rivers,

as well as distribute leaflets and put noticeboards on the

importance of looking after the environment. For more information

see link:

https://www.easternmining.co.uk/news/eastern-mining-team-join-vares-clean-up-initiative/

Funds from the cancelled Eastern Mining end of year celebration

have been donated to a number of local humanitarian institutions in

the Vares region. The initiatives that received the donations were

chosen by employees of Eastern Mining. For more information see

link: https://www.easternmining.co.uk/content/?contentID=3106

Concentrate Marketing

The Company has appointed leading commodity trading house,

Bluequest Resources AG ("Bluequest") to manage the marketing and

offtake of the Vares Silver Project's concentrates. Bluequest are

active in the global physical trade of refined non-ferrous metals,

minerals, non-ferrous and precious metal concentrates. The Company

expects to receive offtake term sheets this quarter.

A separate marketing study has been initiated by an external

consultant for the offtake of the barite by-product. The study

targets specifically the sale of barite into the oil and gas

drilling services markets of the Middle East, Americas and Europe,

as well as the global chemicals markets. Analysis has indicated

that these are the most viable markets for the barite by-product

from the Vares Silver Project. A confidentiality agreement has been

signed with a European chemical grade barite refiner, with samples

provided for initial mineralogical analysis and beneficiation

test-work.

Zinc Concentrate Treatment Charge Market Update

As reported in recent media, the zinc concentrate market is

experiencing a tightening, which has resulted in a significant fall

in treatment charges ("TC") over the past 12 months. On 07 April

2021, Fastmarkets reported that the spot zinc concentrate TC (CIF

China) ranges from US$60 to US$74 per tonne. This is substantially

lower than the 2020 contractual high of US$300 per tonne. The

Project PFS used a TC of US$230 per tonne of zinc concentrate.

Therefore, the current spot TC is 67-74% lower than that used in

the Vares Project PFS. It is estimated in the PFS that over the

life of mine the Project will produce 655,224 dmt of zinc

concentrate and is attributable to circa 30% of Project revenue.

The treatment charges for the silver and lead concentrates are not

expected to have materially altered since the PFS was

completed.

Logistics

A logistics study has been initiated to confirm the most

effective routes to market for the DFS. The study includes the

shipping of the multiple concentrate streams to end product

off-takers. The study also includes the use of the Adriatic ports

of Ploce and Rijeka in Croatia. Discussions have been initiated

with major shipping lines regarding the loadout and sea freight of

concentrate from these ports based on a single source supplier for

the complete logistics route.

Infrastructure

Rail

The Company is in advanced discussions with state-owned railway

company, Railways Federation Bosnia and Herzegovina ("Railways

FBiH"). Railways FBiH own the railway line and rail infrastructure

in Vares, as well as the surrounding land around the terminal that

the Company proposes to use for temporary storage and loading of

containers onto the wagons ("Vares Rail Head").

Figure 4. Plan view of the Vares Rail Head, Vares

The scope in discussion involves Railways FBiH recommissioning

the 17km stretch of line from Breza to Vares, providing the Company

with locomotives and rolling stock on an ongoing basis, as well as

conducting ongoing maintenance of the rail infrastructure and

rolling stock as required. The line between Breza and Podlugovi,

where the line from Vares and Breza connects into the electrified

Bosnian rail network, is currently active.

Preliminary discussions with Railways FBiH confirm that the

existing rail infrastructure is in good condition and is capable of

supporting the Vares Project's operational requirements in terms of

weight, volume, capacity and duration, with minimal additional

investment required by the Company. Each train load will transport

concentrate across 18 wagons, with a maximum of two complete train

will be loaded per day.

The Vares Majdan station, located 1km south of the Vares Rail

Head may also be utilised for holding inbound rolling stock, as

well as for marshalling and temporary storage as required. The

Vares Majdan station has capacity to hold circa 30 containers,

double stacked if required, as well as 18 wagons. The railway line

from Breza to Vares Majdan was last used in 2012.

Following the conclusion of an executed agreement between

Eastern Mining & Railways FBiH, which is expected in due

course, reconditioning of the line is expected to commence

immediately thereafter. The Company will update the market on

further discussions and agreements made with Railways FBiH in due

course.

Road

A total of 28km of haulage road is required for the Project. The

route utilises 13km of pre-existing forestry roads that will be

upgraded, however in order to avoid dwellings and villages, 15km of

new road will be constructed. The haulage road's route has been

finalised and surveying has commenced. Based on the work conducted

to date, no significant bridge construction or major civil works

are required.

Water

The nearby Mala Rijeka will be the primary raw water source for

the Vares Processing Plant, as described in the PFS, with a raw

water storage pond placed upstream of the Old Processing Plant

Site's historical tailings dam. Further refinements have been made

on raw water storage pond, with its new location now downstream of

the Old Processing Plant Site's historical tailings dam. It will be

closer to the Vares Processing Plant and also smaller in size.

Supporting the primary water supply, a secondary raw water

source has been secured using a pre-existing pipeline that served

the Old Processing Plant Site. A contract has been agreed with

local services provider, JKP Vares, to supply potable water at flow

rate of eight litres per second.

Human Resource Development

Hiring continues to occur aggressively, with a total employee

count of 78. To support the continued growth in the workforce, the

Company has appointed human resource consultants Globe 24-7. Globe

24-7, who are mining industry specialists, will support the

Project's hiring process as well as creating and implementing its

Human Resources Framework and Workforce Development Program.

Vares Project Key Appointments

Adriaan Van der Merwe has been appointed as Processing Manager.

Mr. Van der Merwe has 12 years' operational experience in

metallurgical and mineral processing, as well as 18 years'

experience in project management, commissioning and mineral

processing advisory. He has a Bachelors and Masters Engineering

Degree in Extractive Metallurgy.

Mark Richards has been appointed as Logistics and Procurement

Manager. Mr Richards has over 25 years of logistics, procurement

and project management experience, in both military and commercial

environments. His 18-year career as a British Army Officer in The

Royal Logistic Corps included deployment to the Adriatic ports in

Croatia, as well as managing various supply-chain locations

throughout Bosnia and Kosovo.

Raska Project Key Appointment

Jelena Aleksi ć has been appointed as General Manager, Serbia.

She joins Adriatic from Rio Tinto, where she led the external

affairs team for their Jadar lithium-borate project in Western

Serbia. Ms Aleksi ć is a corporate relations professional with 20

years of experience in government relations, public affairs and

communications. She has also held the position of Director

Corporate Affairs for Philip Morris in Serbia and Montenegro and

worked for the European Commission as a Special UNDP Advisor for

the EU to the Serbian Finance Ministry. Ms Aleksi ć has a Masters

and PhD degree in Economics

CORPORATE

Vares Project Financing

The Company has received several non-binding term sheets for the

Vares Project Financing. The term sheets have been received from a

number of banks, as well as alternative financiers. The Company

will continue to review these options to ensure that financing

occurs in the best interest of shareholders. The Company will

update the market as the process advances.

Corporate Appointment

The Company has appointed Thomas Horton as Head of Corporate

Development & Investor Relations. He joins Adriatic from Giyani

Metals Corp, where he was the Vice President for Business

Development. Mr. Horton has 14 years of mining industry experience

and has held various roles in project engineering, corporate

broking, and corporate development. Mr. Horton has a Masters degree

in mechanical engineering from the University of Manchester and an

MBA from London Business School.

Appointment of Joint Corporate Broker

The Company has appointed RBC Capital Markets as the Company's

Joint Corporate Broker, effective 30 March 2021. RBC Capital

Markets will work alongside the Company's existing Joint Corporate

Brokers, Stifel Nicolaus Europe Limited and Canaccord Genuity.

Authorised by, and for further information please contact:

Paul Cronin

Managing Director & CEO

info@adriaticmetals.com

**S **

Market Abuse Regulation Disclosure

The information contained within this announcement is deemed by

Adriatic (LEI: 549300OHAH2GL1DP0L61) to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014. The person responsible for arranging and authorising

the release of this announcement on behalf of Adriatic is Paul

Cronin, Managing Director and CEO.

For further information please visit www.adriaticmetals.com ;

@AdriaticMetals on Twitter; or contact:

Adriatic Metals PLC

Paul Cronin / Thomas Horton Tel: +44 (0) 7866

913207

Canaccord Genuity Limited (Joint Corporate

Broker)

Jeremy Dunlop (Australia) Tel: +61 2 9263

2700

James Asensio (UK) Tel: +44 (0) 207

523 8000

RBC Capital Markets (Joint Corporate Broker)

Marcus Jackson / Jamil Miah Tel: +44 (0) 20

7653 4000

Stifel Nicolaus Europe Limited (Joint Corporate

Broker)

Ashton Clanfield / Callum Stewart Tel: +44 (0) 20

7710 7600

Tavistock Communications Limited

Charles Vivian Tel: +44 (0) 7977

297 903

The Capital Network

Julia Maguire / Lelde Smits Tel: +61 2 8999

3699

COMPETENT PERSONS REPORT

The information in this report which relates to exploration

results is based on information compiled by Mr Phillip Fox, who is

a member of the Australian Institute of Geoscientists (AIG). Mr Fox

is a consultant to Adriatic Metals PLC, and has sufficient

experience relevant to the style of mineralisation and type of

deposit under consideration and to the activity he is undertaking

to qualify as a Competent Person as defined in the 2012 Edition of

the "Australian Code of Reporting of Exploration Results, Mineral

Resources and Ore Reserves". Mr Fox consents to the inclusion in

this report of the matters based on that information in the form

and context in which it appears.

ABOUT MINING PLUS

Mining Plus is a leading mining technical services provider that

specialises in geological, mining engineering, geotechnical

engineering, mine ventilation and operational management. Mining

Plus is part of the Byrnecut Group of Companies. Byrnecut is one of

the world's leading underground mining contractors.

ABOUT WARDELL ARMSTONG INTERNATIONAL

Wardell Armstrong are a multidisciplinary Environmental,

Engineering, and Mining consultancy working in the Infrastructure

& Utilities, Property & Development, and Mining &

Minerals Sectors. Its history dates back over 180 years and has a

reputation for high quality service, both in the UK and

internationally.

ABOUT AUSENCO LIMITED

Ausenco Limited is a global company providing consulting,

engineering, project delivery and asset operations, management and

optimisation solutions to the minerals & metals, oil & gas

and industrial sectors. Headquartered out of Brisbane, Australia

the global team is based across 26 offices in 14 countries, as well

as many project locations.

Ausenco were the appointed engineering consultants that produced

the Vares Silver Project PFS, released in October 2020.

ABOUT GLOBE 24-7

Since 2003, Globe 24-7 (Globe) has been conducting human

resource consulting & recruitment assignments for international

mining, power & energy companies around the world. Globe's goal

is to partner with companies who seek to build great teams with

contemporary, creative and custom-fit human resource and

recruitment solutions. Globe primarily works with small &

mid-tier organizations through its HR Consulting, RPO, Search,

Training and HR Systems divisions.

ABOUT ADRIATIC METALS

Adriatic Metals Plc (ASX:ADT, LSE:ADT1) is a precious and base

metals explorer and developer that owns the world-class Vares

Silver Project in Bosnia & Herzegovina and the Raska Project in

Serbia.

The Vares project's captivating economics and impressive

resource inventory have attracted Adriatic's highly experienced

team, which is expediting exploration efforts to expand the current

JORC resource. Results of a recent pre-feasibility study announced

on 15 October 2020 indicate a post-tax NPV 8 % of US$1,040 million

and IRR of 113%. Leveraging its first-mover advantage, Adriatic is

rapidly advancing the project into the development phase and

through to production with significant cornerstone investment of

US$28 million from Queen's Road Capital Investment and EBRD.

There have been no material changes to the assumptions

underpinning the forecast financial information derived from the

production target in the 15 October 2020 announcement and these

assumptions continue to apply. There have been no material changes

to the assumptions and technical parameters on the updated Mineral

Resource Estimate announced on 1 September 2020 and these

assumptions continue to apply.

Adriatic Metals acquired TSX-listed Tethyan Resource Corp in

2020, to advance the former Kizevak and Sastavci polymetallic mines

in the Raska District, southern Serbia.

DISCLAIMER

Forward-looking statements are statements that are not

historical facts. Words such as "expect(s)", "feel(s)",

"believe(s)", "will", "may", "anticipate(s)", "potential(s)"and

similar expressions are intended to identify forward-looking

statements. These statements include, but are not limited to

statements regarding future production, resources or reserves and

exploration results. All of such statements are subject to certain

risks and uncertainties, many of which are difficult to predict and

generally beyond the control of the Company, that could cause

actual results to differ materially from those expressed in, or

implied or projected by, the forward-looking information and

statements. These risks and uncertainties include, but are not

limited to: (i) those relating to the interpretation of drill

results, the geology, grade and continuity of mineral deposits and

conclusions of economic evaluations, (ii) risks relating to

possible variations in reserves, grade, planned mining dilution and

ore loss, or recovery rates and changes in project parameters as

plans continue to be refined, (iii) the potential for delays in

exploration or development activities or the completion of

feasibility studies, (iv) risks related to commodity price and

foreign exchange rate fluctuations, (v) risks related to failure to

obtain adequate financing on a timely basis and on acceptable terms

or delays in obtaining governmental approvals or in the completion

of development or construction activities, and (vi) other risks and

uncertainties related to the Company's prospects, properties and

business strategy. Our audience is cautioned not to place undue

reliance on these forward-looking statements that speak only as of

the date hereof, and we do not undertake any obligation to revise

and disseminate forward-looking statements to reflect events or

circumstances after the date hereof, or to reflect the occurrence

of or non-occurrence of any events.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUWRRRAUUSAUR

(END) Dow Jones Newswires

April 19, 2021 02:00 ET (06:00 GMT)

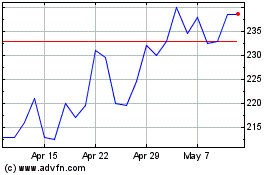

Adriatic Metals (LSE:ADT1)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adriatic Metals (LSE:ADT1)

Historical Stock Chart

From Apr 2023 to Apr 2024