TIDMADT1

RNS Number : 7793W

Adriatic Metals PLC

28 April 2021

Adriatic Metals PLC

('Adriatic Metals' or the 'Company')

QUARTERLY ACTIVITIES REPORT

For the 3 months ended 31 March 2021

HIGHLIGHTS

-- Veovaca Exploitation Permit Received

-- Rupice Environmental Permit Issued a with positive Record of Decision ("RoD")

-- Assay results from ongoing exploration work at the Raska Project, in Serbia

-- Acquisition completed of the remaining 90% of Ras Metals

d.o.o. that the Company did not previously own for a consideration

of cash and shares. The Ras Metals assets include the exploration

licences for both Kizevak and Sastavci prospects that make up the

Raska Project.

-- Post quarter-end the Company provided a Vares Project Operations and Corporate Update;

-- Optimised underground mine plan for Rupice, which targets the

central higher-grade zones sooner. This has resulted in a 26%

increase in silver-equivalent contained metal mined during the

first 24 months.

-- Demolition of the Old Processing Plant Site is nearing

completion. A geotechnical drilling program to test the structural

integrity of the original concrete pad has been completed.

-- Urban Planning Permit and Exploitation Permit for Rupice are

on course to be received later this quarter.

-- Exploration permit for the 32km(2) of new concession area,

granted in Q3 2020, is expected within a month.

-- Exploration drilling has now re-commenced at Rupice

Paul Cronin, Adriatic's Managing Director and CEO commented:

"During the first quarter of 2021, two important permits for the

Vares Silver Project were delivered, which is a significant step

forward in the development of the Project. This gives me great

confidence in the timely delivery of the Main Mining Project permit

this summer.

The Company is well positioned for what will be a

transformational year for the for the Vares Silver Project, with

the completion of the Definitive Feasibility Study and associated

Project Financing.

Adriatic Metals PLC is pleased to provide the following

Quarterly Activities Report ("QAR") that summarises the progress

made and reported during the three months ended 31 March 2021 ("Q1"

or the "Quarter").

1. Vares Project Permitting Approvals

During the Quarter the Company received two key permits to the

development of the Vares Project.

On 28 January, 2021 the company received the Veovaca

Exploitation Permit from the Federal Ministry for Energy, Mining

and Industry ("Exploitation Permit"). The receipt of the

Exploitation Permit initiated the formal exploitation period for

the project, which under the terms of the Concession Agreement is

up to 30 years. As the Concession Agreement covers both the Veovaca

and Rupice deposits, the security of tenure applies to both the

Veovaca open pit and plant areas, as well as the Rupice underground

mine area.

The receipt of the Exploitation Permit also enables Adriatic to

complete the Main Mining Project permit for the Veovaca open pit

mine, flotation plant, and tailings management facility at a

detailed engineering level for the start of construction in Q3

2021. The Exploitation Permit for Rupice, which is expected in Q2

2021, is required before the commencement of underground

development at Rupice, and the application will be made following

the issue of the Urban Planning Permits for Rupice, in a process

similar to what has completed for Veovaca.

On 8 February, 2021 the Federal Ministry of Environment and

Tourism ("Ministry") issued a positive Record of Decision ("RoD")

for the Rupice Environmental Permit - one of the key approvals

required for the issue of the Exploitation Permit at Rupice. The

RoD was received following the submission of an Environmental

Impact Assessment, which was prepared in accordance with the

Federal Mining Code and reviewed by a five-member expert committee,

as well as a public hearing in August 2020.

The Environmental Permit is required to be issued within 30 days

from the date of the RoD, at which point Adriatic will submit an

application for an Urban Planning Permit to the Federal Ministry

for Spatial Planning. Following the receipt of the Urban Planning

Permit, Adriatic will apply for an Exploitation Permit, in a

process similar to what was recently completed for Veovaca.

2. Vares Project Operations and Corporate Update

Post quarter end, on 19 April 2021, the Company provided a Vares

Project Operations and Corporate Update. The highlights were as

follows:

Vares Project Highlights

- Optimised underground mine plan for Rupice, which targets the

central higher-grade zones sooner. This has resulted in a 26%

increase in silver-equivalent contained metal mined during the

first 24 months.

Demolition of the Old Processing Plant Site is nearing

completion. A geotechnical drilling program to test the structural

integrity of the original concrete pad has been completed.

- Urban Planning Permit and Exploitation Permit for Rupice are

on course to be received later this quarter.

- Exploration permit for the 32km(2) of new concession area,

granted in Q3 2020, is expected within a month.

- Exploration drilling has now re-commenced at Rupice.

- Adriatic Metals Chief Geologist, Phil Fox, hosted a Vares

Project Geology Webinar on Tuesday, 20 April 2021. A recording of

the webinar is available, see link:

https://www.adriaticmetals.com/news/the-vares-project-geology-presentation/

- The webinar's Vares Project Geology Presentation is available

on the ASX announcements page of the Company's website , see link:

https://www.adriaticmetals.com/investors/asx-announcements/

- The Company has received several non-binding term sheets for the Vares Project Financing.

Corporate Highlights

- Appointment of Thomas Horton as Head of Corporate Development & Investor Relations.

- Appointment of RBC Capital Markets as the Company's Joint

Corporate Broker, effective 30 March 2021.

3. Raska Project Drill Results

In the Quarter, the Company reported on two sets of assay

results from ongoing exploration work at the Raska Project, in

Serbia.

On 27 January, 2021 Adriatic reported assay results from 16

diamond core holes at the Kizevak Prospect and 3 drill holes at the

Sastavci Prospect. The Drilling at the Kizevak Prospect confirmed

the down dip continuity of a high grade lens in the

central-northwest part of the deposit, beneath the limits of

historic drilling, where mineralisation remains open. Drill hole

KZDD-030 intercepted thick mineralisation down dip from the

previously reported drill hole KZDD-014, demonstrating excellent

continuity as well as elevated gold grade. This thick, high-grade

lens remains open to depth. Mineralisation in the central-south

eastern part of the Kizevak Prospect licence has been identified,

occurring as an array of sub-parallel, near-surface vein zones with

some high-grade parts in several holes. Drilling at the Sastavci

Prospect has continued to deliver excellent intercepts of wide,

high grade mineralisation from surface at the base of the historic

Sastavci open pit. Thicker zones of mineralisation than

historically reported have been encountered, and mineralisation is

open in all directions.

Subsequently on 22 March 2021, Adriatic reported further

exploration results, as well as providing plans for an expansion of

the Company's exploration plans at the Raska Project in Serbia. At

the Kizevak Prospect, near-surface, high grade mineralisation

continues to be identified, confirmed by drill hole KZDD-051, which

was located up-dip from a thick, deeper lens. In addition, drill

hole KZDD-042 also extended mineralisation down dip and southeast

from the historically defined limits of mineralisation. At

Sastavci, drill hole SSDD-006 intercepted two thick zones of

mineralisation that are both sub-parallel to the historically mined

vein zone and are open to the northwest. Drill hole SSDD-007

intercepted a broad, well mineralised zone from surface that

continues to demonstrate much thicker zones of mineralisation are

present than historically interpreted. As part of the 25,000 metres

of diamond drilling planned at the Raska Project for 2021, a third

drill rig will be deployed to focus on more regional exploration

targets.

4. Completion of Ras Metals Acquisition

On 23 February 2021, the Company announced that it has completed

the acquisition of the entire share capital of Ras Metals d.o.o

("Ras Metals") under an agreement held by Tethyan Resource Corp

("Tethyan"), now a wholly owned subsidiary of Adriatic.

The Ras Metals assets include the exploration licences for both

Kizevak and Sastavci prospects (together, the "Raska Project"). The

consideration paid for the remaining 90% of the shares in Ras

Metals that the Company did not already hold was EUR 1,365,000,

plus the allotment of 166,000 Ordinary shares of 0.013355p each in

the Company ("Shares"). Additionally, there is deferred

consideration of EUR 500,000, payable on 14 May 2022, and 498,000

Ordinary shares in the Company that will be allotted in three equal

tranches on or around 22 August 2021, 22 February 2022 & 22

August 2022.

The Shares rank pari passu with the existing Ordinary shares and

application has been made to the Financial Conduct Authority and

the London Stock Exchange for the Shares to be admitted to the

standard segment of the Official List of the London Stock Exchange.

Admission of the Shares is expected on 2 March 2021.

Since the Tethyan acquisition last year, 11,000m of diamond core

("DC") drilling has been completed on the Raska licenses. Drilling

has been focussed around the area South East of the Kizevak

Prospect, where under the prior ownership of Tethyan, thick

intersections of high-grade mineralisation were drilled. See

Tethyan announcement dated 04 September 2018 on SEDAR for more

information. Adriatic has a further 25,000m of step-out DC drilling

planned across the Raska Project during 2021.

5. Summary of Expenditure

A summary of operating and investing expenditure made by

Adriatic on a consolidated basis during the Quarter in relation to

operating and investing activities reported in the Appendix 5B Cash

Flow Report is as follows:

GBP'000

Exploration & Evaluation (capitalised) 1,313

Exploration & Evaluation (expensed) 491

Staff costs 497

Administration and corporate

costs 1,340

Property, plant and equipment

acquisitions 138

Interest paid 411

Payments to acquire entities 1,189

Other - VAT Refunds (24)

Total GBP 5,355

6. Payments to Related Parties

During the Quarter, Adriatic paid an aggregate total of GBP146k

to Directors, or companies controlled by them, comprised of

salaries, fees and reimbursement / recharge of corporate office

facilities & associated services used / provided by the

Company. This is disclosed in Item 6 of the accompanying Appendix

5B Cash Flow Report.

7. Tenement Holdings

In accordance with ASX Listing Rule 5.3.3 please find below the

Company's tenements as at 31 March 2021. The Company holds a 100%

interest in all concession agreements and licences via its wholly

owned subsidiaries, with the exception of the Raska (Suva Ruda)

licence held by Deep Research d.o.o.. The Company has an option

agreement to acquire 100% ownership of Deep Research d.o.o. but has

no equity interest in that entity at present.

Area

Concession License (km(2) Date Expiry

document Registration number holder Concession name ) granted date

------------------------------ -------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Bosnia and Concession No.:04-18-21389-1/13 Eastern Veovaca1 1.08 12-Mar-2013 11-Mar-2038

Herzegovina Agreement Mining

d.o.o.

-------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Veovaca 2 0.91 12-Mar-2013 11-Mar-2038

-------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Rupice-Jurasevac, 0.83 12-Mar-2013 13-Mar-2038

Brestic

-------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Annex 3 - No.: Eastern Rupice - Borovica 4.52 14-Nov-2018 13-Nov-2038

Area 04-18-21389-3/18 Mining

Extension d.o.o.

-------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Veovaca - Orti - 1.32 14-Nov-2018 13-Nov-2038

Seliste - Mekuse

-------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Annex 5 - No: 04-18-14461-1/20 Eastern Barice- Smajlova 19.45 03-Dec-2020 03-Dec-2050

Area Mining Suma-Macak

Extension d.o.o.

-------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Droskovac - 2.88 03-Dec-2020 03-Dec-2050

Brezik

-------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Borovica - 9.91 03-Dec-2020 03-Dec-2050

Semizova Ponikva

-------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Ras

Exploration Metals

Serbia License 310-02-1721/2018-02 d.o.o. Kizevak 1.84 03-Oct-2019 03-Oct-2022

-------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Ras

Metals

Exploration License 310-02-1722/2018-02 d.o.o. Sastavci 1.44 12-Mar-2013 03-Oct-2022

--------------------------------------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Taor

Exploration License 310-02-1114/2015-02 d.o.o. Kremice 8.54 21-Apr-2016 21-April-2022

--------------------------------------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Deep

Research

Exploration License 310-02-00060/2015-02 d.o.o. Raska (Suva Ruda) 87.17 28-Dec-2015 18-Feb-2022

--------------------------------------------- ---------------------- ---------- ------------------- -------- ------------- ---------------

Authorised by, and for further information please contact:

Paul Cronin

Managing Director & CEO

info@adriaticmetals.com

-ends-

For further information please visit www.adriaticmetals.com ,

@AdriaticMetals on Twitter, or contact:

Adriatic Metals PLC

Paul Cronin / Thomas Horton Tel: +44 (0) 7866

913207

Canaccord Genuity Limited (Joint Corporate Broker)

Jeremy Dunlop (Australia) Tel: +61 2 9263 2700

James Asensio (UK) Tel: +44 (0) 207

523 8000

RBC Capital Markets (Joint Corporate Broker)

Marcus Jackson / Jamil Miah Tel: +44 (0) 20 7653

4000

Stifel Nicolaus Europe Limited (Joint Corporate

Broker)

Ashton Clanfield / Callum Stewart Tel: +44 (0) 20 7710

7600

Tavistock Communications Limited

Charles Vivian Tel: +44 (0) 7977

297 903

The Capital Network

Julia Maguire / Lelde Smits Tel: +61 2 8999 3699

ABOUT ADRIATIC METALS

Adriatic Metals Plc (ASX:ADT, LSE:ADT1) is a precious and base

metals developer that is advancing the world-class Vares Silver

Project in Bosnia & Herzegovina, as well as the Raska

Zinc-Silver Project in Serbia.

The Vares Project Pre-Feasibility Study boasts robust economics

of US$1,040 million post-tax NPV(8) , 113% post-tax IRR and a capex

of US$173 million. Adriatic is the only publicly listed mining

company exploring in Bosnia and is leveraging its first-mover

advantage. The Company is well-funded and concurrent with the

advancing Definitive Feasibility Study, continues to explore across

its large, highly prospective 41km(2) concession package.

Adriatic Metals completed the acquisition TSX-listed Tethyan

Resource Corp. in Q4 2020, which contained the Raska Zinc-Silver

Project in southern Serbia. The Company is exploring across its

99km(2) highly prospective concession area, which includes around

the formerly operating Kizevak and Sastavci polymetallic mines.

There have been no material changes to the assumptions

underpinning the forecast financial information derived from the

production target in the 15 October 2020 announcement and these

assumptions continue to apply and have not materially changed.

Adriatic Metals is not aware of any new information or data that

materially affects the information included in the announcement of

the updated Mineral Resource Estimate announced on 1 September 2020

and all material assumptions and technical parameters underpinning

the Mineral Resource Estimate continue to apply and have not

materially changed.

COMPETENT PERSONS' REPORT

The information in this report which relates to Exploration

Results is based on, and fairly represents, information compiled by

Mr Philip Fox, who is a member of the Australian Institute of

Geoscientists (AIG). Mr Fox is a consultant to Adriatic Metals PLC,

and has sufficient experience relevant to the style of

mineralisation and type of deposit under consideration and to the

activity he is undertaking to qualify as a Competent Person as

defined in the 2012 Edition of the "Australasian Code for Reporting

of Exploration Results, Mineral Resources and Ore Reserves". Mr Fox

consents to the inclusion in this report of the matters based on

that information in the form and context in which it appears.

The information in this report which relates to Metallurgical

Results is based on, and fairly represents, information compiled by

Mr Philip King of Wardell Armstrong. Mr King and Wardell Armstrong

are consultants to Adriatic Metals plc and Mr King has sufficient

experience in metallurgical processing of the type of deposits

under consideration and to the activity he is undertaking to

qualify as a Competent Person as defined in the 2012 Edition of the

"Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves". Mr King is a Fellow of the Institute

of Materials, Minerals & Mining (which is a Recognised

Professional Organisation (RPO) included in a list that is posted

on the ASX website from time to time), and consents to the

inclusion in this report of the matters based on that information

in the form and context in which it appears.

Rule 5.5

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity

--------------------------------------------------

ADRIATIC METALS PLC

ABN Quarter ended ("current quarter")

------------ ----------------------------------

624 403 163 31 MARCH 2021

----------------------------------

Consolidated statement of cash (a) Current (b) Year to

flows quarter date (3 months)

GBP'000 GBP'000

1. Cash flows from operating

activities

1.1 Receipts from customers 0 0

1.2 Payments for

(a) exploration & evaluation

(if expensed) (491) (491)

(b) development 0 0

(c) production 0 0

(d) staff costs (497) (497)

(e) administration and corporate

costs (1,340) (1,340)

Dividends received (see note

1.3 3) 0 0

1.4 Interest received 0 0

Interest and other costs of

1.5 finance paid (411) (411)

1.6 Income taxes paid 0 0

Government grants and tax

1.7 incentives 0 0

1.8 Other - VAT refund 24 24

------------ -----------------

Net cash from / (used in)

1.9 operating activities (2,715) (2,715)

----- ----------------------------------- ------------ -----------------

2. Cash flows from investing

activities

2.1 Payments to acquire:

(a) entities (1,189) (1,189)

(b) tenements 0 0

(c) property, plant and equipment (138) (138)

(d) exploration & evaluation

(if capitalised) (1,313) (1,313)

(e) investments 0 0

(f) other non-current assets 0 0

2.2 Proceeds from the disposal

of:

(a) entities 0 0

(b) tenements 0 0

(c) property, plant and equipment 0 0

(d) investments 0 0

(e) other non-current assets 0 0

Cash flows from loans to other

2.3 entities 0 0

Dividends received (see note

2.4 3) 0 0

2.5 Other 0 0

------------ -----------------

Net cash from / (used in)

2.6 investing activities (2,640) (2,640)

----- ----------------------------------- ------------ -----------------

3. Cash flows from financing

activities

Proceeds from issues of equity

securities (excluding convertible

3.1 debt securities) 0 0

Proceeds from issue of convertible

3.2 debt securities 0 0

Proceeds from exercise of

3.3 options 486 486

Transaction costs related

to issues of equity securities

3.4 or convertible debt securities (120) (120)

3.5 Proceeds from borrowings 0 0

3.6 Repayment of borrowings 0 0

Transaction costs related

3.7 to loans and borrowings (143) (143)

3.8 Dividends paid 0 0

Other (Pre-acquisition loan

3.9 to Tethyan) 0 0

------------ -----------------

Net cash from / (used in)

3.10 financing activities 223 223

----- ----------------------------------- ------------ -----------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 29,249 29,249

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (2,715) (2,715)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (2,640) (2,640)

Net cash from / (used in)

financing activities (item

4.4 3.10 above) 223 223

Effect of movement in exchange

4.5 rates on cash held (86) (86)

------------ -----------------

Cash and cash equivalents

4.6 at end of period 24,031 24,031

----- ----------------------------------- ------------ -----------------

5. Reconciliation of cash and (c) Current (d) Previous

cash equivalents quarter quarter

at the end of the quarter GBP'000 GBP'000

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

----- ----------------------------------- ------------ -----------------

5.1 Bank balances 24,031 29,249

5.2 Call deposits 0 0

5.3 Bank overdrafts 0 0

5.4 Other (provide details) 0 0

------------ -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 24,031 29,249

----- ----------------------------------- ------------ -----------------

6. Payments to related parties of the entity (e) Current

and their associates quarter

GBP'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 146

-------------

6.2 Aggregate amount of payments to related 0

parties and their associates included in

item 2

------ -------------------------------------------------- -------------

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly

activity report must include a description of, and an explanation

for, such payments

7. Financing facilities (f) Total facility (g) Amount

Note: the term "facility' amount at quarter drawn at quarter

includes all forms of financing end end

arrangements available to GBP'000 GBP'000

the entity.

Add notes as necessary for

an understanding of the sources

of finance available to the

entity.

7.1 Loan facilities 14,510 14,510

------------------- ------------------

7.2 Credit standby arrangements 0 0

------------------- ------------------

7.3 Other (please specify) 0 0

------------------- ------------------

7.4 Total financing facilities 14,510 14,510

------------------- ------------------

Unused financing facilities available at

7.5 quarter end 0

------------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

---- --------------------------------------------------------------------------

The loan facilities comprise USD 20 million unsecured convertible

debentures at 8.5% interest and a maturity date of December

2024 issued to Queen's Road Capital Investment Ltd. For further

details see announcement dated 27 October 2020.

8. Estimated cash available for future operating (h) GBP'000

activities

Net cash from / (used in) operating activities

8.1 (Item 1.9) (2,715)

8.2 Capitalised exploration & evaluation (Item (1,313)

2.1(d))

8.3 Total relevant outgoings (Item 8.1 + Item (4,028)

8.2)

8.4 Cash and cash equivalents at quarter end 24,031

(Item 4.6)

8.5 Unused finance facilities available at quarter 0

end (Item 7.5)

8.6 Total available funding (Item 8.4 + Item 24,031

8.5)

Estimated quarters of funding available

8.7 (Item 8.6 divided by Item 8.3) 6.0

---- ----------------------------------------------------

8.8 If Item 8.7 is less than 2 quarters, please provide answers

to the following questions:

1. Does the entity expect that it will continue to have

the current level of net operating cash flows for the

time being and, if not, why not?

-------------------------------------------------------------------

Answer:

-------------------------------------------------------------------

2. Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

-------------------------------------------------------------------

Answer:

-------------------------------------------------------------------

3. Does the entity expect to be able to continue its operations

and to meet its business objectives and, if so, on what

basis?

-------------------------------------------------------------------

Answer:

-------------------------------------------------------------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 27 April 2021

Authorised by: Audit and Risk Committee

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBLGDSCBDDGBR

(END) Dow Jones Newswires

April 28, 2021 02:00 ET (06:00 GMT)

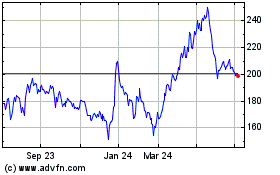

Adriatic Metals (LSE:ADT1)

Historical Stock Chart

From Mar 2024 to Apr 2024

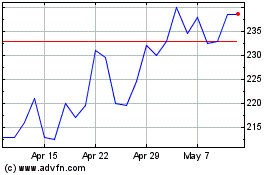

Adriatic Metals (LSE:ADT1)

Historical Stock Chart

From Apr 2023 to Apr 2024