TIDMAEG

RNS Number : 7158B

Active Energy Group PLC

14 June 2021

Active Energy Group Plc / EPIC: AEG / Sector: Alternative

Energy

14 June 2021

Active Energy Group Plc

("Active Energy", "AEG", "Group" or the "Company")

Audited Results for the year ended 31 December 2020

Active Energy, the London quoted renewable energy company

focused on the production and development of next generation

biomass products, is pleased to announce the publication of its

financial results for the year ended 31 December 2020.

CoalSwitch(TM) development and ongoing operations

-- Ongoing IP development with awards of patents in US in

December 2020 and Canada in June 2021. EU patent approval pending.

Ongoing applications for patents in South East Asia.

-- Air and construction permit awarded in August 2020 for the

Lumberton CoalSwitch(TM) facility (the "Lumberton Facility").

-- First commercial order from PacifiCorp to deliver

CoalSwitch(TM) ("CoalSwitch") to its coal-fired power plant in

Utah.

-- Appointment of Player Design Inc. ("PDI"), well known

throughout North America as an EPC for pellet manufacturing

facilities, as the Company's EPC contractor. Construction on time

and on budget until suspension in May to amend the air permit for

additional emissions reduction equipment.

-- Ongoing interaction with environmental regulators in North

Carolina to amend the permit and allow final completion of the

Lumberton Facility.

-- A second CoalSwitch production facility at Ashland in Maine,

USA (the "Ashland Facility") obtained requisite operating

permission to produce CoalSwitch from the State of Maine and a

joint venture established between AEG and PDI for CoalSwitch

production from the Ashland facility.

-- First production of CoalSwitch at the Ashland Facility in

June 2021 and commencement of delivery of CoalSwitch to PacifiCorp

in Utah.

-- Lumber operations continued at Lumberton throughout the

period despite COVID-19 restrictions. Saw log export operation

ceased in 2021, and sawmill activities under review.

Corporate activity

-- Equity fundraise of GBP1.51m (before expenses) completed in September 2020.

-- Funds raised of GBP800,000 (gross) via the issuance of

Convertible Loan Notes ("CLNs") during 2020.

-- Impairment of non-core assets and decision to focus resources

on commercialisation of CoalSwitch.

-- Awarded London Stock Exchange's Green Economy Mark reflecting

AEG's environmental credentials.

-- Balance sheet restructuring with a fundraise of GBP7.0 million (before expenses) and conversion/redemption of the entire outstanding CLN obligation completed in February 2021.

-- All PLC corporate security obligations extinguished.

Outlook

-- AEG is delivering on its strategy to commercialise

CoalSwitch, our proprietary technology which transforms waste

biomass material into high-value renewable fuels through AEG's own

resources and through commercial partnerships.

-- The Board believes that AEG's CoalSwitch technology process

has clear advantages over traditional biomass manufacturing

processes and that there are few alternative next generation

biomass fuels currently available.

-- CoalSwitch now available for customers for their independent

analysis, a significant milestone. The Company is witnessing

considerable market interest in North America in both its process

and product.

Annual General Meeting and Annual Report

The Annual General Meeting ("AGM") of the Company will be held

on 8 July 2021 at 3 p.m. at SP Angel Corporate Finance LLP, Prince

Frederick House, 35-39 Maddox Street, London, W1S 2PP.

Unfortunately, due to ongoing Covid-19 restrictions, with a

limited number of Company representatives attending in person to

ensure that a quorate meeting is held in accordance with the

Company's articles of association, the Directors strongly advise

shareholders not to attend the AGM in person but to vote for

resolutions using the proxy forms provided.

The following documents are now available on our website at:

https://www.aegplc.com/investors/regulatory-news/

-- 2020 Annual Report and Accounts;

-- Notice of Annual General Meeting; and

-- Proxy Form

Copies of the above-mentioned documents have been posted to the

Company's shareholders as per individual request.

Regulatory Information

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

S

Enquiries

Active Energy Group Michael Rowan (Chief info@aegplc.com

Plc Executive Officer)

Andrew Diamond (Chief

Financial Officer)

------------------------------ -------------------

SP Angel Corporate David Hignell / Caroline Office: +44 (0)20

Finance LLP Rowe 3470 0470

Nominated Adviser and (Corporate Finance)

Joint Broker Rob Rees (Sales)

------------------------------ -------------------

Allenby Capital Limited Nick Naylor/James Reeve Office: +44 (0)20

Joint Broker (Corporate Finance) 3328 5656

Amrit Nahal (Sales/Corporate

Broking)

------------------------------ -------------------

Camarco Gordon Poole / Tom Huddart aeg@camarco.co.uk

Financial PR Adviser / Emily Hall Office: +44 (0)20

3757 4980

------------------------------ -------------------

About Active Energy Group

Active Energy Group plc is a London listed (AIM: AEG) renewable

energy company focused on the production and development of next

generation biomass products that have the potential to transform

the traditional coal fired-power industry and existing renewable

biomass industry.

The Company has developed a proprietary technology which

transforms waste biomass material into high-value renewable fuels.

Its patented product CoalSwitch is a leading drop-in renewable fuel

that can be co-fired with coal, completely replace coal as an

alternative feedstock without requiring significant plant

modifications or replace existing biomass feedstock resources.

Active Energy Group's immediate strategic focus is the production

and commercialisation of CoalSwitch and further CoalSwitch fuel

blends that utilise other waste wood and residual materials.

CoalSwitch is a registered trademark belonging to AEG plc.

CHAIRMANS LETTER

Dear Shareholders

During 2020, Active Energy Group achieved a number of

significant milestones on its path to commercialising the

transformation of waste biomass material into high-value renewable

fuels . At the same time, it has been encouraging to witness the

changes within Active Energy as it matures into a company capable

of delivering fuel and its underlying technology to prospective

commercial partners in North America and internationally from its

UK base.

Having joined the Board in November 2019 as a Non-Executive

Director, I was appointed to the role of Non-Executive Chairman in

February 2021. I welcome the opportunity to make an increasing

contribution towards AEG in terms of achieving its commercial

goals, building out of a successful transatlantic operation and at

the same time founded on strong principles of corporate

governance.

Your Company made encouraging progress during 2020: having

acquired the site in Lumberton in April 2019, the Company moved to

assemble a new CoalSwitch(TM) ("CoalSwitch") manufacturing facility

at the site, established limited complementary lumber operations

and commenced an air permit approval process for the site. Local

interests were active in that debate which revealed concerns from

local environmental proponents about the construction of the

CoalSwitch reference plant. AEG welcomed the cross examination on

the issues and, after public consultation and full scrutiny by all

relevant local agencies, an air and construction permit was

approved and issued at the beginning of August 2020 by the North

Carolina Department of Environmental Quality ("NCDEQ").

We listen to the concerns of local environmental groups and

encourage the opportunity to interact with all parties to explain

more fully the environmental benefits of AEG's proprietary

technology processes. The recent construction delays, resulting

from the installation of additional enhanced emissions controlling

equipment, serve as further evidence that the Company remains

wholly focussed on current and future compliance with all

applicable environmental regulations. We must ensure that the

positive message of the opportunities and benefits that CoalSwitch

offers remain clear and the Company's focus on using residual

forestry and waste wood products from the timber industry is

delivered effectively.

In December 2020, the Company secured its first test order for

CoalSwitch from PacifiCorp, the largest grid operator in the

western United States and part of the Berkshire Hathaway Group. The

PacifiCorp order delivered to the Hunter Power Station in Utah

represents a fantastic opportunity for AEG to use a world-class

platform to test CoalSwitch performance. This trial run is being

conducted in conjunction with a study group from the University of

Utah and Brigham Young University and will provide exceptional data

and analysis of CoalSwitch performance in an operating environment,

which we anticipate will support future marketing activities and

additional commercial interest.

Our research and marketing activities in 2021 have already

identified that there are several timber producers with issues in

the handling of residual and waste wood products. Given the market

interest in an accelerated roll out and availability of CoalSwitch,

a near term emphasis on the production and delivery of smaller

volume production plants, with proximity to the timber producers

presents a unique opportunity for AEG. Aligned with this focus, we

are working with feedstock providers in the North-Eastern United

States and, having completed the second reference plant in Ashland,

Maine, these commercial goals can be achieved.

Given the current permitting issues in Lumberton, the CoalSwitch

plant in Ashland, which is now complete and operational, provided

an alternative location to produce CoalSwitch to fulfil initial

customer orders. I am pleased to report that at the time of writing

CoalSwitch is being delivered to the Hunter Power Station in

Utah.

A final significant development from work commenced in 2020 and

announced in February 2021 was the completion of the balance sheet

restructuring of the Convertible Loan Note ("CLN"). We were

encouraged by the support of the CLN holders throughout the process

to allow the Company to restructure the indebtedness, which had

been restricting the Company's growth strategy. We are also

grateful to those shareholders and new investors who contributed to

the GBP7.0 million (gross) capital raise in the same month. As

intended, the Company has utilised those funds mainly in the

construction of the Lumberton and Maine Facilities, and the ongoing

corporate development of AEG.

Significant effort has gone into strengthening your Board and

broadening the requisite skill sets. In January 2020, we were

delighted to announce the appointment of two independent

non-executive directors, Max Aitken based in the UK and Jason

Zimmermann, based in Canada. Each brings considerable experience,

relevant knowledge, and energy from their sectors of expertise in

the biomass and forestry industries. In late November 2020, we were

also able to attract Andrew Diamond to join the Board as Group

Finance Director, a post hitherto unfilled. The benefits of the new

board members to the Company are already being felt. As part of the

restructuring process, it was also announced that Antonio Esposito

would step down from the Board. Antonio has remained on hand to

focus on the construction and commissioning of the CoalSwitch

reference plants during his notice period. I wish to express my

gratitude, on behalf of the Board, to Antonio for his extraordinary

contribution to AEG over the years and particularly during the

difficult months of 2020 with the challenges presented by the

Covid-19 pandemic.

AEG's new Board is highly focused on the development and

commercial roll-out of the CoalSwitch product. The Company operates

within a limited budget and will seek to maximise returns from this

exciting technology. We wish to distinguish ourselves as a 'next

generation' biomass product which is distinct from existing

products, both in terms of feedstock sourcing to manufacture the

fuel and in terms of the creation of renewable fuel which exceeds

existing performance parameters. We believe strongly in the

positive environmental impact this product could have on the

operations of current coal-fired and biomass power producers, and

at the same time assisting the timber industry in making strides to

utilise residual products as feedstock. Our aim is to create an

environmental win-win for both industries as the world transitions

to a fully renewable energy state.

The Board is committed to the core principles of corporate

governance, as set out in the QCA corporate governance code and

each of the directors is currently ensuring that these principles

are observed.

The headwind in the form of Covid-19 that has harassed and

unsettled many businesses over the period to the end of calendar

2020, was also felt by AEG. On the ground in North Carolina there

were, for a period, severe restrictions on the movement of people

and product. I am pleased to say the situation has now improved in

part. Travel restrictions meant that the executive directors were

unable to make relevant site visits for the period, which impacted

on our ability to execute our growth strategy and, more importantly

hampered our efforts in establishing and developing an

infrastructure for community and local authority relations in North

Carolina. It is pleasing to note that most recently both our CEO

and FD have been able to cross the Atlantic to re-energise the

strategy planning and local relations. The pandemic has exacted a

tragic death toll across the globe, and AEG remains determined to

play its part in minimising the effects of the crisis where it

can.

AEG is focusing its capital allocation on CoalSwitch. Existing

timber cutting permits in Ukraine and Newfoundland do not align to

this strategy, and the Company is looking for an orderly exit from

those interests.

Further, whilst it was a positive to see revenues being

generated from the small-scale sawmill and saw log export

businesses, the act of felling trees and exporting lumber products

could not be supported in the context of a corporate strategy which

focuses on environmental credentials as a core operating

principle.

By contrast, the sawmill business has been instrumental in

identifying critical local business partners in the South-Eastern

United States from whom to source residual feedstock for future

CoalSwitch operations. Its immediate profitability has been

hampered by sub-scale throughput, a continuing requirement to

invest in additional capital expenditure and the extended industry

disruption caused by exceptional operating conditions within the

Covid-19 pandemic which remains at this time. The Board has decided

to exit the saw log export operations while the sawmill operation

remains under review.

These ancillary activities have consumed much of management's

time and effort and future operations need to be focused on the

development of CoalSwitch and its commercial roll-out, which is

where the Board believes AEG's greatest commercial opportunities

lie. The Financial Statements for 2020 contain impairments to

reflect these strategic decisions taken by the Board. The current

global focus on climate change and the US political landscape are

very encouraging for growth in the renewable energy industry,

including biomass sourced renewable fuels. We believe that

CoalSwitch is perfectly suited to take advantage of this

momentum.

After a long wait, it is undoubtedly an exciting time for your

Company. We look forward to the outcome from the forthcoming

deliveries of CoalSwitch fuel to customers, including PacifiCorp,

the co-firing test results, and the consequent commercial

opportunities. On these and other developments, I look forward to

updating you as we progress.

James Leahy

Non-executive Chairman

14 June 2021

CHIEF EXECUTIVE OFFICER'S STATEMENT

Strategy

Our strategy is to commercialise CoalSwitch, a proprietary

technology which transforms waste biomass material into high-value

renewable fuels.

Events in the last eighteen months have created new

opportunities for the biomass industry and an increasing market

awareness that biomass will play a part in future renewable energy

solutions. At the same time, increasing environmental regulation

and scrutiny is rightfully being applied. AEG is focussed on making

its contribution towards the biomass industry goals in developing

its unique proprietary technology to ensure that there is a

long-term future for next generation sustainable biomass

production. These goals will be achieved through a combination of

its own production facilities, creating commercial partnerships for

fuel production, and licensing the relevant technology.

AEG believes that CoalSwitch will have an immediate positive

impact on reducing emissions from existing coal-fired power

facilities. As a result, AEG is focussing its near-term commercial

activities on the production of next generation biomass fuels in

North America. The USA is only now aligning itself with other

countries in the use of sustainable power alternatives and

awareness of a need for solutions which mitigate pollution from the

consumption of fossil fuels. North America is already dominant in

the production of biomass fuels and has vast knowledge and

operating capacity in the production of such fuels for

international markets but, to date, domestic consumption has been

limited. By producing next generation fuels in the United States,

using waste biomass resources, AEG is intent on capturing this

immediate market opportunity.

Summary of 2020

Operationally, 2020 was an important year for AEG. We worked

toward the completion of a commercial scale CoalSwitch production

facility at Lumberton, North Carolina. At the same time, we

developed ancillary small-scale sawmill and saw log export

operations at the Lumberton site to demonstrate to prospective

commercial partners how CoalSwitch production aligns with

traditional timber operations. AEG has faced the challenges of the

Covid-19 pandemic and our colleagues have responded tremendously to

the difficulties presented by these operating conditions.

CoalSwitch operations

Lumberton is, and will remain, an important component for AEG's

future growth in the United States. Its location on the US East

Coast is commercially valuable. Our goal remains to develop it as a

'carbon neutral' site with its prime focus on the production and

development of next generation biomass fuels, using forestry

co-products. During 2020, a significant focus of management's time

was spent on securing the relevant air and construction permits

(the "Permits") for the Lumberton Facility, which involved working

with our partners in Robeson County, State Officials and with

officials at North Carolina Department of Environmental Quality

("NCDEQ"). A public hearing was scheduled to take place in March

2020, however due to Covid-19 restrictions, the meeting was

postponed to 22 June 2020. While the public hearing was not

technically required, for such a minor permit, AEG worked alongside

the local community to take the opportunity to address

environmental concerns. The public hearing process raised concerns

on the potential emissions from the production process and the

exact specifications of the manufacturing procedures, which are

wholly different to existing biomass manufacturing processes. AEG

welcomed the analysis of local groups and the NCDEQ and continues

to address these ongoing environmental concerns.

AEG has always ensured that all operations at the Lumberton Site

remain in compliance with all relevant environmental regulations.

The Board considers the recent claims made by the Southern Law

Environmental Centre to be totally without foundation and AEG is

seeking appropriate legal redress in North Carolina.

AEG obtained the requisite Permits in August 2020, thereby

allowing AEG to commence construction of the Lumberton Facility.

The Permits allow for CoalSwitch production through to November

2028 in volumes of up to 5tph (or circa 35,000 tonnes per

annum).

With the Permits obtained, AEG appointed Player Design Inc

("PDI") as its engineering, procurement, and construction partner

to orchestrate the planning and construction of the Lumberton

Facility. PDI has a well-respected reputation in the biomass

industry in North America, having completed a number of small and

large manufacturing facilities over the last two decades and their

involvement has proven invaluable.

In September 2020, PDI carried a full-scale review of all

equipment on site, independent evaluation of the CoalSwitch

technology and provided financial budgets towards the completion of

the first reference plant. The project plan was approved by the

Board in Q4 2020, and work commenced immediately. Despite ongoing

Covid-19 disruptions, additional equipment was sourced by PDI from

within the United States and the key component deliveries to the

Lumberton Facility commenced late in Q4 2020.

With visibility on a construction timeline for the Lumberton

Facility, in December 2020, AEG was pleased to announce the first

commercial order from PacifiCorp to test CoalSwitch fuel in its

coal-fired power plant at Hunter Valley in Utah. The fuel is to be

used for a test burn, co-firing with coal, monitored by both the

University of Utah and Brigham Young University. The results will

be published later this year to demonstrate the co-firing results

from CoalSwitch and the emissions benefits.

Post Period End

With all components on site, construction commenced in early

2021 and the Lumberton Facility was in the final stages of

construction, both on time and on budget, in early May 2021.

The CoalSwitch manufacturing process has certain novel elements

requiring both the NCDEQ and AEG to proceed cautiously to ensure

that the process meets and exceeds all current environmental

regulations. To that end, during construction, AEG and PDI added

additional emissions control equipment which satisfied standard

Environmental Protection Agency regulations in the United States.

Given the award of the Permits, in most circumstances in the US,

such improvements to minor permits are uncontroversial and

generally quickly accepted. However, NCDEQ decided to require a

formal permit amendment from AEG for these minor revisions. In May

2021, AEG complied with the notice from NCDEQ to suspend

construction of the additional components at the Lumberton

Facility, made the requisite amendment application and provided

relevant information to address NCDEQ's concerns. Discussions are

ongoing between AEG and NCDEQ to expedite the approval of the

amendment request.

The emissions data being gathered from the Ashland Facility is

expected to demonstrate that producing CoalSwitch is wholly

different from existing biomass production processes. However, it

is not possible to comment on the timing or process of obtaining

approval of the permit amendment. AEG's goal remains to commence

production of CoalSwitch from the Lumberton Facility at the

earliest opportunity.

AEG has received several enquiries from prospective customers

and partners who wish to test CoalSwitch product and observe an

operational production facility in the heart of North Carolina. AEG

has also received additional commercial enquiries about additional

uses for the Lumberton Site and these are currently being evaluated

by AEG to work alongside the forthcoming operational CoalSwitch

reference plant.

Joint Venture with PDI

As construction continued at the Lumberton Facility in Q2 2021,

PDI itself also received additional enquiries for CoalSwitch fuel,

principally from prospective partners in North-Eastern United

States. PDI and AEG both wanted to build a second facility to

increase production capacity in the United States, and to benefit

from the additional operating data from a second working CoalSwitch

facility.

PDI is based in Maine, with a series of engineering and

manufacturing operations, and in April 2021 arranged for AEG and

PDI to meet with local regulatory and environmental agencies in

Maine to examine the possibility of building a second such

facility. Following the meeting, an operating permit was granted to

allow the operation of a second CoalSwitch production facility at

Ashland, Maine (the "Ashland Facility"). This permit allowed for

the production of an initial 1,000 tons of CoalSwitch by no later

than 31 July 2021. Following submission of emissions results, we

will submit a permit application to increase production capacity up

to 35,000 tonnes per annum.

PDI and its associated companies own the Ashland Facility. AEG

and PDI agreed that the most efficient route forward was via a

joint venture between the parties, details of which were announced

on 26 May 2021. In summary, the joint venture only applies to

production activities from the Ashland Facility and allows for a

fully operational second CoalSwitch reference plant to produce fuel

for onward sale and to further demonstrate the operating technology

to prospective customers.

Sales teams assembled in the United States and

internationally

During the first half of 2021, AEG assembled a sales team in

North Carolina who are currently marketing to a variety of

prospective off-take customers for CoalSwitch fuel and potential

commercial production partners across North America. In addition,

AEG has also appointed sales representatives in Japan to

accommodate customer enquiries for CoalSwitch. AEG has complemented

these activities with the addition of a data analysis team to

assemble a proprietary database on the fuel requirements of

prospective customers throughout North America.

The marketing feedback, the expanding data information and

general background of increasing environmental awareness in the US

has accelerated prospective customer interest for CoalSwitch fuel

and the immediate customer demand for test samples of CoalSwitch

fuel. The joint venture with PDI, complementing the activities at

the Lumberton Facility form a further critical step forward for the

full-scale commercial roll out of CoalSwitch.

CoalSwitch technology - Continuing Technology and Commercial

Development

Throughout 2020, AEG continued to develop and extend its

intellectual property portfolio regarding CoalSwitch and the

underlying production processes within the production reactors. In

December 2020, AEG was awarded an additional patent in the US

(Patent No 10,858,607). After this award, an additional and

complementary patent application was filed in the US.

In late 2019, applications had also been made to file for

Canadian patents. On 7 June 2021, the Canadian Intellectual

Property Office indicated that we have been granted a notice of

allowance, meaning that AEG will be awarded the Canadian

patent.

AEG has maintained a continual filing, review, and renewal

programme for its current intellectual property ("IP") during 2020

and will continue to expand the IP portfolio and know-how as the

first operational data and fuel testing from production fuels are

completed. In 2021, AEG has also been establishing links with

various academic institutions in the US and Canada whose forestry

expertise will facilitate and accelerate expansion of AEG's

technical knowledge of CoalSwitch IP and further increase market

awareness of these next generation biomass fuels.

International interest for licensing the CoalSwitch production

technology has also continued and with those forthcoming

opportunities, AEG has ensured that the proprietary technology is

correctly protected. Applications are being processed for patents

for the EU (including the UK) and territories in South-East Asia.

The timing of any such patent awards will not affect the timing of

prospective commercial opportunities, given the current validity of

the US patents.

AEG has continued to develop commercial relationships for

complementary licensing and production deals both in North America

and elsewhere. The first precedent was established in Canada in

2019.During 2020 and 2021, AEG has engaged in several additional

enquires. Ongoing discussions continue with parties in South-East

Asia, India, South Africa and within the US.

Sawmill and lumber activities at Lumberton

During 2020, the initial focus for operations at the Lumberton

site had been on the establishment of an operational lumber

business, whose focus was not only to generate revenues to allow

the Lumberton site to function, but also to become a component of

the forthcoming CoalSwitch production operations.

To consolidate the operations from existing joint venture

arrangements, in March 2020, AEG and RLS agreed to operate all the

lumber activities in Lumberton under the trading name Active Energy

Renewable Power ("AERP"). The prime operations were the production

of rail ties and saw log export. Both operations continued to

operate through Covid-19 but remained small scale. Operation of the

sawmill has brought a number of benefits, including establishing

AERP's reputation in North Carolina with local lumber suppliers and

commercial partners, who are increasingly enthusiastic to supply

forestry waste and residual for the forthcoming CoalSwitch

operations.

Post Period End

In Q2 2021, the Board determined that saw log export was neither

aligned with the future environmental strategy for the Group nor

was it able to produce sufficient economic returns to become a

profitable operation. To achieve a profitable operation AEG would

be required to invest heavily in equipment to expand production and

scale up these operations. The Board has therefore decided to focus

its capital allocation toward CoalSwitch production activities and

has decided to withdraw from saw log export operations. The

sawmill, which is viewed as more complementary to the Group's

strategy, has continued to operate through H1 2021 as it supports

forthcoming CoalSwitch operations with the processing of residual

feedstock. Decisions made on its future will depend on NCDEQ's

approval of the Permit amendments and how the Lumberton Facility

develops in the coming months.

Forestry assets in Ukraine and Newfoundland and Labrador

Prior to 2018, AEG's strategy was based upon the ownership of

timberland assets which might assist in the commercial development

and production of biomass fuels.

In respect of the Province of Newfoundland and Labrador (the

"Province') AEG was awarded commercial cutting permits with a

5-year duration which included certain performance thresholds

required to be achieved prior to May 2021. During 2020 and 2021,

Covid-19 restrictions prevented any travel to the Province. In

2020, AEG appointed advisers to seek modifications to the

commercial cutting permits, which were initially rejected by the

Province. Nonetheless AEG continues to work with the Province to

mitigate the consequences resulting from not achieving the required

harvesting thresholds during this difficult period. AEG believes

that there are benefits for the Province in establishing a

CoalSwitch solution and working with local lumber partners to

utilise the cutting permits.

In Ukraine, AEG also held timberland interests for an area

surrounding Lyubomi through its operating subsidiary, AE Ukraine.

During 2020, AEG sought to dispose of these assets. As it was

unable to do so, the Board decided to accelerate the impairment of

the entire asset from the balance sheet and cease any further

activities in Ukraine.

Financing Activities during 2020 and post period in 2021

During the year, AEG completed a series of financing activities,

including the issuance of some additional convertible loan notes in

June 2020, and an equity fundraising in August 2020 of GBP1.5

million (before expenses), completed upon the news of the award of

the Permits for the Lumberton Facility. The funding for this came

from existing shareholders and bondholders and we remain grateful

to their support.

These events were a prelude to the balance sheet restructuring

completed in February 2021, where all outstanding convertible loan

notes were converted to equity or redeemed to ensure the full

extinguishment of the outstanding Convertible Loan Note (the

"Notes"). At the same time, AEG was grateful for the support of

existing and new shareholders to raise additional equity totalling

GBP7 million (before expenses). Most importantly the redemption or

conversion of the Notes meant that all former security obligations

which were incumbent upon the entire AEG group were extinguished,

allowing AEG the flexibility to properly utilise its balance sheet.

In addition, the Company will benefit from reduced finance charges

going forward.

Appointment of a Finance Director

The appointment of Andrew Diamond as Finance Director in January

2021 was a significant appointment for AEG. Andrew's previous PLC

experience has already proven invaluable in recent months.

Post Period End

All the foundations achieved in 2020 allowed AEG to move toward

the delivery stage of its strategy in H1 2021. While the Lumberton

Facility has been under construction in recent months, the

management team has already been building toward the next stage of

growth for AEG. The joint venture with PDI and the assembly and

completion of a second CoalSwitch facility in Maine within 14 weeks

demonstrate the forthcoming commercial opportunities AEG is seeking

to realise.

Outlook

AEG is delivering on our strategy to commercialise CoalSwitch,

our proprietary technology which transforms waste biomass material

into high-value renewable fuels through AEG's own resources and

through commercial partnerships.

The Board believes that AEG's CoalSwitch technology process has

clear advantages over traditional biomass manufacturing processes

and that there are few alternative next generation biomass fuels

currently available.

Our achievement in making CoalSwitch available for customers for

their independent analysis is a significant milestone and we are

now witnessing considerable market interest in North America in

both our process and our product.

Our clear focus is on accelerating the commercialisation of

CoalSwitch.

Michael Rowan

Chief Executive Officer

14 June 2021

FINANCE REVIEW

FOR THE YEARED 31 DECEMBER 2020

Having started as the incoming Finance Director on 1 January

2021, a look back at the year ended 31 December 2020 ("Current

Year") reveals a year where progress has been made, but the rate of

that progress was hampered by Covid-19 related factors. I can

report that the rate of progress following the year end is much

improved, and the Company is now at a very exciting point where it

has just produced the first commercial volumes of CoalSwitch from

its Ashland Facility.

Subsequent events

It is unusual to start a report with events which happen after

the period being reported upon but given the magnitude of these

events it is appropriate to do so this year.

In January 2021, Advanced Biomass Solutions Plc, a subsidiary of

the Company, completed and drew upon a debt facility of GBP550,000.

The debt instrument is repayable within twelve months based on

monthly capital repayments following a four-month repayment

holiday. Initiation fees of 7% were payable, and interest is

charged at 10% p.a. payable quarterly in arrears. The Company has

provided a corporate guarantee as security.

In February 2021, the convertible loan note ("CLN") holders

agreed to either convert their CLN's or have them redeemed.

Furthermore, the CLN holders agreed to a release of the securities

held over the Companies assets in favour of the CLN holders. At the

same time the Company raised GBP7.0 million in a fundraising

(before expenses), principally to progress the final stages of

construction of the Lumberton Facility. At the time of reporting

the CLN obligation has been fully extinguished. The shares in issue

at the reporting date were 3,902,051,743, compared to 1,541,178,043

at 31 December 2020. This injection of funding, along with the

removal of the debt and the underlying security obligations have

provided the Company an opportunity to deliver on its long-promised

product: CoalSwitch .

On 20 May 2021, the Company announced its joint venture

arrangement with Player Design Inc. ("PDI"). Under the JV, AEG and

PDI will jointly own and operate a CoalSwitch plant in Ashland,

Maine. The plant has been completed and is in production and will

supply CoalSwitch for customers, including PacifiCorp.

Going concern

The Financial Statements have been prepared on a going concern

basis. Note 1 of the Financial Statements lays out the material

uncertainties relating to the Company's ability to continue as a

going concern. The proceeds raised in February 2021, after fees and

certain CLN redemptions, have been used to construct the CoalSwitch

plants in Lumberton NC and Ashland Maine, and further funding will

be required in the coming 12-month period to finance expansion of

CoalSwitch production, additional research and testing programs and

marketing activities.

Summary of 2020

Having acquired the property in Lumberton, in 2019 (the "Prior

Year") the Company made application for an air and construction

permit ("Permit") to enable the construction of the CoalSwitch

reference plant. The Permit was issued on 4 August 2020, after

lengthy delays due to Covid-19. Following the Permit issuance, the

Company proceeded to engage a contractor for final engineering

designs and plan the construction of the 5tph CoalSwitch plant,

with equipment orders, in addition to equipment previously acquired

by AEG, being placed late in the year.

In March 2020, the Company acquired a 100% interest in the

lumber activities at Lumberton from its joint venture partner

Renewable Logistics Systems LLC ("RLS"). As consideration, AEG

agreed to pay RLS US$350,000 in equity for the outstanding 70%

equity interest, waive $250,000 of loans, and a further $150,000

has been provided for as contingent consideration. AEG issued

64,863,412 new ordinary shares of 1p to RLS. The assets and

inventory acquired were transferred into Active Energy Renewable

Power LLC ("AERP"), which has since operated the lumber

businesses.

The acquisition allowed the Company to:

-- Control the lumber operations at Lumberton outright;

-- Assess the local timber suppliers with the intention of

securing a long-term feedstock provider for the CoalSwitch

reference plant; and

-- Demonstrate to future prospective customers the benefit of

locating a CoalSwitch plant alongside lumber operations.

In 2021, the Board has reassessed AEG's strategy, and determined

that the saw log export business, which involved loading sawlogs

into containers to be shipped to South-East Asia, did not align

with AEG's strategy of being a consumer of residual and waste

forestry products from the lumber industry. The Company has not

been able to operate the container business at a scale to produce

profitable returns. Whilst the objectives above were achieved, the

level of capital investment required to scale up and operate

profitably was deemed unacceptable and the Board decided to exit

this business.

Likewise, the sawmill business has also struggled to operate

profitably, principally due to a lack of capital investment to

allow the business to operate at a scale that recovers the fixed

cost elements. The Board is determined to focus its time and

capital allocations on CoalSwitch and has placed this business

under review.

Statement of Consolidated Income

Despite revenues, principally from the sale of lumber, of US$1.8

million (2019: US$1.9 million mainly from the granting of a

CoalSwitch licence), the costs incurred in processing and selling

the lumber products resulted in a gross loss of US$1.1 million

(2019: gross profit of US$1.9 million). As mentioned above, the

Company was unable to operate at a scale large enough in either the

sawmill or saw log export businesses to generate profits and has

taken appropriate action in 2021.

Furthermore, the Board determined that the timber-cutting

licences in Ukraine and Newfoundland are not aligned with AEG's

environmental strategy and the Company will seek to dispose or

amend these licences, if permitted. The Company will not allocate

future capital to the development these licenses. Consequently, the

Board has determined that it is prudent to fully impair these

assets. A non-cash impairment charge of US$4.2 million has been

raised (2019: US$nil). In addition to the impairments of licences,

with losses generated by the lumber and saw log export businesses,

a full impairment of the goodwill arising on the RLS acquisition of

US$0.6 million (2019: US$nil). The total impairment charge for the

year was US$4.8 million (2019: US$nil).

Administrative expenses of US$1.7 million (2019: US$2.8 million)

reflect ongoing corporate costs and business development activity.

Excluding non-cash share-based payments, administrative expenses

were US$1.6 million (2019: US$2.4 million), with losses on disposal

of assets of US$0.7 million recorded in the prior year. Finance

expenses were US$ 1.3 million (2019: US$ 2.5 million ). These costs

relate to ongoing servicing of the Group's Convertible Loan Notes,

other loan interest and foreign exchange gains and losses, offset

by interest capitalised to tangible and intangible fixed

assets.

The tax credit of US$0.2 million (2019: US$0.9 million) reflects

the deferred tax impact resulting from the impairment of assets in

the current year, and income associated with research and

development tax credits.

Loss for the year was US$8.8 million (2019: US$2.5 million).

Other comprehensive loss of US$0.7 million (2019: income of US$1.2

million) reflects a reversal of the non-cash revaluation of other

financial assets raised in the prior year of $0.5 million, with a

gain of US$0.5 million related to the Lumberton property

revaluation in the prior year. Total comprehensive loss was US$9.4

million (2019: US$1.3 million). Loss per share (basic and diluted)

was US$0.65 (2019: US$0.21).

Statement of financial position

As a result of the operating losses in 2020, and in particular

the impairment provisions raised against non-core operations and

licences, the Group's overall net assets position declined to a net

liability position of US$5.9 million (2019: net asset position of

US$ 0.4 million), underlining the importance of the CLN conversion

which occurred after financial year end.

Non-current assets decreased to US$16.6 million (2019: US$ 19.9

million). This decrease relates to the impairment of the intangible

licences in Ukraine and Newfoundland and the revaluation of other

financial assets. Current assets remained stable at US$1.5 million

(2019: US$1.5 million).

Current liabilities decreased to US$2.4 million (2019: US$2.5

million). Non-current liabilities increased to US$22.5 million

(2019: US$18.6 million) as a result of new CLN issuances, and CLN

issuances in settlement of CLN interest charges for the first three

quarters of the year.

Statement of cash flows

The Group utilised cash of US$1.3 million in operating

activities (2019: generated US$1.7 million).

US$1.5 million of proceeds were received from CLN issuances

(2019: US$2.8 million). Net proceeds of US$1.8 million were raised

in the September placing.

US$1.0 million of cash and cash equivalents was on hand at year

end (2019: US$0.4 million).

Andrew Diamond

Finance Director

14 June 2021

CONSOLIDATED STATEMENT OF INCOME AND OTHER COMPREHENSIVE

INCOME

FOR THE YEARED 31 DECEMBER 2020

2020 2019

US$ US$

REVENUE 1,810,206 1,895,972

------------ ------------

GROSS (LOSS)/PROFIT (1,122,864) 1,895,972

Impairment charges (4,758,707) -

Administrative expenses (1,743,294) (2,779,473)

------------ ------------

OPERATING LOSS (7,624,865) (883,501)

Finance costs (1,347,230) (2,461,376)

LOSS FROM CONTINUING OPERATIONS (8,972,095) (3,344,877)

Taxation 214,176 874,655

------------ ------------

LOSS FOR THE YEAR - ATTRIBUTABLE

TO THE PARENT COMPANY (8,757,919) (2,470,222)

============ ============

Basic and Diluted loss per share

(US cent) (0.65) (0.21)

OTHER COMPREHENSIVE (LOSS) / INCOME

Items that may be subsequently reclassified

to profit or loss

Exchange differences on translation

of operations (117,701) 137,540

Revaluation of land and buildings - 504,646

Revaluation of other financial

assets (539,327) 563,948

------------ ------------

Total other comprehensive (loss)

/ income (657,028) 1,206,134

------------ ------------

TOTAL COMPREHENSIVE LOSS FOR THE

YEAR (9,414,947) (1,264,088)

============ ============

CONSOLIDATED AND COMPANY STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2020

Group Group Company Company

2020 2019 2020 2019

US$ US$ US$ US$

NON-CURRENT ASSETS

Intangible assets 5,259,024 9,180,466 - -

Property, plant &

equipment 10,443,641 9,231,743 900 -

Investment in subsidiaries - - 1,495,943 1,455,091

Long term loans - - 23,204,528 23,272,315

Other financial assets 931,312 1,470,639 931,312 1,470,649

-------------

16,633,977 19,882,848 25,632,683 26,198,055

------------- ------------- ------------- -------------

CURRENT ASSETS

Inventory 237,506 - - -

Trade and other receivables 270,755 1,146,815 - 954,232

Cash and cash equivalents 999,631 397,323 811,901 360,622

------------- -------------

1,507,892 1,544,138 811,901 1,314,854

TOTAL ASSETS 18,141,869 21,426,986 26,444,584 27,512,909

============= ============= ============= =============

CURRENT LIABILITIES

Trade and other payables 2,091,657 2,391,229 1,183,827 1,441,593

Lease liabilities 136,891 - - -

Other current liabilities 150,000

Loans and borrowings 21,772 108,850 21,772 -

2,400,320 2,500,079 1,205,599 1,441,593

------------- ------------- ------------- -------------

NON-CURRENT LIABILITIES

Deferred taxation 150,139 364,316 - -

Lease liabilities 202,417 - - -

Loans and borrowings 22,105,551 18,190,732 21,961,104 18,190,732

------------- ------------- ------------- -------------

22,458,107 18,555,048 21,961,104 18,190,732

------------- ------------- ------------- -------------

TOTAL LIABILITIES 24,858,427 21,055,127 23,166,703 19,632,325

------------- ------------- ------------- -------------

NET (LIABILITIES)/ASSETS (6,716,558) 371,859 3,277,881 7,880,584

============= ============= ============= =============

EQUITY

Share capital - Ordinary

shares 219,436 17,265,379 219,436 17,265,379

Share capital - Deferred

shares 18,148,898 - 18,148,898 -

Share premium 18,711,637 17,303,159 18,711,637 17,303,159

Merger reserve 2,350,175 2,350,175 2,350,175 2,350,175

Foreign exchange reserve (184,975) (67,274) (124,920) (468,793)

Own shares held reserve (268,442) (268,442) (268,442) (268,442)

Convertible debt/warrant

reserve 3,701,803 3,490,621 3,701,803 3,490,621

Retained earnings (49,899,736) (40,206,405) (39,460,706) (31,791,515)

Revaluation reserve 504,646 504,646 - -

------------- ------------- ------------- -------------

TOTAL EQUITY (6,716,558) 371,859 3,277,881 7,880,584

============= ============= ============= =============

GROUP CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2020

Own Convertible Non-controlling

Foreign shares debt and Interest

Share Share Merger exchange held warrant Retained Revaluation Total

capital premium reserve reserve reserve reserve earnings Reserve equity

US$ US$ US$ US$ US$ US$ US$ US$ US$ US$

At 31 December

2018 17,265,379 17,303,159 2,350,175 (204,815) (268,442) 2,720,933 (38,310,938) - (358,043) 497,408

Loss for the

year - - - - - - (2,470,222) - - (2,470,222)

Other

comprehensive

income - - - 137,541 - - 563,948 - - 701,489

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------ ---------------- ------------

Total

comprehensive

income - - - 137,541 - - (1,906,274) - - (1,768,733)

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------ ---------------- ------------

Revaluation of

land

& buildings - - - - - - 504,646 - 504,646

Embedded

derivative

on CLN issue - - - - - 769,688 - - - 769,688

Share based

payments - - - - - - 368,850 - - 368,850

Minority

Interest

adjustment - - - - - - (358,043) - 358,043 -

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------ ---------------- ------------

At 31 December

2019 17,265,379 17,303,159 2,350,175 (67,274) (268,442) 3,490,621 (40,206,405) 504,646 - 371,859

=========== =========== ========== ========== ========== ============ ============= ============ ================ ============

Loss for the

year - - - - - - (8,757,919) - - (8,757,919)

Other

comprehensive

income - - - (117,701) - - (539,327) - - (657,028)

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------ ---------------- ------------

Total

comprehensive

income - - - (117,701) - - (9,297,246) - - (9,414,947)

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------ ---------------- ------------

Issue of share

capital 835,801 1,381,401 - - - - (452,467) 1,764,735

Conversion of

CLN 267,154 27,077 - - - - - - - 294,231

Embedded

derivative

on CLN issue - - - - - 211,182 - - - 211,182

Share based

payments - - - - - - 56,382 - - 56,382

At 31 December

2020 18,368,334 18,711,637 2,350,175 (184,975) (268,442) 3,701,803 (49,899,736) 504,646 - (6,716,558)

=========== =========== ========== ========== ========== ============ ============= ============ ================ ============

COMPANY STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2020

Own Convertible

Foreign shares debt and

Share Share Merger exchange held warrant Retained Total

capital premium reserve reserve reserve reserve earnings equity

US$ US$ US$ US$ US$ US$ US$ US$

At 31 December

2018 17,265,379 17,303,159 2,350,175 (716,115) (268,422) 2,720,933 (33,830,064) 4,825,025

Profit for the

year - - - - - - 1,105,751 1,105,751

Other

comprehensive

income - - - 247,322 - - 563,948 811,270

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------

Total

comprehensive

income - - - 247,322 - - 1,669,669 1,917,021

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------

Embedded

derivative

on CLN issue - - - - - 769,688 - 769,688

Share based

payments - - - - - - 368,850 368.850

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------

At 31 December

2019 17,265,379 17,303,159 2,350,175 (468,793) (268,442) 3,490,621 (31,791,515) 7,880,584

=========== =========== ========== ========== ========== ============ ============= ============

Loss for the

year - - - - - - (6,733,779) (6,733,779)

Other

comprehensive

income - - - 343,873 - - (539,327) (195,454)

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------

Total

comprehensive

income - - - 343,873 - - (7,273,106) (6,929,233)

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------

Issue of share

capital 835,801 1,381,401 - - - - (452,467) 1,764,735

Conversion of

CLN 267,154 27,077 - - - - - 294,231

Embedded

derivative

on CLN issue - - - - - 211,182 - 211,182

Share based

payments - - - - - - 56,382 56,382

----------- ----------- ---------- ---------- ---------- ------------ ------------- ------------

At 31 December

2020 18,368,334 18,711,637 2,350,175 (124,920) (268,442) 3,701,803 (39,460,706) 3,277,881

=========== =========== ========== ========== ========== ============ ============= ============

CONSOLIDATED AND COMPANY STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2020

Group Group Company Company

2020 2019 2020 2019

US$ US$ US$ US$

Cash (outflow)/inflow

from operations (1,302,560) 1,675,831 (1,761,243) 1,201,865

Income tax paid - - - -

------------ ------------ ------------- -------------

Net cash (outflow)/inflow

from operating activities (1,302,560) 1,675,831 (1,761,243) 1,201,865

Cash flows from investing

activities

Purchase of intangible

assets (661,939) (519,312) - -

Increase in share

of subsidiary undertaking - - - (1,396,666)

Purchase of property,

plant and equipment (738,993) (1,756,619) (1,222) -

Sale of property,

plant and equipment - 362,790 - -

------------ ------------ ------------- -------------

Net cash outflow from

investing activities (1,400,932) (1,913,141) (1,222) (1,396,666)

Cash flows from financing

activities

Issue of equity share

capital, net of share

issue costs 1,754,489 - 1,754,489 -

Issue of CLN 1,467,778 2,762,781 1,467,778 2,762,781

Intercompany loans

advanced - - (1,076,176) -

Unsecured debt repaid - (1,218,857) - (1,000,000)

Unsecured debt proceeds 212,600 - 68,183 -

Principal elements

of lease payments (95,758) - - -

Finance expenses (37,842) (1,207,093) - (1,207,093)

------------ ------------ ------------- -------------

Net cash inflow from

financing activities 3,301,267 336,831 2,214,244 555,688

------------ ------------ ------------- -------------

Net increase in cash

and cash equivalents 597,775 99,521 451,779 360,887

Cash and cash equivalents

at beginning of the

year 397,323 298,768 360,622 234

Exchange losses on

cash and cash equivalents 4,533 (966) (500) (499)

------------ ------------ ------------- -------------

Cash and cash equivalents

at end of the year 999,631 397,323 811,901 360,622

============ ============ ============= =============

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2020

1. PUBICATION OF NON-STATUTORY ACCOUNTS

The financial information, for the year ended 31 December 2020,

set out in this announcement does not constitute statutory

accounts. This information has been extracted from the Group's 31

December 2020 statutory financial statements upon which the

auditors' opinion is unqualified. However, the auditors' report

highlights material uncertainty relating to going concern and

includes the following additional key audit matters:

-- Recoverability of intangible assets; and

-- Recoverability of property, plant and equipment and other assets, Group and Parent.

2. BASIS OF PREPARATION

The financial information, for the year ended 31 December 2020,

set out in this announcement, has been:

-- presented in accordance with International Financial

Reporting Standards ("IFRSs"), however this preliminary

announcement does not contain sufficient information to comply with

IFRSs. The IFRS compliant Consolidated Financial Statements is

published in the Annual Report and Accounts for the year ended 31

December 2020, available on the Company's website;

-- prepared on the going concern basis, however the Directors

have highlighted a number of material uncertainties which may

affect the Company's ability to continue operating as a going

concern; and

-- prepared on the basis of the accounting policies as stated in

the Report and Accounts for the year ended 31 December 2019, with

the exception of those changes required in the application of new

and revised IFRSs, none of which has a material impact on the

Group.

3. GOING CONCERN

The Directors are required to give careful consideration to the

appropriateness of the going concern basis in the preparation of

the Financial Statements.

During 2020 the Group applied for and obtained a construction

and air permit for the CoalSwitch(TM) reference plant in Lumberton,

North Carolina. Engineering and design works for the plant were

completed, and the required equipment procured. Construction of the

3tph plant commenced in 2021. Despite an interruption to the

construction required to amend the air permit for additional

emissions control equipment, the reference plant is anticipated to

be commissioned during Q3 2021. The Company has signed a joint

venture agreement with Player Design Inc., on a 50/50 basis, to

develop a 5tph CoalSwitch(TM) plant in Ashland, Maine, which is

strategically located in proximity to several large timber

manufacturers who have significant wood residuals to dispose of.

Managements plans to expand the production capacity of both the

Lumberton and Ashland CoalSwitch(TM) plants will result in the

Group having capacity to produce 140,000 tons of CoalSwitch(TM) per

annum from the start of 2022.

The Group announced its first order of CoalSwitch by PacifiCorp

for their Hunter Power Station, a coal-fired power plant in Utah,

in December 2020. This first order is significant and will be

incorporated in a test burn in conjunction with a study group from

the University of Utah to assess the performance of CoalSwitch(TM)

in terms of calorific value and emissions reductions. The ability

to provide samples to prospective customers, in conjunction with

the data and findings from the PacifiCorp test burn will greatly

enhance existing marketing efforts to obtain long-term off-take

agreements.

In February 2021, the Company restructured its balance sheet by

securing the conversion and redemption of the entire convertible

loan note obligation ("CLN"). Furthermore, the securities in place

for the CLN holders have been revoked. At the same time the Company

recapitalised the business by raising GBP7.0 million (gross) to be

used principally for the construction of the Lumberton CoalSwitch

reference plant, certain CLN redemptions and improvement of the

working capital position.

At the reporting date the Group has sufficient funding to

complete both the Lumberton and Ashland CoalSwitch(TM) plants, and

to fund near-term administration, working capital costs and debt

servicing but will need to seek additional funding to finance

further plant expansions and/or new plant developments.

Uncertainties exist in relation to the performance of the

CoalSwitch product, the completion of the Lumberton and Ashland

CoalSwitch plants, the Group's ability to locate and secure

long-term off-take agreements for CoalSwitchTM and the Company's

ability to secure additional funding, either equity or debt, to

support these activities. These conditions indicate the existence

of a material uncertainty which may cast significant doubt over the

Group's ability to continue as a going concern.

The Directors have reviewed the cash forecasts in respect of the

Group's operating and planned growth activities. The expected cash

flows, plus available cash on hand, after allowing for funds

required and allowing for existing debt facilities, are not

sufficient to cover these activities. The Company will need to

raise funding to support operations in the twelve-month period from

the date of approval of these Financial Statements. The Directors

are confident, based on the CoalSwitch(TM) progress made to date,

and the restructured balance sheet of the Group, that it will be

able to secure the funding required.

On the basis of the considerations set out above, the Directors

have concluded that it is appropriate to prepare the Financial

Statements on a going concern basis. These Financial Statements do

not include any adjustments to the carrying amount and

classification of assets and liabilities that may arise if the

Group or the Parent Company was unable to continue as a going

concern.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BIGDLLXBDGBX

(END) Dow Jones Newswires

June 14, 2021 02:00 ET (06:00 GMT)

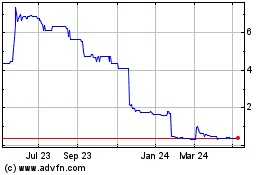

Active Energy (LSE:AEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

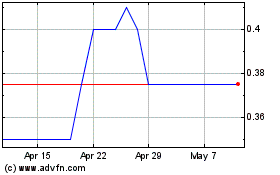

Active Energy (LSE:AEG)

Historical Stock Chart

From Apr 2023 to Apr 2024