TIDMAEWU

RNS Number : 7095P

AEW UK REIT PLC

22 June 2022

AEW UK REIT PLC

Announcement of Full Year Results for the year ended 31 March

2022

AEW UK REIT plc (the 'Company'), which holds a diversified

portfolio of 36 commercial investment properties throughout the UK,

is pleased to publish its full year results for the year ended 31

March 2022.

Mark Burton, Chairman of AEW UK REIT plc, commented :

"We are delighted with the Company's performance over the past

twelve months, which has delivered strong share price total returns

for the year of 53.61% to investors. NAV total returns, which

increased to 29.73%, were the highest recorded by any of the UK's

diversified REITs. These returns have been driven partly by the

removal of pandemic restrictions but also by our Investment

Manager's strategy which combines defensive positioning,

identifying assets with shorter unexpired lease terms that are

often mispriced and active asset management of the portfolio. We

are also pleased the Company has continued to pay its full 8.00p

per share annual dividend for the sixth consecutive year and that

our strong performance has been recognised by industry awards that

also acknowledge the hard work and dedication of the whole AEW UK

REIT team."

Financial Highlights

-- Net Asset Value ('NAV') of GBP191.10 million and 120.63 pence

per share ('pps') as at 31 March 2022 (31 March 2021: GBP157.08

million and 99.15 pps).

-- Operating profit before fair value changes of GBP11.75

million for the year (year ended 31 March 2021: GBP10.73

million).

-- Profit before tax ('PBT')* of GBP46.70 million and earnings

per share ('EPS') of 29.47 pps for the year (year ended 31 March

2021: GBP22.17 million and 13.98 pps).

-- EPRA Earnings Per Share ('EPRA EPS')* for the year of 6.79

pps (year ended 31 March 2021: 6.19 pps). See note 10 in the full

Annual Report for the calculation of EPRA EPS.

-- Total dividends of 8.00 pps declared for the year (year ended

31 March 2021: 8.00 pps).

-- Shareholder total return* for the year of 53.61% (year ended

31 March 2021: 33.72%).

-- The price of the Company's Ordinary Shares on the Main Market

of the London Stock Exchange was 119.80 pps as at 31 March 2022 (31

March 2021: 83.20 pps).

-- As at 31 March 2022, the Company had drawn GBP54.00 million

(31 March 2021: GBP39.50 million) of a GBP60.00 million (31 March

2021: GBP60.00 million) term credit facility with the Royal Bank of

Scotland International Limited ('RBSi') and was geared to 28.26% of

NAV (31 March 2021: 25.15%) (see note 15 in the full Annual Report

for further details).

-- The Company held cash balances totalling GBP6.77 million as

at 31 March 2022 (31 March 2021: GBP17.45 million).

Property Highlights

-- As at 31 March 2022, the Company's property portfolio had a

valuation of GBP240.18 million across 36 properties (31 March 2021:

GBP179.00 million across 34 properties) as assessed by the

Valuer(1) and a historical cost of GBP207.96 million (31 March

2021: GBP173.28 million).

-- The Company acquired four properties during the year for a

total purchase price of GBP38.23 million, excluding acquisition

costs (year ended 31 March 2021: one property for a purchase price

of GBP5.40 million).

-- The Company made two disposals during the year with total

gross sale proceeds of GBP16.71 million (year ended 31 March 2021:

two disposals with total gross sale proceeds of GBP29.30

million).

-- The portfolio had an EPRA Vacancy Rate** of 10.69% as at 31

March 2022 (31 March 2021: 8.96%). Excluding vacancy contributed by

Bath Street, Glasgow, which was exchanged to be sold with the

condition of vacant possession, the vacancy rate was 5.42% (31

March 2021: 5.58%).

-- Rental income generated in the year under review was GBP15.92

million (year ended 31 March 2021: GBP15.71 million). The number of

tenants as at 31 March 2022 was 131 (31 March 2021: 99).

-- EPRA Net Initial Yield ('NIY')** of 5.87% as at 31 March 2022

(31 March 2021: 7.37%).

-- Weighted Average Unexpired Lease Term ('WAULT')* of 3.94

years to break (31 March 2021: 4.43 years) and 5.78 years to expiry

(31 March 2021: 6.71 years).

-- The Company has achieved very high rent collection levels,

which stand at over 98% for each quarter since March 2020

(excluding current quarter where rent continues to be

collected).

* See KPIs in the full Annual Report for definition of

alternative performance measures.

** See Glossary in the full Annual Report for definition of

alternative performance measures.

(1) The valuation figure is reconciled to the fair value under

IFRS in note 12 in the full Annual Report.

Enquiries

AEW UK

L aura Elkin Laura.Elkin@eu.aew.com

Nicki Gladstone Nicki.Gladstone-ext@eu.aew.com

+44(0) 771 140 1021

Liberum Capital Darren.Vickers@liberum.com

Darren Vickers +44 (0)20 3100 2218

TB Cardew AEW@tbcardew.com

Ed Orlebar +44(0) 7738 724 630

Tania Wild +44(0) 7425 536 903

Lucas Bramwell +44(0) 7939 694 437

Chairman's Statement

Overview

This financial year has seen the gradual removal of restrictions

that had been implemented as a result of the COVID-19 pandemic.

This has been a welcome change that has assisted the Company in

producing a strong share price total return for the year of 53.61%

(31 March 2021: 33.72%). This return to normality has been

particularly important for the sectors of the property market that

were hardest hit by the pandemic, most notably leisure and some

parts of the retail market. The Company has continued to take a

cautious approach to cash and debt management, mindful that a

degree of uncertainty remains. As is often the case, uncertainty

has created opportunities, and pragmatic choices have been rewarded

with another year of strong performance for the Company. We are

pleased this has allowed the Company to be the only REIT in its

peer group to continue paying its full 8p per share annual

dividend. Indeed, the Company's dividend of 2p per share per

quarter has now been paid consistently since Q1 2016 for 26

consecutive quarters, with the Company's EPRA earnings covering in

excess of 98% of this amount.

For this financial year, the Company's NAV per share has

increased by 21.66%, providing a NAV total return for the year of

29.73% (31 March 2021: 15.06%). This was the highest NAV total

return recorded by any of the UK diversified REIT's and, as a

result, the Company has been awarded the Citywire award for best

generalist UK property trust for the second consecutive year.

During the year, the Company also received awards from EPRA, the

European Public Real Estate Association, who awarded the Company a

gold medal for the standards of our financial reporting and a

silver medal for the standards of our sustainability reporting. We

are delighted that these awards recognise the hard work and

dedication that is put into the running of the Company by both my

colleagues on the Board, and the Company's Investment Manager,

AEW.

The Company has benefited from its defensively positioned

portfolio which achieved, at property level, a total return of

25.87% over the year, an outperformance of 0.51% relative to the

MSCI Benchmark. This success further builds upon the outperformance

of 10.7% achieved in the prior year. Relatively small lot sizes,

geographical diversification and valuations that are underpinned by

alternative use values have all contributed to the Company's

resilience during a time of protracted economic uncertainty. This

strong performance supports the Company's long-standing strategy of

diversification, benefitting both performance and risk

mitigation.

Exposure to various key sectors of the property market via its

diversified strategy has allowed the Company to maximise

shareholder returns with significant profits crystallised this year

following the sale of two industrial assets that had seen large

valuation uplifts. The Company's industrial assets at Bessemer Road

in Basingstoke and Langthwaite Business Park, South Kirkby, were

sold achieving sale prices 1.7x and 1.9x ahead of their respective

purchase prices.

The proceeds of these industrial sales have now been reinvested

into the retail warehouse and leisure sectors in order to create

opportunities for future income and NAV growth. The Central Six

Retail Park in Coventry was purchased in November 2021 for a price

of GBP16.41 million, producing a net initial yield of circa 11%.

The site occupies a strategic and central location close to

Coventry city centre with an anticipated reversionary yield of

circa 12.5%.

The PRYZM Nightclub in Cardiff was purchased for a price of

GBP3.63 million, reflecting a net initial yield of 7.7%, with an

anticipated reversionary yield of circa 9.2% and a low capital

value of GBP92 per sq ft.

Two further assets were purchased in the year, also in the

leisure and retail warehousing sectors. The first of these was

Arrow Point Retail Park in Shrewsbury which was acquired in May

2021 for a price of GBP8.35 million. Secondly, the Company acquired

15-33 Union Street Bristol in June 2021 for a price of GBP10.19

million, providing a net initial yield of 8.0%.

All of these purchases deliver very attractive levels of income

and contribute immediately to the Company's earnings, as well as

offering further opportunities to manage the assets proactively to

enhance NAV over the long term. Assets such as these form the basis

of an attractive pipeline which the Company is currently pursuing

in order to reinvest the sale proceeds that are due to be received

following the expected sales of assets in 225 Bath Street, Glasgow

and Eastpoint Business Park, Oxford. The Company will continue to

target acquisitions that offer the opportunity to deliver both

strong income and capital performance. The Company's Investment

Manager continues to use its extensive knowledge in both asset

selection and asset management to select each asset on its own

specific merits, rather than being entirely sector driven in its

purchasing strategy.

Active asset management continues to form a major part of the

Company's strategy where key targets are to improve the length and

quality of income streams, as well as maximising rental receipts.

Notable successes within the year include the settlement of the

Company's September 2021 open market rent review at its industrial

holding in Knowles Lane, Bradford, at a level representing a 14%

increase over the three-year period. New high rental tones were

also set at the Company's multi-let industrial assets in Runcorn

and Basildon at GBP6 per sq ft and GBP8 per sq ft, respectively. At

the Company's office holding in Queen Square, Bristol, strong

rental growth has also been observed, with current rents being

GBP30 per sq ft, almost doubling the rental value at

acquisition.

The realisation of some business plans within the portfolio has

led to periods of income volatility with total EPS of 6.79p

achieved over the four quarters of the year. The cause of this has

been multi-faceted, with income subdued by the necessity of service

charge works at Blackpool, the removal of tenants in preparation

for the vacant possession sale of Glasgow and the reinvestment of

proceeds following profitable sales. Once the sale of Glasgow

completes and its sale proceeds are reinvested, EPS is expected to

return to a level in line with the Company's target level of 8p per

annum. Looking forward, the portfolio's future income generation

prospects appear strong as assessed independently by Knight Frank,

the Company's valuer. As at year-end, the portfolio's total

estimated market rental value remained 20% higher than its current

gross income, demonstrating the portfolio's inherent ability to

grow income receipts over the medium term.

Financial Results Summary

Year ended Year ended

31 March 31 March 2021

2022

----------- ---------------

Operating Profit before fair value

changes (GBP'000) 11,752 10,735

Operating Profit (GBP'000) 46,913 23,102

Profit before Tax (GBP'000) 46,695 22,172

Earnings Per Share (basic and diluted)

(pence)* 29.47 13.98

EPRA Earnings Per Share (basic and

diluted) (pence)* 6.79 6.19

Ongoing Charges (%) 1.35 1.36

Net Asset Value per share (pence) 120.63 99.15

* See note 10 of the financial statements in the full Annual

Report for calculation.

Financing

The Company had a GBP60.00 million loan facility, of which it

had drawn a balance of GBP54.00 million as at 31 March 2022 (31

March 2021: GBP60.00 million facility; GBP39.50 million drawn),

producing the following measures of gearing:

Year ended Year ended

31 March 2022 31 March

2021

% %

---------------- -----------

Loan to NAV 28.26 25.15

Gross Loan to GAV 22.48 22.07

Net Loan to GAV (deducts cash balance

from the outstanding loan value) 19.67 12.32

The unexpired term of the facility was 1.6 years as at 31 March

2022 (31 March 2021: 2.6 years). The loan incurred interest at

SONIA +1.4%, which equated to an all-in rate of 2.20% as at 31

March 2022 (31 March 2021: 1.44%).

The Company had in place interest rate caps at the year-end a

notional value of GBP51.50 million (31 March 2021: GBP51.00

million), resulting in the loan being 95% hedged (31 March 2021:

130%). These interest rate caps were effective for the remaining

period of the loan.

As at 31 March 2022, the Company had GBP12.89 million of the

facility available up to the maximum 35.00% Loan to NAV at

drawdown.

Post year-end, the decision was taken to complete the

refinancing of the portfolio, as announced in May 2022. The Company

has secured a new GBP60.00 million, 5-year term loan facility with

AgFe, a leading independent asset manager specialising in

debt-based investments. The loan is priced as a fixed rate loan

with a total interest cost of 2.959%. The existing RBSi loan

facility, which was priced at a floating rate according to SONIA,

was due to mature in October 2023 and has been repaid in full by

the new loan facility. Simultaneous to the funding, the Company's

interest rate cap was sold for proceeds of GBP743,000. In the

current inflationary environment, the Company considers it prudent

to fix the loan now, rather than run the risk of further rising

rates. The Company intends to utilise borrowings to enhance returns

over the next five years.

Dividends

The Company has continued to deliver on its target of paying

dividends of 8.00 pps per annum. During the year, the Company

declared and paid four quarterly dividends of 2.00 pence per share,

in line with its target, which were 84.88% covered by the Company's

EPRA EPS of 6.79 pence. It remains the Company's intention to

continue to pay dividends in line with its dividend policy. In

determining future dividend payments, regard will be given to the

circumstances prevailing at the relevant time, as well as the

Company's requirement, as a UK REIT, to distribute at least 90% of

its distributable income annually, which will remain a key

consideration.

Outlook

Post year-end, the Company made the announcement that Alex

Short, joint Portfolio Manager, had taken the decision to resign

from her position within the Company's Investment Manager and

therefore also resigned her position in respect of the Company.

Laura Elkin continues as Portfolio Manager of the Company supported

by the wider AEW UK team which remains unchanged. Laura has played

a key role in the portfolio management team since the Company's

launch in 2015 and as such, the Board have confidence in her

abilities to continue to lead the team at AEW. Laura will work

alongside Henry Butt as Assistant Portfolio Manager. All investment

decisions made on behalf of AEW UK require the approval of AEW UK's

Investment Management Committee, which has remained unchanged for

the past 11 years. My colleagues on the Board and I would like to

take the opportunity to thank Alex for her involvement in the

Company to date and wish her the best for future endeavours.

Despite various headwinds facing the UK economy, the Board feels

confident that the asset management opportunities inherent within

the portfolio and the Company's investment pipeline provide a

strong basis for the continuation of attractive returns to the

Company's shareholders. The portfolio's future income generation

prospects appear strong as assessed independently by Knight Frank,

the Company's valuer. As at 31 March 2022, the portfolio's total

estimated market rental value remained 20% higher than its current

gross income, demonstrating Knight Frank's belief in the

portfolio's inherent ability to grow income receipts over the

medium term.

In anticipation of capital receipts from the sale of Glasgow and

Oxford later this year, AEW are pursuing an attractive pipeline of

retail warehousing, leisure and office assets across the UK, which

offer income levels and capital growth opportunities in line with

the existing portfolio. Also, as part of the Company's

re-financing, the remaining GBP6.00m available in the loan facility

was drawn post year-end, which further extends purchasing

capability.

We are pleased to see that the Company's strong performance has

been recognised in the rating of its shares, where demand has

delivered periods of a share price premium to NAV. With an

attractive pipeline of opportunities, we hope the Company will be

in a position to take advantage of continued strong demand for its

shares and grow its capital base in the future.

Mark Burton

Chairman

21 June 2022

Investment Manager's Report

Economic Outlook

Despite COVID-19 restrictions finally being lifted, the

anticipated post-pandemic rebound appears to have slowed as UK GDP

fell by a disappointing 0.1% month-on-month in March 2022. It is

likely this is primarily due to a significant increase in the rate

of inflation with a 30-year high of 9.0% recorded for April 2022.

Russia's invasion of Ukraine, and the consequential sanctions

imposed by the international community, continues to drive up

energy and commodity prices. There is a risk that, as well as

affecting manufacturing industries, this may further damage

consumer and investor sentiment as real income and wealth levels

are reduced. Economic growth is now forecast to slow to 3.8% by

2022 year-end.

(SOURCE - Oxford Economics)

With higher than expected inflation, the Bank of England has

increased interest rates from 0.50% in February 2022 to 1.25% in

June 2022. Despite this backdrop of rising inflation and rising

interest rates, over a five-year period, we consider that bond

yields are likely to remain low with central banks reluctant to

push economies into recession, particularly in times of war.

Property Market Outlook

Industrial

The sector has seen significant growth for a number of years due

to the growth of e-commerce. The COVID-19 pandemic caused an

acceleration of this trend as lockdowns and social distancing

forced changes in shoppers' habits. These trends have positively

impacted values throughout the industrial market from the prime end

to more traditional manufacturing accommodation as older stock has

been redeveloped and low rented accommodation has become

scarcer.

Strong investor demand in the sector has compressed yields and

driven much value growth within the Company's portfolio and, as a

result of a number of the asset values being felt to have been

maximised, two industrial assets were disposed of during the

period. For this reason, we exercise caution when analysing

pipeline assets in the sector.

Attributes which we still find very compelling within the sector

are the historically low levels of availability of accommodation

and continued strong tenant demand. It is these attributes which

continue to drive rental growth and with the portfolio's average

passing rent within the sector being only GBP3.30 per sq ft we

believe that we are ideally placed to be able to benefit from this.

This growth potential has been demonstrated by a number of recent

asset management transactions including the Company's asset in

Bradford where the settlement of a rent review during the period

resulted in a 14% increase in income over a three-year period.

The industrial sector represents the portfolio's largest sector

holding, making up 50.3% of the portfolio's value as at year-end.

The Company's industrial holding delivered a total return of 34.8%

during the year and an income yield of 6.3%. In contrast, benchmark

total return was 46.5%, reflecting the very strong investor demand

seen for prime assets, which delivered a significantly lower income

yield of 3.7%.

Office

Despite numerous lockdowns and work from home mandates during

the pandemic, we have not seen the significant decline in office

occupation that some had predicted. It is certainly the case that

hybrid working has become more commonplace, however it is clear

that at least some exposure to the physical office brings numerous

benefits over its more solitary alternative, including increased

collaboration and higher levels of personal wellbeing.

UK employment levels have also remained robust, rising to

pre-pandemic levels and showing a historic high level.

The office assets within the portfolio have been the subject of

much recent discussion with the proposed sales of the Company's

assets in Glasgow and Oxford both into alternative uses. When

considering office assets for investment, we have often sought to

acquire those showing strong alternative use values and we believe

that this has assisted in delivering the benchmark outperformance

that we have seen from the sector over recent periods.

The investment pipeline for offices focuses on strong, regional

centres and a preference for town or city centres rather than

business park locations where alternative uses may be more

limited.

Our office assets represent the second largest sector holding,

with 18.0% of the valuation. This was the strongest performing

sector relative to the Benchmark, achieving an outperformance of

13.2%, which was largely driven by capital growth outperformance of

13.7% resulting from key asset management transactions.

Alternatives

This is a sector in which AEW as Investment Manager has

significant expertise and has seen a number of compelling

opportunities in the market. The Company's current alternatives

holding comprises assets within the leisure sector that have been

selected due to their defensive, value protection characteristics

as well as their high-income yield.

The leisure sector suffered significant strain during the

pandemic as lockdowns kept customers away for many months. However,

due to the high levels of cost involved in relocation and fit out,

occupiers tend to move accommodation far less than in other

sectors. This has been shown by the fact that, since the lifting of

all social distancing restrictions, headway has been made in

various asset management initiatives within the Company's

portfolio. We also find the sector attractive on a selective basis

going forward, particularly those properties that occupy larger

land holdings or sites in economically active areas such that can

often be underpinned by alternative use values.

Assets held in alternative sectors comprise 7.0% of the 31 March

2022 valuation, all of which is within the leisure sector. The

Company's alternative holdings outperformed the Benchmark, with a

relative outperformance of 7.5%, driven by an income return

outperformance of 8.6%.

Retail

The high street retail sector (referred to as 'Standard Retail')

suffered greatly during the pandemic and experienced an

acceleration of trends already present in consumer habits. Values

in high street retail have now stabilised somewhat and we believe

that the sector is likely to offer opportunities for repurposing to

alternative uses over the medium term.

By contrast, performance in the retail warehousing sector has

generally been significantly stronger than that seen on the high

street due to the ease of parking and open air environments which,

in a post COVID-19 world, have been perceived as more pleasant and

safer places to shop. This effect has been felt quite acutely in

the growing demand for investment properties within the sector and

we expect the Company's recently purchased investments to benefit

accordingly.

We are attracted to assets located within established commercial

locations with low passing rents and particularly where values for

warehousing assets have been surpassed by those within the existing

use.

Retail represents 11.6% of the valuation and our retail assets

have performed weaker than the Benchmark, as Central London retail,

where we have no exposure, props up the Benchmark performance to

some extent.

Property Portfolio

The Company made four acquisitions during the year:

Arrow Point Retail Park, Shrewsbury

In May 2021, the Company acquired Arrow Point Retail Park in

Shrewsbury for a purchase price of GBP8.35 million. The established

retail park is located on a busy commercial estate and is fully

let. The estate provides a net initial yield of 8.7%, with low

passing rents compared with competing locations. It comprises a

modern purpose-built retail park constructed in 2007, arranged

across nine units with 176 car parking spaces, and is prominently

located within the main retail warehouse provision of Shrewsbury,

approximately 2.5 miles north east of the town centre.

Union Street, Bristol

In June 2021, the Company acquired 15-33 Union Street for a

purchase price of GBP10.2 million. 15-33 Union Street occupies a

prominent location in Bristol city centre, opposite The Galleries

Shopping Centre and near Cabot Circus, Bristol's premier retail

destination. Located on a busy thoroughfare for pedestrians, the

65,238 sq ft site experiences high footfall and is ideally suited

for retail or leisure units. Constructed in 2001, the property

currently comprises five purpose built split-level retail or

leisure units over four floors and road access to both Union Street

and Fairfax Street. Four of the five units are let to three

household names and a successful local retailer. The location of

the site has been identified as a major regeneration area and it

offers the ability for further growth through development.

Central Six Retail Park, Coventry

In November 2021, the Company completed the acquisition of the

11.9 acre Central Six Retail Park in Coventry for a purchase price

of GBP16.4 million. The purchase price reflects a net initial yield

of circa 11%, with an anticipated reversionary yield of circa 12.5%

and a capital value per sq ft of GBP110. The site occupies a

strategic and central location, approximately 0.7 miles away from

Coventry city centre and adjacent to Coventry Railway Station and

the Friargate Regeneration area. The retail park is highly

accessible and provides 148,765 sq ft of modern purpose-built

retail space with parking for 635 cars. Site coverage is low at

just 27%. Units are let to TK Maxx, Next, Boots, Sports Direct,

Burger King and Poundland. The site presents opportunities to add

value through active asset management by renewing current tenancies

and securing new tenants on the park. This purchase will be

accretive to the Company's income return and it is anticipated that

asset management initiatives will result in NAV growth over the

medium term.

Greyfriars Road, Cardiff

In February 2022, the Company completed the acquisition of PRYZM

nightclub in Cardiff for a purchase price of GBP3.6 million

reflecting GBP92 per sq ft. The purchase price represents a net

initial yield of 8%, with an anticipated reversionary yield of

circa 9%. The property is prominently located within the leisure

and late-night district of Cardiff city centre near the

Principality Stadium and St David's Shopping Centre. Cardiff

University and the University of Wales are located approximately

300m from the property, contributing to the total student

population of circa 75,000.

The property provides 39,469 sq ft of nightclub and bar

accommodation and is single-let to a subsidiary of Rekom UK

(formerly The Deltic Group), providing over 14 years' unexpired

lease term. Rekom UK is one of the largest specialist late-night

operators in the UK with 46 clubs and bars across a number of

brands. The nightclub trades as "PRYZM" and "Steinbeck &

Shaw".

The Company made two disposals during the year:

Langthwaite Business Park, South Kirkby

During August 2021, a sale of the Company's asset at Langthwaite

Business Park in South Kirkby was completed for a price of GBP10.84

million. The sale price achieved was 87% ahead of the purchase

price paid by the Company for the asset in Q4 2015.

No capital expenditure had been invested into the asset during

its hold period, however the tenant's lease had been extended and

rental levels increased by 13%. Throughout its hold period the

asset remained income producing with a minimum yield of 11% against

the purchase price.

Bessemer Road, Basingstoke

In October 2021, the Company completed on the sale of its

warehouse at Bessemer Road, Basingstoke for a price of GBP5.9

million, a 73% premium above the purchase price of GBP3.4 million

paid in Q1 2016.

No capital expenditure had been invested into the asset during

its hold period, however, prior to the sale, the tenant's lease had

been extended for a period of five years and rental levels

increased by 16%. Throughout its hold period the asset remained

income producing with a minimum yield of 9.8% against the purchase

price.

Asset Management Update

The Company completed the following material asset management

transactions during the period:

- Arrow Point Retail Park, Shrewsbury (retail warehousing) -

During Q2 2021, the Company completed an agreement with tenant

British Heart Foundation to push its November 2021 break option out

to December 2024 in return for four months' rent free. The majority

of the rent free was used to write off rent arrears predating the

Company's ownership.

- Diamond Business Park, Wakefield (industrial) - During Q2

2021, the Company completed a new five year lease at Unit 14

reflecting a rent of GBP3.75 per sq ft. The annual rental of

GBP41,866 pa sits 25% above the independently assessed March 2021

estimated rental value and six months' rent free was given as an

incentive. The lease was agreed outside of the provisions of the

Landlord and Tenant Act 1954 meaning that the Company benefits from

greater flexibility upon expiry of the lease.

- Bristol, 40 Queen Square (office) - During Q2 2021, the

Company completed a new five year lease to Brewin Dolphin at a rent

of GBP103,770 pa reflecting GBP30 per sq ft versus the previous

passing rent of GBP22 per sq ft and the March 2021 ERV of GBP26 per

sq ft. A 12 month rent free incentive was given.

- Vantage Point, Hemel Hempstead (office) - During Q3 2021, the

Company completed a new five-year lease to Netronix Integration

Limited at a rent of GBP33,683 pa reflecting GBP14.50 psf. The

rental level agreed reflects GBP3 per sq ft above valuers, ERV.

Four months' rent free incentive was given to the tenant who also

has the ability to bring the lease to an end at the expiry of three

years.

- Bristol, 40 Queen Square (office) - During Q3 2021, the

Company completed a lease renewal to Candide Limited until February

2025 at a rent of GBP30 psf, GBP116,970 pa. The previous passing

rent reflected GBP22.81 per sq ft and only 1.5 months' rent free

incentive was given.

- Sarus Court, Runcorn (industrial) - During Q3 2021, the

Company completed a 10 year lease renewal with tenant NTT United

Kingdom Limited, trading as Dimension Data. Rental income from the

lease was agreed at GBP5.75 per sq ft as compared to the previous

level of passing rent of GBP5.25 per sq ft. There is a tenant break

option in December 2025. Five months' rent free was given to the

tenant as an incentive.

- 15-33 Union Street, Bristol (Standard Retail) - During Q4

2021, the Company completed a new 15 year lease to Roxy Leisure

Limited, a "competitive social" leisure occupier, at a rent of

GBP181,000 pa reflecting GBP10 per sq ft. The lease provides for

five yearly RPI linked reviews, collared and capped at 1.5% and 4%

respectively. A 12-month rent free period was granted to the tenant

as an incentive along with a GBP300,000 capital contribution to the

tenant's fit out. On acquisition in June 2021, the 18,122 sq ft of

upper floor space was vacant, with the Company benefiting from a

12-month rental guarantee from the vendor of the asset with a value

of GBP190,000.

- Pearl House, Nottingham (Standard Retail) - During Q4 2021,

the Company completed the renewal of Cancer Research's lease for a

term of 5 years with a tenant break in year three, subject to a

break penalty equivalent to three months' rent. The rent agreed is

GBP21,000 pa. Three months' rent-free incentive was given to the

tenant.

- Above Bar Street, Southampton (Standard Retail) - During Q4

2021, the Company completed a new straight five year lease to Shoe

Zone at its property at 69 Above Bar Street. The transaction will

provide the Company with a rental income of GBP80,000 pa with 12

months' rent free incentive given to the tenant. The lease was

agreed outside of the provisions of the Landlord and Tenant Act

1954 meaning that the Company benefits from greater flexibility

upon expiry of the lease. The transaction exchanged during Q3 2021

and was subject to approximately GBP40,000 of landlord works which

have now been completed.

- Walkers Lane, St Helens (industrial) - During Q4 2021, the

Company reached agreement with tenant Kverneland in respect of its

October 2020 open market rent review. The review has been settled

at GBP389,000 pa reflecting GBP4.16 per sq ft and representing a

GBP89,000 pa increase above the prior passing rent.

- Westlands Distribution Park, Weston-Super-Mare (industrial) -

During Q4 2021, the Company completed a new letting to North

Somerset District Council at GBP20,000 pa, rising to GBP30,000 pa

in April 2022. The lease provides for five yearly upwards only rent

reviews to the higher of open market or RPI (capped at 1.5% per

annum) in 2027 and 2032. The lease expires in April 2037 with

mutual rolling break options in 2024, 2027 and 2032.

- Sarus Court, Runcorn (industrial) - During Q4 2021, the

Company completed a new 10 year lease to KMS (Europe) Ltd at a

headline rent of GBP6 per sq ft reflecting an annual rental income

of GBP95,000 pa. The letting set a new high rental tone for the

estate and far exceeds the prior passing rent of GBP4.83 per sq ft.

The incoming tenant was given the benefit of a 12-month rent free

period spread out over the first three years of the lease.

- Knowles Lane, Bradford (industrial) - During March 2022, the

Company settled the September 2021 open market rent review with

tenant, Pilkington United Kingdom Ltd, at our industrial unit in

Bradford. The agreed rent is GBP208,000 per annum reflecting

GBP4.50 per sq ft . The previous passing rent was GBP182,500 per

annum reflecting GBP3.95 per sq ft, representing a 14% increase

over a three-year period.

- Apollo Business Park, Basildon (industrial) - During March

2022, the Company completed a new 10-year letting at Unit 1 Apollo

Business Park, Basildon. The lease provides the tenant with a

five-year break option and offers six months' rent free. The

letting produces annual rental income of GBP240,750 and realises a

new headline rent of GBP8 per sq ft versus an expected market

rental value of GBP7 per sq. ft.

- First Avenue, Deeside (industrial) - In Q4 2021, incumbent

tenant, Magellan Aerospace (UK) Ltd, served notice to bring its

lease to an end on 1 April 2022. Discussions have been ongoing

since the service of the break notice to agree terms for a

short-term lease extension. This agreement has now been signed,

extending the tenant's occupation by six months. Upon completion of

the new lease, the tenant paid to the Company a dilapidations

settlement of GBP250,000, three months' rent up front at a rate of

GBP6 per sq ft (vs market rent value of GBP5.25 per sq ft and

previous passing rent of GBP3.75 per sq ft) and a single lease

premium of GBP50,000. The total capital receipt from the tenant

upon completion was GBP457,400 excluding VAT. The property

continues to be marketed.

- Bath Street, Glasgow (office) - During February 2022, the

Company received confirmation that planning consent had been

granted for the demolition and development of a 527-unit student

accommodation scheme at 225 Bath Street in Glasgow city centre.

This follows the exchange of contracts for the sale of the site

with a subsidiary company of IQ Student Accommodation in October

2020. The sale of 225 Bath Street is expected to complete after the

standard three-month judicial review period.

Once the sale of Bath Street completes, occupancy within the

portfolio is expected to increase by just over 4% with a

corresponding decrease in the Company's costs and associated

increase in income once sale proceeds have been reinvested.

Earnings are then expected to normalise at a level much closer to

the Company's long-term target.

Vacancy

The portfolio's overall vacancy level now sits at 5.42%,

excluding vacancy contributed by the asset at 225 Bath Street,

Glasgow, which as discussed above, has now been exchanged for sale

for alternative use redevelopment. As a condition of the sale

agreement, full vacancy had to be achieved in the building before

the sale could be completed. Including this asset, overall vacancy

is 10.69%.

Financial Results

The Company's Net Asset Value as at 31 March 2022 was GBP191.10

million or 120.63 pps (31 March 2021: GBP157.08 million or 99.15

pps). This is an increase of 21.48 pps or 21.7% over the year, with

the underlying movement in NAV set out in the table below:

Pps

NAV as at 1 April 2021 99.15

Portfolio acquisition costs (1.60)

Profit on sale of investments 1.80

Capital expenditure (0.49)

Valuation changes in property

portfolio 22.49

Valuation change in derivatives 0.48

Income earned for the period 10.87

Expenses for the period (4.07)

Interim dividend paid (8.00)

NAV as at 31 March 2022 120.63

EPRA earnings per share for the period was 6.79 pps which, based

on dividends paid of 8.00 pps, reflects a dividend cover of 84.88%.

The increase in dividend cover compared to the prior 12-month

period has largely arisen due to improvements in rent collection

levels, along with successful legal outcomes that have recovered

significant arrears. Income across the tenancy profile has remained

largely intact. Collection rates have reached 99% for both the

March 2022 and June 2022 quarters, with further payments expected

to be received under longer term payment plans; of the outstanding

arrears, GBP0.76 million has been provided for expected credit

losses.

Financing

As at 31 March 2022, the Company had a GBP60.00 million loan

facility with RBSi, which was due to be in place until October

2023, the details of which are presented below:

31 March 2022 31 March 2021

----------------- -----------------

Facility GBP60.00 million GBP60.00 million

Drawn GBP54.00 million GBP39.50 million

Gearing (Loan to NAV) 28.26% 25.15%

Interest rate 2.20% all-in 1.44% all-in

(SONIA +1.4%) (LIBOR +1.4%)

Notional Value of

Loan Balance Hedged 95% 130.4%

Due to GBP LIBOR ending at the end of 2021, the Company

transitioned to SONIA on 20 July 2021, with a credit adjustment

spread of 0.0981%. Post year-end, the Company secured a new

GBP60.00 million, five-year term loan facility with AgFe. See above

for further detail .

Property Portfolio

Summary by Sector as at 31 March 2022

Gross Gross Like- Like-

WAULT passing passing for-like for-like

Number Vacancy to rental rental Rental rental rental

of Valuation Area by ERV break income income ERV ERV income growth growth

Sector assets (GBPm) (sq ft) (%) (years) (GBPm) (GBPpsf) (GBPm) (GBPpsf) (GBPm) (GBPm) (%)

-------------- -------- ----------- ---------- --------- --------- -------- --------- -------- --------- -------- --------- ---------

Industrial 19 120.75 2,364,571 4.87 3.60 7.80 3.30 9.28 3.92 7.88 0.29 4.16

Office 5 43.28 251,812 31.59 3.88 1.58 6.27 3.64 14.47 1.74 (0.71) (28.89)

Retail

Warehouse 3 34.25 285,704 14.78 2.05 3.11 10.89 3.38 11.82 2.17 (0.01) (1.98)

Standard

Retail 6 24.98 237,792 2.53 5.03 2.58 10.87 2.33 9.79 2.59 (0.06) (3.19)

Alternatives 3 16.92 151,824 0.00 7.67 1.80 11.83 1.59 10.47 1.54 (0.05) (2.98)

-------- ----------- ---------- --------- --------- -------- --------- -------- --------- -------- --------- ---------

Portfolio 36 240.18 3,291,703 10.69 3.94 16.87 5.13 20.22 6.14 15.92 (0.54) (3.91)

-------- ----------- ---------- --------- --------- -------- --------- -------- --------- -------- --------- ---------

Summary by Geographical Area as at 31 March 2022

Gross Gross Like- Like-

WAULT passing passing for-like for-like

Number Vacancy to rental rental Rental rental rental

Geographical of Valuation Area by ERV break income income ERV ERV income growth growth

area assets (GBPm) (sq ft) (%) (years) (GBPm) (GBPpsf) (GBPm) (GBPpsf) (GBPm) (GBPm) (%)

West Midlands 5 42.65 598,405 14.03 2.76 3.73 6.23 4.01 6.69 2.72 (0.12) (9.22)

South West 5 40.08 517,232 6.42 3.28 2.78 5.38 3.48 6.73 2.73 0.26 13.89

Yorkshire and

Humberside 7 38.02 791,858 6.75 2.44 2.23 2.81 3.33 4.20 2.54 (0.22) (8.77)

South East 4 27.90 137,026 5.01 5.06 1.36 9.91 1.72 12.57 1.85 (0.14) (8.07)

Eastern 5 26.90 344,339 0.00 2.19 1.99 5.78 2.12 6.16 1.85 0.19 11.51

Wales 3 23.13 415,607 0.00 7.50 1.76 4.24 1.84 4.43 1.35 0.00 0.12

North West 4 19.15 301,654 0.00 4.33 1.56 5.17 1.43 4.75 1.51 0.16 11.59

Rest of London 1 9.90 71,720 0.00 9.62 0.96 13.40 0.75 10.45 0.96 (0.04) (4.56)

Scotland 1 8.50 85,643 91.85 1.42 0.09 1.10 1.16 13.54 0.01 (0.64) (98.55)*

East Midlands 1 3.95 28,219 0.00 4.67 0.41 14.56 0.38 13.38 0.40 0.01 2.69

--------------- -------- ----------- ---------- --------- --------- -------- --------- -------- --------- -------- --------------- ---------

Portfolio 36 240.18 3,291,703 10.69 3.94 16.87 5.13 20.22 6.14 15.92 (0.54) (3.91)

--------------- -------- ----------- ---------- --------- --------- -------- --------- -------- --------- -------- --------------- ---------

* Excluding the vacancy from 225 Bath Street Glasgow, which has

exchanged to be sold with the condition of vacant possession, the

vacancy rate is 5.42%.

Properties by Market Value as at 31 March 2022

Sector weighting by valuation - high industrial weighting and

low exposure to retail

Sector Percentage

Industrial 50%

Offices 18%

Standard Retail 11%

Alternative 7%

Retail Warehouse 14%

Geographical weighting by valuation - highly diversified across

the UK

Region Percentage

Yorkshire and

Humberside 16%

South East 11%

Eastern 11%

South West 17%

West Midlands 18%

East Midlands 2%

North West 8%

Wales 10%

Rest of London 4%

Scotland 3%

Properties by Market Value as at 31 March 2022

Market Value

Property Sector Region Range (GBPm)

Top 10:

1. Central Six Retail Park, Retail Warehouses West Midlands 15.0 - 20.0

Coventry

2. Eastpoint Business Park, Offices South East 15.0 - 20.0

Oxford

3. Gresford Industrial Estate, Industrial Wales 10.0 - 15.0

Wrexham

4. 40 Queen Square, Bristol Offices South West 10.0 - 15.0

5. Lockwood Court, Leeds Industrial Yorkshire 10.0 - 15.0

and Humberside

6. 15-33 Union Street, Bristol Standard Retail South West 10.0 - 15.0

7. London East Leisure Park, Alternatives Rest of London 7.5 - 10.0

Dagenham

8. Arrow Point Retail Park, Retail Warehouses West Midlands 7.5 - 10.0

Shrewsbury

9. Apollo Business Park, Basildon Industrial Eastern 7.5 - 10.0

10. 225 Bath Street, Glasgow Offices Scotland 7.5 - 10.0

The Company's top 10 properties listed above comprise 49.4%

(2021: 49.7%) of the total value of the portfolio.

Market

Value

Range

Property Sector Region (GBPm)

11. Sarus Court, Runcorn Industrial North West 7.5 - 10.0

12. Storey's Bar Road, Peterborough Industrial Eastern 7.5 - 10.0

13. Euroway Trading Estate, Bradford Industrial Yorkshire 5.0 - 7.5

and Humberside

14. Westlands Distribution Park, Industrial South West 5.0 - 7.5

Weston Super Mare

15. Brockhurst Crescent, Walsall Industrial West Midlands 5.0 - 7.5

16. Barnstaple Retail Park, Barnstaple Retail Warehouses South West 5.0 - 7.5

17. Walkers Lane, St Helens Industrial North West 5.0 - 7.5

18. Deeside Industrial Park, Deeside Industrial Wales 5.0 - 7.5

19. Diamond Business Park, Wakefield Industrial Yorkshire 5.0 - 7.5

and Humberside

20. Mangham Road, Rotherham Industrial Yorkshire < 5.0

and Humberside

21. 710 Brightside Lane, Sheffield Industrial Yorkshire < 5.0

and Humberside

22. Oak Park, Droitwich Industrial West Midlands < 5.0

23. Pipps Hall Industrial Estate, Industrial Eastern < 5.0

Basildon

24. Pearl House, Nottingham Standard Retail East Midlands < 5.0

25. Eagle Road, Redditch Industrial West Midlands < 5.0

26. Cedar House, Gloucester Offices South West < 5.0

27. PRYZM, Cardiff Alternatives Wales < 5.0

28. 69-75 Above Bar Street, Southampton Standard Retail South East < 5.0

29. Clarke Road, Milton Keynes Industrial South East < 5.0

30. Odeon Cinema, Southend-on-Sea Alternatives Eastern < 5.0

31. Bridge House, Bradford Industrial Yorkshire < 5.0

and Humberside

32. Commercial Road, Portsmouth Standard Retail South East < 5.0

33. Pricebusters Building, Blackpool Standard Retail North West < 5.0

34. Vantage Point, Hemel Hempstead Offices Eastern < 5.0

35. Moorside Road, Swinton Industrial North West < 5.0

36. 11/15 Fargate, Sheffield Standard Retail Yorkshire < 5.0

and Humberside

Top 10 Tenants as at 31 March 2022

% of

Portfolio

Passing Total

Rental Passing

Income Rental

Tenant Sector Property (GBP'000) Income

Gresford Industrial

1. Plastipak UK Ltd Industrial Estate, Wrexham 883 5.2

2. Sports Direct Retail Various 678 4.0

3. Wyndeham Group Industrial Wyndeham, Peterborough 644 3.8

4. Poundland Limited Retail Various 631 3.7

London East Leisure

5. Mecca Bingo Ltd Leisure Park, Dagenham 625 3.7

Harrogate Spring

6. Water Limited Industrial Lockwood Court, Leeds 603 3.6

Magellan Aerospace

7. (UK) Ltd Industrial Excel 95, Deeside 580 3.4

8. Odeon Cinemas Leisure Victoria Circus, Southend-on-Sea 535 3.2

15-33 Union Street,

9. Wilko Retail Limited Retail Bristol 481 2.9

Advanced Supply Euroway Trading Estate,

10. Chain (BFD) Ltd Industrial Bradford 467 2.8

The Company's top ten tenants, listed above, represent 36.3%

(2021: 38.8%) of the total passing rental income of the

portfolio.

Alternative Investment Fund Manager ('AIFM')

AEW UK Investment Management LLP is authorised and regulated by

the FCA as a full-scope AIFM and provides its services to the

Company.

The Company has appointed Langham Hall UK Depositary LLP

('Langham Hall') to act as the depositary to the Company,

responsible for cash monitoring, asset verification and oversight

of the Company.

Information Disclosures under the AIFM Directive

Under the AIFM Directive, the Company is required to make

disclosures in relation to its leverage under the prescribed

methodology of the Directive.

Leverage

The AIFM Directive prescribes two methods for evaluating

leverage, namely the 'Gross Method' and the 'Commitment Method'.

The Company's maximum and actual leverage levels are as per

below:

31 March 2022 31 March 2021

Commitment Gross Commitment

Leverage Exposure Gross Method Method Method Method

------------------- ------------- ----------- -------- -----------

Maximum Limit 140% 140% 140% 140%

Actual 125% 129% 114% 125%

In accordance with the AIFM Directive, leverage is expressed as

a percentage of the Company's exposure to its NAV and adjusted in

line with the prescribed 'Gross' and 'Commitment' methods. The

Gross method is representative of the sum of the Company's

positions after deducting cash balances and without taking into

account any hedging and netting arrangements. The Commitment method

is representative of the sum of the Company's positions without

deducting cash balances and taking into account any hedging and

netting arrangements. For the purposes of evaluating the methods

above, the Company's positions primarily reflect its current

borrowings and NAV.

Remuneration

The AIFM has adopted a Remuneration Policy which accords with

the principles established by AIFMD. AIFMD Remuneration Code Staff

includes the members of the AIFM's Management Committee, those

performing Control Functions, Department Heads, Risk Takers and

other members of staff that exert material influence on the AIFM's

risk profile or the AIFs it manages.

Staff are remunerated in accordance with the key principles of

the firm's remuneration policy, which include:

(1) promoting sound risk management;

(2) supporting sustainable business plans;

(3) remuneration being linked to non-financial criteria for

Control Function staff;

(4) incentivising staff performance over long periods of

time;

(5) awarding guaranteed variable remuneration only in

exceptional circumstances; and

(6) having an appropriate balance between fixed and variable

remuneration.

As required under section 'Fund 3.3.5.R(5)' of the Investment

Fund Sourcebook, the following information is provided in respect

of remuneration paid by the AIFM to its staff for the year ended 31

December 2021.

Year ended

31 December

2021

-------------

Total remuneration paid to employees during financial

year:

a) remuneration, including, where relevant, any

carried interest paid by the AIFM 2,938,680

b) the number of beneficiaries 30

The aggregate amount of remuneration of the AIFM

Remuneration Code staff, broken down by:

a) senior management GBP753,900

b) members of staff GBP2,184,780

Fixed Variable Total

remuneration remuneration remuneration

-------------- -------------- --------------

Senior management GBP681,900 GBP72,000 GBP753,900

Staff GBP1,615,193 GBP569,587 GBP2,184,780

-------------- -------------- --------------

Total GBP2,297,093 GBP641,587 GBP2,938,680

-------------- -------------- --------------

Fixed remuneration comprises basic salaries and variable

remuneration comprises bonuses.

AEW UK Investment Management LLP

21 June 2022

FURTHER INFORMATION

AEW UK REIT PLC's annual report and accounts for the year ended

31 March 2022 (which includes the notice of meeting for the

Company's AGM) will be available today on www.aewukreit.com.

It will also be submitted shortly in full unedited text to the

Financial Conduct Authority's National Storage Mechanism and will

be available for inspection at

data.fca.org.uk/#/nsm/nationalstoragemechanism in accordance with

DTR 6.3.5(1A) of the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules.

LEI: 21380073LDXHV2LP5K50

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUAAQUPPGMG

(END) Dow Jones Newswires

June 22, 2022 02:00 ET (06:00 GMT)

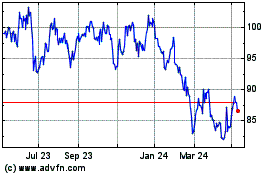

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Mar 2024 to Apr 2024

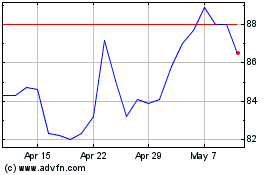

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Apr 2023 to Apr 2024