TIDMAEXG

RNS Number : 5415O

AEX Gold Inc

10 February 2021

("AEX" or the "Company")

AEX Provides an Update on its Nalunaq Development

TORONTO, ONTARIO - February 10, 2021 - AEX Gold Inc. (AIM: AEXG;

TSXV: AEX), provides an update on development plans at its Nalunaq

property in South Greenland.

As previously disclosed, AEX is planning the redevelopment of

the Nalunaq mine with the objective of first gold pour by the end

of 2021. In January 2021, the government of Greenland implemented a

temporary travel ban, initially effective until at least the end of

February 2021, although as with many other countries in the world

there is a risk that this could be extended.

The development of Nalunaq is dependent on the Company being

able to access the entirety of the property with a significant

number of both externally contracted and locally sourced labour.

Given the travel restrictions, there can be no certainty that the

Company will be able to deploy the sizeable workforce necessary to

complete the development of the project and meet the timeframes

initially envisaged.

Furthermore, as part of the Company's detailed planning prior to

deploying the greater part of the Nalunaq development programme,

the project budget has incurred a number of areas of very

significant cost increase, many related to the increased cost of

logistics as result of the COVID pandemic, as well as widespread

and material inflation relating to mining activities and equipment,

resulting from the positive commodity price dynamic globally.

Whilst the project's contingencies were intended to cover such cost

overruns, in addition to the above cost increases, there are two

notable areas of specific overrun, which in aggregate would require

further external capital to resolve.

Firstly, AEX has selected the inclusion of a flotation circuit

as a low cost and highly value accretive secondary recovery process

targeting a recovery rate of 91-97%, increasing the previous

recovery rate from 65-70%. This process has significant economic

and ESG benefits for the mine. It does however require a change in

civil engineering requirements.

Secondly, AEX has engaged an external consultant to assess

various aspects of the mine, including the structural stability of

a concrete bulkhead located near the main portal inside the mine.

This bulkhead supports historic tailings left by the previous

operator and retains the tailings within an underground tailings

storage facility. The bulkhead has been assessed as being unsafe

and the Board has resolved that it cannot proceed with its previous

development plan until this is rectified. Whilst the Board does not

consider this to be a major project in its own right, in light of

COVID related restrictions to the movement of personnel, it

represents a material risk to the successful completion of the

summer 2021 development programme. It would also have the effect of

delaying production and reducing initial head grade, with a

consequent drop in early stage revenue.

With approximately C$13 million committed to long lead items to

date, some of which may be recoverable, and approximately C$58

million of cash on hand, the Board has assessed that the fluidity

of both the operational risks and variability in costs is too great

to warrant committing the bulk of the Company's available liquidity

in a timeframe that would permit the Company's current development

schedule to be met. Accordingly, the decision to proceed with the

development has been deferred.

AEX's planned exploration programme, staffed principally by

local contractors and staff, and planned to capitalise on the

recent success of the 2020 exploration programme, is not expected

to be impacted by current COVID related restrictions.

Management is reviewing various scenarios and will commence a

short period of consultation with shareholders and provide an

update in due course.

Eldur Olafsson, CEO of AEX, commented:

"The Board has taken the difficult but ultimately prudent

decision to defer development and gold production from Nalunaq

until such time as the current pandemic subsides and the Company is

able to make an accurate assessment of costs and schedule.

"AEX's intention is unwavering in executing its objective to

maximise value from its vast southern Greenland gold licences. The

potential to add a flotation circuit is an example of adding

significant value through increasing recovery rates. Whilst we

would prefer not to defer the development schedule this is a

necessary action in the context of our current circumstances. We

will now engage our shareholders as part of the process in

developing the forward plan and report to all shareholders in due

course."

Enquiries:

AEX Gold Inc.

Eddie Wyvill, Investors Relations +44 7713 126727

ew@aexgold.com

Eldur Olafsson, Director and CEO +354 665 2003

eo@aexgold.com

Stifel Nicolaus Europe Limited (Nominated +44 (0) 20 7710

Adviser and Broker) 7600

Callum Stewart

Simon Mensley

Ashton Clanfield

+44 (0) 20 3757

Camarco (Financial PR) 4980

Gordon Poole

Nick Hennis

Further Information:

About AEX

AEX's principal business objectives are the identification,

acquisition, exploration and development of gold properties in

Greenland. The Company's principal asset is a 100% interest in the

Nalunaq Project, an advanced exploration stage property with an

exploitation license including the previously operating Nalunaq

gold mine. The Company has a portfolio of gold assets covering 3870

km(2) , the largest portfolio of gold assets in Southern Greenland

covering the two known gold belts in the region. AEX is

incorporated under the Canada Business Corporations Act and wholly

owns Nalunaq A/S, incorporated under the Greenland Public Companies

Act.

Forward-Looking Information

This press release contains forward-looking information within

the meaning of applicable securities legislation, which reflects

the Company's current expectations regarding future events and the

future growth of the Company's business. In this press release

there is forward-looking information based on a number of

assumptions and subject to a number of risks and uncertainties,

many of which are beyond the Company's control, that could cause

actual results and events to differ materially from those that are

disclosed in or implied by such forward-looking information. Such

risks and uncertainties include, but are not limited to the factors

discussed under "Risk Factors" in the Final Prospectus available

under the Company's profile on SEDAR at www.sedar.com. Any

forward-looking information included in this press release is based

only on information currently available to the Company and speaks

only as of the date on which it is made. Except as required by

applicable securities laws, the Company assumes no obligation to

update or revise any forward-looking information to reflect new

circumstances or events. No securities regulatory authority has

either approved or disapproved of the contents of this press

release. Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Inside Information

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014, and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSSIEDUEFSEIE

(END) Dow Jones Newswires

February 10, 2021 02:00 ET (07:00 GMT)

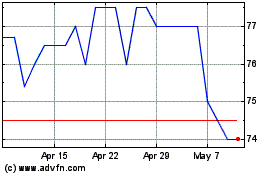

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024