TIDMAEXG

RNS Number : 9613Z

AEX Gold Inc

27 May 2021

("AEX" or the "Corporation")

AEX Gold Inc. Reports First Quarter Financial Results

TORONTO, ONTARIO - MAY 27, 2021 - AEX Gold Inc. (AIM: AEXG;

TSXV: AEX), an independent gold company with a portfolio of gold

licences in Greenland, announces its unaudited condensed interim

consolidated financial statements ("Financial Statements") for the

first quarter ended March 31, 2021. All figures are in Canadian

dollars unless otherwise noted.

The Financial Statements and the accompanying Management

Discussion and Analysis are available on the Corporation's website

at www.aexgold.com and will be filed under the Corporation's SEDAR

profile at

www.sedar.com later today .

At the time of the AIM listing AEX announced the development of

the Nalunaq Project of which the main engineering and constructing

activities commenced in Q4-2020. A large part of the cost increases

between Q1-2020 and Q1-2021 relate to the transition of AEX from an

exploration and evaluation focused company to a development and

exploration company post the AIM listing.

Financial Highlights

-- The Corporation had a strong cash balance of $55.0 million at

March 31, 2021 ($61.9 million at December 31, 2020), with no debt,

and total working capital of $54.3 million ($61.4 million at

December 31, 2020).

-- Capital asset purchase commitments, net of deposits on order

as at March 31, 2021 was $6.6 million. These commitments as

previously reported, relate to the purchase of components of

process plant equipment, infrastructure and vehicles. Available

liquidity, net of commitments as at March 31, 2021 was $47.7

million.

-- Construction in progress increased by $0.6 million in Q1-21

(zero at December 31, 2020) as a result of capitalized engineering

on the Nalunaq Project prior to suspension on February 10,

2021.

-- Exploration and evaluation expenses during the period were

$1.3 million (Q1 2020: $0.6 million), predominantly on the Nalunaq

Property.

-- General and administrative expenses during the period were

$1.6 million (Q1 2020: $0.4 million), with the increase a result of

higher management, consulting and professional fees associated with

right-sizing the organizational structure to develop Nalunaq.

Selected Financial Information

The following selected financial data is extracted from the

Financial Statements for the three months ended March 31, 2021.

Financial Results

Three months

ended March 31,

2021 2020

$ $

----------- ---------

Exploration and evaluation

expenses 1,247,147 611,775

General and administrative 1,585,071 382,911

Net loss and comprehensive

loss (3,289,052) (966,437)

Basic and diluted loss per

common share (0.02) (0.01)

----------- ---------

Financial Position

As at March 31, 2021 As at December 31,

2020

$ $

-------------------- ------------------

Cash on hand 55,012,910 61,874,999

Total assets 62,868,344 65,944,682

Total current liabilities 1,109,749 897,799

Shareholders' equity 60,993,918 64,282,970

Working capital 54,318,593 61,411,208

-------------------- ------------------

Corporate and Operational Update

-- The tender process for the Internal 3(rd) party engineering

study is well under way with most interested parties having access

to the Nalunaq Project data room. The internal 3(rd) party

engineering study will advance the process plant cost, supporting

infrastructure cost and schedule to a AACE International

Recommended Practice No. 18R-97 (2005) Class I estimate, with

planned completion later this year.

-- Critical contracts to advance the 2021 exploration and

limited infrastructure 'early works' program have been signed and

work is expected to commence in early June.

-- In relation to permitting the Terms of Reference for the

Environmental Impact Assessment ("EIA") and Social Impact

Assessment ("SIA") were approved for public consultation with

various Greenlandic Stakeholders. The draft SIA and draft EIA

reports are in the process of being reviewed by the

Authorities.

Eldur Olafsson, CEO of AEX, commented:

"With strong liquidity and improved access to Greenland we are

looking forward to the commencement of the exploration program this

year while also setting ourselves up for the revised development

plan for Nalunaq."

Enquiries:

AEX Gold Inc.

Jaco Crouse, Director and CFO

1-416-271-4767

jc@aexgold.com

Eldur Olafsson, Director and CEO

+354 665 2003

eo@aexgold.com

Stifel Nicolaus Europe Limited (Nominated Adviser and

Broker)

Callum Stewart

Simon Mensley

Ashton Clanfield

+44 (0) 20 7710 7600

Camarco (Financial PR)

Gordon Poole

Nick Hennis

+44 (0) 20 3757 4980

AEX Gold Inc: Unaudited Condensed Interim Consolidated Financial

Statements for the Three Months Ended March 31, 2021

AEX Gold Inc.

Consolidated Statements of Financial Position

( Unaudited, i n Canadian Dollars)

As at As at December

March 31, 31,

Notes 2021 2020

-------------------------------------------- ----- ------------ ---------------

$ $

ASSETS

Current assets

Cash 55,012,910 61,874,999

Sales tax receivable 67,754 62,750

Prepaid expenses and others 347,678 371,258

Total current assets 55,428,342 62,309,007

Non-current assets

Deposit on order 4 5,018,556 1,711,970

Escrow account for environmental monitoring 435,328 460,447

Mineral properties 3 62,244 62,244

Capital assets 4 1,923,874 1,401,014

Total non-current assets 7,440,002 3,635,675

-------------------------------------------- ----- ------------ ---------------

TOTAL ASSETS 62,868,344 65,944,682

-------------------------------------------- ----- ------------ ---------------

LIABILITIES AND EQUITY

Current liabilities

Trade and other payables 1,060,781 831,899

Lease liabilities - current portion 5 48,968 65,900

-------------------------------------------- ----- ------------ ---------------

Total current liabilities 1,109,749 897,799

Non-current liabilities

Lease liabilities 5 764,677 763,913

Total non-current liabilities 764,677 763,913

Total liabilities 1,874,426 1,661,712

Equity

Capital stock 88,500,205 88,500,205

Contributed surplus 2,925,952 2,925,952

Accumulated other comprehensive loss (36,772) (36,772)

Deficit (30,395,467) (27,106,415)

-------------------------------------------- ----- ------------ ---------------

Total equity 60,993,918 64,282,970

-------------------------------------------- ----- ------------ ---------------

TOTAL LIABILITIES AND EQUITY 62,868,344 65,944,682

-------------------------------------------- ----- ------------ ---------------

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

AEX Gold Inc.

Consolidated Statements of Comprehensive Loss

( Unaudited, i n Canadian Dollars)

Three months

ended March 31,

----------------------------------------- ----- -----------------------

Notes 2021 2020

----------------------------------------- ----- ----------- ----------

$ $

Expenses

Exploration and evaluation expenses 7 1,247,147 611,775

General and administrative 8 1,585,071 382,911

Foreign exchange loss (gain) 490,599 (25,397)

Operating loss 3,322,817 969,289

Other expenses (income)

Interest income (44,070) (5,042)

Finance costs 10,305 2,190

----------------------------------------- ----- ----------- ----------

Net loss and comprehensive loss (3,289,052) (966,437)

----------------------------------------- ----- ----------- ----------

Weighted average number of common shares

outstanding - basic and diluted 177,098,737 73,438,570

Basic and diluted loss per common share (0.02) (0.01)

----------------------------------------- ----- ----------- ----------

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

AEX Gold Inc.

Consolidated Statements of Changes in Equity

( Unaudited, i n Canadian Dollars)

Accumulated

Number of other

common shares Capital Contributed comprehensive Total

Notes outstanding Stock Warrants surplus loss Deficit Equity

-------------- -------- -------------- ---------- --------- ----------- ------------- ------------ -----------

$ $ $ $ $ $

Balance at January 1,

2020 70,946,394 13,883,611 1,459,604 1,535,400 (36,772) (14,767,303) 2,074,540

Net loss and

comprehensive

loss - - - - - (966,437) (966,437)

Warrants exercised 8,399,556 4,506,143 (726,343) - - - 3,779,800

------------------------ -------------- ---------- --------- ----------- ------------- ------------ -----------

Balance at March 31,

2020 79,345,950 18,389,754 733,261 1,535,400 (36,772) (15,733,740) 4,887,903

------------------------ -------------- ---------- --------- ----------- ------------- ------------ -----------

Balance at January 1,

2021 177,098,737 88,500,205 - 2,925,952 (36,772) (27,106,415) 64,282,970

Net loss and

comprehensive

loss - - - - - (3,289,052) (3,289,052)

------------------------ -------------- ---------- --------- ----------- ------------- ------------ -----------

Balance at March 31,

2021 177,098,737 88,500,205 - 2,925,952 (36,772) (30,395,467) 60,993,918

------------------------ -------------- ---------- --------- ----------- ------------- ------------ -----------

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

AEX Gold Inc.

Consolidated Statements of Cash Flows

( Unaudited, i n Canadian Dollars)

Three months

Notes ended March 31,

------------------------------------------------ ----- ----------------------

2021 2020

------------------------------------------------ ----- ----------- ---------

$ $

Operating activities

Net loss for the period (3,289,052) (966,437)

Adjustments for:

Depreciation 4 71,862 57,158

Finance costs - 2,190

Foreign exchange loss (gain) 504,799 (25,246)

------------------------------------------------ ----- ----------- ---------

(2,712,391) (932,335)

Changes in non-cash working capital items:

Sales tax receivable (5,004) (15,520)

Prepaid expenses and others 23,580 80,424

Trade and other payables 96,077 90,348

------------------------------------------------ ----- ----------- ---------

114,653 155,252

------------------------------------------------ ----- ----------- ---------

Cash flow used in operating activities (2,597,738) (777,083)

------------------------------------------------ ----- ----------- ---------

Investing activities

Acquisition of mineral properties 3 - (978)

Acquisition of capital assets 4 (594,722) -

Deposit on order 4 (3,306,586) -

Cash flow used in investing activities (3,901,308) (978)

------------------------------------------------ ----- ----------- ---------

Financing activities

Principal repayment - lease liabilities 5 (16,168) -

Exercise of warrants - 3,779,800

Deferred share issuance costs - (153,423)

Cash flow from financing activities (16,168) 3,626,377

------------------------------------------------ ----- ----------- ---------

Net change in cash before effects of exchange

rate changes on cash during the period (6,515,214) 2,848,316

Effects of exchange rate changes on cash (346,875) 3,051

------------------------------------------------ ----- ----------- ---------

Net change in cash during the period (6,862,089) 2,851,367

Cash, beginning of period 61,874,999 1,515,406

------------------------------------------------ ----- ----------- ---------

Cash, end of period 55,012,910 4,366,773

------------------------------------------------ ----- ----------- ---------

Supplemental cash flow information

Interest received 44,070 5,042

Acquisition of mineral properties included in

trade and other payables - 6,370

Exercise of warrants credited to capital stock - 726,343

Deferred share issuance costs included in trade

and other payables - 506,967

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

AEX Gold Inc.

Condensed Notes to the interim Consolidated Financial

Statements

Three months ended March 31, 2021 and 2020

( Unaudited, i n Canadian Dollars)

1. NATURE OF OPERATIONS, BASIS OF PRESENTATION

AEX Gold Inc. (the "Corporation") was incorporated on February

22, 2017 under the Canada Business Corporations Act. The

Corporation's head office is situated at 3400, One First Canadian

Place, P.O. Box 130, Toronto, Ontario, M5X 1A4, Canada. The

Corporation operates in one industry segment, being the

acquisition, exploration and development of mineral properties. It

owns interests in properties located in Greenland. The

Corporation's financial year ends on December 31. Since July 2017,

the Corporation's shares are listed on the TSX Venture Exchange

(the "TSX-V") under the AEX ticker and since July 2020, the

Corporation's shares are also listed on the AIM market of the

London Stock Exchange ("AIM") under the AEXG ticker.

These unaudited condensed interim consolidated financial

statements for the three months ended March 31, 2021 ("Financial

Statements") were approved by the Board of Directors on May 26,

2021.

1.1 Basis of presentation

The Financial Statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") as issued by

the International Accounting Standards Board ("IASB") including

International Accounting Standard ("IAS") 34, Interim Financial

Reporting. The Financial Statements have been prepared under the

historical cost convention.

The Financial Statements should be read in conjunction with the

annual financial statements for the year ended December 31, 2020

which have been prepared in accordance with IFRS as issued by the

IASB. The accounting policies, methods of computation and

presentation applied in these Financial Statements are consistent

with those of the previous financial year ended December 31,

2020.

During the 2020 year, an outbreak of a new strain of coronavirus

(COVID-19) resulted in a major global health crisis which continues

to have impacts on the global economy and the financial markets at

the date of completion of the Financial Statements. These events

may cause significant changes on the Corporation's ability to

complete planned exploration and evaluation activities in the

future, meet its other obligations and existing commitments for the

exploration and evaluation programs or our ability to obtain debt

and equity financing. Following these events, the Corporation has

taken and will continue to take action to minimize the impact of

the COVID-19 pandemic. However, it is impossible to ultimately

determine the financial implications of these events.

2. CRITICAL ACCOUNTING JUDGMENTS AND ASSUMPTIONS

The preparation of the Financial Statements requires Management

to make judgments and form assumptions that affect the reported

amounts of assets and liabilities at the date of the Financial

Statements and reported amounts of expenses during the reporting

period. On an ongoing basis, Management evaluates its judgments in

relation to assets, liabilities and expenses. Management uses

historical experience and various other factors it believes to be

reasonable under the given circumstances as the basis for its

judgments. Actual outcomes may differ from these estimates under

different assumptions and conditions.

In preparing the Financial Statements, the significant

judgements made by Management in applying the Corporation

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the Corporation's audited

annual financial statements for the year ended December 31, 2020.

Estimates and assumptions are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

3. MINERAL PROPERTIES

As at December

31, 2020 As at March 31,

Additions 2021

------------------------- -------------- --------- ---------------

$ $ $

Nalunaq 1 - 1

Tartoq 18,431 - 18,431

Vagar 11,103 - 11,103

Naalagaaffiup Portornga 6,334 - 6,334

Nuna Nutaaq 6,076 - 6,076

Saarloq 7,348 - 7,348

Anoritooq 6,389 - 6,389

Kangerluarsuk 6,562 - 6,562

Total mineral properties 62,244 - 62,244

------------------------- -------------- --------- ---------------

.

As at As at

December December

31, 31,

2019 Additions 2020

-------------------------- --- ---------- ---------- ----------

$ $ $

Nalunaq 1 - 1

Tartoq 18,431 - 18,431

Vagar 11,103 - 11,103

Naalagaaffiup Portornga 6,334 - 6,334

Nuna Nutaaq 6,076 - 6,076

Saarloq - 7,348 7,348

Anoritooq - 6,389 6,389

Kangerluarsuk - 6,562 6,562

Total mineral properties 41,945 20,299 62,244

------------------------------- ---------- ---------- ----------

4. CAPITAL ASSETS

Field Vehicles Equipment Construc-tion Right-of-use Total

equipment and rolling (including In Progress assets

and infrastruc- stock intangible)

ture

$ $ $ $ $ $

-------------------------- ----------------- ------------- ------------- -------------- ------------- ----------

Three months ended

March 31, 2021

Opening net book

value 146,203 256,865 177,052 - 820,894 1,401,014

Additions - - - 594,722 - 594,722

Depreciation (30,611) (15,805) (5,260) - (20,186) (71,862)

-------------------------- ----------------- ------------- ------------- -------------- ------------- ----------

Closing net book

value 115,592 241,060 171,792 594,722 800,708 1,923,874

As at March 31,

2021

Cost 387,323 533,800 185,878 594,722 841,080 2,542,803

Accumulated depreciation (271,731) (292,740) (14,086) - (40,372) (618,929)

-------------------------- ----------------- ------------- ------------- -------------- ------------- ----------

Closing net book

value 115,592 241,060 171,792 594,722 800,708 1,923,874

-------------------------- ----------------- ------------- ------------- -------------- ------------- ----------

4. CAPITAL ASSETS (CONT'D)

Depreciation of capital assets related to exploration and

evaluation properties is being recorded in exploration and

evaluation expenses in the consolidated statement of comprehensive

loss, under depreciation. Depreciation of $49,316 ($57,158 for the

three months ended March 31, 2020) was expensed as exploration and

evaluation expenses during the three months ended March 31,

2021.

As at March 31, 2021, the Corporation had capital asset purchase

commitments, net of deposit on order, of $6,597,326. These

commitments relate to purchases of equipment, infrastructure and

vehicles.

5. LEASE LIABILITIES

As at

March 31

2021

---------------------------------------- ------------

$

Balance beginning 829,813

Principal repayment (16,168)

---------------------------------------- ------------

Balance ending 813,645

Non-current portion - lease liabilities (764,677)

Current portion - lease liabilities 48,968

---------------------------------------- ------------

6. STOCK OPTIONS

An incentive stock option plan (the "Plan") was approved

initially in 2017 and renewed by shareholders on June 17, 2020. The

Plan is a "rolling" plan whereby a maximum of 10% of the issued

shares at the time of the grant are reserved for issue under the

Plan to executive officers and directors, employees and

consultants. The Board of directors attributes the stock options

and the exercise price of the options shall not be less than the

closing price on the last trading day preceding the grant date. The

options have a maximum term of ten years. Options granted pursuant

to the Plan shall vest and become exercisable at such time or times

as may be determined by the Board, except options granted to

consultants providing investor relations activities shall vest in

stages over a 12 month period with a maximum of one-quarter of the

options vesting in any three-month period. The Corporation has no

legal or constructive obligation to repurchase or settle the

options in cash.

Changes in stock options are as follows:

Three months ended Year ended December 31,

March 31, 2021 2020

------------------- ---------------------------- ----------------------------

Weighted Weighted

Number of average exercise Number of average exercise

options price options price

------------------- --------- ----------------- --------- -----------------

$ $

Balance, beginning 7,745,000 0.51 5,650,000 0.43

Granted - - 2,195,000 0.70

Exercised - - (100,000) 0.38

Balance, end 7,745,000 0.51 7,745,000 0.51

------------------- --------- ----------------- --------- -----------------

6. STOCK OPTIONS (CONT'D)

Stock options outstanding and exercisable as at March 31, 2021

are as follows:

Number of options

outstanding and Exercise

exercisable price Expiry date

----------------- -------- -----------------

$

1,360,000 0.50 July 13, 2022

1,660,000 0.45 August 22, 2023

2,530,000 0.38 December 31, 2025

2,195,000 0.70 December 31, 2026

----------------- -------- -----------------

7,745,000

----------------- -------- -----------------

7. EXPLORATION AND EVALUATION EXPENSES

Three months

ended March 31,

------------------------------------ ---------------------

2021 2020

------------------------------------ ----------- --------

$ $

Geology 143,538 270,561

Underground works - 22,807

Drilling - (635)

Analysis 79,219 23,863

Transport 957 60,733

Logistic support 21,202 78,487

Insurance 8,663 1,226

Maintenance infrastructure 931,866 84,854

Government fees 12,386 12,721

Depreciation 49,316 57,158

-------------------------------------- ----------- --------

Exploration and evaluation expenses 1,247,147 611,775

-------------------------------------- ----------- --------

8. GENERAL AND ADMINISTRATION

Three months

ended March 31,

----------------------------------- -------------------

2021 2020

----------------------------------- ---------- -------

$ $

Salaries and benefits 387,508 -

Management and consulting fees - 116,072

Director's fees 119,500 25,000

Professional fees 556,355 123,755

Marketing and industry involvement 165,723 86,375

Insurance 117,965 10,561

Travel and other expenses 130,209 14,574

Regulatory fees 85,265 6,574

Depreciation 22,546 -

------------------------------------- ---------- -------

General and administration 1,585,071 382,911

------------------------------------- ---------- -------

Further Information:

About AEX

AEX's principal business objectives are the identification,

acquisition, exploration and development of gold properties in

Greenland. The Corporation's principal asset is a 100% interest in

the Nalunaq Project, an advanced exploration stage property with an

exploitation license including the previously operating Nalunaq

gold mine. The Corporation has a portfolio of gold assets covering

3,870km(2) , the largest portfolio of gold assets in Southern

Greenland covering the two known gold belts in the region. AEX is

incorporated under the Canada Business Corporations Act and wholly

owns Nalunaq A/S, incorporated under the Greenland Public Companies

Act.

Forward-Looking Information

This press release contains forward-looking information within

the meaning of applicable securities legislation, which reflects

the Corporation's current expectations regarding future events and

the future growth of the Corporation's business. In this press

release there is forward-looking information based on a number of

assumptions and subject to a number of risks and uncertainties,

many of which are beyond the Corporation's control, that could

cause actual results and events to differ materially from those

that are disclosed in or implied by such forward-looking

information. Such risks and uncertainties include, but are not

limited to the factors discussed under "Risk Factors" in the Final

Prospectus available under the Corporation's profile on SEDAR at

www.sedar.com. Any forward-looking information included in this

press release is based only on information currently available to

the Corporation and speaks only as of the date on which it is made.

Except as required by applicable securities laws, the Corporation

assumes no obligation to update or revise any forward-looking

information to reflect new circumstances or events. No securities

regulatory authority has either approved or disapproved of the

contents of this press release. Neither TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Inside Information

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No. 596/2014 on

Market Abuse ("UK MAR"), as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018, and Regulation

(EU) No. 596/2014 on Market Abuse ("EU MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFSEMESMEFSELI

(END) Dow Jones Newswires

May 27, 2021 02:00 ET (06:00 GMT)

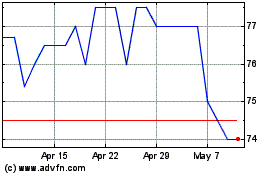

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024