TIDMAFC

RNS Number : 7231V

AFC Energy Plc

16 April 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA,

CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR

JAPAN OR IN OR INTO ANY OTHER JURISDICTION WHERE TO DO SO WOULD

BREACH ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR

CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION, OFFER OR

ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE

OF ANY SECURITIES OF AFC ENERGY PLC IN ANY JURISDICTION WHERE TO DO

SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 AS IT FORMS

PART OF THE UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 ("MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS

INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN

.

16 April 2021

AFC Energy plc

("AFC Energy" or the "Company")

Result of Fundraising

AFC Energy plc (AIM: AFC), a leading provider of hydrogen power

generation technologies, announces that, further to its

announcement of 7.00 a.m. today, it has successfully completed and

closed the Fundraising.

The Fundraising, which was oversubscribed, has raised gross

proceeds of approximately GBP36 million through the placing of

48,404,614 new Ordinary Shares ("New Ordinary Shares") with

institutional investors and a subscription of 5,038,760 New

Ordinary Shares by the ABB group, 2,325,580 New Ordinary Shares by

Dutco group and 45,000 New Ordinary Shares by certain Directors

("Director Subscription Shares"), in each case at a price of 64.5

pence per share.

The net proceeds of the Fundraising will be used to support (i)

the continued product development of AFC Energy and ABB's next

generation high power sustainable electric vehicle (EV) charging

solutions; (ii) the development of new power solutions utilising

AFC Energy's alkaline fuel cell technology platform, including the

high growth global data centre market in collaboration with ABB;

and (iii) the continued development of the Company's scalable

manufacturing capacity to address possible future growth in system

demand .

Admission and Total Voting Rights

In aggregate, 56,259,690 New Ordinary Shares are being issued,

comprising 7,364,340 Subscription Shares, 48,404,614 Placing

Shares, 45,000 Director Subscription Shares and 445,736 New

Ordinary Shares by capitalisation and in settlement of an adviser's

fees incurred in connection with the Subscription . The New

Ordinary Shares are being allotted and issued conditional on their

admission to trading on AIM and will rank pari passu with the

existing Ordinary Shares in issue.

Application will be made to the London Stock Exchange for the

New Ordinary Shares to be admitted to trading on AIM. It is

expected that the New Ordinary Shares will be admitted to trading

on AIM at 8.00 a.m. on or around 23 April 2021 (or such later date

as may be agreed between the Company and the Joint Bookrunners, but

no later than 30 April 2021).

Following Admission, the total number of Ordinary Shares in the

Company in issue will be 732,750,500 and the total number of voting

rights will be 732,750,500. This figure may be used by shareholders

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in the Company under the FCA's Disclosure

Guidance and Transparency Rules.

Conditions to the Placing and Admission

The Placing is conditional, amongst other things, upon:

(i) none of the warranties given by the Company to the Joint

Bookrunners being untrue, inaccurate or misleading in each case by

reference to the facts and circumstances then subsisting;

(ii) the Company having performed all of its obligations under

the Placing Agreement to be performed prior to the Admission and

not being in breach of the Placing Agreement;

(iii) there not having occurred, in the opinion of the Joint

Bookrunners (acting together and in good faith), a Material Adverse

Change at any time prior to Admission; and

(iv) Admission having become effective by not later than 8.00

a.m. on 23 April 2021 (or such later time or date as the Company

and the Joint Bookrunners may agree, not later than 8.00 a.m. on 30

April 2021).

Adam Bond, Chief Executive of AFC Energy, said:

"Global markets for sustainable power systems continue to grow

as timelines for delivering Net Zero draw ever near.

AFC Energy continues to validate its proposition in the off-grid

power market, and through high quality international partnerships

with ABB and Dutco, the strategic investments they make into our

Company, and the continued support of our investors, we are

increasingly well positioned to successfully deliver on this

growing market.

"We are delighted with the results of today's oversubscribed

fundraise which will further strengthen our manufacturing

capability and position AFC Energy to capitalise on these emerging

opportunities, with our partners, in furtherance of a more

sustainable future."

Unless the context otherwise requires, capitalised terms in this

Announcement shall have the meanings given to such terms in the

Company's announcement at 7.00 a.m. on 16 April 2021.

Enquiries:

AFC Energy plc +44 (0) 1483 276 726

Adam Bond (Chief Executive Officer) www.afcenergy.com

WH Ireland - Nominated Adviser and Joint Bookrunner +44 (0) 207 220 1666

Mike Coe / Chris Savidge (Corporate Finance) www.whirelandcb.com

Jasper Berry (Corporate Broking)

M C Peat & Co LLP - Joint Bookrunner +44 (0) 20 7104 2334

Charlie Peat www.peatandco.com

Zeus Capital Ltd - Joint Bookrunner +44 (0) 203 829 5000

D an Harris (Corporate Finance) www.zeuscapital.co.uk

John Goold / Dominic King (Corporate Broking)

FTI Consulting - Public Relations +44 (0) 203 727 1000

Sara Powell / Ben Brewerton www.f ticonsulting.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIDQLBFFZLEBBE

(END) Dow Jones Newswires

April 16, 2021 03:57 ET (07:57 GMT)

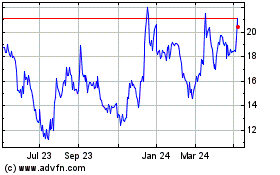

Afc Energy (LSE:AFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Afc Energy (LSE:AFC)

Historical Stock Chart

From Apr 2023 to Apr 2024