TIDMAFN

RNS Number : 1982C

ADVFN PLC

21 February 2022

21 February 2022

For immediate release

ADVFN PLC

("ADVFN" or the "Group")

Unaudited Interim Results for the Six Months Ended 31 December

2021

ADVFN today announces its unaudited interim results for the six

months ended 31 December 2021

(the "Period").

Chief Executive's Statement

The Board is very pleased to report the results for the six

months ended 31 December, when ADVFN consolidated the progress made

last year.

Revenue was GBP4.2 million, the same level as the comparable

period for the six months ended 31 December 2020, with a profit

after tax for the Period of GBP202,000, which although lower by

GBP62,000 than the previous year was GBP601,000 better than the

comparable period in 2019.

We have been a little more aggressive in investing for the

future in this half with the addition to our offerings of new

features and data, with a special focus on Crypto. We will continue

to freshen our offerings which we see as helping to sustain and

grow our future revenue.

Financial Performance

The key financial performance for the period is summarised in

the table below:

Six Months ended Six Months ended

31 December 2021 31 December 2020

-------------------------------- -----------------

GBP'000 GBP'000

-------------------------------- -----------------

Revenue 4,228 4,233

-------------------------------- -----------------

Profit / (loss) for the period 202 264

-------------------------------- -----------------

Operating profit / (loss) 229 277

-------------------------------- -----------------

Profit per share - basic (see

note 3) 0.77p 1.03 p

-------------------------------- -----------------

Post Period Events

Following the Period end the Board announced that it had

concluded its strategic review of the Company's options and ended

the "formal sale process" of the Company which it had commenced

previously in accordance with Rules 2.4 and 2.6 of the Takeover

Code. The Board concluded that the Company should take advantage of

the available options to grow its business offering and geographic

reach through business partnerships and possible joint venture

arrangements or acquisitions.

While there can be no certainty as to whether these

opportunities can be consummated, the Board believes that these

potential development opportunities would enable the Group to build

value for all shareholders.

Dividend Policy and Interim Dividend

As announced last year, while the Board will continue to deploy

the Group's cash resources to the growth of, and investment in, the

business, the Board concluded that as a result of the much-improved

financial performance of the Group, the Company was in a position

to adopt a dividend policy to generate returns for shareholders.

The Board's adopted policy was to pay dividends twice a year in

equal instalments on a semi-annual basis following the release of

the interim and full year financial results. Accordingly, for the

Period, the Board is therefore pleased to announce that the Company

will pay an interim dividend of 0.75 pence per ordinary share,

which is in line with last year's dividend of 1.5 pence for the

year as a whole. The interim dividend will be payable as per the

timetable below:

- Ex dividend dated: 24 March 2022

- Record date: 25 March 2022

- Payment date: 11 April 2022

Outlook

While we are focused on the successful future development of

ADVFN, on 26 January 2022, the Board announced that it had received

a letter from Mr Yair Tauman in which Mr Yair Tauman requested that

the Company convene a general meeting under section 303 of the

Companies Act, to consider t o consider proposed changes to the

Board including my removal as a director of the Company and the

proposed appointment of Messrs Anthony Wollenberg, Amit Tauman and

Lord David Gold as directors of the Company. The Company requested

information from Mr Yair Tauman in respect of the individuals

proposed by him as directors of the Company and will make a further

announcement in due course.

This may well be my last CEO statement and as such I will take

this opportunity to wish shareholders, customers and staff my best

wishes for a good outcome for all.

Clem Chambers

CEO

21 February 2022

Enquiries:

For further information please contact:

ADVFN PLC

Clem Chambers +44 20 3868 670203

Beaumont Cornish Limited (Nominated

Adviser)

www.beaumontcornish.com

Roland Cornish/Michael Cornish +44 (0) 207 628 3396

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018. The person who arranged for the release of this announcement

on behalf of the Company was Clem Chambers, Director.

A copy of this announcement is available on the Group's website

: www.ADVFNPLC.com

Consolidated income statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Notes

Revenue 4,228 4,233 9,059

Cost of sales (162) (244) (452)

---------- ---------- ----------

Gross profit 4,066 3,989 8,607

Share based payment - (44) (43)

Amortisation of intangible assets (138) (128) (251)

Other administrative expenses (3,699) (3,540) (6,849)

Total administrative expense (3,837) (3,712) (7,143)

Government grant - - 162

Operating profit 229 277 1,626

Finance expense (27) (13) (22)

Other income - - 4

Profit/(loss) before tax 202 264 1,608

Taxation - - 10

---------- ---------- ----------

Profit/(loss) for the period attributable

to shareholders of the parent 202 264 1,618

========== ========== ==========

Earnings per share

Basic 3 0.77p 1.03 p 6.28p

Diluted 0.74p 0.99 p 5.97p

Consolidated statement of comprehensive

income

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Profit/ for the period 202 264 1,618

Other comprehensive income:

Items that will be reclassified

subsequently to profit or loss:

Exchange differences on translation

of foreign operations (50) (49) (95)

Total other comprehensive income (50) (49) (95)

---------- ---------- ----------

Total comprehensive income for

the year attributable to shareholders

of the parent 252 215 1,523

========== ========== ==========

Consolidated balance sheet

31 Dec 31 Dec 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Assets

Non-current assets

Property, plant and equipment 180 283 239

Goodwill 929 927 870

Intangible assets 1,584 1,460 1,562

Deferred tax asset - - -

Trade and other receivables 25 - 110

2,718 2,670 2,781

Current assets

Trade and other receivables 725 647 546

Cash and cash equivalents 2,032 931 1,939

---------- ---------- --------

2,757 1,578 2,485

Total assets 5,475 4,248 5,266

========== ========== ========

Equity and liabilities

Equity

Issued capital 52 51 52

Share premium 223 167 223

Share based payments reserve 343 411 343

Foreign exchange reserve 260 256 210

Retained earnings 2,497 874 2,295

---------- ---------- --------

3,375 1,759 3,123

Non-current liabilities

Borrowing - bank loans 47 83 54

Borrowing - lease liabilities 37 101 87

---------- ---------- --------

84 184 141

Current liabilities

Trade and other payables 1,902 2,082 1,886

Borrowing - bank loans 13 88 13

Borrowing - lease liabilities 101 135 103

2,016 2,305 2,002

Total liabilities 2,100 2,489 2,143

---------- ---------- --------

Total equity and liabilities 5,475 4,248 5,266

========== ========== ========

Consolidated statement of changes in equity

Share Share Share Foreign Retained Total

capital premium based exchange earnings equity

payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2020 51 167 367 305 610 1,500

Share based payments 44 44

Profit for the period after

tax - - - - 264 264

Other comprehensive income

Exchange differences on

translation of foreign operations - - - (49) - (49)

--------- --------- --------- ---------- ---------- --------

Total comprehensive income - - - (49) 264 215

--------- --------- --------- ---------- ---------- --------

At 31 December 2020 51 167 411 256 874 1,759

Transactions with equity

shareholders:

Shares issued 1 56 - - - 57

Transfer on exercise - - (67) - 67 -

--------- --------- --------- ---------- ---------- --------

1 56 (67) - 67 57

Reprice share options - - (1) - - (1)

Profit for the period after

tax - - - - 1,354 1,354

Other comprehensive income

Exchange differences on

translation of foreign operations - - - (46) - (46)

--------- --------- --------- ---------- ---------- --------

Total comprehensive income - - - (46) 1,354 1,308

At 30 June 2021 52 223 343 210 2,295 3,123

Share based payments - - - - - -

Profit for the period after

tax - - - - 202 202

Other comprehensive income

Exchange differences on

translation of foreign operations - - - 50 - 50

--------- --------- --------- ---------- ---------- --------

Total comprehensive income - - - 50 202 252

--------- --------- --------- ---------- ---------- --------

At 31 December 2021 52 223 343 260 2,497 3,375

========= ========= ========= ========== ========== ========

Consolidated cash flow statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Cash flows from operating activities

Profit for the year 202 264 1,618

Taxation expense - - (10)

Net finance expense in the income statement 27 13 22

Depreciation of property, plant and

equipment 110 95 167

Amortisation 138 128 251

Forgiveness of US loan - (174)

Loss on disposal of PPE - - -

Share based payment - 44 43

(Increase) in trade and other receivables (94) (73) (72)

Increase / (Decrease) in trade and other

payables 16 (254) (392)

Net cash generated by continuing operations 399 217 1,453

Income tax recovered - - -

---------- ---------- ----------

Net cash generated/(used) by operating

activities 399 217 1,453

Cash flows from financing activities

Issue of share capital - - 57

Repayment of lease principle (59) (41) (92)

Drawdown of loans - - 17

Lease interest paid (6) (9) (19)

Other interest paid (21) (4) (3)

---------- ---------- ----------

Net cash (used)/generated by financing

activities (86) (54) (40)

Cash flows from investing activities

Payments for property, plant and equipment (51) (13) (39)

Purchase of intangibles (160) (160) (385)

Net cash used by investing activities (211) (173) (424)

Net (decrease)/increase in cash and

cash equivalents 102 (10) 989

Exchange differences (9) 26 35

---------- ---------- ----------

Net increase/(decrease) in cash and

cash equivalents 93 16 1024

Cash and cash equivalents at the start

of the period 1,939 915 915

---------- ---------- ----------

Cash and cash equivalents at the end

of the period 2,032 931 1,939

========== ========== ==========

1. Legal status and activities

The principal activity of ADVFN PLC ("the Company") and its

subsidiaries (together "the Group") is the development and

provision of financial information, primarily via the internet,

research services and the development and exploitation of ancillary

internet sites.

The principal trading subsidiaries are All IPO Plc,

InvestorsHub.com Inc, NA Data Inc, MJAC InvestorsHub International

Conferences Ltd and Cupid Bay Limited.

The Company is a public limited company which is quoted on the

AIM of the London Stock Exchange and is incorporated and domiciled

in the UK. The address of the registered office is Suite 28, Essex

Business Centre, The Gables, Fyfield Road, Ongar, Essex, CM5

0GA.

The registered number of the company is 0 2374988 .

2. Basis of preparation

The unaudited consolidated interim financial information is for

the six-month period ended 31 December 2021. The financial

information does not include all the information required for full

annual financial statements and should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 30 June 2021, which were prepared under applicable law and

International Accounting Standards (IAS) in conformity with the

requirements of the Companies Act 2006 as at 30 June 2021.

The accounting policies adopted in this report are consistent

with those of the annual financial statements for the year to 30

June 2021 as described in those financial statements.

The financial statements are presented in Sterling (GBP) rounded

to the nearest thousand except where specified.

The unaudited interim financial information does not include all

the information required for full annual financial statements and

should be read in conjunction with the financial statements of the

Group for the year ended 30 June 2021.

The interim financial information has been prepared on the going

concern basis which assumes the Group will continue in existence

for the foreseeable future.

No material uncertainties that cast significant doubt about the

ability of the Group to continue as a going concern have been

identified by the directors. Accordingly, the directors believe it

is appropriate for the interim financial statement to be prepared

on the going concern basis.

The interim financial information has not been audited nor has

it been reviewed under ISRE 2410 of the Auditing Practices Board.

The financial information presented does not constitute statutory

accounts as defined by section 434 of the Companies Act 2006. The

Group's statutory accounts for the year to 30 June 2021 have been

filed with the Registrar of Companies. The auditors, Saffery

Champness LLP reported on these accounts and their report was

unqualified and did not contain a statement under section 498(2) or

Section 498(3) of the Companies Act 2006.

3. Profit per share

6 months 6 months 12 months

to to to

31 Dec 2021 31 Dec 2020 30 June

2021

GBP'000 GBP'000 GBP'000

Profit for the year attributable to

equity shareholders 202 264 1,618

Earnings per share (pence)

Basic 0.77p 1.03 p 6.28p

Diluted 0.74p 0.99 p 5.97p

============ ============ ===========

Shares Shares Shares

Weighted average number of shares in

issue for the period 26,115,318 25,703,845 25,773,739

Dilutive effect of options 1,144,585 1,092,868 1,336,807

------------ ------------ -----------

Weighted average shares for diluted

earnings per share 27,259,903 26,796,713 27,110,546

Where a loss has been recorded for the year the diluted loss per

share does not differ from the basic loss per share. Where a profit

has been recorded but the average share price for the year remains

under the exercise price the existence of options is not normally

dilutive. However, whilst the average exercise price of all

outstanding options is above the average share price there are a

number of options which are not. Under these circumstances those

options where the exercise price is below the average share price

are treated as dilutive.

4. Dividends

A dividend was announced on 5 July 2021. Final equity dividends

to the shareholders of ADVFN plc are recognised in the period that

they are approved by shareholders. Interim equity dividends are

recognised in the period that they are paid.

Dividends receivable are recognised when the Company's right to

receive payment is established

5. Financial statements

Copies of these accounts are available from ADVFN Plc's

registered office at Suite 28, Ongar Business Centre, The Gables,

Fyfield Road, Ongar, Essex, CM5 0GA or from Companies House, Crown

Way, Maindy, Cardiff, CF14 3UZ.

www.companieshouse.gov.uk

and from the ADVFN plc website:

www.ADVFNPLC.com

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KVLFFLLLFBBL

(END) Dow Jones Newswires

February 21, 2022 02:00 ET (07:00 GMT)

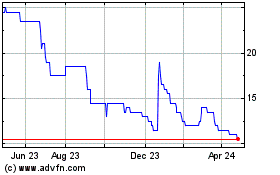

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

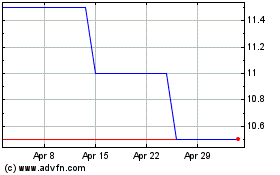

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024