TIDMAIEA

RNS Number : 1584R

Airea PLC

04 March 2021

Airea plc

Final results for the year ended 31st December 2020

Strategic Report

Airea plc is pleased that the group has been able to remain open

for business throughout the year navigating its way through the

most unpredictable and volatile of years driven by the Covid-19

pandemic and Brexit transition phase. This has caused unprecedented

market conditions which have proved to be extremely disruptive.

During this turbulent political and economic year the group

benefitted from the improved operational and supply chain processes

implemented during the previous 12 months enabling the group to

navigate and mitigate these challenges and continue to prepare the

group for growth opportunities when they arise.

Highlights for the year

-- Increased year-end cash balance from GBP3.0m to GBP6.6m

(GBP3.9m excluding CBILS loan of GBP2.75m);

-- Profitable during the Covid-19 pandemic;

-- Underlying gross profit margins (revenue less cost of sales) increased year on year;

-- Three new product launches during the year.

Principal activity and strategy

The group remains focused on the design, manufacture, marketing

and distribution of floor coverings. Our approach to strategy is

uncomplicated; to develop products that sell, exploit the strength

of our combined manufacturing and distribution operation and

deliver robust cash flows to support the ongoing investment in the

business.

Overview

After a strong start in the first quarter the effects of the

Covid-19 pandemic and various national and regional lockdowns had a

significant impact on the groups ability to trade. Whilst the group

remained open for business throughout the year management had to

reassess its strategic priorities and made the decision to

prioritise cash and working capital to provide the best defence

against uncertainty. This did not stop the group looking to the

future and continuing to develop new products to provide

opportunities for growth.

The group was able to take advantage of the Covid-19 support

provided by the UK government and the group's banking partner to

help during the period including:

-- A six-year CBILS loan of GBP2.75m with no fees, interest or

repayments for the initial 12-month period

-- Capital repayment holiday for 6 months on existing long-term loan

-- Extended overdraft from GBP0.5m to GBP1.0m

-- Q1 2020 VAT payment deferred until 2021

-- Furloughed employees throughout the year

All of these initiatives have helped to bolster the financial

performance of the group; however, due to the market conditions

revenues were below prior year particularly with regards to export

sales. This generated a significantly lower operating profit

although we are pleased that underlying gross profit margins

actually increased year on year.

The group continued to develop new products, although product

launches were pushed back to the fourth quarter and early 2021. It

is too early to see any benefits of the new product launches on the

performance of the group; however, the feedback from customers has

been extremely positive and bodes well for their success in 2021

and beyond. There was a small increase in inventory at the year-end

due to the manufacture of new product launch stock.

Despite the pension scheme deficit increasing slightly to

GBP1.8m from GBP1.5m the group considered its investment strategy a

success in limiting the impact the Covid-19 pandemic could have had

on the deficit. There continues to be volatility in global equity

markets with the scheme's investment strategy constantly under

review to mitigate the scheme's long-term risk profile as much as

possible.

The value of our investment property increased from GBP3.6m to

GBP3.7m. The gain is highlighted separately in the income

statement.

Group results

Revenue for the year was significantly below prior year at

GBP14.6m (2019: GBP19.2m) as the Covid-19 pandemic had a

significant impact on market demand. As a result operating profit

before valuation gain decreased to GBP0.7m (2019: GBP2.2m).

Underlying gross profit margins increased year on year and the

group benefitted from furlough savings (GBP0.5m) which helped to

reduce overheads compared to the prior year even after the

additional Covid-19 related costs of GBP0.1m safeguarding the

employees and site.

There was an unrealised valuation gain on the investment

property of GBP0.1m (2019: GBP0.2m) giving an operating profit

after valuation gains of GBP0.9m (2019: GBP2.4m).

Other finance costs relating in the main to the defined benefit

pension scheme were GBP0.4m (2019: GBP0.4m).

After a tax charge of GBP0.1m primarily due to deferred tax on

the pension scheme, partial unwinding of the deferred tax asset as

brought forward losses are utilised and unrealised valuation gain

on the investment property (2019: GBP0.4m) profit attributable to

shareholders of the group for the year was GBP0.4m (2019: GBP1.6m).

Earnings per share were 1.00p (2019: 3.97p).

Operating cash flows before movements in working capital and

other payables were GBP1.5m (2019: GBP2.7m). Working capital

decreased by GBP0.8m (2019: GBP0.4m) following a reduction in trade

receivables and increase in trade and other payables. Contributions

of GBP0.4m (2019: GBP0.4m) were made to the defined benefit pension

scheme in line with the agreement reached with the trustees based

on the 2017 actuarial valuation. Capital expenditure of GBP0.2m

(2019: GBP0.4m) related to investment in the Ossett site improving

warehouse capacity and machine efficiency.

The group borrowed GBP2.75m under the government Coronavirus

Business Interruption Loan Scheme ("CBILS"). This is a 6-year term

loan with no fees, interest or repayment due for the initial 12

months. The group took a 6-month capital repayment holiday on the

existing long-term loan taken out to acquire shares for the

Employee Benefit Trust. GBP0.4m of the loan was repaid during the

year. The loan is unsecured and repayable over three years in equal

quarterly instalments with five instalments remaining.

No dividend payments were made during the year due to the

Covid-19 pandemic (2019: GBP1.1m) and the Board has decided not to

declare a final dividend for 2020.

Key performance indicators

As part of its internal financial control procedures the board

monitors the key financial metrics of revenue, operating profit,

gross margin, working capital (debtor and creditor days), inventory

turns and cash. These KPI's are reviewed in comparison to previous

year and the budget and analysis undertaken to establish trends and

variances. For the year ended 31st December 2020, operating return

on sales was 5.1% (2019: 11.3%), return on net operating assets was

4.0% (2019: 13.5%) and working capital to sales percentage was

63.4% (2019: 36.0%).

Principal risks and uncertainties

The board has responsibility for determining the nature and

extent of the risks it is willing to take in achieving its

strategic objectives and ensuring that risks are managed

effectively across the group. The board and the management team

meet regularly to discuss the business and the risks that it faces.

Risks are identified as being principally based on the likelihood

of occurrence and potential impact on the group. The group's

principal risks, which remain consistent with the prior year, are

identified below, together with a description of how the group

mitigates those risks.

The key operational risk facing the business continues to be the

competitive nature of the markets for the group's products. To

mitigate this risk the group seeks to improve existing products,

introduce new products and achieve high levels of customer service

and efficiency to attempt to differentiate from the

competition.

The Covid-19 pandemic presents significant uncertainty for the

upcoming financial year with an unknown impact of the virus on the

company's performance. However, the group is well placed to

mitigate this continued risk by drawing on the experience gained

navigating the issues during this year when the group was able to

remain open for business and continuing to take advantage of

available government support. The group can also point towards its

strong balance sheet and cash reserves.

The post Brexit transition export trading conditions present a

short-term risk to the group whilst the most optimal and efficient

supply route is established to the group's many customers in the

European Union. Whilst the export of goods is initially zero rated

for UK VAT purposes the differing treatment our customers face in

individual countries has made it more difficult for the customer to

import goods into their respective countries. We continue to work

with our customers to find the best solution to the logistical

challenges to ensure continued and smooth trading conditions.

The majority of the group's revenue arises from trade with

flooring contractors and fit out companies. The activity levels

within this customer base are determined by consumer demand that is

created through a wide range of commercial refurbishment and new

build projects. The general level of activity in these underlying

markets has the potential to affect the demand for products

supplied by the group and is subject to seasonal variations. The

group mitigates these factors by closely monitoring sales trends

and taking appropriate action early, along with strengthening the

product range and developing new channels to market, both at home

and abroad, to grow demand across a wider range of markets and

negate the impact of seasonality.

The group operates a defined benefit pension scheme. At present,

in aggregate, there is an actuarial deficit between the value of

the projected liabilities of this scheme and the assets they hold.

The amount of the deficit may be adversely affected by changes in a

number of factors, including investment returns, long-term interest

rate and price inflation expectations and anticipated members'

longevity. Further increases in the pension scheme deficit may

require the group to increase the amount of cash contributions

payable to the scheme, thereby reducing cash available to meet the

group's other operating, investing and financing requirements. The

performance and risk management of the group's pension scheme and

deficit recovery plan are regularly reviewed by both the group and

the trustees of the scheme, taking actuarial and investment advice

as appropriate. The results of these reviews are discussed with the

board and appropriate action taken. Following the triennial funding

valuation of the group's pension scheme as at 1st July 2017, a

revised deficit recovery plan was agreed. Under the plan, the

company will continue to make annual contributions of GBP0.4m to

allow a gradual reduction in investment risk. The next triennial

funding valuation will be drawn up to 1st July 2020 and completed

within the permitted 15-month period.

Other risks

Raw material costs are a significant constituent of overall

product cost and are impacted by global commodity markets.

Significant fluctuations in raw material costs can have a material

impact on profitability. The group continuously seeks out

opportunities to develop a robust and competitive supply base,

substitute new materials, agree fixed pricing where possible,

source material with improved and shortened lead times and closely

monitors selling prices and margins making adjustments when

necessary.

The global nature of the group's business means it is exposed to

volatility in currency exchange rates in respect of foreign

currency denominated transactions, the most significant being the

euro. In order to protect itself against currency fluctuations the

group has taken advantage of the opportunity to naturally hedge

euro revenue with euro payments utilising foreign currency bank

accounts. No transactions of a speculative nature are undertaken.

Other risks include the availability of necessary materials,

business interruption and the duty of care to our employees,

customers and the wider public. These risks are managed through the

combination of quality assurance and health and safety procedures

and insurance cover.

Management and personnel

We continue to recognise the hard work and dedication our staff

have applied during this most challenging of years working through

the Covid-19 pandemic and uncertainty it has brought to them and

their families. We look forward to the contribution they can make

going forward in the future of the company.

Current trading and future prospects

The continued investment in our successful commercial flooring

business provides significant opportunities for profitable growth;

however, the Covid-19 pandemic and nationwide lockdowns continue to

suppress market activity on a global basis. We expect this to

impact demand for the foreseeable future. The group has flexibility

and can adapt to these unprecedented times and will continue to

invest in new products throughout 2021 based upon our confidence in

the future prospects of the business during and particularly post

the Covid-19 pandemic.

MARTIN TOOGOOD NEIL RYLANCE

Chairman Chief Executive Officer 4th March 2021

Enquiries:

Neil Rylance 01924 266561

Chief Executive Officer

Paul Stevenson 01924 266561

Group Finance Director

Peter Steel 020 7496 3061

N+1 Singer

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

The financial information set out in the announcement does not

constitute the group's statutory accounts for the 12 month period

ended 31 December 2020 or the 12 month period ended 31 December

2019. The financial information for the 12 month period ended 31

December 2019 is derived from the statutory accounts for that year

which have been delivered to the Registrar of Companies. The

auditors reported on those accounts; their report was unqualified

and did not include any statement under s498(2) or s498(3) of the

Companies Act 2006. The consolidated balance sheet at 31 December

2020, the consolidated income statement, the consolidated statement

of comprehensive income, the consolidated cash flow statement, the

consolidated statement of changes in equity and the segmental

reporting for the 12 month period then ended have been extracted

from the Group's 2020 statutory financial statements upon which the

auditor's opinion is unqualified and does not include any statement

under s498(2) or s498(3) of the Companies Act 2006.

The announcement has been agreed with the company's auditor for

release.

Consolidated Income Statement

Year ended 31 December 2020

Year ended Year ended

31 December 31 December

2020 2019

GBP'000 GBP'000

Continuing Operations

Revenue 14,554 19,183

Operating costs (14,090) (17,297)

Other operating income 280 280

Operating profit before valuation gain 744 2,166

Unrealised valuation gain 125 200

--------------------------------------------- ------------ ------------

Operating profit 869 2,366

Finance income 7 6

Finance costs (376) (411)

_______ _______

Profit before taxation 500 1,961

Taxation (109) (403)

_______ _______

Profit attributable to shareholders of the

group 391 1,558

_______ _______

Consolidated Statement of Comprehensive Income

Year ended 31 December 2020

2020 2020 2019 2019

GBP GBP GBP GBP

Profit attributable to

shareholders of the group 391 1,558

Items that will not be

classified to profit or

loss

Actuarial (loss)/gain recognised

in the pension scheme (389) 2,172

Related deferred taxation 74 (369)

(315) 1,803

Items that will be reclassified

subsequently to profit

or loss when specific conditions

are met

Revaluation/(impairment)

of property 37 (17)

Related deferred taxation (4) 3

------ ------ ------ --------

33 (14)

Total other comprehensive

(loss)/income (282) 1,789

Total comprehensive income

attributable to shareholders

of the group 109 3,347

------ ------ ------ --------

Consolidated Balance Sheet

Year ended 31 December 2020

2020 2020 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and

equipment 4,271 4,229

Intangible assets 54 39

Investment property 3,725 3,600

Deferred tax asset 920 847

Right-of-use-asset 1,086 1,233

_______ _______

10,056 9,948

Current assets

Inventories 5,622 5,461

Trade and other receivables 1,712 2,112

Cash and cash equivalents 6,555 2,957

_______ _______

13,889 10,530

_______ _______

Total assets 23,945 20,478

_______ _______

Current liabilities

Trade and other payables (2,895) (2,412)

Provisions (465) (320)

Lease liabilities (243) (329)

Loans and borrowings (1,071) (562)

_______ _______

(4,674) (3,623)

Non-current liabilities

Deferred tax (609) (457)

Pension deficit (1,789) (1,472)

Lease liabilities (188) (323)

Loans and borrowings (2,641) (724)

_______ _______

(5,227) (2,976)

_______ _______

Total liabilities (9,901) (6,599)

_______ _______

Net assets 14,044 13,879

_______ _______

Equity

Called up share capital 10,339 10,339

Share premium account 504 504

Own shares (1,197) (1,839)

Share based payment

reserve 141 85

Capital redemption reserve 3,617 3,617

Revaluation reserve 3,014 3,048

Retained earnings (2,374) (1,875)

_______ _______

Total equity 14,044 13,879

_______ _______

Consolidated Cash Flow Statement

Year ended 31 December 2020

Year ended Year ended

31 December 31 December

2020 2019

GBP'000 GBP'000

Cash flows from operating activities

Profit for the year 391 1,558

Depreciation 228 206

Depreciation of right-of-use-assets 270 274

Amortisation 38 65

Movement in provisions 145 -

Share based payment expense 56 -

Net finance costs 369 405

Profit on disposal of property, plant and

equipment - (12)

Tax charge 109 403

Unrealised valuation gain (125) (200)

_______ _______

_______ _______

Operating cash flows before movements in

working capital 1,481 2,699

(Increase)/decrease in inventories (161) 1,336

Decrease in trade and other receivables 456 221

Increase/(decrease) in trade and other

payables 467 (1,159)

_______ _______

_______ _______

Cash generated from operations 2,243 3,097

Contributions to defined benefit pension

scheme (400) (400)

_______ _______

Net cash generated from operating activities 1,843 2,697

Cash flows from investing activities

Payments to acquire intangible fixed assets (53) (9)

Payments to acquire tangible fixed assets (233) (378)

Receipts from sales of tangible fixed assets - 136

_______ _______

_______ _______

Net cash used in generated from investing

activities (286) (251)

Cash flows from financing activities

Interest paid on lease liabilities (15) (21)

Interest paid on borrowings (33) (34)

Interest received 7 6

Proceeds from loan 2,750 1,700

Purchase of own shares by the EBT - (2,000)

Principal paid on lease liabilities (344) (343)

Repayment of loan (324) (448)

Equity dividends paid - (1,081)

_______ _______

Net cash received/(used) in financing activities 2,041 (2,221)

_______ _______

Net increase in cash and cash equivalents 3,598 225

Cash and cash equivalents at start of the

year 2,957 2,732

_______ _______

Cash and cash equivalents at end of the

year 6,555 2,957

_______ _______

Consolidated Statement of Changes in Equity

Year ended 31 December 2020

Share Capital

Share premium Share Share redemption Revaluation Retained Total

capital account based Option reserve reserve earnings equity

payment

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ------------ ------------

At 1st January 2019 10,339 504 - - 3,617 3,096 (4,028) 13,528

Comprehensive income for

the year

Profit for the year - - - - - - 1,558 1,558

Actuarial gain recognised

on the pension scheme - - - - - - 1,803 1,803

Impairment of property - - - - - (14) - (14)

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ------------ ------------

Total comprehensive income

for the year - - - - - (14) 3,361 3,347

Contributions by and

distributions to owners

Dividend paid - - - - - - (1,081) (1,081)

Purchase of own Shares

by the EBT - - (2,000) - - - - (2,000)

Share based payment - - - 85 - - - 85

Own Shares Transfer - - 161 - - - (161) -

Revaluation Reverse Transfer

- - - - - (34) 34 -

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ------------ ------------

Total contributions by and

distributions to owners

- - (1,839) 85 - (34) (1,208) (2,996)

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ------------ ------------

At 31st December 2019 10,339 504 (1,839) 85 3,617 3,048 (1,875) 13,879

At 1st January 2020

Comprehensive income for

the year

Profit for the year - - - - - - 391 391

Actuarial loss recognised

on the pension scheme - - - - - - (315) (315)

Impairment of property - - - - - - 33 33

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ------------ ------------

Total comprehensive income

for the year - - - - - - 109 109

Contributions by and

distributions to owners

Dividend paid - - - - - - - -

Share based payment - - - 56 - - - 56

Own Shares Transfer - - 642 - - - (642) -

Revaluation Reserve Transfer

- - - - - (34) 34 -

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ------------ ------------

Total contributions by and

distributions to owners

- - 642 56 - (34) (608) 56

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ------------ ------------

At 31st December 2019 10,339 504 (1,197) 141 3,617 3,014 (2,374) 14,044

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ------------ ------------

In accordance with Rule 20 of the AIM Rules, Airea confirms that

the annual report and accounts for the year ended 31 December 2020

and notice of Annual General Meeting ("AGM") and related proxy form

will be available to view on the Company's website at

www.aireaplc.co.uk on 5 March 2021 and will be posted to

shareholders by 19 March 2021. The AGM will be held on 12th May

2021, at 2.00 p.m. at the company's registered office at Victoria

Mills, The Green, Ossett, West Yorkshire, WF5 0AN. Due to the

ongoing Covid-19 pandemic and government "stay at home" measures

this will be a closed meeting; however, shareholders will be able

to dial in and listen to the AGM. Further details are set out in

the notice of the AGM available within the financial statements

which can be viewed on the group's website.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAXDLEEXFEEA

(END) Dow Jones Newswires

March 04, 2021 02:30 ET (07:30 GMT)

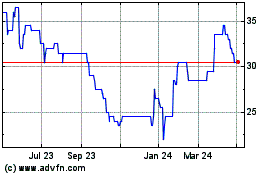

Airea (LSE:AIEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

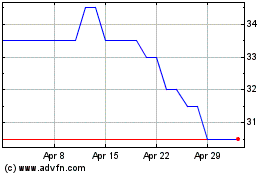

Airea (LSE:AIEA)

Historical Stock Chart

From Apr 2023 to Apr 2024