TIDMAIEA

RNS Number : 9882G

Airea PLC

30 July 2021

AIREA PLC

(the "Group")

Interim report for t he six months ended 30 June 2021

The principal activity of the group is the design, manufacture,

marketing and distribution of floor coverings.

Chairman's Statement

The group's performance in the six months ended 30th June 2021

has continued to be impacted by the COVID-19 pandemic and the

related lockdown restrictions which continue to suppress activity

in our key markets. Our export business has been most severely

impacted by lockdown restrictions in target markets and the

additional costs of administration and freight following the post

Brexit transition period. Availability of labour and raw materials

have been a major challenge with unprecedented increases in raw

material prices. H1 delivered improved sales and operating profit

versus the prior year as demand in the market continued to recover

albeit at a slower pace than expected.

Throughout H1 the group has remained open for business and

continues to support customers whilst also looking to prioritise

the well-being of employees. The board recognises and values the

tremendous efforts of our employees throughout the period.

With reference to COVID-19 support packages deferred VAT

repayments have commenced, our loan balance repayments have

recommenced and the level of furlough support has reduced

significantly in the first half.

As at 30th June 2021 our cash reserves were GBP6.2m (2020:

GBP6.5m), excluding the CBILS loans our cash position was

GBP3.5m (2020: GBP3.7m), with further liquidity available of

GBP1.0m via our unutilised overdraft facility (2020: GBP1.0m

unutilised). Our cash reserves and strong balance sheet enable us

to manage the impact of the pandemic and related risks.

Group Results

Revenue for the period was GBP0.3m above the prior year, GBP7.4m

(2020: GBP7.1m). In the UK our sales were 18.5% ahead of the prior

six month comparative period as home sales began to recover. Export

sales were down 35.5% compared to the comparative period, largely

due to the effect of COVID-19 on all our target export markets and

the significant disruption caused by differing interpretations of

import regulations post Brexit.

The operating profit was GBP574,000 (2020: GBP137,000).

Excluding inventory absorption impacts, underlying product margins

are broadly in line with prior year, however product margins are

facing significant pressure due to significant raw material

inflation and our ability to pass on these price increases. After

charging pension, lease and loan related finance costs of

GBP114,000 (2020: GBP193,000) and incorporating the appropriate tax

charge the net profit for the period was GBP440,000 (2020:

GBP43,000 loss). Basic earnings per share were 1.14p (2020:loss

0.11p).

Operating cash flows before movements in working capital were

GBP0.5m (2020: GBP0.5m). Working capital increased in the period by

GBP0.1m (2020: GBP1.0m decrease). Contributions to the defined

benefit pension scheme were GBP0.2m (2020: GBP0.2m) in line with

the agreement reached with the scheme trustees following the last

triennial valuation as at 1st July 2017. Capital expenditure of

GBP1.2m (2020: GBP0.2m) was spent renewing and enhancing

manufacturing plant and equipment, with major spend on new

equipment to continue to support our new exciting product

development programme.

Outlook

The UK sales recovery is expected to continue with a strong

order book, however the impact of lifting lockdown restrictions is

unknown and so forecasting sales performance in the second half is

particularly difficult. Market activity in our European Markets is

expected to improve but relatively slowly. Difficulties exporting

to Europe are now well documented, with significant increases in

cost and additional complexity in exporting to Europe

Post-Brexit.

Of greatest concern is the level of raw material price inflation

and supply chain tensions putting a strain on the availability of

materials and the costs of obtaining them, the increases

experienced to date are relentless and unprecedented. Key to our

success will be our ability to pass on these price increases and a

halt or reversal of current pricing trends.

We have however continued to invest in development of our

product range with investment in new equipment and the launches of

new products ongoing throughout 2021 based upon our confidence in

the future prospects of the business and our secure financial

position.

Given the financial performance of the group and the continued

levels of uncertainty in the market and wider economy the group

will continue to prioritise cash to ensure medium to long-term

stability and therefore will not be proposing an interim dividend

(2020: nil).

MARTIN TOOGOOD

Chairman 30th July 2021

Consolidated Income Statement

6 months ended 30th June 2021

Unaudited 6 Unaudited Audited

months ended 6 months 12 months

30th June ended ended 31st

2021 30th June December

2020 2020

GBP000 GBP000 GBP000

-------------------------------------------- --------------------------- --------------- ---------------------

Revenue 7,431 7,100 14,554

Operating costs (6,997) (7,103) (14,090)

Other operating income 140 140 280

-------------------------------------------- --------------------------- --------------- ---------------------

Operating profit before valuation

gain 574 137 744

Unrealised valuation gain - - 125

-------------------------------------------- --------------------------- --------------- ---------------------

Operating profit 574 137 869

Finance income 4 2 7

Finance costs (114) (193) (376)

-------------------------------------------- --------------------------- --------------- ---------------------

Profit/(loss) before taxation 464 (54) 500

Taxation (24) 11 (109)

-------------------------------------------- --------------------------- --------------- ---------------------

Profit/(loss) attributable to shareholders

of the group 440 (43) 391

-------------------------------------------- --------------------------- --------------- ---------------------

Earnings per share (basic and diluted)

for the group 1.14p 0.11p 1.00p

Consolidated Statement of Comprehensive Income

6 months ended 30th June 2021

Unaudited Unaudited Audited

6 months 6 months 12 months

ended 30th ended ended

June 30th June 31st December

---------------------------------------------

2021 2020 2020

---------------------------------------------

GBP000 GBP000 GBP000

--------------------------------------------- -------------------- -------------- ---------------------

Profit/(loss) attributable to shareholders

of the group 440 (43) 391

Items that will not be reclassified

to profit or loss

Actuarial gain/(loss) recognised in

the pension scheme 3,997 (3,448) (389)

Related deferred taxation (797) 655 74

--------------------------------------------- -------------------- -------------- ---------------------

3,200 (2,793) (315)

--------------------------------------------- -------------------- -------------- ---------------------

Items that will be reclassified subsequently

to profit or loss when specific conditions

are met

Revaluation of property - 12 37

Related deferred taxation - (2) (4)

--------------------------------------------- -------------------- -------------- ---------------------

- 10 33

--------------------------------------------- -------------------- -------------- ---------------------

Total other comprehensive income/(loss) 3,200 (2,783) (282)

--------------------------------------------- -------------------- -------------- ---------------------

Total comprehensive income/(loss)

attributable to shareholders of the

group 3,640 (2,826) 109

--------------------------------------------- -------------------- -------------- ---------------------

Consolidated Balance Sheet

as at 30th June 2021

Unaudited 30th Unaudited Audited

June 30th June 31st December

2021 2020 2020

GBP000 GBP000 GBP000

------------------------------ ---------------------------------- --------------- -----------------------

Non-current assets

Property, plant and equipment 5,279 4,282 4,271

Intangible assets 62 67 54

Investment property 3,725 3,600 3,725

Right-of-use asset 1,011 1,126 1,086

Pension Surplus 2,310 - -

Deferred tax asset 733 1,563 920

------------------------------ ---------------------------------- --------------- -----------------------

13,120 10,638 10,056

Current assets

Inventories 5,877 4,728 5,622

Trade and other receivables 2,093 1,915 1,712

Cash and cash equivalents 6,226 6,451 6,555

------------------------------ ---------------------------------- --------------- -----------------------

14,196 13,094 13,889

------------------------------ ---------------------------------- --------------- -----------------------

Total assets 27,316 23,732 23,945

------------------------------ ---------------------------------- --------------- -----------------------

Current liabilities

Trade and other payables (3,679) (2,482) (2,895)

Provisions (138) (320) (465)

Lease liabilities (145) (213) (243)

Loans and borrowings (1,359) (580) (1,071)

------------------------------ ---------------------------------- --------------- -----------------------

(5,321) (3,595) (4,674)

Non-current liabilities

Pension deficit - (4,888) (1,789)

Deferred tax (1,206) (526) (609)

Lease liabilities (174) (297) (188)

Loans and borrowings (2,911) (3,317) (2,641)

------------------------------ ---------------------------------- --------------- -----------------------

(4,291) (9,028) (5,227)

------------------------------ ---------------------------------- --------------- -----------------------

Total liabilities (9,612) (12,623) (9,901)

------------------------------ ---------------------------------- --------------- -----------------------

Net assets 17,704 11,109 14,044

------------------------------ ---------------------------------- --------------- -----------------------

Equity

Called up share capital 10,339 10,339 10,339

Share premium account 504 504 504

Own Shares (876) (1,518) (1,197)

Share-based payment reserve 161 141 141

Capital redemption reserve 3,617 3,617 3,617

Revaluation reserve 3,014 3,058 3,014

Retained earnings 945 (5,032) (2,374)

------------------------------ ---------------------------------- --------------- -----------------------

Total equity 17,704 11,109 14,044

------------------------------ ---------------------------------- --------------- -----------------------

Consolidated Cash Flow Statement

6 months ended 30(th) June 2021

Unaudited Unaudited Audited

6 months 6 months 12 months

ended 30(th) ended ended 31(st)

June 30(th) December

2021 June 2020

2020

GBP000 GBP000 GBP000

--------------------------------------- ------------------------ --------------- -----------------------

Cash flow from operating activities

Profit/(loss) for the period 440 (43) 391

Depreciation 123 114 228

Depreciation of right-of-use assets 128 140 270

Amortisation 16 25 38

Movement in Provision (327) - 145

Share-based payment expense 20 56 56

Net Finance costs 110 191 369

Tax charge/(credit) 24 (11) 109

Unrealised valuation gain - - (125)

--------------------------------------- ------------------------ --------------- -----------------------

Operating cash flows before movements

in working capital 534 472 1,481

(Increase)/decrease in inventory (255) 733 (161)

(Increase)/decrease in trade and

other receivables (417) 197 456

Increase in trade and other payables 784 70 467

--------------------------------------- ------------------------ --------------- -----------------------

Cash generated from operations 646 1,472 2,243

Contributions to defined benefit

pension scheme (200) (200) (400)

--------------------------------------- ------------------------ --------------- -----------------------

Net cash generated from operating

activities 446 1,272 1,843

--------------------------------------- ------------------------ --------------- -----------------------

Cash flows from investing activities

Payments to acquire intangible fixed

assets (24) (33) (53)

Payments to acquire tangible fixed

assets (1,131) (156) (233)

(1,155) (189) (286)

--------------------------------------- ------------------------ --------------- -----------------------

Cash flows from financing activities

Interest paid on lease liabilities (6) (8) (15)

Interest paid on borrowings (11) (18) (33)

Interest received 4 2 7

Proceeds from new loans and borrowings 934 2,750 2,750

Principal paid on lease liabilities (166) (177) (344)

Repayment of loans and borrowings (375) (138) (324)

Net cash generated from financing

activities 380 2,411 2,041

--------------------------------------- ------------------------ --------------- -----------------------

Net (decrease)/increase in cash and

cash equivalents (329) 3,494 3,598

Cash and cash equivalents at start

of the period 6,555 2,957 2,957

--------------------------------------- ------------------------ --------------- -----------------------

Cash and cash equivalents at end

of the period 6,226 6,451 6,555

--------------------------------------- ------------------------ --------------- -----------------------

Consolidated Statement of Changes in Equity

6 months ended 30th June 2021

Share Share-based Capital Profit

Share premium Own payment redemption Revaluation and Total

capital account Shares reserve reserve reserve loss equity

account

--------------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------- ------------ ------------ ------------- --------------- --------------- ------------- ----------- ------------

At 1st January

2020 10,339 504 (1,839) 85 3,617 3,048 (1,875) 13,879

Comprehensive

income

for the

year

Profit for the

year - - - - - - 391 391

Actuarial loss

recognised

on the pension

scheme - - - - - - (315) (315)

Impairment of

property - - - - - - 33 33

-------------- ------------------------------------------------------------------------------------------ ----------- --------------

Total

comprehensive

income for the year

- - - - - - 109 109

Contributions by and

distributions to

owners

Dividend paid - - - - - - - -

Share-based payment

- - - 56 - - - 56

Own share transfer

- - 642 - - - (642) -

Revaluation Reverse

Transfer - - - - - (34) 34 -

---------------------------- ------------ ------------- --------------- --------------- ------------- ----------- ------------

Total contributions

by and distributions

to owners - - 642 56 - (34) (608) 56

---------------------------- ------------ ------------- --------------- --------------- ------------- ----------- ------------

At 31st December 2020

and 1st January 2021

10,339 504 (1,197) 141 3,617 3,014 (2,374) 14,044

---------------------------- ------------ ------------- --------------- --------------- ------------- ----------- ------------

Comprehensive

income for the

period

Profit for the

period - - - - - - 440 440

Actuarial gain

recognised

on the pension

scheme - - - - - - 3,200 3,200

Revaluation of - - - - - - - -

property

-------------- ------------ ------------ ------------- --------------- --------------- ------------- ----------- ------------

Total

comprehensive

income for the period

- - - - - - 3,640 3,640

Contributions by and

distributions to

owners

Share-based payment

- - - 20 - - - 20

Own Shares Transfer

- - 321 - - - (321) -

---------------------------- ------------ ------------- --------------- --------------- ------------- ----------- ------------

Total contributions

by and distributions

to

owners - - 321 20 - - (321) 20

---------------------------- ------------ ------------- --------------- --------------- ------------- ----------- ------------

At 30th June 2021

10,339 504 (876) 161 3,617 3,014 945 17,704

---------------------------- ------------ ------------- --------------- --------------- ------------- ----------- ------------

Notes to the Financial Statements

1. BASIS OF PREPARATION AND ACCOUNTING POLICIES

The financial information for the six months ended 30th June

2021 and the six months ended 30th June 2020 have not been audited

and do not constitute full financial statements within the meaning

of Section 434 of the Companies Act 2006.

The financial information relating to the year ended 31st

December 2020 does not constitute full financial statements within

the meaning of Section 434 of the Companies Act 2006. This

information is based on the group's

statutory accounts for that period. The statutory accounts were

prepared in accordance with International Financial Reporting

Standards as adopted by the European Union ("IFRS") and received an

unqualified audit report and did not contain statements under

Section 498(2) or (3) of the Companies Act 2006. These financial

statements have been filed with the Registrar of Companies.

These interim financial statements have been prepared using the

recognition and measurement principles of International Financial

Reporting Standards as adopted by the European Union ("IFRS"). The

accounting policies used are the same as those used in preparing

the financial statements for the period ended 31st December 2020.

These policies are set out in the annual report and accounts for

the period ended 31st December 2020 which is available on the

company's website at www.aireaplc.co.uk.

Further copies of this report are available from the Company

Secretary at the registered office at Victoria Mills, The Green,

Ossett, Wakefield, West Yorkshire WF5 0AN and are also available,

along with this announcement, on the company's website at

www.aireaplc.co.uk.

Enquiries:

Neil Rylance 01924 266561

Chief Executive Officer

Ryan Thomas 01924 266561

Group Finance Director

Peter Steel 020 7496 3000

Singer Capital Markets

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEMFWUEFSELW

(END) Dow Jones Newswires

July 30, 2021 02:00 ET (06:00 GMT)

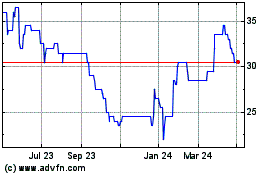

Airea (LSE:AIEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

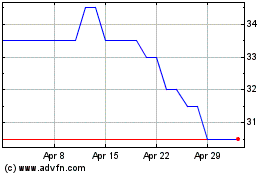

Airea (LSE:AIEA)

Historical Stock Chart

From Apr 2023 to Apr 2024