Alpha Growth PLC BlackOak Alpha Growth Fund Year End Results (7787L)

January 15 2021 - 1:00AM

UK Regulatory

TIDMALGW

RNS Number : 7787L

Alpha Growth PLC

15 January 2021

Alpha Growth Plc

("Alpha", or the "Company")

Life Settlement specialist Alpha Growth announces year end

results of BlackOak Alpha Growth Fund managed by the Group.

Alpha Growth Plc (LSE: ALGW and OTCQB: ALPGF), the financial

services specialist in the growing Senior Life Settlement ("SLS")

asset class, is pleased to announce the year end results for its

BlackOak Alpha Growth Fund (the "Fund") investing in SLS.

On a net basis, the Fund produced a 2020 calendar year return of

10.63% and a 13.71% total return since inception, September

2019.

Alpha continues to actively market to registered investment

advisors in the US and to look at supplementing the direct outreach

with virtual events in the US that showcase the Fund.

With its December listing on the OTCQB, Alpha intends to closely

coordinate the US marketing of the Fund with greater reference to

the Company so US investors are able to follow the holding company

of the General Partner and Investment Manager of the Fund as well.

The Directors believe that this will expand the interest of US

investors in the Company's shares.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

For more information, please visit www.algwplc.com or contact

the following:

Alpha Growth Plc +44 (0) 20 3959 8600

Gobind Sahney, Executive Chairman info@algwplc.com

Pello Capital Limited +44 (0) 20 7710 9610

Mark Treharne mt@pellocapital.com

BlackOak Alpha Growth Funds +1 949-326-9799

Austin King, Investor Relations ak@algwplc.com

About Alpha Growth Plc

Specialist in Longevity Assets

Alpha Growth Plc is a financial advisory business providing

specialist consultancy, advisory, and supplementary services to

institutional and qualified investors globally in the multi-billion

dollar market of longevity assets. Building on its well-established

network, the Alpha Growth Group has a unique position in the

longevity asset services and investment business, as a listed

entity with global reach. The Group's strategy is to expand its

advisory and business services via acquisitions and joint ventures

in the UK and the US to attain commercial scale and provide

holistic solutions to alternative institutional investors who are

in need of specialised skills and unique access to deploy their

financial resource in longevity assets. www.algwplc.com .

SLS Assets and Non-correlation

A SLS refers to the sale of an existing life insurance policy to

a third party for a cash payment. Such a payment will be in excess

of the policy's surrender value, but less than its face value.

After the sale, the purchaser becomes the policy's beneficiary and

assumes payment of its premiums. There are many reasons why policy

holders may choose to sell their life insurance policies and sales

are usually only undertaken when the insured person doesn't have a

known life-threatening illness. The SLS provides individuals with

policies the option to realise value from an asset under a

regulated transaction. As a longevity asset, the SLS is

non-correlated to the real estate, equity capital and commodity

markets. Its value is a function of time because as time passes the

value gets closer to the face value of the policy. Hence creating a

steady increase in the net asset value of the investment. This

makes it highly attractive to investors wishing to counteract

volatility within an investment portfolio and add yield.

Note: The Company only advises on and manages SLS Assets that

originate in the USA where the SLS market is highly regulated.

About BlackOak Alpha Growth Fund

The Fund was established by two highly experienced longevity

asset management companies. The Fund invests in life settlements,

is a Cayman LP with a tax efficient Master/Feeder structure in an

open-ended format with quarterly redemptions. The Fund seeks to

provide well-diversified, non-correlated returns. The Fund aims to

achieve this objective through the acquisition of secondary and

tertiary Life Settlement policies that will be structured and

purchased to mitigate longevity risk and other investment and

business risks and where the Company's expertise can add value.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEANFLFDSFEFA

(END) Dow Jones Newswires

January 15, 2021 02:00 ET (07:00 GMT)

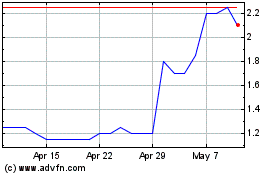

Alpha Growth (LSE:ALGW)

Historical Stock Chart

From Mar 2024 to Apr 2024

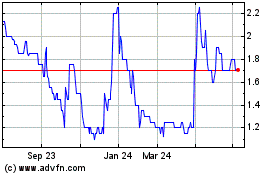

Alpha Growth (LSE:ALGW)

Historical Stock Chart

From Apr 2023 to Apr 2024