Altitude Group PLC Trading update (1734S)

July 07 2020 - 1:00AM

UK Regulatory

TIDMALT

RNS Number : 1734S

Altitude Group PLC

07 July 2020

7 July 2020

Altitude Group plc

(the "Company" or "Altitude")

Trading update

Altitude Group plc (AIM: ALT), the operator of the leading

marketplace for personalised products, provides an update on its

progress since it last reported on 23 March 2020 to date, a period

that has been dominated by the COVID 19 pandemic.

Trading had been as forecast from January through to mid-March,

with 175 suppliers participating in the Preferred Supplier Program

from 1st January 2020 and AIM membership continuing to grow.

As the enormity of the crisis evolved, we took clear, practical

and decisive action to manage cash resources through the limitation

of discretionary spend and marketing costs. Additionally, on 23

March, for the health and welfare of our employees and in

accordance with government guidelines, the Company transitioned

quickly and seamlessly to a remote working model across the UK and

US without detriment to its ability to serve the AIM network.

At the onset of COVID-19, the Company quickly pivoted to provide

educational information, SME guidance on government programs,

supplier business operations updates, virtual events and group

access to Personal Protective Equipment (PPE) products via trusted

supplier sources. Through these efforts, membership numbers are

steady at c. 2136 AIM Member, with average distributor revenue

increasing to c. $1m pa and aggregate member revenue of circa $2.2

Bn. Our VIP supplier partners remain unchanged at 175 from our last

update.

From mid-March and throughout April and May, our supplier

partners reported sharp year on year declines of up to 80% in

regular promotional product orders, in-line with wider industry

reporting. With US States beginning to emerge from shutdown,

activity has increased through our marketplace with demand for

traditional products showing modest increases. Industry reporting

supports order activity for June at around 50% of 2019 levels.

Cash and Liquidity

Cash at 31 March 2020, was GBP2.5m, and as of 2nd July is

GBP2.0m. Current cash does not include approximately GBP1.0m of

extended receivables, the deferral of which was attributable to

COVID-19. The Company was able to benefit from US government

programs, receiving $0.5m in funding under the US Federal Payroll

Protection Program. The Company is confident that all conditions

for the forgiveness of the funding received under the Program have

been met, and that the deferred receivables are collectible. The

Company remains debt-free, continues to be cautious in its approach

to all discretionary spend and is carefully managing cash whilst

adapting marketing and sales plans to meet the changing needs of

AIM Members and suppliers.

Revenue from subscription and fixed program fees, comprising

approximately 25% of Company's revenue, are not reliant on

transactional volume and remain minimally affected by COVID-19. The

significant COVID-19 related reduction in other revenue during the

quarter to June 20 and which is reliant on transactional volume,

will adversely impact the Company's cashflow in the quarter to

September. However, subject to continued steady recovery in

transactional volume through 2020 in the promotional products

market, we believe the Company has sufficient financial resources

and liquidity to see the business through to more normalized market

conditions.

Outlook

The Company has adapted quickly and well in navigating the

initial challenges imposed by the COVID-19 pandemic and subsequent

government lockdown. Given, the continued high level of uncertainty

the Company remains unable to give any guidance for the 12 month

trading period to the end of March 2021, but wishes to reassure

shareholders that the Company remains focused, nimble and

responsive to the current crisis. The Board is confident that

Altitude will continue to progress in the new and emergent post

COVID-19 environment. We continue to enjoy the support of our

supplier partners and AIM members, many of whom have expressed deep

gratitude for the assistance the Company has provided to them

during the crisis.

As a result of the reporting challenges caused by COVID-19 and

particularly in establishing the quantum of the revenue accrual up

to March 2020 for partners on annual service fee agreements, the

Company intends to announce full year results for the 15 months

ended 31 March by the end of September 2020.

Enquiries:

Altitude Group plc Via Instinctif - 020 7457

Nichole Stella, Chief Executive 2020

Officer

Graeme Couturier, Chief Financial

Officer

finnCap ltd

Jonny Franklin-Adams (Corporate

Finance)

Charlie Beeson (Corporate Finance)

Richard Chambers (ECM) 020 7220 0500

Instinctif Partners (Financial

PR)

Matthew Smallwood

Chantal Woolcock 020 7457 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKKABQPBKDCOK

(END) Dow Jones Newswires

July 07, 2020 02:00 ET (06:00 GMT)

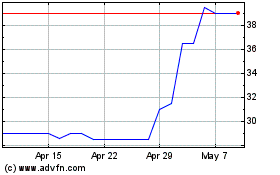

Altitude (LSE:ALT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altitude (LSE:ALT)

Historical Stock Chart

From Apr 2023 to Apr 2024