Altitude Group PLC Postponement of results and trading update (5127A)

September 30 2020 - 1:00AM

UK Regulatory

TIDMALT

RNS Number : 5127A

Altitude Group PLC

30 September 2020

30 September 2020

Altitude Group plc

(the "Company" or "Altitude")

Postponement of Results and Trading Update

Altitude Group plc (AIM: ALT), the operator of the leading

marketplace for personalised products, provides an update on its

results for the 15 month-period ended 31 March 2020.

In line with the Financial Reporting Council ("FRC") guidance*,

the Company now expects to release its results for the 15

month-period ended 31 March 2020 by the end of October 2020. This

delay is caused by the impact of the coronavirus pandemic on the

audit, including the remote audit process of the Company's main

operations in the US and the impact of business disruption on

judgmental balance sheet valuations. While the Board cannot be

certain as to the level of adjustments that the auditors may take

in relation to the coronavirus pandemic effects on the Company's

operations until their work is fully concluded, management expects

to report the following for the 15 months period ending 31 March

2020:

-- Revenue from continuing operations not less than GBP8.0 million**

-- Comparable revenue for the 12 months ending 31 December 2018 was GBP2.9 million

-- Cash position of GBP2.4 million

The Company can also report that the cash position at 31 August

2020 was GBP1.6 million which was in line with management's

expectations. The Company continues to be cautious in relation to

managing cash and discretionary spending. Following the cessation

of the US Payroll Protection Programme, the Company instituted a

temporary 20% salary reduction for the management team and

temporary reduction in staffing hours for all other employees in

both the US and the UK.

Current Trading

The Company has continued to trade and support its distributor

and supplier customers through the worst period of lockdown. As

previously detailed 25% of US revenue is not reliant on

transactional volume.

Recent industry reporting indicates that market transactional

volume was 44% down in the June quarter vs 2019 but improved in

July to 29% down and was steady in August at 26% down. Smaller and

medium sized distributors are reported to be slightly higher in

terms of year on year reductions. The slower rate of improvement in

August has tempered industry expectations for a V shaped recovery

and whilst August may be indicative of a longer and slower climb

through 2020 and into 2021, it is currently impossible to predict

with any degree of certainty.

We have retained 175 suppliers within the Preferred Supplier

Programme and AIM Smarter distributor membership has held steady

and currently stands at 2,103, who collectively historically

delivered aggregate annual revenues of circa $2.2 billion to

end-users.

We look forward to providing a further update with our full

Preliminary Results on 30(th) October.

* Financial Reporting Council ("FRC") guidance states,

"Companies, and in particular their audit committees, understand it

is vital that auditors have sufficient time and support to carry

out their work to an appropriate standard, including reassessing

work done to reflect changed circumstances - in some cases, this

may need companies to reconsider their reporting deadlines. Taken

from FRC Guidance on audit issues arising from the Covid-19

(Coronavirus) pandemic, 16 March 2020.

** Continuing Operations exclude Ad Products which has been

sold.

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. The above notification

is made in accordance with the requirements of the EU Market Abuse

Regulation.

Enquiries:

Altitude Group plc Via Instinctif - 020 7457

Nichole Stella, Chief Executive 2020

Officer

Graeme Couturier, Chief Financial

Officer

Keith Edelman, Non-Executive

Chairman

finnCap ltd

Jonny Franklin-Adams (Corporate

Finance)

Charlie Beeson (Corporate

Finance)

Richard Chambers (ECM) 020 7220 0500

Instinctif Partners (Financial

PR)

Matthew Smallwood

Chantal Woolcock 020 7457 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCLLMBTMTTTTIM

(END) Dow Jones Newswires

September 30, 2020 02:00 ET (06:00 GMT)

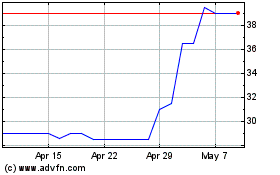

Altitude (LSE:ALT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altitude (LSE:ALT)

Historical Stock Chart

From Apr 2023 to Apr 2024