Altitude Group PLC Trading Update (7536D)

July 01 2021 - 1:00AM

UK Regulatory

TIDMALT

RNS Number : 7536D

Altitude Group PLC

01 July 2021

Altitude Group plc

("Altitude", "Group" or the "Company")

Trading Update

Altitude Group Plc (AIM: ALT), the operator of a leading

marketplace for the global promotional products industry, is

pleased to provide the following trading update for the first

quarter of the current financial year (April, May and June 2021) ("

Q1 2021 ") .

The Board is pleased to report that the Group continues to trade

positively, and current business performance is in line with the

Board's expectations. Despite industry headwinds in Q4 of the

financial year ended 31 March 2021, trading remained robust and

full year revenue is expected to be not less than GBP7.4 million,

with gross profit expected to be not less than GBP5.2 million.

The progressive recovery since the initial impact of the global

pandemic has continued into Q1 2021 with increasing purchase orders

through the AIM platform resulting in our June 2021 order value

exceeding both 2019 and 2020 levels. In line with this, the Group

has maintained a robust cash balance, with an expected closing

balance on 30 June 2021 of GBP1.4 million.

AIM Capital Solutions ("ACS") systemwide sales and revenue has

grown c.125% through Q1 2021. ACS affiliate members are required to

process all orders through the AIM platform to participate in the

program.

AIM Smarter ("AIM") membership is stable with 2,071 standard

members. Throughout the global pandemic period, membership numbers

have remained solid reflecting community loyalty and reliance on

AIM services.

Revenue from preferred partners on annual revenue agreements for

calendar year 2020 are fully settled and in line with management

expectations. Additionally, the Group has added 8 new preferred

partners during 2021, while maintaining 100% membership of the VIP

Preferred Partners. We supported our partners during coronavirus

through innovative marketing campaigns and collaborative PPE

programs strengthening those key relationships.

The Board continues to be pleased with the resilient trading and

liquidity performance of the Group. We remain confident in the

strength of the business, are focused on execution, and are well

positioned to benefit from continued market recovery. The Group

expects to report a profitable adjusted EBITDA for the financial

year ended 31 March 2021 in line with Board expectations. We look

forward to announcing full year results in September 2021.

For enquiries, please contact:

Altitude Group plc Via Zeus Capital

Nichole Stella, Chief Executive Officer

Graeme Couturier, Chief Financial Officer

Keith Edelman, Non-Executive Chairman

Zeus Capital Limited (Nominated Adviser & Broker) Tel: 0203 829

Dan Bate / David Foreman / James Edis (Corporate 5000

Finance)

Dominic King (Corporate Broking)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDKKBQDBKBQAN

(END) Dow Jones Newswires

July 01, 2021 02:00 ET (06:00 GMT)

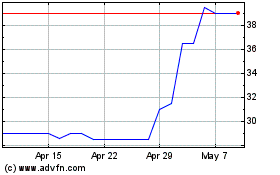

Altitude (LSE:ALT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altitude (LSE:ALT)

Historical Stock Chart

From Apr 2023 to Apr 2024