Amur Minerals Corporation Sale of Subsidiary (0850E)

July 05 2021 - 1:00AM

UK Regulatory

TIDMAMC

RNS Number : 0850E

Amur Minerals Corporation

05 July 2021

5 July 2021

Amur Minerals Corporation

("Amur" or the "Company")

Sale of Subsidiary

Amur Minerals Corporation, a nickel-copper sulphide mineral

exploration and resource development company which possesses a

wholly owned nickel sulphide asset located in the far east of

Russia, is pleased to announce the sale of its wholly-owned

subsidiary Carlo Holdings Limited ("CHL") for a cash consideration

of US$6,137,019 pursuant to a share sale agreement entered into on

3 July 2021 with Hamilton Investments Pte. Ltd., a subsidiary of

Britmar (Asia) Pte Ltd ("Brit Mar"). Completion of the sale will

take place immediately.

CHL holds the Amur group's investment of US$4.67 million in

secured convertible loan notes ("CLNs") in Nathan River Resources

Pte Limited ("Nathan River Resources") which owns the Roper Bar

Iron Ore Project located in the Northern Territory in

Australia.

Amur acquired CHL on 28 August 2020 for a cash consideration of

GBP1, and immediately provided the funding whereby CHL subscribed

for the CLNs with a principal amount of US$4.67 million issued by

Nathan River Resources. The CLNs have a 14% coupon, paid quarterly,

and are convertible at the holder's option at any time from issue

until 15 days prior to their maturity date on the third anniversary

of issue. Any CLNs not converted by the third anniversary of issue

are redeemable at par.

As per the original agreement between CHL and Nathan River

Resources, Nathan River Resources has the right to buy back the

CLN's in advance of the maturation of the CLN's on 28 August 2023

by repayment of the US$4.67 million in principle and all

outstanding unpaid interest through to the expiration of the notes

(the interest covers the period from 1 April 2021 through to 28

August 2023). Amur is now selling CHL for US$6,137,019,

representing a profit of US$1.47 million when set against its

original investment, albeit foregoing the interest that would

otherwise be payable over the lifetime of the CLNs. In the year

ended 31 December 2020, CHL audited profit after tax was US$215,000

and gross assets were US$4,883,450. The consideration is payable in

cash and will be settled by Hamilton Investments Pte. Ltd.

immediately.

The Company intends to use the sale proceeds to fund the

continued development of the far eastern located Kun-Manie nickel

copper sulphide project and general working capital, as well as

providing a cash reserve with which to consider investment

opportunities. Amur also announces that Mr Adam Habib, President of

Amur, has left the Company.

Robin Young, CEO of Amur Minerals Corporation, commented :

"Brit Mar's interest in this transaction is no surprise when you

look at the substantial increase of the iron ore price from August

2020 at US$120/t, at the time of our purchase, to the current

US$208/t price. This substantial increase is and should be

beneficial to the Nathan River Resources operation. Brit Mar's

purchase of our interest in Nathan River Resources and its Roper

Bar iron ore mine also comes as no surprise.

"Onboarding of US$1.47 million in interest and the repayment of

the US$4.67 million principal used to purchase the Convertible Loan

Notes in one lump sum cash transaction instead of quarterly derived

US$160,000 quarterly interest payments through to 28 August 2023 is

highly beneficial to Amur. Especially when one views it from a time

value of money aspect. Our cash reserves are now US$8.9 million,

having increased from US$2.8 million. Completion of this

transaction excludes any equity dilution."

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, as it forms part of UK law by virtue

of the European Union (Withdrawal) Act 2018, until the release of

this announcement.

Enquiries:

Company Nomad and Broker Public Relations

Amur Minerals Corp. S.P. Angel Corporate Blytheweigh

Finance LLP

Robin Young CEO Richard Morrison Megan Ray

Adam Cowl Tim Blythe

+44 (0) 20 3470

+7 (4212) 75 56 15 0470 +44 (0) 20 7138 3204

For further information, and Company updates see the Company

website at www.amurminerals.com and twitter page @

amur_minerals.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISBBGDRISGDGBS

(END) Dow Jones Newswires

July 05, 2021 02:00 ET (06:00 GMT)

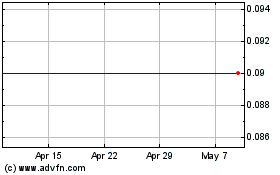

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

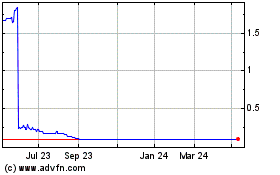

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024