TIDMAMOI

RNS Number : 8373U

Anemoi International Ltd

08 April 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR PUBLICATION, RELEASE, OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN, INTO, OR FROM THE UNITED STATES, AUSTRALIA, CANADA, NEW

ZEALAND, JAPAN, SOUTH AFRICA OR ANY JURISDICTION IN WHICH THE SAME

WOULD BE UNLAWFUL. THE INFORMATION CONTAINED HEREIN DOES NOT

CONSTITUTE AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES,

AUSTRALIA, CANADA, NEW ZEALAND, JAPAN OR SOUTH AFRICA (UNLESS AN

EXEMPTION UNDER THE RELEVANT SECURITIES LAWS IS AVAILABLE) OR IN

ANY OTHER JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED UNDER

THE MARKET ABUSE REGULATION (EU) NO. 596/2014, AS IT FORMS PART OF

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018.

PLEASE SEE THE IMPORTANT NOTICES AT THE OF THIS

ANNOUNCEMENT.

8 April 2021

Anemoi International Ltd

Completion of Placing

Ticker: AMOI

Anemoi international LTD

("Anemoi" or the "Company")

Completion of Placing

The board of directors of Anemoi is pleased to announce the

successful completion of a placing of Depositary Interests ("DIs")

representing interests in ordinary shares of no par value in the

Company ("Ordinary Shares").

A total of 6,000,000 new DIs (the "Placing DIs") have been

placed by Peterhouse Capital Limited ("Peterhouse") at a price of

GBP0.04 per Placing DIs (the "Placing") with existing and new

investors ("Placees") raising gross proceeds of approximately

GBP240,000. The Placing DIs represent Ordinary Shares representing

20 per cent. of the Ordinary Share capital of the Company prior to

the Placing.

The Placing proceeds, together with the Group's existing cash

resources, will be used to expand the Company's balance sheet in

advance of a reverse takeover transaction ("RTO").

An application has been made for the Ordinary Shares represented

by the Placing DIs to be admitted to a Standard Listing on the

Official List and to trading on the Main Market of the London Stock

Exchange ("Admission"). It is expected that Admission will take

place at or around 8.00 a.m. (London time) on 13 April 2021 and

that dealings in the Placing DIs will commence at the same

time.

The Ordinary Shares represented by the Placing DIs will, when

issued, be credited as fully paid and will rank pari passu in all

respects with the existing issued Ordinary Shares.

Grant of Warrants

Subject to Admission, the Company will grant one 'A' Warrant and

one 'B' Warrant to each Placee for each Placing DI purchased by the

Placee pursuant to the Placing.

-- The 'A' Warrants have an exercise period of one year from the

first anniversary of the date of grant and entitle an 'A' Warrant

holder to subscribe for one Ordinary Share in the Company for each

'A' Warrant held at a subscription price of GBP0.08.

-- The 'B' Warrants have an exercise period of one year from the

second anniversary of the date of grant and entitle a 'B' Warrant

holder to subscribe for one Ordinary Share in the Company for each

'B' Warrant held at a subscription price of GBP0.12.

-- In each case, the subscription rights and price per Ordinary

Share are subject to adjustment in the event of any share splits or

share consolidations by the Company. The 'A' Warrants and 'B'

Warrants are (i) unquoted; (ii) certificated; (iii) transferable

subject to the consent of the Company's board of directors; and

(iv) without any shareholder rights.

-- Accelerated exercise rights apply to both classes of warrant

in the event of further equity fundraises by the Company (including

in connection with a merger, acquisition or reverse takeover

transaction).

-- Both the 'A' Warrants and the 'B' Warrants are callable by

the Company at any time during their respective exercise periods

upon the Company's share price reaching the subscription price of,

respectively, GBP0.08 per share for the 'A' Warrants and GBP0.12

per share for the 'B' Warrants. Any warrants that remain

unexercised at the end of the relevant exercise period will

automatically lapse.

Duncan Soukup, Chief Executive Officer of Anemoi, commented:

"We are extremely grateful for the support of both existing and

new shareholders. The proceeds of the Placing strengthen the

Company's balance sheet and should enhance the Company's chances of

completing a successful RTO."

Following Admission, the total issued share capital of the

Company will be 36,000,000 Ordinary Shares of no par value. This

figure may be used by Shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

-S-

For further information, please contact:

Enquiries:

Anemoi International Ltd

---------------------

+33 (0)6 78 63 26

Duncan Soukup (Chief Executive Officer) 89

---------------------

Peterhouse Capital Limited (Broker)

---------------------

Charles Goodfellow

Heena Karani +44 (0) 20 7469 0930

---------------------

Important Notice

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

Market Abuse Regulation (Regulation 596/2014), as it forms part of

domestic law by virtue of the European Union (Withdrawal) Act 2018

("MAR"). Upon the publication of this Announcement via a Regulatory

Information Service ("RIS") this inside information is now

considered to be in the public domain.

This Announcement (the "Announcement") has been issued by and is

the sole responsibility of the Company.

This Announcement is not for publication or distribution,

directly or indirectly, in or into the United States (including its

territories and possessions, any state of the United States and the

District of Columbia, collectively, the "United States"),

Australia, Canada, Japan, New Zealand, the Republic of South

Africa, or any other jurisdiction where to do so might constitute a

violation or breach of any applicable law. The Placing and the

distribution of this Announcement and other information contained

herein may be restricted by law in certain jurisdictions and

persons into whose possession any document or other information

referred to herein comes should inform themselves about and observe

any such restriction. Any failure to comply with the restrictions

may constitute a violation of the securities laws of any such

jurisdiction.

This Announcement is for information purposes only and does not

constitute or form part of, and should not be construed as, an

offer for sale or subscription of, or solicitation of any offer to

subscribe for or to acquire, any Ordinary Shares or DIs in any

jurisdiction, including in or into the United States, Australia,

Canada, Japan, New Zealand or the Republic of South Africa, where

to do so would be unlawful. Investors should not subscribe for or

purchase any Ordinary Shares or DIs except on the basis of

information publicly announced by the Company to a RIS by or on

behalf of the Company on or prior to the date of this

Announcement.

No public offering of the Placing DIs is being made in the

United States, United Kingdom, Australia, Canada, Japan, New

Zealand, the Republic of South Africa, or elsewhere. The Placing

DIs have not been and will not be registered under the applicable

securities laws of any state, province or territory of Australia,

Canada, Japan, New Zealand or the Republic of South Africa. Subject

to certain exceptions, the Placing DIs may not be offered or sold

in Australia, Canada, Japan, New Zealand or the Republic of South

Africa or to, or for the account or benefit of, any national,

resident or citizen of Australia, Canada, Japan, New Zealand or the

Republic of South Africa.

This Announcement is not for publication or distribution,

directly or indirectly, in or into the United States. This

Announcement is not an offer of securities for sale into the United

States. The Placing DIs have not been and will not be registered

under the US Securities Act, or any securities laws of any state or

other jurisdiction of the United States and may not be offered,

sold, pledged, taken up, exercised, resold, renounced, transferred

or delivered, directly or indirectly, in or into the United States

absent registration under the US Securities Act, except pursuant to

an exemption from the registration requirements of the Securities

Act and in compliance with any applicable securities laws of any

state or other jurisdiction of the United States. The Placing DIs

have not been approved, disapproved or recommended by the U.S.

Securities and Exchange Commission, any state securities commission

in the United States or any other U.S. regulatory authority, nor

have any of the foregoing authorities passed upon or endorsed the

merits of the offering of Placing DIs. There will be no public

offer of DIs or of the Ordinary Shares represented by them in the

United States. The Company has not been and will not be registered

under the US Investment Company Act, and investors will not be

entitled to the benefits of the US Investment Company Act.

This Announcement does not constitute, or purport to include the

information required of, a disclosure document under Chapter 6D of

the Australian Corporations Act 2001 (the "Corporations Act") or a

product disclosure statement under Chapter 7 of the Corporations

Act and will not be lodged with the Australian Securities and

Investments Commission. No offer of shares is or will be made in

Australia pursuant to this Announcement, except to a person who is:

(i) either a "sophisticated investor" within the meaning of section

708(8) of the Corporations Act or a "professional investor" within

the meaning of section 9 and section 708(11) of the Corporations

Act; and (ii) a "wholesale client" for the purposes of section

761G(7) of the Corporations Act (and related regulations) who has

complied with all relevant requirements in this respect, or another

person who may be issued shares without requiring a disclosure

document. No Placing DIs or the Ordinary Shares represented by them

may be offered for sale (or transferred, assigned or otherwise

alienated) to investors in Australia for at least 12 months after

their issue, except in circumstances where disclosure to investors

is not required under Part 6D.2 of the Corporations Act.

The Placing is available, and is and may be made, in or from

within the Bailiwick of Guernsey:

i. by persons licensed to do so under the Protection of

Investors (Bailiwick of Guernsey) Law, 1987 (as amended); or

ii. to persons licensed under the Protection of Investors

(Bailiwick of Guernsey) Law, 1987 (as amended), the Insurance

Business (Bailiwick of Guernsey) Law, 2002 (as amended), the

Banking Supervision (Bailiwick of Guernsey) Law, 1994 (as amended)

or the Regulation of Fiduciaries, Administration Businesses and

Company Directors, etc. (Bailiwick of Guernsey) Law, 2000 (as

amended).

The Placing is not available in or from within the Bailiwick of

Guernsey other than in accordance with paragraphs (i) and (ii)

above and must not be relied upon by any person unless made or

received in accordance with such paragraphs.

Subject to certain exemptions (if applicable), the Company shall

not raise money in Jersey by the issue anywhere of Placing DIs or

of the Ordinary Shares represented by them. Subject to certain

exemptions (if applicable), offers for securities in the Company

may only be distributed and promoted in or from within Jersey by

persons with appropriate registration under the Financial Services

(Jersey) Law 1998, as amended. It must be distinctly understood

that the Jersey Financial Services Commission does not accept any

responsibility for the financial soundness of or any

representations made in connection with the Company.

The Placing is available, and is and may be made, in or from

within the Isle of Man only:

i. by persons licensed to do so under the Isle of Man Financial Services Act 2008; or

ii. to persons: (a) licensed under Isle of Man Financial

Services Act 2008; or (b) falling within exclusion 2(r) of the Isle

of Man Regulated Activities Order 2011 (as amended); or (c) whose

ordinary business activities involve them in acquiring, holding,

managing or disposing of shares or debentures (as principal or

agent), for the purposes of their business.

The Placing is not available in or from within the Isle of Man

other than in accordance with paragraphs (i) and (ii) above and,

accordingly, neither may be relied upon by any person unless made

or received in accordance with such paragraphs.

The comparability of the information on the Company's

performance to date to its future performance is by its nature

limited for a variety of reasons. Without limitation, results can

be positively or negatively affected by market conditions beyond

the control of the Company or any other person. Neither past

performance of the Company is a reliable indicator of, and cannot

be relied upon as a guide to, the future performance of the

Company. Prospective investors should be aware that any investment

in the Company is speculative, involves a high degree of risk, and

could result in the loss of all or substantially all of their

investment. Persons considering making such an investment should

consult an authorised person specialising in advising on such

investments. This Announcement does not constitute a recommendation

concerning the Placing and prospective investors should note that

the value of DIs and the Ordinary Shares represented by them can

decrease as well as increase.

Peterhouse, which is authorised and regulated in the United

Kingdom by the UK Financial Conduct Authority, are acting

exclusively for the Company and no one else in connection with the

Placing and Admission. Peterhouse will not regard any other persons

as their clients in relation to the subject matter of this

Announcement and will not be responsible to anyone other than the

Company for providing the protections afforded to their respective

clients, nor for providing advice in relation to the Placing,

Admission, the contents of this Announcement or any transaction,

arrangement or other matter referred to herein.

Save as set out above, none of the Company, Peterhouse or any of

their operating partners, co-investors and joint venture partners,

or any of their respective parent or subsidiary undertakings, or

the subsidiary undertakings of any such parent undertakings, or any

of such person's respective directors, officers, employees, agents,

affiliates or advisers or any other person ("their respective

affiliates") accepts any responsibility or liability whatsoever

for/or makes any representation or warranty, express or implied, as

to this Announcement, including the truth, accuracy or completeness

of the information in this Announcement (or whether any information

has been omitted from this Announcement) or any other information

relating to the Company, its subsidiaries or associated companies,

whether written, oral or in a visual or electronic form, and

howsoever transmitted or made available or for any loss howsoever

arising from any use of this Announcement or its contents or

otherwise arising in connection therewith. The Company, Peterhouse

and their respective affiliates accordingly disclaim all and any

liability whatsoever whether arising in tort, contract or otherwise

which they might otherwise have in respect of this Announcement or

its contents or otherwise arising in connection therewith. No

representation or warranty, express or implied, is made by

Peterhouse or any of their affiliates as to the accuracy, fairness,

completeness or sufficiency of the information contained in this

Announcement.

In connection with the Placing, Peterhouse and any of their

affiliates, acting as an investor for its own account(s), may

acquire Placing DIs or the Ordinary Shares represented by them and,

in that capacity, may retain, purchase, sell, offer to sell or

otherwise deal for its or their own account(s) in such securities

of the Company, any other securities of the Company or other

related investments in connection with the Placing or otherwise.

Accordingly, references to Placing DIs or Ordinary Shares being

offered, subscribed, acquired, placed or otherwise dealt in should

be read as including any issue or offer to, or subscription,

acquisition, placing or dealing by Peterhouse and any of their

affiliates acting as an investor for its or their own account(s).

Neither Peterhouse nor any of their affiliates intends to disclose

the extent of any such investment or transactions otherwise than in

accordance with any legal or regulatory obligation to do so. In

addition, in connection with the Placing, Peterhouse may enter into

financing arrangements with investors, such as share swap

arrangements or lending arrangements where Placing DIs or the

Ordinary Shares represented by them are used as collateral, that

could result in Peterhouse acquiring shareholdings in the

Company.

This Announcement does not constitute a recommendation

concerning the Placing. The price and value of securities and any

income from them can go down as well as up and investors may not

get back the full amount invested on disposal of the securities.

Past performance is not a guide to future performance. Information

in this Announcement or any of the documents relating to the

proposed Placing cannot be relied upon as a guide to future

performance. The Placing timetable may be influenced by a range of

circumstances such as market conditions. There is no guarantee that

the Placing will occur and you should not base your financial

decisions on the Company's intentions in relation to the Placing or

the information contained in this Announcement. The contents of

this Announcement are not to be construed as legal, business or tax

advice. Each prospective investor should consult his, her or its

own legal adviser, financial adviser or tax adviser for legal,

financial or tax advice.

This Announcement does not identify or suggest, or purport to

identify or suggest, the risks (direct or indirect) that may be

associated with an investment in the Placing DIs or the Ordinary

Shares represented by them. Any investment decision to buy Placing

DIs or Ordinary Shares in the Placing must be made solely on the

basis of publicly available information, which has not been

independently verified by Peterhouse.

Certain statements in this Announcement are, or may be deemed to

be, forward-looking statements which are based on the Company's

expectations, intentions and projections regarding its future

performance, anticipated events or trends and other matters that

are not historical facts. These forward-looking statements, which

may use words such as "anticipates", "believes", "estimates",

"expects", "intends", "may", "plans", "projects", "seeks", "aims",

"should" or "will" or, in each case, their negative or other

variations or similar expressions.

These forward-looking statements include all matters that are

not historical facts. They appear in a number of places throughout

this Announcement and include, but are not limited to, statements

regarding the Company's intentions, beliefs or current expectations

concerning, among other things, the Company's results of

operations, financial position, prospects, growth, target total

return, investment strategy, financing strategies, and the

development of the industries in which the Company's businesses

operate. Such forward-looking statements involve unknown risks,

uncertainties and other factors, which may cause the actual results

of operations, performance or achievement of the Company, or

industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. In addition, even if the Company's

results of operations, financial position and growth, and the

development of the market and the industry in which the Company

operates, are consistent with the forward-looking statements

contained in this Announcement, those results or developments may

not be indicative of results or developments in subsequent

periods.

Given these uncertainties, prospective investors are cautioned

not to place any undue reliance on such forward-looking statements.

These forward-looking statements speak only as at the date of such

statements. Except as required by applicable law, none of the

Company, Peterhouse or their respective affiliates assumes any

obligation or undertaking to update, review or revise any forward

looking statements contained in this Announcement whether as a

result of new information, future developments or otherwise.

The Placing DIs will not be admitted to trading on any stock

exchange other than the London Stock Exchange.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRUWRRRAVUSRAR

(END) Dow Jones Newswires

April 08, 2021 06:07 ET (10:07 GMT)

Anemoi (LSE:AMOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

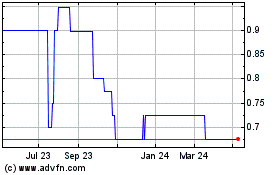

Anemoi (LSE:AMOI)

Historical Stock Chart

From Apr 2023 to Apr 2024