TIDMAMTE

RNS Number : 0974T

AMTE Power PLC

23 March 2021

23 March 2021

AMTE POWER PLC

Interim Results

AMTE Power plc ("AMTE Power", the "Company" and together with

its subsidiary undertakings, the "Group"), a developer and

manufacturer of lithium-ion and sodium-ion battery cells for

specialist markets, announces half year results for the six months

to 31 December 2020.

Financial highlights

-- Revenue of GBP0.62 million for the six months to 31 December

2020 (H1 19/20: GBP0.58 million).

-- Loss before tax of GBP1.46 million for the period (H1 19/20:

loss GBP0.86 million), in line with management's expectations. The

rise in losses reflects increased investment in product

development, recruitment of key employees and marketing as the

Group moves towards commercialisation.

-- Cash and cash equivalents at 31 December 2020 of GBP0.22 million (H1 19/20: GBP0.60 million).

Operational highlights

-- Secured new commercial contracts and grant funding in support

of its product development work, winning ten new projects in the

period with an aggregate value of GBP1.9 million (H1 19/20: won ten

new projects with total value of GBP1.0 million). Seven of the ten

projects are expected to complete by 30 June 2021.

Post period end events

-- In February 2021, the Group signed a framework agreement with

UK Battery Industrialisation Centre ("UK BIC") enabling it to

access the cell manufacturing facility, test its manufacturing

processes for some of its battery cells, and materially expand its

production capacity.

-- Completed a successful IPO with admission to AIM on 12 March

2021 alongside an oversubscribed placing to new and existing

shareholders raising gross proceeds to the Group of GBP13.0

million.

Outlook

-- The Board believes that the full year outlook will be in line

with market expectations and that the level of income will continue

to grow through the second half of the year.

Kevin Brundish, CEO of AMTE Power said:

"We were very pleased by the response to our IPO from investors.

Joining the market has coincided with a period of significant

interest in our battery cells as governments globally look to

decarbonise their economies. The IPO has provided us with

sufficient capital to take our battery cells into production as we

respond to this growing interest."

For further information contact:

AMTE Power plc Tel: +44 (0)1847 867 200

Kevin Brundish (Chief Executive Officer)

Adam Westcott (Chief Financial Officer)

WH Ireland Limited (NOMAD and Joint Broker) Tel: +44 (0)207 220 1666

Chris Fielding / Matt Chan

SI Capital Limited (Joint Broker) Tel: +44 (0)1483 413 500

Nick Emerson / Nick Briers

Novella Communications Tel: +44 (0)203 151 7008

Tim Robertson / Fergus Young

Chief Executive's Statement

Introduction

We are pleased to make the following inaugural interim statement

for AMTE Power as a public company. The six months under review to

31 December 2020 was an important period for the business. In

November 2020 the UK Government set out its plan for a "Green

Industrial Revolution" in the UK, voicing the need to establish a

battery manufacturing base of scale in the UK and committing to

back UK based battery related product development. As a leading

developer and manufacturer of battery cells focussed on specialist

markets, combined with the visible acceleration in the global move

to decarbonisation and our recent successful IPO, means, we

believe, that we are well placed to achieve our commercial goals.

The next phase of our business is the continued product development

of our three highly differentiated battery cells through to product

release over the next three years.

During the period we invested in our sales and marketing team as

we saw increased interest in our product offerings. This increased

investment, along with the enhanced profile that the IPO has given

us, should elicit further engagements with new potential customers.

Our objective is to secure long-term engagements with clients who

are aligned with our timeline for when our products become

accredited and ready for volume production.

To be able to produce our battery cells at scale we need to

finalise the manufacturing processes which continued to be

developed in line with expectations through the period. The

Government established the UK BIC to help UK companies prove

whether their battery related technologies - from subcomponents

such as electrodes and cell materials through to full cells and

battery modules and packs - can be manufactured at the required

volume, speed, performance and cost, in order to be commercially

successful. To this end, the framework agreement we have with the

UK BIC was negotiated in the period and signed soon afterwards in

February 2021. This agreement will take us a long way towards our

volume production goals.

Alongside the product development, we continued to progress our

plans for a 'gigafactory' as part of the proposed expansion of our

production capability, developing our ability to meet the expected

customer demand for our products.

Operational overview

The value of potential sales in our pipeline continued to grow

throughout the period. A key driver of this growth has been the

interest being shown in our Ultra High Power and Ultra Energy cells

from specialised automotive manufacturers, resulting in a growing

number of engagements with end users.

We are delighted that progress under our development and supply

agreement with an equipment manufacturer within the oil and gas

sector continued in line with expectations. With the further work

completed in the period on our Ultra Prime product, our client

began to disclose further details on the demand profile expected

for this product.

We have always believed that Ultra Safe, aimed at the energy

storage market, whilst at an earlier stage than the other pipeline

products, has the greatest opportunity to be a transformational

product in the battery market place, given the significant

potential advantages it has over lithium-ion based battery cells as

a storage medium in terms of safety, efficacy and cost. We are

therefore delighted to say that we continue to make good progress,

in line with expectations, towards product release.

We are also seeing early demand opportunities for some of our

products outside of the UK, including India, Africa, and,

importantly, Australia where the Group has signed a Memorandum of

Understanding concerning the establishment of a joint venture with

InfraNomics (an Australian company which developed the strategy for

Lithium Valley, a substantial battery supply chain initiative in

Australia) to facilitate access for energy storage cells to that

market, which the Board perceives to be one of the world's most

active markets for such cells.

Financial results

Total income for the period was GBP0.62million (H1 19/20:

GBP0.58million), an increase of 7.8%. During the reporting period

we secured ten new projects with an aggregate value of GBP1.90

million, of which seven are due to finish by 30 June 2020. These

provide a significant increase in the growth trajectory of income

for the second half of the year.

The loss before tax for the period was GBP1.46 million (H1

19/20: loss GBP0.86 million). The primary driver of the rise in

losses was the Group's accelerated investment in its people,

including the expansion of its sales and business development team,

and the ongoing development of its products. The Group continues to

seek support for its development work from grant schemes such as

the UK's Faraday Challenge and funding bodies such as Innovate to

help support investment in product development. At 31 December

2020, the Group was active on live grant funded projects with a

total of GBP2.90 million of income remaining, which we expect to

recognise over multiple financial periods.

At 31 December 2020, the Group had cash and short-term deposits

of GBP0.22 million (H1 19/20: GBP0.61 million). The cash position

was further supplemented in early February 2021 with GBP0.25

million of funds attributable to the Group's R&D tax credit and

expenditure credit submissions for the period ended 30 June 2020.

The Group raised GBP11.33 million net of fees as part of its IPO on

AIM in March 2021.

Outlook

Following our successful IPO, the Group is in a strong financial

position. We continue to build opportunities across all of our core

markets. As at the end of February we had 80 active engagements on

a range of opportunities including commercial development and

product request opportunities as well as discussions to create

consortia to secure grant funding for focused projects aimed at

financing key work streams relating to our product development

work. We expect to continue to make good progress in all these

areas.

Consolidated statements of comprehensive income

Unaudited Unaudited Audited

6 months ended 6 months ended 15 months ended

31 December 31 December 30 June 2020

2020 2019

GBP GBP GBP

------------------------ ----------------------- -----------------------

Continuing operations

------------------------ ----------------------- -----------------------

Revenue 623,536 578,702 1,264,855

------------------------ ----------------------- -----------------------

Cost of sales (460,782) (537,554) (1,231,343)

------------------------ ----------------------- -----------------------

Gross profit 162,754 41,148 33,512

------------------------ ----------------------- -----------------------

Other income 88,356 125,977 199,760

------------------------ ----------------------- -----------------------

Administrative expenses (1,565,838) (942,170) (2,111,959)

------------------------ ----------------------- -----------------------

Operating loss (1,314,728) (775,045) (1,878,687)

------------------------ ----------------------- -----------------------

Finance income 1,169 8,204 16,741

------------------------ ----------------------- -----------------------

Finance expense (142,110) (89,771) (242,111)

------------------------ ----------------------- -----------------------

Loss before taxation (1,455,669) (856,612) (2,104,057)

------------------------ ----------------------- -----------------------

Taxation 45,926 154,000 222,271

------------------------ ----------------------- -----------------------

Loss and total comprehensive

loss for the period (1,409,743) (702,612) (1,881,786)

------------------------ ----------------------- -----------------------

Basic loss per share (GBP21.38) (GBP12.26) (GBP32.57)

------------------------ ----------------------- -----------------------

Diluted loss per share (GBP21.38) (GBP12.26) (GBP32.57)

------------------------ ----------------------- -----------------------

Consolidated statements of financial position

Note Unaudited Unaudited Audited

As at As at As at

31 December 31 December 30 June 2020

2020 2019

GBP GBP GBP

----- ------------------------- ------------------------- -------------------------

Non-current assets

----- ------------------------- ------------------------- -------------------------

Intangible assets 5 19,438,264 16,575,141 18,061,139

----- ------------------------- ------------------------- -------------------------

Property, plant and

equipment 6 1,104,329 1,156,842 1,165,179

----- ------------------------- ------------------------- -------------------------

Right-of-use assets 7 1,059,007 312,739 1,146,450

----- ------------------------- ------------------------- -------------------------

Investments 2 - 2

----- ------------------------- ------------------------- -------------------------

Total non-current assets 21,601,602 18,044,722 20,372,770

----- ------------------------- ------------------------- -------------------------

Current assets

----- ------------------------- ------------------------- -------------------------

Inventories 231,755 155,926 219,133

----- ------------------------- ------------------------- -------------------------

Trade and other receivables 1,151,471 1,086,716 889,120

----- ------------------------- ------------------------- -------------------------

Tax receivables 142,469 45,926 96,543

----- ------------------------- ------------------------- -------------------------

Receivables under sub-leases - - -

----- ------------------------- ------------------------- -------------------------

Cash and cash equivalents 221,218 607,122 949,569

----- ------------------------- ------------------------- -------------------------

Total current assets 1,746,913 1,895,690 2,154,365

----- ------------------------- ------------------------- -------------------------

Total assets 23,348,515 19,940,412 22,527,135

----- ------------------------- ------------------------- -------------------------

Current liabilities

----- ------------------------- ------------------------- -------------------------

Trade and other payables (1,011,228) (427,926) (610,042)

----- ------------------------- ------------------------- -------------------------

Borrowings (20,349) (19,276) (20,350)

----- ------------------------- ------------------------- -------------------------

Patent licence obligations (575,177) (411,043) (500,401)

----- ------------------------- ------------------------- -------------------------

Lease liabilities (114,060) (73,130) (106,316)

----- ------------------------- ------------------------- -------------------------

Deferred income (28,564) (24,327) (28,564)

----- ------------------------- ------------------------- -------------------------

Total current liabilities (1,749,378) (955,702) (1,265,673)

----- ------------------------- ------------------------- -------------------------

Non-current liabilities

----- ------------------------- ------------------------- -------------------------

Borrowings (85,509) (59,669) (95,216)

----- ------------------------- ------------------------- -------------------------

Patent licence obligations (15,184,713) (13,947,269) (14,595,655)

----- ------------------------- ------------------------- -------------------------

Lease liabilities (937,328) (172,476) (1,001,304)

----- ------------------------- ------------------------- -------------------------

Deferred income (2,178,862) (1,481,540) (1,898,091)

----- ------------------------- ------------------------- -------------------------

Provisions for dilapidations (208,687) (203,551) (208,309)

----- ------------------------- ------------------------- -------------------------

Total non-current liabilities (18,595,099) (15,864,505) (17,798,575)

----- ------------------------- ------------------------- -------------------------

Total liabilities (20,344,477) (16,820,207) (19,064,248)

----- ------------------------- ------------------------- -------------------------

Net assets 3,004,038 3,120,205 3,462,887

----- ------------------------- ------------------------- -------------------------

Equity

----- ------------------------- ------------------------- -------------------------

Share capital 336 302 321

----- ------------------------- ------------------------- -------------------------

Share premium 9,023,909 7,096,361 8,067,562

----- ------------------------- ------------------------- -------------------------

Share options reserve 122,584 104,130 128,052

----- ------------------------- ------------------------- -------------------------

Accumulated losses (6,142,791) (4,080,588) (4,733,048)

----- ------------------------- ------------------------- -------------------------

Total equity 3,004,038 3,120,205 3,462,887

----- ------------------------- ------------------------- -------------------------

Consolidated statements of changes in equity

Share Share premium Retained Share Total

capital deficit options

reserve

--------------- ---------------------- -------------------- -------------------- ------------------- ----------------

GBP GBP GBP GBP GBP

---------------------- -------------------- -------------------- ------------------- ----------------

Balance at 1

April

2019 267 5,092,139 (2,851,262) 62,446 2,303,590

---------------------- -------------------- -------------------- ------------------- ----------------

Share based

payments - - - 15,869 15,869

---------------------- -------------------- -------------------- ------------------- ----------------

Total

comprehensive

loss for the

period - - (526,714) - (526,714)

---------------------- -------------------- -------------------- ------------------- ----------------

Balance at 30

June

2019 267 5,092,139 (3,377,976) 78,315 1,792,745

---------------------- -------------------- -------------------- ------------------- ----------------

Balance at 1

July

2019 267 5,092,139 (3,377,976) 78,315 1,792,745

---------------------- -------------------- -------------------- ------------------- ----------------

Share based

payments - - - 25,815 25,815

---------------------- -------------------- -------------------- ------------------- ----------------

Issue of

shares (less

fundraising

costs) 35 2,004,222 - - 2,004,257

---------------------- -------------------- -------------------- ------------------- ----------------

Total

comprehensive

loss for the

period - - (702,612) - (702,612)

---------------------- -------------------- -------------------- ------------------- ----------------

Balance at 31

December

2019 302 7,096,361 (4,080,588) 104,130 3,120,205

---------------------- -------------------- -------------------- ------------------- ----------------

Balance at 1

January

2020 302 7,096,361 (4,080,588) 104,130 3,120,205

---------------------- -------------------- -------------------- ------------------- ----------------

Share based

payments - - - 23,922 23,922

---------------------- -------------------- -------------------- ------------------- ----------------

Issue of

shares (less

fundraising

costs) 19 971,201 - - 971,220

---------------------- -------------------- -------------------- ------------------- ----------------

Total

comprehensive

loss for the

period - - (652,460) - (652,460)

---------------------- -------------------- -------------------- ------------------- ----------------

Balance at 30

June

2020 321 8,067,562 (4,733,048) 128,052 3,462,887

---------------------- -------------------- -------------------- ------------------- ----------------

Balance at 1

July

2020 321 8,067,562 (4,733,048) 128,052 3,462,887

---------------------- -------------------- -------------------- ------------------- ----------------

Share based

payments - - - (5,468) (5,468)

---------------------- -------------------- -------------------- ------------------- ----------------

Issue of

shares (less

fundraising

costs) 15 956,347 - - 956,362

---------------------- -------------------- -------------------- ------------------- ----------------

Total

comprehensive

loss for the

period - - (1,409,743) - (1,409,743)

---------------------- -------------------- -------------------- ------------------- ----------------

Balance at 31

December

2020 336 9,023,909 (6,142,791) 122,584 3,004,038

---------------------- -------------------- -------------------- ------------------- ----------------

Consolidated statements of cash flows

Unaudited Unaudited Audited

6 months ended 6 months ended 15 months

ended

31 December 31 December 30 June 2020

2020 2019

Cash flow from operating GBP GBP GBP

activities

------------------------- ------------------------- ---------------------

Losses after taxation (1,409,743) (702,612) (1,881,786)

------------------------- ------------------------- ---------------------

Adjustments for non-cash

items 272,282 148,484 641,139

------------------------- ------------------------- ---------------------

Tax credits received 4,691 224,864 224,864

------------------------- ------------------------- ---------------------

Cash flow used in operating

activities before changes

in working capital (1,132,770) (329,264) (1,015,783)

------------------------- ------------------------- ---------------------

Change in working capital

------------------------- ------------------------- ---------------------

Change in inventories (12,622) (68,711) (196,217)

------------------------- ------------------------- ---------------------

Change in current receivables (272,396) (423,674) (209,243)

------------------------- ------------------------- ---------------------

Change in current non-interest

bearing liabilities 401,186 (519,971) 335,832

------------------------- ------------------------- ---------------------

Cash flow from/(used-in)

changes in working capital 116,168 (1,012,356) (69,628)

------------------------- ------------------------- ---------------------

Net cash flow used in

operating activities (1,016,602) (1,341,620) (1,085,411)

------------------------- ------------------------- ---------------------

Investing activities

------------------------- ------------------------- ---------------------

Intangible fixed asset

additions (546,618) (381,754) (1,055,027)

------------------------- ------------------------- ---------------------

Purchase of property,

plant and equipment (121,807) (145,384) (415,562)

------------------------- ------------------------- ---------------------

Investments - - (2)

------------------------- ------------------------- ---------------------

Repayment of sub-lease - 41,499 62,250

------------------------- ------------------------- ---------------------

Interest received 7,198 1,812 4,573

------------------------- ------------------------- ---------------------

Net cash used in investing

activities (661,227) (483,827) (1,403,768)

------------------------- ------------------------- ---------------------

Financing activities

------------------------- ------------------------- ---------------------

Proceeds from borrowings - 50,000 100,000

------------------------- ------------------------- ---------------------

Re-payment of borrowings (6,884) (5,627) (18,585)

------------------------- ------------------------- ---------------------

Proceeds on issue of

shares 956,362 2,004,256 2,975,477

------------------------- ------------------------- ---------------------

Cash flow from financing

activities 949,478 2,048,629 3,056,892

------------------------- ------------------------- ---------------------

Net change in cash and

cash equivalents (728,351) 223,182 567,713

------------------------- ------------------------- ---------------------

Cash and cash equivalents,

beginning of year 949,569 383,940 381,856

------------------------- ------------------------- ---------------------

Cash and cash equivalents,

end of year 221,218 607,122 949,569

------------------------- ------------------------- ---------------------

Cash and cash equivalents

for continuing operations 221,218 607,122 949,569

------------------------- ------------------------- ---------------------

1. General information

AMTE Power plc is a public company incorporated in the England

and Wales. The address of its registered office is Suite 1, 3rd

Floor 11-12 St. James's Square, London, United Kingdom, SW1Y

4LB.

AMTE Power develops a range of lithium-ion and lithium-ion

derivative battery cells to meet the needs of specialist customers.

Such customers, which include manufacturers of high-performance

vehicles, energy storage solutions and specialist engineering

equipment, are not the primary focus of the international battery

cell manufacturers and thereby offer a significant and scalable

opportunity for the Group.

2. Basis of preparation and significant accounting policies

(a) BASIS OF PREPARATION

The unaudited interim condensed consolidated financial

information of AMTE Power has been prepared in accordance with

international accounting standards (IAS) in conformity with the

requirements of the Companies Act.

The interim condensed consolidated financial information has

been prepared on the historical cost basis except for certain

financial instruments which are required to be measured at fair

value. The financial information has been prepared on a going

concern basis and is presented in Sterling.

The Group changed its year-end from 31 March to 30 June and the

period ended 30 June 2020 is the first financial reporting period

for the new year end date. The Group extended its reporting period

to allow it to complete certain changes to its policies and an

internal restructuring of the business ahead of the admission to

AIM, see Note 10. As a result, the period ended 30 June 2020 is a

15-month period. The audited consolidated numbers for that period

were as presented in the Group's Admission Document, as the

financial statements of the company were previously prepared under

FRS 102 and were unaudited. The Company changed its name from AMTE

Power Ltd. to AMTE Power plc on 3 March 2021.

(b) SIGNIFICANT ACCOUNTING POLICIES

Basis of consolidation

The unaudited interim condensed consolidated financial

information comprises the financial information of AMTE Power and

its subsidiaries. The subsidiaries are consolidated from the date

on which control is transferred to the Group and cease to be

consolidated from the date on which control is transferred out of

the Group. The results, assets and liabilities of associates are

accounted for under the equity method of accounting.

The accounting policies used in the preparation of the interim

condensed consolidated financial information are consistent with

those set out in the Group's Admission Document. The Group will

continue to review its accounting policies in the light of emerging

industry consensus on the practical application of IFRS.

3. Segmental analysis

Operating segments are determined by the chief operating

decision maker based on information used to allocate the Group's

resources. The information as presented to internal management is

consistent with the statement of comprehensive income. It has been

determined that there is one operating segment, the development of

battery cells. In the periods covered in the interim condensed

consolidated financial information, the Group operated mainly in

the United Kingdom. All non-current assets are located in the

United Kingdom.

4. Loss per share

The calculation of the basic loss per share is based upon the

net loss after tax attributable to ordinary shareholders and a

weighted average number of shares in issue for the year.

Unaudited Unaudited Audited 15

6 months 6 months months ended

ended ended

31 December 31 December 30 June 2020

2020 2019

GBP GBP GBP

Basic loss per share (GBP) (GBP21.38) (GBP12.26) (GBP32.57)

Diluted loss per share (GBP) (GBP21.38) (GBP12.26) (GBP32.57)

Loss attributable to equity

shareholders (1,409,743) (702,612) (1,881,786)

Weighted average number of

shares in issue 65,926 57,318 57,777

Diluted earnings per share

There are share options and warrants outstanding as at the end

of each period which, if exercised, would increase the number of

shares in issue. However, the diluted loss per share is the same as

the basic loss per share, as the loss for the year has an

antidilutive effect.

5. Intangible fixed assets

The Group's intangible fixed assets, which include Development

Battery Cells and IP Rights, had additions of GBP1,622,552 in the

six months to 31 December 2020 (six months to 31 December 2019:

GBP1,587,173; 15 months to 30 June 2020: GBP3,622,519).

The Group capitalised the development costs relating to the

products it is developing, in line with IAS 38, however it has not

yet amortised the costs. The Group also records the value of the IP

Rights it holds through licences. The amortisation of the IP Rights

and the interest arising from the licence obligations has been

capitalised into the intangible assets (Development Battery Cells)

whilst the battery cells are being developed. Amortisation of IP

Rights were GBP245,427 (2019: GBP188,987; 15 months to 30 June

2020: GBP447,943) for the same periods above.

No impairments of intangible assets were made.

6. Property, plant and equipment

There were no significant movements on tangible fixed assts over

the period of the interim accounts.

7. Right-of-use assets

The Group has lease contracts for buildings and equipment used

in its operations, which have the following lease terms:

-- Leased equipment has terms of between 3 and 5 years,

-- Property leases have terms of under 3 years in the case of

office space near Oxford and for 10 years for manufacturing

facility in Thurso,

-- The sub-lease has a duration of under 3 years.

Right-of-use assets include additions of GBPnil for the six

months to 31 December 2020 (six months to 31 December 2019:

GBP145,176; 15 months to 30 June 2020: GBP1,144,569). During the

six months to 30 June 2020 the Group ended a property lease with a

sub-lease which was fully written down. The charge for depreciation

was GBP87,441 (2019: GBP86,722; 2020: GBP110,723) for the same

periods above.

8. Principle risks

The risks anticipated by the Group have not changed from those

provided for in the Admission Document. These risks include:

Interest rate risks

The Group's activities expose it to the financial risks of

interest rates. The Group reviews its risk management strategy on a

regular basis and if appropriate it will enter into derivative

financial instruments in order to manage interest rate risk. At

present, the Group does not have any financial leases that have a

floating interest rate, however should it take on such facilities

where this is the case, then it will review the risk exposure it

has.

Foreign currency risks

The Group has limited exposure to transactional foreign currency

risk from trading transactions. The Group considers the need to

mitigate this exposure as and when appropriate and will enter into

forward foreign exchange contracts to mitigate any significant

risks. The Group also seeks to issue invoices to customers based in

Europe or USA in the respective currencies to provide a natural

hedge against a small portion of the Group's overall costs.

At present, the Group has taken out a forward contract on its US

dollar exposure of US$ 150,000.

Liquidity risk

Liquidity risk is the risk that the Group will encounter

difficulty in meeting the obligations associated with its financial

liabilities that are settled by delivering cash or other financial

assets. The ability to do this relies on the Group expanding its

customer base, collecting its trade receivables, completing

financings in a timely manner and by maintaining sufficient cash

and cash equivalents on hand.

The Group monitors its payables on a periodic basis and uses the

credit terms to manage the timing of payments to suppliers.

Market Risk

Due to the development nature of the contracts and product

programmes that the Group enters into, currently it is not

materially exposed to a market directly. However, its products are

focused on meeting certain current or expected requirements of

individual markets, and these requirements could evolve before the

Group is able to complete its product development programmes.

The Group periodically reviews the markets, and demands expected

of products, to minimise the risk to its business. It is also

reviewing new markets to identify future demand outside of the

initial intended markets.

Once the Group has released products, then it will carry out an

assessment of the market risk it is exposed to and will carry out

sensitivity analysis on the impact that each risk will have on the

product(s)' performance and the wider impact on the Group's income

statement and its financial position.

Credit risk

Credit risk is the risk that a counterparty will not meet its

obligations under a financial instrument or customer contract,

leading to a financial loss.

The Group applies the IFRS 9 simplified approach to measuring

expected credit losses which uses a lifetime expected loss

allowance for all trade receivables and contract assets.

On an ongoing basis, trade receivable balances attributable to

each customer are monitored and appropriate action is taken to

follow up on those balances when they are considered overdue. In a

limited number of customer contracts, an initial payment is secured

which helps to mitigate the overall credit risk of a project.

Although the Group has its own terms and conditions with a

30-day payment expectation, under some contracts it accepts longer

terms with suitable customers. Should a trade debtor exceed the

payment terms, then the Group engages to ensure swift payment. Due

to the development nature of the contract, any payments that

continue to be delayed may result on discussions over the delivery

of the rest of the project. Should there be no engagement from the

customer for a period of time then a provision is made for the

amount outstanding.

9. Statement of Directors' Responsibilities

The Directors confirm to the best of their knowledge that:

a. The condensed interim financial information has been prepared in accordance with IAS 34; and

b. The interim management report includes a fair review of the

information required by the FCA's Disclosure and Transparency Rules

(4.2.7 R and 4.2.8 R).

Financial statements are published on the Company's website in

accordance with legislation in the United Kingdom governing the

preparation and dissemination of financial statements, which may

vary from legislation in other jurisdictions. The maintenance and

integrity of the Company's website is the responsibility of the

Directors. The Directors' responsibility also extends to the

ongoing integrity of the financial statements contained

therein.

10. Events after the reporting period

The following events have taken place after 31 December

2020.

Capitalisation of Share Premium Account and Reduction of

Capital

On 20 January 2021, a sum of GBP134,548 standing to the

Company's share premium account was capitalised by the issue of

bonus shares, in the form of ordinary shares in the Company ("Bonus

Shares").

The Bonus Shares have been issued to Shareholders pro rata to

each shareholder's existing holding, such that each Shareholder has

received 400 Bonus Shares for each ordinary share held. The

proposed rights attaching to the Bonus Shares are identical to the

existing ordinary shares. Following the issue of Bonus Shares, the

total number of ordinary shares in issue was 26,976,874.

On 20 January 2021, the capital (consisting of the share capital

and share premium) of the Company was reduced so that the Company

would therefore satisfy the net assets criteria of the Companies

Act. This action has the effect of reducing the un-distributable

reserves, and therefore the capital, by GBP8,825,536.88 such that

the net assets of the Company are above the revised capital of the

Company, as required by the Act in order that the Company could

re-register as a public limited company.

Issue of Ordinary Shares

Following the reporting period, the Company issued 286,715

shares at par to David Morgan, Chair of the Group, on 20 January

2021.

Admission to AIM and Fundraise of GBP13.0m of gross

proceeds.

On 12 March 2021, the Company's shares were admitted to trading

on AIM, the market operated by the London Stock Exchange Plc. The

Company issued 7,402,438 shares at 175 pence per share, raising net

proceeds of GBP11,332,712.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR JTMRTMTATBBB

(END) Dow Jones Newswires

March 23, 2021 03:00 ET (07:00 GMT)

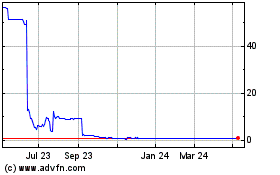

Amte Power (LSE:AMTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amte Power (LSE:AMTE)

Historical Stock Chart

From Apr 2023 to Apr 2024