TIDMANIC

RNS Number : 4081U

Agronomics Limited

02 December 2021

Results of the Placing and Subscription and Launch of Open

Offer

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO, THE UNITED

STATES (INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE

UNITED STATES OR THE DISTRICT OF COLUMBIA), CANADA, AUSTRALIA,

JAPAN, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL. PLEASE SEE THE

IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE GROUP TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE

MARKET ABUSE REGULATION (EU) NO. 596/2014, AS IT FORMS PART OF UK

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018.

UPON PUBLICATION OF THIS ANNOUNCEMENT, THIS INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

2 December 2021

Agronomics Limited

("Agronomics" or the "Group" or the "Company")

Results of the Placing and Subscription

Proposed Open Offer to raise up to GBP6.5 million

Further to the announcement made on 1 December 2021 by the

Company in connection with the proposed placing and subscription to

raise a minimum of GBP25.0 million (the "Placing Announcement"),

Agronomics, a leading listed investor in cellular agriculture,

announces that it has successfully raised total gross proceeds of

GBP27.75 million before expenses under the Placing and Subscription

at an Issue Price of 23 pence per Unit. Each Unit consists of one

ordinary share and one November 2021 Warrant.

This includes amounts from Directors of the Company, including

Jim Mellon through Galloway Limited, who have confirmed their

intention to subscribe for an additional minimum of GBP2.3 million.

As the Company is currently in a close period under MAR until the

publication of its results for the financial year ended 30 June

2021, the Directors are not permitted to enter into a subscription

agreement until after publication of these results (and subject to

each not being in possession of any other unpublished price

sensitive information at such time). It is expected that the

Results will be published before the Subscription Closing Date, and

the Directors expect to able to participate in the Directors'

Intended Subscription as indicated.

In addition, as announced on 1 December 2021, in order to

provide shareholders who did not have the opportunity to

participate in the Placing and Subscription to now do so, the

Company is undertaking an Open Offer to allow Qualifying

Shareholders to subscribe for an aggregate of 28,558,897 Open Offer

Units at the Issue Price of 23 pence per Open Offer Unit to raise

up to an aggregate c. GBP6.6 million.

Pursuant to the Open Offer, Qualifying Shareholders will be

given the opportunity to subscribe for:

1 Open Offer Unit for every 28 Existing Ordinary Shares

held by Qualifying Shareholders at the Record Date and so on in

proportion for any other number of Existing Ordinary Shares then

held. The Record Date for receiving Entitlements Under the Open

Offer is 6.00 p.m. on 1 December 2021 and Existing Ordinary Shares

are expected to be marked "ex" by the London Stock Exchange at 8.00

a.m. on 3 December 2021. A full timetable is set out below in the

appendix.

Other than where defined, capitalised terms used in this

announcement have the meanings given to them in the Placing

Announcement.

Results of the Placing and Subscription

The Group is pleased to announce that following an accelerated

bookbuild process, a total of 92,254,805 Placing Units have been

successfully placed by Cenkos Securities Plc at a price of 23 pence

per Placing Unit (the "Placing Shares"), with new and existing

investors. In addition, a further 18,397,369 Subscription Units

have been subscribed for under the Subscription. In total the

Placing and Subscription has raised gross proceeds of GBP25.5

million (net proceeds of approximately GBP24.4 million after

expenses) subject to the Placing Agreement becoming unconditional.

The Issue Price represents a discount of 6.1 per cent. to the

closing price of Ordinary Shares on AIM on 30 November 2021 and

19.9 per cent. to the average daily volume weighted average price

of Ordinary Shares on AIM for the 20 days to 30 November 2021. The

Issue Price is also at a premium of 77.1 per cent. to the latest

reported net asset value ("NAV") of 12.99 pence per share as at 30

September 2021.

The Placing Shares and the Subscription Shares together

represent 13.8% of the Existing Ordinary Shares. From the date of

their issue, the Placing Shares and the Subscription Shares will

rank pari passu in all respects with the Ordinary Shares currently

in issue.

The New Shares and any shares issued pursuant to the exercise of

the November 2021 Warrants will be issued pursuant to the existing

Shareholder authorities granted at the general meeting of the

Company held in May 2021 and therefore no Shareholder approval is

required in respect of the Fundraising. Application has been made

for the Placing Shares to be admitted to trading on AIM which is

expected to occur at 8.00 a.m. on 8 December 2021. In order to

provide sufficient time for the settlement procedure and payment of

funds under the Subscription, application will be made for the

Subscription Shares to be admitted to trading on AIM which is

expected to occur at 8.00 a.m. on 21 2021.

Neither the Placing nor the Subscription have been underwritten.

The Placing was conducted by way of an accelerated book build

process. Cenkos acted as sole bookrunner in connection with the

Placing.

Open Offer

The Company is proposing to raise up to approximately GBP6.6

million (before expenses) through an Open Offer pursuant to which

Qualifying Shareholders will have an opportunity to subscribe for

an aggregate of 28,558,897 Open Offer Units at an Issue Price of 23

pence per Open Offer Unit. Each Open Offer Unit consists of one

ordinary share and one November 2021 Warrant.

Pursuant to the Open Offer, Qualifying Shareholders will be

given the opportunity to subscribe for:

1 Open Offer Unit for every 28 Existing Ordinary Shares

held by Qualifying Shareholders at the Record Date and so on in

proportion for any other number of Existing Ordinary Shares then

held.

Any Open Offer Units not subscribed for by Qualifying

Shareholders will be available to Qualifying Shareholders under the

Excess Application Facility and as such, Qualifying Shareholders

seeking to limit their dilution from the Placing and Subscription

can also request additional Open Offer Units under the Excess

Application Facility. The Open Offer is not being underwritten.

The Open Offer is conditional upon, among other things,

Admission of the Placing Shares having become effective at or

before 8.00 a.m. on 8 December 2021 (or such later time and/or date

as Cenkos may agree with the Company not being later than 8.00 a.m.

on 31 December 2021).

Posting of Circular

The Company also confirms that a circular, which contains

further details regarding the Open Offer (the "Circular"), will be

posted tomorrow to Qualifying Shareholders, along with the

Application Form (where applicable). The Circular will also be made

available on the Company's website: https://agronomics.im/ .

Richard Reed, Chairman of Agronomics Limited, said:

"We are very pleased to announce another successful fund raise

and would like to thank all of our existing and new shareholders as

Agronomics continues on its rapid growth trajectory. This financing

will allow for further investment into current portfolio companies

and projects and a pipeline of exciting new opportunities within

the rapidly expanding cellular agriculture sector."

Total Voting Rights

Application has been made for the Placing Shares to be admitted

to trading on AIM, and it is expected that Admission of the Placing

Shares will occur at 8.00 a.m. on 8 December 2021. Following

Admission of the Placing Shares the Group's issued ordinary share

capital will comprise 891,903,935 Ordinary Shares, none of which

are held in treasury.

Therefore, following Admission of the Placing Shares, the total

number of Ordinary Shares with voting rights in the Group will be

891,903,935, which may be used by Shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, the Group under the FCA's Disclosure Guidance and Transparency

Rules.

Application will be made for the Subscription Shares and the

Open Offer Shares to be admitted to trading on AIM on 21 December

2021.

For further information, please contact:

Agronomics Limited Beaumont Cornish Limited Cenkos Securities Plc TB Cardew

The Company Nomad Broker Public Relations

------------------------- ---------------------- ------------------------

Richard Reed Roland Cornish Giles Balleny Ed Orlebar

Denham Eke James Biddle Michael Johnson Joe McGregor

------------------------- ---------------------- ------------------------

+44 (0) 20 7930 0777

+44 (0) 7738 724 630

+44 (0) 1624 639396 +44 (0) 207 628 3396 +44 (0) 207 397 8900 agronomics@tbcardew.com

------------------------- ---------------------- ------------------------

APPIX - TIMETABLE

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date and time for entitlements under the 6.00 p.m. on 1 December

Open Offer 2021

Announcement of the Fundraising 2 December 2021

Existing Ordinary Shares marked 'ex' by London 8.00 a.m. on 3 December

Stock Exchange 2021

Announcement of the results of the Placing and 2 December 2021

launch of the Open Offer

Posting of this Document and, to Qualifying Non-CREST 3 December 2021

Shareholders, the Application Form

Basic Entitlements and Excess Open Offer Entitlements As soon as possible

credited to stock accounts in CREST of Qualifying after 8.00 a.m. on

CREST Shareholders 4 December 2021

Admission and commencement of dealings in the 8.00 a.m. on 8 December

Placing Shares on AIM 2021

CREST accounts expected to be credited for the 8 December 2021

Placing Units to be held in uncertificated form

Latest date for posting of share and warrant certificates Within 10 business

for the Placing Units in certificated form (if days from Placing Admission

applicable)

Recommended latest time for requesting withdrawal 4.30 p.m. on 14 December

of Basic Entitlements and Excess Open Offer Entitlements 2021

from CREST

Latest time and date for depositing Basic Entitlements 3.00 p.m. on 15 December

and Excess CREST Open Offer Entitlements in CREST 2021

Latest time and date for splitting Application 3.00 p.m. on 16 December

Forms (to satisfy bona fide market claims only) 2021

Latest time and date for receipt of completed 11.00am on 20 December

Application Forms and payment in full under the 2021

Open Offer or settlement of relevant CREST instructions

(as appropriate)

Announcement of result of Open Offer 21 December 2021

Admission and commencement of dealings in the 8.00 a.m. on 22 December

Open Offer Shares on AIM 2021

CREST accounts expected to be credited for the 22 December 2021

Open Offer Units to be held in uncertificated

form

Latest date for posting of share and warrant certificates Within 10 business

for the Open Offer Units in certificated form days of Admission of

(if applicable) Open Offer Shares

---------------------------------------------------------- -----------------------------

Notes: Each of the times and dates referred to above and where

used elsewhere in this Announcement refer to GMT (unless otherwise

stated) and are subject to change by the Company (with the

agreement of the Broker), in which case details of the new times

and dates will be notified to the London Stock Exchange and the

Company will make an appropriate announcement through a Regulatory

Information Service.

IMPORTANT NOTICES

Terms defined at the end of this announcement have the meaning

given thereto when used in this announcement.

This announcement is not an offer to sell or a solicitation of

any offer to buy the New Shares in the United States, Australia,

Canada, New Zealand or the Republic of South Africa, Japan, or in

any other jurisdiction where such offer or sale would be

unlawful.

This Announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

The merits or suitability of any securities must be

independently determined by the recipient on the basis of its own

investigation and evaluation of the proposed investment trust. Any

such determination should involve, among other things, an

assessment of the legal, tax, accounting, regulatory, financial,

credit and other related aspects of the securities.

This announcement may not be used in making any investment

decision. This announcement does not contain sufficient information

to support an investment decision and investors should ensure that

they obtain all available relevant information before making any

investment. This announcement does not constitute and may not be

construed as an offer to sell, or an invitation to purchase or

otherwise acquire, investments of any description, nor as a

recommendation regarding the possible offering or the provision of

investment advice by any party. No information in this announcement

should be construed as providing financial, investment or other

professional advice and each prospective investor should consult

its own legal, business, tax and other advisers in evaluating the

investment opportunity. No reliance may be placed for any purposes

whatsoever on this announcement or its completeness.

Nothing in this announcement constitutes investment advice and

any recommendations that may be contained herein have not been

based upon a consideration of the investment objectives, financial

situation or particular needs of any specific recipient.

The information and opinions contained in this announcement are

provided as at the date of the document and are subject to change

and no representation or warranty, express or implied, is or will

be made in relation to the accuracy or completeness of the

information contained herein and no responsibility, obligation or

liability or duty (whether direct or indirect, in contract, tort or

otherwise) is or will be accepted by the Company, Cenkos, or any of

their affiliates or by any of their respective officers, employees

or agents in relation to it. No reliance may be placed for any

purpose whatsoever on the information or opinions contained in this

announcement or on its completeness, accuracy or fairness. The

document has not been approved by any competent regulatory or

supervisory authority.

Potential investors should be aware that any investment in the

Company is speculative, involves a high degree of risk, and could

result in the loss of all or substantially all of their investment.

Results can be positively or negatively affected by market

conditions beyond the control of the Company or any other person.

The returns set out in this document are targets only. There is no

guarantee that any returns set out in this document can be achieved

or can be continued if achieved, nor that the Company will make any

distributions whatsoever. There may be other additional risks,

uncertainties and factors that could cause the returns generated by

the Company to be materially lower than the returns set out in this

announcement. Past performance cannot be relied on as a guide to

future performance.

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements, as well as those included in any related materials, are

subject to risks, uncertainties and assumptions about the Company,

including, among other things, the development of its business,

trends in its operating industry, and future capital expenditures

and acquisitions. In light of these risks, uncertainties and

assumptions, the events in the forward-looking statements may not

occur.

Each of the Company, Cenkos, and their affiliates and their

respective officers, employees and agents expressly disclaim any

and all liability which may be based on this announcement and any

errors therein or omissions therefrom.

No representation or warranty is given to the achievement or

reasonableness of future projections, management targets,

estimates, prospects or returns, if any. Any views contained herein

are based on financial, economic, market and other conditions

prevailing as at the date of this announcement. The information

contained in this announcement will not be updated.

This announcement does not constitute or form part of, and

should not be construed as, any offer or invitation or inducement

for sale, transfer or subscription of, or any solicitation of any

offer or invitation to buy or subscribe for or to underwrite, any

share in the Company or to engage in investment activity (as

defined by the Financial Services and Markets Act 2000) in any

jurisdiction nor shall it, or any part of it, or the fact of its

distribution form the basis of, or be relied on in connection with,

any contract or investment decision whatsoever, in any

jurisdiction. This announcement does not constitute a

recommendation regarding any securities.

Cenkos Securities plc ("Cenkos") which is authorised and

regulated in the United Kingdom by the FCA, is acting as broker to

Agronomics Limited and for no one else, including any recipient of

this announcement, in connection with the Fundraising and other

matters referred to in this announcement and will not be

responsible to anyone other than Agronomics Limited for providing

the protections afforded to clients of Cenkos or for affording

advice in relation to the Fundraising or any other matter referred

to in this announcement. Cenkos has not authorised the contents of,

or any part of, this announcement and no liability whatsoever is

accepted by Cenkos nor does it make any representation or warranty,

express or implied, for the accuracy of any information or opinions

contained in this announcement or for the omission of any

information. Cenkos expressly disclaims all and any responsibility

or liability whether arising in tort, contract or otherwise which

it might otherwise have in respect of this announcement.

Beaumont Cornish Limited ("BCL"), which is authorised and

regulated in the UK by the FCA and is a member of the London Stock

Exchange, is the Company's nominated adviser for the purposes of

the AIM Rules. BCL is acting exclusively for the Company and will

not regard any other person (whether or not a recipient of this

Document) as a client and will not be responsible to anyone other

than the Company for providing the protections afforded to its

clients nor for providing advice in relation to the contents of

this Document or any other matter referred to herein. BCL's

responsibilities as the Company's nominated adviser under the AIM

Rules for Nominated Advisers are owed to the London Stock Exchange

and not to any other person and in particular, but without

limitation, in respect of their decision to acquire Open Offer

Units in reliance on any part of this Document. BCL has not

authorised the contents of this Document for any purpose and no

liability whatsoever is accepted by BCL nor does it make any

representation or warranty, express or implied, as to the accuracy

of any information or opinion contained in this Document or for the

omission of any information. BCL expressly disclaims all and any

responsibility or liability whether arising in tort, contract or

otherwise which it might otherwise have in respect of this

Document.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIZZMGZFZGGMZM

(END) Dow Jones Newswires

December 02, 2021 08:29 ET (13:29 GMT)

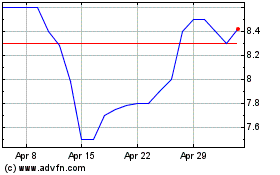

Agronomics (LSE:ANIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agronomics (LSE:ANIC)

Historical Stock Chart

From Apr 2023 to Apr 2024