TIDMANIC

RNS Number : 9350D

Agronomics Limited

08 March 2022

8(th) March 2022

Agronomics Limited

("Agronomics" or the "Company")

Agronomics co-leads SuperMeat's Series A Financing

Agronomics, the leading listed company focused on the field of

cellular agriculture, is pleased to announce it has co-led the

Series A Financing for portfolio company SuperMeat The Essence of

Meat Ltd ("SuperMeat") with a US$ 10 million investment,

subscribing for 188,158 Series A Preferred Shares. SuperMeat is a

leading cultivated chicken meat company based in Israel. The

funding round was co-led alongside New Agrarian Company Limited

("New Agrarian"). Following the close of the funding round,

Agronomics will have the right to appoint a board member to

SuperMeat and will have a 7.77% equity interest. The investment

will be made using cash from the Company's own resources.

Agronomics first invested in SuperMeat in December 2020, with a

US$ 2 million investment in the form of a SAFE (Simple Agreement

for Future Equity). This SAFE will convert to 119,551 Series A

Preferred Shares, representing a Multiple on Investable Capital

("MOIC") of 2.97. In February 2022, Agronomics purchased an

additional 50,774 Preferred Seed Shares in SuperMeat via a

secondary transaction from an existing shareholder for total

transaction cost of US$ 500,124 which will, subject to audit,

represent a MOIC of 5.04.

Agronomics will now carry the aggregate position in its accounts

at a book value of US$ 19.35 million, subject to audit, including

an unrealised gain on cost of US$ 6.95 million, representing an

internal rate of return of 207%. The SuperMeat position in the

Agronomics portfolio will represent approximately 10% of Net Asset

Value.

SuperMeat is a leading cultivated meat player, with their

bioprocess capable of producing cell densities of 150 million

cells/ml, as well as displaying strong product demonstration. In a

taste test that occurred in January 2022, SuperMeat's unseasoned

chicken was indistinguishable to conventional chicken as judged by

a panel of culinary experts . SuperMeat currently allows

individuals to visit their restaurant experience 'The Chicken' to

try their cultivated chicken products. At present, SuperMeat is

working to obtain regulatory approval in the US and Singapore for

its chicken products to be made available for inclusion in consumer

products. The funding raised by SuperMeat in this Series A

financing will be used to establish SuperMeat's first facility, as

the company seeks to commercialise its chicken product in the next

24 months.

Since this Acquisition is considered a Substantial Transaction

under AIM Rule 12, this announcement requires certain disclosures

under Schedule Four. SuperMeat is an early-stage company with no

revenues with operating costs of approximately US$ 260k per month,

and total assets as at 31 December 2020 of approximately US$ 3.3

million with no material liabilities.

Jim Mellon, co-founder and executive director of Agronomics

commented:-

" Agronomics is pleased to provide further support to SuperMeat,

one of the most established companies in this rapidly advancing

field. The technical progress they have made since our first

investment has been exceptional with some technical production

metrics at the upper end of what the Agronomics team has observed

in the entire field. This recently culminated in a landmark blind

tasting event which demonstrated SuperMeat's chicken to be

indiscernible from conventional chicken by culinary experts."

Ido Savir, co-founder and CEO of SuperMeat, added:-

"We are excited to take further steps towards commercialization

with the leadership and support of Agronomics. Agronomics, which

currently holds the largest portfolio of cellular agriculture

companies, provides a strong and professional support as well as a

global network of partners and connections invaluable for our path

to market. We are honoured to receive their continued support.

New Agrarian, the new unquoted entity formed to accept funds

from private equity investors seeking exposure to the field of

cellular agriculture also participated in the financing for

SuperMeat on the same terms as Agronomics with a US $5 million

investment and, following the investment, holds an aggregate

position, on a fully diluted basis, of 3.14%.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

About SuperMeat

SuperMeat, headquartered in Tel Aviv, Israel, is a food-tech

company working to supply the world with high-quality meat grown

directly from animal cells. Their products offer a delicious meat

experience and a high quality nutritional profile, while being

manufactured in a sustainable, slaughter-free way.

SuperMeat's proprietary cultivated meat platform allows food

companies to be at the forefront of the emerging cultivated meat

industry and manufacture a wide range of products containing

cultivated meat inside. SuperMeat is the first B2B company to

address the entire category of poultry meat from fat to muscle,

providing a complete solution to cultivated meat production.

The company has been showcasing the versatility of its meat

platform at various events at its pilot production plant, The

Chicken , the world's first farm-to-fork facility for local meat

production.

For more information about SuperMeat, visit Supermeat.com .

About Agronomics

Agronomics is a leading listed alternative proteins company with

a focus on cellular agriculture and cultivated meat. The Company

has established a portfolio of 20 companies at the Pre-Seed to

Series C stage in this rapidly advancing sector. It seeks to secure

minority stakes in companies owning technologies with defensible

intellectual property that offer new ways of producing food and

materials with a focus on products historically derived from

animals. These technologies are driving a major disruption in

agriculture, offering solutions to improve sustainability, as well

as addressing human health, animal welfare and environmental

damage. This disruption will decouple supply chains from the

environment and animals, as well as being fundamental to feeding

the world's expanding population. A full list of Agronomics'

portfolio companies is available at https://agronomics.im/ .

About Cellular Agriculture

Cellular Agriculture is the production of agriculture products

directly from cells, as opposed to raising an animal for slaughter,

or growing crops. This encompasses cell culture to produce

cultivated meat and materials, and fermentation processes that

harness a combination of molecular biology, synthetic biology,

tissue engineering and biotechnology to massively simplify

production methods in a sustainable manner.

Over the coming decades, the source of the world's food supply

traditionally derived from conventional agriculture is going to

change dramatically. We have already witnessed the first wave of

this shift with the consumer adoption of plant-based alternative

proteins but today, we are on the cusp of an even bigger wave of

change. This is being facilitated by advances in cellular

agriculture. This change is necessary, given scientists claims that

if we maintain existing animal protein consumption patterns, then

we will not meet the Paris Agreement's goal of limiting warming to

1.5

AT Kearney, a global consultancy firm, projects that cultivated

meat's market share will reach 35% by 2040. This combined with the

Good Food Institute's estimate that a US $1.8 trillion investment

will be required in order to produce just 10% of the world's

protein using this technology, means that we are on the cusp of a

multi-decade flow of capital to build out manufacturing facilities.

Funding in the field of cellular agriculture is accelerating,

however still less than US$ 2 billion has been invested worldwide

since the industry's inception in 2016.

For further information please contact:

Agronomics Beaumont Cenkos Peterhouse

Limited Cornish Securities Capital TB Cardew

Limited Plc Limited

The Company Nomad Joint Broker Joint Broker Public Relations

---------------- --------------- --------------- ------------------------

Richard Reed Roland Cornish Giles Balleny Lucy Williams Ed Orlebar

Denham Eke James Biddle Michael Charles Joe McGregor

Johnson Goodfellow

---------------- --------------- --------------- ------------------------

+44 (0) 20 7930

0777

+44 (0) 1624 +44 (0) +44 (0) +44 (0) +44 (0) 7738 724

639396 207 628 207 397 207 469 630

info@agronomics.im 3396 8900 0936 agronomics@tbcardew.com

---------------- --------------- --------------- ------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPUQUWUPPGBM

(END) Dow Jones Newswires

March 08, 2022 02:00 ET (07:00 GMT)

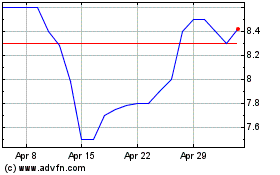

Agronomics (LSE:ANIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agronomics (LSE:ANIC)

Historical Stock Chart

From Apr 2023 to Apr 2024