TIDMANIC

RNS Number : 2994U

Agronomics Limited

01 August 2022

1(st) August 2022

Agronomics Limited

("Agronomics" or the "Company")

Agronomics Leads Clean Food Group's Seed Financing of GBP1.65

million

Agronomics, the leading listed company focused on the field of

cellular agriculture, is pleased to announce it has led Clean Food

Group Limited's ("Clean Food Group") seed financing with a

GBP577,500 investment, subscribing for 5,775,000 Ordinary Shares at

10 pence per share (the "Subscription"). Clean Food Group is a

UK-based cellular agriculture company focused on the

commercialisation of palm oil by fermentation. The Subscription

will be made using cash from the Company's own resources. Also

joining the round is AIM traded SEED Innovations Limited (of which

Jim Mellon, executive director of Agronomics, has a 6.95%

holding).

Clean Food Group was co-founded by CEO Alex Neves and

Co-Chairman Ed McDermott in 2021, with the goal of becoming a

leading independent UK cultivated food ingredients business. Ed

McDermott founded EMMAC Life Sciences Limited, a European medicinal

cannabis business which was scaled and sold to Curaleaf Holdings

Limited ( CuraLeaf ) for US$ 345 million in April 2021. Alex Neves

was Head of EMMAC's Consumer Division and played a key role in the

company's success.

In March 2022, Agronomics subscribed for 32,300,000 Ordinary

Shares at 1p per share in Clean Food Group's founder's round for a

total consideration of GBP0.323 million which will, subject to

audit and based on the price per share of the latest Subscription,

be carried at GBP3.23 million, representing a multiple on invested

capital of 10. Following the close of the seed financing, the

Company will hold a total of 38,075,000 ordinary shares with an

equity stake of 35.03% and an aggregate value of GBP3,807,500.

Agronomics will have the right to a board seat of Clean Food Group

and Jim Mellon, an Agronomics' director, will be appointed as

non-executive Co-Chairman.

Clean Food Group recently acquired the intellectual property

from the University of Bath for a technology platform that produces

a bio-equivalent palm oil alternative using microbial fermentation

and has secured a two-year collaboration with the University to

scale the technology and bring its palm oil alternative to market.

Additionally, the proprietary technology platform also produces

natural 2-phenylethanol as a by-product, which is used worldwide as

a rose fragrance and flavour and will also be commercialised.

The technology has been developed over the last eight years by

Professor Chris Chuck and his team at the University of Bath.

Professor Chris Chuck joined Clean Food Group as a technical

advisor and leads a team of scientists at a dedicated Clean Food

Group laboratory and Pilot Plant at the University of Bath.

Clean Food Group is currently identifying partners to work with

and intends to submit a novel foods dossier for market approval of

its palm oil alternative product to the European Food Standards

Agency and UK Food Standards Agency in 2022.

The global palm oil market reached a value of US$ 50.6 billion

in 2021 and is expected to reach US$ 65.5 billion by 2027. However,

palm oil has been, and continues to be, a major driver of

deforestation of some of the world's most biodiverse forests,

destroying the habitat of already endangered species like the

orangutan, pygmy elephant and Sumatran rhino. This forest loss

coupled with conversion of carbon rich peat soils are generating

millions of tonnes of greenhouse gases into the atmosphere and

contributing to climate change. There also remains the issues of

exploitation of workers and child labour.

Jim Mellon, executive director of Agronomics commented:-

"We are thrilled to be supporting Clean Food Group and

broadening our portfolio into sustainable bio-equivalent palm oil.

This is an important and exciting development, and this latest

investment will help Clean Food Group to achieve R&D milestones

and prepare regulatory dossiers for approval. The technology has

huge scale potential and we look forward to being part of the

company's next stage of growth."

Alex Neves, co-founder and CEO of Clean Food Group added:-

"We are pleased to have seen such significant demand for our

seed financing round and are particularly excited to be working

with Agronomics, widely recognised as a pioneer of the cellular

agriculture investment community, as our cornerstone investor. We

are committed to establishing ourselves as a leading UK cultivated

food ingredients business, starting with the commercialisation of

our bio-equivalent palm oil alternative, a product that has already

received significant market interest. With this funding round now

successfully completed, we are not only well capitalised to

complete the next stage of our corporate development, but are also

well placed to take the next step on the path to bringing our palm

oil alternative, an ingredient with the potential to solve

substantial environmental, food security, health and working

environment challenges within the incumbent palm oil supply chain,

to market."

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

About Clean Food Group

The Clean Food Group is a UK based food-tech business focused on

bringing sustainable, cultivated foods to market, initially, in the

UK and Europe.

Clean Food Group operates within the fast-developing cultivated

food industry, a market with significant opportunities driven by

global environmental, health and animal welfare concerns about

existing and future consumption levels of animal protein and other

foods such as palm oil.

Clean Food Group sets itself apart through its strong technical,

consumer and retail expertise, strong financial backing, and its

ability to navigate the complex regulatory environment for new food

products.

Clean Food Group is founded by a team with key experience in

growing bio-tech, food industry and retail businesses supported by

established venture capital and family office investors with a

track record supporting highly successful growth companies in

highly regulated industries.

About Agronomics

Agronomics is a leading listed alternative proteins company with

a focus on cellular agriculture and cultivated meat. The Company

has established a portfolio of 23 companies at the pre-seed to

Series C stage in this rapidly advancing sector. It seeks to secure

minority stakes in companies owning technologies with defensible

intellectual property that offer new ways of producing food and

materials with a focus on products historically derived from

animals. These technologies are driving a major disruption in

agriculture, offering solutions to improve sustainability, as well

as addressing human health, animal welfare and environmental

damage. This disruption will decouple supply chains from the

environment and animals, as well as being fundamental to feeding

the world's expanding population. A full list of Agronomics'

portfolio companies is available at https://agronomics.im/.

About Cellular Agriculture

Cellular Agriculture is the production of agriculture products

directly from cells, as opposed to raising an animal for slaughter,

or growing crops. This encompasses cell culture to produce

cultivated meat and materials, and fermentation processes that

harness a combination of molecular biology, synthetic biology,

tissue engineering and biotechnology to massively simplify

production methods in a sustainable manner.

Over the coming decades, the source of the world's food supply

traditionally derived from conventional agriculture is going to

change dramatically. We have already witnessed the first wave of

this shift with the consumer adoption of plant-based alternative

proteins but today, we are on the cusp of an even bigger wave of

change. This is being facilitated by advances in cellular

agriculture. This change is necessary, given scientists claims that

if we maintain existing animal protein consumption patterns, then

we will not meet the Paris Agreement's goal of limiting warming to

1.5 '

AT Kearney, a global consultancy firm, projects that cultivated

meat's market share will reach 35% by 2040. This combined with the

Good Food Institute's estimate that a US $1.8 trillion investment

will be required in order to produce just 10% of the world's

protein using this technology, means that we are on the cusp of a

multi-decade flow of capital to build out manufacturing facilities.

Funding in the field of cellular agriculture is accelerating,

however still less than US$ 4 billion has been invested worldwide

since the industry's inception in 2016.

For further information please contact:

Agronomics Beaumont Canaccord Cenkos Peterhouse Capital

Limited Cornish Limited Genuity Limited Securities Plc Limited TB Cardew

The Company Nomad Joint Broker Joint Broker Joint Broker Public Relations

---------------------- ----------------------- ---------------------- ---------------------- --------------------

Richard Reed Roland Cornish Andrew Potts Giles Balleny Lucy Williams

Denham Eke James Biddle Harry Rees Max Gould Charles Goodfellow Ed Orlebar

Alex Aylen (Head of Michael Johnson Alistair Walker

Equities)

---------------------- ----------------------- ---------------------- ---------------------- --------------------

+44 (0) 1624 +44 (0) 20 7930 0777

639396 +44 (0) 7738 724 630

info@agronomics. agronomics@tbcardew.

im +44 (0) 207 628 3396 +44 (0) 207 523 8000 +44 (0) 207 397 8900 +44 (0) 207 469 0936 com

---------------------- ----------------------- ---------------------- ---------------------- --------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUGCMUPPGGB

(END) Dow Jones Newswires

August 01, 2022 02:00 ET (06:00 GMT)

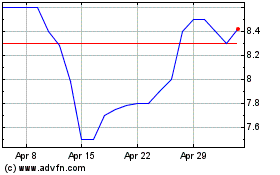

Agronomics (LSE:ANIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agronomics (LSE:ANIC)

Historical Stock Chart

From Apr 2023 to Apr 2024