TIDMANIC

RNS Number : 3230D

Agronomics Limited

19 October 2022

19 October 2022

Agronomics Limited

("Agronomics" or the "Company")

Net Asset Value calculation to 30 September 2022

Agronomics Limited (AIM:ANIC), the leading listed company

focused on the field of cellular agriculture, announces that its

unaudited Net Asset Valuation ("NAV") calculation as at closing on

30 September 2022 was 16.51 pence per share, up 8.1% from 15.27

pence per share on 30 June. Net Assets stand at GBP160.2 million,

including investments of GBP122.9 million. Uninvested cash was

GBP39.4 million

The share price of 12.5 pence at the 30 September 2022 close

represents a discount of 24% to the NAV per share. The average

premium to NAV per share over the last 12-month period was 36%.

Under IFRS, the Company's unquoted investments are carried at cost

or the most recent priced funding round.

Richard Reed, Chairman of Agronomics, commented: -

"Agronomics has continued its investment activity in cellular

agriculture this quarter, despite broader market conditions, and

now has a comprehensive portfolio of 24 companies across cultivated

meat, materials and precision fermentation technologies.

This quarter, Agronomics led two funding rounds in precision

fermentation, expanding the portfolio to include cultivated palm

oil in Clean Food Group, and we made our first investment in

Australia in All G Foods, a leading dairy precision fermentation

company. We are increasingly seeking larger equity ownerships and

board representation in funding rounds, to maintain our dominant

role in the field.

Notably, venture funding in Q3 2022 has reached a nine-quarter

low, representing a 34% decline quarter on quarter. Whilst market

conditions continue to be volatile and the pace of deal activity is

declining, we continue to identify cellular agriculture as a sector

with huge promise and future growth prospects.

Financing

During the quarter ended 30 September 2022, the Company received

notification of warrants being exercised. A total of 32,008 new

ordinary shares were issued following the warrant exercise, for

proceeds of GBP9,546.90. These funds, together with existing cash

resources, will be utilised to provide backing for opportunities

within the field of cellular agriculture, both by supporting

existing companies, as well as identifying new opportunities in

which to invest.

Investment review

On 1 August 2022 , the Company announced it led the seed

financing round of Clean Food Group Limited (" Clean Food Group "),

with an investment of GBP577,500 for 5,775,000 ordinary shares

following an earlier small investment in the company. Following

this, the carrying amount of the existing investment will be

carried at GBP3.23 million, representing an unrealised uplift of

GBP2.91m (subject to audit). Following close of the Seed round,

Agronomics owns an equity stake of 35.03%, with an aggregate value

of GBP3.8 million.

On 4 August 2022 , Agronomics led the Series A financing for All

G Food Holding Pty Ltd (" All G Foods ") with an investment of AU$

15 million, subscribing for 2,803,214 Series A Preferred Shares.

Agronomics will own 8.01% of All G Foods on a fully diluted basis

following close of the round.

On 8 September 2022 , Agronomics announced that existing

portfolio company Bond Pet Foods Inc (" Bond Pets "), completed its

Series A Financing Round, raising US$ 17.5 million. Agronomics

invested in Bond Pet Foods in September 2019, with a US$ 150k

investment in the form of a convertible promissory note ("CPN").

The CPN has now converted into 531,692 Series A Preferred Shares,

representing an equity ownership of 1.85%. Subject to audit,

Agronomics will now carry this position at a book value of US$

933k, representing an unrealised gain on cost of US$ 783k. This

provides a multiple on invested capital (MOIC) of 6.22 and an

internal rate of return (IRR) of 84% on the initial investment.

Unaudited to

30 September

2022

GBP

Current Assets

Investments 122,925,485

Uninvested cash 39,406,533

Trade and other receivables 146,702

Current Liabilities

Trade and other creditors (2,274,374)

--------------

Net Assets 160,204,346

Capital and Reserves

Share capital 969

Share premium 129,865,214

Retained earnings 30,338,163

--------------

Net assets 160,204,346

Shares in Issue 970,371,316

Net Asset Value per 16.51 pence

share

The quoted investments within the portfolio are valued under

IFRS at bid price.

Portfolio Details

Investments as at 30 Value (GBP) % of Total Portfolio

September 2022

Cellular agriculture

holdings 122,569,356 99.71%

Legacy holdings 356,129 0.29%

Total 122,925,485 100%

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

For further information please contact:

Agronomics Beaumont Canaccord Cenkos Peterhouse TB Cardew

Limited Cornish Genuity Limited Securities Capital

Limited Plc Limited

The Company Nomad Joint Broker Joint Broker Joint Broker Public Relations

================ ================== ================== ================= ====================

Richard Reed Roland Cornish Andrew Potts Giles Balleny Lucy Williams Ed Orlebar

Denham Eke James Biddle Harry Rees Michael Johnson Charles Alistair Walker

Alex Aylen Goodfellow

(Head of Equities)

================ ================== ================== ================= ====================

+44 (0) 20

7930 0777

+44 (0) 1624 +44 (0) 7738

639396 724 630

info@agronomics. +44 (0) 207 +44 (0) 207 +44 (0) 207 +44 (0) 207 agronomics@tbcardew.

im 628 3396 523 8000 397 8900 469 0936 com

================ ================== ================== ================= ====================

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVKZMMGVRVGZZM

(END) Dow Jones Newswires

October 19, 2022 02:00 ET (06:00 GMT)

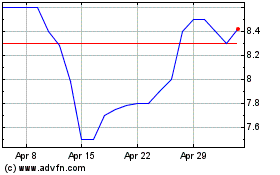

Agronomics (LSE:ANIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agronomics (LSE:ANIC)

Historical Stock Chart

From Apr 2023 to Apr 2024