TIDMANX

RNS Number : 0221L

Anexo Group PLC

11 May 2022

11 May 2022

Anexo Group plc

('Anexo' or the 'Group')

Final Results

"Significant growth in profits driven by increased cash

collections"

Anexo Group plc (AIM: ANX), the specialist integrated credit

hire and legal services provider, announces its final results for

the year ended 31 December 2021 (the 'period' or 'FY 2021').

Financial Highlights 2021 2020 % movement

Total revenues (GBP'000s) 118,237 86,752 +36.2%

Operating profit (GBP'000s) 27,350 18,050 +51.4%

Adjusted(1) operating profit before

exceptional items (GBP'000s) 27,728 18,708 +48.1%

Adjusted(1) operating profit margin

(%) 23.5 21.6 +8.8%

Profit before tax (GBP'000s) 23,746 15,488 +52.9%

Adjusted(1) profit before tax and exceptional

items (GBP'000s) 24,124 16,146 +49.7%

Adjusted(2) basic EPS (pence) 16.8 11.4 +48.2%

Total dividend for the year (pence) 1.5 1.5 -

Equity attributable to the owners of

the Company (GBP'000s) 128,224 110,438 +16.1%

Net cash flow (GBP'000s) -7,300 +200 -

Net debt balance (GBP'000s) 62,000 40,500 +53.1%

Note: The basis of preparation of the consolidated financial

statements for the current and previous year is set out in the

Financial Review on page 14.

1. Adjusted operating profit and profit before tax: excludes

share -- based payment charges in 2020 and 2021. A reconciliation

to reported (IFRS) results is included in the Financial Review on

page 19.

2. Adjusted EPS: adjusted PBT less tax at statutory rate divided

by the weighted number of shares in issue during the year.

Financial and Operational KPIs

-- During 2021, we saw the continued improvement in a number

of key performance measures (detailed below). These have

resulted in a significant improvement in financial performance

for the Group during the period, notwithstanding the continuing

issues faced during 2021 from COVID-19. Opportunities

within the Credit Hire division have never been so strong,

following the introduction of the Civil Liabilities Act

2021, and the Group has deployed increasing working capital

facilities and reinvested significant levels of cash collections

into the new case portfolio. Consequently, the number

of new cases funded rose from 7,535 to 10,265, an increase

of 36.2%. This investment is supported by growth in cash

collections, which rose by 21.5% in the year to reach

GBP119.0 million in 2021.

-- Our ability to fund growth in our core business has been

supported by investment in legal staff. In 2021, the number

of senior fee earners grew by 45% to reach 237 at the

year end. This investment has driven increased cash collections

in the year despite the challenges of the reduced operation

of the court system. Much of the investment will start

to impact during 2022 and beyond, reflecting the life

cycle of a typical credit hire claim and the time a new

starter takes to reach settlement maturity.

KPI's 2021 2020 % movement

Total revenues (GBP'000s) 118,237 86,752 +36.3%

Gross profit (GBP'000s) 91,481 67,952 +34.6%

Adjusted operating profit (GBP000's) 27,728 18,708 +48.2%

Adjusted operating profit margin

(%) 23.5% 21.6% +10.9%

Vehicles on hire at the year-end

(no) 2,366 1,613 +46.7%

Average vehicles on hire for

the year (no) 1,834 1,515 +21.1%

Number of hire cases settled 6,187 5,236 +18.2%

Cash collections from settled

cases (GBP'000s) 119,007 97,977 +21.5%

New cases funded (no) 10,265 7,535 +36.2%

Legal staff at the period end

(no) 634 518 +22.4%

Average number of legal staff

(no) 590 498 +18.5%

Total senior fee earners at

period end (no) 237 163 +45.4%

Average senior fee earners (no) 201 144 +39.6%

Commenting on the Final Results, Alan Sellers, Executive

Chairman of Anexo Group plc, said:

"I am pleased to report that the Group has had a successful

2021, building on the achievements of 2020. The results demonstrate

the resilience of the Group's business model, as we improved on

last year's cash collections, whilst still facing uncertainty due

to the COVID-19 pandemic. Group revenues in 2021 increased by over

a third compared to the previous year.

"Opportunities within the Credit Hire division have never been

so strong. As a result, the Group has focused considerable resource

here and has seen the number of new cases funded rise

substantially.

"The Board remains focused on long term growth, and we are

confident that there are significant opportunities that exist in

2022 to build upon our successful platform. The growth of our

Housing Disrepair Division throughout 2021, as well as our already

resilient business model, presents an exciting outlook for the year

ahead."

Analyst Briefing

A conference call for analysts will be held at 9.30am today, 11

May 2022. A copy of the Final Results presentation is available at

the Group's website: https://www.anexo-group.com/

An audio webcast of the conference call with analysts will be

available after 12pm today:

https://www.anexo-group.com/content/investors/latest-results

For further enquiries:

Anexo Group plc +44 (0) 151 227 3008

www.anexo-group.com

Alan Sellers, Executive Chairman

Mark Bringloe, Chief Financial Officer

Nick Dashwood Brown, Head of Investor

Relations

WH Ireland Limited

(Nominated Adviser & Joint Broker)

Chris Hardie / Darshan Patel / Enzo +44 (0) 20 7220 1666

Aliaj (Corporate) www.whirelandplc.com/capital-markets

Fraser Marshall / Harry Ansell (Broking)

Arden Partners plc

(Joint Broker)

John Llewellyn-Lloyd / Louisa Waddell +44 (0) 20 7614 5900

(Corporate) www.arden-partners.co.uk

Tim Dainton (Equity sales)

Notes to Editors:

Anexo is a specialist integrated credit hire and legal services

provider. The Group has created a unique business model by

combining a direct capture Credit Hire business with a wholly owned

Legal Services firm. The integrated business targets the

impecunious not at fault motorist, referring to those who do not

have the financial means or access to a replacement vehicle.

Through its dedicated Credit Hire sales team and network of

1,100 plus active introducers around the UK, Anexo provides

customers with an end-to-end service including the provision of

Credit Hire vehicles, assistance with repair and recovery, and

claims management services. The Group's Legal Services division,

Bond Turner, provides the legal support to maximise the recovery of

costs through settlement or court action as well as the processing

of any associated personal injury claim.

The Group was admitted to trading on AIM in June 2018 with the

ticker ANX. For additional information please visit:

www.anexo-group.com

Chairman's Statement

On behalf of the Board, I am pleased to report a year of

significant growth by the Group in the face of considerable ongoing

nationwide challenges. These results reflect our continued focus on

increasing cash settlements through the expansion of our Legal

Services division, while using our working capital to maximum

effect to ensure growth in our Credit Hire division. This emphasis

on facilitating growth led to significant increases in both cash

collections and vehicle numbers, culminating in record numbers of

vehicles on the road at the end of the year. We have continued to

invest in our advocacy practice, particularly through our Housing

Disrepair Division, and we believe the division will become a

significant contributor to future revenues.

The Board continues its close monitoring of progress in our core

divisions while seeking to take advantage of the significant growth

opportunities which are presenting themselves as we emerge from the

pandemic and believes that the Group is well positioned for further

strong performance in 2022 and beyond.

Group Performance

Anexo experienced strong growth in 2021, despite the ongoing

disruption caused by the ongoing COVID restrictions. Trading across

our divisions has been robust and our core business has proved

extremely resilient. As a result, Group revenues in 2021 increased

by 36.2% to GBP118.2 million (2020: GBP86.8 million). Adjusted

profit before tax rose 49.7% to GBP24.1 million (2020: GBP16.1

million), reflecting the continued investment in staff, IT and

associated infrastructure costs associated with the headcount

increase (investment in 2020: GBP6.5 million). The Group issued a

trading statement on 18 January 2022 stating that profit before tax

would significantly exceed market expectations.

The Group's focus on growth meant that 2021 was a period of cash

absorption to take advantage of the opportunities for new

contracts, as well as the ongoing withdrawal of a number of

competitors from the market and the impact of the introduction of

the Civil Liabilities Act, which severely curtails the ability of

personal injury solicitors to recover substantial legal costs. To

accommodate this growth the Group increased its available working

capital facilities and continued the expansion of staff numbers and

the necessary supporting infrastructure to support increased case

settlements.

Credit Hire division

The Group's Credit Hire division, EDGE, saw further record

performance in vehicle provision during the year. The number of new

vehicle hires continued to be impacted by lockdowns in 2021.

However, a large number of EDGE customers are classed as key

workers, including couriers (who have been extremely active

throughout the pandemic) as well as health professionals, teachers,

nursery staff, emergency workers and supermarket personnel. As a

consequence, and with the backdrop of a reduction in competition in

the market following changes implemented by the Civil Liabilities

Act 2021, vehicle numbers recovered strongly and reached record

levels in the latter part of 2021. The number of vehicles on hire

at the end of 2021 rose 46.7% to 2,366 (2020: 1,613) and the

average number of vehicles on hire throughout the financial year

rose 21.1% to 1,834 (2020: 1,515).

Revenues within the Credit Hire division grew by 38.2% to

GBP71.3 million (2020: GBP51.6 million). The Group maintains its

claims acceptance strategy of deploying its resources into the most

valuable claims, thereby growing claims while preserving working

capital. The Group monitors its fleet size constantly, enabling it

to respond quickly to changes in demand and strategic priorities by

deploying its vehicles appropriately with focus remaining firmly on

McAMS, the motorcycle division.

Legal Services division

The Group's Legal Services division, Bond Turner, has continued

its focus on cash collections and corresponding investment in staff

to drive increased case settlements. This strategy has had a

significant positive impact on financial performance. Revenues

within the Legal Services division, which strongly correlates to

cash, increased by 33.2% to GBP46.9 million (2020: GBP35.2

million). The continued growth of the Bolton office, which opened

in December 2018, and the opening of the Leeds office at the

beginning of 2021 have provided considerable opportunities for

recruitment. During the pandemic, and following the implementation

of the Civil Liabilities Act 2021, the Group has seen a number of

personal injury solicitors withdrawing from the market and

embarking on a run-off strategy. In addition, a number of

high-quality staff at competitor firms were placed on furlough.

Taking advantage of these recruitment opportunities has resulted in

staff numbers rising at all levels, with the ability to retrain

personal injury solicitors in the field of credit hire for suitable

placement within Bond Turner. At the end of December staff numbers

within Bond Turner stood at 634, a 22.4% increase on the 2020

figure of 518. Of these, a total of 237 were senior fee earners, up

46.3% (2020: 163).

MCE Insurance

Towards the end of 2021 we announced the signing of a major

agreement with UK-based broker MCE Insurance ('MCE') to offer

post-accident claims services to all MCE's non-fault insurance

customers. This follows motor insurer Sabre Insurance Group plc

signing an agreement with MCE which will see it become the

exclusive underwriter of MCE's motorcycle policies.

UK-based MCE is independently owned and since its foundation in

1975 has grown to become one of the UK's largest providers of

motorcycle insurance. Under the terms of the agreement, we will

assume responsibility for dealing with claims from customers of MCE

who are victims of non-fault accidents. Replacement motorcycles

will be provided through our credit hire division, Edge, and

customers will be supported in their legal claims against the

at-fault insurer by its legal services division, Bond Turner. Where

appropriate, claims will include personal injury and damage to

possessions and equipment as well as vehicle repair or replacement.

Statistics show that motorcyclists are particularly vulnerable to

personal injury as a result of non-fault accidents.

The contract commenced in November 2021 and generated over 500

claims by the end of the year. We anticipate that the contract will

generate an increasing level of credit hire opportunities for the

Group during 2022, adding to our growth opportunities within the

core business.

VW Emissions Case

The pursuit of the class action against Volkswagen AG ('VW') and

its subsidiaries (the 'VW Emissions Case') has continued during

2021. A judgment announced in the High Court of Justice on 6 April

2020 found that VW had indeed subverted key air pollution tests. VW

was subsequently refused permission to appeal that judgment. Time

limitations for the case expired in September 2021, meaning that no

more claims can be brought against VW.

A court date for the case has now been scheduled for January

2023, prior to which we will seek to negotiate settlement of the

case.

Bond Turner is acting on behalf of a number of individuals who

have registered claims against VW and is currently actively engaged

on approximately 13,000 cases. The marketing campaign has been

largely conducted via social media channels as well as via the use

of internal customer records with all marketing costs being written

off as incurred.

The Board believes that, in the event of a settlement, the

percentage of potential damages and associated costs accruing to

Anexo would have a significant positive impact on the Group's

expectations for profits and cash flow for the relevant accounting

period. There is no certainty that a settlement in favour of Bond

Turner's clients will be reached, nor is there any guarantee that

such a settlement would include financial compensation. The

timeline for progress towards a potential settlement is also

unclear and no assumptions as to revenue have been included in the

Board's internal forecasts for 2022.

Mercedes Benz Emissions Case

Having undertaken our own internal research, which has been

subsequently corroborated by counsel, the Group is to start

actively sourcing claims against Mercedes Benz, as we have

successfully done for VW. To support the case, the Group sourced an

additional GBP3.0 million of funding in November 2021 to cover the

anticipated marketing costs.

Housing Disrepair

During the latter part of 2020 we created a new team within our

legal services division, Bond Turner, to deal with claims arising

from housing disrepair. This team expanded rapidly during 2021.

During the year we successfully settled some 500+ claims. At the

end of the year, we had a portfolio of over 1,500 ongoing claims.

With further investment planned into 2022, the Housing Disrepair

team is expected to generate a significant contribution to earnings

in 2022 and beyond.

Dividends

The Board is pleased to propose a final dividend of 1.0p per

share, which if approved at the Annual General Meeting to be held

on 16 June 2022 will be paid on 24 June 2022 to those shareholders

on the register at the close of business on 20 May 2022. The shares

will become ex-dividend on 19 May 2022. An interim dividend of 0.5p

per share was paid on 22 October 2021 (2020: total dividend 1.5p

per share).

Corporate Governance

Anexo values corporate governance highly and the Board believes

that effective corporate governance is integral to the delivery of

the Group's corporate strategy, the generation of shareholder value

and the safeguarding of our shareholders' long-term interests.

As Chairman, I am responsible for the leadership of the Board

and for ensuring its effectiveness in all aspects of its role. The

Board is responsible for the Group's strategic development,

monitoring and achievement of its business objectives, oversight of

risk and maintaining a system of effective corporate governance. I

will continue to draw upon my experience to help ensure that the

Board delivers maximum shareholder value.

Our employees and stakeholders

The strong performance of the Group reflects the dedication and

quality of the Group's employees. We rely on the skills, experience

and commitment of our team to drive the business forward. Their

enthusiasm, innovation and performance remain key assets of the

Group and are vital to its future success. On behalf of the Board,

I would like to thank all of our employees, customers, suppliers,

business partners and shareholders for their continued support over

the last year.

COVID-19 Update

The COVID-19 pandemic has inevitably caused some continued

disruption to the Group's operations. The Group's operations are,

however, categorised as essential businesses and as such have been

exempted throughout from government restrictions. Its businesses

supply and service a broad range of customers who are involved in a

non-fault accident and who would otherwise be unable to access the

mobility they need. Among these, the Group provides replacement

vehicles to many key workers, including couriers (who have been

increasingly active throughout the pandemic) and other customers

such as doctors, nurses, schoolteachers, nursery staff, emergency

workers and supermarket personnel.

The Group's core businesses continued to be fully operational

following the reintroduction of a national lockdown at the end of

2020. Activity levels in the Credit Hire Division (EDGE) have

remained high. The COVID-19 pandemic has led to a number of the

Group's competitors withdrawing from the market and, as a result,

Anexo has been approached by a number of high-quality introducer

garages looking for new partnerships. The Group has taken advantage

of this unprecedented opportunity to expand its introducer network.

Notwithstanding the relaxation of restrictions, vehicles have

continued to be delivered and collected by staff who are protected

in line with government guidelines. All returned vehicles are

valeted as a matter of course before being allocated to a new

customer and comprehensive cleaning procedures are being rigorously

enforced.

The courts began to return to normal working practices during

2021, while remaining open for remote working. A backlog of those

cases requiring physical attendance has inevitably arisen, but the

Group's Legal Services division, Bond Turner, has continued to

reach case settlements via telephone and online hearings where

possible. The progression and settlement of cases was aided by

moves from the Ministry of Justice (MOJ), supported by the

Judiciary, to allow the remote operation of courts through online

and telephone hearings. All our staff returned to office working as

quickly as practicable; social distancing guidelines have been

observed in all our office locations and extensive COVID safety

measures have been implemented.

EDGE, the Group's Credit Hire division, has also remained fully

operational throughout 2021.

Due to the unprecedented global impacts of COVID-19, the Company

has continually re-assessed and analysed its business strategy with

the key focus being minimising the impact on critical work streams,

ensuring business continuity and conserving cash flows. As such,

increased stakeholder engagement and open communication have become

increasingly important in decision making for the Board.

While the COVID-19 crisis has interrupted our regular physical

face to face interactions with various stakeholders internally and

externally, we do consider them to be important in maintaining open

communications and team cohesion and will be reintroducing these

gradually, provided it is safe to do so in line with Government

guidelines and the needs of individual attendees. In the meantime,

we have taken advantage of various video conferencing platforms

where appropriate.

Current Trading and Outlook

As our financial performance and KPI's have demonstrated, the

Group has continued to perform throughout a period of significant

uncertainly, improving vehicle numbers and cash collections to

record levels during 2021, demonstrating the strength and

resilience of the Group during the current COVID-19 crisis. Whilst

others have made redundancies, furloughed staff and withdrawn from

the credit hire market, we have continued recruitment throughout

the period. This impacted our reported financial performance in

2020 but these investments have resulted in the growth seen in 2021

and will continue to contribute to growth in 2022 and beyond.

As a Board we developed a plan for managing the Group during

this ever-changing year and continue to react to take advantage of

opportunities as they arise. The expansion of the national

vaccination programme and the relaxation of national lockdown from

April 2021 has resulted in an increase in opportunities and

vehicles on the road, consistent with the trends seen in 2020. As

previously announced, however, since year end the Group has

modified its approach to vehicle funding. We have adopted a

targeted approach. This has led to a reduction in the number of

vehicles on the road since the beginning of FY22 to a level which

best facilitates management of the Group's working capital

requirements. The Group remains focused on quality claims, high

service standards and high success rates.

While uncertainties remain given the current environment, I

continue to have great confidence in the strategy post COVID and

look to the future with continued optimism.

Subsequent Events

In March 2022, the Group secured an increase in facilities from

Secure Trust Bank plc, increasing the overall draw rate on the

invoice discounting facility alongside an increase in the overall

facility limit to GBP43.0 million. In addition to this increase the

Group secured a loan of GBP7.5 million from Blazehill Capital

Finance Limited. The loan, which is non amortising and is committed

for a three year period was also drawn in March 2022.

Alan Sellers

Executive Chairman

11(th) May 2022

Financial Review

Basis of Preparation

As previously reported, Anexo Group Plc was incorporated on 27

March 2018, acquired its subsidiaries on 15 June 2018, and was

admitted to AIM on 20 June 2018 (the 'IPO'). Further details are

included within the accounting policies.

To provide comparability across reporting periods, the results

within this Financial Review are presented on an "underlying"

basis, adjusting for the GBP0.7 million charge recorded for

share-based payments in 2020 and the GBP0.4 million charge for

share-based payments in 2021.

A reconciliation between adjusted and reported results is

provided at the end of this Financial Review. This Financial Review

forms part of the Strategic Report of the Group.

New Accounting Standards

As reported on page 73 there have been a number of new UK IFRS

accounting standards applicable from 1 January 2021, none of which

have resulted in adjustment to the way in with the Group accounts

or presents its financial information.

Revenue

In 2021, Anexo successfully increased revenues across both its

divisions, Credit Hire and Legal Services, resulting in Group

revenues of GBP118.2 million, representing a 36.2% increase over

the prior year (2020: GBP86.8 million). This growth is particularly

pleasing given the fact that we have all been operating under

restrictions imposed by the Government to limit the impact of the

COVID-19 pandemic.

During 2021 EDGE, the Credit Hire division, provided vehicles to

10,265 individuals (2020: 7,535) a significant increase on that

seen in the prior year (36.2%). This constitutes a strong

performance given the restrictions imposed during the year. Our

strategy remains, as previously reported, to focus investment

within the McAMS business. This reflects the fact that, on average,

a motorcycle claim has a similar value to that of a car with a

take-on cost significantly less, allowing the Group to deploy its

resources into the most valuable claims, thereby growing revenues

whilst preserving working capital. This investment led to the award

of our first insurance contract in November 2021. The Group secured

an exclusive contract with MCE to support their non fault customers

with replacement vehicles.

With the number of claims rising significantly in 2021, the

strategy of deploying capital into the most valuable claims to the

Group resulted in revenues for the Credit Hire division increasing

to GBP71.3 million in 2021, an increase of 38.2% over 2020 (GBP51.6

million).

With investment in staff continuing as other firms made

redundancies and furloughed staff, the Legal Services division

reported significant revenue growth of 30.6%, with revenues rising

from GBP35.9 million in 2020 to GBP46.9 million in 2021.

Expansion of headcount in Bond Turner has been critical to

increasing both revenues and cash settlements within the Group and

the continued growth of the Bolton office, supported by expansion

into Leeds, has provided a crucial platform for growth in both

factors. During 2021, the Group continued its recruitment campaign,

as a number of high-quality staff became available as a result of

competitor firms either entering a run-off plan or simply

furloughing staff to remain viable.

We have taken advantage of these opportunities, taking the

decision to continue to recruit throughout the year, thereby

investing in the future settlement capacity of the Group and

consequently driving cash collections and the number of new cases

we can fund without the need for additional working capital

facilities. By the end of December 2021, we employed 634 staff in

Bond Turner (December 2020: 518), of which 237 (December 2020: 163)

were senior fee earners, an increase of 31.6%.

Investment in this new department, following the implementation

of the Extension of the Homes (Fitness for Human Habitation) Act

2019, expanded significantly in 2021. With GBP1.7 million being

invested in marketing for the generation of new claims, we secured

c 2,000 new claims in 2021, settling c 500 in an average of 180 to

200 days, significantly less than the working capital cycle of an

average Credit Hire claim. As such, and following the significant

investment in staff in 2021, further recruitment is planned into

2022 to enhance performance and improve cash flow for the Group as

a whole.

With the signing of the lease for the Leeds office, recruitment

and associated training has continued and as at the end of 2021 the

office held 24 staff. Recruitment is scheduled to continue

throughout 2022 across all of our three office locations.

Gross Profits

Gross profits are reported at GBP91.5 million (at a margin of

77.4%) in 2021, increasing from GBP68.0 million in 2020 (at a

margin of 78.3%). It should be noted, furthermore, that staffing

costs within Bond Turner are reported within Administrative

Expenses. Consequently, gross profit within Bond Turner is in

effect being reported at 100%.

Operating Costs

Administrative expenses before exceptional items increased

year-on-year, reaching GBP55.1 million in 2021 (2020: GBP42.6

million), an increase of GBP12.5 million (29.3%). This reflects the

continued investment in staffing costs within Bond Turner to drive

settlement of cases and cash collections. Staffing costs for Bond

Turner increased to GBP20.5 million (2020: GBP16.6 million), an

increase of GBP3.9 million (23.5%) which, together with significant

investment in staff within the Credit Hire division (2021: GBP12.4

million, 2020: GBP8.1 million) to ensure we maintained our high

standards of service to an increasing number of clients, accounted

for a total increase of GBP8.2 million. Following the establishment

of our Housing Disrepair team in late 2020, some GBP1.7 million was

invested in marketing costs in 2021 (2020: GBP0.1 million), all of

which has been expensed as incurred. The balance of the increase

reflects the investment in marketing and infrastructure to allow

the Group to meet its growth aspirations.

Profit Before Tax

Adjusted profit before tax reached GBP24.1 million in 2021,

increasing significantly from GBP16.1 million in 2020 (49.7%). To

provide a better guide to underlying business performance, adjusted

profit before tax excludes share-based payments charged to profit

and loss.

The GAAP measure of the profit before tax was GBP23.7 million

(2020: GBP15.5 million) reflecting the non-cash share-based payment

charge of GBP0.4 million (2020: GBP0.7 million). Where we have

provided adjusted figures, they are after the add-back of this item

and a reconciliation of the adjusted and reported results is

included on page 19 of the Annual Report.

Finance Costs

Finance costs reached GBP3.6 million in 2021, increasing from

GBP2.6 million in 2020 (38.5%), reflecting the increased level of

financing facilities held within the Group to support its growth

strategy.

EPS and Dividend

Statutory basic EPS is 16.5 pence (2020: 10.8 pence). Statutory

diluted EPS is 16.2 pence (2020: 10.6 pence). The adjusted EPS is

16.8 pence (2020: 11.4 pence). The adjusted diluted EPS is 16.5

pence (2020: 11.2 pence). The adjusted figures exclude the effect

of share-based payments. The detailed calculation in support of the

EPS data provided above is included within Note 12 of the financial

statements of the annual report.

The Board is pleased to propose a final dividend of 1.0p per

share, which if approved at the Annual General Meeting to be held

on 16 June 2022 will be paid on 24 June 2022 to those shareholders

on the register at the close of business on 20 May 2022. The shares

will become ex-dividend on 19 May 2022. An interim dividend of 0.5p

per share was paid on 22 October 2021 (2020: total dividend 1.0p

per share).

Group Statement of Financial Position

The Group's net assets position is dominated by the balances

held within trade and other receivables. These balances include

credit hire and credit repair debtors, together with disbursements

paid in advance which support the portfolio of ongoing claims. The

gross claim value of trade receivables totalled GBP325.3 million in

2021, rising from GBP262.6 million in 2020. In accordance with our

income recognition policies, a provision is made to reduce the

carrying value to recoverable amounts, the net balance increasing

to GBP146.4 million (2020: GBP119.6 million). This increase

reflects the recent trading activity and strategy of the Group and

is in line with management expectations given that throughout the

majority of 2021 the legal services teams have been operating

within COVID-19 restrictions and there have been periods when

capacity within the court system has been significantly hampered.

The increase has been primarily funded from the significant rise in

cash collections seen year on year as well as additional facilities

secured from our two principal working capital funders.

In addition, the Group has a total of GBP39.4 million reported

as accrued income (2020: GBP27.1 million) which represents the

value attributed to those ongoing hires and claims at the year end,

the number of vehicles on the road in particular increasing

significantly during the year.

The increases in both trade receivables and accrued income

reflect an increase in net volume of new cases funded which

increased to 4,078 in 2021 (having funded 10,265 hire cases and

settled 6,187 in the year) from 2,299 in 2020 (having funded 7,535

hire cases and settled 5,236 in that year).

Whilst activity levels have risen and fallen in line with the

local and national lockdowns, impacting the number of vehicles on

the road and hence opportunities for new claims for the Group,

further investment has been required and made in 2021 into the

motorcycle fleet so as to meet the demand from our significant pool

of introducers. Total fixed asset additions totalled GBP13.1

million in 2021 (2020: GBP11.2 million), the fleet continues to be

largely externally financed.

Trade and other payables, including tax and social security

increased to GBP12.6 million compared to GBP9.5 million at 31

December 2020, the Group utilising additional cash availability to

reduce the balance over and above the general increase in trading

activity.

Net assets at 31 December 2021 reached GBP128.2 million (2020:

GBP110.4 million).

Net Debt, Cash and Financing

Net debt increased to GBP62.0 million at 31 December 2021 (31

December 2020: GBP40.5 million) and comprised cash balances at 31

December 2021 of GBP7.6 million (2020: GBP8.2 million), plus

borrowings which increased during the year to fund the additional

working capital investment in the Group's portfolio of claims,

support the investment by the Group in the VW and Mercedes Benz

emissions claims and facilitate expansion of the vehicle fleet.

The total debt balance rose from GBP48.7 million in 2020 to

GBP69.6 million at the end of 2021; these balances include lease

liabilities recognised in line with IFRS16. The Group has a number

of funding relationships and facilities to support its working

capital and investment requirements, including an invoice

discounting facility within Direct Accident Management Limited

(secured on the credit hire and repair receivables), lease

facilities to support the acquisition of the fleet and a revolving

credit facility within Bond Turner Limited.

Subsequent to the year end, the group secured an increase in

facilities from Secure Trust Bank plc alongside a loan of GBP7.5

million from Blazehill Capital Finance Limited. Secured Trust Bank

plc increased both the overall draw rate on the invoice discounting

facility as well as the overall facility limit to GBP43.0 million.

The loan from Blazehill Capital Finance Limited is non amortising

and committed for a three year period; both were available to be

drawn from March 2022.

Having considered the Group's current trading performance, cash

flows and headroom within our current debt facilities, maturity of

those facilities, the Directors have concluded that it is

appropriate to prepare the Group and the Company's financial

statements on a going concern basis. Further details are included

on page 73 of the financial statements.

Cash Flow

Notwithstanding the impact of COVID-19 on the Business (further

details provided earlier), whilst other businesses have furloughed

staff and made redundancies, particularly within the personal

injury legal market, we have continued to invest in talent and grow

our settlement capacity throughout Bond Turner. The number of

senior fee earners increased from 163 to 237 during 2021 (an

increase of 45.4%) and continues to rise across each of our

offices, the third of which opened in Leeds in February 2021.

Cash collections for the Group (and excluding settlements for

our clients), a key metric for the Group, increased from GBP98.0

million in 2020 to GBP119.0 million in 2021, an increase of 21.4%.

This is a significant improvement, given the fact that many of the

new recruits will not reach settlement maturity until 2022.

Furthermore, with settlements impacted by the reduction in capacity

within the court system arising from the impact of COVID, this

growth is testament to the quality of staff within the Group.

During 2020 and 2021, we have seen a number of competitors furlough

staff and withdraw from the market leading to increases in market

opportunities; we have sought to take advantage of this and

increase market share. Despite the noticeable decline in road

traffic during the various periods of lockdown, with the overall

number of vehicles on the road visibly lower than in a typical year

and many people working from home, we have actually seen the

average number of vehicles on the road rise in 2021, reaching 1,834

(2020: 1,515). This contributed to the strong revenue performance

of the Credit Hire division.

This growth correspondingly impacted cash flows in the second

half of the year with vehicle numbers peaking at over 2,500 in the

later part of the year, culminating in the award of our first

insurance contract with MCE (further details have been provided

above).

With such a raft of growth opportunities, the Board approved an

increase in availability of approximately GBP11.1 million of new

debt, provided by an increase in facilities from Secure Trust Bank

plc (GBP3.6 million) and Blazehill Capital Finance Limited (GBP7.5

million), to take advantage of these opportunities, whilst ensuring

the relationship between the number of new claims taken on within

EDGE is balanced with the settlement capacity of Bond Turner. These

additional facilities were secured in March 2022.

As growth opportunities within the Credit Hire division expanded

significantly during 2021, the Group reported an outflow from

operating activities of GBP7.3 million (2020: cash inflow of GBP0.2

million), this position being impacted not only from the

significant increase in hire cases funded (which increased by 2,730

(36.2%) to 10,265) but continued delays and adjournments within the

court system. However, we successfully reduced the average working

capital cycle from c520 days in 2020 to c460 days in 2021 as the

level of claims processed under protocol type arrangements with a

number of at fault insurers increased to cover approximately 15% of

our claims taken.

With a net cash inflow of GBP7.2 million resulting from

financing activities, having secured additional facilities from our

two primary funders (Secure Trust Bank Plc and HSBC Bank Plc)

alongside an additional GBP3.0 million to fund the Mercedes Benz

emissions claim, (2020: net cash inflow of GBP4.9 million), the

Group reported a net cash outflow in 2021 of GBP0.7 million (2020:

net cash inflow of GBP6.0 million).

Reconciliation of Adjusted and Reported IFRS Results

In establishing the adjusted operating profit, the costs

adjusted include GBP0.4 million of costs related to share-based

payments (2020: GBP0.7 million).

A reconciliation between adjusted and reported results is

provided below:

Year to December 2021

---------------------

Adjusted Share-based Reported

GBP'000s payment GBP'000s

GBP'000s

--------------------- ----------- -------------- -----------

Revenue 118,237 - 118,237

Gross profit 91,481 - 91,481

Other operating

costs (net) (63,149) (378) (63,527)

Operating profit 27,728 (378) 27,350

Finance costs (net) (3,604) - (3,604)

Profit before tax 24,124 (378) 23,746

Year to December 2020

---------------------

Adjusted Share-based Reported

GBP'000s payment GBP'000s

GBP'000s

--------------------- ----------- -------------- -----------

Revenue 86,752 - 86,752

Gross profit 67,952 - 67,952

Other operating

costs (net) (49,244) (658) (49,902)

Operating profit 18,708 (658) 18,050

Finance costs (net) (2,562) - (2,562)

Profit before tax 16,146 (658) 15,488

By order of the board

Mark Bringloe

Chief Financial Officer

11 May 2022

Consolidated Statement of Total Comprehensive Income

for year ended 31 December 2021

2021 2020

Note GBP'000s GBP'000s

Revenue 3 118,237 86,752

Cost of sales (26,756) (18,800)

---------- ------------

Gross profit 91,481 67,952

Depreciation & profit / loss on disposal 4 (8,504) (6,571)

Amortisation 4 (137) (92)

Administrative expenses before share

based payments 4 (55,112) (42,581)

Operating profit before share based

payments 4 27,728 18,708

---------- ------------

Share based payment charge 4 (378) (658)

---------- ------------

Operating profit 4 27,350 18,050

Finance costs (3,604) (2,562)

---------- ------------

Profit before tax 23,746 15,488

Taxation (4,598) (3,173)

Profit and total comprehensive income

for the year attributable to the owners

of the company 19,148 12,315

---------- ------------

Earnings per share

Basic earnings per share (pence) 5 16.5 10.8

---------- ------------

Diluted earnings per share (pence) 5 16.2 10.6

---------- ------------

The above results were derived from continuing operations.

Consolidated Statement of Financial Position

as at 31 December 2021

2021 2020

Assets Note GBP'000s GBP'000s

Non-current assets

Property, plant and equipment 6 2,071 2,187

Right of use assets 6 16,896 13,081

Intangible assets 7 188 234

Deferred tax assets 7 112 112

19,267 15,614

---------- ----------

Current assets

Trade and other receivables 8 188,134 147,931

Corporation tax receivable - 439

Cash and cash equivalents 7,562 8,220

195,696 156,590

---------- ----------

Total assets 214,963 172,204

---------- ----------

Equity and liabilities

Equity

Share capital 58 58

Share premium 16,161 16,161

Share based payments reserve 2,077 1,699

Retained earnings 109,928 92,520

---------- ----------

Equity attributable to the owners

of the Company 128,224 110,438

---------- ----------

Non-current liabilities

Other interest-bearing loans and borrowings 9 13,814 3,681

Lease liabilities 9 8,430 8,945

Deferred tax liabilities 32 32

22,276 12,658

---------- ----------

Current liabilities

Other interest-bearing loans and borrowings 9 38,499 31,294

Lease liabilities 9 8,833 4,753

Trade and other payables 12,635 9,505

Corporation tax liability 4,496 3,556

64,463 49,108

---------- ----------

Total liabilities 86,739 61,766

---------- ----------

Total equity and liabilities 214,963 172,204

---------- ----------

The financial statements were approved by the Board of Directors

and authorised for issue on 10 May 2022. They were signed on its

behalf by:

Mark Bringloe

Chief Financial Officer

11 May 2022

Consolidated Statement of Changes in Equity

for the year ended 31 December 2021

Share

Based

Share Share Merger Payments Retained

Capital Premium Reserve Reserve Earnings Total

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

At 1 January 2020 55 9,235 - 1,041 81,365 91,696

Profit for the

year and total

comprehensive

income - - - - 12,315 12,315

Issue of share

capital 3 - - - - 3

Increase in share

premium - 6,926 - - - 6,926

Share based payment

charge - - - 658 - 658

Dividends - - - - (1,160) (1,160)

At 31 December

2020 58 16,161 - 1,699 92,520 110,438

Profit for the

year and total

comprehensive

income - - - - 19,148 19,148

Share based payment

charge - - - 378 - 378

Dividends - - - - (1,740) (1,740)

At 31 December

2021 58 16,161 - 2,077 109,928 128,224

------------ -------------- ------------ -------------- --------- -----------

Consolidated Statement of Cash Flows

for the year ended 31 December 2021

2021 2020

Note GBP'000s GBP'000s

Cash flows from operating

activities

Profit for the year 19,148 12,315

Adjustments for:

Depreciation and profit /

loss on disposal 4 8,504 6,571

Amortisation 4 137 92

Financial expense 3,604 2,562

Share based payment charge 4 378 658

Taxation 4,598 3,173

----------------- ------------

36,369 25,371

Working capital adjustments

Increase in trade and other

receivables (40,224) (20,686)

Increase in trade and other

payables 3,131 1,588

----------------- ------------

Cash generated from operations (724) 6,273

Interest paid (3,364) (2,422)

Tax paid (3,219) (3,646)

----------------- ------------

Net cash from operating activities (7,307) 205

----------------- ------------

Cash flows from investing

activities

Proceeds from sale of property,

plant and equipment 941 853

Acquisition of property,

plant and equipment (1,439) (223)

Investment in intangible

fixed assets (91) (150)

Receipt of directors loan

receivable - 415

Net cash from investing activities (589) 895

----------------- ------------

Cash flows from financing

activities

Net proceeds from the issue

of share capital - 6,929

Proceeds from new loans 25,039 12,924

Repayment of borrowings (7,951) (6,257)

Lease payments (8,110) (7,586)

Dividends paid (1,740) (1,160)

----------------- ------------

Net cash from financing activities 7,238 4,850

----------------- ------------

Net (decrease)/increase in

cash and cash equivalents (658) 5,950

Cash and cash equivalents

at 1 January 8,220 2,270

Cash and cash equivalents

at 31 December 7,562 8,220

----------------- ------------

Notes to the Consolidated Financial Statements

for the year ended 31 December 2021

1. Basis of Preparation and Principal Activities

Whilst the financial information included in this preliminary

announcement has been prepared on the basis of the requirements of

International Accounting Standards in conformity with the

requirements of the Companies Act 2006 and effective as at 31

December 2021, this announcement does not itself contain sufficient

information to comply with International Accounting Standards.

The financial information set out in this preliminary

announcement does not constitute the group's statutory financial

statements for the years ended 31 December 2021 or 2020 but is

derived from those financial statements.

Statutory financial statements for 2020 have been delivered to

the registrar of companies and those for 2021 will be delivered in

due course. The auditors have reported on those financial

statements; their reports were (i) unqualified and (ii) did not

contain a statement under section 498 (2) or (3) of the Companies

Act 2006.

The financial statements are presented in Pounds Sterling, being

the presentation currency of the Group, generally rounded to the

nearest thousand. Pounds Sterling is also the functional currency

for each of the Group entities.

The annual financial statements have been prepared on the

historical cost basis.

The principal activities of the Group are the provision of

credit hire and associated legal services.

The Company is a public company limited by shares, which is

listed on the Alternative Investment Market of the London Stock

Exchange and incorporated and domiciled in the UK. The address of

its registered address office is 5th Floor, The Plaza, 100 Old Hall

Street, Liverpool, L3 9QJ.

Going concern

Throughout the year, ensuring the health and wellbeing of our

people and clients was paramount, and steps were taken to allow our

staff to be able to work on an agile basis in order to follow

social distancing, lockdown and self-isolation measures and to

mitigate the impact on client service.

During 2021, the vast majority of staff within Bond Turner, the

Group's Legal Services division, operated from within the office

under certain measures detailed within the Group's COVID-19 risk

assessment which included certain office adaptations. Progress

continues to be made for the transition from virtual to face to

face court hearings, supporting an ever-improving level of case

settlements and cash collections for the Group.

Within EDGE, the Group's Credit Hire division, vehicles have

been delivered and collected by staff who are protected in line

with government guidelines. our need for vehicle delivery increased

during the pandemic and the trend towards increasing opportunities

within our motorcycle business also expanded during 2021 as many

courier and motorcycle delivery businesses recruited thousands of

new riders to keep up with public demand. The number of vehicles on

the road reached record levels in the autumn of 2021, coinciding

with the award of the contract from MCE. Vehicle numbers are now

returning to lower levels in order to manage growth within EDGE and

remain within the capacity of Bond Turner.

The reported results for 2021 demonstrate the resilience shown

by the Group, our business model and our employees. The

introduction of the Housing Disrepair division supported a

shortening of our working capital cycle, an area with significant

capacity for growth during 2022 and beyond. The pandemic and the

changes in the Civil Liabilities Act have created opportunities for

the Group to both grow market share within the core business,

including the opportunity to secure our first insurance contract

with MCE, and to take advantage of opportunities as they arise in

other areas within the legal services arena.

Following the recent announcement of additional facilities from

Secure Trust Bank plc and Blazehill Capital Finance Limited, which

are expected to provide additional funding of GBP15.0 million into

2022, the Group has a strong balance sheet with a conservative

gearing level and good liquidity with headroom within its funding

facilities and associated covenants, which include a revolving

credit facility of GBP10.0 million with HSBC Bank plc (due for

repayment in October 2024), an invoice discounting facility of

GBP40.0 million with Secure Trust Bank plc (due for renewal in

December 2023) and a loan facility of GBP7.5 million from Blazehill

Capital Finance Limited.

Measures implemented to maintain a stable relationship between

EDGE and Bond Turner, alongside the additional headroom created

from the recent refinancing, means that the Board remains confident

that the Group is in a strong financial position and is well placed

to weather the current worldwide uncertainty and to take advantage

of further opportunities in a more stable future environment.

The Directors have prepared trading and cash flow forecasts for

the period ended December 2023, against which the impact of various

sensitivities have been considered covering the level of cash

receipts and the volume of work taken on. Working capital

management is considered to be the most critical aspect of the

Group's assessment. The Group has the ability to improve cash flow

and headroom from a number of factors that are within the direct

control of management, examples of which could be by limiting the

level of new business within EDGE, managing the level of investment

in people and property within Bond Turner or by limiting the

investment in the Mercedes Benz emissions case. These factors allow

management to balance any potential shortfall in cash receipts and

headroom against forecast levels, something the Directors have been

doing for many years, such that the Group maintains adequate

headroom within its facilities.

It is in that context that the Directors have a reasonable

expectation that the Group will have adequate cash headroom. The

Group continues to trade profitably and early indications for

growth in the current year are positive. Accordingly, the directors

continue to adopt the going concern basis in preparing the

consolidated and the company financial statements.

2. Critical Accounting Judgements and Key Sources of Estimation Uncertainty

In the application of the Group's accounting policies,

management is required to make judgements, estimates and

assumptions about the carrying value of assets and liabilities that

are not readily apparent from other sources. The estimates and

underlying assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period, or in the period of revision and prior periods if

the revision affects both current and prior periods.

The key sources of estimation uncertainty that have a

significant effect on the amounts recognised in the financial

statements are described below.

Credit Hire

Due to the nature of the business, there are high levels of

trade receivables and accrued income at the year end, and therefore

a risk that some of these balances may be impaired or

irrecoverable. The Group applies its policy for accounting for

impairment of these trade receivables as well as expected credit

losses whereby debts are assessed and provided against when the

recoverability of these balances is considered to be uncertain.

This requires the use of estimates based on historical claim and

settlement information.

Revenue is accrued on a daily basis, after adjustment on a

portfolio basis for an estimation of the recovery of those credit

hire charges based on historical settlement rates. This adjustment

is made to ensure that revenue is only recognised to the extent

that it is highly probable that a significant reversal of revenue

will not occur upon settlement of a customer's claim. Revenue

recognised is updated on settlement once the amount of fees that

will be recovered is known.

The settlement percentages applied and expected credit loss

provisions are based on historical settlement information, revenue,

accrued income and trade receivables are sensitive to these

estimates. This assumes that claims which have settled historically

are representative of the trade receivables and accrued income in

the balance sheet. This assumption represents a significant

judgement. If the settlement percentages applied in calculating

revenue were reduced by 1% it would reduce credit hire revenue and

trade receivables and accrued income (GBP71.3 million and GBP143.0

million respectively) by GBP2.3 million. (2020: by GBP1.9 million,

credit hire revenue being GBP51.0 million and trade receivables and

accrued income GBP110.9 million).

Legal Services

The Group carries an element of accrued income for legal costs,

the valuation of which reflects the estimated level of recovery on

successful settlement by reference to the lowest level of fees

payable by reference to the stage of completion of those credit

hire cases. Where we have not had an admission of liability no

value is attributed to those case files.

Accrued income is also recognised in respect of serious injury

and housing disrepair claims, only where we have an admission of

liability and by reference to the work undertaken in pursuing a

settlement for our clients, taking into account the risk associated

with the individual claim and expected future value of fees from

those claims on a claim-by-claim basis.

For both credit hire and legal services, the historical

settlement rates used in determining the carrying value may differ

from the rates at which claims ultimately settle. This represents

an area of key estimation uncertainty for the Group.

3. Segmental Reporting

The Group's reportable segments are as follows:

-- the provision of credit hire vehicles to individuals who have had a non-fault accident, and

-- associated legal services in the support of the individual

provided with a vehicle by the Group and other legal service

activities

Management monitors the operating results of business segments

separately for the purpose of making decisions about resources to

be allocated and of assessing performance.

Year ended 31 December 2021

Group

Housing VW &

Credit Legal Disrepair Class Central

Hire Services Action Costs Consolidated

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

Revenues

Third party 71,338 41,823 5,076 - - 118,237

Total revenues 71,338 41,823 5,076 - - 118,237

--------- ------------ ------------- --------- --------- -------------

Profit before taxation 19,811 4,423 2,592 (819) (2,261) 23,746

--------- ------------ ------------- --------- --------- -------------

Net cash from

operations (10,654) 5,637 (568) (819) (903) (7,307)

--------- ------------ ------------- --------- --------- -------------

Depreciation,

amortisation

and gain on disposal

of property, plant

and equipment 7,205 1,436 - - - 8,641

--------- ------------ ------------- --------- --------- -------------

Segment assets 161,578 49,545 3,648 - 192 214,963

--------- ------------ ------------- --------- --------- -------------

Capital expenditure 998 441 - - - 1,439

--------- ------------ ------------- --------- --------- -------------

Segment liabilities 55,415 25,413 - 5,501 410 86,739

--------- ------------ ------------- --------- --------- -------------

Year ended 31 December 2020

Group

Housing VW &

Credit Legal Disrepair Class Central

Hire Services Action Costs Consolidated

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

Revenues

Third party 51,591 34,419 742 - - 86,752

Total revenues 51,591 34,419 742 - - 86,752

-------- ------------ ------------- --------- --------- -------------

Profit before taxation 17,891 2,476 341 (2,906) (2,314) 15,488

-------- ------------ ------------- --------- --------- -------------

Net cash from

operations (15) 3,455 (168) (2,906) (161) 205

-------- ------------ ------------- --------- --------- -------------

Depreciation,

amortisation

and gain on disposal

of property, plant

and equipment 5,492 1,173 - - - 6,665

-------- ------------ ------------- --------- --------- -------------

Segment assets 125,055 45,280 509 - 1,360 172,204

-------- ------------ ------------- --------- --------- -------------

Capital expenditure 4,238 900 - - - 5,138

-------- ------------ ------------- --------- --------- -------------

Segment liabilities 39,521 16,886 - 2,251 3,108 61,766

-------- ------------ ------------- --------- --------- -------------

Interest income/expense and income tax are not measured on a

segment basis.

4. Operating Profit

Operating profit is arrived at after charging:

2021 2020

GBP'000s GBP'000s

Depreciation on owned assets 653 474

Depreciation on right of use assets 8,039 6,333

Amortisation 137 91

Share based payments 378 658

Gain on disposal of property, plant

and equipment (188) (236)

There were no non-recurring costs in the year ended 31 December

2021 or 2020.

Included in the above are the costs associated with the

following services provided by the Company's auditor:

2021 2020

GBP'000s GBP'000s

Audit services

Audit of the Company and the consolidated

financial statements 50 40

Audit of the Company's subsidiaries 120 89

Total audit fees 170 129

All other services - -

Total fees payable to the Company's

auditor 170 129

---------- ----------

5. Earnings Per Share

2021 2020

Number of shares: No. No.

Weighted number of ordinary shares

outstanding 116,000,000 113,550,685

Effect of dilutive options 2,200,000 2,200,000

------------ ------------

Weighted number of ordinary shares

outstanding - diluted 118,200,000 115,750,685

------------ ------------

Earnings: GBP'000s GBP'000s

Profit basic and diluted 19,148 12,315

------------ ------------

Profit adjusted and diluted 19,526 12,973

------------ ------------

Earnings per share: Pence Pence

Basic earnings per share 16.5 10.8

------------ ------------

Adjusted earnings per share 16.8 11.4

------------ ------------

Diluted earnings per share 16.2 10.6

------------ ------------

Adjusted diluted earnings per share 16.5 11.2

------------ ------------

The adjusted profit after tax for 2021 and adjusted earnings per

share are shown before share -- based payment charges of GBP0.4

million (2020: GBP0.7 million). The Directors believe that the

adjusted profit after tax and the adjusted earnings per share

measures provide additional useful information for shareholders on

the underlying performance of the business. These measures are

consistent with how underlying business performance is measured

internally. The adjusted profit after tax measure is not a

recognised profit measure under IFRS and may not be directly

comparable with adjusted profit measures used by other

companies.

6. Property, Plant and Equipment

Fixtures,

Right fittings

of Property & Office

use assets improvements Equipment equipment Total

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

Cost

At 1 January 2020 17,176 453 1,781 787 20,197

Additions 10,176 39 894 91 11,200

Disposals (2,659) - - - (2,659)

At 31 December 2020 24,693 492 2,675 878 28,738

Additions 12,607 2 450 85 13,144

Disposals (7,656) - - (334) (7,990)

At 31 December 2021 29,644 494 3,125 629 33,892

----------- ------------- ---------- ---------- ---------

Depreciation

At 1 January 2020 7,319 273 460 651 8,703

Charge for year 6,333 24 399 51 6,807

Eliminated on disposal (2,040) - - - (2,040)

At 31 December 2020 11,612 297 859 702 13,470

Charge for the year 8,039 25 559 69 8,692

Eliminated on disposal (6,903) - - (334) (7,237)

At 31 December 2021 12,748 322 1,418 437 14,925

----------- ------------- ---------- ---------- ---------

Carrying amount

At 31 December 2021 16,896 172 1,707 192 18,967

----------- ------------- ---------- ---------- ---------

At 31 December 2020 13,081 195 1,816 176 15,268

----------- ------------- ---------- ---------- ---------

Motor Vehicles are all financed and as such are included in the

right of use assets column above.

Property, plant and equipment includes right-of-use assets with

carrying amounts as follows:

Land and Motor

Buildings vehicles Total

GBP000 GBP000 GBP000

Right-of-use assets

At 1 January 2020 4,819 5,038 9,857

Depreciation charge for the year (920) (5,413) (6,333)

Additions to right-of use assets 1,201 8,975 10,176

Disposals of right-of-use assets - (619) (619)

At 31 December 2020 5,100 7,981 13,081

Depreciation charge for the year (950) (7,089) (8,039)

Additions to right-of-use assets - 12,607 12,607

Disposals of right-of-use assets - (753) (753)

At 31 December 2021 4,150 12,746 16,896

---------- --------- -------

7. Intangibles

Intangible Assets

Software

licences

GBP'000s

Cost

At 1 January

2020 210

Additions 151

At 31 December

2020 361

Additions 91

At 31 December

2021 452

----------

Amortisation

At 1 January

2020 35

Charge for year 92

At 31 December

2020 127

Charge for the

year 137

At 31 December

2021 264

----------

Carrying amount

At 31 December

2021 188

----------

At 31 December

2020 234

----------

8. Trade and Other Receivables

2021 2020

GBP'000s GBP'000s

Gross claim value 325,260 262,575

Settlement adjustment on initial

recognition (151,507) (121,967)

Trade receivables before impairment

provision 173,753 140,608

Provision for impairment of trade

receivables (27,360) (21,016)

Net trade receivables 146,393 119,592

Accrued income 39,431 27,100

Prepayments 1,849 596

Other debtors 461 643

188,134 147,931

---------- ----------

The Group's exposure to credit and market risks, including

impairments and allowances for credit losses, relating to trade and

other receivables is disclosed in the financial risk management and

impairment of financial assets note. Whilst credit risk is

considered to be low, the market risks inherent in the business

pertaining to the nature of legal and court cases and ageing

thereof is a significant factor in the valuation of trade

receivables.

Average gross debtor days calculated on a count back basis were

432 at 31 December 2021 and 428 at 31 December 2020.

Age of net trade receivables

2021 2020

GBP'000s GBP'000s

Within 1 year 83,166 67,361

1 to 2 years 34,931 32,049

2 to 3 years 19,716 12,791

3 to 4 years 7,524 6,709

Over 4 years 1,056 682

146,393 119,592

---------- ------------

Average age (days) 432 428

---------- ------------

The provision for impairment of trade receivables is the

difference between the carrying value and the present value of the

expected proceeds. The Directors consider that the fair value of

trade and other receivables is not materially different from the

carrying value.

Movement in provision for impairment of trade receivables

2021 2020

GBP'000s GBP'000s

Opening balance 21,016 19,478

Increase in provision 10,635 6,448

Utilised in the year (4,291) (4,910)

27,360 21,016

---------- ----------

9. Borrowings

2021 2020

GBP'000s GBP'000s

Non-current loans and borrowings

Lease liabilities 8,430 8,945

Revolving credit facility 10,000 -

Other borrowings 3,814 3,681

22,244 12,626

---------- ----------

Current loans and borrowings

Revolving credit facility - 8,000

Lease liabilities 8,833 4,753

Invoice discounting facility 29,258 16,341

Other borrowings 9,241 6,953

47,332 36,047

---------- ----------

Direct Accident Management Limited uses an invoice discounting

facility which is secured on the trade receivables of that company.

Security held in relation to the facility includes a debenture over

all assets of Direct Accident Management Limited dated 11 October

2016, extended to cover the assets of Anexo Group Plc and Edge

Vehicles Rentals Group Limited from 20 June 2018 and 28 June 2018

respectively, as well as a cross corporate guarantee with

Professional and Legal Services Limited dated 21 February 2018. At

the end of December 2021, Direct Accident Management Limited has

availability within the invoice discounting facility of GBP1.3

million (2020: GBP2.2 million).

In July 2020 Direct Accident Management Limited secured a GBP5.0

million loan facility from Secure Trust Bank Plc, under the

Government's CLBILS scheme. The loan was secured on a repayment

basis over the three year period, with a three month capital

repayment holiday.

Direct Accident Management Limited is also party to a number of

leases which are secured over the respective assets funded.

The revolving credit facility is secured by way of a fixed

charge dated 26 September 2019, over all present and future

property, assets and rights (including uncalled capital) of Bond

Turner Limited. The loan is structured as a revolving credit

facility which is committed for a three-year period, until 13

October 2024, with no associated repayments due before that date.

Interest is charged at 3.25% over the Respective Rate. The facility

increased in the year from GBP8.0 million to GBP10.0 million and

was fully drawn down as at 31 December 2021 and 2020.

The Group's banking arrangements are subject to monitoring

through financial performance measures or covenants. During the

COVID pandemic, certain of these measures and covenants came under

pressure and required action by the Group which included a regular

dialogue between all parties to ensure that the reasons behind the

breaches were fully understood, agreed and ultimately waived. All

the required waivers were fully in place post year end. A facility

from Secure Trust (GBP29.3 million as at 31 December 2021) was

already classified as repayable on demand so was not impacted.

In July 2020 Anexo Group Plc secured a loan of GBP2.1m from a

specialist litigation funder to support the investment in marketing

costs associated with the VW Emissions Class Action. The terms of

the loan are that interest accrues at the rate of 10% per annum,

with maturity three years from the date of receipt of cunding with

an option to repay early without charge. In addition to the

interest charges the loan attracts a share of the proceeds to be

determined by reference to the level of fees generated for the

Group.

In November 2021 a further GBP3.0 million loan was sourced from

certain of the principal shareholders and directors of the Group to

support the investment in 2022 of the Mercedes Benz emissions

claim. The terms of the loan are that interest accrues at the rate

of 10% per annum, with maturity two years from the date of receipt

of funding with an option to repay early without charge. In

addition to the interest charges the loan attracts a share of the

proceeds to be determined by reference to the level of fees

generated for the Group.

The loans and borrowings are classified as financial instruments

and are disclosed in the financial instruments note.

The Group's exposure to market and liquidity risk; including

maturity analysis, in respect of loans and borrowings is disclosed

in the financial risk management and impairment of financial assets

note.

Changes in liabilities arising from financing activities

Invoice

discounting Lease liabilities Other borrowings

facility GBP'000s GBP'000s

GBP'000s

Balance at 1 January 2020 17,784 10,307 10,383

Cash flows

Proceeds from new loans - - 12,924

Repayment of borrowings (1,443) - (4,814)

Lease payments - (7,585) -

Non-cash changes * - 10,976 141

------------- -------------------- -------------------

Balance at 31 December 2020 16,341 13,698 18,634

Cash flows

Proceeds from new loans 12,917 - 12,122

Repayment of borrowings - - (7,971)

Lease payments - (8,110) -

Non-cash changes * - 11,675 270

------------- -------------------- -------------------

Balance at 31 December 2021 29,258 17,263 23,055

------------- -------------------- -------------------

* This balance includes GBP11.7 million (2020: GBP11.0 million)

of new leases entered into during the year.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAFSEFEPAEAA

(END) Dow Jones Newswires

May 11, 2022 02:01 ET (06:01 GMT)

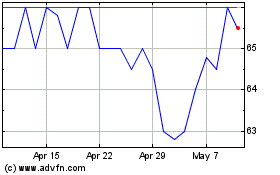

Anexo (LSE:ANX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Anexo (LSE:ANX)

Historical Stock Chart

From Dec 2023 to Dec 2024