TIDMAOF

RNS Number : 2299D

Africa Opportunity Fund Limited

25 June 2021

25 June 2021

Africa Opportunity Fund Limited (AOF LN)

Annual Results for the Year ended 31 December 2020

The Board of Africa Opportunity Fund Limited ("AOF", the

"Company" or the "Fund") is pleased to announce its audited results

for the year ended 31 December 2020. The Company's full annual

report and financial statements will shortly be sent to

shareholders and will be available to view and download from the

Company's website at: www.africaopportunityfund.com.

The following text and financial information does not constitute

the Company's annual report but has been extracted from the annual

report and financial statements for the year ended 31 December

2020.

For further information please contact:

Africa Opportunity Fund Limited

Francis Daniels Tel: +2711 684 1528

Liberum (Corporate Broker)

Darren Vickers

Owen Matthews Tel: +44 20 3100 2223

The Company

Africa Opportunity Fund Limited ("AOF" or the "Company") is a

Cayman Islands incorporated closed-end investment company traded on

the Specialist Fund Segment ("SFS") of the London Stock Exchange

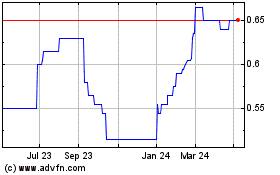

("LSE"). AOF's net asset value on 31 December 2020 was $22.6

million and its market capitalisation was $15.8 million.

CHAIRPERSON'S STATEMENT

2020 Review

Africa Opportunity Fund (the "Fund" or "AOF") completed the

first half of its three year asset realization period at the end of

2020. It made two distributions to shareholders amounting to $25

million or 59% of its December 2019 net asset value.

2020 was a difficult year for the Fund as its net asset value

(including redemptions) declined 0.8% while its share price

declined by 19%[1]. To provide some basis for comparison, South

Africa rose 1%, Nigeria rose 43%, Kenya fell 11%, and Egypt fell

10%. In non-African emerging markets, China rose 38%, Brazil fell

20%, Russia fell 5% and India rose 13%. In developed markets, Japan

rose 24%, the US rose 18%, Europe rose 8%, and the UK fell 8%.

([2])

Covid-19 was the overarching theme of 2020. Despite countries

like Tanzania which claimed to have vanquished the virus by prayer

or Zambia which decided against imposing lockdown restrictions, the

overall impact on the typical African household was decidedly

negative. The actual number of African victims of covid-19 will

never be known. What is certain, though, is that, unlike other

economies, a majority of Sub-Saharan Africa's economies grew

anemically in 2020. But, the gross domestic products of its two

largest economies-South Africa and Nigeria-shrank, respectively,

7%, the biggest decline in a century, and 3%. Africa's recovery

picked up in 2020's second half as prices of major commodities like

crude oil, and copper, as well as precious metals like gold and

platinum group metals, rose in 2020. Palm oil was up 30%. However,

prices of key imports for African consumers such as white maize and

yellow maize also rose 33% and 27% respectively. To offset the

harsh impact of the pandemic on poor citizens, financial conditions

were loosened in heavily indebted countries like South Africa,

Ghana, and Kenya even as most African governments also increased

dramatically their budget deficits. Zambia defaulted on its

Eurobonds in Q4 2020. Hyperinflation in Zimbabwe declined from 460%

in 2019 to 340% in 2020. ([3]) The Fund participated in this

recovery as its net asset value per share rose 13% in H2 2020.

AOF's 2020 strategy was one of deliberate realization to

maximize the value of the assets returned to shareholders. In some

cases, that objective inclined the Fund towards corporate

transactions to create value for the Fund. In several other cases,

the Fund exited through the secondary public markets.

2021 Outlook

AOF's 2021 is likely to be determined by commodity price

trends-currently favourable-and the slow pace of Africa recovery

from the Covid-19 pandemic matching the slow rollout of vaccines in

Africa. The International Monetary Fund forecasts that Sub-Saharan

Africa's gross domestic product should rise 3.2% in 2021 and 3.9%

in 2022. Sub-Saharan Africa will be the second slowest growing

region in 2021. There is little doubt that it will take a few years

for Africa to recover from this pandemic.

Concluding Thoughts

In closing, I wish also to extend my thanks to our shareholders

for their support.

Dr. Myma Belo-Osagie

Chairperson

June 2021

MANAGER'S REPORT

2020 Review

2020 marked the thirteenth full year of operation of Africa

Opportunity Fund (the "Fund" or "AOF"). Its ordinary shares had an

annual return of -0.8%. At year-end, AOF held $3.9 million in cash,

$20.8 million in equity securities, and $1 million in debt

securities. The Fund's underlying end-of-year holdings were in

Botswana, Cote d'Ivoire, Egypt, Ghana, Kenya, Senegal, South

Africa, Tanzania, Zambia, and Zimbabwe.

The Fund's shareholders decided in June 2019 to commence an

orderly realization of the Fund over a three-year period ending in

June 2022. Realization proceeds are to be returned to shareholders

via intermittent mandatory redemptions of the Fund's shares. The

Fund liquidated nine investments in their entirety in 2020, of

which, Anglogold, Kosmos Energy, and Continental Reinsurance, were

the most significant in size. The Fund made those disposals via the

secondary markets as well as in corporate transactions. It also

reduced its holdings in seven other issuers. After year end, it

completed its exit from Egypt. The balance of this report will

discuss a few of the Fund's holdings.

The Fund's largest investment is in Enterprise Group. Enterprise

Group's total return was -14% in 2020. It announced in November

that it had been granted a license to commence life assurance

operations in Nigeria. With this entry into Nigeria, Enterprise is

present in three West African countries: Gambia, Ghana, and

Nigeria. Greenfield insurance operations tend to commence in

losses, as they pay upfront commissions to agents to build their

life policy books, in the hope of enjoying subsequent profits. A

cautious approach is to expect up to three years of losses. Today's

overvalued Naira and the negative real interest rates of Nigeria's

money market instruments will handicap Enterprise in its search for

inflation-beating investment destinations for its Nigerian

premiums. Lastly, Nigeria's low insurance penetration must exist

for good reason. Our enquiries indicate that Nigeria's insurance

industry is perceived to be a slow claims-paying industry. Against

these negatives stand Nigeria's patent potential and size.

Enterprise Life Assurance Company (Nigeria) Limited faces

formidable opportunities and obstacles. Yet, it should succeed in

its Nigerian mission. Enterprise's Ghanaian subsidiaries remain, by

market share, number one in life assurance, property and casualty

insurance, and pension administration. Its property subsidiary

continues to be a profit drag. Enterprise recorded solid 2020

results. It is very encouraging that, despite Enterprise's actual

revenue and investment income results turning out much lower than

forecast in its March 2018 rights offering circular and the

unanticipated covid-19 pandemic, its 2020 group profits exceeded

those forecasts for the third year in a row. Enterprise's trend of

rising management expense and claims ratios reversed in 2019 and

2020. Those diminishing ratios improve Enterprise's

competitiveness. Operating expenses, year-on-year, rose 17% in an

11% inflation environment; net premiums rose 22%, and profit after

tax rose 18% (in $ terms) to $26 million. Enterprise's own

shareholders were entitled to $13 million of those profits. The

most significant development, though, was that Enterprise's cost of

float (money owed to policyholders that is treated a balance sheet

liability in accounting terms) declined for the third straight year

to 1.4%, as it reduced its underwriting losses. Contrast that 1.4%

cost of float with the risk-free Government of Ghana 5 year bonds

of 20.6% and Ghana's inflation rate to understand how Enterprise's

float earned a minimum real (inflation adjusted) spread of 9.6%.

Whether measured in Cedis or Dollars, in a world of negative real

interest rates, that spread is a wide moat. No wonder it reported a

return on assets of 9%, and a return on equity of 17% in 2020. The

most important development, though, was that the embedded value of

Enterprise Life had risen to 775 million Cedis (or $132 million) at

year end versus 678 million Cedis ($119 million) in December 2019.

Enterprise Group is valued at a 45% discount to its share of its

December 2020 embedded value of Enterprise Life (worth $79

million). With a current market capitalization of $45 million,

Enterprise is trading on a P/E of 3x and a P/B ratio of 0.4x. At

these levels, investors are getting Enterprise's other Ghanaian

businesses and its Nigerian life expansion for free. Our goal is to

realize a commercially reasonable value for the Fund's Enterprise

stake.

The Fund's second largest holding is in African Leadership

International ("ALI"). The Fund made its initial investment in

2015, followed by an additional investment in 2016. Founded in 2013

by Fred Swaniker - one of four co-founders of African Leadership

Academy, a small two-year pre-university high school for Africa

students located in South Africa, ALI is a for-profit private

Mauritius holding company for educating talented young Africans

(regardless of income or background) to be ethical and

entrepreneurial leaders. The original intent was to use a blend of

(a) regular classroom instruction; (b) online university course

through modern Internet technology; (c) mutual instruction among

students organized in teams; and (d) 3-4 month internships of

students with the same employers during their university careers to

provide high quality "employment ready" university education to

some of the brightest students in Africa. The hope was that ALI

would be a low-cost tertiary institution. Like many start-ups,

though, ALI's strategy has undergone several twists

while preserving a steadfast focus on its goals. It started with

an undergraduate university campus in Mauritius. African parents

were unwilling or unable to pay its tuition costs. A second and

cheaper campus in Rwanda suffered the same financial fate. Campus

capital and operating costs were too high, inflicting losses on

ALI.

ALI spun out its campuses to place them in a not-for-profit

entity. It: (a) retained an educational division - ALX - that uses

only student-driven and technology enabled instruction outside the

conventional accreditation requirements for tertiary educational

institutions; (b) launched a network for connecting talented

individuals - the Room - to economic opportunities; and (c)

concluded the first of several collaborations with both charitable

organizations and companies to accelerate job creation on the

African continent for its network. ALI is far more capital-lite

today than it was at inception, but it has succeeded in raising a

considerable amount of equity capital and non-dilutive capital in

its short existence to build its business. We expect to sell our

ALI holding in the private secondary market.

The Fund's Zimbabwean property holdings turned in excellent

returns. First Mutual posted an annual total return of 247% while

Mashonaland Holdings generated a total return of 101%. We continue

to monitor the various Zimbabwe Dollar exchanges rates to select

the most realistic rate for valuing the Fund's Zimbabwean

holdings[4].

Zimbabwe continues to suffer from hyperinflation and intense

foreign currency shortages. Covid-19 lockdowns have hurt several

sectors like commercial property, as tenants are forced to work

remotely. Nevertheless, our property holdings do preserve

purchasing power in the long run. Like property companies

elsewhere, it is apparent that First Mutual Properties and

Mashonaland Holdings will have to adapt to a post Covid world.

First Mutual's buildings are well located in Harare's suburbs while

those of Mashonaland suffer from their older age and location in

Harare's city centre. There is likely to be consolidation, via

corporate transactions, to align commercial real estate supply with

changing demand. As Zimbabwe's economy recovers - the timing of

such a recovery a known unknown - there will also be need for

significant increases in capital expenditure and new construction.

Our intent in disposing of these holdings is to minimize the

devaluation risk facing disposal proceeds.

Copperbelt's share price gained 19% in H2, scant relief after

the 51% decline of H1. However, its total return was down 18% for

2020. Copperbelt raised its dividend for the 4(th) straight year by

11% in Dollar terms, giving it an astounding 44% dividend yield.

Evidently the market did not believe the dividend would be

forthcoming, but the Fund received its dividend despite Zambia

having defaulted on its sovereign debt. The reason? Zambia has no

exchange controls. Copperbelt's future remains shrouded in

uncertainties as it wages legal and arbitral battles against two

key parties: a major customer - Konkola Copper Mine - seeking

repayment of $145 million in unpaid invoices; and also a major

supplier - ZESCO and the Zambian government - for imposing

loss-making tariffs on its electricity transmission services. So

far, the Zambian high courts have ruled in favor of Copperbelt

against Konkola Copper Mine and the Zambian government. Both

Konkola Copper Mines and the Zambian government have appealed to

the Zambian appeals court against the two high court decisions.

Copperbelt delivered strong results in 2020, despite its legal

battles and the covid-19 pandemic. As is its norm, Copperbelt

completed its twelfth fatality free year. Its electricity sales

rose 5% to 3284GWh, a sign of copper production recovery.

Underlying net profit (excluding impairments and write-offs)

climbed to its highest level in 5 years - $54 million, although net

profit fell 54% to $5.6 million. Copperbelt has written off or

impaired $80 million of receivables over the last two years because

of the outstanding Konkola Copper Mine debt. Net cash from

operations rose 43% to $71 million-the third highest level in the

last five years. By contrast, net debt dropped to $27 million-its

lowest level in five years. Copperbelt's current enterprise value

of $118 million is less than 2x operating cash flow. Despite the

uncertainties, it is a deeply undervalued holding.

The Fund's financial liabilities - primarily short positions and

hedges - generated profits of $1,173,488 in 2020. The four

loss-incurring years for financial liabilities were 2009, 2012,

2016, and 2019. Over its life, the Fund has generated from its

financial liabilities a cumulative gain of $5.7 million and a

cumulative gain of $3.3 million since 2014.

2021 promises to be a year in which the pandemic will continue

to cast doubts on the pace of economic recovery. We shall strive to

preserve the value of the Fund in this fog of doubts and

uncertainty. Although the realization pace may slow, we continue to

believe that the Fund's holdings are undervalued. Our mission is to

monetize that undervaluation through our realization strategy.

Francis Daniels

Africa Opportunity Partners

June 2021

AFRICA OPPORTUNITY FUND LIMITED

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2020

Notes 2020 2019

-------------------------- -----------------------------

USD USD

Income

Net gains on investment in subsidiaries

at fair value

through profit or loss 6(a) 482,924 -

482,924 -

-------------------------- -----------------------------

Expenses

Net losses on investment in subsidiaries

at fair value

through profit or loss 6(a) - 1,115,691

Management fee 534,637 1,002,326

Other operating expenses 107,015 37,219

Directors' fees 70,000 148,750

Audit and professional fees 173,016 199,628

884,668 2,503,614

-------------------------- -----------------------------

Loss/total comprehensive loss for the

year attributable to equity holders (401,744) (2,503,614)

========================== =============================

Earnings per share attributable

to equity holders (0.011) (0.033)

AFRICA OPPORTUNITY FUND LIMITED

STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2020

Notes 2020 2019

------------------------ ------------------------

USD USD

ASSETS

Cash and cash equivalents 8 38,965 103,067

Other receivables 7 7,516 7,911

Loan receivable from related

party 7 83,329 70,180

Investment in subsidiaries

at fair value through profit

or loss* 6(a) 22,584,303 47,888,007

Total assets 22,714,113 48,069,165

------------------------ ------------------------

EQUITY AND LIABILITIES

LIABILITIES

Trade and other payables 10 147,817 334,497

Total liabilities 147,817 334,497

------------------------ ------------------------

Net assets attributable to

shareholders 22,566,296 47,734,668

======================== ========================

Ordinary share capital 350,062 748,496

Share premium 13,553,258 37,921,452

Retained earnings 8,662,976 9,064,720

Total equity 9(b) 22,566,296 47,734,668

======================== ========================

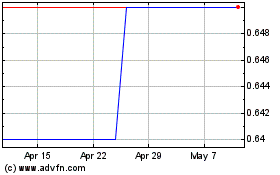

Net assets value per share:

- Ordinary shares 9(b) 0.645 0.638

* The investment in subsidiaries at fair value through profit

or loss include the investment in the Master Fund- Africa Opportunity

Fund L.P

AFRICA OPPORTUNITY FUND LIMITED

STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2020

Share Share Retained

Capital Premium Earnings Total

------------------------ -------------------------- --------------------- --------------------

USD USD USD USD

At 1 January

2019 748,496 37,921,452 11,568,334 50,238,282

OPERATIONS:

Loss/total

comprehensive

loss

for the year - - (2,503,614) (2,503,614)

------------------------ -------------------------- --------------------- --------------------

At 31 December

2019 748,496 37,921,452 9,064,720 47,734,668

======================== ========================== ===================== ====================

Share Share Retained

Capital Premium Earnings Total

------------------------ -------------------------- --------------------- --------------------

USD USD USD USD

At 1 January 2020 748,496 37,921,452 9,064,720 47,734,668

CAPITAL TRANSACTIONS:

Redemption of

ordinary shares (398,434) (23,601,566) - (24,000,000)

Dividend Payment - (766,628) - (766,628)

OPERATIONS:

Total

comprehensive

loss for

the year - - (401,744) (401,744)

------------------------ -------------------------- --------------------- --------------------

At 31 December

2020 350,062 13,553,258 8,662,976 22,566,296

======================== ========================== ===================== ====================

AFRICA OPPORTUNITY FUND LIMITED

STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2020

2020 2019

-------------------------------- ----------------------------------

USD USD

Operating activities

Loss for the year (401,744) (2,503,614)

Adjustment for non-cash items:

Net (gain)/losses on investment

in

subsidiaries at

fair value through profit or

loss 6(a) (482,924) 1,115,691

-------------------------------- ----------------------------------

Cash used in operating

activities (884,668) (1,387,923)

-------------------------------- ----------------------------------

Net changes in operating assets

and

liabilities

Reduction in investment in

subsidiaries

at fair value through profit

or loss

* 6(a) 25,786,628 1,382,200

Repayment of loan receivable

from

related party (13,149) (70,180)

Decrease/(increase) in other

receivables 395 (2,962)

(Decrease)/increase in trade

and

other payables (186,680) 177,556

-------------------------------- ----------------------------------

Net cash generated from

operating

activities 25,587,194 1,486,614

-------------------------------- ----------------------------------

Financing activities

(24,000,000) -

Redemption of ordinary shares

(766,628) -

Divided payment

-------------------------------- ----------------------------------

(24,766,628) -

Net cash flow used in financing

activities

-------------------------------- ----------------------------------

Net increase/(decrease) in

cash and

cash equivalents (64,102) 98,691

Cash and cash equivalents at 1

January 103,067 4,376

-------------------------------- ----------------------------------

Cash and cash equivalents at

end

of year 38,965 103,067

================================ ==================================

* The investment in subsidiaries at fair value through profit or

loss include the investment in the Master Fund- Africa Opportunity

Fund L.P.

NOTES TO THE FINANCIAL STATEMENTS

1. GENERAL INFORMATION

Africa Opportunity Fund Limited (the "Company") was launched

with an Alternative Market Listing "AIM" in July 2007 and moved to

the Specialist Funds Segment "SFS" in April 2014.

Africa Opportunity Fund Limited is a closed-ended fund

incorporated with limited liability and registered in Cayman

Islands under the Companies Law on 21 June 2007, with registered

number MC-188243. The Company is exempted from registering with

CIMA under the Private Funds Act of the Cayman Islands given that

it is listed on the Specialist Funds Segment of the London Stock

Exchange which is approved by CIMA.

The Company aims to achieve capital growth and income through

investment in value, arbitrage, and special situations investments

in the continent of Africa. The Company may therefore invest in

securities issued by companies domiciled outside Africa which

conduct significant business activities within Africa. The Company

has the ability to invest in a wide range of asset classes

including real estate interests, equity, quasi-equity or debt

instruments and debt issued by African sovereign states and

government entities.

The Company's investment activities are managed by Africa

Opportunity Partners Limited, a limited liability company

incorporated in the Cayman Islands and acting as the investment

manager pursuant to an Amended and Restated Investment Management

Agreement dated 12 February 2014.

To ensure that investments to be made by the Company and the

returns generated on the realisation of investments are both

effected in the most tax efficient manner, the Company has

established Africa Opportunity Fund L.P. ("the Master Fund") as an

exempted limited partnership in the Cayman Islands. All investments

made by the Company are made through the Master Fund. The limited

partners of the Master Fund are the Company and AOF CarryCo

Limited. The general partner of the Master Fund is Africa

Opportunity Fund (GP) Limited. Africa Opportunity Fund Limited has

100% holdings in Africa Opportunity Fund (GP) Limited.

The financial statements for the Company for the year ended 31

December 2020 were authorised for issue in accordance with a

resolution of the Board of Directors on 25 June 2021.

Presentation currency

The financial statements are presented in United States dollars

("USD"). All figures are presented to the nearest dollar.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of

these financial statements are set out below. These policies have

been consistently applied from the prior year to the current year

for items which are considered material in relation to the

financial statements.

Statement of compliance

The financial statements are prepared in accordance with

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board (IASB).

Basis of preparation

The Company satisfies the criteria of an investment entity under

IFRS 10: Consolidated Financial Statements. As such, the Company

does not consolidate the entities it controls. Instead, its

interest in the subsidiaries has been classified as fair value

through profit or loss and measured at fair value. This

consolidation exemption has been applied prospectively and more

details of this assessment are provided in Note 4 "significant

accounting judgements, estimates and assumptions." The financial

statements are prepared in accordance with International Financial

Reporting Standards ("IFRS") as issued by the International

Accounting Standards Board (IASB). The financial statements have

been prepared under the historical cost convention except for

financial assets and financial liabilities measured at fair value

through profit or loss. The preparation of financial statements in

accordance with IFRS requires the use of estimates and assumptions

that affect the reported amounts of assets and liabilities and

disclosures of contingent assets and liabilities at the date of the

financial statements and the reported at the date of the financial

statements and the reported amounts of revenues and expenses during

the reporting year.

Although these estimates are based on management's knowledge of

current events and actions, actual results ultimately may differ

from those estimates. In additional to the following: All assets

including the investment in subsidiaries have been assessed for

impairment regardless of whether any indicators for impairment were

identified; and all possible liabilities that might arise from the

winding up of the Company have been accrued for. Following the

assessment, no assets were identified which were subject to

impairment. The preparation of financial statements in conformity

with IFRS requires the use of certain critical accounting

estimates. It also requires the Board of Directors to exercise its

judgment in the process of applying the Company's accounting

policies. The areas involving a higher degree of judgement or

complexity, or areas where assumptions and estimates are

significant to the financial statements are disclosed in Note

4.

As the entity is not a going concern due to the limited life,

the directors have considered an alternative basis of preparation

but believe that IFRS as a basis for preparation best reflects the

financial position and performance of the entity. The carrying

value of the assets, which were determined in accordance with the

accounting policies, have been reviewed for possible impairment and

changes which have occurred since the year end and consideration

has been given to whether any additional provisions are necessary

as a result of the decision to deregister. It is expected that all

assets will realise at least at the amounts at which they are

included in the statement of financial position and there will be

no material additional liabilities.

The Company presents its statement of financial position in

order of liquidity. An analysis regarding recovery within 12 months

(current) and more than 12 months after the reporting date

(non-current) is presented in Note 14.

The Company's financial statements include disclosure notes on

the Master Fund, Africa Opportunity Fund L.P given that the net

asset value of the Master Fund is a significant component of the

Investment in subsidiaries of the Company. These additional

disclosures are made in order to provide the users of the financial

statements with an overview of the Master Fund performance.

Foreign currency translation

(i) Functional and presentation currency

The Company's financial statements are presented in USD, which

is the functional currency, being the currency of the primary

economic environment in which both the Company operates. The

Company determines its own functional currency and items included

in the financial statements of each entity are measured using that

functional currency. The functional currency of the Company is USD.

The Company chooses USD as the presentation currency.

(ii) Transactions and balances

Transactions in foreign currencies are initially recorded at the

functional currency rate prevailing at the date of transaction.

Monetary assets and liabilities denominated in foreign currencies

are retranslated at the functional currency spot rate of the

exchange ruling at the reporting date. All differences are taken to

profit or loss. Non-monetary items that are measured in terms of

historical cost in a foreign currency are translated using the

exchange rates as at the dates of the initial transactions.

Non-monetary items measured at fair value in a foreign currency are

translated using the exchange rates at the date when the fair value

is determined.

Financial instruments

A financial instrument is any contract that gives rise to a

financial asset of one entity and a financial liability or equity

instrument of another entity.

(a) Classification

The Company classifies its financial assets and liabilities in

accordance with IFRS 9 into the following categories:

(i) Financial assets and liabilities at fair value through

profit or loss

For the Company, financial assets classified at fair value

through profit or loss upon initial recognition include investment

in subsidiaries.

Investment in subsidiaries

In accordance with the exception under IFRS 10 Consolidated

Financial Statements, the Company does not consolidate subsidiaries

in the financial statements. Investments in subsidiaries are

accounted for as financial assets at fair value through profit or

loss in accordance with IFRS 9-Financial Instruments.

Management concluded that the Company meets the definition of an

investment entity as it invests solely for returns from capital

appreciations, investment income or both, and measures and

evaluates the performance of its investments on a fair value basis.

Accordingly, consolidated financial statements have not been

prepared.

(ii) Financial assets at amortised cost

The Company measures financial assets at amortised cost if both

of the following conditions are met:

-- The financial asset is held within a business model with the

objective to hold financial assets in

order to collect contractual cash flows

-- The contractual terms of the financial asset give rise on

specified dates to cash flows that are solely payments of principal

and interest on the principal amount outstanding

Financial assets at amortised cost are subsequently measured

using the effective interest (EIR) method and are subject to

impairment. Gains and losses are recognised in profit or loss when

the asset is derecognised, modified or impaired. The Company's

financial assets at amortised cost comprise 'trade and other

receivables' and 'cash and cash equivalents in the statement of

financial position.

(iii) Other financial liabilities

This category includes all financial liabilities, other than

those classified as fair value through profit or loss. The Company

includes in this category amounts relating to trade and other

payables and dividend payable.

(a) Initial Recognition

The Company recognises a financial asset or a financial

liability when, and only when, it becomes a party to the

contractual provisions of the instrument.

Purchases or sales of financial assets that require delivery of

assets within the time frame generally established by regulation or

convention in the market place are recognised directly on the trade

date, i.e., the date that the Master Fund commits to purchase or

sell the asset.

(b) Initial measurement

Financial assets and liabilities at fair value through profit or

loss are recorded in the statement of financial position at fair

value. All transaction costs for such instruments are recognised

directly in profit or loss.

Derivatives embedded in other financial instruments are treated

as separate derivatives and recorded at fair value if their

economic characteristics and risks are not closely related to those

of the host contract, and the host contract is not itself

classified as held for trading or designated at fair value though

profit or loss. Embedded derivatives separated from the host are

carried at fair value.

Financial assets at amortised cost and financial liabilities

(other than those classified as held for trading) are measured

initially at their fair value plus or minus any directly

attributable incremental costs of acquisition or issue.

(c) Subsequent measurement

The Company measures financial instruments which are classified

at fair value through profit or loss at fair value. Subsequent

changes in the fair value of those financial instruments are

recorded in 'Net gain or loss on financial assets and liabilities

at fair value through profit or loss. Interest earned elements of

such instruments are recorded separately in 'Interest revenue'.

Financial assets at amortised costs are subsequently measured

using the effective interest method and are subject to impairment.

Gains and losses are recognised in profit or loss when the asset is

derecognised, modified or impaired.

Financial liabilities, other than those classified as at fair

value through profit or loss, are measured at amortised cost using

the effective interest method. Gains and losses are recognised in

profit or loss when the liabilities are derecognised, as well as

through the amortisation process.

The effective interest method is a method of calculating the

amortised cost of a financial asset or a financial liability and of

allocating the interest income or interest expense over the

relevant period. The effective interest rate is the rate that

exactly discounts estimated future cash payments or receipts

through the expected life of the financial instrument or, when

appropriate, a shorter period to the net carrying amount of the

financial asset or financial liability. When calculating the

effective interest rate, the Company estimates cash flows

considering all contractual terms of the financial instruments but

does not consider future credit losses. The calculation includes

all fees paid or received between parties to the contract that are

an integral part of the effective interest rate, transaction costs

and all other premiums or discounts.

(e) Derecognition

A financial asset (or, where applicable, a part of a financial

asset or part of a group of similar financial assets) is

derecognised where:

-- The rights to receive cash flows from the asset have expired; or

-- The Company has transferred its rights to receive cash flows

from the asset or has assumed an obligation to pay the received

cash flows in full without material delay to a third party under a

'pass-through' arrangement; and

Either (a) the Company has transferred substantially all the

risks and rewards of the asset, or (b) the Company has neither

transferred nor retained substantially all the risks and rewards of

the asset, but has transferred control of the asset. When the

Company has transferred its rights to receive cash flows from an

asset (or has entered into a pass-through arrangement), and has

neither transferred nor retained substantially all the risks and

rewards of the asset nor transferred control of the asset, the

asset is recognised to the extent of the Company's continuing

involvement in the asset.

The Company derecognises a financial liability when the

obligation under the liability is discharged, cancelled or expires.

When an existing financial liability is replaced by another from

the same lender on substantially different terms, or the terms of

an existing liability are substantially modified, such an exchange

or modification is treated as the derecognition of the original

liability and the recognition of a new liability. The difference in

the respective carrying amounts is recognised in profit or

loss.

Determination of fair value

The Company measures it investments in subsidiaries at fair

value through profit or loss at fair value at each reporting

date.

Fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. The fair value

measured is based on the presumption that the transaction to sell

the asset or transfer the liability takes place either in the

principal market for the asset or liability or, in the absence of a

principal market, in the most advantageous market for the asset or

liability. The principal or the most advantageous market must be

accessible to the Company. The fair value for financial instruments

traded in active markets at the reporting date is based on their

quoted price without any deduction for transaction costs.

For all other financial instruments not traded in an active

market, the fair value is determined by using appropriate valuation

techniques. Valuation techniques include: using recent arm's length

market transactions; reference to the current market value of

another instrument that is substantially the same; discounted cash

flow analysis and option pricing models making as much use of

available and supportable market data as possible. An analysis of

fair values of financial instruments and further details as to how

they are measured is provided in Note 6.

The Company uses the following hierarchy for determining and

disclosing the fair value of the financial instruments by valuation

technique:

-- Level 1: quoted (unadjusted) market prices in active markets

for identical assets and liabilities.

-- Level 2: valuation techniques for which the lowest level

input that is significant to the fair value measurement is directly

or indirectly observable.

-- Level 3: valuation techniques for which the lowest level

input that is significant to the fair value measurement is

unobservable.

Impairment of financial assets

The Company recognises an allowance for expected credit losses

(ECLs) for all financial assets measured at amortised cost. When

measuring ECL, the Company uses reasonable and supportable

forward-looking information, which is based on assumptions for the

future movement of different economic drivers and how these drivers

will affect each other. Loss given default is an estimate of the

loss arising on default. It is based on the difference between the

contractual cash flows due and those that the entity would expect

to receive, taking into account cash flows from credit

enhancements. The Company considers a financial asset in default

when contractual payments are 90 days past due. However, in certain

cases, the Company may also consider a financial asset to be in

default when internal or external information indicates that the

Company is unlikely to receive the outstanding contractual amounts

in full before taking into account any credit enhancements held by

the Company. A financial asset is written off when there is no

reasonable expectation of recovering the contractual cash

flows.

At the reporting date, the trade and other receivables and cash

and cash equivalents are de minimis. As a result, no ECL has been

recognised as any amount would have been insignificant.

Offsetting financial instruments

Financial assets and financial liabilities are offset and the

net amount reported in the statement of financial position if, and

only if, there is a currently legally enforceable right to offset

the recognised amounts and there is an intention to settle on a net

basis, or to realise the asset and settle the liability

simultaneously.

Net gain or loss on financial assets and liabilities at fair

value through profit or loss

This item includes changes in the fair value of financial assets

and liabilities held for trading or designated upon initial

recognition as 'at fair value through profit or loss' and excludes

interest and expenses.

Unrealised gains and losses comprise changes in the fair value

of financial instruments for the year and from reversal of prior

year's unrealised gains and losses for financial instruments which

were realised in the reporting period.

Shares that impose on the Company, an obligation to deliver to

shareholders a pro-rata share of the net asset of the Company on

liquidation classified as financial liabilities

The shares are classified as equity if those shares have all the

following features:

(a) It entitles the holder to a pro rata share of the Company's

net assets in the event of the Company's liquidation.

The Company's net assets are those assets that remain after

deducting all other claims on its assets. A pro rata share is

determined by:

(i) dividing the net assets of the Company on liquidation into units of equal amount; and

(ii) multiplying that amount by the number of the shares held by the shareholder.

(b) The shares are in the class of instruments that is

subordinate to all other classes of instruments. To be in such a

class the instrument:

(i) has no priority over other claims to the assets of the Company on liquidation, and

(ii) does not need to be converted into another instrument

before it is in the class of instruments that is subordinate to all

other classes of instruments.

(c) All shares in the class of instruments that is subordinate

to all other classes of instruments must have an identical

contractual obligation for the issuing Company to deliver a pro

rata share of its net assets on liquidation.

In addition to the above, the Company must have no other

financial instrument or contract that has:

(a) total cash flows based substantially on the profit or loss,

the change in the recognised net assets or the change in the fair

value of the recognised and unrecognised net assets of the Company

(excluding any effects of such instrument or contract); and

(b) the effect of substantially restricting or fixing the residual return to the shareholders.

The shares that meet the requirements to be classified as a

financial liability have been designated as at fair value through

profit or loss on initial recognition.

Dividend expense

Dividend expense relating to equity securities sold short is

recognised when the shareholders' right to receive the payment is

established.

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank. Cash

equivalents are short term, highly liquid investments that are

readily convertible to known amounts of cash and which are subject

to an insignificant risk of change in value.

3. CHANGES IN ACCOUNTING POLICIES AND DISCLOSURES

The Company applied for the first-time certain standards and

amendments, which are effective for annual periods beginning on or

after 1 January 2020. The Company has not early adopted any other

standard, interpretation or amendment that has been issued but is

not yet effective.

The accounting policies adopted are consistent with those of the

previous financial year except for the following new and amendments

to IFRS as from 1 January 2020:

Effective for

accounting period

beginning on

or after

Amendments to IFRS 3: Definition of a Business 1 January 2020

Amendments to IFRS 7, IFRS 9 and IAS 39 Interest 1 January 2020

Rate Benchmark Reform

Amendments to IAS 1 and IAS 8 Definition of Material 1 January 2020

Conceptual Framework for Financial Reporting 1 January 2020

The above new standards and amendments applied for the first

time in 2020, they did not have a material impact on the financial

statements of the Company.

3.1 ACCOUNTING STANDARDS AND INTERPRETATIONS ISSUED BUT NOT YET EFFECTIVE

The following standards, amendments to existing standards and

interpretations were in issue but not yet effective. The Company

would adopt these standards, if applicable, when they become

effective. No early adoption of these standards and interpretations

is intended by the Board of directors.

Effective for

accounting period

beginning on

or after

IFRS 17 Insurance Contracts 1 January 2023

Amendments to IAS 1: Classification of Liabilities 1 January 2023

as Current or Non-current

Reference to the Conceptual Framework - Amendments 1 January 2022

to IFRS 3

Property, Plant and Equipment: Proceeds before 1 January 2022

intended use - Amendments to IAS 16

Onerous Contracts - Costs of Fulfilling a Contract 1 January 2022

- Amendments to IAS 37

IFRS 1 First-time Adoption of International Financial 1 January 2022

Reporting Standards - Subsidiary as a first-time

adopter

IFRS 9 Financial Instruments - Fees in the '10 1 January 2022

per cent' test for derecognition of financial liabilities

IAS 41 Agriculture - Taxation in fair value measurements 1 January 2022

Amendments to IFRS 16 Covid-19 Related Rent Concessions 1 June 2020

The Company does not expect that the adoption of these standards

will have any material impact on its financial statements.

4. SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS

The preparation of the Company's financial statements requires

management to make judgements, estimates and assumptions that

affect the reported amounts recognised in the financial statements

and disclosure of contingent liabilities. However, uncertainty

about these assumptions and estimates could result in outcomes that

could require a material adjustment to the carrying amount of the

asset or liability affected in future periods.

Judgements

In the process of applying the Company's accounting policies,

management has made the following judgements, which have the most

significant effect on the amounts recognised in the financial

statements:

Going concern

In June 2019, the Directors convened an Annual General Meeting

and an Extraordinary General Meeting where the following was

passed:

-- Ordinary resolution that the requirement of the Company to

propose the realisation opportunity be and is hereby waived.

-- Ordinary resolution that the continuation of the existence of

the Company be and is hereby approved.

-- The text set out under "New Investing Policy" in paragraph 2

of Part III of the Company's circular to Shareholders dated 5 June

2019 (the "Circular") be and is hereby adopted as the new

investment policy of the Company;

-- The terms of the Amended and Restated Investment Management

Agreement (as defined in the Circular) be and are hereby

approved;

-- The memorandum and the articles of association in the form

initialled by the Chair of the meeting be adopted as the memorandum

and articles of association of the Company in substitution for and

to the exclusion of the existing memorandum and articles of

association; and

-- Any variation to the rights attaching to the Ordinary Shares

in the Company pursuant to the adoption of the new memorandum and

articles of association, and in particular the right for the

Company to redeem the Ordinary Shares (including any redemptions

made of 15 per cent. or more of the Company's issued share

capital), be and is hereby approved.

Below is a brief synopsis of the "New Investing Policy" as per

the Company's Circular dated 5 June 2019:

For a period of up to three years following the Extraordinary

General Meeting (the "Return Period"), the Company will make no new

investments (save that it may invest in, or advance additional

funds to, existing investments within the Company's portfolio to

maximise value and assist in their eventual realisation). The

Company will adopt the New Investment Policy whereby the Company's

existing portfolio of investments will be divested in a controlled,

orderly and timely manner to facilitate a staged return of capital.

It should be appreciated that there is no time horizon in terms of

the implementation of the New Investment Policy. Although the

Company's portfolio is comprised of largely liquid equity holdings,

the Company has some illiquid investments and it may take the

Investment Manager some time to realise these. Shareholders will be

provided with an opportunity to reassess the investment policy and

distribution policy at the end of the Return Period. To that end, a

further ordinary resolution for the Company's continuation will be

proposed at an extraordinary general meeting to be convened at the

end of the Return Period (the "Second Continuation Vote").

Subsequent to the disposal of the investments, the Company will be

liquidated, which indicates that it will no longer be a going

concern. IAS 1 - Presentation of Financial Statements and IAS 10 -

Events after the reporting period require that the financial

statements should not be prepared on a going concern basis if

management determines that it intends to liquidate the entity. The

directors have considered an alternative basis of preparation but

believe that International Financial Reporting Standards ("IFRS")

as a basis for preparation best reflects the financial position and

performance of the Company.

Other than financial assets at fair value through profit or

loss, the carrying value of the remaining assets, which were

determined in accordance with the accounting policies, have been

reviewed for any possible impairment, and consideration has been

given to whether any additional provision is necessary as a result

of the Directors' intention to wind up the Company at the end of

the Return Period that is in June 2022. It is expected that all

assets will realise at least at the amounts at which they are

presented in the statement of financial position and that there

will be no material additional liabilities. It should be noted that

due to events after finalisation of the interim financials, the

final amounts to be received could vary from the amount shown in

the statement of financial position due to circumstances which

arise subsequent to preparation of the financial statement and

these variations could be material.

Determination of functional currency

The determination of the functional currency of the Company is

critical since recording of transactions and exchange differences

arising thereon are dependent on the functional currency selected.

As described in Note 2, the directors have considered those factors

therein and have determined that the functional currency of the

Company is the United States Dollar.

Assessment for an investment entity

An investment entity is an entity that:

(a) Obtains funds from one or more investors for the purpose of

providing those investor(s) with investment management

services;

(b) Commits to its investor(s) that its business purpose is to

invest funds solely for returns from capital appreciation,

investment income, or both; and

(c) Measures and evaluates the performance of substantially all

of its investments on a fair value basis.

An investment entity must demonstrate that fair value is the

primary measurement attribute used. The fair value information must

be used internally by key management personnel and must be provided

to the entity's investors. In order to meet this requirement, an

investment entity would:

-- Elect to account for investment property using the fair value

model in IAS 40 Investment Property

-- Elect the exemption from applying the equity method in IAS 28

for investments in associates and joint ventures, and

-- Measure financial assets at fair value in accordance with IFRS 9.

In addition, an investment entity should consider whether it has

the following typical characteristics:

-- It has more than one investment, to diversify the risk portfolio and maximise returns;

-- It has multiple investors, who pool their funds to maximise investment opportunities;

-- It has investors that are not related parties of the entity; and

-- It has ownership interests in the form of equity or similar interests.

The Board considers that the Company meets the definition of an

investment entity as it invests solely for returns from capital

appreciations, investment income or both, and measures and

evaluates the performance of its investments in subsidiaries on a

fair value basis. In addition, the Company has more than one

investor and the major investors are not related parties of the

Company. The Company also has an exit strategy given that it is a

limited life entity, realising its investments at the end of the

Return Period of 3 years as per the 'New Investment Policy'.

Accordingly, consolidated financial statements have not been

prepared. IFRS 10 allows the application of this change to be made

prospectively in the period in which the definition is met. IFRS 10

Consolidated Financial Statements provides 'investment entities' an

exemption from the consolidation of particular subsidiaries and

instead require that an investment entity measures the investment

in each eligible subsidiary at fair value through profit or loss in

accordance with IFRS 9 Financial Instruments.

Assumptions and Estimates

The key assumptions concerning the future and other key sources

of estimation uncertainty at the reporting date, that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next financial year,

are discussed below. The Company based its assumptions and

estimates on parameters available when the financial statements

were prepared. However, existing circumstances and assumptions

about future developments may change due to market changes or

circumstances arising beyond the control of the Company. Such

changes are reflected in the assumptions when they occur. When the

fair value of financial assets and financial liabilities recorded

in the statement of financial position cannot be derived from

active markets, their fair value is determined using a variety of

valuation techniques that include the use of mathematical

models.

Fair value of financial instruments

The inputs to these models are taken from observable markets

where possible, but where this is not feasible, estimation is

required in establishing fair values. The estimates include

considerations of liquidity and model inputs such as credit risk

(both own and counterparty's), correlation and volatility. Changes

in assumptions about these factors could affect the reported fair

value of financial instruments in the statement of financial

position and the level where the instruments are disclosed in the

fair value hierarchy.

The models are calibrated regularly and tested for validity

using prices from any observable current market transactions in the

same instrument (without modification or repackaging) or based on

any available observable market data. An analysis of fair values of

financial instruments and further details as to how they are

measured is provided in Note 6.

IFRS 13 requires disclosures relating to fair value measurements

using a three-level fair value hierarchy. The level within which

the fair value measurement is categorised in its entirety is

determined on the basis of the lowest level input that is

significant to the fair value measurement in its entirety as

provided in Note 6. Assessing the significance of a particular

input requires judgement, considering factors specific to the asset

or liability. To assess the significance of a particular input to

the entire measurement, the Company performs sensitivity analysis

or stress testing techniques.

5a. AGREEMENTS

Investment Management Agreement

For the period 1 January 2019 to 30 June 2019, the Amended and

Restated Investment Management Agreement with Africa Opportunity

Partners (the "Investment Manager"), an investment management

company incorporated in the Cayman Islands, to manage the

operations of the Company subject to the overall supervision of the

Company's board as specified in the 2014 prospectus of the Company,

was in effect. Under the Amended and Restated Investment Management

Agreement, the Investment Manager received, a management fee equal

to the aggregate of: (i) two percent of the Net Asset Value per

annum up to US$50 million; and (ii) one per cent of the Net Asset

Value per annum in excess of US$50 million, payable in US$

quarterly in advance.

In addition, the principals (directors) of the Investment

Manager are beneficially interested in CarryCo, which under the

terms of the Amended and Restated Limited Partnership Agreement, is

entitled to share an aggregate annual carried interest (the

"Performance Allocation") from the Limited Partnership equivalent

to 20 per cent of the excess of the Net Asset Value (as at 31

December in each year) over the sum of (i) the annual management

fee for that year end (ii) a non-compounding annual hurdle amount

equal to the Net Asset Value as at 31 December in the previous

year, as increased by 5 per cent. The Performance Allocation will

be subject to a "high watermark" requirement. Subsequent to the

merger of the ordinary shares and the C shares, the high watermark

is calculated as the aggregate of the Net Asset Value of the

pre-merger ordinary share high watermark plus the proceeds of the C

class share placing before expenses. The Performance Allocation

accrues monthly and is calculated as at 31 December in each year

and is allocated following the publication of the NAV for such

date.

Effective 1 July 2019, the Company and the Investment Manager

have, upon the approval of the Reorganisation Resolution at the EGM

in June 2019, entered into the Amended and Restated Investment

Management Agreement which amends the fees payable to the

Investment Manager as follows:

Management fees

The management fee shall be reduced to 1 per cent of the Net

Asset Value per annum for the first two years of the Return Period

(the period of up to three years following the EGM held in June

2019) and then further reduced to 0 per cent in the last year of

the Return Period.

The Investment Manager's entitlement to future performance fees

(through AOF CarryCo Limited) will be cancelled and AOF CarryCo

Limited's limited partnership interest in the Limited Partnership

will be transferred to the Company for nominal value in the last

year of the Return Period, that being 2022.

Realisation fees

The Investment Manager shall be entitled to the following

realisation fees during the Return Period from the net proceeds of

all portfolio realisations (including any cash returned by way of a

Compulsory Redemption):

On distributions of cash to Shareholders where the applicable

payment date is on or prior to 30 June 2020: 2 per cent of the net

amounts realised.

On distributions of cash to Shareholders where the applicable

payment date is 1 July 2020 or later: 1 per cent of the net amounts

realised.

The revisions to the arrangements with the Investment Manager,

constitute a related party transaction under the Company's related

party policy, and in accordance with that policy, the Company was

required to obtain: (i) the approval of a majority of the Directors

who are independent of the Investment Manager; and (ii) a fairness

opinion or third-party valuation in respect of such related party

transaction from an appropriately qualified independent

adviser.

The management fee for the financial year under review amounts

to USD 534,637 (2019: USD 1,002,326) of which USD 134,585 (2019:

USD 246,321) relates to accrued realisation fees and the

performance fees for the financial year under review was nil (2019:

nil).

Administrative Agreement

SS&C Technologies is the Administrator for the Company.

Administrative fees are expensed at the Master Fund level and have

been included in the NAV of the subsidiary.

Custodian Agreement

A Custodian Agreement has been entered into by the Master Fund

and Standard Chartered Bank (Mauritius) Ltd, whereby Standard

Chartered Bank (Mauritius) Ltd would provide custodian services to

the Master Fund and would be entitled to a custody fee of between

18 and 25 basis points per annum of the value of the assets held by

the custodian and a tariff of between 10 and 45 basis points per

annum of the value of assets held by the custodian. The custodian

fees are expensed at the Master Fund level and have been included

in the NAV of the subsidiary.

Prime Brokerage Agreement

Under the Prime Brokerage Agreement, the Master Fund appointed

Credit Suisse Securities (USA) LLC as its prime broker for the

purpose of carrying out the Master Fund's instructions with respect

to the purchase, sale and settlement of securities. Custodian fees

are expensed at the Master Fund level and have been included in the

NAV of the subsidiary.

Brokerage Agreement

Under the Broker Agreement revised during 2016, the Master Fund

appointed Liberum, a company incorporated in England to act as

Broker. The broker fee is payable in advance at six-month

intervals. The broker fees are expensed at the Master Fund level

and have been included in the NAV of the subsidiary.

5b. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AT THE MASTER FUND LEVEL

Africa Opportunity Fund LP (the "Master Fund") is incorporated

in the Cayman Islands and is not subject to regulatory review.

Management has voluntarily disclosed all the policies and notes to

the accounts of the Master Fund to provide shareholders of the

Company with a better insight.

The primary accounting policies for interest revenue and

expense, dividend revenue and expense and cash and cash

equivalents, are similar as in Note 2. Those policies which only

relate to the Master Fund's financial statements are set out below.

These policies have been consistently applied from the prior year

to the current year for items which are considered material in

relation to the financial statements.

Financial instruments

A financial instrument is any contract that gives rise to a

financial asset of one entity and a financial liability or equity

instrument of another entity.

(a) Classification

The Master Fund classifies its financial assets and liabilities

in accordance with IFRS 9 into the following categories:

(i) Financial assets and liabilities at fair value through

profit or loss

The category of the financial assets and liabilities at fair

value through the profit or loss is subdivided into:

Financial assets and liabilities held for trading

Financial assets are classified as held for trading if they are

acquired for the purpose of selling and repurchasing in the near

term. This category includes equity securities, investments in

managed funds and debts instruments. These assets are acquired

principally for the purpose of generating a profit from short term

fluctuation in price. All derivatives and liabilities from the

short sales of financial instruments are classified as held for

trading.

Financial assets at fair value through profit or loss upon

initial recognition

These include equity securities and debt instruments that are

not held for trading. These financial assets are classified at

FVTPL on the basis that they are part of a group of financial

assets which are managed and have their performance evaluated on a

fair value basis, in accordance with risk management and investment

strategies of the Company, as set out in each of their offering

documents. The financial information about the financial assets is

provided internally on that basis to the Investment Manager and to

the Board of Directors.

Derivatives - Options

Derivatives are classified as held for trading (and hence

measured at fair value through profit or loss), unless they are

designated as effective hedging instruments (however the Company

does not apply any hedge accounting). The Master Fund's derivatives

relate to option contracts.

Options are contractual agreements that convey the right, but

not the obligation, for the purchaser either to buy or sell a

specific amount of a financial instrument at a fixed price, either

at a fixed future date or at any time within a specified

period.

The Master Fund purchases and sells put and call options through

regulated exchanges and OTC markets. Options purchased by the

Master Fund provide the Master Fund with the opportunity to

purchase (call options) or sell (put options) the underlying asset

at an agreed-upon value either on or before the expiration of the

option. The Master Fund is exposed to credit risk on purchased

options only to the extent of their carrying amount, which is their

fair value.

Options written by the Master Fund provide the purchaser the

opportunity to purchase from or sell to the Master Fund the

underlying asset at an agreed-upon value either on or before the

expiration of the option.

Options are generally settled on a net basis.

Derivatives relating to options are recorded at the level of the

Master Fund. The financial statements of the Company do not reflect

the derivatives as they form part of the net asset value (NAV.) of

the Master Fund which is fair valued.

(ii) Financial assets at amortised cost

The Master Fund measures financial assets at amortised cost if

both of the following conditions are met:

-- The financial asset is held within a business model with the

objective to hold financial assets in order to collect contractual

cash flows

-- The contractual terms of the financial asset give rise on

specified dates to cash flows that are solely payments of principal

and interest on the principal amount outstanding

Financial assets at amortised cost are subsequently measured

using the effective interest (EIR) method and are subject to

impairment. Gains and losses are recognised in profit or loss when

the asset is derecognised, modified or impaired. The Master Fund's

financial assets at amortised cost comprise 'trade and other

receivables' and 'cash and cash equivalents in the statement of

financial position.

(iii) Other financial liabilities

This category includes all financial liabilities, other than

those classified as fair value through profit or loss. The Master

Fund includes in this category amounts relating to trade and other

payables and dividend payable.

(a) Recognition

The Master Fund recognises a financial asset or a financial

liability when, and only when, it becomes a party to the

contractual provisions of the instrument.

Purchases or sales of financial assets that require delivery of

assets within the time frame generally established by regulation or

convention in the market place are recognised directly on the trade

date, i.e., the date that the Master Fund commits to purchase or

sell the asset.

(b) Initial measurement

Financial assets and liabilities at fair value through profit or

loss are recorded in the statement of financial position at fair

value. All transaction costs for such instruments are recognised

directly in profit or loss.

Derivatives embedded in other financial instruments are treated

as separate derivatives and recorded at fair value if their

economic characteristics and risks are not closely related to those

of the host contract, and the host contract is not itself

classified as held for trading or designated at fair value though

profit or loss. Embedded derivatives separated from the host are

carried at fair value.

Financial assets at amortised cost and financial liabilities

(other than those classified as held for trading) are measured

initially at their fair value plus any directly attributable

incremental costs of acquisition or issue.

(c) Subsequent measurement

The Master Fund measures financial instruments which are

classified at fair value through profit or loss at fair value.

Subsequent changes in the fair value of those financial instruments

are recorded in 'Net gain or loss on financial assets and

liabilities at fair value through profit or loss. Interest earned

elements of such instruments are recorded separately in 'Interest

revenue'. Dividend expenses related to short positions are

recognised in 'Dividends on securities sold not yet purchased'.

Dividend income/distributions received on investments at FVTPL is

recorded in "Net gain or loss on financial assets at fair value

through profit or loss".

Financial assets at amortised costs are subsequently measured

using the effective interest method and are subject to impairment.

Gains and losses are recognised in profit or loss when the asset is

derecognised, modified or impaired.

(iii) Other financial liabilities

(d) Subsequent measurement

Financial liabilities, other than those classified as at fair

value through profit or loss, are measured at amortised cost using

the effective interest method. Gains and losses are recognised in

profit or loss when the liabilities are derecognised, as well as

through the amortisation process.

The effective interest method is a method of calculating the

amortised cost of a financial asset or a financial liability and of

allocating the interest income or interest expense over the

relevant period. The effective interest rate is the rate that

exactly discounts estimated future cash payments or receipts

through the expected life of the financial instrument or, when

appropriate, a shorter period to the net carrying amount of the

financial asset or financial liability. When calculating the

effective interest rate, the Master Fund estimates cash flows

considering all contractual terms of the financial instruments, but

does not consider future credit losses. The calculation includes

all fees paid or received between parties to the contract that are

an integral part of the effective interest rate, transaction costs

and all other premiums or discounts.

(e) Derecognition

A financial asset (or, where applicable, a part of a financial

asset or part of a group of similar financial assets) is

derecognised where:

-- The rights to receive cash flows from the asset have expired; or

-- The Company has transferred its rights to receive cash flows

from the asset or has assumed an obligation to pay the received

cash flows in full without material delay to a third party under a

'pass-through' arrangement; and

Either (a) the Master Fund has transferred substantially all the

risks and rewards of the asset, or (b) the Master Fund has neither

transferred nor retained substantially all the risks and rewards of

the asset, but has transferred control of the asset. When the

Master Fund has transferred its rights to receive cash flows from

an asset (or has entered into a pass-through arrangement), and has

neither transferred nor retained substantially all the risks and

rewards of the asset nor transferred control of the asset, the

asset is recognised to the extent of the Master Fund's continuing

involvement in the asset.

The Master Fund derecognises a financial liability when the

obligation under the liability is discharged, cancelled or expires.

When an existing financial liability is replaced by another from

the same lender on substantially different terms, or the terms of

an existing liability are substantially modified, such an exchange

or modification is treated as the derecognition of the original

liability and the recognition of a new liability. The difference in

the respective carrying amounts is recognised in profit or

loss.

Determination of fair value

The Master Fund measures its investments in financial

instruments, such as equities, debentures and other

interest-bearing investments and derivatives, at fair value at each

reporting date.

Fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. The fair value

measured is based on the presumption that the transaction to sell

the asset or transfer the liability takes place either in the

principal market for the asset or liability or, in the absence of a

principal market, in the most advantageous market for the asset or

liability. The principal or the most advantageous market must be

accessible to the Master Fund. The fair value for financial

instruments traded in active markets at the reporting date is based

on their quoted price without any deduction for transaction

costs.

For all other financial instruments not traded in an active

market, the fair value is determined by using appropriate valuation

techniques. Valuation techniques include: using recent arm's length

market transactions; reference to the current market value of

another instrument that is substantially the same; discounted cash

flow analysis and option pricing models making as much use of

available and supportable market data as possible. An analysis of

fair values of financial instruments and further details as to how

they are measured is provided in Note 6.

Impairment of financial assets

The Master Fund uses the following hierarchy for determining and

disclosing the fair value of the financial instruments by valuation

technique:

-- Level 1: quoted (unadjusted) market prices in active markets

for identical assets and liabilities.

-- Level 2: valuation techniques for which the lowest level