TIDMAPAX

RNS Number : 5363X

Apax Global Alpha Limited

05 May 2021

(LSE: APAX)

Apax Global Alpha Limited

Quarterly results for the period ended 31 March 2021

Key highlights

-- Strong performance during the quarter: AGA's Total NAV

Return(1) was 10.4% (6.8% constant currency).

-- Focus on four key sectors and a strategy of business

improvement in private equity driving strong returns in the

portfolio.

-- Two full exits signed or closed (Boats Group, Signavio), one

significant partial exit (Psagot), and one public listing

(InnovAge) in Private Equity. Excluding the InnovAge IPO (primary

only), the average uplift on exits was 50.5%(2) to previous

Unaffected Valuations(2) .

-- Apax X continues to have a strong pipeline of new

investments, having signed or closed six new deals in the first

quarter.

-- The Derived Investment portfolio had a Total Return(1) of

8.0% in Q1, driven by strong performance in Derived Debt which

makes up the largest part of the Derived Investment portfolio and a

rebound in the Derived Equity positions.

-- AGA's liquidity position is healthy with EUR100m of cash and

its evergreen revolving credit facility of EUR140m undrawn. Derived

Investments of EUR369m(3) provide a further source of funding for

AGA.

-- Consumer sector renamed 'Internet / Consumer' (incorporating

all online marketplaces previously included under Services) to

reflect increased focus on digital consumer opportunities away from

traditional retail.

Commenting on the results, Ralf Gruss, COO of Apax Partners,

said:

"It has been a very good start to the year with AGA continuing

to deliver strong NAV performance in the quarter. There is a strong

pipeline of new investments and the current portfolio is performing

well, benefitting from a focus on sectors that are showing strong

structural growth, and investment in digital enablement and digital

acceleration. As global economies continue to open, AGA's portfolio

is well positioned for continued growth and to generate further

value for shareholders."

Financial highlights

-- Significant growth in Adjusted NAV(3) to EUR1.3 billion, up

from EUR1.2 billion in the last quarter, despite dividend payment

of 5.28p per share during the quarter.

-- Portfolio weighted towards Private Equity (69%) vs. Derived Investments (31%).

-- AGA was 93% invested as at 31 March 2021 and had outstanding

commitments to the Apax Funds (together with recallable

distributions) of EUR443m.

Q1 2021 (EUR) Q1 2021 (GBP)

Adjusted NAV (3) EUR 1,297m GBP 1,106m

-------------- --------------

Adjusted NAV (3) per EUR 2.64 GBP 2.25

share

-------------- --------------

NAV (3) per share EUR 2.65 GBP 2.25

-------------- --------------

Exposure Q1 2021 Q1 2021

constant currency

Total NAV Return(1) 10.4% 6.8%

--------- -------- -------------------

Total Return(1) -

Private Equity 64% 13.7% 9.6%

--------- -------- -------------------

Total Return(1) -

Derived Debt 25% 6.4% 2.5%

--------- -------- -------------------

Total Return(1) -

Derived Equity 4% 18.3% 14.1%

--------- -------- -------------------

Cash & Others 7%

--------- -------- -------------------

Private Equity portfolio highlights

-- The Private Equity portfolio performed strongly in the

quarter: Total Return(1) of 13.7% (9.6% constant currency).

-- Deal activity reflective of Apax's 'good to great' investment

strategy and sub-sector expertise, focusing on opportunities where

there is a significant re-rating at exit based on business quality

improvement.

-- Aggregate Gross IRR(4) and Gross MOIC(4) on Private Equity

exits in Q1 2021, excluding the InnovAge IPO (primary only), were

15.3% and 1.7x respectively. Including the InnovAge IPO the

aggregate Gross IRR(4) and Gross MOIC(4) increase to 134.5% and

2.5x, respectively.

-- On a look-through basis, AGA invested c.EUR70m(5) in six new

investments signed or closed during the period. (Azentio, Lutech,

Herjavec, PIB Group, Rodenstock and idealista)

-- Continued strong operating performance from the portfolio

companies with earnings growth accelerating in Q1 2021: LTM

Revenue(6) and EBITDA growth(6) of 12.1% and 44.2% respectively

across the Private Equity portfolio.

Derived Investments portfolio highlights

-- Derived Investments leverage the insights and expertise of

the Investment Advisor. The portfolio is weighted towards Tech and

is predominantly invested in Derived Debt (87% of Derived

Investments).

-- Strong performance of Derived Investments with a Total

Return(1) of 8.0% (4.0% constant currency) in Q1, driven by

performance in Derived Debt with a Total Return(1) of 6.4% (2.5%

constant currency).

-- Performance of Derived Equity rebounded during the period

with a Total Return(1) of 18.3% (14.1% constant currency).

-- Continued deployment of excess liquidity into Derived Debt

with new investments of EUR54.7m(7) .

For further information regarding the announcement of AGA's 2021

first quarter results, including the Company's results presentation

and dial-in details for today's analyst and investor webcast at

9.30am (UK time), please visit www.apaxglobalalpha.com .

Contact details

Katarina Sallerfors

Investor Relations - AGA

Telephone: +44 (0)207 666 6526

Email: katarina.sallerfors@apax.com

APPIX

Movements in NAV

Adjusted NAV(3) movements Private Derived Treasury Facility 1Q 20

(EURm) Equity Investments Cash Shares drawn Other Total

-------- ------------- -------- --------- --------- ------- --------

Adjusted NAV at 31.12.20 788.3 319.4 124.6 - - (31.1) 1,201.2

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+ Investments 41.2 54.7 (126.8) - - 30.9 -

--------------------------- -------- ------------- -------- --------- --------- ------- --------

- Distributions/

divestments (101.5) (28.1) 129.6 - - - -

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+ Interest and dividend

income - - 5.3 - - - 5.3

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Gains/(losses) 73.1 10.3 - - - - 83.4

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- FX gains/(losses)(8) 29.6 12.6 0.4 - - - 42.6

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Costs and other

movements - - (3.2) - - 0.2 (3.0)

--------------------------- -------- ------------- -------- --------- --------- ------- --------

- Dividends paid - - (30.0) - - - (30.0)

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Performance fee

reserve - (2.9) - - - - (2.9)

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Treasury shares - - - - - - -

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Revolving credit - - -

facility

drawn/repaid - - - -

--------------------------- -------- ------------- -------- --------- --------- ------- --------

Adjusted NAV at

31.3.21 (3) 830.7 366.0 99.9 - - - 1,296.6

--------------------------- -------- ------------- -------- --------- --------- ------- --------

Private Equity - operational metrics

Private Equity - operational metrics 31 March 2021 31 December 2020

-------------

Portfolio year-over-year LTM revenue growth(6) 12.1% 6.6%

================================================ ============== ================

Portfolio year-over-year LTM EBITDA growth(6) 44.2% 20.8%

================================================ ============== ================

Enterprise Value / EBITDA valuation multiple(6) 18.2x 16.9x

================================================ ============== ================

Net debt / EBITDA multiple (6) 3.9x 3.9x

------------------------------------------------ -------------- ----------------

Derived Investments - operational metrics

Derived Investments - operational metrics 31 March 2021 31 December 2020

-------------

Debt year-over-year LTM EBITDA growth(9) 30.3% 26.2%

=========================================== ============= ================

Debt average income yield to maturity(9) 7.3% 8.1%

=========================================== ============= ================

Debt average years to maturity 5.6 5.7

=========================================== ============= ================

Debt average income yield(10) 6.9% 7.3%

=========================================== ============= ================

Equity price-to-earnings ratio(11) 9.1x 7.1x

------------------------------------------- ------------- ----------------

Other Invested Portfolio highlights

Invested Portfolio analysis(12) EURm EURm % %

----- ------- ---

Private Equity 830.7 69%

================================ ===== ======= === ====

* AMI 25.5 2%

================================ ===== ======= === ====

* AEVI 6.3 0%

================================ ===== ======= === ====

* AEVII 30.6 2%

================================ ===== ======= === ====

* AVIII 169.4 14%

================================ ===== ======= === ====

* AIX 498.3 42%

================================ ===== ======= === ====

* ADF 31.2 3%

================================ ===== ======= === ====

* AX 69.4 6%

================================ ===== ======= === ====

Derived Investments 368.9 31%

================================ ===== ======= === ====

* Derived Debt 332.8 27%

================================ ===== ======= === ====

* Derived Equity 46.1 4%

================================ ===== ======= === ====

Total 1,199.6 100%

-------------------------------- ----- ------- --- ----

Footnotes

1. "Total NAV Return" means the movement in the Adjusted NAV

per share over the quarter plus any dividends paid. "Total

Return" reflects the sub-portfolio performance on a stand-alone

basis. It excludes items at the overall AGA level such as

cash, management fees, and costs

2. Valuation uplifts on exits are calculated based on the total

actual or estimated sales proceeds and income as appropriate

since the last Unaffected Valuation. Unaffected Valuation

is determined as the fair value in the last quarter before

exit, when valuation is not affected by the exit process

(i.e. because an exit was signed, or an exit was sufficiently

close to being signed that the Apax Funds incorporated the

expected exit multiple into the quarter end valuation).

Average uplift of full exits and significant partial exits

in the current quarter calculated based on the expected

sales proceeds and/ or the fair value remaining. Weighted

average uplift on two full exits, one significant partial

exit and one public listing (InnovAge) were 91.2%, whilst

excluding InnovAge's IPO weighted average uplift was 50.5%

3. NAV was EUR1,299.5m whilst Adjusted NAV was EUR1,296.6m

reflecting the estimated performance fee reserve of EUR2.9m

at period end. Private Equity NAV and Adjusted NAV were

the same at EUR830.7m. Derived Investments NAV was EUR368.9m

whilst it's Adjusted NAV was EUR366.0m reflecting the adjustment

for the performance fee reserve of EUR2.9m.

4. Private Equity Aggregate Gross IRR and Gross MOIC of 15.3%

and 1.7x calculated based on the expected aggregate cash

flows across all funds for the 2 full exits (Boats Group

and Signavio) and 1 significant partial exit (Psagot). Including

InnovAge (all primary) Gross IRR and Gross MOIS were 134.5%

and 2.5x respectively. Gross IRR represents concurrent Gross

IRR

5. Invested cost remains subject to closing on investments

signed which have yet to close (Lutech, Herjavec Group,

Rodenstock)

6. Gross Asset Value weighted average of the respective metric

across the portfolio. LTM Revenue growth and LTM EBITDA

growth rates exclude companies where EBITDA is not meaningful

such as financial services or high growth business with

fluctuations in EBITDA. TietoEVRY is also excluded due to

the unavailability of reported data. Net debt/EBITDA multiple

and EV/EBITDA valuation multiple excluded companies where

EBITDA is not meaningful such as financial services or companies

with negative EBITDA, or high growth business valued on

a revenue basis. MATCHESFASHION.COM is excluded due to low

EBITDA from opex investments and short-term fluctuations

in EBITDA. Cole Haan has been excluded at March 2021 as

it has negative EBITDA

7. Total invested of EUR54.7m includes EUR1.2m related to a

delayed draw on existing position Evercommerce during the

period

8. FX on cash includes the revaluation of cash balances and

net losses arising from the differences in exchange rates

between transaction dates and settlement dates, and unrealised

net losses arising from the translation into euro of assets

and liabilities (other than investments) which are not denominated

in euro

9. Gross Asset Value weighted average of the respective metric

across the Derived Debt portfolio

10. Gross Asset Value weighted average of the current full year

income (annual coupon/clean price as at the respective date)

for each debt position in the Derived Debt portfolio as

at the respective date

11. Gross Asset Value weighted average of the respective metric

across the Derived Equity portfolio. (Answers, FullBeauty

and Cengage were excluded from both LTM earnings growth

and P/E ratio)

12. Invested Portfolio excludes cash and cash equivalents, revolving

credit facility drawn and net current assets, including

these the NAV was EUR1,299.5m and Adjusted NAV was EUR1,296.6m

reflecting adjustment of EUR2.9m for the estimated performance

fee reserve accrued

Notes

1. Note that references in this announcement to Apax Global Alpha

Limited have been abbreviated to "AGA" or "the Company". References

to Apax Partners LLP have been abbreviated to "Apax Partners"

or "the Investment Adviser"

2. Please be advised that this announcement may contain inside

information as stipulated under the Market Abuse Regulations

(EU) NO. 596/2014 ("MAR")

3. This announcement is not for release, publication or distribution,

directly or indirectly, in whole or in part, into or within

the United States or to "US persons" (as defined in Regulation

S under the United States Securities Act of 1933, as amended

(the "Securities Act")) or into or within Australia, Canada,

South Africa or Japan. Recipients of this announcement in jurisdictions

outside the UK should inform themselves about and observe any

applicable legal requirements in their jurisdictions. In particular,

the distribution of the announcement may be restricted by law

in certain jurisdictions

4. The information presented herein is not an offer for sale within

the United States of any equity shares or other securities

of Apax Global Alpha Limited ("AGA"). AGA has not been and

will not be registered under the US Investment Company Act

of 1940, as amended (the "Investment Company Act"). In addition,

AGA's shares (the "Shares") have not been and will not be registered

under the Securities Act or any other applicable law of the

United States. Consequently, the Shares may not be offered

or sold or otherwise transferred within the United States,

or to, or for the account or benefit of, US Persons, except

pursuant to an exemption from the registration requirements

of the Securities Act and under circumstances which will not

require AGA to register under the Investment Company Act. No

public offering of the Shares is being made in the United States

5. This announcement may include forward-looking statements. The

words "expect", "anticipate", "intends", "plan", "estimate",

"aim", "forecast", "project" and similar expressions (or their

negative) identify certain of these forward-looking statements.

These forward-looking statements are statements regarding AGA's

intentions, beliefs or current expectations concerning, among

other things, AGA's results of operations, financial condition,

liquidity, prospects, growth and strategies. The forward-looking

statements in this presentation are based on numerous assumptions

regarding AGA's present and future business strategies and

the environment in which AGA will operate in the future. Forward-looking

statements involve inherent known and unknown risks, uncertainties

and contingencies because they relate to events and depend

on circumstances that may or may not occur in the future and

may cause the actual results, performance or achievements of

AGA to be materially different from those expressed or implied

by such forward looking statements. Many of these risks and

uncertainties relate to factors that are beyond AGA's ability

to control or estimate precisely, such as future market conditions,

currency fluctuations, the behaviour of other market participants,

the actions of regulators and other factors such as AGA's ability

to continue to obtain financing to meet its liquidity needs,

changes in the political, social and regulatory framework in

which AGA operates or in economic or technological trends or

conditions. Past performance should not be taken as an indication

or guarantee of future results, and no representation or warranty,

express or implied, is made regarding future performance. AGA

expressly disclaims any obligation or undertaking to release

any updates or revisions to these forward-looking statements

to reflect any change in AGA's expectations with regard thereto

or any change in events, conditions or circumstances on which

any statement is based after the date of this announcement,

or to update or to keep current any other information contained

in this announcement. Accordingly, undue reliance should not

be placed on the forward-looking statements, which speak only

as of the date of this announcement.

About Apax Global Alpha Limited

AGA is a Guernsey registered closed-ended collective investment

scheme incorporated as a non-cellular company that listed on the

London Stock Exchange on 15 June 2015. It is regulated by the

Guernsey Financial Services Commission.

AGA's objective is to provide shareholders with capital

appreciation from its investment portfolio and regular dividends.

The Company is targeting an annualised Total Return, across

economic cycles, of 12-15% (net of fees and expenses) including a

dividend yield of 5% of Net Asset Value.

The investment policy of the Company is to make Private Equity

investments in Apax Funds, and Derived Investments which are

investments in equities and debt derived from the insights gained

via Apax Partners' Private Equity activities.

Further information regarding the Company and its publications

are available on the Company's website at

www.apaxglobalalpha.com.

About Apax Partners LLP

Apax Partners LLP ("Apax") is a leading global private equity

advisory firm. For nearly 50 years, Apax has worked to inspire

growth and ideas that transform businesses. The firm has raised and

advised funds with aggregate commitments of more than $60 billion.

The Apax Funds invest in companies across four global sectors of

Tech, Services, Healthcare, and Internet/Consumer. These funds

provide long-term equity financing to build and strengthen

world-class companies. For further information about Apax, please

visit www.apax.com.

Apax Partners is authorised and regulated by the Financial

Conduct Authority in the UK.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFDZLFBFELXBBQ

(END) Dow Jones Newswires

May 05, 2021 02:00 ET (06:00 GMT)

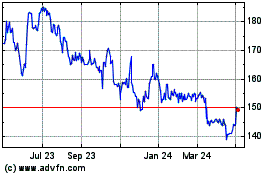

Apax Global Alpha (LSE:APAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

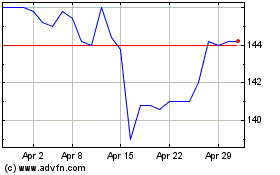

Apax Global Alpha (LSE:APAX)

Historical Stock Chart

From Apr 2023 to Apr 2024