TIDMAPAX

RNS Number : 0930J

Apax Global Alpha Limited

19 August 2021

(LSE: APAX)

Apax Global Alpha Limited

Interim results for the period ended 30 June 2021

Key highlights

-- Strong performance across the portfolio in the first six months

of 2021: AGA's Total NAV Return(1) was 17.4% (14.9% constant

currency).

-- Total Adjusted NAV increased to c. EUR 1.4bn with Adjusted NAV

per share increasing from EUR2.45 (GBP2.19) to EUR2.81 (GBP2.41)

in the six months to 30 June 2021.

-- Focus on four target sectors and a "good-to-great" strategy

of business improvement in Private Equity driving strong returns

in the portfolio.

-- The Apax Funds were able to identify attractive opportunities

to invest, with AGA deploying EUR85m across eleven new Private

Equity investments (seven in Apax X, two in the Apax Digital

Fund, one in the AMI Opportunities Fund, and one joint investment

by the AMI Opportunities Fund and the Apax Digital Fund).

-- Record distributions of EUR131.1m received from full and significant

partial Private Equity exits, deployed into 13 new Derived Debt

positions to absorb liquidity in the fund into attractive yield

investments.

-- New commitment of $90m to the Apax Digital Fund II, the successor

fund to the Apax Digital Fund which invests in minority equity

and growth buyout opportunities in mid-market technology companies.

-- Liquidity position is healthy with available cash after net

liabilities of EUR29m, and undrawn evergreen revolving credit

facility of EUR140m. Derived Investments of EUR439m(3) provide

a further source of funding for AGA.

-- Interim dividend of 5.97 pence per share declared, in line with

the stated policy to distribute 5% of NAV p.a.

Tim Breedon CBE, Chairman of Apax Global Alpha, said:

"The focus on global opportunities and sectors that continue to

show strong structural growth has delivered good results in the

first half of the year. AGA's portfolio is now mature with the

Private Equity portfolio diversified across fund vintages and

generating substantial cash distributions. As the Covid-19 vaccine

rollout continues and global economies further rebound, AGA is well

positioned to continue to provide long-term value and attractive

income for shareholders."

Commenting on the results, Ralf Gruss, COO of Apax Partners,

said:

"AGA's strong NAV performance in the first six months reflects

the quality of the portfolio. There is good momentum as seen

through several successful realisations with good uplifts, and

there was a good pace of deployment, with new investments in both

Private Equity and Derived Debt. There is a strong pipeline of new

investments, and AGA is well positioned for emerging

opportunities."

Financial highlights

-- Significant growth in Adjusted NAV(3) to just under EUR1.4

billion, up from EUR1.2 billion as at 31 December 2020, despite

dividend payment of 5.28 pence per share during the first

quarter.

-- Portfolio weighted towards Private Equity (68%), vs. Derived

Debt (29%) and Derived Equity (3%).

-- Reflecting the strong investment pace in Q2, AGA was 98%

invested as at 30 June 2021 and had outstanding commitments

to the Apax Funds (together with recallable distributions)

of EUR419m.

H1 2021 (EUR) H1 2021 (GBP)

Adjusted NAV (3) EUR 1,380m GBP 1,183m

-------------- --------------

Adjusted NAV (3) per EUR 2.81 GBP 2.41

share

-------------- --------------

NAV (3) per share EUR 2.82 GBP 2.42

-------------- --------------

Exposure H1 2021 H1 2021

constant currency

Total NAV Return(1) 17.4% 14.9%

--------- -------- -------------------

Total Return(1) -

Private Equity 66% 24.5% 21.9%

--------- -------- -------------------

Total Return(1) -

Derived Debt 29% 7.3% 4.5%

--------- -------- -------------------

Total Return(1) -

Derived Equity 3% 28.6% 25.0%

--------- -------- -------------------

Cash & Others 2%

--------- -------- -------------------

Private Equity portfolio highlights

-- The Private Equity portfolio performed strongly in the first

six months of 2021: Total Return(1) of 24.5% (21.9% constant

currency).

-- Deal activity reflective of Apax's 'good to great' investment

strategy and sub-sector expertise, focusing on opportunities

where there is a significant re-rating at exit based on business

quality improvement.

-- Aggregate Gross IRR(4) and Gross MOIC(4) on Private Equity

exits in H1 2021, excluding the InnovAge and Global-e IPOs

(primary only), were 52.4% and 3.9x respectively. Exits were

achieved at an average uplift(2) of 25.7%, reflecting the quality

of the portfolio.

-- On a look-through basis, AGA invested c.EUR85m(5) in eleven

new investments that closed during the period.

-- Continued strong earnings growth and operating performance

from the portfolio companies: LTM Revenue(6) and EBITDA growth(6)

of 22.3% and 42.7% respectively across the Private Equity portfolio.

Derived Investments portfolio highlights

-- Good performance across the portfolio with Derived Investments

achieving a Total Return(1) of 9.8% (7.0% constant currency)

in H1 2021, driven by performance in Derived Debt which makes

up 88% of the Derived Investments portfolio, with a Total

Return(1) of 7.3% (4.5% constant currency).

-- In Derived Debt the focus remained on investments in lower

risk first and second lien loans where there is a high degree

of visibility on cash flow, and in target sub-sectors where

Apax has unique insights gained from the Private Equity investment

activity - EUR161.3m deployed across 13 new debt positions

in H1 2021.

-- Strong operating performance from underlying Derived Debt

portfolio companies: LTM EBITDA growth from 26.2% to 37.3%

in the six months to 30 June 2021.

-- Reflecting the increased share of first lien loans and the

impact of lower base rates in the portfolio, the overall yield

to maturity of the portfolio reduced to 6.8% at 30 June 2021.

-- Derived Equity delivered Total Return(1) of 28.6% (25.0% constant

currency) in the first six months of 2021.

For further information regarding the announcement of AGA's 2021

interim results, including the Company's interim report, results

presentation and dial-in details for today's analyst and investor

webcast at 9.30am (UK time), please visit www.apaxglobalalpha.com

.

Contact details

Katarina Sallerfors

Investor Relations - AGA

Telephone: +44 (0)207 666 6526

Email: katarina.sallerfors@apax.com

APPIX

Movements in NAV

Adjusted NAV(3) movements Private Derived Treasury Facility H1 2021

(EURm) Equity Investments Cash Shares drawn Other Total

-------- ------------- -------- --------- --------- ------- --------

Adjusted NAV at 31.12.20 788.3 319.4 124.6 - - (31.1) 1,201.2

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+ Investments 78.7 161.3 (218.6) - - (21.4) -

--------------------------- -------- ------------- -------- --------- --------- ------- --------

- Distributions/

divestments (131.1) (69.8) 196.8 - - 4.1 -

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+ Interest and dividend

income - - 9.4 - - 0.4 9.8

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Gains/(losses) 161.0 17.8 - - - - 178.8

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- FX gains/(losses)(7) 19.7 10.5 0.2 - - - 30.4

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Costs and other

movements - - (4.0) - - (1.4) (5.4)

--------------------------- -------- ------------- -------- --------- --------- ------- --------

- Dividends paid - - (30.0) - - - (30.0)

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Performance fee

reserve - (4.5) - - - - (4.5)

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Treasury shares - - - - - - -

--------------------------- -------- ------------- -------- --------- --------- ------- --------

+/- Revolving credit - - -

facility

drawn/repaid - - - -

--------------------------- -------- ------------- -------- --------- --------- ------- --------

Adjusted NAV at

30.6.21 (3) 916.6 434.7 78.4 - - (49.4) 1,380.3

--------------------------- -------- ------------- -------- --------- --------- ------- --------

Private Equity - operational metrics

Private Equity - operational metrics 30 June 2021 31 December 2020

-------------

Portfolio year-over-year LTM revenue growth(6) 22.3% 6.6%

================================================ ============== ================

Portfolio year-over-year LTM EBITDA growth(6) 42.7% 20.8%

================================================ ============== ================

Enterprise Value / EBITDA valuation multiple(6) 18.0x 16.9x

================================================ ============== ================

Net debt / EBITDA multiple (6) 3.7x 3.9x

------------------------------------------------ -------------- ----------------

Derived Investments - operational metrics

Derived Investments - operational metrics 30 June 2021 31 December 2020

------------

Debt year-over-year LTM EBITDA growth(8) 37.3% 26.2%

=========================================== ============ ================

Debt average income yield to maturity(8) 6.8% 8.1%

=========================================== ============ ================

Debt average years to maturity 5.9 5.7

=========================================== ============ ================

Debt average income yield(9) 6.4% 7.3%

------------------------------------------- ------------ ----------------

Other Invested Portfolio highlights

Invested Portfolio analysis(10) EURm EURm % %

----- ------- ---

Private Equity 916.6 68%

================================ ===== ======= === ====

* AMI 50.0 4%

================================ ===== ======= === ====

* AEVI 6.6 0%

================================ ===== ======= === ====

* AEVII 26.2 2%

================================ ===== ======= === ====

* AVIII 172.2 13%

================================ ===== ======= === ====

* AIX 522.6 38%

================================ ===== ======= === ====

* ADF 35.3 3%

================================ ===== ======= === ====

* AX 103.7 8%

================================ ===== ======= === ====

Derived Investments 439.2 32%

================================ ===== ======= === ====

* Derived Debt 388.6 29%

================================ ===== ======= === ====

* Derived Equity 50.6 3%

================================ ===== ======= === ====

Total 1,355.8 100%

-------------------------------- ----- ------- --- ----

Footnotes

1. "Total NAV Return" means the movement in the Adjusted NAV

per share over the period plus any dividends paid. "Total

Return" reflects the sub-portfolio performance on a stand-alone

basis. It excludes items at the overall AGA level such as

cash, management fees, and costs

2. Valuation uplifts on exits are calculated based on the total

actual or estimated sales proceeds and income as appropriate

since the last Unaffected Valuation. Unaffected Valuation

is determined as the fair value in the last quarter before

exit, when valuation is not affected by the exit process

(i.e. because an exit was signed, or an exit was sufficiently

close to being signed that the Apax Funds incorporated the

expected exit multiple into the quarter end valuation).

Average uplift of full exits and significant partial exits

in the current period calculated based on the expected sales

proceeds and/ or the fair value remaining. For investments

where there were subsequent partial realisations since December

2020, uplift calculated by taking proceeds received in H1

2021 plus remaining fair value at 30 June 2021 compared

to fair value at 31 December 2020

3. NAV was EUR1,384.8m whilst Adjusted NAV was EUR1,380.3m

reflecting the estimated performance fee reserve of EUR4.5m

at period end. Private Equity NAV and Adjusted NAV were

the same at EUR916.6m. Derived Investments NAV was EUR439.2m

whilst it's Adjusted NAV was EUR434.7m reflecting the adjustment

for the performance fee reserve of EUR4.5m.

4. Private Equity Aggregate Gross IRR and Gross MOIC of 52.4%

and 3.9x calculated based on the expected aggregate cash

flows across all funds for the 12 full or significant partial

exits or IPOs

5. Invested cost remains subject to closing on investments

signed which have yet to close

6. Gross Asset Value weighted average of the respective metric

across the portfolio. LTM Revenue growth and LTM EBITDA

growth rates exclude companies where EBITDA is not meaningful

such as financial services or high growth business with

fluctuations in EBITDA. TietoEVRY is also excluded due to

the unavailability of reported data. Net debt/EBITDA multiple

and EV/EBITDA valuation multiple excluded companies where

EBITDA is not meaningful such as financial services or companies

with negative EBITDA, or high growth business valued on

a revenue basis. MATCHESFASHION.COM is excluded due to low

EBITDA from opex investments and short-term fluctuations

in EBITDA. Cole Haan has been excluded at June 2021 as it

has negative EBITDA

7. FX on cash includes the revaluation of cash balances and

net losses arising from the differences in exchange rates

between transaction dates and settlement dates, and unrealised

net losses arising from the translation into euro of assets

and liabilities (other than investments) which are not denominated

in euro

8. Gross Asset Value weighted average of the respective metric

across the Derived Debt portfolio

9. Gross Asset Value weighted average of the current full year

income (annual coupon/clean price as at the respective date)

for each debt position in the Derived Debt portfolio as

at the respective date

10. Invested Portfolio excludes cash and cash equivalents, revolving

credit facility drawn and net current assets, including

these the NAV was EUR1,384.8m and Adjusted NAV was EUR1,380.3m

reflecting adjustment of EUR4.5m for the estimated performance

fee reserve accrued

Notes

1. Note that references in this announcement to Apax Global Alpha

Limited have been abbreviated to "AGA" or "the Company". References

to Apax Partners LLP have been abbreviated to "Apax Partners"

or "the Investment Adviser"

2. Please be advised that this announcement may contain inside

information as stipulated under the Market Abuse Regulations

(EU) NO. 596/2014 ("MAR")

3. This announcement is not for release, publication or distribution,

directly or indirectly, in whole or in part, into or within

the United States or to "US persons" (as defined in Regulation

S under the United States Securities Act of 1933, as amended

(the "Securities Act")) or into or within Australia, Canada,

South Africa or Japan. Recipients of this announcement in jurisdictions

outside the UK should inform themselves about and observe any

applicable legal requirements in their jurisdictions. In particular,

the distribution of the announcement may be restricted by law

in certain jurisdictions

4. The information presented herein is not an offer for sale within

the United States of any equity shares or other securities

of Apax Global Alpha Limited ("AGA"). AGA has not been and

will not be registered under the US Investment Company Act

of 1940, as amended (the "Investment Company Act"). In addition,

AGA's shares (the "Shares") have not been and will not be registered

under the Securities Act or any other applicable law of the

United States. Consequently, the Shares may not be offered

or sold or otherwise transferred within the United States,

or to, or for the account or benefit of, US Persons, except

pursuant to an exemption from the registration requirements

of the Securities Act and under circumstances which will not

require AGA to register under the Investment Company Act. No

public offering of the Shares is being made in the United States

5. This announcement may include forward-looking statements. The

words "expect", "anticipate", "intends", "plan", "estimate",

"aim", "forecast", "project" and similar expressions (or their

negative) identify certain of these forward-looking statements.

These forward-looking statements are statements regarding AGA's

intentions, beliefs or current expectations concerning, among

other things, AGA's results of operations, financial condition,

liquidity, prospects, growth and strategies. The forward-looking

statements in this presentation are based on numerous assumptions

regarding AGA's present and future business strategies and

the environment in which AGA will operate in the future. Forward-looking

statements involve inherent known and unknown risks, uncertainties

and contingencies because they relate to events and depend

on circumstances that may or may not occur in the future and

may cause the actual results, performance or achievements of

AGA to be materially different from those expressed or implied

by such forward looking statements. Many of these risks and

uncertainties relate to factors that are beyond AGA's ability

to control or estimate precisely, such as future market conditions,

currency fluctuations, the behaviour of other market participants,

the actions of regulators and other factors such as AGA's ability

to continue to obtain financing to meet its liquidity needs,

changes in the political, social and regulatory framework in

which AGA operates or in economic or technological trends or

conditions. Past performance should not be taken as an indication

or guarantee of future results, and no representation or warranty,

express or implied, is made regarding future performance. AGA

expressly disclaims any obligation or undertaking to release

any updates or revisions to these forward-looking statements

to reflect any change in AGA's expectations with regard thereto

or any change in events, conditions or circumstances on which

any statement is based after the date of this announcement,

or to update or to keep current any other information contained

in this announcement. Accordingly, undue reliance should not

be placed on the forward-looking statements, which speak only

as of the date of this announcement.

About Apax Global Alpha Limited

AGA is a Guernsey registered closed-ended collective investment

scheme incorporated as a non-cellular company that listed on the

London Stock Exchange on 15 June 2015. It is regulated by the

Guernsey Financial Services Commission.

AGA's objective is to provide shareholders with capital

appreciation from its investment portfolio and regular dividends.

The Company is targeting an annualised Total Return, across

economic cycles, of 12-15% (net of fees and expenses) including a

dividend yield of 5% of Net Asset Value.

The investment policy of the Company is to make Private Equity

investments in Apax Funds, and Derived Investments which are

investments in equities and debt derived from the insights gained

via Apax Partners' Private Equity activities.

Further information regarding the Company and its publications

are available on the Company's website at

www.apaxglobalalpha.com.

About Apax Partners LLP

Apax Partners LLP ("Apax") is a leading global private equity

advisory firm. For nearly 50 years, Apax has worked to inspire

growth and ideas that transform businesses. The firm has raised and

advised funds with aggregate commitments of more than $60 billion.

The Apax Funds invest in companies across four global sectors of

Tech, Services, Healthcare, and Internet/Consumer. These funds

provide long-term equity financing to build and strengthen

world-class companies. For further information about Apax, please

visit www.apax.com.

Apax Partners is authorised and regulated by the Financial

Conduct Authority in the UK.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUWRWRARUWAAR

(END) Dow Jones Newswires

August 19, 2021 02:00 ET (06:00 GMT)

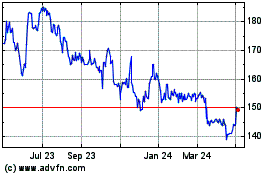

Apax Global Alpha (LSE:APAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

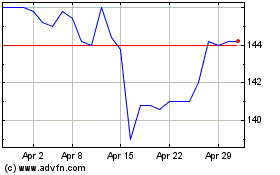

Apax Global Alpha (LSE:APAX)

Historical Stock Chart

From Apr 2023 to Apr 2024