TIDMAQX

RNS Number : 3978Y

Aquis Exchange PLC

09 September 2020

9 September 2020

Aquis Exchange PLC

("Aquis", the "Company" or the "Group")

Interim results for the six months ended 30 June 2020

Continued strong growth and first period of profit

Aquis Exchange PLC (AQX.L), the exchange services group, is

pleased to announce its unaudited results for the six months ended

30 June 2020.

Highlights:

-- Revenue increased 42% to GBP4.9 million (1H19: GBP3.4 million)

-- EBITDA of GBP0.54 million (1H19: GBP0.18 million loss)

-- Profitability reached for the first time with a profit after

tax of GBP16,000 (1H19: GBP623,000 loss)

-- Cash and cash equivalents at 30 June 2020 of GBP11.2 million

(30 June 2019: GBP11.2 million)

-- Market share of all pan-European trading rose to 4.51% (1H19:

3.56%), despite the increased volatility

driving significant additional proprietary trading

-- The share of available liquidity increased further to 21% (1H19: 19%)

-- Following approval from the FCA, the acquisition of Aquis

Stock Exchange (AQSE) was completed on 11 March 2020 (formerly NEX

Exchange)

-- Integration into the Group progressing well

-- Cost savings derived from synergies ahead of management expectations so far

-- Three new companies quoted on AQSE since acquisition, one of which was post-period end

Post-period highlights:

-- Current trading in line with market expectations for the full

year, although we recognise the volatility

of licensing contracts and their timing in this climate and their potential effect on revenues

-- Plans to enhance Aquis Stock Exchange announced:

-- Segmenting the market

-- Gaining greater institutional and asset manager support

-- Prohibiting short selling

-- Enhancing trading mechanisms

Alasdair Haynes, Chief Executive Officer of Aquis,

commented:

"We are pleased to announce our first period of profitability,

reached through further strong revenue growth. This growth has been

driven by our existing Members continuing to increase their trading

volumes through our pan-European lit equities market.

The completion of the acquisition of Aquis Stock Exchange in

March was a milestone for the Group and marked a significant step

towards achieving our ambition to become the leading exchange

services group in Europe. We have now entered the primary listings

market, with exciting plans in motion to further build AQSE into

the first choice for quality growth businesses.

Despite the impact of Covid-19 on the global economy and

business confidence, Aquis has maintained a robust competitive

position in the marketplace and has successfully operated almost

entirely remotely since March, highlighting the flexibility and

resilience of the business.

While we anticipate the prevailing economic uncertainty will

continue to impact market participants in the short to medium term,

we have proven we have the right model, team, technology and vision

to deliver shareholder value and look to the future with

confidence."

The Company is hosting a webinar for retail investors at 11.30am

on Friday 11 September 2020. If you would like to attend this

presentation, please register using the following link:

http://bit.ly/AQX_H1202_piworldwebinar

This announcement contains inside information for the purposes

of EU Regulation 596/2014.

Enquiries:

Aquis Exchange PLC Tel: +44 (0)20 3597

6321

Alasdair Haynes, CEO

Jonathan Clelland, CFO and COO Belinda Tel: +44 (0)20 3597

Keheyan, Head of Marketing 6329

Liberum Capital Limited (Nominated Adviser Tel: +44 (0)20 3100

and Broker) 2000

Clayton Bush

Chris Clarke

Edward Thomas

Kane Collings

Alma PR (Financial PR Adviser) Tel: +44 (0)20 3405

0209

Susie Hudson aquis@almapr.co.uk

Rebecca Sanders-Hewett

Caroline Forde

Notes to editors:

Aquis Exchange PLC is an exchange services group, which operates

a pan-European cash equities trading business (Aquis Exchange) and

develops and licenses exchange software to third parties (Aquis

Technologies).

Aquis Exchange PLC (AQX.L) is quoted on the London Stock

Exchange's Alternative Investment Market (AIM).

Aquis Exchange is authorised and regulated by the UK Financial

Conduct Authority and France's Autorité des Marchés Financiers to

operate Multilateral Trading Facility businesses in the UK and in

EU27 respectively.

Aquis operates a lit order book and does not permit aggressive

non-client proprietary trading, which has resulted in lower

toxicity and signalling risk on Aquis than other trading venues in

Europe. According to independent studies, trades on Aquis are less

likely to lead to price movement than on other lit markets. Aquis

applies a subscription pricing model which works by charging users

according to the message traffic they generate, rather than a

percentage of the value of each security that they execute. This

model can significantly reduce the cost of trading.

Aquis Technologies is the software and technology division of

Aquis Exchange PLC. It creates and licenses cutting-edge,

cost-effective matching engine and trade surveillance technology

for banks, brokers, investment firms and exchanges.

Aquis Stock Exchange (AQSE) is a UK-based stock market providing

primary and secondary markets for equity and debt products. It is

permissioned as a Recognised Investment Exchange, which allows it

to operate a regulated listings venue.

For more information, please go to www.aquis.eu and

www.aquis.technology

Chief Executive Officer's Report

The six months to 30 June 2020 have been another strong period

of growth and we are very pleased to have recorded our first period

of profit. Alongside this we have maintained our competitive

position in the market and made good operational progress to help

drive us forward towards our long-term goals. The fact that we have

achieved all this amidst the challenging economic circumstances

arising from the global Covid-19 pandemic demonstrates our strong

operational resilience and the continued demand for our unique

offering.

A highlight of the Group's growth journey so far was the

announcement of the completion of the acquisition of Aquis Stock

Exchange in March 2020 and we have been rapidly developing the

market since. The acquisition has further strengthened our position

by allowing us to access new opportunities in the primary listings

market and we are excited to build it into a true home for quality

growth businesses, aligning it with Aquis' overall strategy and

vision. Our planned enhancements for the market, following a

consultation process, have now been formulated and are laid out in

further detail below. So far we have been very pleased with the

progress made, with cost savings derived from synergies between our

business activities ahead of management expectations and with the

transfer of the business onto the core Aquis technology platform

scheduled for mid-September.

Covid-19 Update

As previously communicated, the Group had well-established

remote working policies and disaster recovery plans, which were put

into practice in March as a result of Covid-19. The market has been

successfully operating almost entirely remotely since. Thanks to

our focus on technology and in line with being a relatively small

and agile operation, we have continued to serve our clients

effectively whilst also pushing ahead with key strategic

initiatives. Whilst the uncertainty and market turmoil has

inevitably impacted decision making processes in the industry, we

are pleased to have made significant progress with our KPIs (see

below) and delivered our first period of profitable trading.

During the early weeks of the pandemic we saw greatly increased

market volumes, which had a positive short-term impact. Since then

trading levels have been closer to historic averages.

It is difficult to predict the medium to long term impact on the

financial industry and more particularly equity market trading

volumes, however, our business model continues to show its strength

and we are confident we have the right strategy in place to

continue delivering significant growth over the long term.

Operational Review

Aquis continued to develop its three complementary business

activities throughout the period: its pan-European lit equities

market: a multi-asset class technology licensing service to an

international client base, a market data offering and, as of March,

a fourth activity with our primary listings market for small and

mid-cap companies. All activities have contributed to the

significant growth experienced in the period and this is set to

continue as synergies are developed and business potential is

harnessed.

We continue to invest in key personnel in all areas, who will be

instrumental in the business development process. The strength,

experience and commitment of our staff, who have also demonstrated

a commendable ability to adapt to the strange and unforeseen

circumstances in the current environment, continue to be a

significant contributor to our success.

We were also delighted to announce, post period, that the

University of Derby has secured funding for a new knowledge

transfer partnership with Aquis, in which we will collaborate on a

research and development project based around machine learning,

artificial intelligence and market surveillance. We firmly believe

that this is where the future of surveillance lies and our

philosophy at Aquis is to be always at the cutting edge of

innovation.

A summary of progress in each of our business activities is

outlined below.

Aquis Exchange

Continued strong growth in the core business

The key performance indicators of the Aquis Exchange business

grew during the period. Exchange revenue increased by GBP1.0m (37%)

from GBP2.7 million to GBP3.7 million and the number of Members

grew from 30 to 31. In addition, a number of Members increased

their trading volumes resulting in increased monthly subscriptions.

This occurred against the backdrop of increased turbulence and

uncertainty in financial markets as a result of Covid-19, which saw

an increase in volatility and overall trading levels amid growing

unease regarding the global economic outlook. Aquis Exchange's

market share of all pan-European trading was at 4.51% (1H19:

3.56%), despite the increased volatility which drove significant

additional proprietary trading and subsequently impacted auction

performance.

The Company currently has an offering in excess of 1,500 stocks

and ETFs across 14 European markets, an increase year on year.

Available liquidity on the exchange further increased to 21% in

1H20 (19% in 1H19) and it is expected this will underpin future

anticipated growth.

The Group's Market at Close product ("MaC") has continued to

attract interest since its launch in August 2019. It reached 3.52%

of total pan-European auction volumes in December last year and, on

average, achieved 3.61% in the first half of 2020 despite the

challenging circumstances. Since the period end, MaC volumes have

strengthened further.

The recognition that Aquis Exchange's toxicity is materially

lower than its competitors continues to grow amongst investment

managers and the wider market. With several market drivers pushing

market participants towards lower toxicity, the opportunity for

Aquis Exchange to attract a wider membership from across Europe and

to facilitate increased trading volumes remains significant.

Aquis Stock Exchange

Building the home for quality growth businesses

AQSE is a modern market for modern business, bringing positive

disruption and competition to the listed SME sector. It champions

entrepreneurship, investment and growth. Innovation drives its

thinking, regulation underpins its products and service culture

guides its behaviour. It uses superior technology to deliver better

results for all participants.

As one of the only two existing options for growing SMEs looking

to IPO in the UK, Aquis' vision is for AQSE to become the home for

quality growth businesses, applying core Aquis values such as

transparency and innovation.

AQSE has committed to enhancing the market through the following

four key actions:

1. Segmenting the market

- providing appropriate support throughout the growth cycle

2. Gaining greater institutional and asset manager support

3. Prohibiting short selling

- protecting issuers and investors

4. Enhancing trading mechanisms

- supporting greater liquidity

These enhancements have been developed following our recent

market consultation process, which saw a broad range of

stakeholders taking part including issuers, investors, corporate

advisers, lawyers, accountants, brokers, market makers institutions

and industry think tanks.

A video providing further detail is available to view on the

Company's website here: https://bit.ly/2QPC578. A further

consultation on rule book changes took place across July and

August, with the new policies anticipated to go live in Autumn this

year.

Since acquisition, AQSE has been undergoing migration onto the

Aquis trading platform and surveillance systems, with harmonisation

in systems and processes being the first step in aligning the

business with Aquis' strategic objectives.

Three listings have been completed since acquisition, in the

beverages, industrial engineering and health care equipment &

services sectors. All were well supported and there is an

encouraging pipeline of businesses in conversation with AQSE

regarding IPO.

As previously communicated, the Group remains committed to

significantly reducing the loss generated by AQSE in the near term

and good progress has been made in achieving the anticipated cost

synergies, ahead of Management's original expectations.

Aquis Technologies

Revenue increased despite challenging market conditions

Aquis licenses its leading exchange-related technology through

its Aquis Technologies division. Aquis Technologies creates and

licenses technology for high volume, low latency trading platforms,

complex connectivity solutions and real-time trade monitoring and

surveillance systems for banks, brokers, investment firms and

exchanges.

Despite the challenging market for new sales created by the

Covid-19 pandemic, Aquis Technologies' revenue grew to GBP0.79m

(1H19: GBP0.70m), driven by new licencing and support contracts,

alongside revenue from the delivery of a number of implementations

across a variety of asset classes, mandated in previous periods.

Clients and prospects' decision processes have been delayed due to

the Covid-19 pandemic but in the medium term this should improve as

conditions begin to normalise.

Aquis will be focused on furthering the growth of the

Technologies division, developing its products and services to help

its clients with the challenges they face and ensuring the

high-performance systems continue to be enhanced.

Aquis Market Data

Revenue from market data vendors more than doubled from GBP0.15m

to GBP0.37m for the 6-month period compared to the 2019 equivalent.

The consolidation of AQSE has helped to boost data revenues and the

number of data vendors on the Aquis Exchange.

Financial Review

Revenue increased 42% to GBP4.9m (1H19: GBP3.4m) and the EBITDA

profit for the half year was GBP0.54m, which compares to an EBITDA

loss of GBP0.18m in 1H19. This EBITDA profit and the profit after

tax of GBP16,000 includes income recognised from an GBP183,000

impairment credit per IFRS 9. The EBITDA profit growth is mainly

attributable to increased exchange revenue as Members'

subscriptions have risen as a result of increased trading levels.

The Group made some controlled increases in costs during 1H 2020 as

it continues to invest in personnel and technological resources and

the Group will continue to invest on a controlled basis going

forward.

The Company's cash and cash equivalents as at 30 June 2020 were

GBP11.2 million (30 June 2019: GBP11.2 million), demonstrating its

continued focus on careful cash management.

Summary

Our strategic goal is to become one of the leading exchange

services groups through delivering best-in-class exchange trading

opportunities, underpinned by our commitment to first class client

service. To this end, our investment in R&D will help improve

the trading experience for clients, as well as improving our market

position and providing further growth and value creation for

shareholders. Having made a significant amount of investment in the

first half, we will see the full impact flow through into the full

year.

Alongside this we are working to enhance our software licensing

activities and build presence internationally.

AQSE has been successfully integrated into the business and we

are in the process of building it into a quality home for growth

companies. This will include a business development process

focussing in particular on listing opportunities and synergies with

Aquis Exchange activities, supported by an investment in key

personnel.

Looking forward, our focus continues to be on executing on our

core growth strategy; increasing trading volumes and improving

fundraising prospects for small and mid-cap companies. Although

uncertainty understandably continues to weigh on decision making we

have already proven ourselves to be able to adapt to adversity and

proactively seek out new opportunities.

Notwithstanding the macroeconomic uncertainty, current trading

is in line with market expectations for the full year. I am

confident that with our philosophy of fairness, transparency and

simplicity, we have a winning formula. We have a strong team,

experienced management and a cutting-edge technology platform. We

are well placed to continue on our successful journey.

Alasdair Haynes

Chief Executive Officer

Condensed consolidated statement of comprehensive income for the

six-month period ended 30 June 2020

6 months 6 months

ended Year ended ended

30/06/2020 31/12/2019 30/06/2019

Note GBP'000 GBP'000 GBP'000

Income Statement

Revenue 3 4,851 6,892 3,419

Impairment credit 4 183 243 120

Administrative expenses (4,497) (7,334) (3,722)

Operating profit/(loss) 537 (199) (183)

Investment income 5 14 42 21

Depreciation and amortisation 7,8 (522) (928) (439)

Net finance costs 16 (17) (41) (20)

Net profit (loss)

before taxation 12 (1,126) (621)

Income tax credit/(expense) - 265 -

Profit/(loss) for

the period 12 (861) (621)

============ ============ ============

Other comprehensive

income

Items that may be

reclassified subsequently

to

profit or loss:

Foreign exchange differences

on translation of

foreign operations,

net of tax 15 4 1 (2)

Other comprehensive profit

/ (loss) for the period 4 1 (2)

Total comprehensive profit

/ (loss) for the period 16 (860) (623)

============ ============ ============

Earnings per share

(pence) 6

Basic

Ordinary shares 0 (3) (2)

Diluted

Ordinary shares 0 (3) (2)

The consolidated statement of comprehensive income has been

prepared on the basis that all operations are continuing

operations.

Condensed consolidated statement of financial position as at 30

June 2020

6 months

6 months Year ended ended

ended 30/06/2020 31/12/2019 31/12/2019

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 7 815 753 695

Property, plant and equipment 8 1,612 2,014 1,900

Trade and other receivables 9 947 967 862

3,374 3,734 3,457

Current assets

Trade and other receivables 9 2,742 1,654 2,152

Cash and cash equivalents 11,182 11,011 11,212

13,924 12,665 13,364

Total assets 17,298 16,399 16,821

------------------ ------------ ------------

Liabilities

Current liabilities

Trade and other payables 10 2,329 1,500 1,650

Non-current liabilities

Lease liabilities 16 1,092 1,190 1,283

Total liabilities 3,421 2,689 2,933

------------------ ------------ ------------

Net assets 13,877 13,710 13,888

================== ============ ============

Equity

Called up share capital 11 2,717 2,715 2,715

Share premium account 12 10,892 10,840 10,840

Other reserves 13 311 213 153

Retained earnings/accumulated

losses 14 (47) (59) 182

Foreign currency translation

reserve 15 4 1 (2)

Total equity 13,877 13,710 13,888

================== ============ ============

The notes to the financial statements on pages 7 to 16 form an

integral part of these financial statements. The interim financial

statements were approved by the board of directors and authorised

for issue on 8(th) September 2020 and are signed on its behalf

by:

J Clelland A Haynes

Director Director

Company Registration No. 07909192

Condensed consolidated statement of changes in equity for the

period ended 30 June 2020

Note Share Share Other Retained Foreign Total

Capital Premium Reserves Earnings Currency

Translation

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2019 2,715 10,840 92 803 - 14,450

-

Loss for the 6-month

period ended 30/06/2019 - - - (621) - (621)

Foreign exchange

differences on

translation of

foreign operations - - - - (2) (2)

Movement in share

option reserve - - 61 - - 61

Balance at 30

June 2019 2,715 10,840 153 182 (2) 13,888

Loss for the 6-month period ended

31/12/2019 (241) (241)

Foreign exchange

differences on

translation of

foreign operations 3 3

Movement in share option

reserve 60 60

Balance at 31 December

2019 2,715 10,840 213 (59) 1 13,710

Profit for the 6-month period

ended

30/06/2020 12 12

Foreign exchange

differences on

translation of

foreign operations 15 3 3

Movement in share

option reserve 13 98 98

Issue of new

shares 11,12 2 52 54

Balance at 30

June 2020 2,717 10,892 311 (47) 4 13,877

========= ========= ========== ========== ============= ========

Condensed consolidated statement of cash flows for the period

ended 30 June 2020

Note 6 months Year 6 months

ended ended ended

30/06/2020 31/12/2019 30/06/2019

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash generated/absorbed by

operations 17 568 386 62

Tax refunded - 265 -

Finance expense on lease liabilities 16 (17) (48) (24)

Net cash inflow from operating

activities 552 603 38

------------ ------------ ------------

Investing Activities

Recognition of intangible

assets 7 (311) (562) (281)

Purchase of property, plant

and equipment 8 (44) (509) (181)

Interest received 5 14 42 21

Net cash used in / generated by

investing activities (341) (1,029) (441)

------------ ------------ ------------

Financing Activities

Proceeds from share issue 11,12 54

Principal portion of lease

liability 16 (98) (183) -

Net cash (used in)/ generated

by financing activities (44) (183)

------------ ------------ ------------

Net increase/(decrease) in cash

and cash equivalents 167 (609) (403)

Cash and cash equivalents at the

beginning of the period 11,011 11,619 11,610

Effect of exchange rate changes

on cash and cash equivalents 4 1 2

Cash and cash equivalents at the

end of the period 11,182 11,011 11,209

============ ============ ============

Notes to the financial statements

1. Basis of preparation of half-year report

This condensed consolidated interim financial report for the

half-year reporting period beginning 1 January 2020 and ending 30

June 2020 ("interim period") has been prepared in accordance with

Accounting Standard IAS 34 Interim Financial Reporting.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2019 and any public announcements made by

Aquis Exchange PLC ("Aquis" or the "Company") during the interim

reporting period.

The accounting policies adopted are consistent with those of the

previous financial year and corresponding interim reporting

period.

2. Significant changes in the current reporting period

The financial position and performance of the group was

particularly affected by the following events and transactions

during the six months to 30 June 2020:

-- The consolidation of newly acquired subsidiary, Aquis Stock Exchange (AQSE); and

-- An increase in revenue as a result of an increase in exchange members and trading volumes.

During the interim period, the acquisition of NEX Exchange

Limited was approved by the FCA and was completed on 11(th) March

2020. The company was renamed Aquis Stock Exchange (AQSE) and has

been included in the Consolidated Financial Statements for the

Aquis Exchange PLC Group ("Group") for the period since

acquisition.

The coronavirus pandemic has had an unprecedented impact on

markets around the world in the first half of 2020. The principal

impact of the pandemic on the Group has been through increased

market volatility and a slower than expected pace of onboarding new

clients.

However, despite challenging market conditions during the six

months ended 30 June 2020, Aquis generated a profit of GBP12k,

largely the result of growing Exchange revenues.

3. Revenue

An analysis of the Group's revenue is as follows:

6 months Year Restated

ended ended 6 months

30/06/2020 31/12/2019 ended

30/06/2019

GBP'000 GBP'000 GBP'000

Exchange Fees 3,682 5,285 2,675

Licence Fees 607 1269 590

Issuer Fees 189 - -

Data Vendor Fees 373 338 154

4,851 6,892 3,419

------------ ------------ ------------

4. Expected credit loss

The expected credit loss on licensing contract assets has been

calculated in accordance with IFRS 9:

GBP'000

As at 31/12/2018 696

Expected credit loss reversal for

the period (120)

---------

As at 30/06/2019 576

Expected credit loss reversal for

the period (123)

---------

As at 31/12/2019 453

Expected credit loss reversal for

the period (183)

As at 30/06/2020 270

---------

5. Investment income

6 months Year 6 months

ended ended ended

30/06/2020 31/12/2019 30/06/2019

GBP'000 GBP'000 GBP'000

Interest income

Bank deposits 14 42 21

------------ ------------ ------------

6. Earnings per share

6 months Year 6 months

ended ended ended

30/06/2020 31/12/2019 30/06/2019

Number of Shares ('000)

Weighted average number

of ordinary shares for

basic earnings per share 27,158 27,150 27,150

Weighted average number

of ordinary shares for

diluted earnings per

share 28,043 27,714 27,710

Earnings (GBP'000)

Profit for the period

from continued operations 12 (862) (623)

Basic and diluted earnings

per share (pence)

Basic earnings per ordinary

share 0 (3) (2)

Diluted earnings per

ordinary share 0 (3) (2)

7. Intangible assets

GBP'000

Cost

As at 31/12/2018 1,493

Additions- internally generated 281

--------

As at 30/06/2019 1,774

Additions- internally generated 281

--------

As at 31/12/2019 2,055

Additions- internally generated 311

As at 30/06/2020 2,366

--------

Accumulated amortisation

and impairment

As at 31/12/2018 855

Charge for the period 224

--------

As at 30/06/2019 1,079

Charge for the period 223

--------

As at 31/12/2019 1,302

Charge for the period 249

As at 30/06/2020 1,551

--------

Carrying amount

As at 31/12/2018 638

As at 30/06/2019 695

As at 31/12/2019 753

As at 30/06/2020 815

--------

8. Property, plant and equipment

Fixtures, Computer Non-current Total

fittings Equipment portion

and equipment of IFRS

16 leased

assets

GBP'000 GBP'000 GBP'000 GBP'000

Cost

As at 31/12/2018 246 1,592 - 1,838

Additions & disposals - 302 - 302

As at 30/06/2019 246 1,894 1,271 3,411

Additions & disposals 3 203 - 207

As at 31/12/2019 249 2,097 1,271 3,617

Additions & disposals - 44 - 44

As at 30/06/2020 249 2,141 1,271 3,661

--------------- ----------- ------------ --------

Accumulated depreciation

and impairment

As at 31/12/2018 78 1,219 - 1,297

Charge for the period 24 103 87 214

As at 30/06/2019 102 1,322 87 1,511

Charge for the period 25 154 86 267

As at 31/12/2019 127 1,476 173 1,778

Charge for the period 25 161 87 273

As at 30/06/2020 152 1,637 260 2,049

--------------- ----------- ------------ --------

Carrying amount

As at 31/12/2018 169 373 - 542

As at 30/06/2019 144 572 1,184 1,900

As at 31/12/2019 122 621 1,098 1,841

As at 30/06/2020 97 504 1,011 1,612

--------------- ----------- ------------ --------

9. Trade and other receivables

Current

----------------------------------------

As at As at As at

30/06/2020 31/12/2019 30/06/2019

GBP'000 GBP'000 GBP'000

Trade receivables

net of impairment 2,204 1,481 1,712

Prepayments 340 166 254

Other receivables 198 7 186

2,742 1,654 2,152

------------ ------------ ------------

Non-Current

----------------------------------------

As at As at As at

30/06/2020 31/12/2019 30/06/2019

GBP'000 GBP'000 GBP'000

Trade receivables

net of impairment 729 752 650

Other receivables 218 215 212

947 967 862

------------ ------------ ------------

Trade receivables are stated net of any credit impairment

provision as set out previously in Note 3 in accordance with IFRS

9, as illustrated below:

As at As at As at

30/06/2020 31/12/2019 30/06/2019

(restated)

GBP'000 GBP'000 GBP'000

Gross trade receivables 3,283 2,686 2,938

Expected credit loss (350) (453) (576)

------------

Trade receivables

net of impairment 2,933 2,233 2,362

------------ ------------ ------------

Impairment includes the expected credit loss on licencing

contract assets stated in Note 4.

10. Trade and other payables

As at As at As at

30/06/2020 31/12/2019 30/06/2019

Trade payables 90 130 271

Accruals 968 1,053 954

Social security and

other taxation 370 174 107

Deferred revenue 709 - -

Other payables 192 142 318

------------ ------------ ------------

2,329 1,499 1,650

------------ ------------ ------------

11. Called up share capital

As at As at As at

30/06/2020 31/12/2019 30/06/2019

GBP'000 GBP'000 GBP'000

Ordinary share capital

Issued and fully paid

27,149,559 Ordinary shares of 10p

each 2,715 2,715 2,715

Issue of new shares following exercise

of 20,137 EMI share options 2

At 30/06/2020 2,717 2,715 2,715

------------ ------------ ------------

12. Share premium account

As at As at As at

30/06/2020 31/12/2019 30/06/2019

GBP'000 GBP'000 GBP'000

Share premium

At beginning of year 10,840 10,840 10,840

Issue of new shares following exercise 52 - -

of 20,137 EMI share options

At 30/06/2020 10,892 10,840 10,840

------------ ------------ ------------

13. Other Reserves

As at As at As at

30/06/2020 31/12/2019 30/06/2019

GBP'000 GBP'000 GBP'000

Movement in reserves 98 60 61

Reserves relating to

share-based payments 311 213 153

------------ ------------ ------------

The reserves relating to share-based payments reflects the

estimated value of the approved Employee Share Option Scheme and

Restricted Share Awards Scheme estimated using a US binomial option

valuation model.

14. Retained earnings

GBP'000

As at 31/12/2018 923

Adjustment arising due to IFRS

16 (120)

Adjusted opening balance as at

31/12/2018 803

Loss for the 6-month period ended

30/06/2019 (621)

As at 31/06/2019 182

Loss for the 6-month period ended

30/12/2019 (241)

As at 31/12/2019 (59)

Profit for the 6-month period

ended 30/06/2020 12

As at 30/06/2020 (47)

--------

15. Foreign currency translation reserve

Aquis Exchange PLC is regulated in the UK by the FCA but with

increasing uncertainty over the outcome of Brexit the Company

decided to establish a European subsidiary and in March 2019

successfully applied for regulatory approval to operate a

Multilateral Trading Facility (MTF) in France through this

subsidiary. The translation of the European subsidiary into the

functional currency of the Group results in foreign exchange

differences that have been recognised in Other Comprehensive Income

('OCI') for the Group which have been accumulated in a separate

component of equity as illustrated below.

6 months Year 6 months

ended ended ended

30/06/2020 31/12/2019 30/06/2019

GBP'000 GBP'000 GBP'000

At the beginning of the year/period - - -

Foreign exchange differences

on translation of foreign operations

recognised in OCI 4 1 (2)

At the end of the year/period 4 1 (2)

------------ ------------ ------------

16. IFRS 16 Leases

The impact on the Group's assets and liabilities, and the related effects on profit and loss, of the

Group's leasing activities

(the Group as a lessee) are detailed below.

Right of Use Asset

Property

GBP

--------------------------------- ---------

Carrying amount at 1 January

2019 1,444

Depreciation for the period (87)

Carrying amount at 30 June 2019 1,358

Depreciation for the period (87)

Carrying amount at 31 December

2019 1,271

Depreciation for the period (87)

Carrying amount at 30 June 2020 1,184

--------------------------------- ---------

Of which are:

Current 173

Non-current 1,011

1,184

--------------------------------- ---------

Rent deposit asset

Rent deposit

asset

GBP

--------------------------------- -------------

Carrying amount at 1 January

2019 215

Finance income on rent deposit

asset for the period 3

Carrying amount at 30 June 2019 218

Finance income on rent deposit

asset for the period 4

Carrying amount at 31 December

2019 222

Finance income on rent deposit

asset for the period 3

Carrying amount at 30 June 2020 225

--------------------------------- -------------

Of which are:

Current 7

Non-current 218

225

--------------------------------- -------------

Lease liability

Lease liability

GBP

------------------------------------ ----------------

Carrying amount at 1 January

2019 1,561

Finance expense on lease liability

for the period 24

Lease payments made during the

period (115)

Carrying amount at 30 June 2019 1,470

Finance expense on lease liability

for the period 24

Lease payments made during the

period (116)

Carrying amount at 31 December

2019 1,378

Finance expense on lease liability

for the period 21

Lease payments made during the

period (115)

Carrying amount at 30 June 2020 1,284

------------------------------------ ----------------

Of which are:

Current 192

Non-current 1,092

1,284

------------------------------------ ----------------

Net finance expense on leases

6 months Year 6 months

ended 30/06/2020 ended ended

31/12/2019 30/06/2019

GBP GBP GBP

------------------------------------ ------------------ ------------ ------------

Finance expense on lease liability 21 48 24

Finance income on rent deposit

asset (4) (7) (3)

Net finance expense relating

to leases 17 41 21

------------------------------------ ------------------ ------------ ------------

The finance income and finance expense arising from the Group's leasing activities as a lessee have

been shown net where applicable

as is permitted by IAS 32 where criteria for offsetting have been met.

Amounts recognised in profit and loss

6 months Year 6 months

ended 30/06/2020 ended ended

31/12/2019 30/06/2019

GBP GBP GBP

-------------------------------------- ------------------ ------------ ------------

Depreciation expense on right-of-use

assets (87) (173) (87)

Finance expense on lease liability (21) (48) (24)

Finance income on rent deposit

asset 3 7 3

Net impact of leases on profit

or loss (105) (214) (108)

-------------------------------------- ------------------ ------------ ------------

The total cash outflow for leases amounted to GBP115k in the 6 months to 30(th) June 2020.

17. Cash generated from operations

6 months Year Restated

ended ended 6 months

30/06/2020 31/12/2019 ended

30/06/2019

GBP'000 GBP'000 GBP'000

Profit / (loss) after tax 12 (862) (621)

Adjustments for:

Taxation - (265) -

Investment revenue (14) (42) (21)

Amortisation and impairment of

intangible assets 249 447 223

Depreciation and impairment of

property, plant and equipment 273 482 215

Equity settled share-based payment

expense 98 120 61

Other losses (29) (24)

Losses on transition of accounting

standards - (120) (224)

Movement in working capital:

Increase in trade and other receivables (850) 43 (329)

Increase in trade and other payables 829 607 758

Cash generated by operations 568 386 62

------------ ------------ ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSDFAAESSELU

(END) Dow Jones Newswires

September 09, 2020 02:00 ET (06:00 GMT)

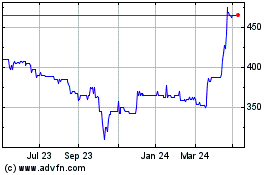

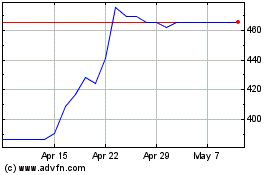

Aquis Exchange (LSE:AQX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aquis Exchange (LSE:AQX)

Historical Stock Chart

From Apr 2023 to Apr 2024