Aquis Exchange PLC New Senior Management Appointments

May 13 2021 - 1:00AM

RNS Non-Regulatory

TIDMAQX

Aquis Exchange PLC

13 May 2021

13 May 2021

Aquis Exchange PLC

("Aquis" or the "Company")

New senior management appointments

Strengthening the management team for future growth

Aquis Exchange PLC (AQX.L), the exchange services company, has

made a series of management changes to better reflect its

post-Brexit structure, as well as its future growth and expansion

plans for both its London and Paris offices.

David Stevens joined Aquis this month in the newly-created role

of Chief Revenue Officer. David, who will be based in London, will

oversee the sales and client servicing activities across all

geographies and across a number of Aquis' revenue streams - Aquis

Exchange, Aquis Stock Exchange and data. Prior to joining Aquis,

David was CEO of foreign exchange broker Global Reach Group.

Previous roles also include senior positions at Investment

Technology Group, JP Morgan and Goldman Sachs.

Graham Dick, who currently holds the role of Head of Sales for

the Company as well as CEO of Aquis Exchange Europe, is retiring.

He will, however, remain as a consultant to the Company. Jonathan

Clelland, the Company's Chief Financial Officer and Chief Operating

Officer will be moving to Paris in the summer and will take on the

additional role of Chief Executive Officer of Aquis Exchange

Europe, subject to regulatory approval from the French authorities.

Jonathan is a fluent French speaker and previously worked in

France. Jonathan will continue in his other roles.

In the finance department, Richard Fisher joined Aquis as

Director of Finance earlier in the year and is based in London.

Prior to joining Aquis, Richard was Director of Finance at Redwood

Bank and other previous roles include Chief Accountant at RBS

Group. Richard's appointment follows that of CTO Viet Lee's arrival

in 2020.

Alasdair Haynes, Chief Executive Officer of Aquis,

commented:

"As Aquis continues to grow and we adapt to the post-Brexit

landscape, we have decided to further strengthen both the team

overall and, in particular, to increase our presence in Paris by

basing the Company CFO/COO in France rather than the UK.

I want to thank Graham for his huge contribution to Aquis over

the last 7 years and I am very grateful that he has agreed to stay

on as a consultant to the Company. His knowledge of markets is vast

and, I believe, he has still much to give our community.

Lastly, I want to welcome Richard and David onboard. I have

worked with David in the past and I know he will be a great asset

to the management team as Aquis continues to expand. I believe we

now have the right group of people in place to drive the business

to the next level."

- Ends -

Enquiries:

Aquis Exchange PLC Tel: +44 (0) 20 3597 6321

Alasdair Haynes, CEO

Jonathan Clelland, CFO and COO

Belinda Keheyan, Head of Marketing +44 (0) 7768 078 110

Liberum Capital Limited (Nominated Adviser Tel: +44 (0) 20 3100 2000

and Joint Broker)

Clayton Bush

Chris Clarke

Edward Thomas

Kane Collings

Canaccord Genuity Limited (Joint Broker) Tel: +44 (0) 20 7523 8000

Emma Gabriel (Corporate Broking)

Jeremy Grime (Specialist Sales)

Alma PR (Financial PR Adviser) Tel: +44 (0)20 3405 0209

Susie Hudson aquis@almapr.co.uk

Kieran Breheny

Faye Calow

Notes to editors:

Aquis Exchange PLC is an exchange services group, which operates

pan-European cash equities trading businesses (Aquis Exchange),

growth and regulated primary markets (Aquis Stock Exchange/AQSE)

and develops/licenses exchange software to third parties (Aquis

Technologies).

Aquis Exchange is authorised and regulated by the UK Financial

Conduct Authority and France's Autorité des Marchés Financiers to

operate Multilateral Trading Facility businesses in the UK and in

EU27 respectively. Aquis operates a lit order book and does not

allow aggressive non-client proprietary trading, which has resulted

in lower toxicity and signalling risk on Aquis than other trading

venues in Europe. According to independent studies, trades on Aquis

are less likely to lead to price movement than on other lit

markets. Aquis uses a subscription pricing model which works by

charging users according to the message traffic they generate,

rather than a percentage of the value of each stock that they

trade.

Aquis Stock Exchange (AQSE) is a stock market providing primary

and secondary markets for equity and debt products. It is

authorised as a Recognised Investment Exchange, which allows it to

operate a regulated listings venue. The AQSE Growth Market is

divided into two segments 'Access' and 'Apex', with different

levels of admission criteria. The Access market focuses on earlier

stage growth companies, while Apex is the intended market for

larger, more established businesses.

Aquis Technologies is the software and technology division of

Aquis Exchange PLC. It creates and licenses cutting-edge,

cost-effective matching engine and trade surveillance technology

for banks, brokers, investment firms and exchanges.

Aquis Exchange PLC (AQX.L) is listed on the Alternative

Investment Market of the LSE (AIM) market. For more information,

please go to www.aquis.eu

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRASFSFMEEFSEDI

(END) Dow Jones Newswires

May 13, 2021 02:00 ET (06:00 GMT)

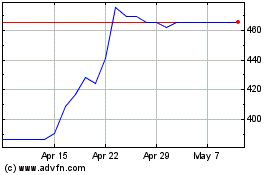

Aquis Exchange (LSE:AQX)

Historical Stock Chart

From Mar 2024 to Apr 2024

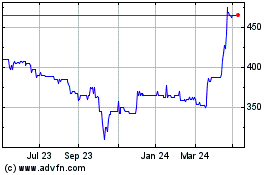

Aquis Exchange (LSE:AQX)

Historical Stock Chart

From Apr 2023 to Apr 2024