Arkle Resources PLC Placing to Accelerate Gold and Zinc Exploration (3552W)

August 17 2020 - 7:52AM

UK Regulatory

TIDMARK

RNS Number : 3552W

Arkle Resources PLC

17 August 2020

17th August 2020

Arkle Resources PLC

("Arkle" or the "Company")

Placing to Accelerate Gold and Zinc Exploration

Arkle Resources (AIM:ARK), the Irish Gold and Zinc resources

discovery company, is pleased to announce an oversubscribed placing

of GBP600,000 ("Placing") for 75,000,000 new ordinary shares at a

price of 0.8p per share ("Placing Shares"). The Placing will fully

fund the Company's planned sampling and drilling campaigns through

to the end of 2021 on its gold properties at Mine River and

Donegal. In addition, the funds will be used for the anticipated

2021 drilling programme for zinc in Limerick at the Stonepark Joint

Venture ("JV") and in surrounding areas, as well as for general

corporate activities.

Highlights

-- Oversubscribed placing raised gross cash proceeds of

GBP600,000 at 0.8p per share with a one for one warrant exercisable

at 1.20p each, with a term of 2 years ("Placing Warrants").

-- Capital raised to fund increasing exploration on Arkle's

Irish gold targets at Mine River and Donegal.

-- Mine River and Donegal are two strategic block of licences

100% owned by Arkle. Mine River has a 15 kilometre gold bearing

trend.

-- The funds will also be used for preparation and drilling for

zinc in Limerick at the Stonepark JV and in surrounding areas.

-- Stonepark contains a maiden Inferred Mineral Resource

totalling 5.1 million tonnes at 8.7% zinc and 2.6% lead, occurring

at depths from 190m to 395m below surface. The project lies

adjacent to Glencore's Pallas Green deposit which contains 45.4

million tonnes at 7% zinc and 1% lead, from 300m to 1,300m below

surface.

-- With this funding, Arkle is fully funded through 2021 and

should the Placing Warrants be fully exercised, a further

GBP900,000 in gross proceeds shall be received and Arkle would be

fully funded well into 2022.

John Teeling, Chairman and CEO, commented. "This cash raise

funds our ongoing gold and zinc exploration programmes until the

end of 2021. We have crews working at both Mine River and Donegal

targeting gold while drilling will commence this month on the

Stonepark zinc project. Follow up drilling is anticipated on all

three projects and we look forward to reporting back to

shareholders on the results of those activities."

ADMISSION, WARRANTS AND TOTAL VOTING RIGHTS

The Placing has raised GBP600,000 (before expenses), comprising

75,000,000 new ordinary shares at 0.8p per share. The issue of the

Placing Shares and the possible issue of new Ordinary Shares from

the exercise of the Placing Warrants, are made under the Company's

existing share authorities.

An application will be made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM ("Admission"). It

is expected that Admission will become effective and that dealings

in the Placing Shares on AIM will commence on or around 7 September

2020.

The Placing Warrants will not be admitted to trading on AIM or

any other stock market and will not be transferable. The issue of

the Placing Warrants is subject to Admission.

In accordance with the FCA's Disclosure Guidance and

Transparency Rules, the Company confirms that on completion of the

Placing and following Admission, the Company's enlarged issued

ordinary share capital will comprise 291,044,926 Ordinary

Shares.

The Company does not hold any Ordinary Shares in Treasury.

Therefore, following Admission, the above figure may be used by

shareholders in the Company as the denominator for the calculations

to determine if they are required to notify their interest in, or a

change to their interest in the Company, under the FCA's Disclosure

Guidance and Transparency Rules.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this announcement.

In addition, market soundings (as defined in MAR) were taken in

respect of the matters contained in this announcement, with the

result that certain persons became aware of inside information (as

defined in MAR), as permitted by MAR. This inside information is

set out in this announcement. Therefore, those persons that

received inside information in a market sounding are no longer in

possession of such inside information relating to the company and

its securities.

ENDS

Enquiries:

Arkle Resources PLC

John Teeling, Chairman +353 (0) 1 833 2833

Jim Finn, Finance Director +353 (0) 1 833 2833

SP Angel Corporate Finance LLP

Nominated Advisor & Joint Broker

+44 (0) 203 470

Matthew Johnson/Soltan Tagiev 0470

First Equity Limited

Joint Broker

+44 (0) 207 374

Jason Robertson 2212

+44 (0) 207 138

Blytheweigh 3204

Megan Ray

Rachael Brooks

Teneo

Luke Hogg +353 (0) 1 661 4055

Thomas Shorthall +353 (0) 1 661 4055

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBDGDIISBDGGR

(END) Dow Jones Newswires

August 17, 2020 08:52 ET (12:52 GMT)

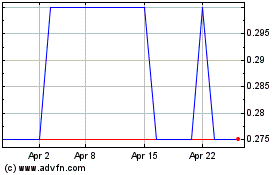

Arkle Resources (LSE:ARK)

Historical Stock Chart

From Mar 2024 to Apr 2024

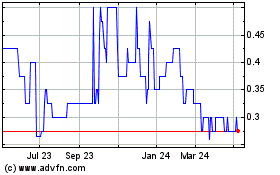

Arkle Resources (LSE:ARK)

Historical Stock Chart

From Apr 2023 to Apr 2024