TIDMARK

RNS Number : 4419N

Arkle Resources PLC

30 September 2021

30(th) September 2021

Arkle Resources PLC

("Arkle" or the "Company")

Interim Statement for the period ended 30 June 2021

Chairman's Statement

Arkle is an active gold and zinc explorer focused on Ireland

(Exhibit 1) -

http://www.rns-pdf.londonstockexchange.com/rns/4419N_1-2021-9-29.pdf

We believe the current high prices for gold and zinc are being

overlooked by investors particularly in AIM shares. Gold at $1,740

per ounce, or over $55 US per gram, is very attractive to miners.

Zinc is over $3,000 per ton. This is very profitable for existing

zinc mining and is an incentive to explorers, against the economic

turmoil of recent years which has significantly reduced exploration

activities.

The economic risk/reward of investing in mineral exploration

should be more attractive, but investors are attaching far higher

risks to the potential reward.

Gold

The principal focus of activity is the Mine River project on the

Wexford/Wicklow borders where ongoing drilling has produced some

spectacular results and greatly extended the mineralised zones

around the Tombreen area.

Arkle has been exploring the Wexford/Wicklow gold trend for some

years. Narrow vein gold exploration is a painstaking business where

veins pinch and swell and can disappear due to faulting and

folding. Irish vein gold is often "nuggety" in nature which means

exactly what is says, much of the gold is in nuggets. Drilling

needs to find the gold bearing veins and then the geologists need

to interpret the results. Very high grades usually means the drill

hole hit a nugget or nuggets. Lower grades can mean the drill hole

missed the nuggets by millimetres, but there may be gold there.

Repeated soil sampling, geophysical and drilling campaigns has

identified a 15km trend along the Wicklow hills. We have narrowed

the high grade areas down to a 3km stretch between two areas:

Knocknalour and Tombreen. Refined soil sampling and trenching

between 2018 and 2020 identified new mineralised zones particularly

around Tombreen. This is the location of the current drilling

programme which has been twice extended due to positive results.

Tombreen West, some 900 metres west from the historic drilling at

Tombreen Main returned gold mineralisation in three drill holes.

Reviewing these results as well as drilling results from deeper

drilling at Tombreen Main suggested further gold veins at depths

below 100 metres in Tombreen West. Drilling to 200 metres is

ongoing.

The rig moved to Tombreen Main where some excellent results were

obtained including the spectacular hole 21-TB-11 which returned 0.5

metres at 51.6 g/t in a 2.5 metre zone averaging 12.13 g/t.

Additional step out drilling is planned here.

While awaiting drilling results, the rig moved to drill Anomaly

A, (Exhibit 2) -

http://www.rns-pdf.londonstockexchange.com/rns/4419N_2-2021-9-29.pdf

a recently discovered but never drilled anomaly, 300 metres

Southwest of Tombreen Main. Visual inspection of the core from the

first drill hole indicated mineralisation at a number of levels.

Step out holes are underway.

The early results from Anomaly A have encouraged us to trench

Anomalies B and C Southwest of Tombreen West (Exhibit 2) -

http://www.rns-pdf.londonstockexchange.com/rns/4419N_2-2021-9-29.pdf

. This drilling is planned for October 2021.

We will need to pause the drilling programme in the near future

to analyse and evaluate what we have found but we are very

encouraged by the results so far.

At Inishowen there had been a lull in exploration following the

successful drilling campaign in 2017. Subsequent prospecting in the

years that followed did not identify the extension of the veins at

Meeneragh or find other significant new gold targets in the area.

We then introduced new technology. The soil sampling technique that

was born out of the Mine River project in 2019 which proved to be

extremely successful was then deployed at Inishowen. The strategy

was twofold: find the 'lost veins' and identify new areas for

follow up. The approach paid off following a trenching programme at

the end of 2020. Not only did we discover new areas for follow up

but we found new gold bearing outcrops and the extension of the

'lost veins' with grades as high as 40.7g/t gold. This programme is

deferred due to the focus on Wexford/Wicklow and while we wait for

state approvals.

Zinc

Stonepark was for a long time the flagship project for Arkle.

Over 180 holes were drilled discovering over 5 million tons grading

over 11 per cent. zinc and lead. Among zinc discoveries worldwide,

this is high grade. The mineralisation is in three separate zones

and is adjacent to the large, 45 million ton plus, Pallas Green

zinc discovery owned by Glencore.

Arkle is a minority partner (23.44%) in this project with Group

Eleven, a Toronto listed zinc explorer, controlling the balance.

Group Eleven, which is also the operator, believes that a

geological trend containing zinc and lead runs Southeast to

Northwest from Ballywire about 20km Southeast of Stonepark through

to Stonepark and Pallas Green. Group Eleven controls the ground to

the Southeast of the five Stonepark licences and have some very

strong drilling results at Ballywire and at Carrickittle. In 2019

Group Eleven drilled Kilteely on the Stonepark licences close to

the border with Carrickittle with positive results. The

mineralisation discovered was deeper than that at Stonepark.

A recently issued update by Group Eleven improved the

prospectively of the Kilteely ground. Magnetic surveys confirmed

the Northwest trend running from Ballywire through Carrickittle and

Kilteely and on to the discoveries at Stonepark and Pallas Green.

Group Eleven expects to drill in the Carrickittle area in the

coming weeks Group Eleven intend to drill on the Stonepark licences

in Q1 2022. It is the current intention of Arkle to pay their

share. It is important to point out that Arkle can agree to

participate or dilute.

In 2020 a proposal to acquire and rapidly drill the Stonepark

ground was received. The proposal was acceptable to Arkle but not

to Group Eleven. Arkle has protection in this area in that it has a

pre-emption right on any proposed buyout.

Future

The future looks bright. We are going to continue our investment

in gold and zinc exploration. We have adequate funds to meet

current and expected exploration expenditure.

John Teeling

Chairman

29(th) September 2021

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries:

Arkle Resources PLC

John Teeling, Chairman +353 (0) 1 833 2833

Jim Finn, Finance Director +353 (0) 1 833 2833

SP Angel Corporate Finance LLP

Nominated Adviser and Joint Broker

Matthew Johnson/Adam Cowl +44 (0) 203 470 0470

First Equity Limited

Joint Broker

Jason Robertson +44 (0) 207 374 2212

Blytheweigh +44 (0) 207 138 3204

Megan Ray

Rachael Brooks

Teneo

Luke Hogg +353 (0) 1 661 4055

Ciara Wylie +353 (0) 1 661 4055

Arkle Resources plc

Financial Information (Unaudited)

Condensed Consolidated Statement of Comprehensive Year

Income Six Months Ended Ended

30 June 30 June 31 Dec

21 20 20

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

Administrative expenses (148) (226) (324)

Impairment of exploration and evaluation

assets - - (330)

----------------- ---------- ---------

OPERATING LOSS (148) (226) (654)

Gain/(Loss) due to fair value volatility

of warrants 185 - (442)

----------------- ---------- ---------

PROFIT/(LOSS) BEFORE TAXATION 37 (226) (1,096)

Income tax expense - - -

PROFIT//(LOSS) FOR THE PERIOD AND TOTAL COMPREHENSIVE

INCOME 37 (226) (1,096)

================= ========== =========

PROFIT/(LOSS) PER SHARE - basic and diluted 0.01c (0.14c) (0.50c)

================= ========== =========

30 June 30 June 31 Dec

Condensed Consolidated Balance Sheet 21 20 20

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

NON-CURRENT ASSETS

Intangible Assets 3,514 3,607 3,373

----------------- ---------- ---------

CURRENT ASSETS

Other receivables 61 11 22

Cash and cash equivalents 571 252 685

----------------- ---------- ---------

632 263 707

----------------- ---------- ---------

TOTAL ASSETS 4,146 3,870 4,080

----------------- ---------- ---------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables (294) (180) (177)

Warrants (653) (18) (906)

----------------- ---------- ---------

NET CURRENT LIABILITIES (315) 65 (376)

NET ASSETS 3,199 3,672 2,997

================= ========== =========

EQUITY

Share Capital - Deferred Shares 992 992 992

Share Capital - Ordinary Shares 765 540 742

Share Premium 6,680 6,557 6,606

Share based remuneration reserve 127 123 127

Retained deficit (5,365) (4,540) (5,470)

TOTAL EQUITY 3,199 3,672 2,997

================= ========== =========

Condensed Consolidated Statement of Changes

in Shareholders Equity

Called-up Called-up

Share Share Share

Capital Capital Share Based Retained

Deferred Ordinary Premium Reserves Deficit Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

As at 1 January 2020 - 1,323 6,209 45 (4,314) 3,263

Sub-division of shares 992 (992) - - - -

Share options granted - - - 78 - 78

Issue of shares - 209 348 - - 557

Loss for the period - - - - (226) (226)

As at 30 June 2020 992 540 6,557 123 (4,540) 3,672

------------- ------------ ----------------- ---------- --------- --------

Share options granted - - - 4 - 4

Issue of shares - 202 49 - - 251

Share issue expenses - - - - (60) (60)

Loss for the period - - - - (870) (870)

As at 31 December 2020 992 742 6,606 127 (5,470) 2,997

------------- ------------ ----------------- ---------- --------- --------

Issue of shares - 23 74 - - 97

Fair value of warrants

exercised - - - - 68 68

Loss for the period - - - - 37 37

As at 30 June 2021 992 765 6,680 127 (5,365) 3,199

============= ============ ================= ========== ========= ========

Condensed Consolidated Cash Flow Six Months Ended Year Ended

30 June 30 June 31 Dec

21 20 20

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CASH FLOW FROM OPERATING ACTIVITIES

Profit/(Loss) for the year 37 (226) (1,096)

Impairment of exploration and evaluation

assets 0 0 330

Share based payments charge 0 35 42

Fair value movement of warrants (185) 0 442

Foreign exchange (27) 0 (5)

---------- ---------- -----------

(175) (191) (287)

Movements in working capital 78 (36) (49)

---------- ---------- -----------

NET CASH USED IN OPERATING ACTIVITIES (97) (227) (336)

CASH FLOW FROM INVESTING ACTIVITIES

Payments for exploration and evaluation (141) (118) (218)

---------- ---------- -----------

NET CASH USED IN INVESTING ACTIVITIES (141) (118) (218)

---------- ---------- -----------

CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from issue of equity shares 97 557 1,254

Share issue expenses 0 0 (60)

---------- ---------- -----------

NET CASH FROM FINANCING ACTIVITIES 97 557 1,194

---------- ---------- -----------

NET (DECREASE)/INCREASE IN CASH AND CASH

EQUIVALENTS (141) 212 640

Cash and Cash Equivalents at beginning

of the period 685 40 40

Effects of exchange rate changes on cash

held in foreign currencies 27 0 5

CASH AND CASH EQUIVALENTS AT OF THE

PERIOD 571 252 685

========== ========== ===========

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2021

and the comparative amounts for the six months ended 30 June 2020

are unaudited.

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. The interim financial statements have been

prepared applying the accounting policies and methods of

computation used in the preparation of the published consolidated

financial statements for the year ended 31 December 2020.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2020, which are available on the Company's website

www.arkleresources.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. No dividend is proposed in respect of the period.

3. LOSS PER SHARE

30 June 30 June 31 Dec

21 20 20

EUR EUR EUR

Profit/(Loss) per share - Basic

and Diluted 0.01c (0.14c) (0.50c)

============== ============== ==============

Basic profit/(loss) per share

The earnings and weighted average number of ordinary shares used

in the calculation of basic loss per share are as follows:

EUR'000 EUR'000 EUR'000

Profit/(Loss) for the year attributable

to equity holders of the parent 37 (226) (1,096)

============== ============== ==============

Weighted average number of ordinary

shares for the purpose of basic

earnings per share 305,051,947 166,401,091 220,039,097

============== ============== ==============

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

4. INTANGIBLE ASSETS

30 June 21 30 June 20 31 Dec 20

Exploration and evaluation assets: EUR'000 EUR'000 EUR'000

Cost at 1 January 3,373 3,446 3,446

Additions 141 161 258

Impairment - - (330)

----------- ----------- ----------

Closing Balance 3,514 3,607 3,373

=========== =========== ==========

In 2012 the Group entered into an agreement with Teck Ireland

Limited ("Teck"), a subsidiary of Teck Resources Limited, which

gave Teck the option of earning a 75% interest in licences held by

the Group in Cavan/Meath by spending EUR1.35 million on the

licences in order to earn the option to acquire 75% interest. As

per the agreement the licences had been transferred into a new

company, Oldcastle Zinc Limited. As at 31 December 2019 Teck had

completed EUR1.35 million worth of expenditure to give them a total

of 75% in the company.

On 10 November 2020, the Group and Teck Ireland Limited agreed

to terminate the Oldcastle agreement and dissolve the joint

venture. Accordingly, the directors have impaired in full all

expenditure relating to the Oldcastle licences, resulting in an

impairment charge of EUR330,000 in the prior year.

In 2007 the Group entered into an agreement with Teck Cominco

which gave Teck Cominco the option to earn a 75% interest in a

number of other licences held by the Group. Teck Cominco had to

spend CAD$3m to earn the interest. During 2012 the relevant

licences were transferred to a new company, TILZ Minerals Limited,

which at 30 June 2021 was owned 23.44% (2020: 23.44%) by Limerick

Zinc Limited (subsidiary of Arkle Resources plc) and 76.56% (2020:

76.56%) by Group Eleven Resources Corp (third party).

On 13 September 2017 t he board of Arkle Resources plc were

informed that Group Eleven Resources Corp. a private company, has

acquired the 76.56% interest held by Teck Ireland in TILZ Minerals.

Arkle Resources plc owns the remaining 23.44%.

The Group's share of expenditure on the licences continues to be

capitalised as an exploration and evaluation asset. The Group is

subject to cash calls from Group Eleven Resources Corp. in respect

of the financing of the ongoing exploration and evaluation of these

licences. In the event that the Group decides not to meet these

cash calls its interest in TILZ Minerals Limited may be diluted

accordingly.

The realisation of the intangible assets is dependent on the

discovery and successful development of economic reserves which is

subject to a number of risks as outlined below. Should this prove

unsuccessful the carrying value included in the balance sheet would

be written off to the statement of comprehensive income.

The group's activities are subject to a number of significant

potential risks including;

- Uncertainties over development and operational risks;

- Compliance with licence obligations;

- Ability to raise finance to develop assets;

- Liquidity risks; and

- Going concern risks.

The directors are aware that by its nature there is an inherent

uncertainty in such exploration and evaluation expenditure as to

the value of the asset. Having reviewed the carrying value of

exploration and evaluation of assets at 30 June 2021, the directors

are satisfied that the value of the intangible asset is not less

than carrying value.

30 June 21 30 June 20 31 Dec 20

Segmental Analysis EUR'000 EUR'000 EUR'000

Limerick 1,600 1,600 1,600

Oldcastle - 330 -

Rest of Ireland 1,914 1,677 1,773

----------- ----------- ----------

Closing Balance 3,514 3,607 3,373

=========== =========== ==========

5. SHARE CAPITAL AND SHARE PREMIUM

On 22 April 2020 the Company converted the 132,311,593 existing

ordinary shares of 1c each into 132,311,593 ordinary shares of

0.25c each and 132,311,593 deferred shares of 0.75c each.

Share Share Premium

Number Capital EUR'000

EUR'000

Allotted, Called Up and Fully

Paid:

Deferred Shares - nominal value

of 0.75c

132,311,593 deferred shares of

0.75c each 132,311,593 992 -

============ ========= ==============

Ordinary Shares - nominal value

of 0.25c

Balance at 1 January 2020 132,311,593 1,323 6,209

Transfer to deferred shares - (992) -

Issued during the period 83,733,333 209 348

Balance at 30 June 2020 216,044,926 540 6,557

Issued during the period 81,000,000 202 49

------------ --------- --------------

Balance at 31 December 2020 297,044,926 742 6,606

Issued during the period 8,937,500 23 74

Balance at 30 June 2021 305,982,426 765 6,680

============ ========= ==============

Movement in shares

On 19 January 2021, a total of 3,000,000 shares were issued on

the exercise of 3,000,000 warrants at a price of 0.5p per share to

provide additional working capital and fund development costs.

On 19 January 2021, a total of 5,937,500 shares were issued on

the exercise of 5,937,500 warrants at a price of 1.2p per share to

provide additional working capital and fund development costs.

6. SHARE BASED PAYMENTS - OPTIONS

30 June 21 Weighted average 30 June 20 Weighted average 31 Dec 20 Weighted average

exercise price in exercise price in exercise price in

pence pence pence

'000 '000 '000

Outstanding at

beginning of

period 13,100 1.22 2,800 2.276 2,800 2.276

Granted during the

period - 9,000 0.95 10,300 0.93

Expired during the - - - - -

period

----------- ------------------ ----------- ------------------ ---------- ------------------

Outstanding at end

of period 13,100 1.22 11,800 1.26 13,100 1.22

=========== ================== =========== ================== ========== ==================

Exercisable at end

of period 13,100 1.22 11,800 1.26 13,100 1.22

=========== ================== =========== ================== ========== ==================

7. SHARE BASED PAYMENTS - WARRANTS

Fair Value

30 June 21 30 June 20 31 Dec 20

EUR'000 EUR'000 EUR'000

At 1 January 906 18 18

FV of warrants issued at grant date - - 446

Exercised (68) - -

Movement in fair value (185) - 442

----------- ----------- ----------

Closing Balance 653 18 906

=========== =========== ==========

Number

30 June 21 30 June 20 31 Dec 20

'000 '000 '000

Outstanding at beginning of period 119,400 46,203 46,203

Granted during the period - 50,400 125,400

Exercised during the period (8,937) - (6,000)

Expired during the period - (27,803) (46,203)

----------- ----------- ----------

Closing Balance 110,463 68,800 119,400

=========== =========== ==========

On 1 January 2021 a total of 44,400,000 warrants with an

exercise price of 0.5p per warrant were outstanding. On 19 January

2021 a total of 3,000,000 warrants with a fair value of EUR27,665

were exercised. The fair value for the remaining 41,400,000

warrants as at 30 June 2021 was EUR299,988. The gain due to the

movement in fair value of EUR68,387 was expensed to the

Consolidated Statement of Comprehensive Income. The fair value was

calculated using the Black-Scholes valuation model.

The inputs into the Black-Scholes valuation model as at 30 June

2021 were as follows:

Weighted average share price at 30 June

2021 (in pence) 1.00p

Weighted average exercise price (in pence) 0.50p

Expected volatility 125.93%

Expected life 0.81 years

Risk free rate 0.1%

Expected dividends None

On 1 January 2021 a total of 75,000,000 warrants with an

exercise price of 1.2p per warrant were outstanding. On 19 January

2021 a total of 5,937,500 warrants with a fair value of EUR40,345

were exercised. The fair value for the remaining 69,062,500

warrants as at 30 June 2021 was EUR353,199. The gain due to the

movement in fair value of EUR116,614 was expensed to the

Consolidated Statement of Comprehensive Income. The fair value was

calculated using the Black-Scholes valuation model.

The inputs into the Black-Scholes valuation model were as

follows:

Weighted average share price at 30 June

2021 (in pence) 1.00p

Weighted average exercise price (in pence) 1.2p

Expected volatility 119.42%

Expected life 1.19 years

Risk free rate 0.1%

Expected dividends none

8. POST BALANCE SHEET EVENTS

There are no material post balance sheet events affecting the

Company.

9. The Interim Report for the six months to 30 June 2021 was

approved by the Directors on 29(th) September 2021.

10. The Interim Report will be available on Arkle Resources

PLC's website www.arkleresources.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCUBDDGBC

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

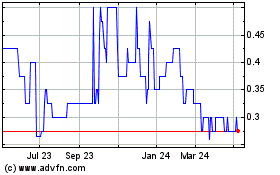

Arkle Resources (LSE:ARK)

Historical Stock Chart

From Mar 2024 to Apr 2024

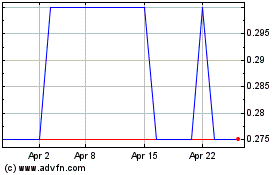

Arkle Resources (LSE:ARK)

Historical Stock Chart

From Apr 2023 to Apr 2024