TIDMARS

RNS Number : 4114A

Asiamet Resources Limited

01 June 2021

1 June 2021

Business Update - BKM Copper Project

Asiamet Resources Limited ("Asiamet" or the "Company") is

pleased to provide an update with respect to several key

workstreams in progress at the BKM copper development project and

the Kalimantan Suraya Kencana Contract of Work ("KSK CoW") located

in Central Kalimantan, Indonesia.

Highlights

-- Value Enhancement works related to transitioning the BKM

copper mine development from a heap leach to tank leach processing

route is making solid progress. Capex and Opex estimates expected

in late July will be used as inputs to update the BKM project

economics.

-- Options for direct shipping of high grade, high value

polymetallic ore from the BKZ deposit is being investigated with

commodity trading companies for potential offtake or smelter feed.

Required metallurgy work will be undertaken from the upcoming

drilling programme.

-- Field Activities - IP geophysical programme results due in

July. Drilling high-priority targets for resource expansion

proximal to BKM is planned to commence in June.

-- Permitting and Community Engagement - continued strong

progress on permitting front, with conditional approval for key

Pinjam Pakai Permit expected over the next 4-6 weeks.

-- Partner Discussions - BKM as one of few shovel ready copper

projects in Asia is seeing strong interest from a number of

Indonesian, Asian and US investors. Good progress is being

made.

Value Enhancement Activities

Value engineering activities related to developing the BKM

copper mine using tank leach processing (vs Heap Leach) is making

solid progress. As part of this workstream, consultants NewPro

engineering will review the capital and operating cost estimates

for the project.

Asiamet expects to receive the revised estimates by mid-late

July 2021 and will then complete an update of the project

economics. The project team led by Andrew Neale are also reviewing

important initiatives related to logistics, reducing power and

environmental costs.

Field Activities - Drilling and IP Geophysics

Field activities have commenced at site including mobilisation

of drilling equipment and line cutting for a 30km Induced

Polarisation (IP) geophysical survey. Drilling of high potential

targets close to the planned BKM copper mine development is

expected to commence in late June overseen by Chief Consulting

Geologist, Pat Creenaune.

The IP survey will allow the Company to better target its

drilling in areas that are yet to be tested and increasing the

probability of successfully adding to the existing mineral

inventory. Results from the IP programme are expected in July, with

drilling in those areas to commence once data has been

assessed.

Increasing the mineral inventory further de-risks the BKM copper

project as part of the financing process through increased mine

life, higher annual production and stronger support for the initial

capital investment and any future expansion.

BKZ High-Grade Polymetallic Zone - Direct Ship Ore

The project team have been investigating the potential for

producing a direct ship ore (DSO) from the near surface high grade

polymetallic (Zinc, Lead, Silver +/- Gold and Copper) BKZ Resource,

located approximately 800 metres north of the BKM copper

Reserve.

Initial discussions have been undertaken with various trading

companies for a potential offtake or feed into a smelter or metals

recovery plant. As part of this assessment, metallurgical testing

to determine the processing characteristics of the BKZ

mineralization will be undertaken from the upcoming drilling

programme.

Subject to the necessary permitting, the potential benefit of

any DSO product is early cash flow generation and hence further

significant de-risking of the BKM copper mine development. BKZ is a

Polymetallic (Cu-Pb-Ag-Pb-Au) deposit located close to BKM that is

zoned from an upper zinc-lead-silver+/- gold and copper to a lower

copper-silver bearing deposit.

The deposit is open in multiple directions and can be rapidly

expanded with further drilling.

Permitting / Community Engagement

Permitting for the key Pinjam Pakai (Borrow-to-Use Forestry

Permit) is making good progress through the Ministry of Environment

and Forestry with conditional approval expected in late June/early

July. This will be a significant milestone for the project and as

it enables the first phases of development and construction to

commence subject to meeting conditional requirements.

Work on secondary permits continues to progress in accordance

with the Company's timelines. Strong support from the local

community is continuing as engagement programs for the BKM copper

mine development are rolled out. This strong local level support

greatly assists in the approvals, secondary permitting, and land

acquisitions process.

Partner Discussions

With copper prices at multiyear highs underpinned by large

infrastructure programs and a major transition to renewable energy

underway, Asiamet is very well placed with one of a few shovel

ready copper projects in Asia.

As anticipated the Company has had significant inbound interest

from a number Indonesian, Asian and US investors seeking to partner

with the Company to develop the BKM project. Confidentiality

agreements have been signed with a small number of serious

investors and discussions are progressing well.

Tony Manini, Executive Chairman of Asiamet Resources

commented

"As per our strategy, work has been progressing on a number of

important value-adding workstreams simultaneously. Significant

progress has been made by Andrew Neale's team on pre-development

and value engineering work and we should soon have some updated

capital and operating costs to enable us to evaluate the tank leach

processing option for the BKM copper mine development.

At the BKZ deposit immediately adjacent to BKM we have

identified a very attractive high-grade, high value,

zinc-lead-silver+/-copper and gold resource that presents as a DSO

opportunity with the potential to generate early cashflow. We will

be assessing this opportunity in tandem with the other value

enhancement workstreams in progress. On the permitting front our

highly capable Indonesian team expect to receive the key forestry

permit shortly, a critical de-risking milestone for financing the

development of the project.

With copper prices at multiyear highs, the Company has had

significant inbound interest from investors seeking to partner with

us to develop the BKM copper project. Discussions are being

progressed with a select number of groups who can bring substantial

capability and value add to the BKM project financing and mine

development.

We have a lot of financing and development related activity in

progress and are looking forward to updating our stakeholders as

these important de-risking milestones materialise."

ON BEHALF OF THE BOARD OF DIRECTORS

Tony Manini, Executive Chairman

For further information, please contact:

-Ends-

Tony Manini

Executive Chairman, Asiamet Resources Limited

Email: tony.manini@ asiametresources .com

Investor Enquiries

Sasha Sethi

Telephone: +44 (0) 7891 677 441

Email: Sasha@flowcomms.com / info@asiametresources.com

Asiamet Resources Nominated Adviser

RFC Ambrian Limited

Bhavesh Patel / Stephen Allen

Telephone: +44 (0)20 3440 6800

Email: Bhavesh.Patel@rfcambrian.com / Stephen.Allen@rfcambrian.com

Optiva Securities Limited

Christian Dennis

Telephone: +44 20 3137 1903

Email: Christian.Dennis@optivasecurities.com

Follow us on twitter @AsiametTweets

FORWARD-LOOKING STATEMENT

This news release contains forward-looking statements that are

based on the Company's current expectations and estimates.

Forward-looking statements are frequently characterised by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", "suggest", "indicate" and other similar

words or statements that certain events or conditions "may" or

"will" occur. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such factors include, among others: the

actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans

continue to be refined; possible variations in ore grade or

recovery rates; accidents, labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals or

financing; and fluctuations in metal prices. There may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Company disclaims

any intent or obligation to update any forward-looking statement,

whether as a result of new information, future events or results or

otherwise. Forward-looking statements are not guarantees of future

performance and accordingly undue reliance should not be put on

such statements due to the inherent uncertainty therein.

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUASWRAVUNRRR

(END) Dow Jones Newswires

June 01, 2021 04:50 ET (08:50 GMT)

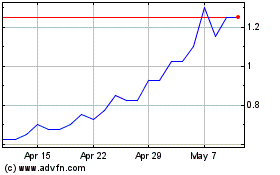

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From Apr 2023 to Apr 2024