TIDMASAI

RNS Number : 3794M

ASA International Group PLC

21 September 2021

ASA International Group plc August 2021 business update

Amsterdam, The Netherlands, 21 September 2021 - ASA

International, ('ASA International', the 'Company' or the 'Group'),

one of the world's largest international microfinance institutions,

today provides the following update of the impact of Covid-19 on

its business operations as at 31 August 2021.

-- Liquidity remains high with approximately USD 116m of

unrestricted cash and cash equivalents across the Group.

-- The pipeline of funding deals under negotiation totalled approximately USD 149m.

-- With the exception of India, Sri Lanka, Myanmar, Sierra

Leone, Uganda and Rwanda, all other operating companies achieved

collection efficiency of more than 95%.

-- India collections slightly improved to 60% as markets recover

from recent lockdowns. Collection efficiency, excluding loans from

clients receiving the one-time loan restructuring offered by the

Reserve Bank of India ('RBI'), increased to 89% from 86% in

July.

-- Sri Lanka collections improved significantly until the

imposition of nationwide lockdowns from 20 August to 13

September.

-- No collections in Myanmar due to a stay-at-home policy

mandated by the government from 17 July to 10 September due to a

sharp increase of Covid-19 infections.

-- Uganda collections did not improve due to local lockdowns and

travel restrictions remaining in certain areas.

-- Portfolio quality remained challenging, particularly in

India, with benchmark PAR>30 for the Group, including off-book

loans and excluding loans overdue more than 365 days, improving to

15.3% from 16.5% in July 2021, and PAR>90 slightly increasing to

11.3% from 11.0% in July 2021.

-- The Group's operating subsidiaries, excluding India, the

Philippines and Myanmar, collectively have been able to reduce

PAR>30 to 3.1%.

-- Disbursements as percentage of collections exceeded 100% in 5

countries with much lower percentages seen in India, Myanmar and

Sri Lanka, due to the rapid spread of the Delta variant in these

countries, which caused, amongst others, additional lockdowns and

other Covid-19 related restrictions.

-- The number of clients remained around 2.5m, while Gross OLP

remained around USD 442m (7% higher than in August 2020).

-- The moratoriums granted in August amounted to USD 48.8 m,

primarily due to the loan restructuring of certain distressed

clients in India as per the RBI guidelines.

Health impact of COVID-19 on staff and clients

-- The immediate health impact of Covid-19 on the Company's

operations substantially increased with 395 of over 12,800 staff

members confirmed as infected since March 2020 , with two deaths .

Since March 2020, confirmed infections amongst 2.5m clients

increased from 11,330 at the end of July 2021 to 16,644 as at 31

August 2021, resulting in 551 deaths since the start of the

pandemic. Of the 551 client deaths across the Group, 407 are from

Myanmar, with 214 of those deaths occurring in August 2021.

Funding

-- Unrestricted cash and cash equivalents remained high at approximately USD 116m.

-- The Company secured approximately USD 20m of new loans from

local and international lenders in August 2021.

-- The majority of the Company's USD 149m pipeline of future

wholesale loans are supported by (agreed) term sheets and/or draft

loan documentation. The terms and conditions of the remaining loans

are being negotiated with lenders.

Collection efficiency until 31 August 2021 (1,2)

Countries Jan/21 Feb/21 Mar/21 Apr/21 May/21 Jun/21 Jul/21 Aug/21

------- ------- ------- ------- ------- ------- -------

India 82% 84% 87% 87% 67% 55% 58% 60%

Pakistan 98% 99% 99% 99% 99% 99% 99% 99%

Sri Lanka 97% 90% 91% 93% 57% 76%(3) 76% 80%(3)

The Philippines 75% 80% 85% 84% 89% 99% 100% 99%

Myanmar 89% 78% 59% 55% 67% 70% 64%(4) Nil(5)

Ghana 99% 100% 100% 100% 99% 99% 99% 99%

Nigeria 95% 97% 96% 95% 94% 96% 96% 96%

Sierra Leone 95% 89% 96% 93% 92% 94% 93% 92%

Kenya 97% 98% 100% 100% 99% 99% 99% 99%

Uganda 87% 93% 99% 100% 100% 95% 83% 84%

Tanzania 99% 100% 100% 100% 100% 100% 100% 100%

Rwanda 93% 91% 96% 95% 96% 96% 96% 94%

Zambia 100% 100% 100% 100% 99% 100% 100% 99%

----------------- ------- ------- ------- ------- ------- ------- ------- -------

(1) Collection efficiency refers to actual collections from

clients divided by expected collections for the period; since

any moratorium/restructuring on the repayment of loans are only

granted to clients after the end of the month, the collection

efficiency is not affected by the grant of such moratorium/restructuring.

(2) As of December 2020, the definition of collection efficiency

has been amended in view of the increased amount of overdue

collection and advance payments in various countries to: the

sum of actual regular collections, actual overdue collections

and actual advance payments divided by the sum of expected regular

collections, actual overdue collections and actual advance payments.

This also means that collection efficiency no longer can exceed

100%.

(3) The collection efficiency for 1-15 June 2021 and for 20

-31 August 2021 is nil due to the lockdowns in Sri Lanka. Only

the collection efficiency for 16-30 June 2021 and 1-19 August

2021 is provided.

(4) Collection efficiency for 1-16 July 2021. The collection

efficiency for 17-31 July is nil due to the holiday from 17

July to 1 August 2021, announced by the Myanmar Government,

so only the collection efficiency for 1-16 July 2021 is provided.

(5) Collection efficiency for August 2021 is nil due to the

stay-at-home policy from 1 August to 10 September 2021, announced

by the Myanmar Government.

-- Collection efficiency across the Group increased or remained

broadly stable compared to the previous month in all countries

.

-- Collections in India improved marginally to 60 % as clients'

businesses continue to slowly recover from the impact of recent

lockdowns in most states. Collection efficiency, excluding

instalments due from clients receiving the one-time loan

restructuring, increased to 89% from 86% in July.

-- Collections in Sri Lanka increased to 80% prior to new

nationwide lockdowns introduced from 20 August to 13 September

2021.

-- No collections in Myanmar due to a stay-at-home policy

announced by the government, which was caused by a sharp increase

of Covid-19 infections.

-- In Uganda collections remained unchanged with local lockdowns

and travel restrictions remaining in certain areas.

Loan portfolio quality up to and including August

2021(6,7,8)

Gross OLP (in USDm) Non-overdue loans PAR>30 less PAR>180

------------------------------------- ------------------------- -------------------------

Jun/21 Jul/21 Aug/21 Jun/21 Jul/21 Aug/21 Jun/21 Jul/21 Aug/21

India

(total) 153 144 140 58.3% 56.6% 55.4% 14.0% 14.6% 14.6%

Pakistan 75 74 74 98.4% 98.4% 98.4% 0.3% 0.3% 0.3%

Sri Lanka 8 8 8 59.4% 68.7% 63.5% 9.5% 8.3% 8.2%

Philippines 55 52 55 76.6% 77.3% 76.3% 17.3% 4.2% 1.9%

Myanmar 24 24 23 64.7% 50.4% 98.8% 0.5% 24.2% 0.6%

Ghana 46 43 44 99.0% 98.9% 98.8% 0.2% 0.3% 0.3%

Nigeria 33 33 34 90.8% 88.2% 88.6% 2.8% 3.0% 3.0%

Sierra

Leone 6 6 7 93.5% 81.9% 81.1% 2.5% 2.5% 2.6%

Kenya 17 18 18 87.6% 88.5% 90.1% 0.6% 0.5% 0.5%

Uganda 9 8 8 69.3% 62.6% 70.9% 0.6% 5.7% 8.7%

Tanzania 28 28 28 98.0% 98.0% 98.0% 0.3% 0.4% 0.3%

Rwanda 3 3 3 89.5% 87.0% 85.8% 2.9% 3.2% 2.9%

Zambia 1 1 1 98.9% 98.0% 96.3% 0.3% 0.5% 0.5%

Group 457 442 442 78.3% 77.0% 79.6% 7.4% 7.2% 5.6%

PAR>30 PAR>90 PAR>180

------------------------------------- ------------------------- -------------------------

Jun/21 Jul/21 Aug/21 Jun/21 Jul/21 Aug/21 Jun/21 Jul/21 Aug/21

India

(total) 30.5% 34.2% 35.9% 21.0% 22.8% 24.8% 16.5% 19.6% 21.3%

Pakistan 1.5% 1.2% 1.0% 1.3% 1.1% 0.8% 1.1% 0.9% 0.7%

Sri Lanka 12.2% 10.8% 10.8% 4.0% 5.1% 5.9% 2.8% 2.5% 2.6%

Philippines 19.9% 19.5% 19.1% 19.3% 18.8% 18.1% 2.6% 15.4% 17.2%

Myanmar 0.7% 24.5% 1.0% 0.5% 0.6% 0.9% 0.2% 0.3% 0.3%

Ghana 0.3% 0.4% 0.4% 0.2% 0.2% 0.2% 0.2% 0.1% 0.1%

Nigeria 5.0% 5.1% 5.0% 3.3% 3.6% 3.6% 2.3% 2.1% 2.0%

Sierra

Leone 4.3% 4.3% 4.4% 3.2% 3.2% 3.0% 1.8% 1.8% 1.8%

Kenya 11.4% 9.5% 6.4% 11.1% 9.3% 6.2% 10.8% 9.0% 6.0%

Uganda 12.7% 18.6% 20.1% 12.6% 13.0% 11.6% 12.1% 12.9% 11.5%

Tanzania 1.6% 1.6% 1.1% 1.5% 1.4% 0.9% 1.3% 1.3% 0.8%

Rwanda 8.4% 9.1% 8.7% 7.1% 7.7% 7.4% 5.6% 5.9% 5.8%

Zambia 1.1% 0.8% 0.9% 1.1% 0.6% 0.6% 0.8% 0.3% 0.3%

Group 14.4% 16.5% 15.3% 10.8% 11.0% 11.3% 7.0% 9.3% 9.8%

(6) Gross loan portfolio includes the off-book BC and DA model, excluding

interest receivable and before deducting ECL provisions and modification

loss.

(7) PAR>x is the percentage of outstanding customer loans with at

least one instalment payment overdue x days, excluding loans more

than 365 days overdue, to gross outstanding loan portfolio including

off-book loans.

(8) The table "PAR>30 less PAR>180" shows the percentage of outstanding

client loans with a PAR greater than 30 days, less those loans which

have been fully provided for.

-- PAR>30 for the Group improved slightly to 15.3%, primarily

due to the marginal improvements in Philippines, Kenya and Tanzania

and moratoriums granted in India and Myanmar.

-- Credit exposure of the India off-book BC portfolio of USD

36.3m is capped at 5%. The included off-book DA portfolio of USD

2.2m has no credit exposure.

Disbursements vs collections of loans until 31 August

2021(9)

Countries Jan/21 Feb/21 Mar/21 Apr/21 May/21 Jun/21 Jul/21 Aug/21

-------- -------- -------- ------- -------- ------- -------

India 90% 104% 131% 71% 3% 5% 25% 36%

Pakistan 97% 99% 99% 102% 89%(10) 102% 98% 103%

Sri Lanka 95% 116% 92% 43% 17% 0% 56% 87%

The Philippines 113% 101% 96% 88% 91% 88% 87% 91%

Myanmar 144% 55% 71% 30% 76% 87% 64% Nil(11)

Ghana 94% 112% 118% 99% 91%(10) 99% 85% 112%

Nigeria 68% 105% 109% 109% 108% 109% 103% 104%

Sierra Leone 89% 109% 110% 95% 101% 118% 119% 133%

Kenya 97% 113% 107% 100% 100% 93% 107% 97%

Uganda 46% 99% 99% 105% 99% 53% 60% 93%

Tanzania 78% 97% 102% 107% 109% 96% 86% 91%

Rwanda 60% 73% 86% 95% 106% 81% 61% 95%

Zambia 137% 140% 115% 107% 142% 170% 103% 102%

------------------- -------- -------- -------- ------- -------- ------- ------- --------

(9) Disbursements vs collections refers to actual loan disbursements

made to clients divided by total loans collected from clients in

the period.

(10) Slowdown in disbursements due to official EID holidays in

second week of May.

(11) Disbursements vs collections for August is nil due to the

stay-at-home policy announced by the Myanmar Government.

-- With the business environment continuing to gradually improve

in many countries, disbursements of new loans continued to

stabilise or increase in amount and as a percentage of weekly

collections, with the main exception of Myanmar, primarily due to

the nationwide lockdowns.

Development of Clients and Outstanding Loan Portfolio until 31

August 2021

Gross OLP (in

Clients (in thousands) Delta USDm) Delta

Aug/20- Jul/21

Aug/21 -

Aug/20- Jul/21- Aug/20-Aug/21 CC Aug/21

Countries Aug/20 Jul/21 Aug/21 Aug/21 Aug/21 Aug/20 Jul/21 Aug/21 USD (12) USD

India 707 706 686 -3% -3% 170 144 140 -18% -18% -3%

Pakistan 398 477 486 22% 2% 53 74 74 41% 41% 0%

Sri Lanka 56 53 53 -4% 0% 9 8 8 -5% 2% 0%

The

Philippines 283 338 341 20% 1% 45 52 55 21% 24% 4%

Myanmar 136 119 118 -14% -1% 31 24 23 -25% -9% -2%

Ghana 142 154 151 7% -1% 38 43 44 16% 21% 2%

Nigeria 215 258 259 21% 1% 24 33 34 43% 52% 2%

Sierra Leone 31 40 42 36% 4% 4 6 7 86% 96% 10%

Kenya 79 116 118 50% 2% 12 18 18 48% 50% 1%

Uganda 90 83 83 -8% 0% 8 8 8 1% -2% 3%

Tanzania 101 150 155 54% 3% 18 28 28 61% 61% 1%

Rwanda 19 17 17 -10% 2% 3 3 3 7% 11% 4%

Zambia 4 10 11 189% 5% 0 1 1 212% 153% 21%

Total 2,260 2,521 2,521 12% 0% 414 442 442 7% 10% 0.03%

(12) Constant currency ('CC') implies conversion of local

currency results to USD with the exchange rate from the beginning

of the period.

-- With disbursements stabilising or increasing in many

countries , but significantly reduced or halted in India and

Myanmar, Gross OLP remained stable at USD 442m in August 2021

compared to the previous month.

Selected moratoriums(13) on loan repayments until 31 August

2021

Clients under moratorium

(in thousands)

As % of Total

Countries Jun/21 Jul/21 Aug/21 Clients

India 226 230 230 34%

Pakistan 0 0 0 0%

Sri Lanka 11 6 7 13%

The Philippines 0 0 0 0%

Myanmar 0 0 56 48%

Ghana 0 0 0 0%

Nigeria 0 0 0 0%

Sierra Leone 0 0 0 0%

Kenya 0 0 0 0%

Uganda 0 0 0 0%

Tanzania 0 0 0 0%

Rwanda 0 0 0 0%

Zambia 0 0 0 0%

Total 237 236 293 12%

Moratorium amounts (USD

thousands)

August moratoriums As % of Total

Countries Jun/21 Jul/21 Aug/21 as % of OLP Moratoriums

India 49,033 47,304 47,304 34% 96.9%

Pakistan 0 0 0 0% 0.0%

Sri Lanka 134 96 86 1% 0.2%

The Philippines 0 0 0 0% 0.0%

Myanmar 0 0 1,437 6% 2.9%

Ghana 0 0 0 0% 0.0%

Nigeria 0 0 0 0% 0.0%

Sierra Leone 0 0 0 0% 0.0%

Kenya 0 0 0 0% 0.0%

Uganda 0 0 0 0% 0.0%

Tanzania 0 0 0 0% 0.0%

Rwanda 0 0 0 0% 0.0%

Zambia 0 0 0 0% 0.0%

Total 49,167 47,400 48,827 11% 100.0%

(13) Moratoriums relate to clients who have received an

extension for the payment of one or more loan instalments during

the month.

-- Moratoriums on loan repayments relate primarily to

approximately 34% of clients in India, who accepted to benefit from

the one-time debt restructuring scheme established by the RBI. See

RBI COVID-19 Restructuring Guidelines .

-- Moratoriums granted in Sri Lanka and Myanmar were due to

disruption in operations following national lockdowns.

-- The moratorium amount across the Group was USD 48.8m, which

represents 11 % of the Group's Gross OLP.

Key events in August and September 2021

-- National lockdowns remained in place in Sri Lanka and Myanmar

ending on 21 September and 10 September respectively.

-- In August, ASA India and other MFIs signed the 'Assam

Microfinance Incentive and Relief Scheme 2021', a MoU with the

government of the State of Assam, with the objective to give

incentives and relief to borrowers, who availed small loans from

different MFIs in Assam. The specific objectives of the Scheme are

as follows:

o providing relief to stressed borrowers to encourage and help

them to regularise their repayments; and

o providing partial/full relief from repaying loans to destitute

borrowers with no capacity to repay.

o incentivizing borrowers for making regular repayments and

maintaining good credit discipline.

Please note that, while the Company's operational performance

appears to gradually normalize in most countries except for India,

Myanmar, Sri Lanka and Uganda, the risk of additional challenges to

our operations should not be underestimated, as we have recently

seen in for instance India and Myanmar, due to (i) the still

relatively high infection rates, (ii) the current lack of available

vaccines in most of our operating countries, (iii) the risk of the

introduction of more infectious COVID-19 variants in our operating

countries as have been observed in the United Kingdom, South

Africa, Brazil, the Philippines, Myanmar and India, and (iv) the

associated disruption this may cause to the businesses of our

clients.

---

Enquiries:

ASA International Group plc

Investor Relations +31 6 2030 0139

Véronique Schyns vschyns@asa-international.com

About ASA International Group plc

ASA International is one of the world's largest international

microfinance institutions, with a strong commitment to financial

inclusion and socioeconomic progress. The company provides small,

socially responsible loans to low-income, financially underserved

entrepreneurs, predominantly women, across South Asia, South East

Asia, West and East Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDKBLFLFKLBBBL

(END) Dow Jones Newswires

September 21, 2021 02:00 ET (06:00 GMT)

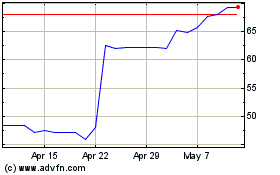

Asa (LSE:ASAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asa (LSE:ASAI)

Historical Stock Chart

From Apr 2023 to Apr 2024