TIDMASLI

RNS Number : 8344N

Aberdeen Standard Eur Lgstc Inc PLC

26 May 2020

Aberdeen Standard European Logistics Income PLC

LEI: 213800I9IYIKKNRT3G50

Net Asset Value as at 31 March 2020 and Dividend Declaration

26 May 2020: Aberdeen Standard European Logistics Income PLC

(LSE: ASLI) (the "Company") announces its unaudited quarterly Net

Asset Value ("NAV") as at 31 March 2020 and declares its first

interim dividend for 2020.

Highlights

-- NAV per Ordinary share of 112.7c (GBp - 99.92p) as at 31

March 2020 (31 December 2019: 111.0c (GBp - 94.21p)). Exchange rate

GBP1 : EUR1.13 (31 December 2019: GBP1 : EUR1.18).

-- Portfolio capital value has increased by 0.7% since 31

December 2019 (on a like-for-like basis including capital

expenditure). The Company's well located and diversified European

logistics portfolio of 14 assets was valued at EUR404.9 million as

at 31 March 2020.

-- A fourth interim distribution of 1.27 pence (equivalent to

1.41 euro cents) per Ordinary share in respect of the year ended 31

December 2019 was paid on 27 March 2020.

-- First interim distribution of 1.41 euro cents (equivalent to

1.24 pence) per Ordinary share in respect of the year ending 31

December 2020 declared.

At the valuation date of 31 March 2020 Europe was in the early

stages of lockdown due to COVID-19 and the investment market had

come to a near standstill. There was a lack of relevant

transactional evidence and so, in line with market practice, the

independent valuers report from CBRE has noted "material

uncertainty" relating to property valuations.

Q1 Investment Activity

During the first quarter of 2020, the Company completed the

acquisition of the logistics warehouse in Den Hoorn, the

Netherlands, for a net value of EUR49.9 million, providing a net

initial yield of 4.5%. This newly built warehouse is located in the

most densely populated area of the Netherlands between the cities

of the Hague and Rotterdam. Built to a modern specification, it is

a quality warehouse providing office and mezzanine space of over

43,000 square metres. Both LED lighting and solar roof panels add

sustainable credentials to the investment. The warehouse has an

attractive income profile and is fully leased to logistics operator

Van der Helm, a Dutch family company founded in 1936, as its

headquarters on a ten year CPI indexed lease.

As part of this acquisition, the Company also finalised and drew

down long term financing secured on its properties at Den Hoorn and

Zeewolde, the Netherlands. This secured loan facility was arranged

with Berlin HYP AG for a total value of EUR35.7 million and fixed

for an eight year term at an attractive all-in interest rate of

1.25% per annum.

The Company has now fully deployed the funds raised in July 2019

and, following draw down of this fixed term loan facility, the

overall asset level gearing sits at 34 per cent. of gross

assets.

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited net

asset value per Ordinary Share over the period from 1 January 2020

to 31 March 2020. The unaudited net asset value has been prepared

under International Financial Reporting Standards ("IFRS").

Per Share Attributable Comment

(EURcents) Assets (EURm)

Net assets as at

31 December 2019 111.0 260.3

------------ --------------- -----------------------------

Portfolio of 14 assets:

Capital values increased

0.7% on a like-for-like

basis from the prior

quarter. Acquisition

costs incurred in the

Unrealised increase period relate to the

in valuation of acquisition of properties

property portfolio 3.7 8.8 in Warsaw and Den Hoorn

------------ --------------- -----------------------------

Acquisition costs

incurred during

the period (0.4) (1.0)

------------ --------------- -----------------------------

Income from the property

Income earned for portfolio and associated

the period 2.1 4.9 running costs

------------ --------------- -----------------------------

Expenses for the

period (0.8) (1.8)

------------ --------------- -----------------------------

Net deferred tax liability

on the difference between

book cost and fair value

of the portfolio, including

the Den Hoorn asset,

which was acquired via

an SPV acquisition during

Deferred tax liability (1.2) (2.7) the quarter

------------ --------------- -----------------------------

Movement in the mark

to market value of a

dividend hedge entered

into in Q1 2020 to fix

FX hedge mark to the EUR:GBP conversion

market revaluation (0.1) (0.2) of the 2020 dividend

------------ --------------- -----------------------------

Fourth interim dividend

of 1.27 pence (1.41

Dividend paid 27 euro cents) per Ordinary

March 2020 (1.4) (3.3) Share

------------ --------------- -----------------------------

Foreign currency

loss (0.0) (0.1)

------------ --------------- -----------------------------

Other movements Movement in lease incentives

in reserves (0.2) (0.6) in the quarter

------------ --------------- -----------------------------

Net assets as at

31 March 2020 112.7 264.3

------------ --------------- -----------------------------

The EPRA NAV per share is 116.4 Euro cents, which excludes

deferred tax liability and fair value of the FX derivative.

Net Asset Value analysis as at 31 March 2020 (unaudited)

EURm % of net assets

Fair value of Property

Portfolio 404.9 153.2%

-------- ----------------

Cash 11.8 4.5%

-------- ----------------

Other Assets 9.5 3.6%

-------- ----------------

Total Assets 426.2 161.3%

-------- ----------------

Bank Loans (143.4) (54.3)%

-------- ----------------

Other Liabilities (10.1) (3.8)%

-------- ----------------

Deferred Tax Liability (8.4) (3.2)%

-------- ----------------

Total Net Assets 264.3 100.0%

-------- ----------------

The NAV per share is based on the external valuation of the

Company's direct property portfolio undertaken by CBRE.

The NAV per share at 31 March 2020 is based on 234 ,500,001

shares of 1 pence each, being the total number of Ordinary shares

in issue at that time.

Q2 Rental Collection Update

At the time of the last COVID-19 update, the Company announced

that all rents had been collected for Q1 2020 and 67% of those due

for Q2 had then been received, with twelve tenants requesting

discussions around their short term financial positions. This

collection figure has now increased to 75% with an expectation that

this will shortly rise to 82%.

Of the remaining 18% currently unpaid, representing

approximately EUR1 million in monthly and quarterly rental

payments, it has been agreed in principle that approximately

EUR820,000 of this will be deferred, with EUR720,000 of this

deferred rent due for payment by December 2020 and EUR100,000 of

this due prior to June 2022.

The remaining EUR180,000 of unpaid rent relates to six tenants

who have requested rent free periods. It is expected that this rent

will be forgiven for Q2, along with an additional EUR210,000 for

the remainder of 2020 and EUR130,000 in respect of 2021/22, in

exchange for material lease extensions. The manager is in the final

stages of negotiations with these tenants and lease extensions are

expected to be agreed for up to five years.

As a result, the Company currently expects that it will collect

approximately 95% of Q2 rental income by December 2020, with an

additional 2% payable in the period to June 2022 and the remaining

3% forgiven, in exchange for material lease extensions. The

Investment Manager considers this to be a positive result for

shareholders and expects to conclude all of these discussions

shortly.

Dividends

Following a thorough review of the latest rent collection

statistics and the recent tenant discussions, the Board has today

declared a first interim dividend in respect of the year ending 31

December 2020 of 1.41 euro cents per Ordinary share (equivalent to

1.24 pence). This will be paid in sterling on 26 June 2020 to

Ordinary shareholders on the register on 5 June 2020 (ex-dividend

date of 4 June 2020). Of this first interim dividend declared of

1.24 pence per Ordinary share, 1.05 pence is declared as dividend

income with 0.19 pence treated as qualifying interest income.

The Board, through the Investment Manager, continues to monitor

the situation and the impact this is having on all of our tenants.

While it remains the Board's intention to pay quarterly interim

dividends in line with the dividend policy, the quantum of these

distributions will ultimately depend on the ability of our tenants

to maintain rental payments in line with the expected agreed terms.

The Board views these terms to be favourable to both shareholders

and the impacted tenants, while permitting the Company to maintain

quarterly dividend payments in line with policy.

Evert Castelein, Aberdeen Standard Investments, commented:

"It was pleasing to see a further uplift in the portfolio

valuation as we reached the March 2020 quarter end date. This

valuation uplift reflects the fact that, notwithstanding the severe

short-term negative impact suffered by a number of our tenants, the

outlook for European logistics real estate remains compelling,

perhaps even more so following the impact this crisis will likely

have on consumer behaviour and supply chain logistics.

As previously noted, while a number of our tenants are

experiencing unprecedented levels of demand, a number of tenants

have inevitably been negatively affected by the COVID-19 pandemic.

Following a period of negotiation with these tenants, the

previously announced level of rental collection for Q2 of 67% is

now expected to increase significantly. Lease extensions are being

agreed where rental income has been forgiven and we are very

pleased with how these discussions have progressed.

The recent increased level of tenant interaction has further

highlighted the importance of having local offices and, in

particular, local asset managers, based in close proximity to our

tenants. The relationships our asset managers have built with

tenants, coupled with a deep understanding of their local logistics

markets, ensured that tenant discussions have been highly

productive from the start. Aberdeen Standard Investments has 25

offices across Europe and employs over 250 real estate

professionals, including over 80 real estate asset managers and 29

transaction managers.

As the European logistics market evolves in response to this

crisis, our local managers expect to see increased levels of

interesting investment opportunities, particularly in the urban

logistics space, as the importance of e-commerce becomes more

prevalent".

Tony Roper, Chairman of the Company, commented:

"The Board and the Investment Manager continue to work safely

from home during these difficult times, remaining in close contact

with our tenants and service providers to ensure the efficient

functioning of the Company.

While the majority of our tenants remain in a strong financial

position and are fully operational, a number of tenants have

required short-term assistance. Following a period of negotiation

with these tenants, we are now in a position where we expect to

agree certain rent deferrals and a limited amount of rent

forgiveness, in exchange for lease extensions.

The Board believes these agreements strike a satisfactory

balance between assisting our tenants through this difficult period

and protecting the interests of our shareholders, particularly in

relation to the payment of quarterly dividends.

Acknowledging the importance of income to our shareholders, the

Board has declared an interim dividend of 1.41 euro cents per

share, in line with our dividend policy. While it is the Board's

intention to maintain the level of dividend throughout 2020, the

Board recognises the unpredictability of this situation and will

therefore keep this under review as the year progresses".

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014). Upon the

publication of this announcement via a Regulatory Information

Service this inside information is now considered to be in the

public domain.

Details of the Company and its property portfolio may also be

found on the Company's website which can be found at:

http://www.eurologisticsincome.co.uk

For further information please contact:

Luke Mason / Gary Jones

Aberdeen Asset Management PLC

0207 463 6000

The above information is unaudited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKKPBKKBKBFPB

(END) Dow Jones Newswires

May 26, 2020 02:01 ET (06:01 GMT)

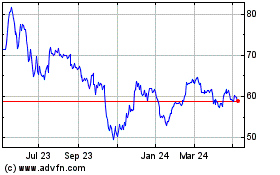

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

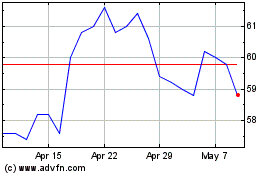

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Apr 2023 to Apr 2024