TIDMASLI

RNS Number : 1261X

Aberdeen Standard Eur Lgstc Inc PLC

25 August 2020

Aberdeen Standard European Logistics Income PLC

LEI: 213800I9IYIKKNRT3G50

Investor demand for logistics real estate in Europe expected to

remain strong

Unaudited Net Asset Value as at 30 June 2020 and Q3 rental

income update

25 August 2020: Aberdeen Standard European Logistics Income PLC

(LSE: ASLI) (the "Company" or "ASLI") announces its unaudited

quarterly Net Asset Value ("NAV") as at 30 June 2020 and provides

an update on Q3 2020 rental income collection.

Highlights

-- NAV per Ordinary Share of 112.8c (GBp - 103.0p) as at 30 June

2020 (31 March 2020: 112.7c (GBp - 99.92p)). Exchange rate GBP1 :

EUR1.10 (31 March 2020: GBP1 : EUR1.13).

-- Resilient portfolio of assets with latest portfolio capital

valuation unchanged from 31 March 2020. The Company's high-quality,

well located and diversified European logistics portfolio of 14

assets remained valued at EUR404.9 million as at 30 June 2020.

-- Rent collection remains strong with Q3 rental income expected

to be in line with our previous projections, allowing the Board to

reaffirm its intention to continue to pay distributions in line

with its stated policy.

-- A first interim distribution of 1.24 pence per Ordinary share

in respect of the year ending 31 December 2020 was paid on 26 June

2020.

-- A second interim distribution of 1.24 pence per Ordinary

share in respect of the year ending 31 December 2020 declared on 25

August 2020.

At the valuation date of 30 June 2020 the independent valuer's

report from CBRE had removed the "material uncertainty" relating to

property valuations that was in place as at 31 March 2020.

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited net

asset value per Ordinary Share over the period from 1 April 2020 to

30 June 2020. The unaudited net asset value has been prepared under

International Financial Reporting Standards ("IFRS").

Per Share Attributable Comment

(EURcents) Assets (EURm)

Net assets as at

31 March 2020 112.7 264.3

------------ --------------- -----------------------------

Unrealised change - - Portfolio of 14 assets.

in valuation of Capital values remained

property portfolio stable from the prior

quarter. Acquisition

costs incurred in the

period relate predominantly

to the final adjustment

of Warsaw acquisition

price.

------------ --------------- -----------------------------

Acquisition costs

incurred during

the period (0.3) (0.7)

------------ --------------- -----------------------------

Income from the property

Income earned for portfolio and associated

the period 2.1 5.1 running costs.

------------ --------------- -----------------------------

Expenses for the

period (0.8) (1.9)

------------ --------------- -----------------------------

Net deferred tax liability

on the difference between

book cost and fair value

Deferred tax liability 0.3 0.7 of the portfolio.

------------ --------------- -----------------------------

Movement in the mark

to market value of a

dividend hedge entered

into in Q1 2020 to fix

FX hedge mark to the EUR:GBP conversion

market revaluation (0.0) (0.1) of the 2020 dividend.

------------ --------------- -----------------------------

First interim distribution

of 1.24 pence (1.41

Dividend paid 26 euro cents) per Ordinary

June 2020 (1.4) (3.3) Share.

------------ --------------- -----------------------------

Foreign currency

loss (0.1) (0.2)

------------ --------------- -----------------------------

Issue of 5,000,000 new

Ordinary shares on 23

Share issue (0.0) 5.7 June 2020.

------------ --------------- -----------------------------

Other movements Movement in lease incentives

in reserves 0.3 0.7 in the quarter.

------------ --------------- -----------------------------

Net assets as at

30 June 2020 112.8 270.3

------------ --------------- -----------------------------

The EPRA NAV per share is 118.6 Euro cents, which excludes

deferred tax liability and fair value of the FX derivative.

Net Asset Value analysis as at 30 June2020 (unaudited)

EURm % of net assets

Property Portfolio 404.9 149.8%

-------- ----------------

Adjustment for lease incentives (4.7) (1.7%)

-------- ----------------

Fair value of property

portfolio 400.2 148.1%

-------- ----------------

Cash 18.7 6.9%

-------- ----------------

Other Assets 12.7 4.7%

-------- ----------------

Total Assets 431.6 159.7%

-------- ----------------

Bank Loans (143.4) (53.1%)

-------- ----------------

Other Liabilities (10.0) (3.7%)

-------- ----------------

Deferred Tax Liability (7.9) (2.9%)

-------- ----------------

Total Net Assets 270.3 100.0%

-------- ----------------

The NAV per share is based on the external valuation of the

Company's direct property portfolio undertaken by CBRE.

The NAV per share at 30 June 2020 is based on 239 ,500,001

shares of 1 pence each, being the total number of Ordinary Shares

in issue at that time.

Rental Collection Update

No new requests for support have been received from tenants and

rent collection remains strong.

Monthly and quarterly advance payments received in respect of Q3

2020 rental income represent well over 90% of rental income due for

the quarter and this is expected to rise to over 95% after

accounting for previously notified rent free periods.

The Company successfully concluded negotiations with certain

tenants negatively impacted by the COVID-19 pandemic and previously

confirmed that 85% of Q2 rental income due was collected, slightly

in excess of the forecast collection percentage of 82%. As

previously disclosed, for the remaining outstanding rental income,

the Investment Manager agreed short-term rent deferrals and a small

number of rent free periods, in exchange for material lease

extensions.

The Board, through the Investment Manager, continues to closely

monitor the performance of the Company's tenants as they recover

from enforced lockdowns and lighter trading. In light of the Q3

rental collection outcome and the previously agreed tenant

positions, it remains the Board's intention to pay quarterly

distributions in line with the Company's dividend policy.

Dividends

The Directors have today declared a second interim distribution

of 1.24 pence (equivalent to 1.41 euro cents) per Ordinary Share,

in respect of the year ending 31 December 2020. This second interim

distribution will be paid in sterling on 25 September 2020 to

Ordinary Shareholders on the register on 4 September 2020

(ex-dividend date of 3 September 2020).

Evert Castelein, Aberdeen Standard Investments, commented:

"Having witnessed uncertain and difficult times of late, it is

gratifying to see our latest portfolio valuation demonstrate stable

values for the June 2020 quarter end which is a reflection of the

quality and locations of the asset base that we have built up. The

COVID pandemic showed the importance of the real estate logistics

sector across Europe with increasing online retail sales and an

obvious focus on supply chains and their resilience.

With no new requests from tenants for support we have seen

strong levels of rent collection, but nonetheless we continue to

monitor the situation closely for any possible impacts on our

tenant base. We remain, through our local network, in contact with

our tenants and available to support them where and when

required.

There are attractive opportunities across Europe to invest in

high-quality, modern and well-located assets. We believe that the

outlook for European logistics real estate remains compelling,

perhaps even more so now given the impact that the COVID-19 crisis

is likely to have on consumer behaviour and supply chain logistics

in the future.

As the European logistics market evolves, our local managers

expect to see increased levels of interesting investment

opportunities as companies seek to bring certain operations back to

their home territories. Our local transaction managers have an

increased focus on urban logistics warehouses as the importance of

e-commerce accelerates."

Tony Roper, Chairman of the Company, commented:

"The latest Q3 rent collection figures give the Board confidence

and underpin the distribution policy of the Company. Today we have

declared a second distribution for the year of 1.24 pence (1.41

euro cents) per share, in line with our previous guidance. Our

Investment Manager continues to maintain regular dialogue with our

tenants and it is pleasing to note that no further requests for

support have been received.

European logistics have fared well over a period when many other

real estate sectors have seen very challenging times. We remain

confident that the quality of the portfolio that has been built

should deliver solid returns for our shareholders.

There is no doubt that the increased focus on supply chain

management and online sales and deliveries will underpin the

increased interest that we are seeing in this sector of the real

estate market.

The quality, location and age of our assets together with

improving sustainable credentials should give confidence for the

future as we look to build on the European logistics story."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014). Upon the

publication of this announcement via a Regulatory Information

Service this inside information is now considered to be in the

public domain.

The Board is not aware of any other significant events or

transactions which have occurred between 30 June 2020 and the date

of publication of this statement which would have a material impact

on the financial position of the Company.

Details of the Company and its property portfolio may also be

found on the Company's website which can be found at:

http://www.eurologisticsincome.co.uk

For further information please contact:

Luke Mason / Gary Jones

Aberdeen Asset Management PLC

0207 463 6000

The above information is unaudited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVPPUGURUPUGCA

(END) Dow Jones Newswires

August 25, 2020 10:03 ET (14:03 GMT)

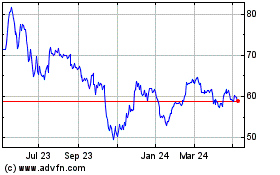

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

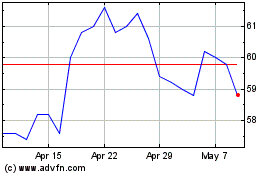

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Apr 2023 to Apr 2024