TIDMASLI

RNS Number : 7985F

Aberdeen Standard Eur Lgstc Inc PLC

19 November 2020

Aberdeen Standard European Logistics Income PLC

LEI: 213800I9IYIKKNRT3G50

Strong rent collection with a well-positioned quality portfolio

in the fast growing European logistics sector

Unaudited Net Asset Value as at 30 September 2020

19 November 2020: Aberdeen Standard European Logistics Income

PLC (LSE: ASLI) (the "Company" or "ASLI") announces its unaudited

quarterly Net Asset Value ("NAV") as at 30 September 2020.

Highlights

-- Stable and robust NAV - NAV per Ordinary share of 112.7c (GBp

- 102.9p) as at 30 September 2020 (30 June 2020: 112.8c (GBp -

103.0p)) [1]

-- Valuation growth - capital values increased in aggregate

across 13 assets by EUR2.1m. A one-off adjustment made in respect

of Dutch real estate transfer tax of EUR1.3m resulting in a total

net increase of EUR800k in Q3. The Company's well located and

diversified European logistics portfolio of 14 assets is now valued

at EUR405.7 million as at 30 September 2020

-- Strong rent collections - rent collection remains strong with

Q4 rental income currently expected to be in line with previous

projections, allowing the Board to continue to pay distributions in

line with its stated policy

-- Dividends - a second interim distribution of 1.24 pence per

Ordinary share in respect of the year ending 31 December 2020 was

paid on 25 September 2020

-- Additional financing flexibility - new uncommitted four year

EUR40 million master facilities loan agreement signed with Investec

Bank increasing the flexibility to acquire new assets prior to any

fresh equity raise and reducing the impact of cash drag on

investment returns

-- Strong shareholder returns - for the 12 months to 30

September 2020, NAV total return of 13.2% (10.4% in Euro terms) [2]

and share price total return of 21.0% [3]

1 Exchange rate GBP1 : EUR1.10 (30 June 2020: GBP1 :

EUR1.10)

2 Source: Aberdeen Standard Investments

3 Source: Bloomberg

Rental Collection

The Board is pleased to report that rent collection remains

strong with all rent received in line with previous

projections.

Payments received in respect of Q3 2020 rental income represent

97% of rental income due for the quarter. During October, the

Company collected 99% of rent from monthly (October) and quarterly

(Q4) advance payers. All rents due under the terms of deferral

agreements have been paid on time.

Almost 97% of full year 2020 rental income is expected to be

received by the financial year end with the balance subject to

previously announced rent deferral agreements or rent free periods

granted in exchange for material lease extensions.

In light of the expected rental collection and the previously

agreed tenant positions, it remains the Board's intention to pay

quarterly distributions in line with the Company's dividend

policy.

Dividends

On 25 August 2020 the Directors declared a second interim

distribution of 1.24 pence (equivalent to 1.41 euro cents) per

Ordinary Share, in respect of the year ending 31 December 2020. The

distribution was paid in sterling on 25 September 2020 to Ordinary

Shareholders on the register on 4 September 2020 (ex-dividend date

of 3 September 2020).

Financing

The Company level loan to value ratio is currently 33.0%, below

the long term target of 35.0%. The EUR40 million uncommitted loan

agreement with Investec Bank has been executed and the facility is

now available, providing additional flexibility in respect of cash

management and future asset purchases. This new facility will help

to avoid cash drag and facilitate new acquisitions in advance of

any new cash raise.

Additionally, with EUR24.3 million of cash at bank, the Company

has a good level of liquidity to help fund future acquisitions.

Performance

The Company's shares continue to trade at a material premium to

NAV, with the closing share price of 107 pence on 30 September

representing a 4% premium to the NAV. For the year to 30 September

2020, the share price total return (with dividends reinvested) was

21.0%. The net asset value total return over the same period of

13.2% (10.4% in Euro terms) underpins the continued share price

premium.

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited net

asset value per Ordinary Share over the period from 1 July 2020 to

30 September 2020. The unaudited net asset value has been prepared

under International Financial Reporting Standards ("IFRS").

Per Share Attributable Comment

(EURcents) Assets (EURm)

Net assets as at

30 June 2020 112.8 270.3

------------ --------------- -----------------------------

Capital values increased

EUR2.1m in aggregate

on a like-for-like basis

in respect of 13 assets.

Adjustment of -EUR1.3m

relates to Den Hoorn

asset, now 6 months

old, on which a Real

Estate Transfer Tax

would become applicable

Unrealised change for any future purchaser

in valuation of impacting the latest

property portfolio 0.3 0.8 CBRE valuation

------------ --------------- -----------------------------

Acquisition costs

during the period (0.1) (0.3)

------------ --------------- -----------------------------

Income from the property

Income earned during portfolio and associated

the period 2.1 5.1 running costs

------------ --------------- -----------------------------

Expenses for the

period (0.8) (2.0)

------------ --------------- -----------------------------

Net deferred tax liability

on the difference between

book cost and fair value

Deferred tax liability (0.2) (0.5) of the portfolio

------------ --------------- -----------------------------

Movement in the mark

to market value of a

dividend hedge rolled

forward in Q3 to fix

FX hedge mark to the EUR:GBP conversion

market revaluation 0.1 0.2 of the 2020 dividend

------------ --------------- -----------------------------

Second interim dividend

of 1.24 pence (1.41

Dividend paid 25 euro cents) per Ordinary

September 2020 (1.4) (3.4) Share

------------ --------------- -----------------------------

Foreign currency

loss (0.1) (0.1)

------------ --------------- -----------------------------

Issue of 5,000,000 new

Ordinary shares on 30

Share issue 0.0 5.7 July 2020

------------ --------------- -----------------------------

Other movements Movement in lease incentives

in reserves (0.0) (0.1) in the quarter

------------ --------------- -----------------------------

Net assets as at

30 September 2020 112.7 275.7

------------ --------------- -----------------------------

The EPRA NAV per share is 116.3 Euro cents, which excludes

deferred tax liability and fair value of the FX derivative.

Net Asset Value analysis as at 30 September 2020 (unaudited)

EURm % of net assets

Property Portfolio 405.7 147.2%

-------- ----------------

Adjustment for lease incentives (4.8) (1.7%)

-------- ----------------

Fair value of property

portfolio 400.9 145.5%

-------- ----------------

Cash 24.3 8.8%

-------- ----------------

Other Assets 13.1 4.8%

-------- ----------------

Total Assets 438.3 159.1%

-------- ----------------

Bank Loans (143.5) (52.0%)

-------- ----------------

Other Liabilities (10.5) (3.8%)

-------- ----------------

Deferred Tax Liability (8.6) (3.3%)

-------- ----------------

Total Net Assets 275.7 100.0%

-------- ----------------

The property portfolio valuation is based on the independent

external valuation of the Company's direct property portfolio

undertaken by CBRE.

The NAV per share at 30 September 2020 is based on 244 ,500,001

shares of 1 pence each, being the total number of Ordinary shares

in issue at that time.

Evert Castelein, Aberdeen Standard Investments, commented:

"There are attractive opportunities across Europe to invest in

high-quality, modern and well-located assets. We believe that the

outlook for European logistics real estate remains compelling, more

so now given the impact that the COVID-19 crisis has had on

consumer behaviour and supply chain logistics in the future.

The global pandemic further accentuated and accelerated many of

the positive demand drivers that were already in motion before the

crisis began. It has also brought important considerations around

sustainability and social responsibility to the forefront of the

sector. Occupiers and investors will become increasingly focused on

the social and environmental costs of their properties with carbon

"net-neutrality" often a minimum requirement by some local

authorities for new builds and we are working closely with our

tenants to seek to deliver better ESG outcomes.

New cohorts are adopting e-commerce for every-day purchases,

particularly amongst senior generations. Growing confidence and

familiarity with this form of retailing is likely to accelerate the

trend with positive implications expected for all logistics real

estate.

As the European logistics market evolves, our local managers

expect to see increased levels of interesting investment

opportunities as companies seek to bring certain operations back to

their home territories. Numerous cases of manufacturers being

frustrated by a lack of component parts highlight the fragility and

inefficiency of operating long distance supply chains and we expect

them to seek to make these more resilient. The continual advance of

technology is increasingly rendering labour cost arbitrage less

important.

The manufacturing industry continues to push the integration of

innovation, with robotics, mechanisation and 3D printing performing

more of the production and assembly of goods. This may well lead to

manufacturers moving their production back to Europe and closer to

the end consumer. The associated supply chain activity will further

boost demand for logistics space."

Tony Roper, Chairman of the Company, commented:

"Our Investment Manager has maintained close dialogue with our

tenants through its on-the-ground presence and we are pleased to

note that all rent has been received in line with previous

projections. These latest rent collection figures continue to

underpin confidence in the distribution policy of the Company.

The pandemic has affirmed more quickly than many thought that

online sales and deliveries will be a growth area across much of

Europe, reshoring of production and inventory building may be

required in many sectors and that technology has a significant role

to play. This environment favours operators with the strongest

global coverage with the best digital platforms to track shipments.

The key drivers will be speed, certainty and end-to-end data

transparency. Businesses too small to provide this offer may be

vulnerable. A full digital service is increasingly expected by

customers.

There is no doubt that the increased focus on supply chain

management and online sales and deliveries will underpin the

increased interest that we are seeing in this sector of the real

estate market.

With the Company's share price and NAV performance over 2020

providing solid returns for shareholders, the quality, location and

age of our assets together with improving sustainability

credentials should give confidence for the future as we look to

build on the European logistics story.

With continued strong rent collection, good cash reserves and a

new loan facility in place, the Company is well positioned to play

its part in this growing space and take advantage of the pipeline

of assets that the Manager is reviewing."

The Board is not aware of any other significant events or

transactions which have occurred between 30 September 2020 and the

date of publication of this statement which would have a material

impact on the financial position of the Company.

Details of the Company and its property portfolio may also be

found on the Company's website which can be found at:

http://www.eurologisticsincome.co.uk

For further information please contact:

Luke Mason / Gary Jones

Aberdeen Asset Management PLC

0207 463 6000

The above information is unaudited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVEANFPFLKEFFA

(END) Dow Jones Newswires

November 19, 2020 02:00 ET (07:00 GMT)

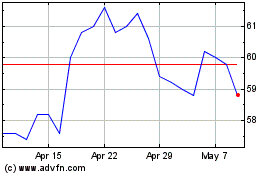

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

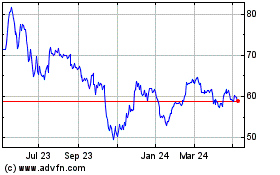

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Apr 2023 to Apr 2024