TIDMASLI

RNS Number : 1034Q

Aberdeen Standard Eur Lgstc Inc PLC

24 February 2021

Aberdeen Standard European Logistics Income PLC

LEI: 213800I9IYIKKNRT3G50

Unaudited Net Asset Value as at 31 December 2020 and Declaration

of Fourth Interim Dividend

STRONG VALUATION UPLIFT AND RENT COLLECTION FROM HIGH-QUALITY

PORTFOLIO SOLELY FOCUSED ON FAST GROWING EUROPEAN LOGISTICS

SECTOR

24 February 2021 - Aberdeen Standard European Logistics Income

PLC (LSE: ASLI), the Company which invests in high quality European

logistics properties, today provides a Company update and announces

its unaudited quarterly Net Asset Value ("NAV") and dividend for

the quarter to 31 December 2020.

Highlights

-- NAV per Ordinary share increased by 6.6% to 120.1c (GBp -

107.9p) (30 September 2020: 112.7c (GBp - 102.9p)), reflecting a

NAV total return of 20.0% (13.6% in Euro terms) 1 for the 12 months

to 31 December 2020 (Exchange rate GBP1 : EUR1.11 (30 September

2020: GBP1 : EUR1.10)

-- Portfolio valuation up 6.0%, or EUR24.5 million, to EUR430.2

million (30 September 2020: EUR405.7 million)

-- 100% of the rent due for the quarter ended 31 December 2020 collected

-- EUR28 million acquisition of a new warehouse in Poland

expected to complete in Q1 2021, following which the portfolio will

comprise 15 strategically located, modern and diversified European

logistics assets

-- The Company declares a fourth interim dividend of 1.24 pence

per Ordinary share in respect of the year ended 31 December,

dividends in respect of the year ended 31 December 2020 will total

4.96 pence per Ordinary share

-- Improving portfolio sustainability metrics with the award of

four out of five Green Stars by GRESB ("Global Real Estate

Sustainability Benchmark")

Tenant Update

The Company has been made aware that Office Dépôt France, the

sole tenant occupying its Meung-sur-Loire asset in France, has

sought court protection and the appointment of an administrator.

The property serves as the tenant's key national distribution hub,

reflecting its strategic location in one of France's

fastest-growing logistics regions.

As at 31 December 2020 the property was valued at EUR27.9

million, or 6.5% of the portfolio GAV. The annual passing rent on

the property represents 6.4% of the overall portfolio annual

contracted rent.

The warehouse has attractive qualities and is ideally located

for national distribution just south of Orleans and close to main

motorways towards Bordeaux/ Northern Spain and towards Marseille/

Lyon/ Toulouse. This location has grown in importance due to the

lack of greenfield locations in and around Paris.

While the Q4 2020 rent was paid in full, the invoice for the

quarterly in advance rent for Q1 2021 has not been collected.

However, the Company benefits from a three month rental security

deposit and will provide a further update in due course.

Declaration of Fourth Interim Dividend

The Directors have today declared a fourth interim dividend of

1.41 euro cents (equivalent to 1.24 pence) per Ordinary share, in

respect of the year ended 31 December 2020 (2019: 1.41 euro cents).

This fourth interim dividend will be paid in sterling on 26 March

2021 to Ordinary shareholders on the register on 5 March 2021

(ex-dividend date of 4 March 2021).

The Company intends to declare quarterly interim dividends to

Shareholders, with dividends declared in respect of the quarters

ending, on the following dates: 31 March, 30 June, 30 September and

31 December in each year.

Any such dividend payment to Shareholders may take the form of

either dividend income or "qualifying interest income" which may be

designated as an interest distribution for UK tax purposes and

therefore subject to the interest streaming regime applicable to

investments trusts.

Of this fourth interim dividend declared of 1.24 pence per

Ordinary share, 0.80 pence is declared as dividend income with 0.44

pence treated as qualifying interest income.

Performance

For the year to 31 December 2020, the share price total return

(with dividends reinvested) was 26.6%. The net asset value total

return over the same period was 20.0% (13.6% in Euro terms).

Acquisition

Advanced due diligence continues on the purchase of a recently

constructed 34,000 sqm warehouse in Poland, for approximately EUR28

million, reflecting a net initial yield of 5.5%. Subject to the

necessary approvals, the Investment Manager expects the transaction

to close by the end of Q1 2021. The property is fully let to seven

tenants with an average WAULT of over six years. Representing the

Company's third property in Poland, the brand-new, high

specification, building is one hour's drive from Warsaw and is

strategically located close to a container terminal offering

excellent connectivity to Western Europe.

Financing

The Company level loan to value ratio is currently 31.4%, below

the long term target of 35.0%. The EUR40 million uncommitted loan

agreement with Investec Bank has been executed and is now available

for drawdown, providing additional flexibility in respect of cash

management. The new facility will help to avoid cash drag and,

along with EUR24.4 million of available cash, provides liquidity as

well as funds for future acquisitions.

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited net

asset value per Ordinary Share over the period from 1 October 2020

to 31 December 2020. The unaudited net asset value has been

prepared under International Financial Reporting Standards

("IFRS").

Per Share Attributable Comment

(EURcents) Assets (EURm)

Net assets as at

30 September 2020 112.7 275.7

------------ --------------- -----------------------------

Capital values increased

EUR24.5m, a 6% increase

on a like-for-like basis

in respect of 14 assets

Positive acquisition

costs relate to a final

Unrealised change true up of the acquisition

in valuation of price related to ASLI's

property portfolio 10.0 24.5 Warsaw investment

------------ --------------- -----------------------------

Acquisition costs

during the period 0.4 1.0

------------ --------------- -----------------------------

Income from the property

portfolio and associated

running costs. Dividend

Income earned during cover for the 12 months

the period 2.1 5.2 to 31 December was 94%.

------------ --------------- -----------------------------

Expenses for the

period (0.8) (2.1)

------------ --------------- -----------------------------

Net deferred tax liability

on the difference between

book cost and fair value

Deferred tax liability (2.8) (7.1) of the portfolio

------------ --------------- -----------------------------

Movement in the mark

to market value of a

dividend hedge rolled

forward in Q4 to fix

FX hedge mark to the EUR:GBP conversion

market revaluation 0.0 0.1 of the 2020 dividend

------------ --------------- -----------------------------

Third interim dividend

of 1.24 pence (1.41

Dividend paid 30 euro cents) per Ordinary

December 2020 (1.4) (3.4) share

------------ --------------- -----------------------------

Other movements Movement in lease incentives

in reserves (0.1) (0.3) in the quarter

------------ --------------- -----------------------------

Net assets as at

31 December 2020 120.1 293.6

------------ --------------- -----------------------------

EPRA Net Tangible Assets per share is 126.5 Euro cents, which

excludes deferred tax liability and fair value of the FX

derivative.

Net Asset Value analysis as at 31 December 2020 (unaudited)

EURm % of net assets

Property Portfolio 430.2 146.5%

-------- ----------------

Adjustment for lease incentives (5.0) (1.6%)

-------- ----------------

Fair value of property

portfolio 425.2 144.9%

-------- ----------------

Cash 24.9 8.5%

-------- ----------------

Other Assets 10.8 3.6%

-------- ----------------

Total Assets 460.9 157.0%

-------- ----------------

Bank Loans (143.3) (48.8%)

-------- ----------------

Other Liabilities (8.4) (2.9%)

-------- ----------------

Deferred Tax Liability (15.6) (5.3%)

-------- ----------------

Total Net Assets 293.6 100.0%

-------- ----------------

The property portfolio valuation is based on the independent

external valuation of the Company's direct property portfolio

undertaken by CBRE GmbH.

The NAV per share at 31 December 2020 is based on 244 ,500,001

shares of 1 pence each, being the total number of Ordinary shares

in issue at that time.

Evert Castelein, Fund Manager, Aberdeen Standard Investments,

commented:

"It is pleasing to see the quality of the portfolio being so

clearly reflected in this latest valuation, with a strong 6%

uplift. Increasing online retail sales penetration and the focus on

more resilient supply chains by building inventory levels and

near-shoring of manufacturing activities continues to support

demand for well specified logistics assets, underpinning valuations

and the Company's investment strategy.

"We continue to see strong levels of rent collection, reflecting

the quality of our tenant mix and critical nature of the assets.

Nonetheless we understand that the pandemic continues to affect

businesses globally, despite early indications of vaccine

successes. We remain in close contact with our tenants and

available to support them where and when required, through ASI's

strong 'on the ground' local network. This includes working through

the situation with the Office Dépôt France asset, where we are

confident of finding a resolution due to the quality of the asset

and its strong location."

Tony Roper, Chairman of the Company, added:

"The quality, location and age of our assets together with

improving sustainability credentials, as demonstrated by our recent

GRESB Award, provides confidence for the future. To date the

portfolio has delivered attractive returns for our shareholders and

today's update illustrates the increasing value of the assets

sourced by our Investment Manager and the value of long term

indexed income which many of our shareholders recognise. With their

support, it remains the Board's intention to continue scaling the

Company, further diversifying the asset and tenant base and

improving the quality and visibility of the income."

The Board is not aware of any other significant events or

transactions which have occurred between 31 December 2020 and the

date of publication of this statement which would have a material

impact on the financial position of the Company.

Details of the Company and its property portfolio may also be

found on the Company's website which can be found at:

http://www.eurologisticsincome.co.uk

For further information please contact:

Aberdeen Standard Fund Managers Limited +44 (0) 20 7463 6000

Luke Mason

Gary Jones

Investec Bank plc +44 (0) 20 7597 4000

Dominic Waters

Neil Brierley

Will Barnett

Alice Douglas

David Yovichic

Denis Flanagan

FTI Consulting +44 (0) 20 3727 1000

Dido Laurimore

Richard Gotla

James McEwan

The above information is unaudited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUOSBRABUUUAR

(END) Dow Jones Newswires

February 24, 2021 02:00 ET (07:00 GMT)

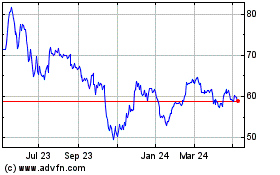

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

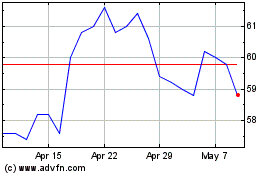

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Apr 2023 to Apr 2024