TIDMASLI

RNS Number : 6252Z

Aberdeen Standard Eur Lgstc Inc PLC

24 May 2021

Aberdeen Standard European Logistics Income PLC

LEI: 213800I9IYIKKNRT3G50

Unaudited Net Asset Value as at 31 March 2021 and Declaration of

First Interim Dividend

ASSET QUALITY AND SECTORAL HEADWINDS DRIVE PORTFOLIO UPLIFT

PROSPECTIVE PIPELINE SUPPORTING GROWTH AMBITIONS

24 May 2021 - Aberdeen Standard European Logistics Income PLC

(LSE: ASLI), the Company which invests in high quality European

logistics properties, announces its unaudited quarterly Net Asset

Value ("NAV") and dividend for the quarter to 31 March 2021.

Highlights

-- NAV per Ordinary share increased by 1.25% to 121.6c (GBp -

103.6p 1 ) (31 December 2020: 120.1c (GBp - 107.9p)), reflecting a

NAV total return of 13.1% (in Euro terms) for the 12 months to 31

March 2021

-- Portfolio valuation increased by 1.6%, or EUR6.9 million, to

EUR437.1 million (31 December 2020: EUR430.2 million), primarily as

a result of further yield compression

-- 97% of the rent due for the quarter ended 31 March 2021 collected

-- Oversubscribed issue of 18.45 million new Ordinary shares at

a price of 105p per share, raising GBP19.4 million in gross issue

proceeds

-- EUR28 million acquisition of a new warehouse in Lodz, Poland,

completed in April 2021, representing a net initial yield of 5.6%,

following which the portfolio now comprises 15 strategically

located, modern and diversified European logistics assets

-- In exclusivity on the purchase of an urban logistics asset,

located in a large supply constrained city in Spain, for c.EUR20

million

-- The Company declares a first interim dividend of 1.41 euro

cents (equivalent to 1.21 pence) per Ordinary share in respect of

its financial year ending 31 December 2021.

New Acquisitions

In April the Company announced the purchase of a 31,500 square

metre property, consisting of 27,888 sqm of warehouse space and

3,612 sqm of office space, for EUR28 million. The asset is 100%

leased, generating a net operating income of EUR1.59 million and

has a weighted average lease term of 6.2 years.

Tenants at the asset include manufacturers Bilplast, Tabiplast

and Alfa Laval, logistics operator EGT Express Polska, retailer

KAN, which owns the Polish fashion brand Tatuum, and Compal, one of

the world's largest computer component manufacturers, which signed

a new 7-year lease in February 2021 and supplies the DELL factory

located less than 1 kilometre from the site.

Located in Lodz, at the centre of Poland's thriving industrial

and manufacturing sector, the site benefits from access to the

Intermodal Container Terminal, created to support the Bosch-Siemens

campus, which offers direct rail connections with China. Lodz is

Poland's third largest city by population and is home to several

universities. The Panattoni Park site is highly accessible by local

public transport and the A1 and A2 motorways which provide North

South, East West access across Europe, whilst Lodz international

airport is just 15 minutes away.

The Company also announces that it is in exclusivity to acquire

a fully let urban logistics asset located in Spain. It currently

expects that the transaction, which will be immediately earnings

accretive, will close by the end of June 2021 once due diligence

has been completed. Having financed the acquisition of the Lodz

asset with the proceeds from the recent oversubscribed equity

issue, this new acquisition will initially be financed using the

Company's uncommitted loan facility, avoiding associated cash drag.

In due course, the Company intends to refinance this asset with

long-term fixed debt, taking advantage of the favourable lending

opportunities available to the Company.

Subject to completion, this acquisition will represent the

Company's sixteenth asset, taking the Company's gross assets to

over EUR500 million, diversified across five countries.

Further updates will be provided following completion of the due

diligence process.

Meung-sur-Loire Tenant Update

A French court hearing is expected to be held shortly to

consider the administrator's proposals in relation to offers made

for the whole business of Office Dépôt France, the sole tenant

occupying the Meung-sur-Loire asset in France. The property serves

as the tenant's key national distribution hub, reflecting its

strategic location in one of France's fastest-growing logistics

regions. As previously stated, the administrator continues to pay

rent under the terms of the lease and the Company benefits from a

three month rental security deposit.

Declaration of First Interim Dividend

The Directors have today declared a first interim dividend of

1.41 euro cents (equivalent to 1.21 pence) per Ordinary share, in

respect of the year ended 31 December 2021 (2020: 1.41 euro cents).

This first interim dividend will be paid in sterling on 25 June

2021 to Ordinary shareholders on the register on 4 June 2021

(ex-dividend date of 3 June 2021).

In line with stated policy, the Company declares interim

dividends to Shareholders in respect of the quarters ending 31

March, 30 June, 30 September and 31 December in each year.

Any such dividend payment to Shareholders may take the form of

either dividend income or "qualifying interest income" which may be

designated as an interest distribution for UK tax purposes and

therefore subject to the interest streaming regime applicable to

investments trusts.

Of this first interim dividend declared of 1.21 pence per

Ordinary share, 0.80 pence is declared as dividend income with 0.41

pence treated as qualifying interest income.

Performance

For the year to 31 March 2021, the share price total return

(with dividends reinvested) was 24.8%. The net asset value total

return over the same period was 13.1% in Euro terms (8.9% in

sterling terms) .

Equity Issue

On 10 March 2021, the Company announced a non-pre-emptive issue

of new Ordinary shares for up to 18.45 million shares, representing

the total remaining authority granted by shareholders at the Annual

General Meeting of the Company held on 30 June 2020. On 12 March

2021, the Company announced that the issue was oversubscribed and

that 18.45 million new shares had been issued at a price of 105

pence per share, raising gross issue proceeds of GBP19.4 million.

The Board was very pleased with the support shown from existing and

new shareholders.

Financing

The Company level loan to value ratio is currently 29.5%. This

figure will increase subject to the completion of the planned

acquisition, however it will remain well below the long term target

of 35.0%, providing additional capacity to fund the Company's

pipeline.

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited net

asset value per Ordinary Share over the period from 1 January 2021

to 31 March 2021. The unaudited net asset value has been prepared

under International Financial Reporting Standards ("IFRS").

Per Share Attributable Comment

(EURcents) Assets (EURm)

Net assets as at

31 December 2020 120.1 293.6

------------ --------------- ------------------------------

Capital values increased

EUR6.9m, a 1.25% increase

on a like-for-like basis

in respect of 14 assets.

Capital expenditure

at the Company's Ede

warehouse in the Netherlands

relates to preparatory

Unrealised change roof works to facilitate

in valuation of the installation of

property portfolio 2.6 6.9 solar panels.

------------ --------------- ------------------------------

Capital expenditure

during the period (0.1) (0.3)

------------ --------------- ------------------------------

Income from the 14 property

Income earned during portfolio and associated

the period 2.1 5.6 running costs.

------------ --------------- ------------------------------

Expenses for the

period (0.9) (2.5)

------------ --------------- ------------------------------

Net deferred tax liability

on the difference between

book cost and fair value

Deferred tax liability (0.8) (2.1) of the portfolio.

------------ --------------- ------------------------------

Movement in the mark

to market value of a

hedge entered into in

March 2021 to fix the

FX hedge mark to EUR:GBP conversion of

market revaluation 0.0 0.1 the 2021 dividend.

------------ --------------- ------------------------------

Fourth interim dividend

of 1.41 euro cents (1.24

Dividend paid 26 pence) per Ordinary

March 2021 (1.4) (3.4) share.

------------ --------------- ------------------------------

Share issuance Issue of 18,450,000

16 March 2021 0.1 22.3 Ordinary shares.

------------ --------------- ------------------------------

Foreign currency Foreign currency gain

gain 0.1 0.2 in the period.

------------ --------------- ------------------------------

Other movements Movement in lease incentives

in reserves (0.2) (0.6) in the quarter.

------------ --------------- ------------------------------

Net assets as at

31 March 2021 121.6 319.8

------------ --------------- ------------------------------

EPRA Net Tangible Assets per share is 128.4 Euro cents, which

excludes deferred tax liability and fair value of the FX

derivative.

Net Asset Value analysis as at 31 March 2021 (unaudited)

EURm % of net assets

Property Portfolio 437.1 136.7%

-------- ----------------

Adjustment for lease incentives (5.2) (1.6%)

-------- ----------------

Fair value of property

portfolio 431.9 135.1%

-------- ----------------

Cash 47.1 14.7%

-------- ----------------

Other Assets 11.7 3.7%

-------- ----------------

Total Assets 490.7 153.5%

-------- ----------------

Bank Loans (143.4) (44.8%)

-------- ----------------

Other Liabilities (9.8) (3.0%)

-------- ----------------

Deferred Tax Liability (17.7) (5.7%)

-------- ----------------

Total Net Assets 319.8 100.0%

-------- ----------------

The property portfolio valuation is based on the independent

external valuation of the Company's direct property portfolio

undertaken by CBRE GmbH.

The NAV per share at 31 March 2021 is based on 262 ,950,001

shares of 1 pence each, being the total number of Ordinary shares

in issue at that time.

Evert Castelein, Fund Manager, Aberdeen Standard Investments,

commented:

"The quality of the portfolio continues to be reflected in

increasing valuations, with a further 1.6% uplift delivered over

the most recent quarter. Alongside an ever-widening pool of

businesses needing to future proof their operations to meet

increasing e-commerce penetration, as the successful vaccination

roll out gains momentum, we expect economies to rebound, which will

further support consumer spending.

"Closing the Lodz deal in early April added another high quality

asset to the portfolio, whilst enabling us to quickly deploy the

funds raised in March. The pipeline remains strong, with the

Company in exclusivity to purchase a well-located urban logistics

warehouse with strong growth prospects. In line with our strategy,

the modern property, built in 2019, is located in a market

characterised by a shortage of high quality warehouse space, which

underpins our confidence that this asset, which will be immediately

earnings enhancing, will deliver on its return potential in the

medium term.

"At a macroeconomic level, we are entering a period of rising

inflation. Against this backdrop, we believe the long income nature

of our assets, with annual indexation, is an even more compelling

investment proposition and protection against the threat of rising

interest rates."

Tony Roper, Chairman of the Company, added:

"Despite growing competition for exposure to the industrial

sector, we continue to benefit from our Manager's network of local

teams across Europe and execution track record, allowing us to

originate and transact on earnings accretive opportunities. Our

ambition to continue scaling the Company remains undimmed, building

on a first mover position established at IPO in 2017, to further

diversify the asset and tenant base and improve the quality and

visibility of the income. The portfolio continues to deliver

attractive returns for our shareholders and today's update again

illustrates the value of the assets sourced by our highly

experienced Investment Manager and the appeal of long term indexed

income to our shareholders."

The Board is not aware of any other significant events or

transactions which have occurred between 31 March 2021 and the date

of publication of this statement which would have a material impact

on the financial position of the Company.

Details of the Company and its property portfolio may also be

found on the Company's website which can be found at:

http://www.eurologisticsincome.co.uk

For further information please contact:

Aberdeen Standard Fund Managers Limited +44 (0) 20 7463 6000

Luke Mason

Gary Jones

Investec Bank plc +44 (0) 20 7597 4000

Dominic Waters

Neil Brierley

Will Barnett

Alice Douglas

David Yovichic

Denis Flanagan

FTI Consulting +44 (0) 20 3727 1000

Dido Laurimore

Richard Gotla

James McEwan

The above information is unaudited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUWWAUPGGWC

(END) Dow Jones Newswires

May 24, 2021 09:34 ET (13:34 GMT)

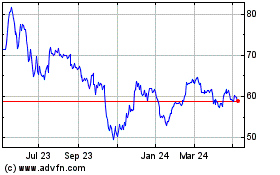

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

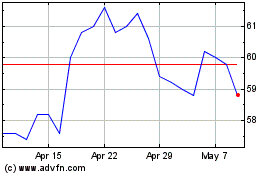

Abrdn European Logistics... (LSE:ASLI)

Historical Stock Chart

From Apr 2023 to Apr 2024