AIM Schedule One - AssetCo Plc (1329U)

March 31 2021 - 5:30AM

UK Regulatory

TIDMASTO

RNS Number : 1329U

AIM

31 March 2021

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

AssetCo plc

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

Singleton Court Business Park

Wonastow Road

Monmouth

Monmouthshire

NP25 5JA

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

www.assetco.com

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

On 8 February 2021, the Board announced its intention to change

the business strategy of the Company to the development of

an asset and wealth management business (the "New Strategy").

The proposed New Strategy will result in a fundamental change

of business and the Company will effect a readmission of its

Ordinary Shares pursuant to AIM Rule 14.

Upon completion of the readmission, the strategy of the Company

will change to the New Strategy of "acquiring, managing and

operating asset and wealth management activities and interests,

together with other related services". The New Strategy will

principally focus on making strategic acquisitions and building

organic activities in areas of the asset and wealth management

sector where the Directors believe structural shifts have the

potential to deliver exceptional growth opportunities. This

could include strategic acquisitions of undervalued asset and

wealth management businesses which have core capabilities that

play to these structural shifts, and where active management

can unlock value.

The Company's headquarters and main country of operation will

be the UK.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

6,532,943 ordinary shares of 10p each ("Ordinary Shares").

No restrictions on the transferability of the Ordinary Shares.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

The Company's current market capitalisation is approximately

GBP52.3 million, based upon its share price at close of business

on 25 March 2021 of 800 pence per Ordinary Share.

No capital has been raised on readmission.

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

54.7 per cent

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Tudor Davies - Chairman, Proposed Non-executive director

Mark Butcher - Non-executive director

Martin Gilbert - Non-executive director, Proposed Chairman

Peter McKellar - Non-executive director, Proposed Deputy Chairman

and CEO

Christopher Mills - Non-executive director

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Number of Existing Percentage

Ordinary Name of Existing

Shares Share Capital

Harwood Capital Management

Limited 1,622,500 24.8%

------------------- ---------------

Toscafund Asset Management

LLP 800,000 12.2%

------------------- ---------------

Lombard Odier Asset Management

(Europe) Limited 651,500 10.0%

------------------- ---------------

Martin Gilbert 650,000 9.9%

------------------- ---------------

ICM Limited 640,000 9.8%

------------------- ---------------

Richard Griffiths 291,872 4.5%

------------------- ---------------

Peter McKellar 225,000 3.4%

------------------- ---------------

Cadoc Limited 200,000 3.1%

------------------- ---------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

n/a

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

i. 30 September

ii. 30 September 2020

iii. First three reports:

a. 30 June 2021 (in respect of the half yearly report to 31

March 2021)

b. 31 March 2022 (in respect of the annual report to 30 September

2021)

c. 30 June 2022 (in respect of the half yearly report to 31

March 2022)

EXPECTED ADMISSION DATE:

16 April 2021

NAME AND ADDRESS OF NOMINATED ADVISER:

Arden Partners plc

125 Old Broad Street, London, EC2N 1AR

NAME AND ADDRESS OF BROKER:

Arden Partners plc

125 Old Broad Street, London, EC2N 1AR

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

A copy of the admission document containing full details about

the applicant and the admission of its securities is available

on the Company's website, www.assetco.com

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

The Company has adopted the Quoted Companies Alliance, Corporate

Governance Code, published by the Quoted Companies Alliance

DATE OF NOTIFICATION:

31 March 2021

NEW/ UPDATE:

New

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAAEAEDFDEXFEFA

(END) Dow Jones Newswires

March 31, 2021 06:30 ET (10:30 GMT)

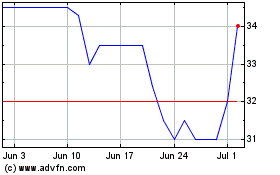

Assetco (LSE:ASTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assetco (LSE:ASTO)

Historical Stock Chart

From Apr 2023 to Apr 2024